The India Elevator Market size was valued at USD 3.94 billion in 2022 and the total India Elevator Market revenue is expected to grow at a CAGR of 8.9 % from 2023 to 2029, reaching nearly USD 7.16 billion. The India Elevator Market stands at a pivotal juncture, reflecting a dynamic landscape characterized by substantial growth, driven by various factors and recent key developments by industry players. The market is witnessing remarkable expansion, largely attributable to India's rapid urbanization, population growth, and burgeoning middle class. The construction of high-rise buildings, commercial spaces, and smart infrastructure projects in major metropolitan regions like Delhi-NCR, Mumbai, and Bangalore has led to a surge in the demand for elevators and escalators, both in the residential and commercial sectors. Government initiatives such as the 'Smart Cities Mission' have accelerated infrastructure development, focusing on energy-efficient and sustainable building solutions, further contributing to the market's growth. Recent developments include innovations such as the integration of smart technologies and IoT into elevators, offering real-time monitoring, predictive maintenance, and enhanced user experiences. For instance, IoT sensors are enabling elevators to detect and address issues before they cause downtime, ensuring smoother operations and lower maintenance costs. Retrofit and modernization services for existing elevator stocks are gaining prominence, offering energy-efficient upgrades and enhanced safety features. The industry is also aligned with sustainability goals, offering eco-friendly solutions that adhere to green building certifications and environmental regulations. This burgeoning market is highly competitive, with key players like KONE, Otis, ThyssenKrupp, and Schindler continuously striving to innovate and offer advanced solutions that cater to the evolving needs of the Indian market. In addition, Mitsubishi Elevator India Pvt Ltd. has made strides by launching the NEXIEZ-LITE MRL elevator, which eliminates the need for a machine room, catering to the evolving needs of the Indian market. These advancements, coupled with the government's initiatives in promoting sustainable urban development and smart cities, are expected to fuel further growth in the Indian elevator market in the coming years. As the nation's infrastructure development and urban expansion continue, the India Elevator Market remains poised for sustained growth, driven by the imperative for improved vertical mobility and efficiency in both residential and commercial settings.To know about the Research Methodology :- Request Free Sample Report

India Elevator Market Scope and Research Methodology:

The research methodology employed in the study of the India Elevator Market involves a comprehensive and multifaceted approach to gathering and analyzing data. It encompasses primary and secondary research methods, ensuring the reliability and accuracy of findings. Primary research is conducted through surveys, interviews, and interactions with key stakeholders in the elevator industry, including manufacturers, distributors, and end-users. Secondary research involves the thorough examination of existing industry reports, market studies, and publicly available data from reputable sources. Market segmentation and trend analysis are carried out to understand the dynamics of the elevator market, with a focus on factors influencing its growth, such as urbanization, regulatory changes, and technological advancements. Statistical and analytical tools are applied to interpret the data, facilitating accurate forecasting and trend analysis. The research methodology aims to provide a holistic view of the India Elevator Market, offering valuable insights to stakeholders, industry players, and decision-makers for informed strategic decisions and investments. The combination of primary and secondary research, along with data analysis, ensures the reliability and depth of the research findings.Market Dynamics:

Smart Cities Mission Boosts Sustainable Elevator Installations: India's rapid urbanization and population growth are driving the demand for elevators, especially in urban centers. As more people move to cities, the construction of high-rise buildings and commercial spaces intensifies. For instance, the construction of modern residential complexes in major cities like Mumbai and Delhi necessitates elevator installations to provide vertical mobility. Government initiatives, such as the 'Smart Cities Mission,' are spurring infrastructure development, including the construction of smart and sustainable buildings that require advanced elevator systems. These initiatives prioritize energy-efficient and eco-friendly solutions in line with the country's sustainability goals. As the middle-class population expands and disposable income rises, there is a growing demand for improved living standards, which includes the installation of elevators in residential buildings. This trend is evident in the proliferation of high-end apartment complexes in cities like Bengaluru and Hyderabad. The growth of commercial real estate, including shopping malls, office complexes, and airports, necessitates the installation of escalators and elevators for the convenience of visitors and employees. Notable examples include the installation of escalators in prominent shopping centers like DLF Mall of India in Noida. Technological innovations like destination control systems and IoT-enabled elevators enhance efficiency and the user experience. For instance, ThyssenKrupp's predictive maintenance technology optimizes elevator performance and minimizes downtime. With a focus on energy conservation, elevator companies are developing energy-efficient solutions. KONE's UltraRope technology, which is lightweight and energy-efficient, reduces the environmental footprint of elevators while improving performance. Strict safety and compliance regulations drive the need for modernization and upgrades in the existing elevator stock. Companies like Otis provide retrofit solutions to ensure older elevators meet current safety standards. India's aging population has led to an increased need for accessibility solutions in public and private buildings. Elevator manufacturers are responding with designs that cater to the elderly and differently-abled individuals. The rising popularity of green building certifications, such as LEED and GRIHA, encourages the installation of eco-friendly elevators. Elevator manufacturers are aligning their products with these sustainability standards to meet market demands. Infrastructure projects like metro rail systems and railway stations integrate elevators and escalators for easy access and improved passenger flow. An example is the Delhi Metro network, which extensively employs these vertical transportation systems in its stations to enhance the commuter experience.Price Sensitivity Deters Energy-Efficient Elevator Adoption: Stringent safety regulations and compliance standards pose challenges for elevator manufacturers. For instance, the need to adhere to the Bureau of Indian Standards (BIS) codes and other safety requirements slows down the approval process for new elevator models and installations. The price sensitivity of the Indian market is a restraint, particularly in the residential segment. High-quality, energy-efficient elevators often come at a premium, which deters cost-conscious consumers and developers from investing in such systems. India's infrastructure challenges, including frequent power outages and voltage fluctuations, impact elevator performance and reliability. Manufacturers must design systems that operate efficiently under these conditions. Escalating prices of raw materials such as steel and copper significantly affect elevator manufacturing costs, potentially leading to increased elevator prices, which may deter potential buyers. The Indian elevator market is highly competitive with several established players. This intense competition limits profit margins and creates challenges for new entrants seeking to gain a foothold. The need for modernizing and maintaining existing elevator infrastructure is a challenge, as many older elevators need upgrades to meet modern safety and energy efficiency standards. The shortage of skilled labor, especially for maintenance and installation, hampers the industry's growth. This shortage may result in delays in servicing and installation. In some cases, the quality of elevator components, particularly those sourced from unregulated markets, may not meet the desired standards, leading to reliability issues. Economic downturns and market fluctuations impact the construction industry, causing delays or cancellations of projects, thereby affecting the elevator market's growth. There is a growing demand for eco-friendly elevators, and challenges exist in implementing sustainable practices across the entire supply chain, from manufacturing to installation and maintenance, to meet evolving environmental expectations. IoT Integration Enhances Elevator Efficiency and Maintenance: The integration of smart technology and the Internet of Things (IoT) into elevators offers opportunities for real-time monitoring, predictive maintenance, and enhanced user experiences. For instance, elevators with IoT sensors can detect and address issues before they cause downtime, ensuring smoother operations and lower maintenance costs. The substantial existing elevator stock in India presents a lucrative market for retrofit and modernization services. Elevator companies can offer energy-efficient upgrades, enhanced safety features, and improved aesthetics, revitalizing older elevators to meet modern standards. The increasing emphasis on sustainability and green building certifications opens doors for elevators with energy-efficient technologies, such as regenerative drives and LED lighting. Elevator manufacturers can tap into this trend by offering eco-friendly solutions that align with environmental regulations and consumer preferences. Offering customization options for elevator aesthetics and functionality allows manufacturers to cater to diverse customer preferences. Customized interiors, cabin shapes, and control panels can differentiate products on the market. The demand for residential elevators is growing, driven by the desire for enhanced convenience and accessibility. Developing affordable and compact home elevator models can tap into this expanding market segment, making vertical mobility accessible to a wider range of homeowners. The aging population in India presents an opportunity for the development of accessibility solutions. Elevator companies can create elevators with features like larger cabin space, user-friendly controls, and enhanced safety measures to cater to the elderly and differently-abled individuals. Utilizing digital marketing and e-commerce platforms can expand reach and increase visibility. Elevator companies can establish online sales channels and provide comprehensive product information and support, facilitating quicker decision-making for customers. The Indian elevator industry can explore export markets in neighboring countries and regions. Developing competitive products and leveraging India's manufacturing capabilities can lead to increased export opportunities and revenue growth beyond domestic borders.

India Elevator Market Segment Analysis:

Based on End Users, The India Elevator Market is analyzed across various end-user segments, each demonstrating unique application and adoption patterns. In the residential sector, elevators are increasingly becoming a standard feature in modern urban homes, particularly in high-rise apartment complexes. The growing demand for convenience and accessibility, coupled with rising disposable incomes, has led to a substantial adoption rate. In the commercial segment, elevators play a critical role in facilitating vertical mobility in office buildings, shopping centers, and airports. With a focus on user experience and energy efficiency, the commercial sector represents a significant market for advanced elevator systems. Government institutions also contribute to elevator adoption, especially in public buildings, hospitals, and educational institutions. These entities prioritize accessibility and safety, driving the installation of elevators. In the industrial sector, elevators are crucial for transporting goods and materials to manufacturing and logistics facilities. While the adoption rate is substantial, the emphasis here is on robust and heavy-duty elevators capable of handling industrial loads. The elevator market in India exhibits a dynamic landscape with varying applications and adoption rates across these end-user segments, reflecting the diverse needs and preferences in this growing market.India Elevator Market Regional Insights:

The India Elevator Market exhibits significant regional variations in terms of production and consumption, reflecting the country's diverse economic and urban development landscape. Two prominent regions, Western India and Northern India, emerge as the largest producing and consuming regions in this market. Western India, comprising states like Maharashtra and Gujarat, serves as a major production hub for elevators. This region is home to several elevator manufacturing facilities, and it benefits from a robust industrial base and logistical infrastructure. Companies such as Otis, Schindler, and ThyssenKrupp have manufacturing units in these states. The Western region has a high concentration of commercial and residential real estate development, particularly in cities like Mumbai and Pune. The demand for elevators in these areas is driven by the construction of high-rise buildings, shopping malls, and urban infrastructure projects. The competitive manufacturing environment in Western India has led to innovation and technology adoption, resulting in a variety of elevator options for consumers. Northern India, encompassing states like Delhi, Uttar Pradesh, and Haryana, is a significant consumer of elevators. The National Capital Region (NCR) around Delhi, including cities like Gurugram and Noida, is a thriving commercial and residential center. The demand for elevators in Northern India is primarily fueled by the construction of office complexes, residential high-rises, and large-scale infrastructure projects. Government initiatives such as the 'Smart Cities Mission' have also accelerated elevator installations in this region. The need for accessibility solutions, given the densely populated urban areas, has further contributed to elevator adoption. Companies like KONE, Mitsubishi, and Johnson Lifts have a strong presence in this market, catering to the burgeoning demand. Southern India, particularly states like Karnataka and Tamil Nadu, also demonstrates a significant market presence, in both production and consumption. Cities like Bengaluru and Chennai are witnessing rapid urbanization and infrastructural development, which includes the construction of high-rise buildings, technology parks, and residential complexes. This has driven both the production and consumption of elevators. South India is increasingly adopting green and sustainable building practices, creating opportunities for energy-efficient elevators in this region. Companies like Fujitec and Omega Elevators have a noteworthy presence here. Eastern India, including states like West Bengal and Bihar, is steadily emerging as a growing market. While not as prominent as the Western, Northern, or Southern regions, Eastern India has shown potential, with an increase in residential and commercial projects. Kolkata, the capital of West Bengal, is witnessing the development of modern housing complexes and retail spaces, driving elevator demand. Elevator manufacturers are establishing their presence in this region to tap into the growing opportunities.

Competitive Landscape

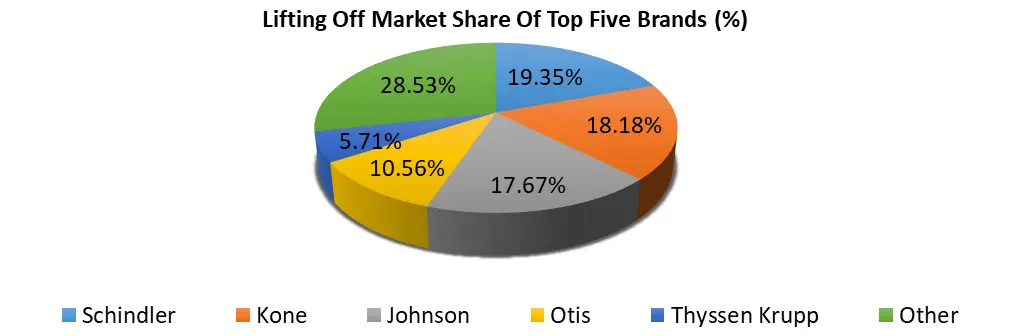

Key Players of the India Elevator Market profiled in the report are Bharat Bijlee Limited, Bengal Lift Maintenance Co, Beacon Elevator Company Private Ltd, Axis Elevator, Mitsubishi Electric, Schindler elevator., Otis elevator., Hitachi., Kinetic Hyundai., ESCON elevators., Expedite automation LLP., ThyssenKrupp elevator India., Fujitec India, Omega Elevators, Express Lifts Ltd., Epic Elevators Pvt. Ltd., KONE Elevator India Private Limited, Otis Elevator Company (India) Limited, ThyssenKrupp Elevator (India) Private Limited, Schindler India Private Limited, Johnson Lifts Private Limited, Mitsubishi Electric India Private Limited, Hitachi Lift India Private Limited, Fujitec India Private Limited, Omega Elevators Private Limited This provides huge, opportunities to serve many End-users and customers and expand the India Elevator Market. In February 2022, a significant development occurred when Schindler introduced the world's inaugural self-climbing autonomous robotic system, known as Schindler's Robotic Installation System for Elevators. This innovative technology was deployed for installation work within elevator shafts, marking a pioneering achievement. The system saw its initial implementation in customer projects located in the Asia-Pacific region. In March 2019, Mitsubishi Elevator India Pvt Ltd. made an announcement by launching the NEXIEZ-LITE MRL elevator, a model produced in India that eliminates the need for a machine room. This marked a significant advancement in elevator technology.India Elevator Market Scope: Inquiry Before Buying

India Elevator Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 3.94 Bn. Forecast Period 2023 to 2029 CAGR: 8.9% Market Size in 2029: US $ 7.16 Bn. Segments Covered: by Type Passenger Freight Other by End User Residential Commercial Government Institutions Industrial India Elevator Market Key Players:

1. Bharat Bijlee Limited 2. Beacon Elevator Company Private Ltd 3. Axis Elevator 4. Hitachi. 5. Kinetic Hyundai. 6. ESCON elevators. 7. Expedite automation LLP. 8. Express lifts Ltd. 9. Epic Elevators Pvt. Ltd. 10. KONE Elevator India Private Limited 11. Otis Elevator Company Limited 12. ThyssenKrupp Elevator Private Limited 13. Schindler India Private Limited 14. Johnson Lifts Private Limited 15. Mitsubishi Electric India Private Limited 16. Fujitec India Private Limited 17. Omega Elevators Private LimitedFAQs:

1. What are the growth drivers for the India Elevator Market? Ans. Smart Cities Mission Boosts Sustainable Elevator Installations and is expected to be the major driver of the India Elevator Market. 2. What is the major Opportunity for the India Elevator Market growth? Ans. IoT Integration Enhances Elevator Efficiency and Maintenance and is expected to be the major Opportunity in the India Elevator Market. 3. What is the projected market size and growth rate of the India Elevator Market? Ans. The India Elevator Market size was valued at USD 3.94 billion in 2022 and the total India Elevator Market revenue is expected to grow at a CAGR of 8.9 % from 2023 to 2029, reaching nearly USD 7.16 billion. 4. What is the study period of this market? Ans: The India Elevator Market is studied from 2022 to 2029. 5. What segments are covered in the India Elevator Market report? Ans. The segments covered in the India Elevator Market report are by Type, End-Users, and Region.

1. India Elevator Market: Research Methodology 2. India Elevator Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. India Elevator Market: Dynamics 3.1 India Elevator Market Trends 3.2 India Elevator Market Dynamics 3.2.1.1 Drivers 3.2.1.2 Restraints 3.2.1.3 Opportunities 3.2.1.4 Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape 3.7 Analysis of Government Schemes and Initiatives For the Indian Elevator Industry 3.8 The Pandemic and Redefining of The India Elevator Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 3.11 India Elevator Production Capacity Analysis 3.11.1 Chapter Overview 3.11.2 Key Assumptions and Methodology 3.11.3 Analysis by Size of Manufacturer 4. India Elevator Market: Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 4.1 India Elevator Market Size and Forecast, By Type (2022-2029) 4.1.1 Passenger 4.1.2 Freight 4.1.3 Other 4.2 India Elevator Market Size and Forecast, By End User (2022-2029) 4.2.1 Residential 4.2.2 Commercial 4.2.3 Government Institutions 4.2.4 Industrial 4.3 India Elevator Market Size and Forecast, by Region (2022-2029) 4.3.1 North India 4.3.2 South India 4.3.3 East India 4.3.4 West India 5. India Elevator Market: Competitive Landscape 5.1 MMR Competition Matrix 5.2 Competitive Landscape 5.3 Key Players Benchmarking 5.3.1 Company Name 5.3.2 Product Segment 5.3.3 End-user Segment 5.3.4 Revenue (2022) 5.3.5 Manufacturing Locations 5.3.6 SKU Details 5.3.7 Production Capacity 5.3.8 Production for 2022 5.4 Market Analysis by Organized Players vs. Unorganized Players 5.4.1 Organized Players 5.4.2 Unorganized Players 5.5 Leading India Elevator Companies, by market capitalization 5.6 Market Structure 5.6.1 Market Leaders 5.6.2 Market Followers 5.6.3 Emerging Players 5.7 Mergers and Acquisitions Details 6. Company Profile: Key Players 6.1 Axis Elevator. 6.1.1 Company Overview 6.1.2 Business Portfolio 6.1.3 Financial Overview 6.1.4 SWOT Analysis 6.1.5 Strategic Analysis 6.1.6 Scale of Operation (small, medium, and large) 6.1.7 Details on Partnership 6.1.8 Regulatory Accreditations and Certifications Received by Them 6.1.9 Awards Received by the Firm 6.1.10 Recent Developments 6.2 Beacon Elevator Company Private Ltd 6.3 Bengal Lift Maintenance Co 6.4 Bharat Bijlee Limited 6.5 Epic Elevators Pvt. Ltd. 6.6 ESCON elevators. 6.7 Expedite Automation LLP. 6.8 Express Lifts Ltd. 6.9 Fujitec India Private Limited 6.10 Hitachi Lift India Private Limited 6.11 Johnson Lifts Private Limited 6.12 Kinetic Hyundai. 6.13 KONE Elevator India Private Limited 6.14 Mitsubishi Electric India Private Limited 6.15 Omega Elevators Private Limited 6.16 Otis Elevator Company Limited 6.17 Schindler India Private Limited 6.18 ThyssenKrupp Elevator Private Limited 7. Key Findings 8. Industry Recommendations 9. Terms and Glossary