The Smart Pill Boxes & Bottles Market size was valued at USD 2.83 billion in 2023 and the total Smart Pill Boxes & Bottles Market revenue is expected to grow at a CAGR of 5.1 % from 2024 to 2030, reaching nearly USD 3.99 billion. Smart pill boxes and bottles are innovative medication management devices designed to improve medication adherence and simplify the process of taking medications. These devices are equipped with various technologies such as IoT (Internet of Things), sensors, connectivity features, and smartphone apps to help users organize, monitor, and track their medication intake. Smart pillboxes typically come with compartments for different pills, while smart pill bottles may dispense pills automatically or provide reminders to users. An increasing prevalence of chronic diseases, a rising geriatric population, and the need for efficient medication management solutions. The Smart Pill Boxes & Bottles Market is characterized by the presence of key players offering a wide range of smart medication adherence devices. Factors such as technological advancements, increasing healthcare expenditures, and growing awareness about the importance of medication adherence are driving the Smart Pill Boxes & Bottles Market growth.To Know About The Research Methodology :- Request Free Sample Report Rapid technological advancements and increasing adoption of these devices across various healthcare settings. The primary driving factors include the growing burden of chronic diseases such as diabetes, cardiovascular disorders, and neurological conditions, which necessitate strict medication adherence to manage symptoms and prevent complications. Additionally, the aging population, coupled with the rising trend of remote patient monitoring and telehealth, is fueling the demand for smart medication management solutions that enable remote monitoring and improve patient outcomes. Technological advancements such as sensor-based tracking, connectivity features, and AI-driven personalized medication regimens are driving innovation in the Smart Pill Boxes & Bottles Market, allowing for more efficient and user-friendly medication management solutions. Moreover, the integration of smart pill boxes and bottles with electronic health records (EHRs) and healthcare provider systems offers opportunities for seamless data exchange and improved care coordination. Recent developments in the Smart Pill Boxes & Bottles Market include product launches by key players such as Ellie Health, AdhereTech, Pillo Health, MedMinder, and Pillsy, introducing advanced smart medication adherence devices with features like Bluetooth connectivity, sensor tracking, AI interaction, and remote monitoring capabilities. These developments signify the continuous innovation and growth potential of the Smart Pill Boxes & Bottles Market, with a focus on enhancing medication adherence, patient engagement, and healthcare outcomes.

Market Dynamics:

Home-Based Healthcare Trend Fuels Demand for Smart Medication Adherence Solutions: The increasing elderly population globally drives the demand for smart pill boxes and bottles to manage medication adherence. For instance, by 2050, the global population aged 60 and above is projected to reach 2.1 billion, fueling market growth. With the rise in chronic diseases like diabetes and hypertension, there's a heightened need for effective medication management. Smart pill boxes and bottles offer reminder and tracking features, enhancing patient compliance. For example, in 2021, the global prevalence of diabetes reached 537 million, underscoring the Smart Pill Boxes & Bottles Market potential. Continuous technological innovations, such as IoT integration and mobile applications, enhance the functionality of smart pill boxes and bottles. These advancements improve medication adherence by providing real-time monitoring and alerts. By 2030, the smart pill boxes and bottles market is projected to witness significant technological enhancements, driving Smart Pill Boxes & Bottles Market growth.Governments worldwide are promoting healthcare initiatives to improve patient outcomes and reduce healthcare costs. Subsidies and incentives for smart healthcare technologies, including smart pill boxes and bottles, propel the Smart Pill Boxes & Bottles Market growth. For instance, in the U.S., initiatives like the Affordable Care Act support innovations in healthcare technology. The rise in healthcare spending globally, coupled with the growing emphasis on preventative healthcare, boosts the adoption of smart pill boxes and bottles. In 2022, healthcare expenditure worldwide amounted to approximately USD 8.6 trillion, indicating a lucrative Smart Pill Boxes & Bottles Market opportunity for smart medication management solutions. The trend towards home-based healthcare solutions drives the demand for convenient medication management devices like smart pill boxes and bottles. Patients prefer the comfort and independence offered by home healthcare, leading to increased adoption of smart medication adherence solutions. By 2032, the home healthcare market is expected to expand substantially, contributing to the growth of the Smart Pill Boxes & Bottles Market. Telehealth growth drives Demand for Remote Medication Monitoring Solutions: Smart pill boxes and bottles contribute to better patient outcomes by reducing medication errors and enhancing adherence rates. Studies show that medication adherence rates improve by up to 30% with the use of smart medication management devices. As a result, healthcare providers increasingly recommend these solutions, driving Smart Pill Boxes & Bottles Market growth. The growth of telehealth services amplifies the need for remote medication monitoring solutions like smart pill boxes and bottles. Telehealth platforms integrate with these devices to enable remote patient monitoring, medication reminders, and adherence tracking. By 2025, the telehealth market is projected to exceed USD 200 billion, indicating significant opportunities for smart medication management solutions. Growing awareness among patients and healthcare providers regarding the importance of medication adherence drives the adoption of smart pill boxes and bottles. Educational campaigns and initiatives emphasize the role of adherence in managing chronic conditions and preventing complications. For example, in 2021, the WHO launched the Medication Without Harm campaign to raise awareness about medication safety and adherence. Manufacturers are expanding their market reach through strategic partnerships, distribution agreements, and product innovations. For instance, partnerships with pharmacies and healthcare providers enable wider access to smart pill boxes and bottles. Additionally, product enhancements such as multi-dose packaging and customizable reminder features to cater to diverse patient needs, driving the Smart Pill Boxes & Bottles Market growth.

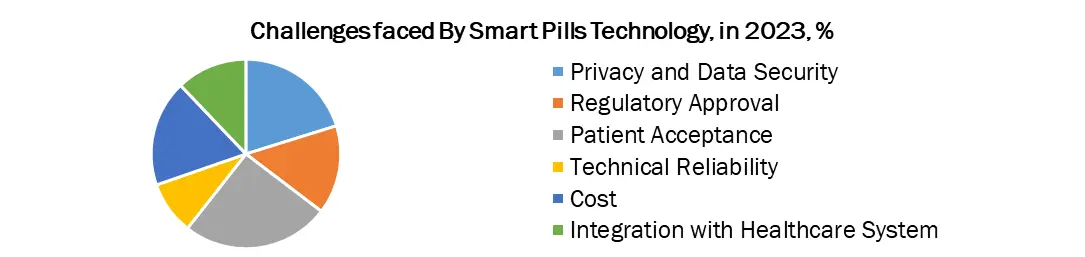

Navigating Evolving Regulatory Standards in the Development of Smart Pill Boxes and Bottles: Smart Pill Boxes & Bottles Market often come with advanced technological features, leading to higher initial costs. For example, a sophisticated smart pill bottle with IoT integration requires a significant investment upfront, limiting adoption by budget-constrained healthcare facilities or patients. The complexity of smart pill boxes and bottles poses challenges for certain patient demographics, such as the elderly or those with limited technological literacy. For example, individuals unfamiliar with smartphone apps or IoT devices struggle to utilize features like medication reminders or adherence tracking effectively, reducing the overall effectiveness of these solutions. Compatibility issues between different smart pill boxes, bottles, and healthcare systems hinder seamless integration and data sharing. For instance, a smart pill box designed to work with specific medication management software is not compatible with a patient's existing electronic health record system, leading to inefficiencies in medication management and data management processes. Stringent regulatory requirements governing medical devices slow down the introduction of new smart pill boxes and bottles to the market. For example, obtaining regulatory approvals from authorities such as the FDA or EMA involves lengthy and costly processes, delaying product launches and market entry. Compliance with evolving regulatory standards adds complexity and uncertainty to the development and commercialization of smart medication management solutions.

Smart Pill Boxes & Bottles Market Segment Analysis:

Based on End-Users, The Smart Pill Boxes & Bottles Market exhibits varying dominance among different end-user segments, with notable implications for application and adoption. The home care settings segment dominated the Smart Pill Boxes & Bottles Market in 2023, due to the increasing preference for home healthcare solutions and the growing aging population needing medication management support at home. The ease of use and convenience offered by smart pill boxes and bottles align well with the needs of patients managing chronic conditions independently. The long-term care centers segment is also significant, driven by the rising demand for assisted living and nursing home facilities catering to elderly patients with complex medication regimens. Hospitals represent a smaller but growing segment as healthcare institutions increasingly adopt digital health solutions for inpatient medication management. The home care settings segment is expected to maintain its dominance, fueled by the continued expansion of home healthcare services and the aging population's preference for aging in place. However, long-term care centers and hospitals will also experience growth as they embrace digital medication management solutions to improve patient care and operational efficiency.Smart Pill Boxes & Bottles Market Regional Insights:

North America stands out as the dominant region in the smart pill boxes and bottles market, accounting for a significant share of the global Smart Pill Boxes & Bottles Market. The region's dominance is attributed to several factors, including the presence of established healthcare infrastructure, high adoption rates of advanced healthcare technologies, and the increasing prevalence of chronic diseases requiring regular medication management. For example, in 2023, North America will remain at the epicenter of market growth, with the United States driving substantial demand for smart medication management solutions. Additionally, favorable reimbursement policies and government initiatives promoting digital healthcare further propel the Smart Pill Boxes & Bottles Market in this region. However, while North America currently dominates, other regions, particularly Asia Pacific, are poised for significant growth. The Asia Pacific region is expected to witness rapid market growth, driven by factors such as increasing healthcare expenditure, rising awareness about the benefits of smart medication adherence solutions, and the growing prevalence of chronic diseases in countries like China, India, and Japan. Moreover, advancements in healthcare infrastructure and the expansion of telehealth services further drive the adoption of smart medication management solutions in this region. While North America currently dominates, the Asia Pacific region's rapid growth underscores its potential to emerge as a key market player in the Smart Pill Boxes & Bottles Market in the forecast period. Competitive Landscape These innovative product launches by Ellie Health, AdhereTech, Pillo Health, MedMinder, and Pillsy are poised to drive Smart Pill Boxes & Bottles Market growth by revolutionizing medication management. By incorporating advanced technology such as Bluetooth connectivity, sensor tracking, artificial intelligence, and personalized scheduling, these smart pill boxes and bottles offer enhanced convenience, adherence, and health outcomes for users. The seamless integration with smartphone apps and connectivity to healthcare providers enable remote monitoring and support, addressing the evolving needs of patients and caregivers. This convergence of technology and healthcare is expected to spur Smart Pill Boxes & Bottles Market growth by catering to the increasing demand for effective medication adherence solutions, ultimately improving patient outcomes and healthcare efficiency. MedMinder introduced a smart pill dispenser equipped with features like visual and auditory reminders, dose tracking, and real-time monitoring. The device helps users manage complex medication schedules and alerts caregivers in case of missed doses. With its user-friendly interface and connectivity options, MedMinder aims to improve medication adherence and simplify medication management AdhereTech launched a smart pill bottle equipped with advanced technology to improve medication adherence. The bottle features sensors that track usage patterns and send reminders to patients via text or phone call if doses are missed. This innovative solution aims to enhance patient compliance and improve health outcomes. Pillo Health unveiled a smart pill dispenser capable of dispensing medication on schedule and providing personalized health insights. The device utilizes artificial intelligence to interact with users, answer health-related questions, and manage medication regimens effectively. It also connects to healthcare providers and caregivers to facilitate remote monitoring and support. Pillsy launched a smart pill bottle designed to track medication usage and provide reminders to users. The bottle syncs with a smartphone app to create personalized medication schedules, track adherence, and send notifications when doses are due. Pillsy's solution targets individuals seeking a user-friendly and accessible way to manage their medication regimen.Smart Pill Boxes & Bottles Market Scope: Inquire before buying

Smart Pill Boxes & Bottles Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.83 Bn. Forecast Period 2024 to 2030 CAGR: 5.1% Market Size in 2030: US $ 3.99 Bn. Segments Covered: by Product Type Smart Pill Boxes Smart Pill Bottles by Indication Dementia Cancer Management Diabetes Care Others by End-Users Home Care Settings Long Term Care Centers Hospitals Smart Pill Boxes & Bottles Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Smart Pill Boxes & Bottles Market Key Players:

Key Players in North America: 1. AdhereTech (New York, USA) 2. PharmRight Corporation (Charlottesville, Virginia, USA) 3. MedMinder (Boston, Massachusetts, USA) 4. Medipense Inc (Montreal, Quebec, Canada) 5. E-pill, LLC (Acton, Massachusetts, USA) 6. Medready Inc (New York, USA) 7. PillDrill Inc (San Francisco, California, USA) 8. Pillsy, Inc. (San Francisco, California, USA) 9. DoseSmart Inc (San Francisco, California, USA) Key Players in Europe: 10. Koninklijke Philips (Amsterdam, Netherlands) FAQs: 1. What are the growth drivers for the Market? Ans. The home-based Healthcare Trend Fuels Demand for Smart Medication Adherence Solutions and is expected to be the major driver for the Market. 2. What is the major Opportunity for the Market growth? Ans. Telehealth growth drives Demand for Remote Medication Monitoring Solutions Profiles is expected to be the major Opportunity in the Market. 3. Which country is expected to lead the global Market during the forecast period? Ans. North America is expected to lead the Market during the forecast period. 4. What is the projected market size and growth rate of the Market? Ans. The Smart Pill Boxes & Bottles Market size was valued at USD 2.83 billion in 2023 and the total Smart Pill Boxes & Bottles Market revenue is expected to grow at a CAGR of 5.1 % from 2024 to 2030, reaching nearly USD 3.99 billion. 5. What segments are covered in the Smart Pill Boxes & Bottles Market report? Ans. The segments covered in the Smart Pill Boxes & Bottles Market report are by Product Type, Indication, End-Users, and Region.

1. Smart Pill Boxes & Bottles Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Smart Pill Boxes & Bottles Market: Dynamics 2.1. Smart Pill Boxes & Bottles Market Trends by Region 2.1.1. North America Smart Pill Boxes & Bottles Market Trends 2.1.2. Europe Smart Pill Boxes & Bottles Market Trends 2.1.3. Asia Pacific Smart Pill Boxes & Bottles Market Trends 2.1.4. Middle East and Africa Smart Pill Boxes & Bottles Market Trends 2.1.5. South America Smart Pill Boxes & Bottles Market Trends 2.2. Smart Pill Boxes & Bottles Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Smart Pill Boxes & Bottles Market Drivers 2.2.1.2. North America Smart Pill Boxes & Bottles Market Restraints 2.2.1.3. North America Smart Pill Boxes & Bottles Market Opportunities 2.2.1.4. North America Smart Pill Boxes & Bottles Market Challenges 2.2.2. Europe 2.2.2.1. Europe Smart Pill Boxes & Bottles Market Drivers 2.2.2.2. Europe Smart Pill Boxes & Bottles Market Restraints 2.2.2.3. Europe Smart Pill Boxes & Bottles Market Opportunities 2.2.2.4. Europe Smart Pill Boxes & Bottles Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Smart Pill Boxes & Bottles Market Drivers 2.2.3.2. Asia Pacific Smart Pill Boxes & Bottles Market Restraints 2.2.3.3. Asia Pacific Smart Pill Boxes & Bottles Market Opportunities 2.2.3.4. Asia Pacific Smart Pill Boxes & Bottles Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Smart Pill Boxes & Bottles Market Drivers 2.2.4.2. Middle East and Africa Smart Pill Boxes & Bottles Market Restraints 2.2.4.3. Middle East and Africa Smart Pill Boxes & Bottles Market Opportunities 2.2.4.4. Middle East and Africa Smart Pill Boxes & Bottles Market Challenges 2.2.5. South America 2.2.5.1. South America Smart Pill Boxes & Bottles Market Drivers 2.2.5.2. South America Smart Pill Boxes & Bottles Market Restraints 2.2.5.3. South America Smart Pill Boxes & Bottles Market Opportunities 2.2.5.4. South America Smart Pill Boxes & Bottles Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Smart Pill Boxes & Bottles Industry 2.8. Analysis of Government Schemes and Initiatives For Smart Pill Boxes & Bottles Industry 2.9. Smart Pill Boxes & Bottles Market Trade Analysis 2.10. The Global Pandemic Impact on Smart Pill Boxes & Bottles Market 3. Smart Pill Boxes & Bottles Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 3.1.1. Smart Pill Boxes 3.1.2. Smart Pill Bottles 3.2. Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 3.2.1. Dementia 3.2.2. Cancer Management 3.2.3. Diabetes Care 3.2.4. Others 3.3. Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 3.3.1. Home Care Settings 3.3.2. Long-Term Care Centers 3.3.3. Hospitals 3.4. Smart Pill Boxes & Bottles Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Smart Pill Boxes & Bottles Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 4.1.1. Smart Pill Boxes 4.1.2. Smart Pill Bottles 4.2. North America Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 4.2.1. Dementia 4.2.2. Cancer Management 4.2.3. Diabetes Care 4.2.4. Others 4.3. North America Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 4.3.1. Home Care Settings 4.3.2. Long-Term Care Centers 4.3.3. Hospitals 4.4. North America Smart Pill Boxes & Bottles Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 4.4.1.1.1. Smart Pill Boxes 4.4.1.1.2. Smart Pill Bottles 4.4.1.2. United States Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 4.4.1.2.1. Dementia 4.4.1.2.2. Cancer Management 4.4.1.2.3. Diabetes Care 4.4.1.2.4. Others 4.4.1.3. United States Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Home Care Settings 4.4.1.3.2. Long-Term Care Centers 4.4.1.3.3. Hospitals 4.4.2. Canada 4.4.2.1. Canada Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 4.4.2.1.1. Smart Pill Boxes 4.4.2.1.2. Smart Pill Bottles 4.4.2.2. Canada Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 4.4.2.2.1. Dementia 4.4.2.2.2. Cancer Management 4.4.2.2.3. Diabetes Care 4.4.2.2.4. Others 4.4.2.3. Canada Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Home Care Settings 4.4.2.3.2. Long-Term Care Centers 4.4.2.3.3. Hospitals 4.4.3. Mexico 4.4.3.1. Mexico Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 4.4.3.1.1. Smart Pill Boxes 4.4.3.1.2. Smart Pill Bottles 4.4.3.2. Mexico Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 4.4.3.2.1. Dementia 4.4.3.2.2. Cancer Management 4.4.3.2.3. Diabetes Care 4.4.3.2.4. Others 4.4.3.3. Mexico Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Home Care Settings 4.4.3.3.2. Long-Term Care Centers 4.4.3.3.3. Hospitals 5. Europe Smart Pill Boxes & Bottles Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 5.2. Europe Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 5.3. Europe Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 5.4. Europe Smart Pill Boxes & Bottles Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 5.4.1.2. United Kingdom Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 5.4.1.3. United Kingdom Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 5.4.2.2. France Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 5.4.2.3. France Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 5.4.3.2. Germany Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 5.4.3.3. Germany Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 5.4.4.2. Italy Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 5.4.4.3. Italy Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 5.4.5.2. Spain Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 5.4.5.3. Spain Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 5.4.6.2. Sweden Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 5.4.6.3. Sweden Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 5.4.7.2. Austria Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 5.4.7.3. Austria Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 5.4.8.2. Rest of Europe Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 5.4.8.3. Rest of Europe Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Smart Pill Boxes & Bottles Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 6.2. Asia Pacific Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 6.3. Asia Pacific Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Smart Pill Boxes & Bottles Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 6.4.1.2. China Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 6.4.1.3. China Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 6.4.2.2. S Korea Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 6.4.2.3. S Korea Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 6.4.3.2. Japan Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 6.4.3.3. Japan Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 6.4.4.2. India Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 6.4.4.3. India Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 6.4.5.2. Australia Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 6.4.5.3. Australia Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 6.4.6.2. Indonesia Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 6.4.6.3. Indonesia Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 6.4.7.2. Malaysia Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 6.4.7.3. Malaysia Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 6.4.8.2. Vietnam Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 6.4.8.3. Vietnam Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 6.4.9.2. Taiwan Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 6.4.9.3. Taiwan Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 6.4.10.3. Rest of Asia Pacific Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Smart Pill Boxes & Bottles Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 7.2. Middle East and Africa Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 7.3. Middle East and Africa Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Smart Pill Boxes & Bottles Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 7.4.1.2. South Africa Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 7.4.1.3. South Africa Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 7.4.2.2. GCC Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 7.4.2.3. GCC Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 7.4.3.2. Nigeria Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 7.4.3.3. Nigeria Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 7.4.4.2. Rest of ME&A Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 7.4.4.3. Rest of ME&A Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 8. South America Smart Pill Boxes & Bottles Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 8.2. South America Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 8.3. South America Smart Pill Boxes & Bottles Market Size and Forecast, by End User(2023-2030) 8.4. South America Smart Pill Boxes & Bottles Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 8.4.1.2. Brazil Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 8.4.1.3. Brazil Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 8.4.2.2. Argentina Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 8.4.2.3. Argentina Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Smart Pill Boxes & Bottles Market Size and Forecast, by Product Type (2023-2030) 8.4.3.2. Rest Of South America Smart Pill Boxes & Bottles Market Size and Forecast, by Indication (2023-2030) 8.4.3.3. Rest Of South America Smart Pill Boxes & Bottles Market Size and Forecast, by End User (2023-2030) 9. Global Smart Pill Boxes & Bottles Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Smart Pill Boxes & Bottles Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. AdhereTech (New York, USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. PharmRight Corporation (Charlottesville, Virginia, USA) 10.3. MedMinder (Boston, Massachusetts, USA) 10.4. Medipense Inc (Montreal, Quebec, Canada) 10.5. E-pill, LLC (Acton, Massachusetts, USA) 10.6. Medready Inc (New York, USA) 10.7. PillDrill Inc (San Francisco, California, USA) 10.8. Pillsy, Inc. (San Francisco, California, USA) 10.9. DoseSmart Inc (San Francisco, California, USA) 10.10. Koninklijke Philips (Amsterdam, Netherlands) 11. Key Findings 12. Industry Recommendations 13. Smart Pill Boxes & Bottles Market: Research Methodology 14. Terms and Glossary