The Tantalum Market size was valued at USD 318.9 million in 2023 and the total Tantalum revenue is expected to grow at 4.80 % from 2024 to 2030, reaching nearly USD 442.78 million. The chemical element tantalum is a transition metal. It has a shiny, silvery-grey and gives significant value in a range of applications. Tin is commonly found in association with niobium and tantalum, Cassiterite is the primary tin mineral, typically containing sizeable quantities of tantalum (Ta) compound.To know about the Research Methodology :- Request Free Sample Report The tantalum industry is expected to grow due to the high growth of tantalum in various uses. The tantalum market is driven by the high demand for tantalum in the electronics trade and the production of semiconductors, capacitors, and other electronic equipment, also in the aerospace, medical, and chemical sectors. The market is divided based on product systems such as Tantalum Carbide, Lithium Tantalite, Tantalum Oxide, and Others. By applications including capacitors, semiconductors, engine turbine blades, medical equipment, and chemical processing equipment. Capacitors and high military applications are the key growth drivers for tantalum market. In the electrical industry, the usage of tantalum alloys in aviation and gas turbines is expected to fuel tantalum market growth during the forecast period. Replacing solid capacitors with polymer tantalum capacitors acts as an opportunity for the tantalum market. APAC is dominating the tantalum market with China being dominant player in tantalum market as in the electrical industry, the usage of tantalum alloys in aviation and gas turbines is growing, and replacing solid capacitors with polymer tantalum capacitors acts as an opportunity for the tantalum industry in China. China owns 3 mines that produce tantalum, namely, Nanping mine, Tongliao mine, and Yichun mine. APAC is followed by North America, which holds the second-largest market share in the global tantalum market and is expected to grow at a CAGR of 3-5%. Global Advanced Metals Pty Ltd, Pilbara Minerals, Alliance Mineral Assets Limited, AMG Advanced Metallurgical Group N.V., and Minsur (Mining Taboca are one of the key players catering to the growing demand of tantalum market.

Tantalum Market Dynamics:

High demand in the electronics industry drives the Tantalum Market The high demand for tantalum in the production of electronic devices and gadgets has driven the tantalum market growth. The major forms of tantalum are wire and powder. The increasing demand for Tantalum is due to tantalum carbide used to make cutting tools, whereas tantalum oxide is used to make camera lenses and X-ray equipment, increasing the need for capacitors in personal computer production, mobile phones, and automotive electronics. These mentioned types of tantalum are key contributors for the growth of the tantalum market. Growth of the Aerospace Industry: Tantalum is utilized in aerospace and defense as a heat-resistant high-strength material for rockets, missiles, and jet engines, and also as a part of control and regulatory systems. The aerospace industry is driving the market growth of the tantalum market. Federal Aviation Administration (FAA), the total commercial aircraft fleet, is expected to grow .This increase in aerospace industry drive the growth for tantalum market. Innovation of High Technology is a New Opportunity for Tantalum Market There has been an increase in demand for electronic devices in the industrial sector the development and adoption of high technology and other such advanced techniques in industries around the globe. Growth of the Tantalum market is being accelerated by technology-driven transformation, including the deployment of networks and Internet of Things services. This has increased demand for electronic devices and appliances, including laptops, computers, air conditioners, and other items. The demand for tantalum is likely to rise with the growth of electronics manufacturing during the forecast period. Limited Supply of Tantalum Challenges the Tantalum Market Tantalum is a relatively uncommon metal, and only a few countries, including Rwanda and the Democratic Republic of the Congo (DRC), have significant reserves. Tantalum can be replaced with other materials applications, which can inferior demand and prices. Also, supply fluctuations had an impact on the global tantalum market as a result of political unrest and conflict in these areas. Such fluctuations may hinder the market.

Tantalum Market Segment Analysis:

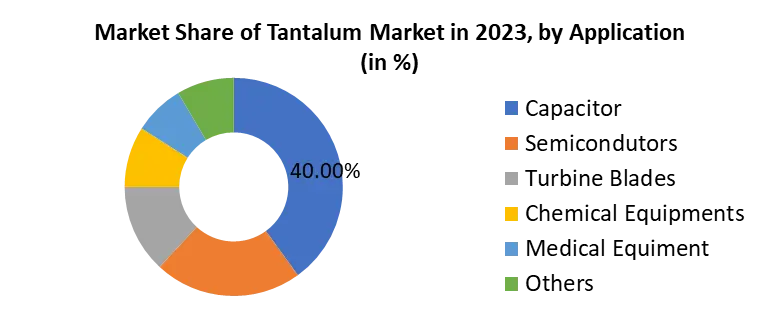

By Application, the Application segment is divided into a capacitor, Semiconductors, Turbine Blades, and others. Capacitors are many types such as tantalum electrolytic capacitors, tantalum capacitors with porous anode and liquid electrolyte, and tantalum capacitors with porous anode and solid electrolyte. Tantalum Capacitors Market size is estimated at USD 3.62 billion in 2023. Approx. 75% of total tantalum electrolytic capacitors are manufactured as tantalum electrolytic chip capacitors in Surface Mount Devices. Tantalum electrolytic capacitors are demanded and used in electronic devices for energy conservation. Europe is expected to grow with a large share of the tantalum capacitor market during the forecast period. Tantalum-based semiconductors are the second dominant segment in the Tantalum Market application, semiconductors including tantalum oxide, tantalite, and tantalum nitride, which are among the most important photocatalysts. Tantalum oxide plays an important role in tantalum semiconductors and tantalum oxide band energy that band energy with their positive and negative conductors is used in solar water splitting technology, hydrogen reaction, and other chemical equipment and reactions.

Tantalum Market Regional Insights:

Asia Pacific is expected larger volume share of 46.5% in the global tantalum market, due to tantalum demand and growth in this region driven by booming demand from key industries including electrical & electronics, aerospace, and others, and also by the growth of the industrial area in APAC. China has the largest consumer of tantalum in the Asia-Pacific region. Capacitors and high military applications are the serious consumption areas for tantalum in the country, China owns 3 mines that produce tantalum, namely, Nanping mine, Tongliao mine, and Yichun mine, which has 76 MT of tantalum. Most of the tantalum smelting companies are present in this region. For instance, Conghua Tantalum and Niobium, Jiujiang Tangbre Co., Ltd, Ningxia Orient Tantalum Industry Co., Ltd., Zhaoqing Duoluoshan Non-ferrous Metals Co., Ltd are some tantalum smelting industries located in China. Global Advanced Metals Japan K.K., H.C. Starck Ltd., Taki Chemical Co., Ltd. Are located in Japan, this is resulting in fueling the growth of the tantalum market. The North American region is expected a significant growth rate in the tantalum market during the forecast period. Thanks to the companies, which are located in the United States that produce tantalum alloys, capacitors, carbides, compounds, and tantalum metal from imported tantalum ores and concentrates and tantalum-containing materials in the North American region which lead the tantalum market.Competitive Landscapes: The production of technological advancements and competitors' strategies, such as acquisitions, joint ventures, and partnerships, has opened up tantalum market prospects. For Instance, Admat Inc. has announced an expanded Tantalum portfolio today with the addition of Tantalum 7.5% Tungsten wire. This alloy is designed for use in chlorination systems for water purification. TANIOBIS GmbH owed EUR 28 million to enhance its facilities at the Map Ta Phut plant in Thailand, aiming to boost the production capacity of functional tantalum powder.

Global Tantalum Market Scope: Inquire before buying

Global Tantalum Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 318.9 Mn. Forecast Period 2024 to 2030 CAGR: 4.80% Market Size in 2030: US $ 442.78 Mn. Segments Covered: by Form Tantalum Carbide Lithium Tantalite Tantalum Oxide Others by Grade Type Medical Grade Tantalum Commercial Grade Tantalum by Application Capacitors Semiconductors Engine Turbine Blades Chemical Processing Equipment Medical Equipment Others by End-User Aerospace Electrical & Electronics Medical & Healthcare Chemical & Pharmaceuticals Others Tantalum Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Tantalum Market Key Players:

1. All Metal Sales, Inc. (United States) 2. Admat, Inc. (Pennsylvania, United States) 3. AMG Advanced Metallurgical Group (PA, United States,) 4. Ultramet. (Pacoima CA, United States) 5. Atlantic Equipment Engineers, Inc. (Upper Saddle River, New Jersey, United States.) 6. California Metal & Supply, Inc. (California, United States) 7. Accumet Materials Co. (New York, United States) 8. Mokawa Inc. (United States) 9. High-Performance Alloys, Inc. (Indiana, United States) 10. ConceptMetal (France, Europe) 11. TANIOBIS GmbH (Niedersachsen, Germany) 12. RS-Recycling GmbH (Germany) 13. JX Metals Europe GmbH (Neue Mainzer Europe) 14. Ultra Metal Minor Limited (Hunan, China) 15. Advanced Metals Pty Ltd(Rajasthan) 16. Pilbara Minerals (WA, Australia) 17. Ningxia Orient Tantalum Industry Co. Ltd (Ningxia, China) 18. Alliance Mineral Assets Limited. (Australia) 19. Multotec (Johannesburg, South Africa ) 20. Ethiopia Mineral Development Share Company (Ethiopia, ME&A) FAQs: 1. What is the market size of the Global Market in 2023? Ans. The market size of the Global Tantalum Market in 2023 is 2.21 Kilotons. 2. What are the different segments of the Global Market? Ans. The Global Tantalum Market is divided into four segments i.e. By Product, By Grade Type, By Application, and By End-User. 3. What is the study period of this global tantalum market? Ans. The Global Tantalum Market will be studied from 2023 to 2030. 4. What is the projected market size & growth rate of the Tantalum Market? Ans. The Tantalum Market size was valued at 2.21 Kilotons in 2023 and the total Tantalum revenue is expected to grow at a CAGR of 4.60% from 2024 to 2030, reaching nearly 3.03 kilotons. 5. Which region is expected to hold the highest Global Tantalum Market share? Ans. The Asia Pacific dominates the market share in the global Tantalum market.

1. Tantalum Market: Research Methodology 2. Tantalum Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Tantalum Market: Dynamics 3.1 Tantalum Market Trends by Region 3.1.1 Global Tantalum Market Trends 3.1.2 North America Tantalum Market Trends 3.1.3 Europe Tantalum Market Trends 3.1.4 Asia Pacific Tantalum Market Trends 3.1.5 Middle East and Africa Tantalum Market Trends 3.1.6 South America Tantalum Market Trends 3.2 Tantalum Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Tantalum Market Drivers 3.2.1.2 North America Tantalum Market Restraints 3.2.1.3 North America Tantalum Market Opportunities 3.2.1.4 North America Tantalum Market Challenges 3.2.2 Europe 3.2.2.1 Europe Tantalum Market Drivers 3.2.2.2 Europe Tantalum Market Restraints 3.2.2.3 Europe Tantalum Market Opportunities 3.2.2.4 Europe Tantalum Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Tantalum Market Drivers 3.2.3.2 Asia Pacific Tantalum Market Restraints 3.2.3.3 Asia Pacific Tantalum Market Opportunities 3.2.3.4 Asia Pacific Tantalum Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Tantalum Market Drivers 3.2.4.2 Middle East and Africa Tantalum Market Restraints 3.2.4.3 Middle East and Africa Tantalum Market Opportunities 3.2.4.4 Middle East and Africa Tantalum Market Challenges 3.2.5 South America 3.2.5.1 South America Tantalum Market Drivers 3.2.5.2 South America Tantalum Market Restraints 3.2.5.3 South America Tantalum Market Opportunities 3.2.5.4 South America Tantalum Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power of Suppliers 3.3.2 Bargaining Power of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 Global 3.6.2 North America 3.6.3 Europe 3.6.4 Asia Pacific 3.6.5 Middle East and Africa 3.6.6 South America 3.7 Analysis of Government Schemes and Initiatives for the Tantalum Industry 3.8 The Global Pandemic and Redefining of The Tantalum Industry Landscape 4. Global Tantalum Market: Global Market Size and Forecast by Segmentation(2024-2030) 4.1 Global Tantalum Market Size and Forecast, By Form (2024-2030) 4.1.1 Tantalum Carbide 4.1.2 Lithium Tantalite 4.1.3 Tantalum Oxide 4.1.4 Others 4.2 Global Tantalum Market Size and Forecast, By Grade Type (2024-2030) 4.2.1 Medical Grade Tantalum 4.2.2 Commercial Grade Tantalum 4.3 Global Tantalum Market Size and Forecast, By End User (2024-2030) 4.3.1 Aerospace 4.3.2 Electrical & Electronics 4.3.3 Medical & Healthcare 4.3.4 Chemical & Pharmaceuticals 4.3.5 Others 4.4 Global Tantalum Market Size and Forecast, By Application (2024-2030) 4.4.1 Capacitors 4.4.2 Semiconductors 4.4.3 Engine Turbine Blades 4.4.4 Chemical Processing Equipment 4.4.5 Medical Equipment 4.4.6 Others 4.5 Global Tantalum Market Size and Forecast, by Region (2024-2030) 4.5.1 North America 4.5.2 Europe 4.5.3 Asia Pacific 4.5.4 Middle East and Africa 4.5.5 South America 5. North America Tantalum Market Size and Forecast by Segmentation (2024-2030) 5.1 North America Tantalum Market Size and Forecast, By Form (2024-2030) 5.1.1 Tantalum Carbide 5.1.2 Lithium Tantalite 5.1.3 Tantalum Oxide 5.1.4 Others 5.2 North America Tantalum Market Size and Forecast, By Grade Type (2024-2030) 5.2.1 Medical Grade Tantalum 5.2.2 Commercial Grade Tantalum 5.3 North America Tantalum Market Size and Forecast, By End User (2024-2030) 5.3.1 Aerospace 5.3.2 Electrical & Electronics 5.3.3 Medical & Healthcare 5.3.4 Chemical & Pharmaceuticals 5.3.5 Others 5.4 North America Tantalum Market Size and Forecast, By Application (2024-2030) 5.4.1 Capacitors 5.4.2 Semiconductors 5.4.3 Engine Turbine Blades 5.4.4 Chemical Processing Equipment 5.4.5 Medical Equipment 5.4.6 Others 5.5 North America Tantalum Market Size and Forecast, by Country (2024-2030) 5.5.1 United States 5.5.1.1 United States Tantalum Market Size and Forecast, By Form (2024-2030) 5.5.1.1.1 Tantalum Carbide 5.5.1.1.2 Lithium Tantalite 5.5.1.1.3 Tantalum Oxide 5.5.1.1.4 Others 5.5.1.2 United States Tantalum Market Size and Forecast, By Grade Type (2024-2030) 5.5.1.2.1 Medical Grade Tantalum 5.5.1.2.2 Commercial Grade Tantalum 5.5.1.3 United States Tantalum Market Size and Forecast, By End User (2024-2030) 5.5.1.3.1 Aerospace 5.5.1.3.2 Electrical & Electronics 5.5.1.3.3 Medical & Healthcare 5.5.1.3.4 Chemical & Pharmaceuticals 5.5.1.3.5 Others 5.5.1.4 United States Tantalum Market Size and Forecast, By Application (2024-2030) 5.5.1.4.1 Capacitors 5.5.1.4.2 Semiconductors 5.5.1.4.3 Engine Turbine Blades 5.5.1.4.4 Chemical Processing Equipment 5.5.1.4.5 Medical Equipment 5.5.1.4.6 Others 5.5.2 Canada 5.5.2.1 Canada Tantalum Market Size and Forecast, By Form (2024-2030) 5.5.2.1.1 Tantalum Carbide 5.5.2.1.2 Lithium Tantalite 5.5.2.1.3 Tantalum Oxide 5.5.2.1.4 Others 5.5.2.2 Canada Tantalum Market Size and Forecast, By Grade Type (2024-2030) 5.5.2.2.1 Medical Grade Tantalum 5.5.2.2.2 Commercial Grade Tantalum 5.5.2.3 Canada Tantalum Market Size and Forecast, By End User (2024-2030) 5.5.2.3.1 Aerospace 5.5.2.3.2 Electrical & Electronics 5.5.2.3.3 Medical & Healthcare 5.5.2.3.4 Chemical & Pharmaceuticals 5.5.2.3.5 Others 5.5.2.4 Canada Tantalum Market Size and Forecast, By Application (2024-2030) 5.5.2.4.1 Capacitors 5.5.2.4.2 Semiconductors 5.5.2.4.3 Engine Turbine Blades 5.5.2.4.4 Chemical Processing Equipment 5.5.2.4.5 Medical Equipment 5.5.2.4.6 Others 5.5.3 Mexico 5.5.3.1 Mexico Tantalum Market Size and Forecast, By Form (2024-2030) 5.5.3.1.1 Tantalum Carbide 5.5.3.1.2 Lithium Tantalite 5.5.3.1.3 Tantalum Oxide 5.5.3.1.4 Others 5.5.3.2 Mexico Tantalum Market Size and Forecast, By Grade Type (2024-2030) 5.5.3.2.1 Medical Grade Tantalum 5.5.3.2.2 Commercial Grade Tantalum 5.5.3.3 Mexico Tantalum Market Size and Forecast, By End User (2024-2030) 5.5.3.3.1 Aerospace 5.5.3.3.2 Electrical & Electronics 5.5.3.3.3 Medical & Healthcare 5.5.3.3.4 Chemical & Pharmaceuticals 5.5.3.3.5 Others 5.5.3.4 Mexico Tantalum Market Size and Forecast, By Application (2024-2030) 5.5.3.4.1 Capacitors 5.5.3.4.2 Semiconductors 5.5.3.4.3 Engine Turbine Blades 5.5.3.4.4 Chemical Processing Equipment 5.5.3.4.5 Medical Equipment 5.5.3.4.6 Others 6. Europe Tantalum Market Size and Forecast by Segmentation (2024-2030) 6.1 Europe Tantalum Market Size and Forecast, By Form (2024-2030) 6.2 Europe Tantalum Market Size and Forecast, By Grade Type (2024-2030) 6.3 Europe Tantalum Market Size and Forecast, By End User (2024-2030) 6.4 Europe Tantalum Market Size and Forecast, By Application (2024-2030) 6.5 Europe Tantalum Market Size and Forecast, by Country (2024-2030) 6.5.1 United Kingdom 6.5.1.1 United Kingdom Tantalum Market Size and Forecast, By Form (2024-2030) 6.5.1.2 United Kingdom Tantalum Market Size and Forecast, By Grade Type (2024-2030) 6.5.1.3 United Kingdom Tantalum Market Size and Forecast, By End User (2024-2030) 6.5.1.4 United Kingdom Tantalum Market Size and Forecast, By Application (2024-2030) 6.5.2 France 6.5.2.1 France Tantalum Market Size and Forecast, By Form (2024-2030) 6.5.2.2 France Tantalum Market Size and Forecast, By Grade Type (2024-2030) 6.5.2.3 France Tantalum Market Size and Forecast, By End User (2024-2030) 6.5.2.4 France Tantalum Market Size and Forecast, By Application (2024-2030) 6.5.3 Germany 6.5.3.1 Germany Tantalum Market Size and Forecast, By Form (2024-2030) 6.5.3.2 Germany Tantalum Market Size and Forecast, By Grade Type (2024-2030) 6.5.3.3 Germany Tantalum Market Size and Forecast, By End User (2024-2030) 6.5.3.4 Germany Tantalum Market Size and Forecast, By Application (2024-2030) 6.5.4 Italy 6.5.4.1 Italy Tantalum Market Size and Forecast, By Form (2024-2030) 6.5.4.2 Italy Tantalum Market Size and Forecast, By Grade Type (2024-2030) 6.5.4.3 Italy Tantalum Market Size and Forecast, By End User (2024-2030) 6.5.4.4 Italy Tantalum Market Size and Forecast, By Application (2024-2030) 6.5.5 Spain 6.5.5.1 Spain Tantalum Market Size and Forecast, By Form (2024-2030) 6.5.5.2 Spain Tantalum Market Size and Forecast, By Grade Type (2024-2030) 6.5.5.3 Spain Tantalum Market Size and Forecast, By End User (2024-2030) 6.5.5.4 Spain Tantalum Market Size and Forecast, By Application (2024-2030) 6.5.6 Sweden 6.5.6.1 Sweden Tantalum Market Size and Forecast, By Form (2024-2030) 6.5.6.2 Sweden Tantalum Market Size and Forecast, By Grade Type (2024-2030) 6.5.6.3 Sweden Tantalum Market Size and Forecast, By End User (2024-2030) 6.5.6.4 Sweden Tantalum Market Size and Forecast, By Application (2024-2030) 6.5.7 Austria 6.5.7.1 Austria Tantalum Market Size and Forecast, By Form (2024-2030) 6.5.7.2 Austria Tantalum Market Size and Forecast, By Grade Type (2024-2030) 6.5.7.3 Austria Tantalum Market Size and Forecast, By End User (2024-2030) 6.5.7.4 Austria Tantalum Market Size and Forecast, By Application (2024-2030) 6.5.8 Rest of Europe 6.5.8.1 Rest of Europe Tantalum Market Size and Forecast, By Form (2024-2030) 6.5.8.2 Rest of Europe Tantalum Market Size and Forecast, By Grade Type (2024-2030). 6.5.8.3 Rest of Europe Tantalum Market Size and Forecast, By End User (2024-2030) 6.5.8.4 Rest of Europe Tantalum Market Size and Forecast, By Application (2024-2030) 7. Asia Pacific Tantalum Market Size and Forecast by Segmentation (2024-2030) 7.1 Asia Pacific Tantalum Market Size and Forecast, By Form (2024-2030) 7.2 Asia Pacific Tantalum Market Size and Forecast, By Grade Type (2024-2030) 7.3 Asia Pacific Tantalum Market Size and Forecast, By End User (2024-2030) 7.4 Asia Pacific Tantalum Market Size and Forecast, By Application (2024-2030) 7.5 Asia Pacific Tantalum Market Size and Forecast, by Country (2024-2030) 7.5.1 China 7.5.1.1 China Tantalum Market Size and Forecast, By Form (2024-2030) 7.5.1.2 China Tantalum Market Size and Forecast, By Grade Type (2024-2030) 7.5.1.3 China Tantalum Market Size and Forecast, By End User (2024-2030) 7.5.1.4 China Tantalum Market Size and Forecast, By Application (2024-2030) 7.5.2 South Korea 7.5.2.1 S Korea Tantalum Market Size and Forecast, By Form (2024-2030) 7.5.2.2 S Korea Tantalum Market Size and Forecast, By Grade Type (2024-2030) 7.5.2.3 S Korea Tantalum Market Size and Forecast, By End User (2024-2030) 7.5.2.4 S Korea Tantalum Market Size and Forecast, By Application (2024-2030) 7.5.3 Japan 7.5.3.1 Japan Tantalum Market Size and Forecast, By Form (2024-2030) 7.5.3.2 Japan Tantalum Market Size and Forecast, By Grade Type (2024-2030) 7.5.3.3 Japan Tantalum Market Size and Forecast, By End User (2024-2030) 7.5.3.4 Japan Tantalum Market Size and Forecast, By Application (2024-2030) 7.5.4 India 7.5.4.1 India Tantalum Market Size and Forecast, By Form (2024-2030) 7.5.4.2 India Tantalum Market Size and Forecast, By Grade Type (2024-2030) 7.5.4.3 India Tantalum Market Size and Forecast, By End User (2024-2030) 7.5.4.4 India Tantalum Market Size and Forecast, By Application (2024-2030) 7.5.5 Australia 7.5.5.1 Australia Tantalum Market Size and Forecast, By Form (2024-2030) 7.5.5.2 Australia Tantalum Market Size and Forecast, By Grade Type (2024-2030) 7.5.5.3 Australia Tantalum Market Size and Forecast, By End User (2024-2030) 7.5.5.4 Australia Tantalum Market Size and Forecast, By Application (2024-2030) 7.5.6 Indonesia 7.5.6.1 Indonesia Tantalum Market Size and Forecast, By Form (2024-2030) 7.5.6.2 Indonesia Tantalum Market Size and Forecast, By Grade Type (2024-2030) 7.5.6.3 Indonesia Tantalum Market Size and Forecast, By End User (2024-2030) 7.5.6.4 Indonesia Tantalum Market Size and Forecast, By Application (2024-2030) 7.5.7 Malaysia 7.5.7.1 Malaysia Tantalum Market Size and Forecast, By Form (2024-2030) 7.5.7.2 Malaysia Tantalum Market Size and Forecast, By Grade Type (2024-2030) 7.5.7.3 Malaysia Tantalum Market Size and Forecast, By End User (2024-2030) 7.5.7.4 Malaysia Tantalum Market Size and Forecast, By Application (2024-2030) 7.5.8 Vietnam 7.5.8.1 Vietnam Tantalum Market Size and Forecast, By Form (2024-2030) 7.5.8.2 Vietnam Tantalum Market Size and Forecast, By Grade Type (2024-2030) 7.5.8.3 Vietnam Tantalum Market Size and Forecast, By End User (2024-2030) 7.5.8.4 Vietnam Tantalum Market Size and Forecast, By Application (2024-2030) 7.5.9 Taiwan 7.5.9.1 Taiwan Tantalum Market Size and Forecast, By Form (2024-2030) 7.5.9.2 Taiwan Tantalum Market Size and Forecast, By Grade Type (2024-2030) 7.5.9.3 Taiwan Tantalum Market Size and Forecast, By End User (2024-2030) 7.5.9.4 Taiwan Tantalum Market Size and Forecast, By Application (2024-2030) 7.5.10 Bangladesh 7.5.10.1 Bangladesh Tantalum Market Size and Forecast, By Form (2024-2030) 7.5.10.2 Bangladesh Tantalum Market Size and Forecast, By Grade Type (2024-2030) 7.5.10.3 Bangladesh Tantalum Market Size and Forecast, By End User (2024-2030) 7.5.10.4 Bangladesh Tantalum Market Size and Forecast, By Application (2024-2030) 7.5.11 Pakistan 7.5.11.1 Pakistan Tantalum Market Size and Forecast, By Form (2024-2030) 7.5.11.2 Pakistan Tantalum Market Size and Forecast, By Grade Type (2024-2030) 7.5.11.3 Pakistan Tantalum Market Size and Forecast, By End User (2024-2030) 7.5.11.4 Pakistan Tantalum Market Size and Forecast, By Application (2024-2030) 7.5.12 Rest of Asia Pacific 7.5.12.1 Rest of Asia Pacific Tantalum Market Size and Forecast, By Form (2024-2030) 7.5.12.2 Rest of Asia Pacific Tantalum Market Size and Forecast, By Grade Type (2024-2030) 7.5.12.3 Rest of Asia Pacific Tantalum Market Size and Forecast, By End User (2024-2030) 7.5.12.4 Rest of Asia Pacific Tantalum Market Size and Forecast, By Application (2024-2030) 8. Middle East and Africa Tantalum Market Size and Forecast by Segmentation (2024-2030) 8.1 Middle East and Africa Tantalum Market Size and Forecast, By Form (2024-2030) 8.2 Middle East and Africa Tantalum Market Size and Forecast, By Grade Type (2024-2030) 8.3 Middle East and Africa Tantalum Market Size and Forecast, By End User (2024-2030) 8.4 Middle East and Africa Tantalum Market Size and Forecast, By Application (2024-2030) 8.5 Middle East and Africa Tantalum Market Size and Forecast, by Country (2024-2030) 8.5.1 South Africa 8.5.1.1 South Africa Tantalum Market Size and Forecast, By Form (2024-2030) 8.5.1.2 South Africa Tantalum Market Size and Forecast, By Grade Type (2024-2030) 8.5.1.3 South Africa Tantalum Market Size and Forecast, By End User (2024-2030) 8.5.1.4 South Africa Tantalum Market Size and Forecast, By Application (2024-2030) 8.5.2 GCC 8.5.2.1 GCC Tantalum Market Size and Forecast, By Form (2024-2030) 8.5.2.2 GCC Tantalum Market Size and Forecast, By Grade Type (2024-2030) 8.5.2.3 GCC Tantalum Market Size and Forecast, By End User (2024-2030) 8.5.2.4 GCC Tantalum Market Size and Forecast, By Application (2024-2030) 8.5.3 Egypt 8.5.3.1 Egypt Tantalum Market Size and Forecast, By Form (2024-2030) 8.5.3.2 Egypt Tantalum Market Size and Forecast, By Grade Type (2024-2030) 8.5.3.3 Egypt Tantalum Market Size and Forecast, By End User (2024-2030) 8.5.3.4 Egypt Tantalum Market Size and Forecast, By Application (2024-2030) 8.5.4 Nigeria 8.5.4.1 Nigeria Tantalum Market Size and Forecast, By Form (2024-2030) 8.5.4.2 Nigeria Tantalum Market Size and Forecast, By Grade Type (2024-2030) 8.5.4.3 Nigeria Tantalum Market Size and Forecast, By End User (2024-2030) 8.5.4.4 Nigeria Tantalum Market Size and Forecast, By Application (2024-2030) 8.5.5 Rest of ME&A 8.5.5.1 Rest of ME&A Tantalum Market Size and Forecast, By Form (2024-2030) 8.5.5.2 Rest of ME&A Tantalum Market Size and Forecast, By Grade Type (2024-2030) 8.5.5.3 Rest of ME&A Tantalum Market Size and Forecast, By End User (2024-2030) 8.5.5.4 Rest of ME&A Tantalum Market Size and Forecast, By Application (2024-2030) 9. South America Tantalum Market Size and Forecast by Segmentation (2024-2030) 9.1 South America Tantalum Market Size and Forecast, By Form (2024-2030) 9.2 South America Tantalum Market Size and Forecast, By Grade Type (2024-2030) 9.3 South America Tantalum Market Size and Forecast, By End User (2024-2030) 9.4 South America Tantalum Market Size and Forecast, By Application (2024-2030) 9.5 South America Tantalum Market Size and Forecast, by Country (2024-2030) 9.5.1 Brazil 9.5.1.1 Brazil Tantalum Market Size and Forecast, By Form (2024-2030) 9.5.1.2 Brazil Tantalum Market Size and Forecast, By Grade Type (2024-2030) 9.5.1.3 Brazil Tantalum Market Size and Forecast, By End User (2024-2030) 9.5.1.4 Brazil Tantalum Market Size and Forecast, By Application (2024-2030) 9.5.2 Argentina 9.5.2.1 Argentina Tantalum Market Size and Forecast, By Form (2024-2030) 9.5.2.2 Argentina Tantalum Market Size and Forecast, By Grade Type (2024-2030) 9.5.2.3 Argentina Tantalum Market Size and Forecast, By End User (2024-2030) 9.5.2.4 Argentina Tantalum Market Size and Forecast, By Application (2024-2030) 9.5.3 Rest Of South America 9.5.3.1 Rest Of South America Tantalum Market Size and Forecast, By Form (2024-2030) 9.5.3.2 Rest Of South America Tantalum Market Size and Forecast, By Grade Type (2024-2030) 9.5.3.3 Rest Of South America Tantalum Market Size and Forecast, By End User (2024-2030) 9.5.3.4 Rest Of South America Tantalum Market Size and Forecast, By Application (2024-2030) 10. Global Tantalum Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Tantalum Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 All Metal Sales, Inc. 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Admat, Inc. 11.3 AMG Advanced Metallurgical Group 11.4 Ultramet. 11.5 Atlantic Equipment Engineers, Inc. 11.6 California Metal & Supply, Inc. 11.7 Accumet Materials Co. 11.8 Mokawa Inc. 11.9 High-Performance Alloys, Inc. 11.10 ConceptMetal 11.11 TANIOBIS GmbH 11.12 RS-Recycling GmbH 11.13 JX Metals Europe GmbH 11.14 Ultra Metal Minor Limited 11.15 Advanced Metals Pvt Ltd 11.16 Pilbara Minerals 11.17 Ningxia Orient Tantalum Industry Co. Ltd 11.18 Alliance Mineral Assets Limited. 11.19 Multotec 11.20 Ethiopia Mineral Development Share Company 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary