The Trailers Market, valued at USD 37.87 Bn in 2024, is set to accelerate at a CAGR of 6% from 2025 to 2032, reaching nearly USD 60.36 Bn, fueled by growing demand for advanced trailer solutions, efficient goods transportation, and innovative logistics across global industries. Trailers are vehicles designed to be towed, enabling efficient transport of goods, materials, and equipment across industries. The Trailers Market encompasses the sale of trailers and related services by businesses, including organisations, sole proprietorships, and partnerships, that manufacture trailers for sale used in the transportation of goods, materials, and commodities. This market includes key segments such as enclosed trailers, dump trailers, tank trailers, flatbed trailers, and semi-trailers, as well as leading trailer manufacturers and trailer dealers worldwide. Businesses also provide trailer rental services and supply trailer parts and accessories, supporting logistics across commercial and industrial applications. Trailers are motorised or non-motorised vehicles designed to be towed by trucks, cars, tractors, and other vehicles, enabling efficient goods transportation. Hitch-mounted trailers and gooseneck trailers are widely used in logistics, construction, agriculture, and e-commerce operations, while light-duty and heavy-duty trailers cater to both commercial and industrial requirements. Historically, growth in the trailers market has been driven by economic growth in emerging nations, rising urbanisation, and increasing demand for global food and goods transportation. However, factors such as fluctuating trailer prices, regulatory pressures, and rising operational costs have occasionally constrained growth. Looking forward, market expansion is expected due to the development of e-commerce, increasing global population, and rising demand for utility trailers, flatbed trailers, and specialized commercial trailers. Challenges such as limited truck drivers, stricter emission regulations, and trade restrictions may moderate growth in certain regions. This report provides a detailed analysis of the Trailers Market by segment, including trailer type, end-use, interferometer type, and regional insights (North America, Europe, Asia Pacific, Middle East & Africa, South America). Comprehensive data, illustrations, and charts covering historical trends from 2019 to 2024 are included to provide actionable insights. Additionally, the report evaluates market drivers, challenges, opportunities, and barriers, offering investor recommendations based on a thorough review of the competitive landscape. With a focus on trailer sales, trailer rentals, trailer manufacturers, and trailer financing, this report serves as a definitive guide for stakeholders looking to understand market trends, growth prospects, and strategies to capitalize on the expanding trailers industry.To know about the Research Methodology :- Request Free Sample Report

Trailers Market Dynamics:

Market drivers:

The market for trailers is being driven by the accelerated urbanisation, particularly in developing nations. The region of East Asia and the Pacific, as well as Sub-Saharan Africa, experienced the biggest increases in urban population during the course of history. Greater urbanisation increased the need for mobility, which in turn raised the need for flatbed and automotive trailers to move cars and motorcycles in large numbers. The growth of the logistical supply chains as a result of the rising demand for goods from the urban population, particularly for fresh food, supported the demand for trailers. Additionally, in developed nations, road transportation accounted for about 72% of all freight moved across North America each year, making it the primary form of transportation for freight. The demand for trailers has increased as a result of the rapid urbanisation of populations in emerging nations and the tendency for goods to be transported by road in industrialised nations. One of the major sectors in the world in terms of revenue Typeion is fast-moving consumer goods (FMCG). The Types have a limited shelf life since they include perishable items with high customer demand, like meat, dairy, fruit, and vegetable Types, as well as baked goods. The goods are frequently purchased, quickly eaten, generally inexpensive, and sold in enormous quantities. The FMCG sector is divided into the food and beverage and personal care sectors. Rising incomes, an growing population, brand awareness, supportive laws, and the digitization of the buying process are major FMCG sector drivers. The logistics of FMCG items have changed in tandem with shifting consumer needs in the industry. All of this is encouraging the FMCG business to develop more technologically advanced trailers.Market restraints:

With rising pricing and regulatory demands, original equipment manufacturers (OEMs) of trailers in developed countries like Europe, North America, Japan, and South Korea were finding it difficult to set themselves apart from rivals. According to a survey by the American management consulting firm McKinsey, the cost of vehicles has essentially remained same since 1998 in real terms, and after accounting for inflation, the net consequence was a decrease in profit per vehicle. OEMs were able to improve quality and efficiency by 4–5 % annually, but stricter emissions and safety rules increased the cost of Typeion for a typical vehicle. Owing to pricing constraints and strict regulatory requirements, the price-cost gap in the trailers business is getting smaller, which is hampers market growth.Market Opportunities:

In the USA, the trailers market grow the highest. The manufacture of lighter trailers, the use of telematics, the use of innovative materials in the manufacture of trailers, and the use of automation and sensors in dump trailers are some market-trend-based strategies for the trailers market. Investing in R&D to create new trailers and bolstering M&A tactics to grow enterprises in new regions are examples of player-adopted strategies in the trailers market. Rising incomes, an expanding population, brand awareness, supportive laws, and the digitization of the buying process are major FMCG sector drivers. The logistics of FMCG items have changed in tandem with shifting consumer needs in the industry. All of this is encouraging the FMCG business to develop more technologically advanced trailers.Market Trends:

As industry rules change, trailer manufacturers are progressively making lightweight trailers. Owing to mounting pressures on trucking companies brought on both rising fuel prices and a more stringent regulatory environment, lighter trailers are becoming more popular. Regulations governing greenhouse gas emissions are forcing trailer makers to assemble more of their Types from lightweight parts. For example, aluminium parts are utilised to reduce the weight of trailers. It saves roughly 30 pounds to utilise an aluminium air tank in a truck trailer rather than a steel one. These smaller trailers help transportation businesses increase fleet safety and efficiency while lowering operating expenses and trailer downtime. Telematics technology is being included by trailer firms to facilitate efficient management of trailers for clients. Telematics is a technique for keeping an eye on automobiles that records their movements on a digital map using GPS and onboard diagnostics. Data sensors on the trailers that are linked to a modem are how trailer telematics functions. Data from the trailer have tracked, analysed, and used to enhance operational efficiency and traffic safety using GPS and a mobile network. Additionally, it aids trucking companies in maximising the use of trailers. The tyre pressure monitoring system (TPMS), another telematics element, aids in improving fuel efficiency for freight carriers.Trailers Market Segment Analysis:

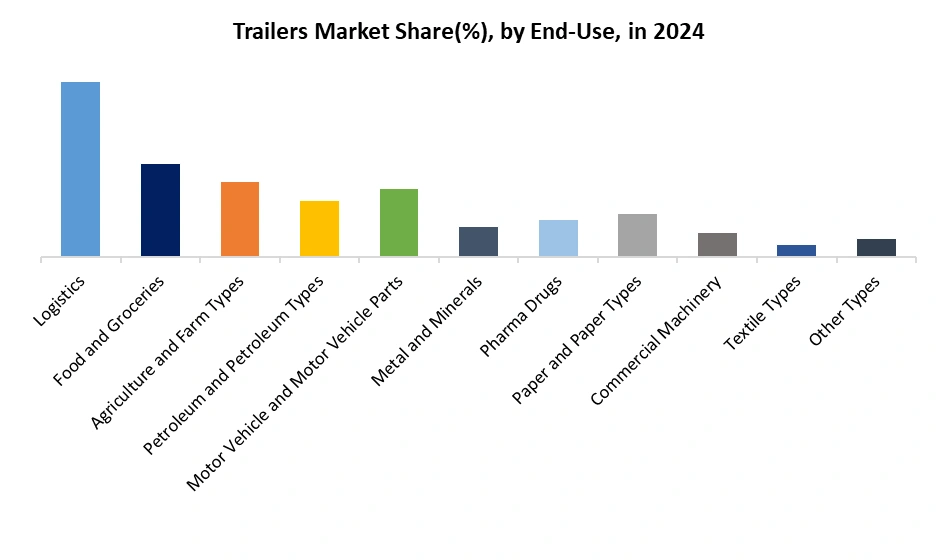

Based on Type, The Enclosed Trailers segment is expected to grow at the highest CAGR during the forecast period. Purchasing an enclosed trailer has several advantages. The three that are most frequently used are storage, protection, and security. Enclosed trailers give you the most storage space possible by having side walls where shelving is puted and a roof from which equipment hang. The fully covered style also shields your belongings from the elements and burglary. Your equipment is shielded from potentially damaging factors such as rain, snow, sun, dirt, and more by enclosed trailers. They additionally offer a higher level of security at the same time. When you lock the doors to your trailer, it makes it very difficult for someone to steal anything from within. Comparatively speaking to other open trailer types, enclosed trailers offer a lot more safety and security.Based on End-Use, The Logistics is expected to grow at the highest CAGR during the forecast period. Owing to its superior cost benefits over other modes, road transportation is the most popular mode in the logistics industry. Thus, one of the main end markets for vehicle trailers is logistics. In addition, the demand for logistics and supply chain services is rising owing to the quick development of the industrial, agricultural, electronics, textile, and garment industries. The majority of businesses rely on third-party logistics Types to reduce fleet investments, staff reductions, and to ensure that different kinds of containers, tanks, and flatbeds are available as needed. Additionally, owing to the huge growth of e-commerce operations, e-commerce enterprises are more dependent on logistics service Types to assure the transit of goods through warehouse and distribution hub. Owing to the adaptability afforded in terms of load-carrying capacity, logistics organisations, particularly less than truckload (LTL) and full truckload (FTL) freight shipping companies, are increasingly embracing automotive trailers. Additionally, compared to rigid trucks, trailers have the lowest cost of transportation per tonne per km, which is boosting their use in logistical operations.

Regional Insights:

Increased fleet operations result from the North American Free Commerce Agreement (NAFTA), which permits free trade between the US, Canada, and Mexico. As a result of increased corporate activity and consumer expenditure, freight transportation is expected to grow. The major players in the North American trailer market include Wabash, Hyundai Translead, Great Dane, and Utility Trailer. These participants are concentrating on working together to introduce technologically upgraded trailers. For instance, Wabash National and the all-electric refrigeration technology from eNow and Carrier Transicold partnered to provide environmentally friendly, thermally efficient refrigerated haulage. The customer reduce the number of batteries needed to move goods and extend the runtime of a battery system because to the significant improvement in thermal efficiency. The North American trailer market is now going through its replacement cycle because of the necessity to replace the old trailer population with more modern ones. As a result, it is expected that the North American trailer market rule the industry in terms of value throughout the forecast period. The most promising construction market is expected to be in Asia Pacific, and this trend is expected to continue in forecast period. The Asia Pacific trailer market is growing as a result of factors including steadily rising infrastructure projects, supporting investments from both local and foreign companies, and favourable trade conditions. The number of dams, airports, and hydropower projects in the area has increased. Songdo International Business District in South Korea, the China-Pakistan Economic Corridor, and Clark Green City in the Philippines are a few of the significant projects propelling the construction equipment industry. The market is driven by these megaprojects, which have increased demand for trailers for the transfer of heavy gear.Trailers Market Competitive Landscape

The competitive landscape of the Trailers Market is shaped by strong global players focusing on technological innovation, durability, and logistics efficiency. Hyundai Motor Company leverages advanced manufacturing and smart trailer technologies to strengthen its global logistics footprint. Great Dane LLC emphasizes product reliability and safety with its wide portfolio of dry vans, reefers, and flatbeds. Randon S.A. Implementos e Partes dominates the Latin American market through integrated trailer and component production. EnTrans International, LLC focuses on specialized tank and bulk trailers with sustainability-driven designs. MANAC Inc. leads in North America with lightweight, corrosion-resistant trailer solutions. CIMS offers customized trailer systems, prioritizing innovation and client-specific engineering solutions to enhance transport efficiency and operational performance worldwide.Trailers Market Scope: Inquire before buying

Trailers Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 37.87 Bn. Forecast Period 2025 to 2032 CAGR: 6% Market Size in 2032: USD 60.36 Bn. Segments Covered: by Type Enclosed Trailers Dump Trailers Tank Trailers Flatbed Trailers Other Trailers by End-Use Logistics Paper And Paper Types Pharma Drugs Textile Types Food and groceries Agriculture And Farm Types Petroleum And Petroleum Types Motor Vehicle And Motor Vehicle Parts Metal And Minerals Commercial Machinery Other Types Trailers Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Trailers Market, Key Players

1. Hyundai Motor Company 2. Great Dane LLC 3. Randon SA Implementos E Part 4. EnTrans International, LLC 5. MANAC Inc. 6. CIMS 7. Fujian Chnagchun 8. Shandong Union 9. Shekou Port 10. Hua-Win 11. Cargobull 12. Schmitz 13. Ashok Leyland 14. Tata International 15. Asia Motor Works 16. Satrac 17. Tratec Eng. 18. Mammut Industries 19. Maxi Trans 20. al-Kadi FAQs: 1. Which is the potential market for the Trailers Market in terms of the region? Ans. In Asia Pacific region, the growing business and educational sectors are expected to help drive the use of collaborative screens. 2. What are the opportunities for new market entrants? Ans. The key opportunity in the market is new initiatives from governments that provide funding for Trailers Markets in educational institutes 3. What is expected to drive the growth of the Trailers Market in the forecast period? Ans. A major driver in the Trailers Market is the prevalence of work from home and remote collaboration created by the COVID-19 pandemic 4. What is the projected market size & growth rate of the Trailers Market? Ans. The Trailers Market, valued at USD 37.87 Bn in 2024, is set to accelerate at a CAGR of 6% from 2025 to 2032, reaching nearly USD 60.36 Bn. 5. What segments are covered in the Trailers Market report? Ans. The segments covered are Type, End-Use and Region.

1. Trailers Market Introduction 1.1. Executive Summary 1.2. Market Size (2024) & Forecast (2025-2032) 1.3. Market Size (in Value USD), Volume (Units), and Market Share(%)- By Segments, Regions, and Country 2. Global Trailers Market: Competitive Landscape 2.1. MMR Competition Matrix [Revenue vs Market Share(%)] 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Product Segment 2.2.3. End-User Segment 2.2.4. Revenue (2024) 2.2.5. Revenue Growth YoY (%) 2.2.6. ASP (USD) 2.2.7. Market Share (%) 2.2.8. Profit Margin (%) 2.2.9. R&D Spend (% of revenue) 2.2.10. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Trailers Market: Dynamics 3.1. Trailers Market Trends 3.2. Trailers Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 4. Technological Advancements in the Trailers Market 4.1. Adoption of Telematics and IoT Solutions for Smart Trailer Monitoring 4.2. Integration of Advanced Braking, Suspension, and Safety Systems 4.3. Rising Role of Electric and Hybrid Trailer Technologies 4.4. Lightweight Materials and Aerodynamic Designs for Fuel Efficiency 4.5. Automation and AI-driven Predictive Maintenance in Modern Trailers 4.6. Digital Connectivity and Fleet Management Innovations 5. Supply Chain and Cost Structure Analysis 5.1. Detailed Value Chain of Trailer Manufacturing and Assembly 5.2. Cost Breakdown: Raw Materials, Labor, and Manufacturing Processes 5.3. Logistics, Transportation, and Distribution Cost Analysis 5.4. Supplier Network Assessment and Regional Sourcing Strategies 5.5. Strategies for Optimizing Production Costs and Increasing Margins 6. Market Investment and ROI Analysis 6.1. Capital Investment Trends and Infrastructure Developments 6.2. Return on Investment (ROI) in Trailer Leasing and Rental Businesses 6.3. Government Incentives and Funding Support for Trailer Manufacturers 6.4. Risk and Reward Analysis of Trailer Market Entry Strategies 6.5. Financial Performance Benchmarking of Key Industry Players 7. Customer Analysis and Buying Behavior 7.1. Fleet Owner Preferences and Trailer Selection Criteria 7.2. Shifting Consumer Focus Toward Cost-Effective and Durable Models 7.3. Influence of After-Sales Service and Warranty on Purchase Decisions 7.4. Trends in Rental vs Ownership Models Among Customers 7.5. Customer Satisfaction, Brand Loyalty, and Retention Strategies 8. Sustainability and Environmental Impact 8.1. Adoption of Eco-Friendly Materials and Green Trailer Design 8.2. Initiatives Toward Carbon Emission Reduction in Logistics Operations 8.3. Lifecycle Assessment of Trailers and Waste Management Practices 8.4. Role of Electric and Hydrogen Trailers in Sustainable Mobility 8.5. Compliance with Global Environmental Regulations and Standards 9. Regional Market Analysis 9.1. North America: Industrial Trailer Demand and OEM Landscape 9.2. Europe: Focus on Sustainability and Smart Trailer Technologies 9.3. Asia-Pacific: Expanding Logistics Sector and Manufacturing Hubs 9.4. Middle East & Africa: Infrastructure Development and Heavy-Duty Trailers 9.5. South America: Market Growth Driven by Construction and Agriculture 10. Trailers Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 10.1. Trailers Market Size and Forecast, By Type (2024-2032) 10.1.1. Enclosed Trailers 10.1.2. Dump Trailers 10.1.3. Tank Trailers 10.1.4. Flatbed Trailers 10.1.5. Other Trailers 10.2. Trailers Market Size and Forecast, By End-Use (2024-2032) 10.2.1. Logistics 10.2.2. Paper And Paper Types 10.2.3. Pharma Drugs 10.2.4. Textile Types 10.2.5. Food and groceries 10.2.6. Agriculture And Farm Types 10.2.7. Petroleum And Petroleum Types 10.2.8. Motor Vehicle And Motor Vehicle Parts 10.2.9. Metal And Minerals 10.2.10. Commercial Machinery 10.2.11. Other Types 10.3. Trailers Market Size and Forecast, By Region (2024-2032) 10.3.1. North America 10.3.2. Europe 10.3.3. Asia Pacific 10.3.4. Middle East and Africa 10.3.5. South America 11. North America Trailers Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 11.1. North America Trailers Market Size and Forecast, By Type (2024-2032) 11.1.1. Enclosed Trailers 11.1.2. Dump Trailers 11.1.3. Tank Trailers 11.1.4. Flatbed Trailers 11.1.5. Other Trailers 11.2. North America Trailers Market Size and Forecast, By End-Use (2024-2032) 11.2.1. Logistics 11.2.2. Paper And Paper Types 11.2.3. Pharma Drugs 11.2.4. Textile Types 11.2.5. Food and groceries 11.2.6. Agriculture And Farm Types 11.2.7. Petroleum And Petroleum Types 11.2.8. Motor Vehicle And Motor Vehicle Parts 11.2.9. Metal And Minerals 11.2.10. Commercial Machinery 11.2.11. Other Types 11.3. North America Trailers Market Size and Forecast, by Country (2024-2032) 11.3.1. United States 11.3.1.1. United States Trailers Market Size and Forecast, By Type (2024-2032) 11.3.1.1.1. Enclosed Trailers 11.3.1.1.2. Dump Trailers 11.3.1.1.3. Tank Trailers 11.3.1.1.4. Flatbed Trailers 11.3.1.1.5. Other Trailers 11.3.1.2. United States Trailers Market Size and Forecast, By End-Use (2024-2032) 11.3.1.2.1. Logistics 11.3.1.2.2. Paper And Paper Types 11.3.1.2.3. Pharma Drugs 11.3.1.2.4. Textile Types 11.3.1.2.5. Food and groceries 11.3.1.2.6. Agriculture And Farm Types 11.3.1.2.7. Petroleum And Petroleum Types 11.3.1.2.8. Motor Vehicle And Motor Vehicle Parts 11.3.1.2.9. Metal And Minerals 11.3.1.2.10. Commercial Machinery 11.3.1.2.11. Other Types 11.3.2. Canada 11.3.2.1. Canada Trailers Market Size and Forecast, By Type (2024-2032) 11.3.2.1.1. Enclosed Trailers 11.3.2.1.2. Dump Trailers 11.3.2.1.3. Tank Trailers 11.3.2.1.4. Flatbed Trailers 11.3.2.1.5. Other Trailers 11.3.2.2. Canada Trailers Market Size and Forecast, By End-Use (2024-2032) 11.3.2.2.1. Logistics 11.3.2.2.2. Paper And Paper Types 11.3.2.2.3. Pharma Drugs 11.3.2.2.4. Textile Types 11.3.2.2.5. Food and groceries 11.3.2.2.6. Agriculture And Farm Types 11.3.2.2.7. Petroleum And Petroleum Types 11.3.2.2.8. Motor Vehicle And Motor Vehicle Parts 11.3.2.2.9. Metal And Minerals 11.3.2.2.10. Commercial Machinery 11.3.2.2.11. Other Types 11.3.3. Mexico 11.3.3.1. Mexico Trailers Market Size and Forecast, By Type (2024-2032) 11.3.3.1.1. Enclosed Trailers 11.3.3.1.2. Dump Trailers 11.3.3.1.3. Tank Trailers 11.3.3.1.4. Flatbed Trailers 11.3.3.1.5. Other Trailers 11.3.3.2. Mexico Trailers Market Size and Forecast, By End-Use (2024-2032) 11.3.3.2.1. Logistics 11.3.3.2.2. Paper And Paper Types 11.3.3.2.3. Pharma Drugs 11.3.3.2.4. Textile Types 11.3.3.2.5. Food and groceries 11.3.3.2.6. Agriculture And Farm Types 11.3.3.2.7. Petroleum And Petroleum Types 11.3.3.2.8. Motor Vehicle And Motor Vehicle Parts 11.3.3.2.9. Metal And Minerals 11.3.3.2.10. Commercial Machinery 11.3.3.2.11. Other Types 12. Europe Trailers Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 12.1. Europe Trailers Market Size and Forecast, By Type (2024-2032) 12.2. Europe Trailers Market Size and Forecast, By End-Use (2024-2032) 12.3. Europe Trailers Market Size and Forecast, by Country (2024-2032) 12.3.1. United Kingdom 12.3.1.1. United Kingdom Trailers Market Size and Forecast, By Type (2024-2032) 12.3.1.2. United Kingdom Trailers Market Size and Forecast, By End-Use (2024-2032) 12.3.1.3. United Kingdom Trailers Market Size and Forecast, By Distribution Channel (2024-2032) 12.3.1.4. United Kingdom Trailers Market Size and Forecast, By Application (2024-2032) 12.3.2. France 12.3.2.1. France Trailers Market Size and Forecast, By Type (2024-2032) 12.3.2.2. France Trailers Market Size and Forecast, By End-Use (2024-2032) 12.3.3. Germany 12.3.3.1. Germany Trailers Market Size and Forecast, By Type (2024-2032) 12.3.3.2. Germany Trailers Market Size and Forecast, By End-Use (2024-2032) 12.3.4. Italy 12.3.4.1. Italy Trailers Market Size and Forecast, By Type (2024-2032) 12.3.4.2. Italy Trailers Market Size and Forecast, By End-Use (2024-2032) 12.3.5. Spain 12.3.5.1. Spain Trailers Market Size and Forecast, By Type (2024-2032) 12.3.5.2. Spain Trailers Market Size and Forecast, By End-Use (2024-2032) 12.3.6. Sweden 12.3.6.1. Sweden Trailers Market Size and Forecast, By Type (2024-2032) 12.3.6.2. Sweden Trailers Market Size and Forecast, By End-Use (2024-2032) 12.3.7. Russia 12.3.7.1. Russia Trailers Market Size and Forecast, By Type (2024-2032) 12.3.7.2. Russia Trailers Market Size and Forecast, By End-Use (2024-2032) 12.3.8. Rest of Europe 12.3.8.1. Rest of Europe Trailers Market Size and Forecast, By Type (2024-2032) 12.3.8.2. Rest of Europe Trailers Market Size and Forecast, By End-Use (2024-2032) 13. Asia Pacific Trailers Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 13.1. Asia Pacific Trailers Market Size and Forecast, By Type (2024-2032) 13.2. Asia Pacific Trailers Market Size and Forecast, By End-Use (2024-2032) 13.3. Asia Pacific Trailers Market Size and Forecast, by Country (2024-2032) 13.3.1. China 13.3.1.1. China Trailers Market Size and Forecast, By Type (2024-2032) 13.3.1.2. China Trailers Market Size and Forecast, By End-Use (2024-2032) 13.3.2. S Korea 13.3.2.1. S Korea Trailers Market Size and Forecast, By Type (2024-2032) 13.3.2.2. S Korea Trailers Market Size and Forecast, By End-Use (2024-2032) 13.3.3. Japan 13.3.3.1. Japan Trailers Market Size and Forecast, By Type (2024-2032) 13.3.3.2. Japan Trailers Market Size and Forecast, By End-Use (2024-2032) 13.3.4. India 13.3.4.1. India Trailers Market Size and Forecast, By Type (2024-2032) 13.3.4.2. India Trailers Market Size and Forecast, By End-Use (2024-2032) 13.3.5. Australia 13.3.5.1. Australia Trailers Market Size and Forecast, By Type (2024-2032) 13.3.5.2. Australia Trailers Market Size and Forecast, By End-Use (2024-2032) 13.3.6. Indonesia 13.3.6.1. Indonesia Trailers Market Size and Forecast, By Type (2024-2032) 13.3.6.2. Indonesia Trailers Market Size and Forecast, By End-Use (2024-2032) 13.3.7. Malaysia 13.3.7.1. Malaysia Trailers Market Size and Forecast, By Type (2024-2032) 13.3.7.2. Malaysia Trailers Market Size and Forecast, By End-Use (2024-2032) 13.3.8. Philippines 13.3.8.1. Philippines Trailers Market Size and Forecast, By Type (2024-2032) 13.3.8.2. Philippines Trailers Market Size and Forecast, By End-Use (2024-2032) 13.3.9. Thailand 13.3.9.1. Thailand Trailers Market Size and Forecast, By Type (2024-2032) 13.3.9.2. Thailand Trailers Market Size and Forecast, By End-Use (2024-2032) 13.3.10. Vietnam 13.3.10.1. Vietnam Trailers Market Size and Forecast, By Type (2024-2032) 13.3.10.2. Vietnam Trailers Market Size and Forecast, By End-Use (2024-2032) 13.3.11. Rest of Asia Pacific 13.3.11.1. Rest of Asia Pacific Trailers Market Size and Forecast, By Type (2024-2032) 13.3.11.2. Rest of Asia Pacific Trailers Market Size and Forecast, By End-Use (2024-2032) 14. Middle East and Africa Trailers Market Size and Forecast (by Value in USD Million) (2024-2032 14.1. Middle East and Africa Trailers Market Size and Forecast, By Type (2024-2032) 14.2. Middle East and Africa Trailers Market Size and Forecast, By End-Use (2024-2032) 14.3. Middle East and Africa Trailers Market Size and Forecast, by Country (2024-2032) 14.3.1. South Africa 14.3.1.1. South Africa Trailers Market Size and Forecast, By Type (2024-2032) 14.3.1.2. South Africa Trailers Market Size and Forecast, By End-Use (2024-2032) 14.3.2. GCC 14.3.2.1. GCC Trailers Market Size and Forecast, By Type (2024-2032) 14.3.2.2. GCC Trailers Market Size and Forecast, By End-Use (2024-2032) 14.3.3. Egypt 14.3.3.1. Egypt Trailers Market Size and Forecast, By Type (2024-2032) 14.3.3.2. Egypt Trailers Market Size and Forecast, By End-Use (2024-2032) 14.3.4. Nigeria 14.3.4.1. Nigeria Trailers Market Size and Forecast, By Type (2024-2032) 14.3.4.2. Nigeria Trailers Market Size and Forecast, By End-Use (2024-2032) 14.3.5. Rest of ME&A 14.3.5.1. Rest of ME&A Trailers Market Size and Forecast, By Type (2024-2032) 14.3.5.2. Rest of ME&A Trailers Market Size and Forecast, By End-Use (2024-2032) 15. South America Trailers Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032 15.1. South America Trailers Market Size and Forecast, By Type (2024-2032) 15.2. South America Trailers Market Size and Forecast, By End-Use (2024-2032) 15.3. South America Trailers Market Size and Forecast, by Country (2024-2032) 15.3.1. Brazil 15.3.1.1. Brazil Trailers Market Size and Forecast, By Type (2024-2032) 15.3.1.2. Brazil Trailers Market Size and Forecast, By End-Use (2024-2032) 15.3.2. Argentina 15.3.2.1. Argentina Trailers Market Size and Forecast, By Type (2024-2032) 15.3.2.2. Argentina Trailers Market Size and Forecast, By End-Use (2024-2032) 15.3.3. Colombia 15.3.3.1. Colombia Trailers Market Size and Forecast, By Type (2024-2032) 15.3.3.2. Colombia Trailers Market Size and Forecast, By End-Use (2024-2032) 15.3.4. Chile 15.3.4.1. Chile Trailers Market Size and Forecast, By Type (2024-2032) 15.3.4.2. Chile Trailers Market Size and Forecast, By End-Use (2024-2032) 15.3.5. Rest Of South America 15.3.5.1. Rest Of South America Trailers Market Size and Forecast, By Type (2024-2032) 15.3.5.2. Rest Of South America Trailers Market Size and Forecast, By End-Use (2024-2032) 16. Company Profile: Key Players 16.1. Hyundai Motor Company 16.1.1. Company Overview 16.1.2. Business Portfolio 16.1.3. Financial Overview 16.1.3.1. Total Company Revenue (2022-2024) 16.1.3.2. Cost of Sales (2022-2024) 16.1.3.3. Net Profit (2022-2024) 16.1.4. SWOT Analysis 16.1.5. Strategic Analysis 16.1.6. Recent Developments 16.2. Great Dane LLC 16.3. Randon SA Implementos E Part 16.4. EnTrans International, LLC 16.5. MANAC Inc. 16.6. CIMS 16.7. Fujian Chnagchun 16.8. Shandong Union 16.9. Shekou Port 16.10. Hua-Win 16.11. Cargobull 16.12. Schmitz 16.13. Ashok Leyland 16.14. Tata International 16.15. Asia Motor Works 16.16. Satrac 16.17. Tratec Eng. 16.18. Mammut Industries 16.19. Maxi Trans 16.20. al-Kadi 17. Key Findings 18. Industry Recommendations 19. Trailers Market: Research Methodology