The Smartwatch Market size was valued at USD 43.57 Billion in 2024, and the total revenue is expected to grow at CAGR of 15.6 % from 2025 to 2032, reaching nearly USD 138.97 Billion. The MMR report provides an in-depth analysis of the global Smartwatch Market, covering key aspects such as user penetration, ARPU, and regional pricing trends. It includes detailed insights into demand dynamics across fitness, lifestyle, and healthcare segments, along with consumer behavior, purchasing drivers, and evolving retail landscapes. The report further examines supply chain structures, import-export trends, and trade policies impacting smartwatch components. Additionally, it highlights advancements in technology, connectivity, and sensor innovation, while also assessing sustainability efforts, regulatory frameworks, and data compliance standards shaping the industry’s future growth.Smartwatch Market Overview

A smart watch is a wearable device that typically resembles a wristwatch but comes with advanced functionalities beyond timekeeping. Smartwatches are equipped with various features such as fitness tracking, heart rate monitoring, GPS navigation, notifications for calls and messages, music playback control, and in some cases, even mobile payment capabilities. These devices often connect to smartphones via Bluetooth or Wi-Fi to synchronize data, display notifications, and sometimes even make calls directly from the watch itself. Smartwatches also support third-party apps, allowing users to expand their functionality according to their preferences. Smartwatches have gained popularity due to their convenience, versatility, and ability to integrate with daily activities and fitness routines. They serve as a companion to smartphones, offering quick access to information and functionalities without the need to take out the phone from one's pocket or bag.To know about the Research Methodology :- Request Free Sample Report The smartwatch market is the increasing emphasis on health and fitness tracking. More than 200 million people use smartwatches globally. Smartwatches have evolved beyond basic timekeeping to incorporate a wide range of features such as fitness and health tracking (including heart rate monitoring, sleep tracking, activity tracking), GPS navigation, notifications (calls, messages, social media), music playback control, contactless payments, and even integration with voice assistants like Siri, Google Assistant, and Alexa. The smart watch market include the increasing adoption of smartwatches by older demographics for health monitoring, the rise of hybrid smartwatches that combine traditional watch designs with smart features, and the continued focus on improving battery life and overall performance.

Smartwatch Market Dynamics

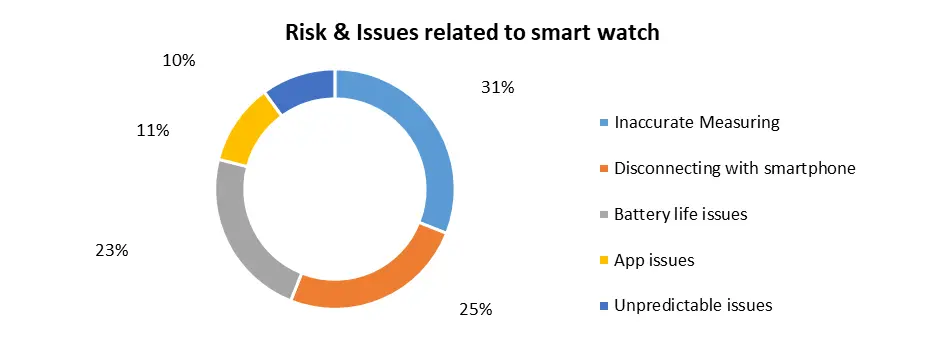

Health and Fitness Tracking to boost the Smart Watch Market growth With growing awareness about the importance of leading a healthy lifestyle, consumers are turning to wearable devices like smartwatches to monitor their physical activity, track workouts, monitor heart rate, and even analyze sleep patterns. Smartwatches equipped with advanced sensors and health monitoring features cater to this demand, empowering users to take control of their well-being. Rapid advancements in technology have played a significant role in driving the smart watch market forward. Smart watch manufacturers are constantly innovating to incorporate new features and functionalities into their devices, such as GPS tracking, waterproofing, blood oxygen monitoring, and ECG capabilities. These technological advancements not only enhance the user experience but also contribute to the overall attractiveness and appeal of smartwatches. Nearly 180 million of smart watch are predicted to be shipped at the end of 2024. 92% of people use smartwatches to maintain their health and fitness. 88% of the people reported that smartwatches helped them achieve their fitness goals. Besides, almost 1 in 2 smart watch users used smartwatches to exercise regularly.Smartwatches are increasingly being positioned as companions to smartphones, offering seamless integration with mobile devices and ecosystems. The ability to receive notifications, make calls, send messages, and control smartphone functions directly from the wrist appeals to consumers seeking convenience and connectivity. Smart Watch manufacturers are leveraging this integration to create cohesive ecosystems that enhance the overall user experience and drive adoption of their smart watch products. The convergence of technology and fashion has led to the emergence of stylish and aesthetically pleasing smartwatches that appeal to fashion-conscious consumers. Smart Watch manufacturers are investing in design and aesthetics, offering a wide range of options in terms of materials, finishes, and customization features. Whether it's traditional round-faced watches or sleek, modern designs, smartwatches are increasingly seen as fashion accessories that complement personal style and individual preferences. High Cost of watches to restrain the Smart Watch Market growth Despite the availability of budget-friendly options, many smartwatches, especially those with advanced features and premium designs, come with a high price tag. This deter price-sensitive consumers from purchasing smartwatches, limiting Smart Watch market penetration, particularly in developing regions where affordability is a significant concern. Battery life remains a persistent issue for many smart watch users. Most smartwatches need to be charged daily or every few days, which is inconvenient for users accustomed to traditional watches that require minimal maintenance. Limited battery life also restricts the use of certain features, such as continuous heart rate monitoring or GPS tracking, which drain the battery quickly. The smart watch market is characterized by a wide variety of devices running different operating systems, such as watchOS, Wear OS, and proprietary platforms. This fragmentation lead to compatibility issues with smartphones and other devices, as well as inconsistencies in user experience and app availability across different platforms.

Smartwatch Market Segment Analysis

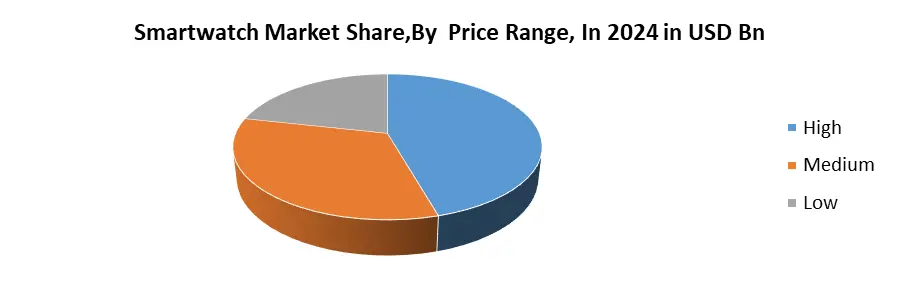

Based on type, the smartwatch market is segmented into Extension, Standalone, and Hybrid. In 2024, the Extension segment dominated the market, functioning as an extension of smartphones through Bluetooth connectivity, enabling users to access notifications, calls, and messages directly from their wrist. Standalone smartwatches, equipped with SIM or eSIM support, operate independently without a smartphone, appealing to users who prefer full connectivity on the go. Hybrid smartwatches combine traditional analog designs with basic smart features like activity tracking and notifications, catering to consumers seeking style, simplicity, and long battery life. Overall, Extension smartwatches led the market, followed by Standalone and Hybrid types. Based on Price Range, in 2024, the High-end segment dominated the global Smartwatch Market, driven by strong consumer preference for premium brands offering advanced health tracking, superior build quality, and seamless integration with smartphone ecosystems. The Medium price range segment followed, attracting tech-savvy consumers seeking balanced performance and affordability, featuring essential fitness and connectivity features without luxury pricing. The Low-price segment, while holding a smaller share, continues to grow rapidly in emerging markets, supported by local brands offering cost-effective models with basic smart functionalities. Overall, the High segment leads the market due to strong brand loyalty and innovation, while the Medium and Low segments contribute significantly to volume growth across price-sensitive regions.

Smartwatch Market Regional Insight

Increasing focus on health and fitness tracking among consumers to boost North America Smart Watch Market growth North America dominated the market in 2024 and is expected to hold the largest Smart Watch market share over the forecast period. With rising awareness about the importance of leading a healthy lifestyle, more individuals are turning to wearable devices like smartwatches to monitor their physical activity, track workouts, and manage their overall well-being. Smart watches equipped with advanced health and fitness features, such as heart rate monitoring, sleep tracking, and activity tracking, cater to this growing demand. These devices allow users to set fitness goals, track their progress over time, and receive personalized insights and recommendations to improve their health and fitness levels. In 2024, North America maintained its leading position in the smart watch market, capturing 29% of total sales. India emerged as a notable contender, experiencing remarkable growth to claim the second-largest share of smart watch sales. China, previously holding the second spot, slipped to third place. Despite this shift, the market for budget-friendly smartwatches priced at $100 or lower continued to hold significance, constituting 35% of total smart watch sales. Conversely, the segment for higher-priced smartwatches exceeding $400 witnessed a remarkable surge in shipments, marking a notable 129% year-on-year increase. This growth is largely propelled by the introduction of the latest Apple Watch models, which fell within this price category. 12.2% of Americans use smart watch as a fitness tracker, which significantly boosts the Smart watch market growth.12.2% of the American population utilizes either a smart watch or a fitness tracker, while globally, 14.4% of individuals rely on smart wristband devices for various purposes. Poland boasts the highest proportion of internet users engaging with smart watch or fitness tracker technology, with 26.5% of its online population employing smart wristbands. Morocco exhibits the lowest adoption rate, with merely 2.1% of its internet users opting for smart wristbands as wearable technology. Smart Watch Market Competitive Landscape Apple continues to be the leader in the global smart watch market, with a share of 34.1% in total shipments. The tech giant also holds a record 60% of the industry’s revenues, making it the dominant player in the market. Analysts attribute this growth to the high demand for the latest Apple Watch models, including the Apple Watch Series 8, Apple Watch Ultra, and Apple Watch SE, which were all released in the fall.

Apple commands 30% of the smart watch market, holding the largest share among all competitors. This significant market dominance is attributed to the impressive array of features offered by Apple watches. These devices ensure seamless connectivity, integrate with Siri for reminders, and boast innovative safety features, enhancing user experience and satisfaction. Samsung holds the second-highest share of the smart watch market, followed by Huawei and Noise. 1. In, September 12, 2023: Apple introduces the advanced new Apple Watch Series 9. Apple Watch Series 9 is more powerful than ever with the new S9 SiP, which increases performance and capabilities; a magical new double tap gesture; a brighter display; faster on-device Siri, now with the ability to access and log health data; Precision Finding for iPhone; and more. Apple Watch Series 9 runs watchOS 10, which delivers redesigned apps, the new Smart Stack, new watch faces, new cycling and hiking features, and tools to support mental health.

Smart watch Market Scope: Inquire before buying

Global Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 43.57 Bn. Forecast Period 2025 to 2032 CAGR: 15.6% Market Size in 2032: USD 138.97 Bn. Segments Covered: by Type Extension Standalone Hybrid by Operating System WatchOS Wear OS HarmonyOS Proprietary / RTOS by Display Technology AMOLED Micro-LED TFT-LCD by Connectivity Bluetooth-only Cellular (4G/LTE) 5G-enabled by Price Range High Medium Low by Application Fitness and Wellness Medical and Chronic-care Personal Assistance and Payments Others by End User Male Female by Distribution Channel Online E-commerce Company websites Offline Supermarkets Specialty stores Others Smart watch Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Smart watch Market, Key Players are

1. Apple Inc. 2. Samsung Electronics 3. Garmin Ltd. 4. Huawei Technologies 5. Fitbit 6. Xiaomi Corporation 7. Fossil Group, Inc. 8. Coros 9. Amazfit 10. Sony Corporation 11. OnePlus 12. Oppo 13. Honor 14. Motorola 15. Casio Computer Co., Ltd. 16. Suunto 17. Withings 18. Mobvoi (TicWatch) 19. LG Electronics 20. Polar Electro 21. boAt 22. Noise 23. Fire-Boltt 24. Realme 25. Titan Company Ltd 26. Fastrack 27. GOQii 28. Pebble 29. Asus 30. Withings 31. OthersFrequently asked questions:

1] What segments are covered in the Smartwatch Market report? Ans. The segments covered in the Smartwatch Market report are based on Type, Operating System, Connectivity, Display Technology, Price Range, Application, End User, Distribution Channel and region 2] Which region is expected to hold the highest share of the Smartwatch Market? Ans. The North America region is expected to hold the highest share of the Smartwatch Market. 3] What is the market size of the Smartwatch Market by 2032? Ans. The market size of the Smartwatch Market by 2032 is USD 138.97 Bn. 4] What is the growth rate of the Smartwatch Market? Ans. The Global Smartwatch Market is growing at a CAGR of 15.6 % during the forecasting period 2025-2032. 5] What was the market size of the Smartwatch Market in 2024? Ans. The market size of the Smartwatch Market in 2024 was USD 43.57 Bn.

1. Smartwatch Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion, Volume in Units’000) - By Segments, Regions, and Country 2. Smartwatch Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Portfolio 2.3.4. End User 2.3.5. Pricing Strategy 2.3.6. New Product Innovation Rate 2.3.7. Market Share (%) 2.3.8. R&D Investment 2.3.9. Revenue, (2024) 2.3.10. Revenue Growth Rate (Y-O-Y) 2.3.11. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 2.6. Research and Development 3. Smartwatch Market: Dynamics 3.1. Smartwatch Market Trends 3.2. Smartwatch Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Smartwatch Market 3.6. Analysis of Government Schemes and Support for the Industry 4. User Penetration and ARPU Analysis 4.1. Global Revenue Comparison of Top 5 Countries, 2025 4.2. User Penetration Comparison of Top 5 Countries, 2025 4.3. Average Revenue per User (ARPU), 2019–2024 4.4. Number of Users Using Smartwatches, 2019–2024 5. Pricing Analysis by Region 5.1. Average Selling Price by Product Type, by Region (2019–2024) 5.2. Price Benchmarks Across Leading Brands 5.3. Impact of Currency Fluctuations and Tariffs on Pricing 5.4. Subscription and Bundled Pricing Models 5.5. Dealer Margins and Retail Discount Strategies 6. Demand Analysis by End Use & Application 6.1. Consumer Demand in Fitness, Lifestyle, and Healthcare Segments 6.2. Demand Drivers: Health Awareness, Tech Adoption, Connectivity 6.3. OEM and Telecom Partnerships Boosting Adoption 6.4. Regional Demand Distribution and Growth Potential 6.5. Impact of Economic Cycles and Disposable Income 7. Consumer Behavior & Purchase Drivers 7.1. Key Purchasing Criteria (Design, Battery Life, Features, OS) 7.2. Brand Loyalty and Repeat Purchase Patterns 7.3. Role of Fitness Trends and Health Goals in Buying Decisions 7.4. Online vs. Offline Purchase Preferences 7.5. Subscription and Service-Based Ownership Models 7.6. Impact of Rising Disposable Income in Emerging Economies 8. Supply Chain & Manufacturing Ecosystem 8.1. Component Sourcing (Sensors, Displays, Batteries, Processors) 8.2. Manufacturing Hubs and Key ODM/EMS Partners 8.3. Logistics and Inventory Management Practices 8.4. Supply Chain Risks and Diversification 8.5. Role of Chipmakers and Technology Integrators 9. Import-Export & Global Trade Analysis (2024) 9.1. Major Exporting and Importing Nations 9.2. Trade Volume and Value Trends (2024) 9.3. Tariff Structures, Trade Agreements & Supply Chain Shifts 9.4. Currency and Freight Impact on Global Shipments 9.5. Impact of Trade Policies on Smartwatch Component Flow 10. Distribution and Retail Landscape 10.1. B2C vs. B2B Distribution Channels 10.2. Role of E-Commerce and Brand-Owned Stores 10.3. Telecom Operators and Wearable Bundling Strategies 10.4. Influence of Online Reviews and Influencer Marketing 10.5. Retail Chain Penetration by Region 11. Technology & Feature Innovation Landscape 11.1. Advancements in Health Sensors and AI Analytics 11.2. Connectivity Upgrades: BLE, 5G, Wi-Fi 11.3. Battery Optimization and Lightweight Material Innovations 11.4. OS and App Ecosystem Developments (WatchOS, WearOS) 11.5. Future Trends: Smart Straps, Haptic Feedback, and AR 12. Sustainability & Environmental Impact 12.1. Environmental Footprint of Manufacturing and Logistics 12.2. Use of Recycled Materials and Eco-Packaging 12.3. E-Waste Management and Battery Recycling Initiatives 12.4. Energy Efficiency and Carbon-Neutral Goals 12.5. Compliance with Global Sustainability Standards 13. Regulatory and Health Compliance Framework 13.1. Health Data Privacy Regulations (HIPAA, GDPR) 13.2. Medical Device Classification and Certification (FDA, CE) 13.3. Data Security and Cyber Protection Standards 13.4. Regional Regulatory Differences and Certification Barriers 13.5. Legal Implications of AI and Health Data Usage 14. Smartwatch Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Units’000) (2024-2032) 14.1. Smartwatch Market Size and Forecast, By Type (2024-2032) 14.1.1. Extension 14.1.2. Standalone 14.1.3. Hybrid 14.2. Smartwatch Market Size and Forecast, By Operating System (2024-2032) 14.2.1. WatchOS 14.2.2. Wear OS 14.2.3. HarmonyOS 14.2.4. Proprietary / RTOS 14.3. Smartwatch Market Size and Forecast, By Display Technology (2024-2032) 14.3.1. AMOLED 14.3.2. Micro-LED 14.3.3. TFT-LCD 14.4. Smartwatch Market Size and Forecast, By Connectivity (2024-2032) 14.4.1. Bluetooth-only 14.4.2. Cellular (4G/LTE) 14.4.3. 5G-enabled 14.5. Smartwatch Market Size and Forecast, By Price Range (2024-2032) 14.5.1. High 14.5.2. Medium 14.5.3. Low 14.6. Smartwatch Market Size and Forecast, By Application (2024-2032) 14.6.1. Fitness and Wellness 14.6.2. Medical and Chronic-care 14.6.3. Personal Assistance and Payments 14.6.4. Others 14.7. OthersSmartwatch Market Size and Forecast, By End User (2024-2032) 14.7.1. Male 14.7.2. Female 14.8. Smartwatch Market Size and Forecast, By Distribution Channel (2024-2032) 14.8.1. Online 14.8.1.1. E-commerce 14.8.1.2. Company websites 14.8.2. Offline 14.8.2.1. Supermarkets 14.8.2.2. Specialty stores 14.8.2.3. Others 14.9. Smartwatch Market Size and Forecast, By Region (2024-2032) 14.9.1. North America 14.9.2. Europe 14.9.3. Asia Pacific 14.9.4. Middle East and Africa 14.9.5. South America 15. North America Smartwatch Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Units’000) (2024-2032) 15.1. North America Smartwatch Market Size and Forecast, By Type (2024-2032) 15.1.1. Extension 15.1.2. Standalone 15.1.3. Hybrid 15.2. North America Smartwatch Market Size and Forecast, By Operating System (2024-2032) 15.2.1. WatchOS 15.2.2. Wear OS 15.2.3. HarmonyOS 15.2.4. Proprietary / RTOS 15.3. North America Smartwatch Market Size and Forecast, By Display Technology (2024-2032) 15.3.1. AMOLED 15.3.2. Micro-LED 15.3.3. TFT-LCD 15.4. North America Smartwatch Market Size and Forecast, By Connectivity (2024-2032) 15.4.1. Bluetooth-only 15.4.2. Cellular (4G/LTE) 15.4.3. 5G-enabled 15.5. North America Smartwatch Market Size and Forecast, By Price Range (2024-2032) 15.5.1. High 15.5.2. Medium 15.5.3. Low 15.6. North America Smartwatch Market Size and Forecast, By Application (2024-2032) 15.6.1. Fitness and Wellness 15.6.2. Medical and Chronic-care 15.6.3. Personal Assistance and Payments 15.6.4. Others 15.7. North America Smartwatch Market Size and Forecast, By End User (2024-2032) 15.7.1. Male 15.7.2. Female 15.8. North America Smartwatch Market Size and Forecast, By Distribution Channel (2024-2032) 15.8.1. Online 15.8.1.1. E-commerce 15.8.1.2. Company websites 15.8.2. Offline 15.8.2.1. Supermarkets 15.8.2.2. Specialty stores 15.8.2.3. Others 15.9. North America Smartwatch Market Size and Forecast, by Country (2024-2032) 15.9.1. United States 15.9.1.1. United States Smartwatch Market Size and Forecast, By Type (2024-2032) 15.9.1.1.1. Extension 15.9.1.1.2. Standalone 15.9.1.1.3. Hybrid 15.9.1.2. United States Smartwatch Market Size and Forecast, By Operating System (2024-2032) 15.9.1.2.1. WatchOS 15.9.1.2.2. Wear OS 15.9.1.2.3. HarmonyOS 15.9.1.2.4. Proprietary / RTOS 15.9.1.3. United States Smartwatch Market Size and Forecast, By Display Technology (2024-2032) 15.9.1.3.1. AMOLED 15.9.1.3.2. Micro-LED 15.9.1.3.3. TFT-LCD 15.9.1.4. United States Smartwatch Market Size and Forecast, By Connectivity (2024-2032) 15.9.1.4.1. Bluetooth-only 15.9.1.4.2. Cellular (4G/LTE) 15.9.1.4.3. 5G-enabled 15.9.1.5. United States Smartwatch Market Size and Forecast, By Price Range (2024-2032) 15.9.1.5.1. High 15.9.1.5.2. Medium 15.9.1.5.3. Low 15.9.1.6. United States Smartwatch Market Size and Forecast, By Application (2024-2032) 15.9.1.6.1. Fitness and Wellness 15.9.1.6.2. Medical and Chronic-care 15.9.1.6.3. Personal Assistance and Payments 15.9.1.6.4. Others 15.9.1.7. United States Smartwatch Market Size and Forecast, By End User (2024-2032) 15.9.1.7.1. Male 15.9.1.7.2. Female 15.9.1.8. United States Smartwatch Market Size and Forecast, By Distribution Channel (2024-2032) 15.9.1.8.1. Online 15.9.1.8.1.1. E-commerce 15.9.1.8.1.2. Company websites 15.9.1.8.2. Offline 15.9.1.8.2.1. Supermarkets 15.9.1.8.2.2. Specialty stores 15.9.1.8.2.3. Others 15.9.2. Canada 15.9.2.1. Canada Smartwatch Market Size and Forecast, By Type (2024-2032) 15.9.2.1.1. Extension 15.9.2.1.2. Standalone 15.9.2.1.3. Hybrid 15.9.2.2. Canada Smartwatch Market Size and Forecast, By Operating System (2024-2032) 15.9.2.2.1. WatchOS 15.9.2.2.2. Wear OS 15.9.2.2.3. HarmonyOS 15.9.2.2.4. Proprietary / RTOS 15.9.2.3. Canada Smartwatch Market Size and Forecast, By Display Technology (2024-2032) 15.9.2.3.1. AMOLED 15.9.2.3.2. Micro-LED 15.9.2.3.3. TFT-LCD 15.9.2.4. Canada Smartwatch Market Size and Forecast, By Connectivity (2024-2032) 15.9.2.4.1. Bluetooth-only 15.9.2.4.2. Cellular (4G/LTE) 15.9.2.4.3. 5G-enabled 15.9.2.5. Canada Smartwatch Market Size and Forecast, By Price Range (2024-2032) 15.9.2.5.1. High 15.9.2.5.2. Medium 15.9.2.5.3. Low 15.9.2.6. Canada Smartwatch Market Size and Forecast, By Application (2024-2032) 15.9.2.6.1. Fitness and Wellness 15.9.2.6.2. Medical and Chronic-care 15.9.2.6.3. Personal Assistance and Payments 15.9.2.6.4. Others 15.9.2.7. Canada Smartwatch Market Size and Forecast, By End User (2024-2032) 15.9.2.7.1. Male 15.9.2.7.2. Female 15.9.2.8. Canada Smartwatch Market Size and Forecast, By Distribution Channel (2024-2032) 15.9.2.8.1. Online 15.9.2.8.1.1. E-commerce 15.9.2.8.1.2. Company websites 15.9.2.8.2. Offline 15.9.2.8.2.1. Supermarkets 15.9.2.8.2.2. Specialty stores 15.9.2.8.2.3. Others 15.9.3. Mexico 15.9.3.1. Mexico Smartwatch Market Size and Forecast, By Type (2024-2032) 15.9.3.1.1. Extension 15.9.3.1.2. Standalone 15.9.3.1.3. Hybrid 15.9.3.2. Mexico Smartwatch Market Size and Forecast, By Operating System (2024-2032) 15.9.3.2.1. WatchOS 15.9.3.2.2. Wear OS 15.9.3.2.3. HarmonyOS 15.9.3.2.4. Proprietary / RTOS 15.9.3.3. Mexico Smartwatch Market Size and Forecast, By Display Technology (2024-2032) 15.9.3.3.1. AMOLED 15.9.3.3.2. Micro-LED 15.9.3.3.3. TFT-LCD 15.9.3.4. Mexico Smartwatch Market Size and Forecast, By Connectivity (2024-2032) 15.9.3.4.1. Bluetooth-only 15.9.3.4.2. Cellular (4G/LTE) 15.9.3.4.3. 5G-enabled 15.9.3.5. Mexico Smartwatch Market Size and Forecast, By Price Range (2024-2032) 15.9.3.5.1. High 15.9.3.5.2. Medium 15.9.3.5.3. Low 15.9.3.6. Mexico Smartwatch Market Size and Forecast, By Application (2024-2032) 15.9.3.6.1. Fitness and Wellness 15.9.3.6.2. Medical and Chronic-care 15.9.3.6.3. Personal Assistance and Payments 15.9.3.6.4. Others 15.9.3.7. Mexico Smartwatch Market Size and Forecast, By End User (2024-2032) 15.9.3.7.1. Male 15.9.3.7.2. Female 15.9.3.8. Mexico Smartwatch Market Size and Forecast, By Distribution Channel (2024-2032) 15.9.3.8.1. Online 15.9.3.8.1.1. E-commerce 15.9.3.8.1.2. Company websites 15.9.3.8.2. Offline 15.9.3.8.2.1. Supermarkets 15.9.3.8.2.2. Specialty stores 15.9.3.8.2.3. Others 16. Europe Smartwatch Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Units’000) (2024-2032) 16.1. Europe Smartwatch Market Size and Forecast, By Type (2024-2032) 16.2. Europe Smartwatch Market Size and Forecast, By Operating System (2024-2032) 16.3. Europe Smartwatch Market Size and Forecast, By Display Technology (2024-2032) 16.4. Europe Smartwatch Market Size and Forecast, By Connectivity (2024-2032) 16.5. Europe Smartwatch Market Size and Forecast, By Price Range (2024-2032) 16.6. Europe Smartwatch Market Size and Forecast, By Application (2024-2032) 16.7. Europe Smartwatch Market Size and Forecast, By End User (2024-2032) 16.8. Europe Smartwatch Market Size and Forecast, By Distribution Channel (2024-2032) 16.9. Europe Smartwatch Market Size and Forecast, By Country (2024-2032) 16.9.1. United Kingdom 16.9.2. France 16.9.3. Germany 16.9.4. Italy 16.9.5. Spain 16.9.6. Sweden 16.9.7. Russia 16.9.8. Rest of Europe 17. Asia Pacific Smartwatch Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Units’000) (2024-2032) 17.1. Asia Pacific Smartwatch Market Size and Forecast, By Type (2024-2032) 17.2. Asia Pacific Smartwatch Market Size and Forecast, By Operating System (2024-2032) 17.3. Asia Pacific Smartwatch Market Size and Forecast, By Display Technology (2024-2032) 17.4. Asia Pacific Smartwatch Market Size and Forecast, By Connectivity (2024-2032) 17.5. Asia Pacific Smartwatch Market Size and Forecast, By Price Range (2024-2032) 17.6. Asia Pacific Smartwatch Market Size and Forecast, By Application (2024-2032) 17.7. Asia Pacific Smartwatch Market Size and Forecast, By End User (2024-2032) 17.8. Asia Pacific Smartwatch Market Size and Forecast, By Distribution Channel (2024-2032) 17.9. Asia Pacific Smartwatch Market Size and Forecast, by Country (2024-2032) 17.9.1. China 17.9.2. S Korea 17.9.3. Japan 17.9.4. India 17.9.5. Australia 17.9.6. Indonesia 17.9.7. Malaysia 17.9.8. Philippines 17.9.9. Thailand 17.9.10. Vietnam 17.9.11. Rest of Asia Pacific 18. Middle East and Africa Smartwatch Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Units’000) (2024-2032) 18.1. Middle East and Africa Smartwatch Market Size and Forecast, By Type (2024-2032) 18.2. Middle East and Africa Smartwatch Market Size and Forecast, By Operating System (2024-2032) 18.3. Middle East and Africa Smartwatch Market Size and Forecast, By Display Technology (2024-2032) 18.4. Middle East and Africa Smartwatch Market Size and Forecast, By Connectivity (2024-2032) 18.5. Middle East and Africa Smartwatch Market Size and Forecast, By Price Range (2024-2032) 18.6. Middle East and Africa Smartwatch Market Size and Forecast, By Application (2024-2032) 18.7. Middle East and Africa Smartwatch Market Size and Forecast, By End User (2024-2032) 18.8. Middle East and Africa Smartwatch Market Size and Forecast, By Distribution Channel (2024-2032) 18.9. Middle East and Africa Smartwatch Market Size and Forecast, By Country (2024-2032) 18.9.1. South Africa 18.9.2. GCC 18.9.3. Nigeria 18.9.4. Rest of ME&A 19. South America Smartwatch Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Units’000) (2024-2032) 19.1. South America Smartwatch Market Size and Forecast, By Type (2024-2032) 19.2. South America Smartwatch Market Size and Forecast, By Operating System (2024-2032) 19.3. South America Smartwatch Market Size and Forecast, By Display Technology (2024-2032) 19.4. South America Smartwatch Market Size and Forecast, By Connectivity (2024-2032) 19.5. South America Smartwatch Market Size and Forecast, By Price Range (2024-2032) 19.6. South America Smartwatch Market Size and Forecast, By Application (2024-2032) 19.7. South America Smartwatch Market Size and Forecast, By End User (2024-2032) 19.8. South America Smartwatch Market Size and Forecast, By Distribution Channel (2024-2032) 19.9. South America Smartwatch Market Size and Forecast, By Country (2024-2032) 19.9.1. Brazil 19.9.2. Argentina 19.9.3. Colombia 19.9.4. Chile 19.9.5. Rest of South America 20. Company Profile: Key Players 20.1. Apple Inc. 20.1.1. Company Overview 20.1.2. Business Portfolio 20.1.3. Financial Overview 20.1.4. SWOT Analysis 20.1.5. Strategic Analysis 20.1.6. Recent Developments 20.2. Samsung Electronics 20.3. Garmin Ltd. 20.4. Huawei Technologies 20.5. Fitbit 20.6. Xiaomi Corporation 20.7. Fossil Group, Inc. 20.8. Coros 20.9. Amazfit 20.10. Sony Corporation 20.11. OnePlus 20.12. Oppo 20.13. Honor 20.14. Motorola 20.15. Casio Computer Co., Ltd. 20.16. Suunto 20.17. Withings 20.18. Mobvoi (TicWatch) 20.19. LG Electronics 20.20. Polar Electro 20.21. boAt 20.22. Noise 20.23. Fire-Boltt 20.24. Realme 20.25. Titan Company Ltd 20.26. Fastrack 20.27. GOQii 20.28. Pebble 20.29. Asus 20.30. Withings 20.31. Others 21. Key Findings 22. Analyst Recommendations 23. Smartwatch Market – Research Methodology