Smart Exoskeleton Market was valued at US$ 559.89 Million in 2022. The Global Smart Exoskeleton Market size is expected to grow at a CAGR of 33.23% through the forecast period.Smart Exoskeleton Market Overview:

A smart exoskeleton is a powered system that uses feedback from the wearer to provide greater assistance to specific body parts or the full body while reducing energy consumption. Smart exoskeleton that adapts to human body motions automatically and aids in optimal performance.To know about the Research Methodology:-Request Free Sample Report The report explores the Smart Exoskeleton Market's segments (Type, Body Part, Application, and Region). Data has been provided by market participants, and regions (North America, Asia Pacific, Europe, Middle East & Africa, and South America). The MMR market report provides a thorough analysis of the rapid advances that are currently taking place across all industry sectors. Facts and figures, illustrations, and presentations are used to provide key data analysis for the historical period from 2017 to 2022. The report investigates the Smart Exoskeleton Market's drivers, limitations, prospects, and barriers. This MMR report includes investor recommendations based on a thorough examination of the Smart Exoskeleton Market's contemporary competitive scenario

Smart Exoskeleton Market Dynamics:

1. Growing Demand for The Healthcare Industry Exoskeleton with the ability to improve user movement, prevent unanticipated injuries, and revive blood circulation in those with muscle weakness. People with health and neurological problems can benefit from a smart exoskeleton. It can also be used in therapeutic settings to support patients with successful exercise and rehabilitation. Motors are installed in the hip and knee joints of exoskeletons. The need for smart exoskeletons in the rehabilitation of persons with physical disabilities and neurological illnesses is a prominent factor driving the global smart exoskeleton market forward. 2. Increase In Demand for Industrial Body Parts The objective of an exoskeleton in the workplace is to supplement, magnify, or reinforce a worker's current body components, mainly the lower back and upper extremity. It aids in the improvement of work quality and the decrease of the risk of work-related musculoskeletal illnesses. These exoskeletons can be custom fitted to the worker's body parts to increase their strength. 3. Initiatives For Military Body Parts Soldiers frequently carry goods when climbing stairs or mountain slopes as part of their daily duties. Furthermore, troops constantly struggle with endurance and strength, and they are prone to hip, back, and knee injuries. As a result, military organisations all around the world have embraced smart exoskeleton technologies that allow them to efficiently transfer burden. Furthermore, these technologies help soldiers perform better while minimising their exertion.Smart Exoskeleton Market Segment Analysis:

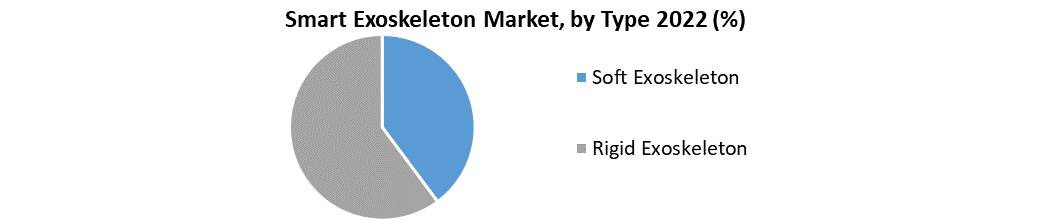

On the basis of components, In 2022, actuators dominated the market with an overall share of around 32.10%. The segment is expected to maintain its dominance during the forecast period since they improve the efficiency of the exoskeletons through control of errant motions. By Type Because most exoskeletons on the market are rigid, rigid exoskeletons are likely to dominate the market in 2022. In healthcare, military, and industrial applications, they also prevent any form of injury to the wearer during a fall or injury. However, owing to the increasing use of carbon fibre in the manufacture of soft exoskeletons, the market for soft exoskeletons is likely to increase significantly throughout the forecast period. Because of their small weight, soft exoskeletons are also seeing a surge in demand from military and industrial applications.

Smart Exoskeleton Market Regional Insights:

From 2022 to 2029, the research includes market size and forecasts for each area, nation, and sub-region. For the forecast period from 2023 to 2029, compound annual growth rates (CAGRs) for each of these areas and nations have also been provided, using 2022 as the base year. The competition landscape in these regions is also included in the smart exoskeleton market analysis. North America was the highest contributor to the global smart exoskeleton with $xx million in 2022 and is estimated to reach $xx million by 2029.Smart Exoskeleton Market Scope: Inquire before buying

Smart Exoskeleton Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 559.89 Bn. Forecast Period 2023 to 2029 CAGR: 33.23% Market Size in 2029: US $ 4171.80 Bn. Segments Covered: by Component • Sensors • Actuators • Power source • Control system • Others by Type • Soft Exoskeleton • Rigid Exoskeleton by Body Part • Upper Body • Lower Body • Full body by Application • Industrial • Healthcare • Military • Others Smart Exoskeleton Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Smart Exoskeleton Market Key Players

• ATOUN INC. • BIONIK • CYBERDYNE, INC. • EKSO BIONICS • HONDA MOTOR CO., LTD. • REWALK ROBOTIC • REX BIONICS LTD. • SARCOS CORP. • TECHNAID. S.L. • US BIONICS • MYOMO • BIONIK LABORATORIES • LOCKHEED MARTIN CORPORTION • RAYTHEON COMPANY • PARKER HANNIFIN CORP • RB3D • TECHNAID • WALKBOT • NOONEE • CYBERDYNE INC Frequently Asked Questions: 1. Which region has the largest share in Global Smart Exoskeleton Market? Ans: North America region held the highest share in 2022. 2. What is the growth rate of Global Smart Exoskeleton Market? Ans: The Global Smart Exoskeleton Market is growing at a CAGR of 33.23% during forecasting period 2023-2029. 3. What is scope of the Global Smart Exoskeleton Market report? Ans: Global Smart Exoskeleton Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Smart Exoskeleton Market? Ans: The important key players in the Global Smart Exoskeleton Market are – ATOUN INC., BIONIK, CYBERDYNE, INC., EKSO BIONICS, HONDA MOTOR CO., LTD., REWALK ROBOTIC, REX BIONICS LTD., SARCOS CORP., TECHNAID. S.L., US BIONICS, MYOMO, BIONIK LABORATORIES, LOCKHEED MARTIN CORPORTION, RAYTHEON COMPANY, PARKER HANNIFIN CORP, RB3D, TECHNAID, WALKBOT, NOONEE, CYBERDYNE INC 5. What is the study period of this Market? Ans: The Global Smart Exoskeleton Market is studied from 2022 to 2029.

1. Smart Exoskeleton Market Size: Research Methodology 2. Smart Exoskeleton Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Smart Exoskeleton Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Smart Exoskeleton Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • Middle East and Africa • South America 3.12. COVID-19 Impact 4. Smart Exoskeleton Market Size Segmentation 4.1. Smart Exoskeleton Market Size, by Type (2022-2029) • Soft Exoskeleton • Rigid Exoskeleton 4.2. Smart Exoskeleton Market Size, by Application (2022-2029) • Industrial • Healthcare • Military • Others 4.3. Smart Exoskeleton Market Size, By Body Part (2022-2029) • Upper Body • Lower Body • Full body 4.4. Smart Exoskeleton Market Size, By Component (2022-2029) • Sensors • Actuators • Power source • Control system • Others 5. North America Smart Exoskeleton Market (2022-2029) 5.1. North America Smart Exoskeleton Market Size, by Type (2022-2029) • Soft Exoskeleton • Rigid Exoskeleton 5.2. North America Smart Exoskeleton Market Size, by Application (2022-2029) • Industrial • Healthcare • Military • Others 5.3. North America Smart Exoskeleton Market Size, By Body Part (2022-2029) • Upper Body • Lower Body • Full body 5.4. North America Smart Exoskeleton Market Size, By Component (2022-2029) • Sensors • Actuators • Power source • Control system • Others 5.5. North America Semiconductor Memory Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Smart Exoskeleton Market (2022-2029) 6.1. European Smart Exoskeleton Market, by Type (2022-2029) 6.2. European Smart Exoskeleton Market, by Application (2022-2029) 6.3. European Smart Exoskeleton Market, By Body Part (2022-2029) 6.4. European Smart Exoskeleton Market, By Component (2022-2029) 6.5. European Smart Exoskeleton Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Smart Exoskeleton Market (2022-2029) 7.1. Asia Pacific Smart Exoskeleton Market, by Type (2022-2029) 7.2. Asia Pacific Smart Exoskeleton Market, by Application (2022-2029) 7.3. Asia Pacific Smart Exoskeleton Market, By Body Part (2022-2029) 7.4. Asia Pacific Smart Exoskeleton Market, By Component (2022-2029) 7.5. Asia Pacific Smart Exoskeleton Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Smart Exoskeleton Market (2022-2029) 8.1. Middle East and Africa Smart Exoskeleton Market, by Type (2022-2029) 8.2. Middle East and Africa Smart Exoskeleton Market, by Application (2022-2029) 8.3. Middle East and Africa Smart Exoskeleton Market, By Body Part (2022-2029) 8.4. Middle East and Africa Smart Exoskeleton Market, By Component (2022-2029) 8.5. Middle East and Africa Smart Exoskeleton Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Smart Exoskeleton Market (2022-2029) 9.1. South America Smart Exoskeleton Market, by Type (2022-2029) 9.2. South America Smart Exoskeleton Market, by Application (2022-2029) 9.3. South America Smart Exoskeleton Market, By Body Part (2022-2029) 9.4. South America Smart Exoskeleton Market, By Component (2022-2029) 9.5. South America Smart Exoskeleton Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. ATOUN INC 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. BIONIK 10.3. CYBERDYNE, INC. 10.4. EKSO BIONICS 10.5. HONDA MOTOR CO., LTD. 10.6. REWALK ROBOTIC 10.7. REX BIONICS LTD. 10.8. SARCOS CORP. 10.9. TECHNAID. S.L. 10.10. US BIONICS 10.11. MYOMO 10.12. BIONIK LABORATORIES 10.13. LOCKHEED MARTIN CORPORTION 10.14. RAYTHEON COMPANY 10.15. PARKER HANNIFIN CORP 10.16. RB3D 10.17. TECHNAID 10.18. WALKBOT 10.19. NOONEE 10.20. CYBERDYNE INC