Gluten Free Product market: size was valued at USD 6.9 Billion in 2023 and Gluten Free Product market grow by 8.7% from 2024 to 2030, reaching nearly USD 9.75 Billion. Objective: Maximize Market Research conducted a brief analysis of the Gluten Free Market. The purpose of this research is to provide stakeholders in the industry with a thorough insight into the Gluten Free Market. The analysis examines all areas of the industry, with a focus on significant companies such as market leaders, followers, and newcomers. The research is an investor's guide since it depicts the competitive analysis of major competitors in the Gluten Free Product market by product, price, financial situation, product portfolio, growth plans, and geographical presence.To know about the Research Methodology :- Request Free Sample Report

Gluten Free Product Market Overview:

Gluten is a protein primarily found in four grains wheat, barley, rye, and triticale. Its main purpose is to give the dough its elasticity, which is used to produce a line of products by imparting a chewy texture and retaining the product’s shape. This protein is not suitable for every consumer, as it results in various health-related issues like gluten ataxia, celiac disease, non-celiac gluten sensitivity, and allergies. So, companies are manufacturing a line of Gluten Free Products. The key driving factors for the Gluten Free Product Market, such as the rising prevalence of celiac disease, gluten sensitivity among individuals, rising consumption of nutritious food items, and many others are analyzed in the report. Some consumers adopt Gluten Free diets for perceived health benefits and weight management. Gluten Free Products are often marketed as part of a healthy lifestyle, attracting consumers who are conscious of their dietary choices, such as Conagra Brands, which is a key player in the Gluten Free Product market, supplies Udi’s Gluten Free Products like Gluten Free bread and bakery products. The demand for Legume flours, such as lentil and chickpea flour, is increasing as it is high-protein substitutes for conventional wheat flour. Legume flours offer a greater variety of Gluten Free Products such as crackers, pasta, and snacks. Maximize market research analysed the Gluten Free Product market over the past 5 years and by using the data, concluded that North America dominated the global Gluten Free Products market, with a 38.9% market revenue share in 2023. Additionally, their widespread availability at almost all grocery stores is expected to increase demand, especially in the United States. With more people becoming aware of celiac disease, the U.S. market is expected to rise by a significant CAGR.Gluten Free Product Market Dynamics:

Growing incidence of Celiac Disease & Gluten Intolerance The Celiac Disease Foundation evaluates the number of people suffering from celiac disease as doubling every 12 years, as per the U.S. National Library Of Medicine, the celiac acid incident is around 0.71% of the population, i.e. around 1 man in 141 people. Symptoms like bloating, abdominal discomfort, diarrhea, and constipation. Increased awareness, changes in eating habits, and genetic predisposition are all factors contributing to the rising prevalence of gluten intolerance and celiac disease. As per MMR analysis, in European coeliac Societies more than 7 million people are affected by celiac disease and the regional market has more than 12000 Gluten Free Products. The number of cases that are diagnosed is projected to keep growing as more people realize about these diseases, seek testing, and get treatment. The Gluten Free Products market is driven by the rising dominance of celiac disease and also the growing population shifting towards health. The demand for Gluten Free food has increased because of a significant rise in the prevalence of celiac disease and gluten intolerance globally.According to MMR, 12% (41500) of people with Down Syndrome have celiac disease. The 6% (165,000) of those diagnosed with Type 1 diabetes also have celiac disease. Of women struggling with fertility, 6% are due to celiac disease. Approximately 0.7% of the World’s population is allergic to wheat. About 8% of the U.S. population is gluten intolerant. The Dermatitis herpetiformis affects 10-15% of people with celiac disease.

Gluten Free Product Market Trends:

Healthy foods and nutritional supplements like nutraceuticals are becoming more popular. Rice and Wheat are replaced with Gluten Free Nutri-cereals example: Millet. The dietary trends and consumption patterns become change. The consumer prefers to intake green vegetables, fruits, green tea, protein food, and olive oil. Growing awareness about various allergies such as gluten allergies, celiac disease, and others. Gluten Free Product Market demand is increasing for healthy Gluten Free food globally. 1. The 54% of Gluten Free people were diagnosed with Celiacs. 35% considered themselves to have a gluten intolerance. 11% were to manage an autoimmune condition. And 7.5% were to heal a leaky gut. The small remainder varied: to lose weight, to have more energy, to eat healthier, wheat allergies, and other health conditions.Gluten Free Product Market Restraints: The Gluten Free Product market confronts revenue growth due to a high-cost structure that affects its manufacturing and pricing. The costs of the procedure of Gluten Free Products and techniques with maintaining the separate storage to avoid cross-contamination become higher production costs. Gluten Free Products are generally costly more than their gluten-containing counterparts with prices ranging from 200- 500% more expensive depending on the product and shopping location. For low-income families and individuals with limited resources. The availability of high-quality Gluten Free Products also varies across shopping venue and regions, making it difficult for some consumers to access them. Gluten Guard: Rising Awareness for Gluten Sensitivity The global market for Gluten Free Products offers a sizable opportunity due to rising knowledge of gluten-related sensitivities. With more individuals becoming aware of celiac illness and gluten intolerance, there is a growing need for Gluten Free Products. Because of this knowledge, food producers reach a wider audience and provide more products in this niche market. It encourages creativity and the production of safer, Gluten Free food options, opening doors for expansion and diversifying the market.

Gluten Free Product Market Regional Analysis Segmentation:

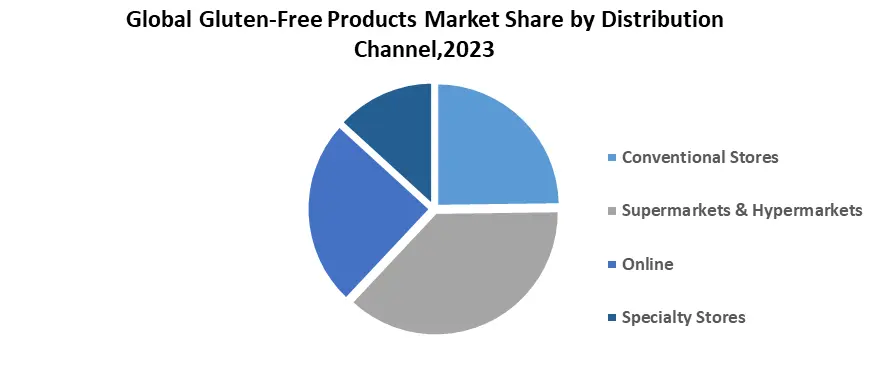

Based by Products: Market share of bakery products is over 29.7% of the total revenue in the Gluten Free Product market and is expected to continue its dominance in the forecast period. The Gluten Free bakery is expected to grow at a compound annual growth rate of 10.8% globally. Because low-carb, Gluten Free, rye, wheat-free, and other forms of bread have so many health benefits, the bread category is expected to hold the largest market share during the forecast period. Meats and poultry are naturally Gluten Free goods, it is expected that application drives the market for Gluten Free goods. China's meat consumption grew by 71%, contributing roughly 31% of the global rise in meat consumption, which increased by 60% overall in 2023. The growing demand for Gluten Free bread is the primary driver of the bakery and confectionery goods sector.Based on Distribution channels, The supermarkets and Hypermarkets segments accounted for the largest revenue share of 29.5% in 2023. Supermarkets or hypermarkets are easily accessible to a variety of product range items under one roof, and customers find it easy to choose products. Products without gluten, help to a good idea for promoting new products, which in turn helps to boost the Gluten Free Product market. Supermarkets give the advantage of catering to a large number of customers base so supermarkets and hypermarkets have significant sales volumes. 1. In 2023 around USD 695,185 million was generated through online sales in Europe, indicating a growing preference for online shopping for Gluten Free Products.

Gluten Free Product Market Regional Analysis:

North America dominates the Gluten Free Product Market with the highest market share accounting for 38.9% in 2023. The region is expected to grow during the forecast period and maintain its dominance by 2030. The North American market has been a significant player in the Gluten Free Products industry with a high prevalence of celiac disease and gluten sensitivity. The availability of a wide range of Gluten Free options along with increased health consciousness has resulted in a rise in demand for Gluten Free Products in European countries. The Latin America Middle East the awareness and demand for Gluten Free Products have been growing in the region. The Gluten Free trends are not limited to a specific region, and regional adaptations in consumer behavior and preferences are shaping the market's future.Gluten Free Product Market Competitive landscape: The market for Gluten Free Products is highly competitive, with multiple international corporations present in certain areas. The majority of the companies are vertically integrated for manufacturing Gluten Free foods, which provides a good product portfolio. The essential factors contributing to the growth of the global Gluten Free Products market include the changing consumer shift towards a healthier lifestyle, driven by concerns over gluten-related health issues and a desire for improved overall well-being. Key start-up players in Gluten Free Products are Vukoo, Skyroots, Sana, Panista, Wild & the Moon 1. Sana, a key start-up player in the Gluten Free Products market offers Gluten Free foods made from low-impact, sustainable crops. The start-up is focusing on using underutilized crops such as coconut, which require less water to cultivate and are rich in essential amino acids. 2. Vukoo, another key start-up player in Gluten Free Products offers plant-based Gourmet Bars that are Gluten Free protein bars. These bars consist of organic raw almonds sourced from Spain and Italy, They are also lactose-free, casein-free, and Gluten Free whey protein. 3. In 2023, Pauling announced it was a seed investor in Swedish Gluten Free pizza firm For Real Foods. 4. Morato’s Gluten Free arm Nt Food take hold of the “strategic management and commercial strategy” at Massimo Zero, according to a company statement. 5. Morato’s investment in Massimo Zero means it now takes over as the major shareholder from the private holding group Botzen Invest Euregio Finance, which has invested in the group since 2022. 6. As of November 2023, the companies residing in the Gold Medal Ventures investment portfolio include Urban Remedy, a California-based plant-based food company General Mills backed in 2018, and PetPlate, a US direct-to-consumer dog-food firm that invested three years earlier. 7. In 2023, the company used Bimbo Ventures to buy a minority stake in Rule Breaker Snacks, a US-based maker of vegan and Gluten Free treats.

Gluten-Free Products Market Scope: Inquire before buying

Global Gluten-Free Products Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 6.4 Bn. Forecast Period 2024 to 2030 CAGR: 7.6% Market Size in 2030: US $ 9.75 Bn. Segments Covered: by Product Bakery Products Dairy Alternatives Meat Alternatives condiments and Dressings Snacks & Ready to Eat products Pasta and Rice Infant food by Form Solid Liquid by Distribution Channel Conventional Stores Supermarkets& Hypermarkets Online Specialty Stores by Source Plant Rice & corn Oilseeds & Pulses Animal Dairy Meat Gluten-Free Products Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key players of Gluten Free Market

1. Conagra Brands, Inc. 2. The Hain Celestial Group 3. General Mills Inc. 4. Valeo Foods Group LTD 5. Mondelez International Inc. 6. Kellogg Co. 7. The Kraft Heinz Company 8. Hero Group 9. Seitz Gluten Free 10. Freedom Foods Group Limited 11. Eco tone 12. Army’s Kitchen Inc. 13. Genius foods 14. Boulder Brands Inc. 15. Glutamate 16. Hero AG 17. Quinoa corporation 18. Raisio plc. 19. Prepared Food 20. Bread 21. Pinnacle Foods Inc. Frequently Asked Questions: 1] Which region is expected to hold the highest share in the Global Gluten Free Product Market? Ans. The North American region is expected to hold the highest share of the Gluten Free Food Market. 2] What is the market size of the Global Gluten Free Product Market from 2023 -2030? Ans. The Gluten Free Product Market size was valued at USD 6.9 Billion IN 2023 reaching nearly USD 9.75 Billion in 2030. 3] What segments are covered in the Global Gluten Free Product Market? Ans. The segments covered in the Gluten Free Food Market report are based on Products, Forms, Sources, Distribution Channels, and Regions. 4] What is the growth rate of the Global Gluten Free Product Market? Ans. The growth rate of the Gluten Free Food Market is 8.7%. 5] What are the factors driving the Gluten Free Products market? Ans. Key factors that are driving the Gluten Free Products market growth include the rising prevalence of celiac disease and other diseases owing to unhealthy lifestyles.

1. Gluten Free Product Market: Research Methodology 2. Gluten Free Product Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Gluten Free Product Market: Dynamics 3.1. Gluten Free Product Market Trends by Region 3.1.1. North America Gluten Free Product Market Trends 3.1.2. Europe Gluten Free Product Market Trends 3.1.3. Asia Pacific Gluten Free Product Market Trends 3.1.4. Middle East and Africa Gluten Free Product Market Trends 3.1.5. South America Gluten Free Product Market Trends 3.2. Gluten Free Product Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Gluten Free Product Market Drivers 3.2.1.2. North America Gluten Free Product Market Restraints 3.2.1.3. North America Gluten Free Product Market Opportunities 3.2.1.4. North America Gluten Free Product Market Challenges 3.2.2. Europe 3.2.2.1. Europe Gluten Free Product Market Drivers 3.2.2.2. Europe Gluten Free Product Market Restraints 3.2.2.3. Europe Gluten Free Product Market Opportunities 3.2.2.4. Europe Gluten Free Product Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Gluten Free Product Market Drivers 3.2.3.2. Asia Pacific Gluten Free Product Market Restraints 3.2.3.3. Asia Pacific Gluten Free Product Market Opportunities 3.2.3.4. Asia Pacific Gluten Free Product Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Gluten Free Product Market Drivers 3.2.4.2. Middle East and Africa Gluten Free Product Market Restraints 3.2.4.3. Middle East and Africa Gluten Free Product Market Opportunities 3.2.4.4. Middle East and Africa Gluten Free Product Market Challenges 3.2.5. South America 3.2.5.1. South America Gluten Free Product Market Drivers 3.2.5.2. South America Gluten Free Product Market Restraints 3.2.5.3. South America Gluten Free Product Market Opportunities 3.2.5.4. South America Gluten Free Product Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technological Roadmap 3.6. Deployment Roadmap 3.7. Regulatory Landscape by Region 3.7.1. North America 3.7.2. Europe 3.7.3. Asia Pacific 3.7.4. Middle East and Africa 3.7.5. South America 3.8. Key Opinion Leader Analysis For Gluten Free Product Market 3.9. Analysis of Government Schemes and Initiatives For the Gluten Free Product Market 4. Gluten Free Product Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2030) 4.1. Gluten Free Product Market Size and Forecast, by Product(2024-2030) 4.1.1. Bakery Products 4.1.1.1. Dairy Alternatives 4.1.1.2. Meat Alternatives 4.1.1.3. Condiments and Dressings 4.1.1.4. Snacks & Ready to eat products 4.1.1.5. Pasta and Rice 4.2. Gluten Free Product Market Size and Forecast, by Form Type (2024-2030) 4.2.1.1. Solid 4.2.1.2. Liquid 4.3. Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 4.3.1. Conventional Stores 4.3.2. Supermarkets & Hypermarkets 4.3.3. Online 4.3.4. Specialty Stores 4.4. Gluten Free Product Market Size and Forecast, by Source(2024-2030) 4.4.1. Plants 4.4.1.1. Rice and Corn 4.4.1.2. Oilseeds and Pulses 4.4.2. Animal 4.4.2.1. Dairy 4.4.2.2. Meat 4.5. Gluten Free Product Market Size and Forecast, by Region (2024-2030) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Gluten Free Product Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2030) 5.1. North America Gluten Free Product Market Size and Forecast, by Product(2024-2030) 5.1.1.1. Dairy Alternatives 5.1.1.2. Meat Alternatives 5.1.1.3. Condiments and Dressings 5.1.1.4. Snacks & Ready to eat products 5.1.1.5. Pasta and Rice 5.2. North America Gluten Free Product Market Size and Forecast, by Form Type (2024-2030) 5.2.1.1. Solid 5.2.1.2. Liquid 5.3. North America Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 5.3.1.1. Conventional Stores 5.3.1.2. Supermarkets & Hypermarkets 5.3.1.3. Online 5.3.1.4. Specialty Stores 5.4. North America Gluten Free Product Market Size and Forecast, by Source(2024-2030) 5.4.1. Plants 5.4.1.1. Rice and Corn 5.4.1.2. Oilseeds and Pulses 5.4.2. Animal 5.4.2.1. Dairy 5.4.2.2. Meat 5.5. North America Gluten Free Product Market Size and Forecast, by Country (2024-2030) 5.5.1. United States 5.5.1.1. United States Gluten Free Product Market Size and Forecast, by Product(2024-2030) 5.5.1.2. Dairy Alternatives 5.5.1.3. Meat Alternatives 5.5.1.4. Condiments and Dressings 5.5.1.5. Snacks & Ready to eat products 5.5.1.6. Pasta and Rice 5.5.1.7. United States Gluten Free Product Market Size and Forecast, by Form Type (2024-2030) 5.5.1.8. Solid 5.5.1.9. Liquid 5.5.1.10. United States Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 5.5.1.11. Conventional Stores 5.5.1.12. Supermarkets & Hypermarkets 5.5.1.13. Online 5.5.1.14. Specialty Stores 5.5.1.15. United States Gluten Free Product Market Size and Forecast, by Source(2024-2030) 5.5.2. Plants 5.5.2.1. Rice and Corn 5.5.2.2. Oilseeds and Pulses 5.5.3. Animal 5.5.3.1. Dairy 5.5.3.2. Meat 5.5.4. Canada 5.5.4.1. Canada Gluten Free Product Market Size and Forecast, by Product(2024-2030) 5.5.4.2. Dairy Alternatives 5.5.4.3. Meat Alternatives 5.5.4.4. Condiments and Dressings 5.5.4.5. Snacks & Ready to eat products 5.5.4.6. Pasta and Rice 5.5.4.7. Canada Gluten Free Product Market Size and Forecast, by Form Type (2024-2030) 5.5.4.8. Solid 5.5.4.9. Liquid 5.5.4.10. Canada Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 5.5.4.11. Conventional Stores 5.5.4.12. Supermarkets & Hypermarkets 5.5.4.13. Online 5.5.4.14. Specialty Stores 5.5.4.15. Canada Gluten Free Product Market Size and Forecast, by Source (2024-2030) 5.5.5. Plants 5.5.5.1. Rice and Corn 5.5.5.2. Oilseeds and Pulses 5.5.6. Animal 5.5.6.1. Dairy 5.5.6.2. Meat 5.5.7. Mexico 5.5.7.1. Mexico Gluten Free Product Market Size and Forecast, by Product(2024-2030) 5.5.7.2. Dairy Alternatives 5.5.7.3. Meat Alternatives 5.5.7.4. Condiments and Dressings 5.5.7.5. Snacks & Ready to eat products 5.5.7.6. Pasta and Rice 5.5.7.6.1. Mexico Gluten Free Product Market Size and Forecast, by Form Type (2024-2030) 5.5.7.7. Solid 5.5.7.8. Liquid 5.5.7.9. Mexico Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 5.5.7.10. Conventional Stores 5.5.7.11. Supermarkets & Hypermarkets 5.5.7.12. Online 5.5.7.13. Specialty Stores 5.5.7.14. Mexico Gluten Free Product Market Size and Forecast, by Source (2024-2030) 5.5.8. Plants 5.5.8.1. Rice and Corn 5.5.8.2. Oilseeds and Pulses 5.5.9. Animal 5.5.9.1. Dairy 5.5.9.2. Meat 6. Europe Gluten Free Product Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2030) 6.1. Europe Gluten Free Product Market Size and Forecast, by Product(2024-2030) 6.2. Europe Gluten Free Product Market Size and Forecast, by Form Type (2024-2030) 6.3. Europe Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 6.4. Europe Gluten Free Product Market Size and Forecast, by Source(2024-2030) 6.5. Europe Gluten Free Product Market Size and Forecast, by Country (2024-2030) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Gluten Free Product Market Size and Forecast, by Product(2024-2030) 6.5.1.2. United Kingdom Gluten Free Product Market Size and Forecast, by Form Type (2024-2030) 6.5.1.3. United Kingdom Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 6.5.1.4. United Kingdom Gluten Free Product Market Size and Forecast, by Source(2024-2030) 6.5.2. France 6.5.2.1. France Gluten Free Product Market Size and Forecast, by Product(2024-2030) 6.5.2.2. France Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 6.5.2.3. France Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 6.5.2.4. France Gluten Free Product Market Size and Forecast, by Source(2024-2030) 6.5.3. Germany 6.5.3.1. Germany Gluten Free Product Market Size and Forecast, by Product(2024-2030) 6.5.3.2. Germany Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 6.5.3.3. Germany Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 6.5.3.4. Germany Gluten Free Product Market Size and Forecast, by Source(2024-2030) 6.5.4. Italy 6.5.4.1. Italy Gluten Free Product Market Size and Forecast, by Product(2024-2030) 6.5.4.2. Italy Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 6.5.4.3. Italy Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 6.5.4.4. Italy Gluten Free Product Market Size and Forecast, by Source(2024-2030) 6.5.5. Spain 6.5.5.1. Spain Gluten Free Product Market Size and Forecast, by Product(2024-2030) 6.5.5.2. Spain Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 6.5.5.3. Spain Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 6.5.5.4. Spain Gluten Free Product Market Size and Forecast, by Source(2024-2030) 6.5.6. Sweden 6.5.6.1. Sweden Gluten Free Product Market Size and Forecast, by Product(2024-2030) 6.5.6.2. Sweden Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 6.5.6.3. Sweden Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 6.5.6.4. Sweden Gluten Free Product Market Size and Forecast, by Source(2024-2030) 6.5.7. Austria 6.5.7.1. Austria Gluten Free Product Market Size and Forecast, by Product(2024-2030) 6.5.7.2. Austria Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 6.5.7.3. Austria Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 6.5.7.4. Austria Gluten Free Product Market Size and Forecast, by Source(2024-2030) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Gluten Free Product Market Size and Forecast, by Product(2024-2030) 6.5.8.2. Rest of Europe Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 6.5.8.3. Rest of Europe Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 6.5.8.4. Rest of Europe Gluten Free Product Market Size and Forecast, by Source(2024-2030) 7. Asia Pacific Gluten Free Product Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2030) 7.1. Asia Pacific Gluten Free Product Market Size and Forecast, by Product(2024-2030) 7.2. Asia Pacific Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 7.3. Asia Pacific Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 7.4. Asia Pacific Gluten Free Product Market Size and Forecast, by Source(2024-2030) 7.5. Asia Pacific Gluten Free Product Market Size and Forecast, by Country (2024-2030) 7.5.1. China 7.5.1.1. China Gluten Free Product Market Size and Forecast, by Product(2024-2030) 7.5.1.2. China Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 7.5.1.3. China Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 7.5.1.4. China Gluten Free Product Market Size and Forecast, by Source(2024-2030) 7.5.2. S Korea 7.5.2.1. S Korea Gluten Free Product Market Size and Forecast, by Product(2024-2030) 7.5.2.2. S Korea Gluten Free Product Market Size and Forecast, by Form Type (2024-2030) 7.5.2.3. S Korea Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 7.5.2.4. S Korea Gluten Free Product Market Size and Forecast, by Source(2024-2030) 7.5.3. Japan 7.5.3.1. Japan Gluten Free Product Market Size and Forecast, by Product(2024-2030) 7.5.3.2. Japan Gluten Free Product Market Size and Forecast, by Form Type (2024-2030) 7.5.3.3. Japan Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 7.5.3.4. Japan Gluten Free Product Market Size and Forecast, by Source(2024-2030) 7.5.4. India 7.5.4.1. India Gluten Free Product Market Size and Forecast, by Product(2024-2030) 7.5.4.2. India Gluten Free Product Market Size and Forecast, by Form Type (2024-2030) 7.5.4.3. India Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 7.5.4.4. India Gluten Free Product Market Size and Forecast, by Source(2024-2030) 7.5.5. Australia 7.5.5.1. Australia Gluten Free Product Market Size and Forecast, by Product(2024-2030) 7.5.5.2. Australia Gluten Free Product Market Size and Forecast, by Form Type (2024-2030) 7.5.5.3. Australia Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 7.5.5.4. Australia Gluten Free Product Market Size and Forecast, by Source(2024-2030) 7.5.6. Indonesia 7.5.6.1. Indonesia Gluten Free Product Market Size and Forecast, by Product(2024-2030) 7.5.6.2. Indonesia Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 7.5.6.3. Indonesia Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 7.5.6.4. Indonesia Gluten Free Product Market Size and Forecast, by Source(2024-2030) 7.5.7. Malaysia 7.5.7.1. Malaysia Gluten Free Product Market Size and Forecast, by Product(2024-2030) 7.5.7.2. Malaysia Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 7.5.7.3. Malaysia Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 7.5.7.4. Malaysia Gluten Free Product Market Size and Forecast, by Source(2024-2030) 7.5.8. Vietnam 7.5.8.1. Vietnam Gluten Free Product Market Size and Forecast, by Product(2024-2030) 7.5.8.2. Vietnam Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 7.5.8.3. Vietnam Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 7.5.8.4. Vietnam Gluten Free Product Market Size and Forecast, by Source(2024-2030) 7.5.9. Taiwan 7.5.9.1. Taiwan Gluten Free Product Market Size and Forecast, by Product(2024-2030) 7.5.9.2. Taiwan Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 7.5.9.3. Taiwan Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 7.5.9.4. Taiwan Gluten Free Product Market Size and Forecast, by Source(2024-2030) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Gluten Free Product Market Size and Forecast, by Product(2024-2030) 7.5.10.2. Rest of Asia Pacific Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 7.5.10.3. Rest of Asia Pacific Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 7.5.10.4. Rest of Asia Pacific Gluten Free Product Market Size and Forecast, by Source(2024-2030) 8. Middle East and Africa Gluten Free Product Market Size and Forecast by Segmentation (by Value in USD Billion) (2022-2029 8.1. Middle East and Africa Gluten Free Product Market Size and Forecast, by Product(2024-2030) 8.2. Middle East and Africa Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 8.3. Middle East and Africa Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 8.4. Middle East and Africa Gluten Free Product Market Size and Forecast, by Source(2024-2030) 8.5. Middle East and Africa Gluten Free Product Market Size and Forecast, by Country (2024-2030) 8.5.1. South Africa 8.5.1.1. South Africa Gluten Free Product Market Size and Forecast, by Product(2024-2030) 8.5.1.2. South Africa Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 8.5.1.3. South Africa Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 8.5.1.4. South Africa Gluten Free Product Market Size and Forecast, by Source(2024-2030) 8.5.2. GCC 8.5.2.1. GCC Gluten Free Product Market Size and Forecast, by Product(2024-2030) 8.5.2.2. GCC Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 8.5.2.3. GCC Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 8.5.2.4. GCC Gluten Free Product Market Size and Forecast, by Source(2024-2030) 8.5.3. Nigeria 8.5.3.1. Nigeria Gluten Free Product Market Size and Forecast, by Product(2024-2030) 8.5.3.2. Nigeria Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 8.5.3.3. Nigeria Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 8.5.3.4. Nigeria Gluten Free Product Market Size and Forecast, by Source(2024-2030) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Gluten Free Product Market Size and Forecast, by Product(2024-2030) 8.5.4.2. Rest of ME&A Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 8.5.4.3. Rest of ME&A Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 8.5.4.4. Rest of ME&A Gluten Free Product Market Size and Forecast, by Source(2024-2030) 9. South America Gluten Free Product Market Size and Forecast by Segmentation (by Value in USD Billion) (2022-2029 9.1. South America Gluten Free Product Market Size and Forecast, by Product(2024-2030) 9.2. South America Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 9.3. South America Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 9.4. South America Gluten Free Product Market Size and Forecast, by Source(2024-2030) 9.5. South America Gluten Free Product Market Size and Forecast, by Country (2024-2030) 9.5.1. Brazil 9.5.1.1. Brazil Gluten Free Product Market Size and Forecast, by Product(2024-2030) 9.5.1.2. Brazil Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 9.5.1.3. Brazil Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 9.5.1.4. Brazil Gluten Free Product Market Size and Forecast, by Source(2024-2030) 9.5.2. Argentina 9.5.2.1. Argentina Gluten Free Product Market Size and Forecast, by Product(2024-2030) 9.5.2.2. Argentina Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 9.5.2.3. Argentina Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 9.5.2.4. Brazil Gluten Free Product Market Size and Forecast, by Source(2024-2030) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Gluten Free Product Market Size and Forecast, by Product(2024-2030) 9.5.3.2. Rest Of South America Gluten Free Product Market Size and Forecast, by Form Type(2024-2030) 9.5.3.3. Rest Of South America Gluten Free Product Market Size and Forecast, by Distribution Channel(2024-2030) 9.5.3.4. Brazil Gluten Free Product Market Size and Forecast, by Source(2024-2030) 10. Gluten Free Product Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Gluten Free Product Market Companies, by market capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Heinz Kraft 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (small, medium, and large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Conagra Brands, Inc. 11.3. The Hain Celestial Group 11.4. General Mills Inc. 11.5. Valeo Foods Group Ltd. 11.6. Mondelez International Inc. 11.7. Kellogg Co. 11.8. The Kraft Heinz Company 11.9. Hero Group 11.10. Seitz glutenfree 11.11. Freedom Foods Group Ltd. 11.12. Eco tone 11.13. Army’s Kitchen Inc. 11.14. Genius Foods 11.15. Boulder Brands Inc. 11.16. Glutamate 11.17. Quinoa Corporation 11.18. Prepared Food 11.19. Bread 11.20. Pinnacle Foods Inc. 11.21. Raisio Plc 12. Key Findings 13. Industry Recommendations