The India Industrial Robotics Market was valued at USD 1.62 Billion in 2024 and is projected to reach USD 4.65 Billion by 2032, growing at a CAGR of 14.1 %India Industrial Robotics Market Overview

The India Industrial Robotics Market is witnessing accelerated transformation, driven by rapid automation, increasing manufacturing competitiveness, and strong adoption across high-growth industries. India recorded 8,510 industrial robot installations in 2023, positioning the country among the top 10 global markets and ranking seventh worldwide. This surge highlights India’s fast-growing role in global automation, surpassing markets such as France, Mexico, Spain, and Italy. The automotive sector remains the dominant adopter, accounting for 42% of installations, with robot deployment rising 139% in 2023. Industries such as rubber and plastics, electronics, and metal fabrication are also expanding automation, supported by India’s rising focus on smart factories, Industry 4.0, and AI-powered robotic systems. Despite strong growth, India’s robot density remains low only 7 robots per 10,000 manufacturing workers, compared to the global average of 141. Even in automotive, India’s density of 148 robots per 10,000 workers trails major economies such as South Korea (2,867) and China (772). This large automation gap presents a massive long-term opportunity for robotic welding systems, material-handling robots, cobots, and AI-enabled industrial robots to scale across India’s expanding manufacturing ecosystem.To know about the Research Methodology :- Request Free Sample Report

India Industrial Robotics Market Dynamics

Automation & Industry 4.0 Adoption to drive the growth of India Industrial Robotics Market A major driver of the India industrial robotics market is the rapid rise in robot installations, boosted by strong adoption across the automotive sector and accelerated Industry 4.0 transformation. According to IFR World Robotics 2024, India recorded 8,510 industrial robot installations in 2023, marking a 59% year-on-year increase. The automotive sector contributed 3,551 units, registering an impressive 139% jump, driven by EV manufacturing, component precision requirements, and large-scale automation in clusters such as Sanand, Halol, Chennai, and Pune. Manufacturers such as Tata Motors, MG Motor, Maruti Suzuki, and Hyundai are expanding robot-powered EV and battery lines, accelerating automation demand. States such as Gujarat, with 28,479 factories and a rapidly scaling EV ecosystem, amplify this trend. The region’s push toward robotics is further supported by strong Industry 4.0 integration, IoT-enabled production, and AI-based quality systems across plastics, rubber, and metal processing units. With India ranking 7th globally in annual robot installations and operational robot stock nearly doubling to 44,958 units since 2018, automation has become a core enabler of manufacturing efficiency. These factors collectively strengthen the adoption of industrial robots across India’s automotive and general manufacturing landscape.High Initial Investment, Skill Gaps & Approval Complexity Slow Adoption The India industrial robotics market faces a significant restraint in the form of high upfront investment, complex regulatory approvals, and a persistent skill gap. Setting up an advanced robotics integration facility in India typically requires around USD 1.13 Million, covering equipment cost approximately USD 0.34 Million, salaries USD 0.45 Million, and infrastructure. For many MSMEs—who form over 90% of India’s manufacturing ecosystem this capital requirement restricts adoption of automation solutions. Additionally, companies must navigate a long approval process involving more than 16 clearances, including environmental NOCs, factory licenses, fire permissions, and land allotment from State Industrial Development Corporations. This slows down deployment timelines, especially in emerging industrial hubs. Skill shortages further challenge adoption. Even though Gujarat alone hosts 678 engineering colleges and 11,167 vocational institutes, the gap between academic training and robotics integration proficiency remains wide. MSMEs often struggle to find robot programmers, simulation experts, or system integrators capable of handling Industry 4.0 environments. This leads to delays, inconsistent ROI, and reduced willingness to automate. High investment, regulatory complexity, and skill shortages collectively restrain the pace of robotic integration across India, particularly among MSMEs and first-time automation adopters. Rising EV Manufacturing, Industry 4.0 Investments & Government Incentives Create Strong Automation Demand A major opportunity for the India industrial robotics market is emerging from the rapid expansion of EV manufacturing, increased Industry 4.0 adoption, and strong state and central government support for automation-led industrial growth. As robot installations in India hit an all-time high in 2023, manufacturers across automotive, electronics, metals, and plastics are accelerating the shift toward robotic welding, painting, assembly, and material-handling solutions. The automotive industry alone installed 3,551 robots in 2023, growing 139%, driven by EV platforms, battery manufacturing, and precision component production. Government incentives further enhance this opportunity. Several Indian states offer capital subsidies, SGST reimbursement, interest subsidy up to 7%, and EPF reimbursement for 10 years, significantly lowering the cost of automation for both MSMEs and large enterprises. For example, states with strong manufacturing ecosystems such as Gujarat with 28,479 factories and large EV clusters are attracting robotics integrators due to simplified land allotment, engineering talent, and industrial incentives. Similar automation-ready environments are growing in Tamil Nadu, Maharashtra, and Karnataka. With India ranking 7th globally in annual robot installations and operational robot stock rising to 44,958 units, the country is positioned for a major surge in robotic adoption across EV, smart manufacturing, and high-precision industrial applications.

India Industrial Robotics Market Segment Analysis

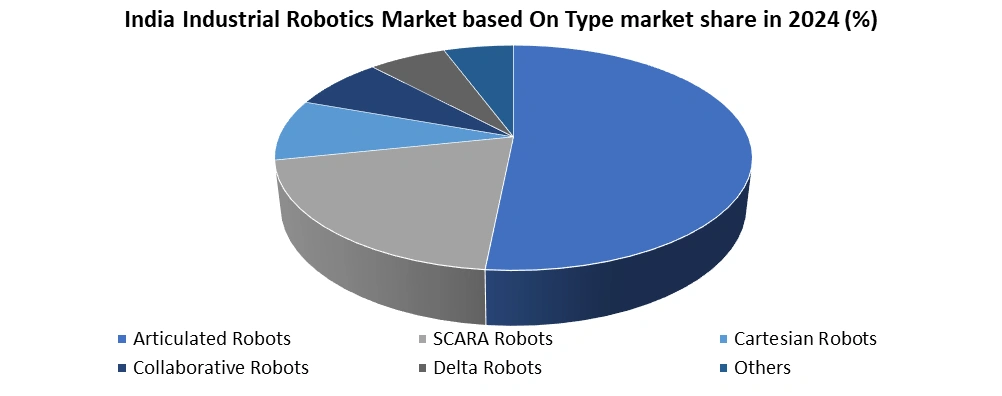

Based On Type, the India Industrial Robotics Market is segmented into Articulated Robots, CARA Robots, Cartesian Robots, Collaborative Robots, Delta Robots and Others. Articulated Robots dominate the Type segment in year 2024. Due to their superior flexibility, multi-axis movement, and broad application across high-growth industries. These robots are widely adopted in the automotive, electronics, metal fabrication, and consumer goods sectors, where precision welding, assembly, painting, and material handling are critical. The sharp rise in automotive automation significantly boosts demand for articulated robots because they can efficiently perform complex tasks that require high reach and agility. Additionally, India’s push toward Industry 4.0, smart manufacturing, and AI-integrated robotic systems further accelerates articulated robot adoption, as they offer seamless compatibility with advanced sensors and machine-vision technologies. Their ability to operate in varied payload capacities from small components to heavy automotive assemblies makes them the most versatile solution in factory automation. As Indian manufacturers increase investments in automation to enhance productivity and global competitiveness, articulated robots continue to lead the market with a clear technological and operational advantage.

India Industrial Robotics Market: Regional Analysis

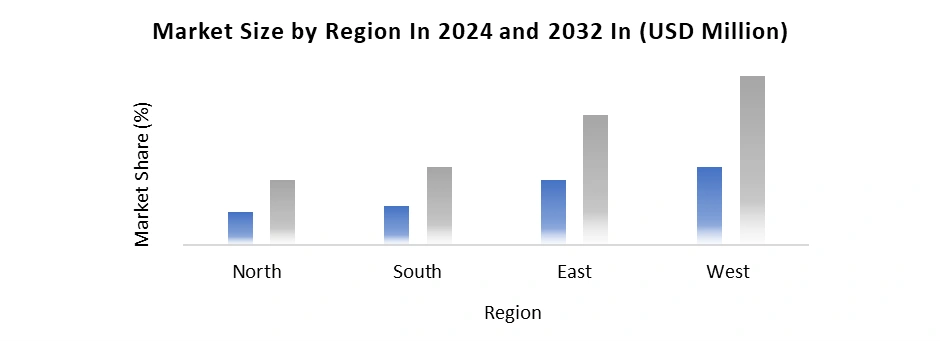

The India Industrial Robotics Market shows strong regional variation, driven by manufacturing maturity, automation readiness, and government-led industrial expansion. Western India, including Maharashtra and Gujarat, leads adoption due to its robust automotive, electronics, and chemical clusters. The presence of major car manufacturers, EV startups, and automation-focused MSMEs strengthens demand for robotic welding systems, robotic assembly lines, and AI-enabled industrial robots. Gujarat’s rapid industrialization and strong logistics infrastructure further accelerate robot installations, particularly across plastics, packaging, and renewable energy component manufacturing. Southern India, including Tamil Nadu, Karnataka, and Telangana, stands out as a hub for electronics manufacturing, semiconductor assembly, and engineering exports. The region benefits from skilled labor, global OEM investments, and supportive state policies that encourage robotics integration into precision engineering and machine tools. Northern India, led by states such as Haryana and Uttar Pradesh, exhibits rising adoption across automotive parts, food processing, and warehousing automation. With expanding industrial corridors, smart factory initiatives, and make in India-driven supply chain restructuring, robot deployment is expected to accelerate. Increasing adoption of automation solutions, robotic material handling, and collaborative robots positions all three regions for strong future growth in India’s robotics ecosystem.

India Industrial Robotics Market: Competitive Landscape

The India Industrial Robotics Market is becoming increasingly competitive, with global robot manufacturers and domestic automation integrators strengthening their presence. Leading international players such as ABB, FANUC, Yaskawa, and KUKA continue to expand their portfolios of robotic arms, palletizing robots, and smart factory automation systems tailored to India’s evolving manufacturing needs. These companies are enhancing their local service networks, training centers, and technical support to accelerate adoption of Industry 4.0 robotics solutions. Indian automation companies also play a crucial role, offering cost-effective integration services, IoT-enabled robotic systems, and custom solutions for MSMEs. Local firms are increasingly partnering with MNCs to deliver applications such as robotic inspection, high-precision pick-and-place automation, and automated quality control for sectors such as automotive, metal fabrication, and electronics. Recent strategies across the competitive landscape emphasize digital twin technology, AI-driven predictive maintenance, and robotics-as-a-service (RaaS) models designed to reduce upfront investment barriers. Strong demand for cobots, vision-guided robots, and autonomous industrial robots is encouraging players to innovate and localize production. As India moves toward high-value manufacturing, competition is expected to intensify, with companies focusing on affordability, customization, and advanced automation capabilities.India Industrial Robotics Market: Recent Development

1. In November 2023, ABB Robotics launched the IRB 930 SCARA robot, designed to enhance high-speed pick-and-place and precision assembly operations across electronics, automotive, and renewable energy industries. The robot delivers a 10% boost in throughput and offers 200% higher push-down strength, enabling efficient handling of heavier components and force-intensive tasks. This advancement supports manufacturers seeking greater productivity, accuracy, and reliability in fast-evolving industrial environments. 2. In November 2023, Yaskawa Electric Corporation introduced the MOTOMAN NEXT series, a breakthrough in adaptive industrial robotics. The series includes five versatile models with payload capacities ranging from 4 kg to 35 kg, all equipped with autonomous adaptive capabilities. These robots can interpret and respond to real-time environmental changes, setting a new benchmark for intelligence-driven automation and driving next-generation efficiencies in manufacturing. 3. In April 2023, Doosan Robotics unveiled the NSF-certified E-SERIES, a specialized range of collaborative robots built for the food and beverage industry. Featuring 13 new cobot models, the series expands Doosan’s portfolio significantly and reinforces its leadership in hygienic, safe, and flexible automation solutions tailored to food processing and handling applications.Scope of the India Industrial Robotics Market: Inquire before buying

India Industrial Robotics Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1.62 Bn. Forecast Period 2025 to 2032 CAGR: 14.1% Market Size in 2032: USD 4.65 Bn. Segments Covered: by Type Articulated Robots SCARA Robots Cartesian Robots Collaborative Robots Delta Robots Others by Payload Low (<20 kg) Medium (20-150 kg) High (>150 kg) by Application Material Handling Welding & Soldering Painting & Coating Pick & Place Quality Inspection Precision Farming Automated Logging & Timber Handling Others by End-Use Industry Automotive Electrical & Electronics Life Science & Healthcare Metal & Machinery Food & Beverage Retail Logistics Construction Agriculture, Forestry & Fishing Others India Industrial Robotics Market, Key Players

1. ABB Robotics 2. Fanuc Corporation 3. Yaskawa Electric Corporation 4. KUKA Robotics 5. Mitsubishi Electric 6. Kawasaki Heavy Industries 7. Hyundai Robotics 8. Toshiba Machine / Shibaura Robotics 9. Universal Robots (Teradyne) 10. Doosan Robotics 11. Epson Robotics 12. Omron Automation 13. Nachi-Fujikoshi Corp 14. Delta Electronics 15. Techman Robot (Foxconn Group).Frequently Asked Questions:

1.What is the Driver for the India Industrial Robotics Market? Ans The growing Manufacturing Sector is driving the India Industrial Robotics Market. Increasing demand for automation to enhance productivity and competitiveness, the adoption of industrial robots is on the rise. 2. What is the challenge of the India Industrial Robotics Market? Ans Infrastructure, lack of Skills, and Regulatory Challenges in India Industrial Robotics Market. 3. What is the projected India Industrial Robotics size & and growth rate of the Market? Ans. The Market size was valued at USD 3.59 Billion in 2023 and the total Market revenue is expected to grow at a CAGR of 15 % from 2024 to 2030, reaching nearly USD 8.26 Billion 4. What segments are covered in the Market report? Ans. The segments covered in the market report are by Type , Payload , Application, End Use Industry and Region .

1. India Industrial Robotics Market: Research Methodology 2. India Industrial Robotics Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global India Industrial Robotics Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Type Segment 3.3.3. End User Segment 3.3.4. Revenue (2024) 3.3.5. Headquarter 3.4. Mergers and Acquisitions Details 4. Pricing Analysis 4.1. Global Price Trends 4.2. Price Segmentation 4.3. Cost Structure Analysis 4.4. Factors Influencing Pricing 4.5. Forecast of Price Dynamics 5. Industrial Robot Installation Analysis (2019–2024) 5.1. Annual installation of industrial robots by customer industry (2019 to 2024) 5.1.1. Automotive 5.1.2. Electrical & Electronics 5.1.3. Metal & Machinery 5.1.4. Food & Beverage 5.1.5. Logistics & Warehousing 5.1.6. Construction 6. Patent Analysis 6.1. Leading Patent Holders in Industrial Robotics 6.2. Top Companies by Number of Patents Filed (till 2024) 6.3. Patent Filing Trends by Region 6.4. Key Innovations Captured in Recent Patents 7. Technological Innovations and Advancements in Industrial Robotics 7.1. AI and Machine Learning Integration 7.2. Human-Robot Collaboration (Cobots) 7.3. Vision Systems and Advanced Sensors 7.4. Industrial IoT (IIoT) and Robotics 7.5. Energy-Efficient Robotics and Battery Innovations 7.6. Wireless Connectivity and Remote Control 8. India Industrial Robotics Market: Dynamics 8.1. India Industrial Robotics Market Trends by Region 8.2. India Industrial Robotics Market Dynamics 8.2.1.1. Drivers 8.2.1.2. Restraints 8.2.1.3. Opportunities 8.2.1.4. Challenges 8.3. PORTER’s Five Forces Analysis 8.4. PESTLE Analysis 8.5. Value Chain Analysis 8.6. Analysis of Government Schemes and Initiatives for India Industrial Robotics Market 9. India Industrial Robotics Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’ Units) (2024-2032) 9.1. India Industrial Robotics Market Size and Forecast, By Type (2024-2032) 9.1.1. Articulated Robots 9.1.2. SCARA Robots 9.1.3. Cartesian Robots 9.1.4. Collaborative Robots 9.1.5. Delta Robots 9.1.6. Others 9.2. India Industrial Robotics Market Size and Forecast, By Payload (2024-2032) 9.2.1. Low (<20 kg) 9.2.2. Medium (20-150 kg) 9.2.3. High (>150 kg) 9.3. India Industrial Robotics Market Size and Forecast, By Application (2024-2032) 9.3.1. Material Handling 9.3.2. Welding & Soldering 9.3.3. Painting & Coating 9.3.4. Pick & Place 9.3.5. Quality Inspection 9.3.6. Precision Farming 9.3.7. Automated Logging & Timber Handling 9.3.8. Others 9.4. India Industrial Robotics Market Size and Forecast, By End-Use Industry (2024-2032) 9.4.1. Automotive 9.4.2. Electrical & Electronics 9.4.3. Life Science & Healthcare 9.4.4. Metal & Machinery 9.4.5. Food & Beverage 9.4.6. Retail 9.4.7. Logistics 9.4.8. Construction 9.4.9. Agriculture, Forestry & Fishing 9.4.10. Others 9.5. India Industrial Robotics Market Size and Forecast, By Region (2024-2032) 9.5.1. North 9.5.2. South 9.5.3. East 9.5.4. West 10. Company Profile: Key Players 10.1. ABB Robotics 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Fanuc Corporation 10.3. Yaskawa Electric Corporation 10.4. KUKA Robotics 10.5. Mitsubishi Electric 10.6. Kawasaki Heavy Industries 10.7. Hyundai Robotics 10.8. Toshiba Machine / Shibaura Robotics 10.9. Universal Robots (Teradyne) 10.10. Doosan Robotics 10.11. Epson Robotics 10.12. Omron Automation 10.13. Nachi-Fujikoshi Corp 10.14. Delta Electronics 10.15. Techman Robot (Foxconn Group). 11. Key Findings 12. Analyst Recommendations