Hill-Start Assist System Market size was valued at USD 5.5 Billion in 2022 and the total Hill-Start Assist System Market size is expected to grow at a CAGR of 7.1% from 2023 to 2029, reaching nearly USD 9.52 Billion. Hill-Start Assist System (HSAS) is a safety feature in modern vehicles that helps prevent rolling backward or forward when starting on a steep slope. The system works by automatically engaging the brakes when the vehicle is stopped on a slope, and then gradually releasing them as the driver applies the accelerator pedal. The Hill-Start Assist System Market has been growing steadily in recent years, with the increasing demand for safety features in vehicles. According to MMR analyses, the global Hill-Start Assist System Market was valued at USD 5.5 billion in 2022 and is expected to grow at a CAGR of 7.1% from 2022 to 2029.Competitive Analysis

The Hill-Start Assist System (HSAS) Market is highly competitive, with several major players competing to capture a share of the growing demand for this technology. One of the key players in the market is Bosch, which offers a range of HSAS systems under its ESP brand. Bosch's systems use sensors to detect the incline of the slope and automatically engage the brake when the vehicle is stopped on an incline. The company is constantly innovating and improving its HSAS technology to provide better performance and safety. Another major player in the market is Continental AG, which offers a range of HSAS systems under its Advanced Driver Assistance Systems (ADAS) portfolio. Continental's systems use a combination of sensors and algorithms to detect the slope and apply the brakes when necessary. The company is focused on developing more advanced HSAS systems that work in a wider range of driving conditions. Other notable players in the Hill-Start Assist System Market include ZF Friedrichshafen AG, Aisin Seiki Co. Ltd., WABCO Holdings Inc., and Hyundai Mobis Co. Ltd. These companies offer a range of HSAS systems with varying features and capabilities, and are constantly working to improve their technology and expand their market share. In order to remain competitive, companies in the HSAS market are investing heavily in research and development to improve the performance, safety, and reliability of their systems. They are also working to expand their distribution networks and partnerships with automakers to ensure their technology is integrated into a wide range of vehicles. Overall, the HSAS market is expected to continue growing as demand for advanced safety features in vehicles continues to rise.To know about the Research Methodology :- Request Free Sample Report

Hill-Start Assist System Market Dynamics:

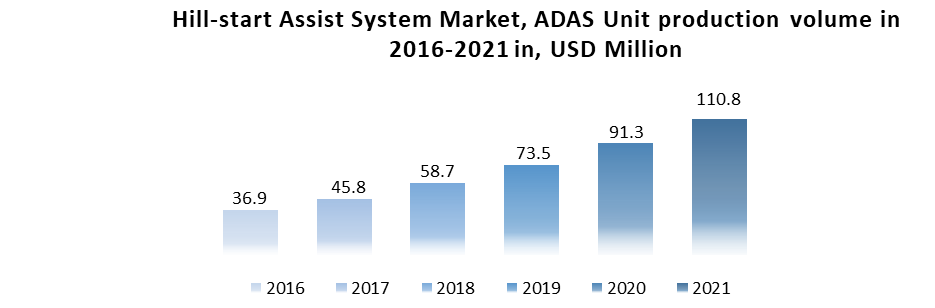

ADAS system penetrating the Hill-Start Assist System Market Hill-Start Assist System (HSAS) Market is the integration of advanced driver assistance systems (ADAS) that work in conjunction with HSAS to provide a more comprehensive safety package for drivers. For example, some automakers are integrating automatic emergency braking, lane departure warning, and adaptive cruise control with their HSAS technology to provide a more complete safety system. This Hill-Start Assist System Market trend is driven by the increasing demand for advanced safety features in vehicles, as well as the growing adoption of electric and autonomous vehicles that require sophisticated ADAS systems to operate safely. As a result, companies in the Hill-Start Assist System Market are investing in research and development to integrate these advanced features into their systems, and partnering with automakers to integrate them into new vehicle models. For example of an ADAS system that integrates HSAS is the Volkswagen Front Assist system. This system uses radar sensors and cameras to detect vehicles and obstacles in front of the vehicle, automatically apply the brakes to avoid collisions. The system also includes HSAS technology, which holds the brakes for a few seconds after the driver releases the brake pedal, giving the driver time to accelerate and prevent the vehicle from rolling back on an incline. Another example is the Toyota Safety Sense system, which includes a range of ADAS features such as lane departure warning, automatic high beams, and pre-collision system with pedestrian detection. The system also includes HSAS technology, which holds the brakes for up to two seconds after the driver releases the brake pedal, giving the driver time to accelerate and prevent the vehicle from rolling back on an incline. The integration of HSAS technology into ADAS systems is becoming increasingly common as automakers seek to provide a more comprehensive safety package to their customers. By integrating Hill-Start Assist System Market with other advanced safety features, automakers improve the overall driving experience and reduce the risk of accidents and collisions.

Market Opportunity

Growing demand for Electric vehicles Hill-Start Assist System Market is high in demand thanks to Hill-Start Assist System (HSAS) is commonly used in electric vehicles (EVs) as it helps prevent the vehicle from rolling back or forward when starting on an incline, which is particularly important for EVs that rely solely on electric power and may have different driving characteristics than traditional internal combustion engine vehicles, which is expected to drive the Hill-Start Assist System Market globally. EVs often have instant torque and may require more precise control when starting on an incline, which be challenging for some drivers. HSAS technology helps make the driving experience more intuitive and user-friendly by providing an additional layer of safety and convenience. Many EV manufacturers, such as Tesla, Nissan, and Chevrolet, offer HSAS technology as a standard or optional feature on their vehicles. For example, the Tesla Model 3 includes HSAS as part of its suite of advanced safety features, which also includes forward-collision warning, automatic emergency braking, and adaptive cruise control, which increases demand for Hill-Start Assist System Market.In addition to HSAS, some EVs also include other features that help improve driving on inclines, such as regenerative braking, which captures energy from the vehicle's momentum and uses it to recharge the battery, and hill descent control, which helps maintain a steady speed when driving down steep inclines. HSAS technology is an important feature for EVs as it helps improve the safety and convenience of driving, particularly in challenging terrain. As more consumers shift towards EVs, it is likely that HSAS technology will become an increasingly common feature across the Hill-Start Assist System industry.

Hill Start Assist Technology challenges faced by manufactures

The availability of skilled drivers is one of the most significant difficulties facing sectors that use Tipper Trucks. This makes it difficult in densely populated regions where the car must stop on uphill slopes, leading it to roll back and cause accidents. In such situations, drivers have a tendency to use aggressive acceleration and partial clutch engagement to counteract the rollback, resulting in clutch damage, tyre wear, and worse fuel economy. This adds to the expensive repair and maintenance costs, as well as the productivity loss caused by the incident, which hamper the Market. Tippers' Hill Start Assist (HSA) is a novel technology that maintains the vehicles working as needed in uphill settings, for both on-road and off-road Vehicle Classs. When the brake pedal is removed, this advanced feature temporarily keeps the vehicle in place, allowing the driver to safely overcome the hill by gradually pressing the accelerator. This improves uphill drivability and makes operations safer. HSA can be activated by just pressing a button on the dashboard. It has been intended to reduce brake wear and tear, consequently extending clutch and tyre life and lowering Tipper maintenance costs. Preventing rollback not only assures the driver's safety, but also increases uptime and reduces repair costs.Hill-Start Assist System Market Segment Analysis:

By Vehicle Propulsion:

The Hill-Start Assist System Market is segmented into ICE Vehicle and Electric & Hybrid Vehicle. ICE Vehicles is expected to dominate the Market during the forecast period. Hill-Start Assist System (HSAS) is commonly used in electric vehicles, it also be useful for internal combustion engine (ICE) vehicles, particularly those with manual transmissions. HSAS help prevent the vehicle from rolling back or forward when starting on an incline, which challenging for some drivers and potentially dangerous if not properly controlled. Hill-Start Assist System (HSAS) helps to protect driver, which expected to drive the Hill-Start Assist System market. For example of an ICE vehicle that includes HSAS technology is the 2022 Volkswagen Golf GTI. The GTI features a six-speed manual transmission and a HSAS system that is designed to engage automatically on slopes with a grade of 5% or more. When the driver releases the brake pedal, the system holds the vehicle in place for approximately two seconds, giving the driver enough time to engage the clutch and accelerate smoothly. Hill-Start Assist System Market is high in demand, thanks to ICE vehicles that include HSAS technology as a standard or optional feature include the Subaru WRX, the Ford Fiesta ST, and the Honda Civic Type R. In general, HSAS technology be particularly useful for drivers of manual transmission vehicles, as it helps make the driving experience more intuitive and user-friendly, particularly in challenging terrain.Regional Insights:

Asia Pacific is expected to dominate the Hill-Start Assist System Market during the forecast period. The Asian market for Hill-Start Assist System is becoming more popular due to growing demand for the Asia Pacific region is known for its challenging road conditions, such as steep hills and congested traffic. HSAS helps drivers to start their vehicles smoothly on inclines, without worrying about rolling back, making it easier and safer to drive in these conditions. HSAS improves safety by preventing accidents that can occur due to vehicles rolling back on steep inclines. This technology gives drivers more control and confidence when starting their vehicles on hills, reducing the risk of accidents, which is expected to drive the Hill-Start Assist System Market. Governments in the Asia Pacific region are introducing regulations to improve road safety, and many of these regulations require the installation of safety features such as HSAS in vehicles. Hill-start assist system (HSAS) is a technology that helps vehicles to start smoothly on an incline by preventing them from rolling backward. This technology is becoming increasingly popular in the Asia Pacific region, where many countries have hilly terrain and heavy traffic, making it difficult for drivers to start their vehicles on inclines. Here are some examples of companies in the Asia Pacific region that offer HSAS in their vehicles. For example: Toyota is a Japanese multinational automotive manufacturer that offers HSAS in many of its vehicles. For example, the Toyota Corolla Altis, a popular sedan in the Asia Pacific region, comes with HSAS as standard.Hill-Start Assist System Market Scope: Inquiry Before Buying

Hill-Start Assist System Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 5.5 Bn. Forecast Period 2023 to 2029 CAGR: 7.1 % Market Size in 2029: USD 9.52 Bn. Segments Covered: by Vehicle Propulsion 1. Passenger Cars 2. Light Commercial Vehicle 3. Heavy Commercial Vehicle by Vehicle Propulsion 1. ICE Vehicle 2. Electric & Hybrid Vehicle by Vehicle Class 1. Luxury 2. Economy Hill-Start Assist System Market Regional Insights:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Hill-Start Assist System Market Key Players:

1. Borgwarner Inc., 2. Continental AG, 3. BWI Group, 4. Aisin Corporation, 5. HELLA GmbH & Co. 6. KGaA, 7. Fujitsu, 8. Knorr-Bremse AG, 9. ZF Friedrichshafen AG, 10. Murata Manufacturing Co., Ltd., 11. Robert Bosch GmbH. 12. Continental AG, FAQs: 1. What are the growth drivers for the Hill-Start Assist System Market? Ans. The increasing prevalence of Electric vehicles, is expected to be the major driver for the Hill-Start Assist System Market. 2. What is the major restraint for the Hill-Start Assist System Market growth? Ans. Stringent government regulations are expected to be the major restraining factor for the Hill-Start Assist System Market growth. 3. Which region is expected to lead the global Hill-Start Assist System Market during the forecast period? Ans. Asia Pacific is expected to lead the global Market during the forecast period. 4. What is the projected market size & growth rate of the Hill-Start Assist System Market? Ans. The Hill-Start Assist System Market size was valued at USD 5.5 Billion in 2022 and the total Hill-Start Assist System Market revenue is expected to grow at a CAGR of 7.1% from 2023 to 2029, reaching nearly USD 9.52 Billion. 5. What segments are covered in the Market report? Ans. The segments covered in the Market report are Type, Vehicle Classs, End-use, and Region.

1. Hill-Start Assist System Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Hill-Start Assist System Market: Dynamics 2.1. Hill-Start Assist System Market Trends by Region 2.1.1. North America Hill-Start Assist System Market Trends 2.1.2. Europe Hill-Start Assist System Market Trends 2.1.3. Asia Pacific Hill-Start Assist System Market Trends 2.1.4. Middle East and Africa Hill-Start Assist System Market Trends 2.1.5. South America Hill-Start Assist System Market Trends 2.2. Hill-Start Assist System Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Hill-Start Assist System Market Drivers 2.2.1.2. North America Hill-Start Assist System Market Restraints 2.2.1.3. North America Hill-Start Assist System Market Opportunities 2.2.1.4. North America Hill-Start Assist System Market Challenges 2.2.2. Europe 2.2.2.1. Europe Hill-Start Assist System Market Drivers 2.2.2.2. Europe Hill-Start Assist System Market Restraints 2.2.2.3. Europe Hill-Start Assist System Market Opportunities 2.2.2.4. Europe Hill-Start Assist System Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Hill-Start Assist System Market Drivers 2.2.3.2. Asia Pacific Hill-Start Assist System Market Restraints 2.2.3.3. Asia Pacific Hill-Start Assist System Market Opportunities 2.2.3.4. Asia Pacific Hill-Start Assist System Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Hill-Start Assist System Market Drivers 2.2.4.2. Middle East and Africa Hill-Start Assist System Market Restraints 2.2.4.3. Middle East and Africa Hill-Start Assist System Market Opportunities 2.2.4.4. Middle East and Africa Hill-Start Assist System Market Challenges 2.2.5. South America 2.2.5.1. South America Hill-Start Assist System Market Drivers 2.2.5.2. South America Hill-Start Assist System Market Restraints 2.2.5.3. South America Hill-Start Assist System Market Opportunities 2.2.5.4. South America Hill-Start Assist System Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Hill-Start Assist System Industry 2.8. Analysis of Government Schemes and Initiatives For Hill-Start Assist System Industry 2.9. Hill-Start Assist System Market Trade Analysis 2.10. The Global Pandemic Impact on Hill-Start Assist System Market 3. Hill-Start Assist System Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 3.1.1. Passenger Cars 3.1.2. Light Commercial Vehicle 3.1.3. Heavy Commercial Vehicle 3.2. Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 3.2.1. ICE Vehicle 3.2.2. Electric & Hybrid Vehicle 3.3. Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 3.3.1. Luxury 3.3.2. Economy 3.4. Hill-Start Assist System Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Hill-Start Assist System Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 4.1.1. Passenger Cars 4.1.2. Light Commercial Vehicle 4.1.3. Heavy Commercial Vehicle 4.2. North America Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 4.2.1. ICE Vehicle 4.2.2. Electric & Hybrid Vehicle 4.3. North America Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 4.3.1. Luxury 4.3.2. Economy 4.4. North America Hill-Start Assist System Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 4.4.1.1.1. Passenger Cars 4.4.1.1.2. Light Commercial Vehicle 4.4.1.1.3. Heavy Commercial Vehicle 4.4.1.2. United States Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 4.4.1.2.1. ICE Vehicle 4.4.1.2.2. Electric & Hybrid Vehicle 4.4.1.3. United States Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 4.4.1.3.1. Luxury 4.4.1.3.2. Economy 4.4.2. Canada 4.4.2.1. Canada Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 4.4.2.1.1. Passenger Cars 4.4.2.1.2. Light Commercial Vehicle 4.4.2.1.3. Heavy Commercial Vehicle 4.4.2.2. Canada Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 4.4.2.2.1. ICE Vehicle 4.4.2.2.2. Electric & Hybrid Vehicle 4.4.2.3. Canada Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 4.4.2.3.1. Luxury 4.4.2.3.2. Economy 4.4.3. Mexico 4.4.3.1. Mexico Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 4.4.3.1.1. Passenger Cars 4.4.3.1.2. Light Commercial Vehicle 4.4.3.1.3. Heavy Commercial Vehicle 4.4.3.2. Mexico Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 4.4.3.2.1. ICE Vehicle 4.4.3.2.2. Electric & Hybrid Vehicle 4.4.3.3. Mexico Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 4.4.3.3.1. Luxury 4.4.3.3.2. Economy 5. Europe Hill-Start Assist System Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 5.2. Europe Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 5.3. Europe Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 5.4. Europe Hill-Start Assist System Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 5.4.1.2. United Kingdom Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 5.4.1.3. United Kingdom Hill-Start Assist System Market Size and Forecast, by Vehicle Class(2022-2029) 5.4.2. France 5.4.2.1. France Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 5.4.2.2. France Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 5.4.2.3. France Hill-Start Assist System Market Size and Forecast, by Vehicle Class(2022-2029) 5.4.3. Germany 5.4.3.1. Germany Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 5.4.3.2. Germany Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 5.4.3.3. Germany Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 5.4.4.2. Italy Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 5.4.4.3. Italy Hill-Start Assist System Market Size and Forecast, by Vehicle Class(2022-2029) 5.4.5. Spain 5.4.5.1. Spain Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 5.4.5.2. Spain Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 5.4.5.3. Spain Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 5.4.6.2. Sweden Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 5.4.6.3. Sweden Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 5.4.7.2. Austria Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 5.4.7.3. Austria Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 5.4.8.2. Rest of Europe Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 5.4.8.3. Rest of Europe Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 6. Asia Pacific Hill-Start Assist System Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 6.2. Asia Pacific Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 6.3. Asia Pacific Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 6.4. Asia Pacific Hill-Start Assist System Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 6.4.1.2. China Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 6.4.1.3. China Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 6.4.2.2. S Korea Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 6.4.2.3. S Korea Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 6.4.3.2. Japan Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 6.4.3.3. Japan Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 6.4.4. India 6.4.4.1. India Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 6.4.4.2. India Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 6.4.4.3. India Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 6.4.5.2. Australia Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 6.4.5.3. Australia Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 6.4.6.2. Indonesia Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 6.4.6.3. Indonesia Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 6.4.7.2. Malaysia Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 6.4.7.3. Malaysia Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 6.4.8.2. Vietnam Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 6.4.8.3. Vietnam Hill-Start Assist System Market Size and Forecast, by Vehicle Class(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 6.4.9.2. Taiwan Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 6.4.9.3. Taiwan Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 6.4.10.2. Rest of Asia Pacific Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 6.4.10.3. Rest of Asia Pacific Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 7. Middle East and Africa Hill-Start Assist System Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 7.2. Middle East and Africa Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 7.3. Middle East and Africa Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 7.4. Middle East and Africa Hill-Start Assist System Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 7.4.1.2. South Africa Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 7.4.1.3. South Africa Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 7.4.2.2. GCC Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 7.4.2.3. GCC Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 7.4.3.2. Nigeria Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 7.4.3.3. Nigeria Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 7.4.4.2. Rest of ME&A Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 7.4.4.3. Rest of ME&A Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 8. South America Hill-Start Assist System Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 8.2. South America Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 8.3. South America Hill-Start Assist System Market Size and Forecast, by Vehicle Class(2022-2029) 8.4. South America Hill-Start Assist System Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 8.4.1.2. Brazil Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 8.4.1.3. Brazil Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 8.4.2.2. Argentina Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 8.4.2.3. Argentina Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 8.4.3.2. Rest Of South America Hill-Start Assist System Market Size and Forecast, by Vehicle Propulsion (2022-2029) 8.4.3.3. Rest Of South America Hill-Start Assist System Market Size and Forecast, by Vehicle Class (2022-2029) 9. Global Hill-Start Assist System Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Hill-Start Assist System Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Borgwarner Inc., 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Continental AG, 10.3. BWI Group, 10.4. Aisin Corporation, 10.5. HELLA GmbH & Co. 10.6. KGaA, 10.7. Fujitsu, 10.8. Knorr-Bremse AG, 10.9. ZF Friedrichshafen AG, 10.10. Murata Manufacturing Co., Ltd., 10.11. Robert Bosch GmbH. 10.12. Continental AG, 11. Key Findings 12. Industry Recommendations 13. Hill-Start Assist System Market: Research Methodology 14. Terms and Glossary