Global Sport Drink Market size was valued at USD 28.11 Bn in 2025, and the total Sport Drink revenue is expected to grow at a CAGR of 6.15% from 2026 to 2032, reaching nearly USD 42.70 Bn. The sports drink category is experiencing a dynamic transformation, driven by a rising focus on holistic health and wellness. The demand for functional beverages is now increasing to a wider audience interesting to individuals who aim to fuel both their body and mind throughout the day.Report Overview

An introduction of functional ingredients like protein-infused sports drinks, immune-boosting beverages, and anti-inflammatory compounds are expected to drive demand for sport drink. The global sports drink consumption topped 1.9 billion liters in 2025. The isotonic sport drink variants held the dominant position with a share of approximately 61% of the total sport drink volume. The Asia-Pacific region has witnessed a significant uptick, with over 550 million liters sport drink consumption in 2025. The prominent sport drink brands are concentrating to deploy sport drink eco-friendly packaging and sourcing ingredients from sustainable practices as sustainability is a top priority for sport drink.Key highlights:

• By soft drink type, isotonic products held 53% in the global sports drinks market share in 2025 and hypertonic beverages are expected to grow at a 6.55% rate of CAGR during the forecast Period. • By geography, North America accounted the largest revenue in 2025, and Asia-Pacific is expected to grow at a 6.8% rate of CAGR during the forecast Period. • Europe sports drinks market was valued at a USD 3.17 billion and expected to grow at a 6.1% rate Of CAGR during the forecast period. • By soft-drink type, isotonic variants held the dominant position in India sports drinks market share, with a 58 % in 2025. • PET bottles dominated with a 94% share in 2025 in the Asia Pacific Sport Drink market in 2025.

Sport Drink Market: Demand Drivers and Growth Catalysts

An Increase in Sport Population Drive the demand for Sport Drink The global sports drink market growth is driven by factors like fitness trends, present of younger generation across developing economies like China & India, growth in disposable incomes, and awareness of health benefits. According to the International Health, Racquet & Sports Club Association, 74% of young people has reported exercising at least once a week in October 2025, which has contributed to a demand for healthy hydration solutions like sport drink. An increase in fitness activity has delicate the requirement for products that replenish electrolytes lost during exercise. The consumption of sports drinks is assisting to fill this gap by delivering hydration and enhancing performance. The presence of approximately 8,000 sports across the globe, and 200 internationally recognized sports are booting the demand for high sport drink. High emphasis on fitness and hydration is expected to drive the demand for sports drinks. Low-Sugar, Organic, and Plant-Based Options are becoming prominent key trend in the Sport Drink Market. Currently, many consumers are preferring sports drinks with lower sugar content or entirely sugar-free, as they become more health-conscious and aware of the effects of excessive sugar consumption. Prominent sport drink Brands are focusing to respond to low-sugar content sport drink preference shift by presenting drinks made with natural sweeteners, organic ingredients, and plant-based components. An increase in interest in clean-label and eco-friendly sport drink products are expected to drive the demand for lower sugar content or entirely sugar-free sport drink. As health concerns around sugar intake increasing, many consumers are preferring to sports drinks that offer healthier, low-sugar alternatives. Brands like Gatorade Zero, Powerade Zero, and other low-calorie options are focusing to respond to low-sugar demand, with sales of sugar-free sports drinks.Sport Drink Market: Price Analysis

To know about the Research Methodology :- Request Free Sample Report The price analysis of the USA sport drink sales volume shows a consistent growth line in both unit sales and revenue during the period 2024-2025. Despite the positive growth in unit sales in (2024-2025), sport drink unit sales growth is comparatively slower at 5.5% for the same period. The graph shows that as the volume of sport drink units sold is increasing significantly, the average price per unit is experiencing pressure, potentially because of competitive pricing strategies, discounting, or product mix formulation. The quarterly growth rates have further revealed that while unit sales are growing at 13.75% from 2024 to 2025. Despite U.S. sports drink market is experiencing robust volume growth, pricing strategies and product positioning are expected to need to be recalibrated to sustain or enhance profitability during the forecast period.

Sports drink consumption Analysis:

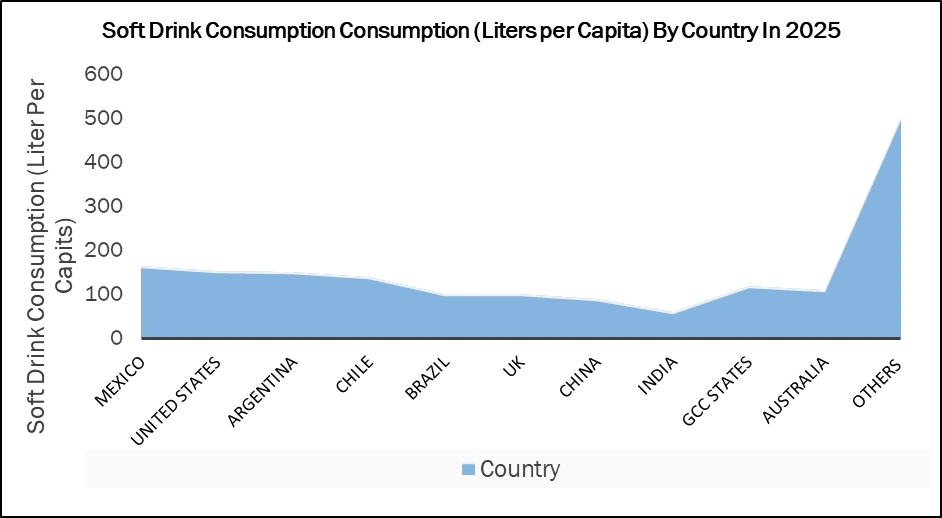

In 2025, sports drink consumption has reached 1.8 billion liters. High demand for energy and electrolyte beverages, increasing participation in fitness activities and awareness of the importance of proper hydration among sport population are some of the prominent factors behind the Sport drink Consumption. High sport drink consumption highlights a broader trend towards functional beverages and hydration drinks as consumers are seeking healthier, more active ways to support their athletic performance. Fitness drinks are becoming integral to many people's daily routines, predominantly as gym memberships, home workout programs. The global fitness industry now valued at over USD 87 billion in 2025, according to the Global Health and Fitness Association, which is expected to drive the demand for Sport Drink, as the number of people engaging in fitness activities has risen exponentially growth rate. The sports protein RTD in consumer health and powder concentrates in soft drinks are expected to grow at CAGR of 12.2% and 4.8%, respectively In the Asia Pacific Region during the forecast period.

Sport Drink Market: Segment Analysis

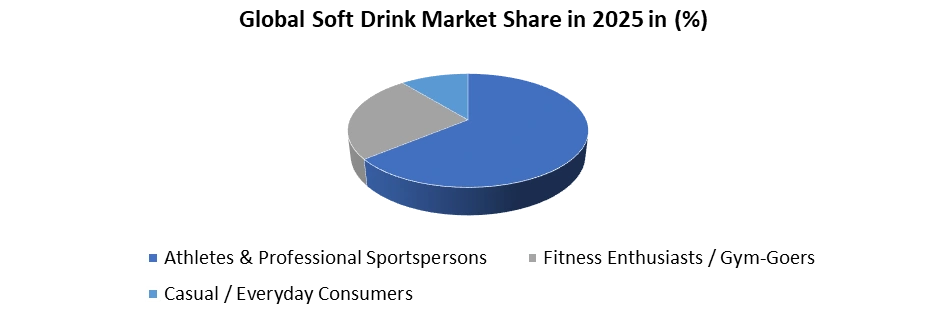

By end-users, athletes segment held a highest market share with a 40% in 2025. Need for hydration, energy, and electrolyte replenishment energy during powerful physical activities are contributing to the high adoption rate of sport drink. High rate of per-capita consumption and need of sport drink for performance with hydration formulations are expected to boost the demand for sport drink.

Sport Drink Market: Regional Analysis

North America held the dominant Position in the Global Sport Drink Market in 2024 with a share of. The high level of fitness consciousness, coupled with a large number of sports and fitness enthusiasts are some of the prominent factors behind the market dominance. The North America Sport Drink market growth is driven by the high levels of fitness consciousness and sports participation in countries like the United States and Canada. USA is expected to hold more than 80% share in the Sport drink market during the forecast period because of presence of number of active consumers and a growing preference for functional beverages. Established brand players are focusing on premium positioning, clean-label formulations, and direct-to-consumer strategies to increase their profit in the sport drink business. Some of the prominent brands are forming authentic connections with health-conscious consumers who are willing to pay a premium price for perceived quality and functional benefits of the sport drink across the North America.The Texas leads with the highest number of facilities at 64, followed by California and Florida, both with 42 facilities each. Other key states such as Illinois, Michigan, New York, Georgia, and New Jersey each have significant manufacturing presence, with facility counts ranging from 34 to 40. The rest of the country accounts for 575 additional facilities in the total USA sport drink active manufacturing facilities. The graph highlights the concentration of sports drink manufacturing in states with strong consumer markets, robust logistics infrastructure, and growing demand for hydration and performance-enhancing beverages in 2025. The United States sports drinks market was valued at USD 12 billion in 2025 and it is expected to grow at a 4.55% rate of CAGR during the forecast period. the premiumization of sport drink products, and innovation in functional sport drink ingredient are some of the prominent drivers behind the sport Drink demand in USA.

Europe Sports Drinks Market Insights

• By sports-drinks type, isotonic sport variant held a dominant share with a 55% in Europe sports drinks market share in 2025 and hypertonic drinks are expected to grow at a 6% rate of CAGR during the forecast period. • By packaging, PET bottles held a maximum share with a 94 % in 2025 and metal cans are expected to grow at a high rate of CAGR in the near future. • The supermarkets/hypermarkets accounted for more than 58% share in the Europe Soft drink market. • By Country, Germany held the dominant position in the Europe Sports Drinks Market with a share of 28%.

Competitive Landscape Analysis

North America: The US Sport Drink Market is dominated by three brands- Gatorade, Powerade and Bodyarmor. Big Three players are making up more than 87% of the USA Sport drink Category. Gatorade held the largest share as 61.6% in the USA sport drink market. The Gatorade is projected to hold maximum share with a range from 58.10% to 63% by 2026, that highlights its strong market leadership in the USA Sport drink market. The competitive landscape is witnessing a steady growth rate among key players, that strengthening the dominance of Gatorade in the USA sports drink Consumption. Sport Drink Product Launched In 2025

Product Name Company Launch Date Key Features Target Market Powerade UltraBoost The Coca-Cola Company March 2025 Enriched with B-vitamins, rapid-absorption electrolytes, and natural energy blends High-performance beverage seekers Gatorade PRO Electro+ PepsiCo February 2025 Enhanced electrolytes, cleaner ingredients, sustained-energy carbohydrates Athletes and fitness enthusiasts needing recovery Monster Hydrate Max Monster Beverage January 2025 Zero-sugar, infused with electrolytes, amino acids, and natural flavors Fitness-focused consumers, moving beyond energy drinks Sport Drink Market Scope: Inquire before buying

Global Sport Drink Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 28.11 Bn. Forecast Period 2026 to 2032 CAGR: 6.15% Market Size in 2032: USD 42.70 Bn. Segments Covered: by Type Isotonic Hypertonic Hypotonic by Liquid Liquid / Ready‑to‑Drink (RTD) Powdered Formulations by Packaging Pet Bottles Cans Pouches Others by Distribution Channel Supermarkets / Hypermarkets Convenience Stores / Retail Stores Online Retail / E‑commerce Platforms Specialty Sports / Fitness Outlets Others by End User Athletes & Professional Sportspersons Fitness Enthusiasts / Gym‑Goers Casual / Everyday Consumers by Flavor Lemon Fruit Punch Orange Grape Mixed Fruit / Others Sport Drink Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Sport Drink Key Players

1. PepsiCo 2. Abbott Nutrition 3. The Coca-Cola Company 4. Monster Beverage Corporation 5. Red Bull GmbH 6. BodyArmor 7. Suntory Holdings 8. Otsuka Pharmaceutical Co., Ltd. 9. AJE Group 10. Danone S.A. 11. Nuun Hydration 12. Electrolit 13. Britvic plc 14. GU Energy Labs 15. Sqwincher 16. Drink Hoist 17. BioSteel Sports Nutrition 18. Isostar 19. A-Bomb Energy 20. Amway Corp 21. Gusto Organic Ltd 22. Hype Energy Drinks 23. Keurig Dr Pepper, Inc. 24. National Beverage Corp. 25. Carlsberg A/S 26. FDC ltd 27. Cipla Health Ltd 28. Tata Consumer Products Limited 29. Ocean Bevaerages 30. Dabur India Limited 31. Hoist 32. Nooma 33. Goodonya 34. Others FAQ: Q1: What key factors are driving growth in the Global Sport Drink Market from 2025 to 2032? Ans: The market growth is primarily fueled by Higher awareness of functional hydration (electrolytes, performance, recovery, presence of fitness, sports participation, and “active lifestyle” consumers and Shift toward low/zero-sugar and clean-label formulations. Q2: How fast is the ready-to-drink Sport Drink segment expected to grow? Ans: The RTD sports drink is expected to grow at a more than 6.5% rate of CAGR during the forecast Period. Q3: Which region held the largest market share in Sport Drink in 2025? Ans: North America leads with about xx% market share, driven by high health and fitness awareness and strong consumer demand for hydration and performance beverages. Q4: Which company has accounted for the highest market share in the Sport Drink Market in 2025? Ans: The company that has accounted for the highest market share in the global Sports Drink market is PepsiCo, Inc., primarily due to its Gatorade brand, which leads globally with the largest individual market share. Q5: Who are the leading players in the Sport Drink Market? Ans: Key players include PepsiCo, Abbott Nutrition, The Coca-Cola Company, Monster Beverage Corporation, Red Bull GmbH, BodyArmor, Suntory Holdings, Otsuka Pharmaceutical Co., Ltd., AJE Group, Danone S.A., Nuun Hydration, Electrolit, Britvic plc and GU Energy Labs.

1. Sport Drink Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2025) & Forecast (2026-2032) 1.1.2. Market Size (Value in USD Bn and Volume 000’ Units) - By Segments, Regions, and Country 2. Sport Drink Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Segment 2.3.4. End User Segment 2.3.5. Total Company Revenue (2025) 2.3.6. Market Share (%) 2.3.7. Profit Margin (%) 2.3.8. Growth Rate (%) 2.3.9. Distribution Network Strength 2.3.10. Sustainability Initiatives 2.3.11. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 2.6. Global vs. Regional Players Comparative Analysis 2.6.1. Leading Global Sport Drink Manufacturers 2.6.2. Emerging Regional Players & Localized Manufacturers 2.6.3. Differentiation by sport Drink Formulation 3. Sport Drink Market: Dynamics 3.1. Sport Drink Market Trends 3.2. Sport Drink Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Sport Drink Market 3.6. Analysis of Government Schemes and Support for the Industry 3.7. Regulatory Framework & Compliance Landscape 3.8. Supply Chain Analysis 4. Adoption Trends and Demand Analysis 4.1. Shift Towards Healthier & Functional Sports Drinks 4.2. Influence of Urbanization and Smart City Initiatives on Material Demand 4.3. Consumer preferences for natural ingredients, low-sugar options, and clean-label drinks 4.4. Seasonal Demand Fluctuations and Construction Cycles 4.5. Influence of Sports and Fitness Industry on Sports Drink Demand 4.6. Impact of Urbanization and Lifestyle Changes on Demand 5. Consumption Analysis of Sport Drink (2025) 5.1. Consumption Volume & Value by Drink Type and Region (2020–2025) 5.2. Top 10 Countries by Sports Drink Consumption (2025) 5.3. Seasonal Demand Fluctuations and Consumption Cycles 5.4. Emerging Trends in Ready-to-Drink (RTD) & Customizable Sports Drinks 6. Production and Sourcing Landscape 6.1. Leading Sports Drink Producing Countries & Capacity Analysis (2025) 6.2. Impact of Raw Material Availability & Price Volatility on Production 6.3. Government Incentives & Tariffs Affecting Local Manufacturing 7. Import-Export and Trade Analysis (2025), by Country 7.1. Top Exporting Countries of Sport Drink 7.2. Leading Import Markets and Regional Demand Dependencies 7.3. Key Trade Routes, Regional Trade Agreements & Tariffs Impact 7.4. Certification & Quality Standards for Cross-Border Material Trade 7.5. Trade Barriers & Compliance Challenges in the Sport Drink Market 8. Price Trend Analysis (2025) 8.1. Historical and Current Pricing Trends by Product Type & Region 8.2. Key Drivers Influencing Prices: Raw Materials, Labor, Energy, Transportation 8.3. Impact of Economic Cycles on Price Volatility on Sport Drink Pricing 8.4. Regional Price Differentials & Currency Fluctuations 8.5. Influence of Government Policies & Regulations on Sport Drink Pricing 9. Distribution & Channel Insights 9.1. Sports Drink Supply Chain Overview: Direct, Wholesale, Retail Channels 9.2. Growth of Digital Marketplaces & E-Commerce by subscription models, DTC brands, and bulk online purchases. 9.3. Role of Logistics & Warehousing in Availability & Cost 9.4. Last-Mile Delivery Challenges in Urban & Remote Locations 9.5. Influence of Cooperative Buying Groups & Large Retail Network 10. Soft Drink Market: Consumer Insights 10.1. Soft Drink Consumer Demographics: Age, Gender, Geography 10.2. Sport Drink Buying Behavior and Preferences 10.3. Health Consciousness and Trends in Consumer Preferences for Soft Drink 10.4. Impact of Social Media & Influencer Marketing on the Soft Drink Sales 11. Soft Drink Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032) 11.1. Soft Drink Market Size and Forecast, By Type (2025-2032) 11.1.1. Isotonic 11.1.2. Hypertonic 11.1.3. Hypotonic 11.2. Soft Drink Market Size and Forecast, By Form (2025-2032) 11.2.1. Low 11.2.2. Medium 11.2.3. High 11.3. Soft Drink Market Size and Forecast, By Packaging (2025-2032) 11.3.1. Electric-based 11.3.2. Steam-based 11.3.3. Hybrid-based 11.3.4. Fuel-based 11.4. Soft Drink Market Size and Forecast, By Distribution Channel (2025-2032) 11.4.1. Supermarkets / Hypermarkets 11.4.2. Convenience Stores / Retail Stores 11.4.3. Online Retail / E‑commerce Platforms 11.4.4. Specialty Sports / Fitness Outlets 11.4.5. Others 11.5. Soft Drink Market Size and Forecast, By End‑User (2025-2032) 11.5.1. Athletes & Professional Sportspersons 11.5.2. Fitness Enthusiasts / Gym‑Goers 11.5.3. Casual / Everyday Consumers 11.6. Soft Drink Market Size and Forecast, By Flavor (2025-2032) 11.6.1. Lemon 11.6.2. Fruit Punch 11.6.3. Orange 11.6.4. Grape 11.6.5. Mixed Fruit / Others 11.7. Soft Drink Market Size and Forecast, By Region (2025-2032) 11.7.1. North America 11.7.2. Europe 11.7.3. Asia Pacific 11.7.4. Middle East and Africa 11.7.5. South America 12. North America Soft Drink Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032) 12.1. North America Soft Drink Market Size and Forecast, By Type (2025-2032) 12.2. North America Soft Drink Market Size and Forecast, By Form (2025-2032) 12.3. North America Soft Drink Market Size and Forecast, By Packaging (2025-2032) 12.4. North America Soft Drink Market Size and Forecast, By Distribution Channel (2025-2032) 12.5. North America Soft Drink Market Size and Forecast, By End‑User (2025-2032) 12.6. North America Soft Drink Market Size and Forecast, By Flavor (2025-2032) 12.7. North America Soft Drink Market Size and Forecast, by Country (2025-2032) 12.7.1. United States 12.7.2. Canada 12.7.3. Mexico 13. Europe Soft Drink Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032) 13.1. Europe Soft Drink Market Size and Forecast, By Type (2025-2032) 13.2. Europe Soft Drink Market Size and Forecast, By Form (2025-2032) 13.3. Europe Soft Drink Market Size and Forecast, By Packaging (2025-2032) 13.4. Europe Soft Drink Market Size and Forecast, By Distribution Channel (2025-2032) 13.5. Europe Soft Drink Market Size and Forecast, By End‑User (2025-2032) 13.6. Europe Soft Drink Market Size and Forecast, By Flavor (2025-2032) 13.7. Europe Soft Drink Market Size and Forecast, by Country (2025-2032) 13.7.1. United Kingdom 13.7.1.1. United Kingdom Soft Drink Market Size and Forecast, By Type (2025-2032) 13.7.1.2. United Kingdom Soft Drink Market Size and Forecast, By Form (2025-2032) 13.7.1.3. United Kingdom Soft Drink Market Size and Forecast, By Packaging (2025-2032) 13.7.1.4. United Kingdom Soft Drink Market Size and Forecast, By Distribution Channel (2025-2032) 13.7.1.5. United Kingdom Soft Drink Market Size and Forecast, By End‑User (2025-2032) 13.7.1.6. United Kingdom Soft Drink Market Size and Forecast, By Flavor (2025-2032) 13.7.2. France 13.7.3. Germany 13.7.4. Italy 13.7.5. Spain 13.7.6. Sweden 13.7.7. Russia 13.7.8. Rest of Europe 14. Asia Pacific Soft Drink Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032) 14.1. Asia Pacific Soft Drink Market Size and Forecast, By Type (2025-2032) 14.2. Asia Pacific Soft Drink Market Size and Forecast, By Form (2025-2032) 14.3. Asia Pacific Soft Drink Market Size and Forecast, By Packaging (2025-2032) 14.4. Asia Pacific Soft Drink Market Size and Forecast, By Distribution Channel (2025-2032) 14.5. Asia Pacific Soft Drink Market Size and Forecast, By End‑User (2025-2032) 14.6. Asia Pacific Soft Drink Market Size and Forecast, By Flavor (2025-2032) 14.7. Asia Pacific Soft Drink Market Size and Forecast, by Country (2025-2032) 14.7.1. China 14.7.2. S Korea 14.7.3. Japan 14.7.4. India 14.7.5. Australia 14.7.6. Indonesia 14.7.7. Malaysia 14.7.8. Philippines 14.7.9. Thailand 14.7.10. Vietnam 14.7.11. Rest of Asia Pacific 15. Middle East and Africa Soft Drink Market Size and Forecast (by Value in USD Million and Volume in Units) (2025-2032) 15.1. Middle East and Africa Soft Drink Market Size and Forecast, By Type (2025-2032) 15.2. Middle East and Africa Soft Drink Market Size and Forecast, By Form (2025-2032) 15.3. Middle East and Africa Soft Drink Market Size and Forecast, By Packaging (2025-2032) 15.4. Middle East and Africa Soft Drink Market Size and Forecast, By Distribution Channel (2025-2032) 15.5. Middle East and Africa Soft Drink Market Size and Forecast, By End‑User (2025-2032) 15.6. Middle East and Africa Soft Drink Market Size and Forecast, By Flavor (2025-2032) 15.7. Middle East and Africa Soft Drink Market Size and Forecast, by Country (2025-2032) 15.7.1. South Africa 15.7.2. GCC 15.7.3. Egypt 15.7.4. Nigeria 15.7.5. Rest of ME&A 16. South America Soft Drink Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032) 16.1. South America Soft Drink Market Size and Forecast, By Type (2025-2032) 16.2. South America Soft Drink Market Size and Forecast, By Form (2025-2032) 16.3. South America Soft Drink Market Size and Forecast, By Packaging (2025-2032) 16.4. South America Soft Drink Market Size and Forecast, By Distribution Channel (2025-2032) 16.5. South America Soft Drink Market Size and Forecast, By End‑User (2025-2032) 16.6. South America Soft Drink Market Size and Forecast, By Flavor (2025-2032) 16.7. South America Soft Drink Market Size and Forecast, by Country (2025-2032) 16.7.1. Brazil 16.7.2. Argentina 16.7.3. Colombia 16.7.4. Chile 16.7.5. Rest Of South America 17. Company Profile: Key Players 17.1. PepsiCo 17.1.1. Company Overview 17.1.2. Business Portfolio 17.1.3. Financial Overview 17.1.4. SWOT Analysis 17.1.5. Strategic Analysis 17.1.6. Recent Developments 17.2. Abbott Nutrition 17.3. The Coca-Cola Company 17.4. Monster Beverage Corporation 17.5. Red Bull GmbH 17.6. BodyArmor 17.7. Suntory Holdings 17.8. Otsuka Pharmaceutical Co., Ltd. 17.9. AJE Group 17.10. Danone S.A. 17.11. Nuun Hydration 17.12. Electrolit 17.13. Britvic plc 17.14. GU Energy Labs 17.15. Sqwincher 17.16. Drink Hoist 17.17. BioSteel Sports Nutrition 17.18. Isostar 17.19. A-Bomb Energy 17.20. Amway Corp 17.21. Gusto Organic Ltd 17.22. Hype Energy Drinks 17.23. Keurig Dr Pepper, Inc. 17.24. National Beverage Corp. 17.25. Carlsberg A/S 17.26. FDC ltd 17.27. Cipla Health Ltd 17.28. Tata Consumer Products Limited 17.29. Ocean Bevaerages 17.30. Dabur India Limited 17.31. Hoist 17.32. Nooma 17.33. Goodonya 18. Key Findings 19. Analyst Recommendations 20. Soft Drink Market: Research Methodology