Indian Tiles Market size was valued at USD 5.86 Billion in 2024 and the total Indian Tiles revenue is expected to grow at a CAGR of 9.49% from 2025 to 2032, reaching nearly USD 12.10 Billion.Indian Tiles Market Overview:

With a population of 1.3 Bn – 65 percent are income earning: India compromises a huge market for international corporations. Talent, one of the main elements for any business, is lavish & available at a lesser cost compared to emerging nations. In the past decade, when the economy was in good shape, the manufacturing & service segments achieved a development rate of 7.7 percent & 9.6 percent respectively. When combined with the rising Income Per Capita, urbanization rate, a growing number of nuclear families & a growing focus on spending, the customer market potential is clear. The range in spending patterns, eating habits & lifestyle changes in different parts of the country offers a sizable market for a range of industries wanting to set up their office in India.To know about the Research Methodology :- Request Free Sample Report Rising Per Capita Income (PPP) in USD:

Rising Urbanization Rate in India is observed every year:

Mumbai is the most crowded city in India, & the 4th most crowded city in the world. Mumbai accommodates 18.4 Mn people, & is the largest metropolis by population in India, followed by Delhi with 16.3 Mn populations. According to MMR study report, by 2032, 40.76 percent of country's population is estimated to reside in urban areas. India will lead the world's urban populace surge by 2050. India: Degree of Urbanization from 2019 to 2024: The Indian government is actively striving towards interesting construction activities in the nation as the construction sector is the 2nd largest employer & contributor to economic activity, after agriculture sectorIndian Tiles Market Segment Analysis:

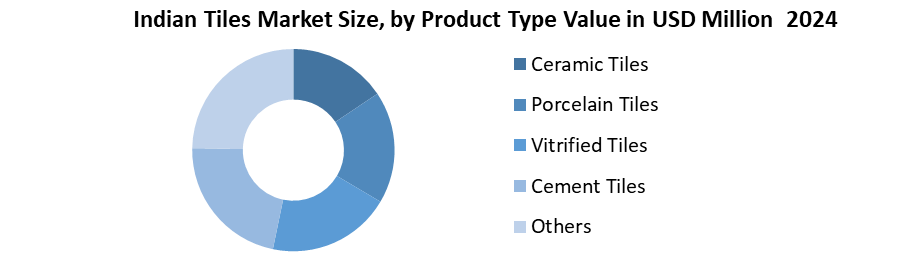

By Product Types, The Indian tiles market is segmented into Ceramic Tiles, Porcelain Tiles, Vitrified Tiles, Cement Tiles, and Others. Ceramic tiles lead the market with an estimated 45% share in 2024, driven by their cost-effectiveness, wide design range, and extensive residential usage. Vitrified tiles hold around 30% of the market, favored for their durability, polished finish, and suitability for both interior and exterior applications. Porcelain tiles, accounting for nearly 12%, are increasingly used in premium residential and commercial projects due to their high strength and aesthetic appeal. Cement tiles, with a 5% share, are gaining traction in niche markets focused on rustic and handcrafted looks. The ‘Others’ segment, including mosaic, glass, and designer tiles, makes up the remaining 8%, primarily catering to decorative and customized interior design applications.

Modular kitchen industry in India:

The modular kitchen Tiles market in India has been rising at a rapid rate of 30 percent per annum, albeit from a low base. According to the MMR report, the market was about 643 Mn USD in size in the year 2017, & could grow to about 1280 Mn USD by 2022. The market is largely unorganized with the presence of domestic & small players. The unorganized market comprises carpenters making custom-designed kitchens based upon the necessities of the households. Modular kitchens account for an expected 25 percent of the organized home interior market. The market is increasing as the demand is no longer limited to the upper-middle class, but is gaining popularity among other socio-economic classes also. The report covers Ceramic Tiles, Vitrified Tiles with detailed analysis Indian Tiles Market industry with the classifications of the market on the Product Type, End Use & region. Analysis of past market dynamics from 2019 to 2024 is given in the report, which will help readers to benchmark the past trends with current market scenarios with the key players' contribution in it. The report has profiled twelve key players in the market from different regions. However, the report has considered all market leaders, followers, and new entrants with investors while analyzing the market and estimation the size of the same. The manufacturing environment in each region is different and focus is given on the regional impact on the cost of manufacturing, supply chain, availability of raw materials, labor cost, availability of advanced Plastic Type, trusted vendors are analyzed and the report has come up with recommendations for a future hot spot in five regions. The major country’s policies about manufacturing & Covid 19 impact on demand side are covered in the report.Indian Tiles Market Scope: Inquire before Buying

Indian Tiles Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 5.86 Billion Forecast Period 2025 to 2032 CAGR: 9.49% Market Size in 2032: USD 12.10 Billion Segments Covered: by Product Type Ceramic Tiles Porcelain Tiles Vitrified Tiles Cement Tiles Others by Application Flooring Tiles Wall Tiles Roof Tiles Ceiling Tiles Others by End Use Industry Residential Institutional Commercial Others by Distribution Channel Offline Retail Online Sales Direct to Project Sales Indian Tiles Market Key Players :

1. Kajaria Ceramics Limited 2. Somany Ceramics Limited 3. H. & R. Johnson (India) Limited 4. Asian Granito India Limited 5. Simpolo Vitrified Private Limited 6. HSIL Limited 7. Cera Sanitaryware Limited 8. Jaquar And Company Private Limited 9. RAK Ceramics 10. Nitco Limited 11. Orient Bell Ceramics 12. Euro Ceramics 13. Others Frequently Asked Questions: 1. Which region has the largest share in Indian Tiles Market? Ans: North India region held the highest share in 2032. 2. What is the growth rate of Indian Tiles Market? Ans: The Indian Tiles Market is growing at a CAGR of 9.49% during forecasting period 2025-2032. 3. What is scope of the Indian Tiles market report? Ans: Indian Tiles Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Indian Tiles market? Ans: The important key players in the Indian Tiles Market are – Kajaria Ceramics Limited, Somany Ceramics Limited, H. & R. Johnson (India) Limited, Asian Granito India Limited, Simpolo Vitrified Private Limited, Indian Sanitary Ware and Bathroom Fittings Industry, HSIL Limited, Parryware Bathroom Products Private Limited, 5. What is the study period of this market? Ans: The Indian Tiles Market is studied from 2024 to 2032. 6. What was the Indian Tiles Market size in 2024? Ans: The Indian Tiles Market size was USD 5.86 Billion in 2024.

1. Indian Tiles Market: Executive Summary 1.1. Executive Summary 2. Indian Tiles Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Top Key Players 2.3. Key Players Benchmarking 2.4. Market Structure 2.5. Mergers and Acquisitions Details 3. Indian Tiles Market: Dynamics 3.1. Market Trends 3.2. Market Dynamics 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Analysis of Government Schemes and Support for the Industry 4. Pricing Analysis 4.1. Average Selling Price (ASP) of Tiles in India (2019–2024) 4.2. ASP by Product Type’ 4.3. ASP by Region 4.4. Price Trend Analysis (2019–2024 & Forecast 2025-2032) 4.5. Price Influencing Factors 5. Import–Export Analysis 5.1 Import Volume & Value of Tiles (2019–2024) 5.2 Top Import Partners 5.3. Export Volume & Value of Indian Tiles (2019–2024) 5.4. Top Export Destinations 5.5. India’s Net Trade Position in Tiles 5.6. Export Growth Rate by Product Type 5.7. Export Share by Indian Manufacturing Hubs 5.8. Trade Regulations, Anti-Dumping Laws, and Duty Structures 6. Supply Chain Analysis 6.1. Raw Material Sourcing in India 6.2. Tile Manufacturing Hubs in India 6.3. Manufacturing Process Overview (Value Chain) 6.4. Distribution Network Structure 6.5. Role of OEMs and Contract Manufacturers 6.6. Logistics and Warehousing Infrastructure 6.7. Challenges in Indian Tile Supply Chain 7. Sustainability & Innovation in Tiles Industry 7.1. Eco-Friendly Tile Manufacturing Techniques 7.2. Water & Energy Conservation in Tile Production 7.3. Adoption of Green Certifications (LEED, GRIHA) 7.4. Use of Digital Printing & Inkjet Technology for Waste Reduction 7.5. Low VOC and Anti-Microbial Tiles 7.6. New Product Innovations 7.7. Circular Economy & Tile Recycling Programs 8. Quantitative & Consumption Analysis 8.1. India – Tile Consumption Share by Type (2024) 8.2. India – Ceramic Tiles Consumption Volume (2019–2024) 8.3. India – Total Tile Consumption (Volume & Value) Forecast (2024-2032) 8.4. Consumption by End-Use Sector 8.5. Urban vs Rural Tile Consumption Dynamics 8.6. Per Capita Tile Consumption in India vs Global Benchmarks 8.7. Tile Demand by Region 9. Indian Tiles Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Million Square Meters) (2024-2032) 9.1. Indian Tiles Market Size and Forecast, by Product Type 9.2. Indian Tiles Market Size and Forecast, by Application 9.3. Indian Tiles Market Size and Forecast, by End Use Industry 9.4. Indian Tiles Market Size and Forecast, by Distribution Channel 10. Company Profile: Key Players 12.1. Kajaria Ceramics Limited 12.2. Somany Ceramics Limited 10.3. H. & R. Johnson (India) Limited 10.4. Asian Granito India Limited 10.5. Simpolo Vitrified Private Limited 10.6. HSIL Limited 10.7. Cera Sanitaryware Limited 10.8. Jaquar And Company Private Limited 10.9. RAK Ceramics 10.10. Nitco Limited 10.11. Orient Bell Ceramics 10.12. Euro Ceramics 10.13. Others 13. Key Findings 14. Analyst Recommendations 15 Indian Tiles Market – Research Methodology