High Strength Steel Market size was valued at USD 42.45 Bn. in 2024, and the total High Strength Steel revenue is expected to grow at a CAGR of 8.2% from 2025 to 2032, reaching nearly USD 79.74 Bn.High Strength Steel Market Overview

High Strength Steel (HSS) refers to advanced steel grades with superior strength-to-weight ratios, offering enhanced durability and load-bearing capacity compared to conventional steel. It includes Advanced High Strength Steel (AHSS) and Ultra-High Strength Steel (UHSS), widely used in automotive, construction, aerospace, and energy sectors for lightweight, high-performance applications while improving fuel efficiency and structural integrity. Demand for High Strength steel is rising in automotive and construction, while supply grows with advancements in steel production and expanding global manufacturing capacity. Asia-Pacific dominates the High Strength steel market, led by China, Japan, and India, driven by automotive and infrastructure growth. Top companies include ArcelorMittal and POSCO, with SSAB and Nippon Steel leading in advanced grades. SSAB excels in ultra-High Strength steel for automotive safety, while Nippon Steel competes with innovative AHSS solutions, intensifying rivalry in lightweight material technology for EVs and sustainable construction. The report explores the High Strength Steel Market's segments (Type, Product Type, Application, End User, and Region). Data has been provided by market participants, and regions (North America, Asia Pacific, Europe, Middle East & Africa, and South America). It provides a thorough analysis of the rapid advances that are currently taking place across all industry sectors. Facts and figures, illustrations, and presentations are used to provide key data analysis for the historical period from 2019 to 2024. The report investigates the High Strength Steel Market's drivers, limitations, prospects, and barriers. This MMR report includes investor recommendations based on a thorough examination of the High Strength Steel Market's contemporary competitive scenario.To know about the Research Methodology :- Request Free Sample Report

High Strength Steel Market Dynamics

Rising Demand from the Automotive Industry to Boost the High Strength Steel Market Growth

The automotive sector is the biggest driver of High Strength steel (HSS) demand, fueled by stricter fuel efficiency and emission regulations. Carmakers use HSS to reduce vehicle weight without compromising safety, improving mileage, and meeting standards like CAFE and Euro 6. Advanced grades like dual-phase (DP) and press-hardened steels (PHS) are key in electric vehicles (EVs) to offset heavy battery weight. With global EV sales surging, HSS adoption is accelerating, making it essential for lightweight, crash-resistant designs while keeping costs lower than alternatives like aluminium or carbon fiber.High Production Costs to Create High Strength Steel Market Challenges

A major hurdle for HSS growth is its complex manufacturing and higher costs. Producing advanced grades requires precise alloying, controlled cooling, and specialized forming techniques, increasing expenses. Additionally, welding and shaping ultra-High Strength steels (UHSS) demand advanced equipment, raising production barriers for smaller manufacturers. While HSS offers long-term savings, initial costs push some industries toward cheaper alternatives like conventional steel or aluminium, limiting market expansion despite its performance benefits.Growth in Renewable Energy Infrastructure to Create High Strength Steel Market Opportunity

The shift toward wind and solar energy creates a strong opportunity for HSS, particularly in wind turbine towers and offshore structures. High Strength steel provides the durability needed for tall turbine masts and corrosive marine environments, reducing maintenance costs. Governments investing in green energy (e.g., the U.S. Inflation Reduction Act, EU Green Deal) will further boost demand. Innovations in corrosion-resistant HSS grades position the material as a critical enabler of sustainable energy expansion.High Strength Steel Market Segment Analysis

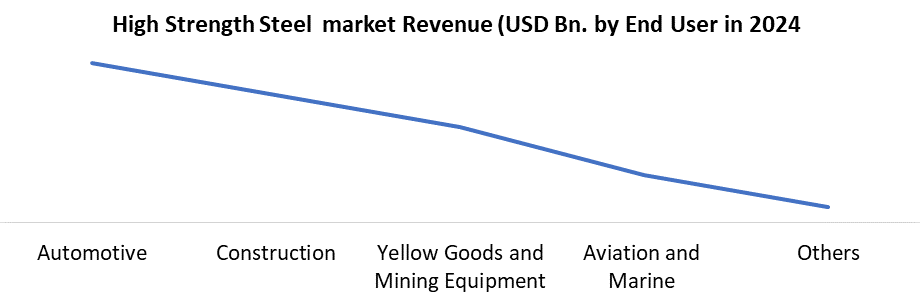

Based on Application, The High Strength Steel Market is segmented into Body and Closure, Suspensions, Bumper and Intrusion Bars, and Others. The Body and Closure segment dominated the High Strength Steel Market in 2024 and is expected to hold the largest market share over the forecast period. The Body and Closure segment dominates the High Strength Steel Market due to the critical role of High Strength Steel in vehicle structures. Body and closure components demand a delicate balance of strength, lightweight design, and safety standards within the High Strength Steel Market. High Strength steel's superior properties enable the creation of lighter yet robust vehicle frames, doors, hoods, and other structural elements essential for the automotive industry's emphasis on safety, fuel efficiency, and structural integrity. This segment's dominance stems from High Strength Steel's significant contributions to meeting these demanding requirements within the automotive sector.Based on End-User, High Strength Steel Market is segmented into Automotive, Construction, Yellow Goods and Mining Equipment, Aviation and Marine, and Others. The automotive segment dominated the High Strength Steel Market in 2024 and is expected to hold the largest market share over the forecast period. Dominance is due to the High Strength steel market, due to stringent fuel efficiency and safety regulations pushing automakers to adopt lightweight yet strong materials. High Strength steels, particularly advanced grades like dual-phase and press-hardened steels, are extensively used in vehicle bodies, chassis, and safety components to reduce weight while maintaining crash resistance. The rapid growth of electric vehicles further accelerates demand, as these steels help offset heavy battery weights to extend driving range. With automakers prioritizing cost-effective solutions over alternatives like aluminium, coupled with global vehicle production growth, the automotive sector remains the largest and fastest-growing end-user of High Strength steel.

High Strength Steel Regional Analysis

The Asia-Pacific region stands at the helm of the High Strength steel market, commanding around 53% of the global share in 2024. The region's dynamic economies, including China, India, and Japan, foster substantial growth in infrastructure, construction, and automotive industries. These sectors are major consumers of High Strength steel due to its lightweight and durable properties. Increased urbanization and rising disposable incomes further propel demand for buildings, vehicles, and appliances, all driving the utilization of High Strength steel. Various Asian governments champion policies promoting High Strength steel usage, offering incentives like tax benefits and subsidies.High Strength Steel Competitive Landscape

The High Strength steel market is dominated by industry giants ArcelorMittal and POSCO, which lead through technological innovation and global production capacity. ArcelorMittal, the world's largest steelmaker, reported $68.3 billion in revenue in 2023, with its S-in motion® lightweight steel solutions driving leadership in automotive AHSS applications. POSCO, South Korea's steel champion, generated $59.8 billion in 2023 revenue, specializing in premium GIGA STEEL® products for vehicles and eco-friendly steel solutions. Both companies are investing heavily in next-generation ultra-High Strength steels (UHSS) for electric vehicles, with ArcelorMittal pioneering Fortiform® grades and POSCO developing proprietary lightweight solutions. Their competitive edge comes from integrated R&D capabilities, strategic partnerships with automakers, and sustainable production methods addressing decarbonization trends. While ArcelorMittal leads in European and North American markets, POSCO maintains strong dominance in Asia-Pacific, creating a dynamic duopoly shaping the future of high-performance steel solutions across automotive, construction, and industrial sectors.High Strength Steel Market Recent Trends

• Electric Vehicles (EVs) Boost Demand – Carmakers use more High Strength steel to make EVs lighter, improving battery range while keeping safety high. • Stronger & Cheaper Grades – Steel companies are developing new types that are even stronger but easier and cheaper to produce. • Sustainability Focus – More recycled steel and energy-efficient production methods to reduce carbon emissions. • Construction & Infrastructure Growth – Governments investing in bridges, wind turbines, and earthquake-resistant buildings need High Strength steel.High Strength Steel Market Recent Development

Date Company Country Recent Development 15-05-2024 ArcelorMittal (Luxembourg) Launched XCarb® green steel for automotive AHSS, reducing CO₂ emissions by 75% 08-03-2024 POSCO (South Korea) Developed PBC-EV Steel with Hyundai for lighter EV frames 12-01-2024 Nippon Steel (Japan) Announced the acquisition of U.S. Steel to expand AHSS production 22-11-2023 SSAB (Sweden) Unveiled fossil-free HYBRIT steel for zero-emission equipment 05-09-2023 Tata Steel (India) Partnered with JLR to supply recycled High Strength steel for next-gen EVs Global High Strength Steel Market Scope: Inquire before buying

Global High Strength Steel Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 42.45 Bn. Forecast Period 2025 to 2032 CAGR: 8.2% Market Size in 2032: USD 79.74 Bn. Segments Covered: by Type High Strength Low Alloy Steel Dual-Phase Steel Carbon Manganese Steel Bake Hardenable Steel Transformation Induced Plasticity Others by Product Type Hot Rolled Cold Rolled Metallic Coated Direct Rolled by Application Body And Closure Suspensions Bumper and Intrusion Beans Others by End User Industry Automotive Construction Yellow Goods and Mining Equipment Aviation and Marine Others High Strength Steel Market, by Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)High Strength Steel Market Key Players are:

North America 1. Nucor Corporation (United States) 2. United States Steel Corporation (United States) 3. Steel Dynamics, Inc. (United States) 4. AK Steel Holding Corporation (United States) Europe 1. ArcelorMittal (Luxembourg) 2. ThyssenKrupp AG (Germany) 3. Voestalpine AG (Austria) 4. SSAB AB (Sweden) 5. Salzgitter AG (Germany) Asia Pacific 1. Nippon Steel Corporation (Japan) 2. China Baowu Steel Group (China) 3. JFE Steel Corporation (Japan) 4. Tata Steel (India) 5. HBIS Group (China) 6. JSW Steel (India) 7. Hyundai Steel (South Korea) Middle East and Africa 1. SABIC (Saudi Arabia) 2. Hadeed (Saudi Arabia) 3. Qatar Steel (Qatar) 4. Emirates Steel (UAE) 5. ArcelorMittal South Africa (South Africa) South America 1. Gerdau SA (Brazil) 2. Companhia Siderúrgica Nacional (CSN) (Brazil) 3. Usiminas (Brazil) 4. Ternium (Argentina) ArcelorMittal Brasil (Brazil)FAQ's:

1] What is the growth rate of the Global High Strength Steel Market? Ans. The Global High Strength Steel Market is growing at a significant rate of 8.2% during the forecast period. 2] Which region is expected to dominate the Global High Strength Steel Market? Ans. APAC is expected to dominate the steel Market during the forecast period. 3] What is the expected Global High Strength Steel Market size by 2032? Ans. The High Strength Steel Market size is expected to reach USD 79.74 Bn by 2032. 4] Which are the top players in the Global High Strength Steel Market? Ans. The major top players in the Global High Strength Steel Market are POSCO - Pohang Iron and Steel Company (South Korea), Nippon Steel Corporation (Japan), Baoshan Iron & Steel Co., Ltd. (China), JFE Steel Corporation (Japan), Hyundai Steel Co. (South Korea) 5] What are the factors driving the Global High Strength Steel Market growth? Ans. The Global High Strength Steel Market is driven by increasing demand in the automotive and construction sectors due to its lightweight, durable properties and advancements in steel technology, meeting stringent safety and efficiency standards. 6] Which country held the largest Global High Strength Steel Market share in 2024? Ans. China held the largest Global High Strength Steel Market share in 2024. Its economic engine, government support for infrastructure development, and expanding automotive industry all contribute to its dominant position.

1. High Strength Steel Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global High Strength Steel Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Headquarter 2.2.3. Service Segment 2.2.4. End-User Segment 2.2.5. Revenue (2024) 2.2.6. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. High Strength Steel Market: Dynamics 3.1. High Strength Steel Market Trends 3.2. High Strength Steel Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. High Strength Steel Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. High Strength Steel Market Size and Forecast, By Type (2024-2032) 4.1.1. High Strength Low Alloy Steel 4.1.2. Dual-Phase Steel 4.1.3. Carbon Manganese Steel 4.1.4. Bake Hardenable Steel 4.1.5. Transformation Induced Plasticity 4.1.6. Others 4.2. High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 4.2.1. Hot Rolled 4.2.2. Cold Rolled 4.2.3. Metallic Coated 4.2.4. Direct Rolled 4.3. High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 4.3.1. Body And Closure 4.3.2. Suspensions 4.3.3. Bumper and Intrusion Beans 4.3.4. Others 4.4. High Strength Steel Market Size and Forecast, By End-User (2024-2032) 4.4.1. Automotive 4.4.2. Construction 4.4.3. Yellow Goods and Mining Equipment 4.4.4. Aviation and Marine 4.4.5. Others 4.5. High Strength Steel Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America High Strength Steel Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America High Strength Steel Market Size and Forecast, By Type (2024-2032) 5.1.1. High Strength Low Alloy Steel 5.1.2. Dual-Phase Steel 5.1.3. Carbon Manganese Steel 5.1.4. Bake Hardenable Steel 5.1.5. Transformation Induced Plasticity 5.1.6. Others 5.2. North America High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 5.2.1. Hot Rolled 5.2.2. Cold Rolled 5.2.3. Metallic Coated 5.2.4. Direct Rolled 5.3. North America High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 5.3.1. Body And Closure 5.3.2. Suspensions 5.3.3. Bumper and Intrusion Beans 5.3.4. Others 5.4. North America High Strength Steel Market Size and Forecast, By End User (2024-2032) 5.4.1. Automotive 5.4.2. Construction 5.4.3. Yellow Goods and Mining Equipment 5.4.4. Aviation and Marine 5.4.5. Others 5.5. North America High Strength Steel Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States High Strength Steel Market Size and Forecast, By Type (2024-2032) 5.5.1.1.1. High Strength Low Alloy Steel 5.5.1.1.2. Dual-Phase Steel 5.5.1.1.3. Carbon Manganese Steel 5.5.1.1.4. Bake Hardenable Steel 5.5.1.1.5. Transformation Induced Plasticity 5.5.1.1.6. Others 5.5.1.2. United States High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 5.5.1.2.1. Hot Rolled 5.5.1.2.2. Cold Rolled 5.5.1.2.3. Metallic Coated 5.5.1.2.4. Direct Rolled 5.5.1.3. United States High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 5.5.1.3.1. Body And Closure 5.5.1.3.2. Suspensions 5.5.1.3.3. Bumper and Intrusion Beans 5.5.1.3.4. Others 5.5.1.4. United States High Strength Steel Market Size and Forecast, By End User (2024-2032) 5.5.1.4.1. Automotive 5.5.1.4.2. Construction 5.5.1.4.3. Yellow Goods and Mining Equipment 5.5.1.4.4. Aviation and Marine 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada High Strength Steel Market Size and Forecast, By Type (2024-2032) 5.5.2.1.1. High Strength Low Alloy Steel 5.5.2.1.2. Dual-Phase Steel 5.5.2.1.3. Carbon Manganese Steel 5.5.2.1.4. Bake Hardenable Steel 5.5.2.1.5. Transformation Induced Plasticity 5.5.2.1.6. Others 5.5.2.2. Canada High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 5.5.2.2.1. Hot Rolled 5.5.2.2.2. Cold Rolled 5.5.2.2.3. Metallic Coated 5.5.2.2.4. Direct Rolled 5.5.2.3. Canada High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 5.5.2.3.1. Body And Closure 5.5.2.3.2. Suspensions 5.5.2.3.3. Bumper and Intrusion Beans 5.5.2.3.4. Others 5.5.2.4. Canada High Strength Steel Market Size and Forecast, By End User (2024-2032) 5.5.2.4.1. Automotive 5.5.2.4.2. Construction 5.5.2.4.3. Yellow Goods and Mining Equipment 5.5.2.4.4. Aviation and Marine 5.5.2.4.5. Others 5.5.3. Mexico 5.5.3.1. Mexico High Strength Steel Market Size and Forecast, By Type (2024-2032) 5.5.3.1.1. High Strength Low Alloy Steel 5.5.3.1.2. Dual-Phase Steel 5.5.3.1.3. Carbon Manganese Steel 5.5.3.1.4. Bake Hardenable Steel 5.5.3.1.5. Transformation Induced Plasticity 5.5.3.1.6. Others 5.5.3.2. Mexico High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 5.5.3.2.1. Hot Rolled 5.5.3.2.2. Cold Rolled 5.5.3.2.3. Metallic Coated 5.5.3.2.4. Direct Rolled 5.5.3.3. Mexico High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 5.5.3.3.1. Body And Closure 5.5.3.3.2. Suspensions 5.5.3.3.3. Bumper and Intrusion Beans 5.5.3.3.4. Others 5.5.3.4. Mexico High Strength Steel Market Size and Forecast, By End User (2024-2032) 5.5.3.4.1. Automotive 5.5.3.4.2. Construction 5.5.3.4.3. Yellow Goods and Mining Equipment 5.5.3.4.4. Aviation and Marine 5.5.3.4.5. Others 6. Europe High Strength Steel Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe High Strength Steel Market Size and Forecast, By Type (2024-2032) 6.2. Europe High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 6.3. Europe High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 6.4. Europe High Strength Steel Market Size and Forecast, By End User (2024-2032) 6.5. Europe High Strength Steel Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom High Strength Steel Market Size and Forecast, By Type (2024-2032) 6.5.1.2. United Kingdom High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 6.5.1.3. United Kingdom High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 6.5.1.4. United Kingdom High Strength Steel Market Size and Forecast, By End User (2024-2032) 6.5.2. France 6.5.2.1. France High Strength Steel Market Size and Forecast, By Type (2024-2032) 6.5.2.2. France High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 6.5.2.3. France High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 6.5.2.4. France High Strength Steel Market Size and Forecast, By End User (2024-2032) 6.5.3. Germany 6.5.3.1. Germany High Strength Steel Market Size and Forecast, By Type (2024-2032) 6.5.3.2. Germany High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 6.5.3.3. Germany High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 6.5.3.4. Germany High Strength Steel Market Size and Forecast, By End User (2024-2032) 6.5.4. Italy 6.5.4.1. Italy High Strength Steel Market Size and Forecast, By Type (2024-2032) 6.5.4.2. Italy High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 6.5.4.3. Italy High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 6.5.4.4. Italy High Strength Steel Market Size and Forecast, By End User (2024-2032) 6.5.5. Spain 6.5.5.1. Spain High Strength Steel Market Size and Forecast, By Type (2024-2032) 6.5.5.2. Spain High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 6.5.5.3. Spain High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 6.5.5.4. Spain High Strength Steel Market Size and Forecast, By End User (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden High Strength Steel Market Size and Forecast, By Type (2024-2032) 6.5.6.2. Sweden High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 6.5.6.3. Sweden High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 6.5.6.4. Sweden High Strength Steel Market Size and Forecast, By End User (2024-2032) 6.5.7. Russia 6.5.7.1. Russia High Strength Steel Market Size and Forecast, By Type (2024-2032) 6.5.7.2. Russia High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 6.5.7.3. Russia High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 6.5.7.4. Russia High Strength Steel Market Size and Forecast, By End User (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe High Strength Steel Market Size and Forecast, By Type (2024-2032) 6.5.8.2. Rest of Europe High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 6.5.8.3. Rest of Europe High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 6.5.8.4. Rest of Europe High Strength Steel Market Size and Forecast, By End User (2024-2032) 7. Asia Pacific High Strength Steel Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific High Strength Steel Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 7.3. Asia Pacific High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 7.4. Asia Pacific High Strength Steel Market Size and Forecast, By End User (2024-2032) 7.5. Asia Pacific High Strength Steel Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China High Strength Steel Market Size and Forecast, By Type (2024-2032) 7.5.1.2. China High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 7.5.1.3. China High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 7.5.1.4. China High Strength Steel Market Size and Forecast, By End User (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea High Strength Steel Market Size and Forecast, By Type (2024-2032) 7.5.2.2. S Korea High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 7.5.2.3. S Korea High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 7.5.2.4. S Korea High Strength Steel Market Size and Forecast, By End User (2024-2032) 7.5.3. Japan 7.5.3.1. Japan High Strength Steel Market Size and Forecast, By Type (2024-2032) 7.5.3.2. Japan High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 7.5.3.3. Japan High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 7.5.3.4. Japan High Strength Steel Market Size and Forecast, By End User (2024-2032) 7.5.4. India 7.5.4.1. India High Strength Steel Market Size and Forecast, By Type (2024-2032) 7.5.4.2. India High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 7.5.4.3. India High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 7.5.4.4. India High Strength Steel Market Size and Forecast, By End User (2024-2032) 7.5.5. Australia 7.5.5.1. Australia High Strength Steel Market Size and Forecast, By Type (2024-2032) 7.5.5.2. Australia High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 7.5.5.3. Australia High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 7.5.5.4. Australia High Strength Steel Market Size and Forecast, By End User (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia High Strength Steel Market Size and Forecast, By Type (2024-2032) 7.5.6.2. Indonesia High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 7.5.6.3. Indonesia High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 7.5.6.4. Indonesia High Strength Steel Market Size and Forecast, By End User (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia High Strength Steel Market Size and Forecast, By Type (2024-2032) 7.5.7.2. Malaysia High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 7.5.7.3. Malaysia High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 7.5.7.4. Malaysia High Strength Steel Market Size and Forecast, By End User (2024-2032) 7.5.8. Philippines 7.5.8.1. Philippines High Strength Steel Market Size and Forecast, By Type (2024-2032) 7.5.8.2. Philippines High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 7.5.8.3. Philippines High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 7.5.8.4. Philippines High Strength Steel Market Size and Forecast, By End User (2024-2032) 7.5.9. Thailand 7.5.9.1. Thailand High Strength Steel Market Size and Forecast, By Type (2024-2032) 7.5.9.2. Thailand High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 7.5.9.3. Thailand High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 7.5.9.4. Thailand High Strength Steel Market Size and Forecast, By End User (2024-2032) 7.5.10. Vietnam 7.5.10.1. Vietnam High Strength Steel Market Size and Forecast, By Type (2024-2032) 7.5.10.2. Vietnam High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 7.5.10.3. Vietnam High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 7.5.10.4. Vietnam High Strength Steel Market Size and Forecast, By End User (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific High Strength Steel Market Size and Forecast, By Type (2024-2032) 7.5.11.2. Rest of Asia Pacific High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 7.5.11.3. Rest of Asia Pacific High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 7.5.11.4. Rest of Asia Pacific High Strength Steel Market Size and Forecast, By End User (2024-2032) 8. Middle East and Africa High Strength Steel Market Size and Forecast (by Value in USD Billion) (2024-2032 8.1. Middle East and Africa High Strength Steel Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 8.3. Middle East and Africa High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 8.4. Middle East and Africa High Strength Steel Market Size and Forecast, By End User (2024-2032) 8.5. Middle East and Africa High Strength Steel Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa High Strength Steel Market Size and Forecast, By Type (2024-2032) 8.5.1.2. South Africa High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 8.5.1.3. South Africa High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 8.5.1.4. South Africa High Strength Steel Market Size and Forecast, By End User (2024-2032) 8.5.2. GCC 8.5.2.1. GCC High Strength Steel Market Size and Forecast, By Type (2024-2032) 8.5.2.2. GCC High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 8.5.2.3. GCC High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 8.5.2.4. GCC High Strength Steel Market Size and Forecast, By End User (2024-2032) 8.5.3. Egypt 8.5.3.1. Egypt High Strength Steel Market Size and Forecast, By Type (2024-2032) 8.5.3.2. Egypt High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 8.5.3.3. Egypt High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 8.5.3.4. Egypt High Strength Steel Market Size and Forecast, By End User (2024-2032) 8.5.4. Nigeria 8.5.4.1. Nigeria High Strength Steel Market Size and Forecast, By Type (2024-2032) 8.5.4.2. Nigeria High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 8.5.4.3. Nigeria High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 8.5.4.4. Nigeria High Strength Steel Market Size and Forecast, By End User (2024-2032) 8.5.5. Rest of ME&A 8.5.5.1. Rest of ME&A High Strength Steel Market Size and Forecast, By Type (2024-2032) 8.5.5.2. Rest of ME&A High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 8.5.5.3. Rest of ME&A High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 8.5.5.4. Rest of ME&A High Strength Steel Market Size and Forecast, By End User (2024-2032) 9. South America High Strength Steel Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032 9.1. South America High Strength Steel Market Size and Forecast, By Type (2024-2032) 9.2. South America High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 9.3. South America High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 9.4. South America High Strength Steel Market Size and Forecast, By End User (2024-2032) 9.5. South America High Strength Steel Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil High Strength Steel Market Size and Forecast, By Type (2024-2032) 9.5.1.2. Brazil High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 9.5.1.3. Brazil High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 9.5.1.4. Brazil High Strength Steel Market Size and Forecast, By End User (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina High Strength Steel Market Size and Forecast, By Type (2024-2032) 9.5.2.2. Argentina High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 9.5.2.3. Argentina High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 9.5.2.4. Argentina High Strength Steel Market Size and Forecast, By End User (2024-2032) 9.5.3. Colombia 9.5.3.1. Colombia High Strength Steel Market Size and Forecast, By Type (2024-2032) 9.5.3.2. Colombia High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 9.5.3.3. Colombia High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 9.5.3.4. Colombia High Strength Steel Market Size and Forecast, By End User (2024-2032) 9.5.4. Chile 9.5.4.1. Chile High Strength Steel Market Size and Forecast, By Type (2024-2032) 9.5.4.2. Chile High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 9.5.4.3. Chile High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 9.5.4.4. Chile High Strength Steel Market Size and Forecast, By End User (2024-2032) 9.5.5. Rest Of South America 9.5.5.1. Rest Of South America High Strength Steel Market Size and Forecast, By Type (2024-2032) 9.5.5.2. Rest Of South America High Strength Steel Market Size and Forecast, By Product Type (2024-2032) 9.5.5.3. Rest Of South America High Strength Steel Market Size and Forecast, By Application Type (2024-2032) 9.5.5.4. Rest Of South America High Strength Steel Market Size and Forecast, By End User (2024-2032) 10. Company Profile: Key Players 10.1. ArcelorMitta 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Nippon Steel Corporation 10.3. China Baowu Steel Group 10.4. POSCO 10.5. Nucor Corporation 10.6. United States Steel Corporation 10.7. Steel Dynamics, Inc. 10.8. ThyssenKrupp AG 10.9. SSAB AB 10.10. JFE Steel Corporation 10.11. Tata Steel 10.12. HBIS Group 10.13. JSW Steel 10.14. Hyundai Steel 10.15. Voestalpine AG 10.16. Salzgitter AG 10.17. Gerdau SA 10.18. Companhia Siderúrgica Nacional (CSN) 10.19. Ternium 10.20. SABIC 10.21. Hadeed 10.22. Qatar Steel 10.23. Emirates Steel 10.24. Usiminas 10.25. AK Steel Holding Corporation 11. Key Findings 12. Industry Recommendations 13. High Strength Steel Market: Research Methodology