The Global Rooftop Solar PV Market size was valued at USD 147.5 Billion in 2024, and the total Rooftop Solar PV Market revenue is expected to grow by 6.93% from 2025 to 2032, reaching nearly USD 252.11 Billion.Rooftop Solar PV Market Overview

Rooftop solar photovoltaic (PV) systems harness the sun’s energy as it is being received and produce their own energy. A rooftop solar PV system consists of solar panels placed on roofs or on land adjacent to a residential, commercial, or industrial building. The rooftop solar PV system also has the components of solar panels, an inverter, a mounting structure, and monitoring. Generally, rooftop solar PV systems produce only clean and renewable energy from solar, avoid grid energy dependency, and save the owner costs. The rooftop solar PV industry globally is maturing quickly. Maturity is fuelled by low solar PV costs, technology advancement in production, and political support from governments worldwide. There are even more opportunities to grow using advances in technology for efficient solar cells (like PERC and bifacial solar), new storage technology, and new regulations requiring renewable energy discussions in legislation (tax credits, feed-in tariffs, and net metering). The continual shift toward electrification and smart energy management will further integrate rooftop solar PV systems into other energy systems.To know about the Research Methodology:-Request Free Sample Report Because of an emphasis on corporate sustainability and decarbonization, there has been a significant increase in commercial and industrial deployments. Additionally, the technological pathways to decarbonization (enabled by digitalization and smart technology) now provide sophisticated monitoring platforms that allow us to control the performance and operation of systems while remaining predictive for maintenance. Also, advancements are occurring from manufacturers in building-integrated photovoltaics (BIPV). For example, these solar products include solar elements being integrated directly into manufactured building materials at the manufacturing point, which effectively eliminates the appearance of solar as a separate element, as the element becomes an integral part of the building envelope. In terms of the market share for rooftop solar PV, Asia-Pacific is the leader, primarily due to high energy demand and government support; China, Japan, and Australia are typically the leaders in capacity additions in this area. North America and Europe are large markets offering steady growth in rooftop solar PV consumption as well, in large part due to climate goals and energy independence. While the residential segment represents the largest share of total number of installations, the commercial and industrial segment typically represents a greater share of the total capacity installed, largely due to the amount of overall available roofing space.

Rooftop Solar PV Market Dynamics

Rising Energy Costs and Climate Ambitions to Fuel Rooftop Solar PV Market Growth The continuous rise in the price of electricity from traditional utilities globally - particularly for large energy-demanding markets - continues to drive the demand for rooftop solar PV. Additionally, the increasing global commitments to climate goals and decarbonization have created another demand across homes and businesses for distributed clean energy generation. Given the growing political concern, many governments have also begun to provide strong policy support, including tax credits, subsidies, and net-metering practices, in response to energy independence and renewable objectives. Our expectation is that in every segment (residential, commercial, and industrial), the overall demand for rooftop solar, in both an economic and environmental context, is increasing and will likely continue to grow. Vertical Integration Restructuring Supply Chains to Rooftop Solar PV Market Growth Like other sectors, the global solar industry is consolidating as bigger manufacturers vertically integrate the production of panels, cells, and wafers to control price and ensure supply. This fact is putting more competition pressure on the smaller component manufacturers, but also may mean that companies that specialize in a specific technology (like advanced mounting systems or unique storage) will have the opportunity to form strategic partnerships. Strategic acquisitions, along with long-term supply agreements, seem to be both more necessary now to stabilize their businesses, but also, given industry instability from the last couple of years, the only "real" way to scale a business. Emerging Markets Offering Massive Growth Potential to boost the Rooftop Solar PV Market Rapidly increasing energy demand in fast-growing economies in the Asia-Pacific, Latin America, and Africa creates unprecedented opportunities for rooftop solar growth. These emerging-market regions typically have high solar resource availability, as well as large populations with limited or unreliable access to an electricity grid, and solar energy makes not only sense but a compelling resource option. Also, with favourable government policies, decreasing technology costs, and novel financing vehicles such as solar leasing, will help satisfy this energy demand in these price-sensitive markets where low-cost and reliable electricity is a necessity.Rooftop Solar PV Market Segment Analysis

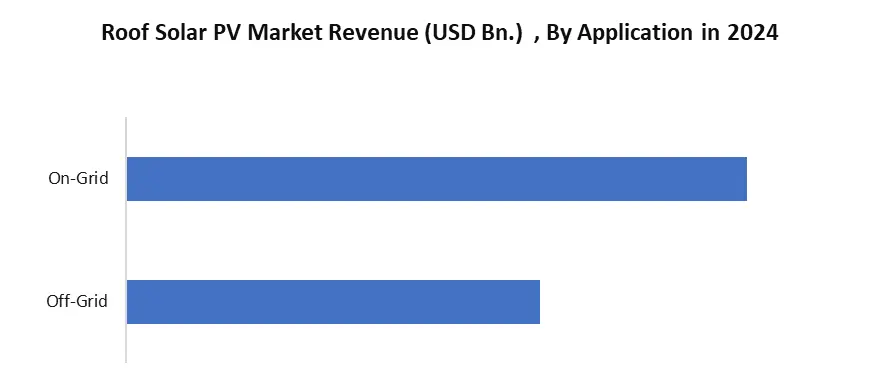

Based on Application Systems, the Rooftop Solar PV Market is segmented into On-Grid, Off-Grid, and Hybrid. On-grid systems are by far the most prevalent application, and have seen strong and steady demand due to their price competitiveness, grid support through net metering, and ease of installation. On-grid systems are the predominant and most viable rooftop solar PV applications because of their economic benefits and fit with existing infrastructure in the urban environment. The on-grid segment is driven largely by net metering policies, which help consumers reduce energy costs by exporting their excess power to the grid, allowing for a faster return on investment. The lower entry price point, as on-grid systems do not include expensive battery storage, makes them the most reasonable and feasible option for the vast majority of consumers.

Rooftop Solar PV Market Regional Insights

The rooftop solar PV market has been expanding quickly, benefiting from improved panel efficiencies, rising electricity prices, and changing decarbonization policies in the Asia-Pacific, North America, Europe, South America, and Middle East & Africa (MEA) regions. However, Asia-Pacific remains the unassailable leader in the world's solar manufacturing and solar market. The Asia-Pacific region is a major contributor to the market for residential, commercial, and industrial rooftop solar systems, with rapid urbanization, strong support and investment from the government, and large energy consumption needs. The global supply chain for solar is predominantly driven by inexpensive, high-volume manufacturing in China, which has established its infrastructure, from raw materials to components. Also well established, but where the conditions of the countries are mature and dominated by countries like Australia and Japan, where there are aspects of the market targeting improved installation techniques, modules with high efficiencies that improve performance, and more complex financing models, which lead to their high per capita adoption. Meanwhile, as the commercial & industrial (C&I) segments continue to grow, with supportive net metering policies driving rooftop consumption, and solar continues a long-term growth trajectory, the Asia-Pacific region will be under pressure to quickly grow hours of clean energy generation in integrated to meet the large, growing demand for electric consumption. The European market is leading the high-end, integrated Building-Integrated Photovoltaics (BIPV) market, particularly in Germany, Italy, the UK, and France. There is a solid push for energy independence, exacerbated by the geopolitical energy crisis and the rise of volatile markets, which makes the economics of self-consumption all the more attractive. The EU's focus remains on the sustainable manufacture of components, the applicability of circular economy principles on the panel recycling industry, and ambitious renewable energy targets. OEMs and developers will need to navigate complicated grid integration, which is now pushing innovations in smart inverters and virtual power plants (VPP) to maintain grid stability while maximizing self-consumption. Therefore, Europe has an intuitive focus on designing high-end, aesthetically based solar solutions to address historic urban landscapes, which remain in focus. The technological advancements of recent years, including but not limited to AI-based energy optimization, bifacial panels, and smart inverters providing grid services, have all created efficiencies and performance advantages around the world. The persistent push for electrification, energy independence, and digitalization is changing regional strategies and shifting perceived fiefdoms into global collaboration. The scale and rapid expansion of new applications, from residential prosumers to large corporate PPAs, will continue to keep the global demand for sophisticated solar systems high and grow in all regions over the next five years.Rooftop Solar PV Market Competitive Landscape:

In the USA, Enphase Energy and in China, Sungrow Power Supply Co., Ltd. have established themselves as global rooftop solar PV market leaders. Each offers unique benefits to the marketplace, but both are pursuing an integrated strategy by utilizing core technologies and manufacturing in residential, commercial, and utility-scale applications. Enphase Energy heavily brands itself as a technology leader in the rooftop solar space with its proprietary microinverter systems and integrated energy management technologies. Enphase's value proposition is based on reliability, system-level monitoring, and maximizing energy harvest from each solar panel, which they establish through a close partnership with a network of certified installers in North America and Europe. Enphase focuses on its brand reputation, software-enabled services, and delivering a seamless user experience, which is then sold at a premium price in more mature markets. Sungrow promotes its value pack of affordable, reliable string inverters and energy storage in addition to its comprehensive portfolio; with its business and market strategy focused on economies of scale through vertical integration and manufacturing efficiencies in Asia. Where Sungrow capitalizes on its competitive advantage over competitors is by its competitive pricing, reliable products that have been proven at scale, and ability to right-size its approach to meet the manufacturing capacity demands for high-growth market segments, especially in the Asia Pacific region. Enphase leads in mature markets and competes on patented technology, premium brand, and established installer networks; Sungrow maximizes and balances market share and positioning through volume manufacturing and a diverse portfolio with affordability and reliability in established and growing markets and price-sensitive segments; and Both companies invest in the integration of solar with home energy storage, but there are two very distinct company approaches to growth; Enphase develops deep locked-in ecosystem loyalty with both homeowners and installers, while Sungrow employs innovation in the supply chain, a high degree of flexibility, and pragmatic supply chain solutions to target large-volume projects and other applications on the open market.Rooftop Solar PV Market Key Developments:

• Aug-2025 - Enphase Energy - Europe Launched a cybersecurity framework for its interconnected energy systems in compliance with newly intensified standards from the EU for wireless devices. The protocol aims to enhance network security and protect customer information while reducing the risk of cyberattacks. They were addressing concerns raised in a report published whitepaper by Solar Power Europe on grid reliability during the 2010s. Enphase's initiative was endorsed by leading European installers such as 1KOMMA5 (Germany), Green Guys B.V. (Netherlands), and ATSE Photovoltaïque (France) as a valuable selling point for homeowners. • Aug-2025 - Enphase Energy - USA Declared a new safe harbour agreement with a prominent solar financing company through which they’ll be providing IQ8HC™ Microinverters, made in the U.S., for the third-party ownership (TPO)- type projects, specifically for leases and PPAs. It is anticipated that this agreement will deliver revenue of approximately $50 million, as well as helping to preserve projects' eligibility for the full Investment Tax Credit (ITC) and domestic content bonus due to the new U.S. federal governmental rules around the eligibility, reducing policy related risks for developers, and allowing them to scale solar systems into larger and more efficacious deals. • Aug-2025 - SolarEdge Technologies - Global Announced second quarter of consecutive year-over-year and sequential growth in revenue, and announced revenues of $289.41 million (32% higher than the previous quarter). The Company achieved an improved non-GAAP gross margin of 13.1% for the quarter. The Company shipped a total of 1,194 MW (AC) of inverters and 247 MWh of batteries for PV applications, showing progress in its strategic turnaround and positioning itself for coming opportunities in the global solar market. • Jan-2025 - REC Group - APAC (Australia) Stressed the high importance of investing in high-quality, market-leading heterojunction (HJT) technology, and warranties that cover product performance (like the REC ProTrust warranty), to provide stability in the long-term performance of solar systems, and financial predictability for families. And in collaboration with Australian installer AG Solar, REC placed importance on utilising reputable manufacturers and certified and local installers to ensure local conditions are accounted for and reliable service is provided as a critical component within the resilient Australian solar market.Rooftop Solar PV Market Key Trends:

• Cybersecurity as a Key Market Differentiator: The implementation of strict platforms for EU cybersecurity regulation has prepared manufacturers to view, invest in, and propose an expensive, robust security regulation as a marketable and necessary component, which advances data protection and fighting system integrity, as a de facto competitive advantage in the European solar market. • Strategic Safe Harboring for U.S. Policy Compliance: Solar companies are increasingly taking advantage of safe harbor agreements for domestically made components for the purposes of locking in advantageous tax credits, a strategic risk-averse financing opportunity that improves the value proposition for American-made components.Rooftop Solar PV Market Scope: Inquire before buying

Global Rooftop Solar PV Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 147.5 Bn. Forecast Period 2025 to 2032 CAGR: 6.93% Market Size in 2032: USD 252.1 Bn. Segments Covered: by System Size Small-Scale (Residential) Medium-Scale (C&I) Large-Scale (Utility) by Application On-Grid Off-Grid by End Use Commercial and Industrial (C&I) Residential Utility-Scale Rooftop Solar PV Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina and Rest of South America)Rooftop Solar PV Market, Key Players

North America 1. First Solar (USA) 2. Silfab Solar (USA/Canada) 3. QCells (Major US manufacturing) 4. Enphase Energy (USA) 5. SolarEdge Technologies (Israel, major US market presence) 6. Sunrun (USA) 7. Tesla Energy (USA) 8. Sunnova Energy (USA) 9. ADT Solar (USA) 10. Freedom Forever (USA) 11. Generac (PWRcell) (USA) 12. Unirac (USA) 13. IronRidge (USA) 14. Quick-Mount PV (USA) Europe 1. REC Group (Norway) 2. Axitec Energy (Germany) 3. Fronius International (Austria) 4. KACO new energy (Germany) 5. Sofar Solar (Major European presence) 6. E.ON SE (Germany) 7. ENGIE (France) 8. Iberdrola (Spain) 9. Sonnen GmbH (Germany) 10. Mounting Systems GmbH (Germany) 11. Schletter GmbH (Germany) Asia-Pacific (APAC) 1. Solar Panel Manufacturers (China & Global): 2. JinkoSolar (China) 3. LONGi Solar (China) 4. JA Solar (China) 5. Trina Solar (China) 6. Canadian Solar (Canada) 7. Hanwha Qcells (South Korea) 8. SunTech (China) 9. Talesun (China) 10. Huawei (China) 11. Sungrow (China) 12. Growatt (China) 13. GoodWe (China) 14. Delta Electronics (Taiwan) 15. Tata Power Solar (India) 16. Canadian Solar (Panels)Frequently Asked Questions

1. What is the growth rate of the Global market? Ans: The Global Rooftop Solar PV Market is growing at a CAGR of 6.93% during the forecasting period 2025-2032. 2. What is the scope of the Global market report? Ans: The Global Rooftop Solar PV Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 3. Who are the key players in the Global market? Ans: The important key players in the Global market are – Hanwha Q CELLS Co. Ltd., JA SOLAR Holdings Co. Ltd., JinkoSolar Holding Co. Ltd., Trina Solar Limited, Canadian Solar Inc., First Solar, Talesun, LONGi Solar, Enphase Energy, SolarEdge Technologies, Sunrun, Tesla Energy, Sunnova Energy, Generac, Silfab Solar, REC Group, Sharp Corporation, Kyocera Corporation, ReneSola, Yingli Green Energy Holding Company Limited, SunPower Corporation, Huawei, Sungrow, GoodWe, Vikram Solar, and Tata Power Solar. 4. What is the study period of this market? Ans: The Global market is studied from 2024 to 2032.

1. Rooftop Solar PV Market: Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Rooftop Solar PV Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Rooftop Solar PV Market: Dynamics 3.1. Region-wise Trends of Rooftop Solar PV Market 3.1.1. North America Rooftop Solar PV Market Trends 3.1.2. Europe Rooftop Solar PV Market Trends 3.1.3. Asia Pacific Rooftop Solar PV Market Trends 3.1.4. Middle East and Africa Rooftop Solar PV Market Trends 3.1.5. South America Rooftop Solar PV Market Trends 3.2. Rooftop Solar PV Market Dynamics 3.2.1. Global Rooftop Solar PV Market Drivers 3.2.2. Global Rooftop Solar PV Market Restraints 3.2.3. Global Rooftop Solar PV Market Opportunities 3.2.4. Global Rooftop Solar PV Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Rooftop Solar PV Market: Global Market Deployment and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 4.1.1. Small-Scale (Residential) 4.1.2. Medium-Scale (C&I) 4.1.3. Large-Scale (Utility) 4.2. Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 4.2.1. On-Grid 4.2.2. Off-Grid 4.3. Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 4.3.1. Commercial and Industrial (C&I) 4.3.2. Residential 4.3.3. UTILITY-SCALE 4.4. Rooftop Solar PV Market Deployment and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Rooftop Solar PV Market Deployment and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 5.1.1. Small-Scale (Residential) 5.1.2. Medium-Scale (C&I) 5.1.3. Large-Scale (Utility) 5.2. North America Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 5.2.1. On-Grid 5.2.2. Off-Grid 5.3. North America Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 5.3.1. Commercial and Industrial (C&I) 5.3.2. Residential 5.3.3. UTILITY-SCALE 5.4. North America Rooftop Solar PV Market Deployment and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 5.4.1.1.1. Small-Scale (Residential) 5.4.1.1.2. Medium-Scale (C&I) 5.4.1.1.3. Large-Scale (Utility) 5.4.1.2. United States Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 5.4.1.2.1. On-Grid 5.4.1.2.2. Off-Grid 5.4.1.3. United States Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 5.4.1.3.1. Commercial and Industrial (C&I) 5.4.1.3.2. Residential 5.4.1.3.3. UTILITY-SCALE 5.4.2. Canada 5.4.2.1. Canada Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 5.4.2.1.1. Small-Scale (Residential) 5.4.2.1.2. Medium-Scale (C&I) 5.4.2.1.3. Large-Scale (Utility) 5.4.2.1. Canada Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 5.4.2.1.2. On-Grid 5.4.2.1.3. Off-Grid 5.4.2.2. Canada Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 5.4.2.2.2. Commercial and Industrial (C&I) 5.4.2.2.3. Residential 5.4.2.2.4. UTILITY-SCALE 5.4.3. Mexico 5.4.3.1. Mexico Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 5.4.3.1.2. Small-Scale (Residential) 5.4.3.1.3. Medium-Scale (C&I) 5.4.3.1.4. Large-Scale (Utility) 5.4.3.2. Mexico Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 5.4.3.2.2. On-Grid 5.4.3.2.3. Off-Grid 5.4.3.3. Mexico Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 5.4.3.3.2. Commercial and Industrial (C&I) 5.4.3.3.3. Residential 5.4.3.3.4. UTILITY-SCALE 6. Europe Rooftop Solar PV Market Deployment and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 6.2. Europe Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 6.3. Europe Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 6.4. Europe Rooftop Solar PV Market Deployment and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 6.4.1.2. United Kingdom Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 6.4.1.3. United Kingdom Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 6.4.2. France 6.4.2.1. France Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 6.4.2.2. France Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 6.4.2.3. France Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 6.4.3.2. Germany Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 6.4.3.3. Germany Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 6.4.4.2. Italy Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 6.4.4.3. Italy Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 6.4.5.2. Spain Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 6.4.5.3. Spain Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 6.4.6.2. Sweden Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 6.4.6.3. Sweden Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 6.4.7.2. Austria Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 6.4.7.3. Austria Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 6.4.8.2. Rest of Europe Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 6.4.8.3. Rest of Europe Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 7. Asia Pacific Rooftop Solar PV Market Deployment and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 7.2. Asia Pacific Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 7.3. Asia Pacific Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 7.4. Asia Pacific Rooftop Solar PV Market Deployment and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 7.4.1.2. China Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 7.4.1.3. China Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 7.4.2.2. S Korea Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 7.4.2.3. S Korea Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 7.4.3.2. Japan Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 7.4.3.3. Japan Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 7.4.4. India 7.4.4.1. India Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 7.4.4.2. India Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 7.4.4.3. India Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 7.4.5.2. Australia Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 7.4.5.3. Australia Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 7.4.6.2. Indonesia Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 7.4.6.3. Indonesia Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 7.4.7.2. Philippines Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 7.4.7.3. Philippines Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 7.4.8.2. Malaysia Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 7.4.8.3. Malaysia Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 7.4.9.2. Vietnam Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 7.4.9.3. Vietnam Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 7.4.10.2. Thailand Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 7.4.10.3. Thailand Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 7.4.11.2. Rest of Asia Pacific Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 7.4.11.3. Rest of Asia Pacific Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 8. Middle East and Africa Rooftop Solar PV Market Deployment and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 8.2. Middle East and Africa Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 8.3. Middle East and Africa Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 8.4. Middle East and Africa Rooftop Solar PV Market Deployment and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 8.4.1.2. South Africa Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 8.4.1.3. South Africa Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 8.4.2.2. GCC Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 8.4.2.3. GCC Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 8.4.3.2. Nigeria Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 8.4.3.3. Nigeria Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 8.4.4.2. Rest of ME&A Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 8.4.4.3. Rest of ME&A Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 9. South America Rooftop Solar PV Market Deployment and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 9.2. South America Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 9.3. South America Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 9.4. South America Rooftop Solar PV Market Deployment and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 9.4.1.2. Brazil Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 9.4.1.3. Brazil Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 9.4.2.2. Argentina Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 9.4.2.3. Argentina Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Rooftop Solar PV Market Deployment and Forecast, By System Size (2024-2032) 9.4.3.2. Rest of South America Rooftop Solar PV Market Deployment and Forecast, By Application (2024-2032) 9.4.3.3. Rest of South America Rooftop Solar PV Market Deployment and Forecast, By End Use (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Power Output Players) 10.1. Enphase Energy (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. First Solar (USA) 10.3. Silfab Solar (USA/Canada) 10.4. QCells (Major US manufacturing) 10.5. SolarEdge Technologies 10.6. Sunrun (USA) 10.7. Tesla Energy (USA) 10.8. Sunnova Energy (USA) 10.9. ADT Solar (USA) 10.10. Freedom Forever (USA) 10.11. Generac (PWRcell) (USA) 10.12. Unirac (USA) 10.13. IronRidge (USA) 10.14. Quick-Mount PV (USA) 10.15. REC Group (Norway) 10.16. Axitec Energy (Germany) 10.17. Fronius International (Austria) 10.18. KACO new energy (Germany) 10.19. Sofar Solar (Major European presence) 10.20. E. ON SE (Germany) 10.21. ENGIE (France) 10.22. Iberdrola (Spain) 10.23. Sonnen GmbH (Germany) 10.24. Mounting Systems GmbH (Germany) 10.25. Schletter GmbH (Germany) 10.26. Solar Panel Manufacturers (China & Global): 10.27. JinkoSolar (China) 10.28. LONGi Solar (China) 10.29. JA Solar (China) 10.30. Trina Solar (China) 10.31. Canadian Solar (Canada) 10.32. Hanwha Qcells (South Korea) 10.33. SunTech (China) 10.34. Talesun (China) 10.35. Huawei (China) 10.36. Sungrow (China) 10.37. Growatt (China) 10.38. GoodWe (China) 10.39. Delta Electronics (Taiwan) 10.40. Tata Power Solar (India) 10.41. Canadian Solar (Panels) 11. Key Findings 12. Analyst Recommendations 13. Rooftop Solar PV Market: Research Methodology