SLI Battery Market was valued at US $ 34027.52 Mn. in 2022. Global SLI Battery Market size is estimated to grow at a CAGR of 3.2%.SLI Battery Market Overview:

The SLI Battery stands for Starting, Lighting, and Ignition battery, which is a lead-acid and rechargeable battery, which is generally used for automobiles and in internal combustion engines. The SLI battery aims to start the engine in all-weather situations and to ensure operation in the case of an onboard electrical recharging type failure, allowing the auxiliary electrical equipment to function normally for a length of time. The SLI battery is generally considered a high-power-consuming battery with a lifespan of 3-6 years. In this type of battery, 6 cells are stacked together in an electrolytic fluid containing sulphuric acid to provide a voltage output of 12V. It works at a wide range of temperatures and provides various advantages, such as high current discharge, low internal resistance, and ultra–long life with a cycle life of more than 100000 times.To know about the Research Methodology :- Request Free Sample Report 2022 is considered as a base year to forecast the market from 2023 to 2029. 2022’s market size is estimated on real numbers and outputs of the key players and major players across the globe. Past five years' trends are considered while forecasting the market through 2029. 2020 is a year of exception and analyzed especially with the impact of lockdown by region.

SLI Battery Market Dynamics:

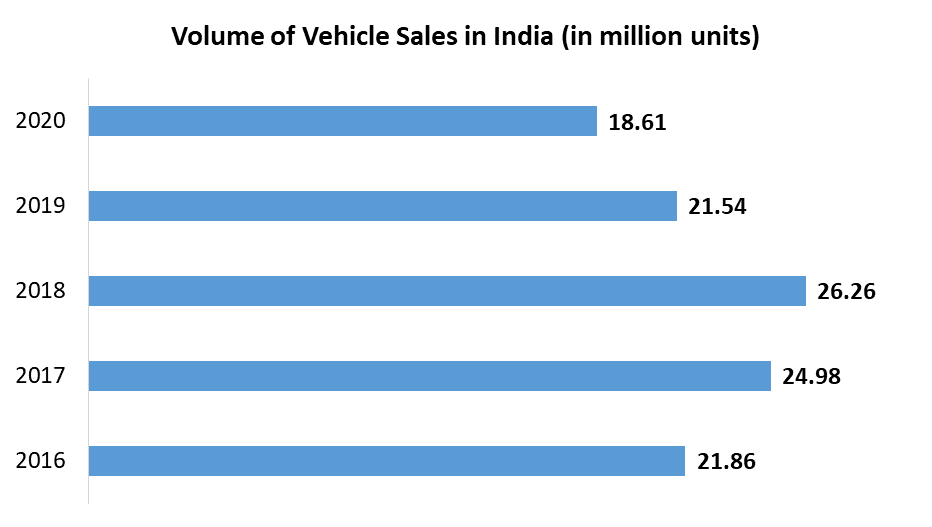

Growing Automobile Sector leads to Increasing usage of SLI Battery: The growing number of automobiles that are no longer under warranty has resulted in a steady demand for lead-acid SLI batteries. The production of high-quality automobiles has increased vehicle operational life, which has increased the usage of starting batteries, which in turn drives SLI battery market growth. The SLI Battery market is showing northward direction growth, thanks to the relocation of vehicle manufacturing sites and rising consumer spending power in developing countries like India and China. Enhanced Flooded Batteries (EFB) and Valve Regulated Lead Acid (VRLA) batteries are benefiting from the adoption of new car technology such as start-stop systems and regenerative braking. The changing trend towards personal mobility and e-hailing is expected to fuel the SLI battery market growth during the forecast period.Growing Stationary and Transportation Energy Storage: The combined markets for stationary and transportation energy storage are expected to expand 2.5 to 4 terawatt-hours (TWh) each year up to 2030, which is almost three to five times the current 800-gigawatt-hour (GWh) market. Growing adoption of on-board energy storage and mobility has become the largest single demand for energy storage, accounting for five to ten times the amount of energy capacity used than fixed energy storage. The convergence of electrified mobility, lower battery storage costs, and increasing variable renewable output has resulted in an increase in energy storage research and commercial deployments across the globe in the electric and transportation sectors. As a result, the growing demand for the product for storage purposes is expected to drive the SLI battery market growth across the globe. SLI batteries have improved with the introduction of new technologies like start-stop and regenerative braking processes to the market. The low cost along with easy availability of lead is a positive aspect for SLI batteries' high popularity among the consumers and end-users. An increase in the number of distribution channels, and a general rise in per capita incomes along with the necessity for personal mobility, are all contributing to the increasing demand for SLI batteries.

SLI Battery Market Segment Analysis:

Based on the Type, the SLI Battery Market is segmented into Flooded, Enhanced Flooded Battery (EFB), and Valve-Regulated Lead-Acid (VRLA). The Flooded segment held the largest market share, accounting for 58.1% in 2022 Flooded SLI batteries come in a variety of shapes and sizes, and they are less expensive than other battery systems. Flooded type batteries are more energy-efficient and high-performing batteries making them more preferable among various end-users. These factors are driving the SLI battery market growth for this segment.Based on the Application, the SLI Battery Market is segmented into Automotive, UPS, Telecom, and Others. The Automatic segment held the largest market share, accounting for 43.7% in 2022. SLI batteries are widely used in automobiles and are always connected to the vehicle's charging system, resulting in a continuous charge and discharge cycle in the battery while the vehicle is in use. For more than 50 years, 12-volt batteries have been the most widely used batteries. However, when used in a car and charged by the alternator, its usual voltage is close to 14 volts. The growing demand for these batteries to power starter motors, lighting, and ignition systems, along with other internal combustion engines with high performance, long life, and cost-efficiency, are driving the SLI battery market growth for this segment.

SLI Battery Market Regional Insights:

Asia Pacific region held the largest market share accounted for 38% in 2022. The region’s growth is attributed to the strong economic growth and stability, along with the growing vehicle manufacturing facilities in the region. The easy availability of trained labor, low-cost steel production along strong research and development facilities are fueling automobile production, which in turn growing need for SLI batteries for vehicles. The growing adoption of two-wheeler and car vehicles among consumers is expected to boost the SLI battery market growth during the forecast period.North America region is expected to witness significant growth at a CAGR of 3.8% during the forecast period. The growing demand for freight trucks and large vehicles, along with significant levels of automobile inventory are driving the SLI battery market growth in the region. According to the OICA, in 2019, more than 23 million vehicles were sold in the United States, with commercial vehicles accounting for more than 61% of all sales. In addition, favorable regulatory measures to reduce vehicle emissions have increased the demand for start-stop vehicles, as a result of the growth in the deployment of SLI batteries. The objective of the report is to present a comprehensive analysis of the global SLI Battery Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the SLI Battery Market dynamic, structure by analyzing the market segments and projecting the SLI Battery Market size. Clear representation of competitive analysis of key players by Sales Channel, price, financial position, product portfolio, growth strategies, and regional presence in the SLI Battery Market make the report investor’s guide.

Global SLI Battery Market Scope: Inquire before buying

SLI Battery Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 34027.52 Mn. Forecast Period 2023 to 2029 CAGR: 3.2% Market Size in 2029: US $ 42421.71 Mn. Segments Covered: by Type Flooded Enhanced Flooded Battery (EFB) Valve-Regulated Lead-Acid (VRLA) by Sales Channel OEM Aftermarket by Application Automotive UPS Telecom Others Global SLI Battery Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Global SLI Battery Market Key Players

1. Johnson Controls, Inc. 2. East Penn Manufacturing Co. Inc. 3. Exide Technologies 4. Enersys 5. Leoch International Technology Limited 6. Crown Battery Manufacturing Company 7. Trojan Battery Company 8. Acumuladores Moura S/A 9. GS Yuasa Corporation 10.Power Sonic Corporation 11.NorthStar Battery Company LLC 12.Interstate Batteries Type International 13.Braille Battery, Inc. 14.U.S. Battery Manufacturing Co. 15.Discover Battery 16.Enerbrax-Acumuladores Ltda 17.Dyno Battery 18.XS Power Battery 19.ACDelco 20.Sears Holdings Corporation Frequently Asked Questions: 1] What segments are covered in the SLI Battery Market report? Ans. The segments covered in the SLI Battery Market report are based on Type, Sales Channel, and Application. 2] Which region is expected to hold the highest share in the SLI Battery Market? Ans. The Asia Pacific region is expected to hold the highest share in the SLI Battery Market. 3] What is the market size of the SLI Battery Market by 2029? Ans. The market size of the Market by 2029 is US$ 42421.71 Mn. 4] What is the forecast period for the Market? Ans. The forecast period for the Market is 2023-2029. 5] What was the market size of the Market in 2022? Ans. The market size of the Market in 2022 was US$ 34027.52 Mn.

1. SLI Battery Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. SLI Battery Market: Dynamics 2.1. SLI Battery Market Trends by Region 2.1.1. North America SLI Battery Market Trends 2.1.2. Europe SLI Battery Market Trends 2.1.3. Asia Pacific SLI Battery Market Trends 2.1.4. Middle East and Africa SLI Battery Market Trends 2.1.5. South America SLI Battery Market Trends 2.2. SLI Battery Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America SLI Battery Market Drivers 2.2.1.2. North America SLI Battery Market Restraints 2.2.1.3. North America SLI Battery Market Opportunities 2.2.1.4. North America SLI Battery Market Challenges 2.2.2. Europe 2.2.2.1. Europe SLI Battery Market Drivers 2.2.2.2. Europe SLI Battery Market Restraints 2.2.2.3. Europe SLI Battery Market Opportunities 2.2.2.4. Europe SLI Battery Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific SLI Battery Market Drivers 2.2.3.2. Asia Pacific SLI Battery Market Restraints 2.2.3.3. Asia Pacific SLI Battery Market Opportunities 2.2.3.4. Asia Pacific SLI Battery Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa SLI Battery Market Drivers 2.2.4.2. Middle East and Africa SLI Battery Market Restraints 2.2.4.3. Middle East and Africa SLI Battery Market Opportunities 2.2.4.4. Middle East and Africa SLI Battery Market Challenges 2.2.5. South America 2.2.5.1. South America SLI Battery Market Drivers 2.2.5.2. South America SLI Battery Market Restraints 2.2.5.3. South America SLI Battery Market Opportunities 2.2.5.4. South America SLI Battery Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For SLI Battery Industry 2.8. Analysis of Government Schemes and Initiatives For SLI Battery Industry 2.9. SLI Battery Market Trade Analysis 2.10. The Global Pandemic Impact on SLI Battery Market 3. SLI Battery Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. SLI Battery Market Size and Forecast, by Type (2022-2029) 3.1.1. Flooded 3.1.2. Enhanced Flooded Battery (EFB) 3.1.3. Valve-Regulated Lead-Acid (VRLA) 3.2. SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 3.2.1. OEM 3.2.2. Aftermarket 3.3. SLI Battery Market Size and Forecast, by Application (2022-2029) 3.3.1. Automotive 3.3.2. UPS 3.3.3. Telecom 3.3.4. Others 3.4. SLI Battery Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America SLI Battery Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America SLI Battery Market Size and Forecast, by Type (2022-2029) 4.1.1. Flooded 4.1.2. Enhanced Flooded Battery (EFB) 4.1.3. Valve-Regulated Lead-Acid (VRLA) 4.2. North America SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 4.2.1. OEM 4.2.2. Aftermarket 4.3. North America SLI Battery Market Size and Forecast, by Application (2022-2029) 4.3.1. Automotive 4.3.2. UPS 4.3.3. Telecom 4.3.4. Others 4.4. North America SLI Battery Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States SLI Battery Market Size and Forecast, by Type (2022-2029) 4.4.1.1.1. Flooded 4.4.1.1.2. Enhanced Flooded Battery (EFB) 4.4.1.1.3. Valve-Regulated Lead-Acid (VRLA) 4.4.1.2. United States SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 4.4.1.2.1. OEM 4.4.1.2.2. Aftermarket 4.4.1.3. United States SLI Battery Market Size and Forecast, by Application (2022-2029) 4.4.1.3.1. Automotive 4.4.1.3.2. UPS 4.4.1.3.3. Telecom 4.4.1.3.4. Others 4.4.2. Canada 4.4.2.1. Canada SLI Battery Market Size and Forecast, by Type (2022-2029) 4.4.2.1.1. Flooded 4.4.2.1.2. Enhanced Flooded Battery (EFB) 4.4.2.1.3. Valve-Regulated Lead-Acid (VRLA) 4.4.2.2. Canada SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 4.4.2.2.1. OEM 4.4.2.2.2. Aftermarket 4.4.2.3. Canada SLI Battery Market Size and Forecast, by Application (2022-2029) 4.4.2.3.1. Automotive 4.4.2.3.2. UPS 4.4.2.3.3. Telecom 4.4.2.3.4. Others 4.4.3. Mexico 4.4.3.1. Mexico SLI Battery Market Size and Forecast, by Type (2022-2029) 4.4.3.1.1. Flooded 4.4.3.1.2. Enhanced Flooded Battery (EFB) 4.4.3.1.3. Valve-Regulated Lead-Acid (VRLA) 4.4.3.2. Mexico SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 4.4.3.2.1. OEM 4.4.3.2.2. Aftermarket 4.4.3.3. Mexico SLI Battery Market Size and Forecast, by Application (2022-2029) 4.4.3.3.1. Automotive 4.4.3.3.2. UPS 4.4.3.3.3. Telecom 4.4.3.3.4. Others 5. Europe SLI Battery Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe SLI Battery Market Size and Forecast, by Type (2022-2029) 5.2. Europe SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 5.3. Europe SLI Battery Market Size and Forecast, by Application (2022-2029) 5.4. Europe SLI Battery Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom SLI Battery Market Size and Forecast, by Type (2022-2029) 5.4.1.2. United Kingdom SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 5.4.1.3. United Kingdom SLI Battery Market Size and Forecast, by Application (2022-2029) 5.4.2. France 5.4.2.1. France SLI Battery Market Size and Forecast, by Type (2022-2029) 5.4.2.2. France SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 5.4.2.3. France SLI Battery Market Size and Forecast, by Application (2022-2029) 5.4.3. Germany 5.4.3.1. Germany SLI Battery Market Size and Forecast, by Type (2022-2029) 5.4.3.2. Germany SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 5.4.3.3. Germany SLI Battery Market Size and Forecast, by Application (2022-2029) 5.4.4. Italy 5.4.4.1. Italy SLI Battery Market Size and Forecast, by Type (2022-2029) 5.4.4.2. Italy SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 5.4.4.3. Italy SLI Battery Market Size and Forecast, by Application (2022-2029) 5.4.5. Spain 5.4.5.1. Spain SLI Battery Market Size and Forecast, by Type (2022-2029) 5.4.5.2. Spain SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 5.4.5.3. Spain SLI Battery Market Size and Forecast, by Application (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden SLI Battery Market Size and Forecast, by Type (2022-2029) 5.4.6.2. Sweden SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 5.4.6.3. Sweden SLI Battery Market Size and Forecast, by Application (2022-2029) 5.4.7. Austria 5.4.7.1. Austria SLI Battery Market Size and Forecast, by Type (2022-2029) 5.4.7.2. Austria SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 5.4.7.3. Austria SLI Battery Market Size and Forecast, by Application (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe SLI Battery Market Size and Forecast, by Type (2022-2029) 5.4.8.2. Rest of Europe SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 5.4.8.3. Rest of Europe SLI Battery Market Size and Forecast, by Application (2022-2029) 6. Asia Pacific SLI Battery Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific SLI Battery Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 6.3. Asia Pacific SLI Battery Market Size and Forecast, by Application (2022-2029) 6.4. Asia Pacific SLI Battery Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China SLI Battery Market Size and Forecast, by Type (2022-2029) 6.4.1.2. China SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 6.4.1.3. China SLI Battery Market Size and Forecast, by Application (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea SLI Battery Market Size and Forecast, by Type (2022-2029) 6.4.2.2. S Korea SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 6.4.2.3. S Korea SLI Battery Market Size and Forecast, by Application (2022-2029) 6.4.3. Japan 6.4.3.1. Japan SLI Battery Market Size and Forecast, by Type (2022-2029) 6.4.3.2. Japan SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 6.4.3.3. Japan SLI Battery Market Size and Forecast, by Application (2022-2029) 6.4.4. India 6.4.4.1. India SLI Battery Market Size and Forecast, by Type (2022-2029) 6.4.4.2. India SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 6.4.4.3. India SLI Battery Market Size and Forecast, by Application (2022-2029) 6.4.5. Australia 6.4.5.1. Australia SLI Battery Market Size and Forecast, by Type (2022-2029) 6.4.5.2. Australia SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 6.4.5.3. Australia SLI Battery Market Size and Forecast, by Application (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia SLI Battery Market Size and Forecast, by Type (2022-2029) 6.4.6.2. Indonesia SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 6.4.6.3. Indonesia SLI Battery Market Size and Forecast, by Application (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia SLI Battery Market Size and Forecast, by Type (2022-2029) 6.4.7.2. Malaysia SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 6.4.7.3. Malaysia SLI Battery Market Size and Forecast, by Application (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam SLI Battery Market Size and Forecast, by Type (2022-2029) 6.4.8.2. Vietnam SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 6.4.8.3. Vietnam SLI Battery Market Size and Forecast, by Application (2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan SLI Battery Market Size and Forecast, by Type (2022-2029) 6.4.9.2. Taiwan SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 6.4.9.3. Taiwan SLI Battery Market Size and Forecast, by Application (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific SLI Battery Market Size and Forecast, by Type (2022-2029) 6.4.10.2. Rest of Asia Pacific SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 6.4.10.3. Rest of Asia Pacific SLI Battery Market Size and Forecast, by Application (2022-2029) 7. Middle East and Africa SLI Battery Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa SLI Battery Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 7.3. Middle East and Africa SLI Battery Market Size and Forecast, by Application (2022-2029) 7.4. Middle East and Africa SLI Battery Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa SLI Battery Market Size and Forecast, by Type (2022-2029) 7.4.1.2. South Africa SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 7.4.1.3. South Africa SLI Battery Market Size and Forecast, by Application (2022-2029) 7.4.2. GCC 7.4.2.1. GCC SLI Battery Market Size and Forecast, by Type (2022-2029) 7.4.2.2. GCC SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 7.4.2.3. GCC SLI Battery Market Size and Forecast, by Application (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria SLI Battery Market Size and Forecast, by Type (2022-2029) 7.4.3.2. Nigeria SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 7.4.3.3. Nigeria SLI Battery Market Size and Forecast, by Application (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A SLI Battery Market Size and Forecast, by Type (2022-2029) 7.4.4.2. Rest of ME&A SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 7.4.4.3. Rest of ME&A SLI Battery Market Size and Forecast, by Application (2022-2029) 8. South America SLI Battery Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America SLI Battery Market Size and Forecast, by Type (2022-2029) 8.2. South America SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 8.3. South America SLI Battery Market Size and Forecast, by Application(2022-2029) 8.4. South America SLI Battery Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil SLI Battery Market Size and Forecast, by Type (2022-2029) 8.4.1.2. Brazil SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 8.4.1.3. Brazil SLI Battery Market Size and Forecast, by Application (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina SLI Battery Market Size and Forecast, by Type (2022-2029) 8.4.2.2. Argentina SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 8.4.2.3. Argentina SLI Battery Market Size and Forecast, by Application (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America SLI Battery Market Size and Forecast, by Type (2022-2029) 8.4.3.2. Rest Of South America SLI Battery Market Size and Forecast, by Sales Channel (2022-2029) 8.4.3.3. Rest Of South America SLI Battery Market Size and Forecast, by Application (2022-2029) 9. Global SLI Battery Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading SLI Battery Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Johnson Controls, Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. East Penn Manufacturing Co. Inc. 10.3. Exide Technologies 10.4. Enersys 10.5. Leoch International Technology Limited 10.6. Crown Battery Manufacturing Company 10.7. Trojan Battery Company 10.8. Acumuladores Moura S/A 10.9. GS Yuasa Corporation 10.10. Power Sonic Corporation 10.11. NorthStar Battery Company LLC 10.12. Interstate Batteries Type International 10.13. Braille Battery, Inc. 10.14. U.S. Battery Manufacturing Co. 10.15. Discover Battery 10.16. Enerbrax-Acumuladores Ltda 10.17. Dyno Battery 10.18. XS Power Battery 10.19. ACDelco 10.20. Sears Holdings Corporation 11. Key Findings 12. Industry Recommendations 13. SLI Battery Market: Research Methodology 14. Terms and Glossary