Road Safety Market size was valued at USD 3.64 Bn. in 2022 and the total Road Safety revenue is expected to grow by 12.4 % from 2023 to 2029, reaching nearly USD 8.25 Bn.Road Safety Market Overview:

Road safety is the prevention and protection of traffic accidents by the use of all available road safety measures. Its purpose is to keep people safe when they travel on the highways. Its goal is to keep all road users safe, including pedestrians, two-wheelers, four-wheelers, multi-wheelers, and other modes of transportation. Implementing road safety measures is beneficial and safe for all people throughout their lives. Less than 3% of traffic accidents involve commercial vehicles, and of those, 85% are the result of human error—25% by the professional driver and 75% by other road users. The incresing in accidents and fatalities, government attempts to increase security, and the creation of new security initiatives by national and international government agencies are all factors that are driving the growth of the road safety market. A number of countries are also making significant investments in road safety market to lower fatalities and serious injuries. For instance, the Australian government has contributed directly USD 2 billion to highway safety. On the other hand, the sector is expected to benefit from attractive growth potential caused by new safety product developments in road safey market. The road safety market is expected to dominate by a small set of competitors who hold a sizable portion of the industry, according to the global road safety market landscape. The leading companies in the road safety sector, such as Kapsch Traffic Com, Cubic Corporation, Siemens, Sensys Gatso Group, Redflex Holdings, Verra Mobility, and Continental AG. The report covered detailed annlysis of local as well as key market players also, the mergers and acquisitions, strategic alliances, joint ventures, and partnerships happening in the market by region, by investment, and their strategic intent in road safety market.To know about the Research Methodology :- Request Free Sample Report

Road Safety Market Dynamics:

Increasing number of road fatalities and accidents drive the market growth Traffic accidents kill around 1.2 million people and damage up to 50 million people globally. they are the greatest cause of death in people aged 15 to 29. Road traffic deaths adversely effect low- and middle-income countries, which account for 90% of global road deaths. Rising incomes in many developing countries have resulted in rapid motorization, but road safety management and laws have delayed, which expected to drive the Road Safety Market. Road traffic deaths disproportionately impact low- and middle-income countries, which account for 90% of global road deaths. Rising incomes in many developing countries have resulted in rapid motorization, but road safety management and regulations have lagged. Reducing traffic-related deaths and injuries can boost income growth in road safety market. According to the research, road traffic deaths and injuries have an impact on medium- and long-term growth prospects by removing prime-age individuals from the labour market and lowering productivity due to the cost of injuries. The study indicates that a 10% decrease in road traffic deaths improves per capita real GDP by 3.6% over a 24-year horizon, based on thorough data on mortality and economic indicators from 135 countries. Over the period 2014-38, halving road traffic deaths and injuries might add 22% to GDP per capita in Thailand, 15% in China, 14% in India, 7% in the Philippines, and 7% in Tanzania. Advanced driver assistance systems (ADAS) and automated vehicles creat an oppurchunity in Road Safety Market Advanced driver assistance systems (ADAS) aim to improve driving convenience and safety while also reducing vehicle accidents. Road to Zero and other federal initiatives attempt to minimize road fatalities throughout the world. Growing production of automobiles with integrated ADAS features in response to increased passenger comfort and safety awareness, as well as government regulations mandating safety measures, are likely to fuel road safety market demand. Furthermore, the growing acceptability of self-driving or automated cars contributes to the market's increased growth. • Modification and improvement of automated safety systems to encourage safer driving among the general public To avoid crashes, ADAS use technology to alert drivers of potential risks or take over the operation of the vehicle to avoid such threats. • Adaptive characteristics. Navigational alerts are used in automated lighting, adaptive cruise control, and pedestrian accident avoidance mitigation (PCAM) to notify drivers to possible hazards such as cars in blind areas, lane departures, and more. • Future sensors may be able to modify themselves to focus on these systems' inherent reliability and safety. These factors create an opportunity for industry participants to drive the road safety market. Lack of infrastructure sparks fear of more deaths on roads The unclear traffic signs, poor lane markings, poor road surfaces, and poor road design can all be hazardous. Road safety may be considerably improved by improvements in the design, building, and maintenance of our road infrastructure. According to traffic experts, lacks proper medical and emergency facilities hamper the road safety market. The road safety system needs a lot of data speed to analyze data in real time. Due to this requirement, the infrastructure for implementing new technology is not evolving as quickly as the technology itself. A lack of or scarcity of funding, insufficient availability of developmental resources, the inefficiency of developmental labour, and poor repair and maintenance are all factors that contribute to poor infrastructure, which highly affects the road safety market.Road Safety Market Segment Analysis:

Based on Solution, The Road Safety Market is segmented into Red Light & Speed Enforcement, ANPR/ALPR, Incident Detection & Response, and Others. Red Light & Speed Enforcement is expected to dominate the market during the forecast period. Without human assistance, a highly accurate device called automatic number plate recognition (ANPR) can scan vehicle license plates. Through the use of high-speed image capture with supporting illumination, character recognition to convert an image to text, character detection within the provided images, and verification that the character sequences are those from a vehicle license plate, a set of metadata that identifies an image containing a vehicle license plate and the associated decoded text of that plate is generated. New emerging technologies such as Artificial intelligence, and the Internet of Things with Automatic Number Plate Recognition systems boost the road safety market growth. In addition to the countless technical developments in the road safety market like 5G, blockchain, cloud services, the Internet of Things (IoT), and Artificial Intelligence (AI), the continuous increase in internet connectivity throughout the world has greatly accelerated economic growth in the past two decades. There were more than 4.5 billion persons actively utilizing the internet as of April 2022. Dahua ANPR systems include Dahua cameras as well as software that can operate on either the camera or a server. It collects license plates automatically and in a release. The ANPR engine comprises the following characteristics, which are based on large amounts of picture data and well-trained deep-learning models. Recognition in Multiple Languages English, Arabic, Chinese, Cyrillic, Thai, and more languages are supported. Alphanumeric number plates have a high recognition rate of 95%-98%. Quick Recognition - The entire reading process takes around 100 milliseconds. Economical Technology-Excellent price/performance ratio these all factors driving the road safety market. Based on the Service, the Road Safety Market is segmented into Professional Services and Managed Services. Managed services held the largest market share in 2021 and is expected to grow faster during the forecast period. Road safety management is the process of detecting safety concerns, developing viable solutions to those problems, and choosing and implementing solutions. Effective safety management is also proactive, looking for methods to avoid safety issues before they occur. To assess the nature of road safety issues, high-quality safety data should be employed which drive the road safety market. These data can be utilized to identify big and small-scale safety issues. Other information, including as highway features, traffic volume, citations, and driver history, can be combined with crash data to help identify safety patterns and high-priority locations. Identifying safety issues, Creating possible safety methods, Strategy selection, and implementation, Network screening, Diagnosis, Countermeasure selection, Safety effectiveness evaluation, and Systemic safety programs are some of the driving factors of management service in road safety market.

Safety Management driving factors Steps of Site-level Safety Management Identify Safety Problems Step 1. Network screening: Identify locations that could benefit from treatments to reduce crash frequency and severity.

Step 2. Diagnosis: Identify crash trends and patterns based on reported crashes, assess the crash types and severity levels, and study other elements that characterize the crashes.

Develop Potential Safety Solutions Step 3. Countermeasure selection: Identify appropriate countermeasures to target crash contributing factors and reduce crash frequency and severity at identified locations. Step 4. Economic appraisal: Estimate the economic benefit and cost associated with implementing a particular countermeasure or set of countermeasures. Select and Implement Strategies Step 5. Project prioritization: Develop a prioritized list of safety improvement projects, considering available resources. Step 6. Safety effectiveness evaluation: Evaluate how a particular countermeasure (or group of countermeasures) has affected crash frequency and severity where it was installed. Road Safety Market Regional Insights:

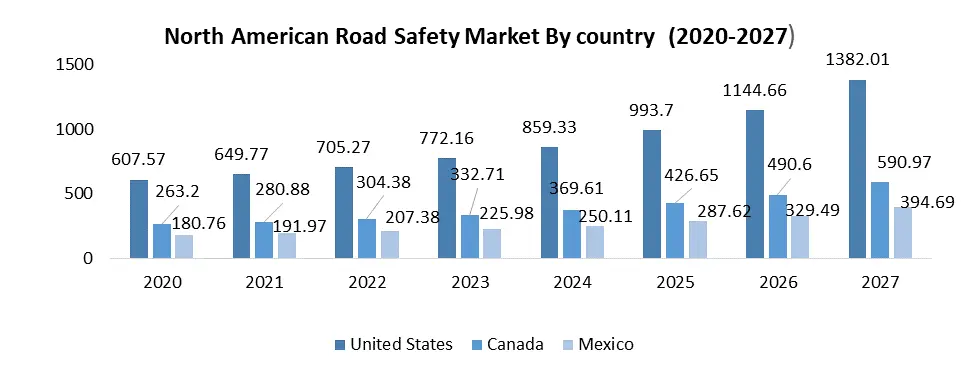

North America held the largest market share in 2022. Thanks totechnological adoption being strong in the region, it is an early user of road safety technologies. Furthermore, the region has a strong startup ecosystem. This region is also home to several of the leading providers of road safety solutions. In the North American area, technologies like red-light enforcement, automatic license plate recognition (ALPR), automatic number plate recognition (ANPR), and incident detection and response are in high demand in the road safety market. The NHTSA identifies two factors that are actively influencing the growing amount of drivers in the United States: employment growth and low gas prices positively affect the road safety market growth. 95% of all traffic fatalities in the US occur on American streets, roads, and highways, and the figure is rising, according to the US Department of Transportation. An estimated 38,680 individuals will pass away in auto accidents in 2020. In the first half of 2022, there were reportedly 20,160 fatalities, a rise of 18.4% over the same period in 2020. The government's decision to review its regulatory regulations was driven by the rise in fatalities, which increased demand for road safety products. The United States has automatic speed safety systems in more than 150 localities (known as speed safety cameras). Such technologies can lessen traffic violence and create a framework for traffic enforcement that is more equitable. Automated speed safety camera systems frequently need to be maintained and replaced, which stimulates market expansion. The US Department of Transportation reports that compared to 2020, traffic deaths in the following categories significantly increased in 2022: fatalities in multi-vehicle crashes by 16%; fatalities on urban roads by 14%; fatalities among drivers 65 and older by 14%; fatalities of pedestrians by 13%; fatalities of motorcyclists by 9%; and fatalities in crashes caused by speeding by 5%. This highlights the need for a more aggressive road safety market in North America measures in the area, which will help the industry growth during the forecast period. Several countries and towns, from Europe to Asia to Latin America, are currently using similar strategies to increase road safety. For instance, a European city that recently adopted this approach intends to invest roughly €5 million every year till 2020 in a number of ways actions that have been selected and are likely to cut Half of all road fatalities and serious injuries were avoided. A significant percentage of these investments will be reallocating resources already within the budget. The software will eventually be free of charge. negative, resulting in a €60 million savings for the city per year. This post will go over how any The strategy can be used by the government to improve Its attempts to improve road safety.

Road Safety Market Scope: Inquire before buying

Global Road Safety Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 3.64 Bn. Forecast Period 2023 to 2029 CAGR: 12.4% Market Size in 2029: US $ 8.25 Bn. Segments Covered: by Solution • Red Light & Speed Enforcement • ANPR/ALPR • Incident Detection & Response • Others by services • Professional services • Managed services by Type ENFORCEMENT SOLUTION ENFORCEMENT SOLUTION TYPE • Red Light Enforcement • Speed Enforcement • Section Enforcement • Bus Lane Enforcement • ALPR or ANPR • INCIDENT DETECTION AND RESPONSE • RAILROAD CROSSING SAFETY • SCHOOL BUS STOP -ARM ENFORCEMENT • BACK OFFICE SYSTEMS Road Safety Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) • Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina, Columbia and Rest of South America)Road Safety Market, Key Players are:

• Sensys Gatso Group • Redflex Holdings • Verra Mobility • IDEMIA • FLIR Systems • Motorola Solutions • SWARCO • Information Engineering Group Inc. • Cubic Corporation • Siemens • Conduent • VITRONIC • Kria • Laser Technology • Optotraffic • Syntell • Traffic Management Technologies • AABMATICA • Clearview Intelligence • Dahua Technology • Truvelo • Trifoil • Continental AG Frequently Asked Questions: 1] What segments are covered in the Global Road Safety Market report? Ans. The segments covered in the Road Safety Market report are based on Product, Age group, End-use, and Region. 2] Which region is expected to hold the highest share in the Global Road Safety Market? Ans. The North American region is expected to hold the highest share in the Road Safety Market. 3] What is the market size of the Global Road Safety Market by 2029? Ans. The market size of the Road Safety Market by 2029 is expected to reach US$ 8.25 Bn. 4] What is the forecast period for the Global Road Safety Market? Ans. The forecast period for the Road Safety Market is 2023 -2029. 5] What was the market size of the Global Road Safety Market in 2022? Ans. The market size of the Road Safety Market in 2022 was valued at US$ 3.64 Bn.

1. Road Safety Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Road Safety Market: Dynamics 2.1. Road Safety Market Trends by Region 2.1.1. Global Road Safety Market Trends 2.1.2. North America Road Safety Market Trends 2.1.3. Europe Road Safety Market Trends 2.1.4. Asia Pacific Road Safety Market Trends 2.1.5. Middle East and Africa Road Safety Market Trends 2.1.6. South America Road Safety Market Trends 2.2. Road Safety Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Road Safety Market Drivers 2.2.1.2. North America Road Safety Market Restraints 2.2.1.3. North America Road Safety Market Opportunities 2.2.1.4. North America Road Safety Market Challenges 2.2.2. Europe 2.2.2.1. Europe Road Safety Market Drivers 2.2.2.2. Europe Road Safety Market Restraints 2.2.2.3. Europe Road Safety Market Opportunities 2.2.2.4. Europe Road Safety Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Road Safety Market Drivers 2.2.3.2. Asia Pacific Road Safety Market Restraints 2.2.3.3. Asia Pacific Road Safety Market Opportunities 2.2.3.4. Asia Pacific Road Safety Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Road Safety Market Drivers 2.2.4.2. Middle East and Africa Road Safety Market Restraints 2.2.4.3. Middle East and Africa Road Safety Market Opportunities 2.2.4.4. Middle East and Africa Road Safety Market Challenges 2.2.5. South America 2.2.5.1. South America Road Safety Market Drivers 2.2.5.2. South America Road Safety Market Restraints 2.2.5.3. South America Road Safety Market Opportunities 2.2.5.4. South America Road Safety Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. Global 2.7.2. North America 2.7.3. Europe 2.7.4. Asia Pacific 2.7.5. Middle East and Africa 2.7.6. South America 2.8. Analysis of Government Schemes and Initiatives For the Road Safety Industry 2.9. The Global Pandemic Impact on Road Safety Market 3. Road Safety Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2022-2029) 3.1. Road Safety Market Size and Forecast, by Solution (2022-2029) 3.1.1. Red Light & Speed Enforcement 3.1.2. ANPR/ALPR 3.1.3. Incident Detection & Response 3.1.4. Others 3.2. Road Safety Market Size and Forecast, by Services(2022-2029) 3.2.1. Professional services 3.2.2. Managed services 3.3. Road Safety Market Size and Forecast, by Type (2022-2029) 3.3.1. ENFORCEMENT SOLUTION 3.3.1.1. Red Light Enforcement 3.3.1.2. Speed Enforcement 3.3.1.3. Section Enforcement 3.3.1.4. Bus Lane Enforcement 3.3.2. ALPR OR ANPR 3.3.3. Incident Detection And Response 3.3.4. Railroad Crossing Safety 3.3.5. School Bus Stop -Arm Enforcement 3.3.6. Back Office Systems 3.4. Road Safety Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Road Safety Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 4.1. North America Road Safety Market Size and Forecast, by Solution (2022-2029) 4.1.1. Red Light & Speed Enforcement 4.1.2. ANPR/ALPR 4.1.3. Incident Detection & Response 4.1.4. Others 4.2. North America Road Safety Market Size and Forecast, by Services(2022-2029) 4.2.1. Professional services 4.2.2. Managed services 4.3. North America Road Safety Market Size and Forecast, by Type (2022-2029) 4.3.1. ENFORCEMENT SOLUTION 4.3.1.1. Red Light Enforcement 4.3.1.2. Speed Enforcement 4.3.1.3. Section Enforcement 4.3.1.4. Bus Lane Enforcement 4.3.2. ALPR OR ANPR 4.3.3. Incident Detection And Response 4.3.4. Railroad Crossing Safety 4.3.5. School Bus Stop -Arm Enforcement 4.3.6. Back Office Systems 4.4. Road Safety Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Road Safety Market Size and Forecast, by Solution (2022-2029) 4.4.1.1.1. Red Light & Speed Enforcement 4.4.1.1.2. ANPR/ALPR 4.4.1.1.3. Incident Detection & Response 4.4.1.1.4. Others 4.4.1.2. United States Road Safety Market Size and Forecast, by Services(2022-2029) 4.4.1.2.1. Professional services 4.4.1.2.2. Managed services 4.4.1.3. United States Road Safety Market Size and Forecast, by Type (2022-2029) 4.4.1.3.1. ENFORCEMENT SOLUTION • Red Light Enforcement • Speed Enforcement • Section Enforcement • Bus Lane Enforcement 4.4.1.3.2. ALPR OR ANPR 4.4.1.3.3. Incident Detection And Response 4.4.1.3.4. Railroad Crossing Safety 4.4.1.3.5. School Bus Stop -Arm Enforcement 4.4.1.3.6. Back Office Systems 4.4.2. Canada 4.4.2.1. Canada Road Safety Market Size and Forecast, by Solution (2022-2029) 4.4.2.1.1. Red Light & Speed Enforcement 4.4.2.1.2. ANPR/ALPR 4.4.2.1.3. Incident Detection & Response 4.4.2.1.4. Others 4.4.2.2. Canada Road Safety Market Size and Forecast, by Services(2022-2029) 4.4.2.2.1. Professional services 4.4.2.2.2. Managed services 4.4.2.3. Canada Road Safety Market Size and Forecast, by Type (2022-2029) 4.4.2.3.1. ENFORCEMENT SOLUTION • Red Light Enforcement • Speed Enforcement • Section Enforcement • Bus Lane Enforcement 4.4.2.3.2. ALPR OR ANPR 4.4.2.3.3. Incident Detection And Response 4.4.2.3.4. Railroad Crossing Safety 4.4.2.3.5. School Bus Stop -Arm Enforcement 4.4.2.3.6. Back Office Systems 4.4.3. Mexico 4.4.3.1. Mexico Road Safety Market Size and Forecast, by Solution (2022-2029) 4.4.3.1.1. Red Light & Speed Enforcement 4.4.3.1.2. ANPR/ALPR 4.4.3.1.3. Incident Detection & Response 4.4.3.1.4. Others 4.4.3.2. Mexico Road Safety Market Size and Forecast, by Services(2022-2029) 4.4.3.2.1. Professional services 4.4.3.2.2. Managed services 4.4.3.3. Mexico Road Safety Market Size and Forecast, by Type (2022-2029) 4.4.3.3.1. ENFORCEMENT SOLUTION • Red Light Enforcement • Speed Enforcement • Section Enforcement • Bus Lane Enforcement 4.4.3.3.2. ALPR OR ANPR 4.4.3.3.3. Incident Detection And Response 4.4.3.3.4. Railroad Crossing Safety 4.4.3.3.5. School Bus Stop -Arm Enforcement 4.4.3.3.6. Back Office Systems 5. Europe Road Safety Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 5.1. Europe Road Safety Market Size and Forecast, by Solution (2022-2029) 5.2. Europe Road Safety Market Size and Forecast, by Services(2022-2029) 5.3. Europe Road Safety Market Size and Forecast, by Type (2022-2029) 5.4. Europe Road Safety Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Road Safety Market Size and Forecast, by Solution (2022-2029) 5.4.1.2. United Kingdom Road Safety Market Size and Forecast, by Services(2022-2029) 5.4.1.3. United Kingdom Road Safety Market Size and Forecast, by Type (2022-2029) 5.4.2. France 5.4.2.1. France Road Safety Market Size and Forecast, by Solution (2022-2029) 5.4.2.2. France Road Safety Market Size and Forecast, by Services(2022-2029) 5.4.2.3. France Road Safety Market Size and Forecast, by Type (2022-2029) 5.4.3. Germany 5.4.3.1. Germany Road Safety Market Size and Forecast, by Solution (2022-2029) 5.4.3.2. Germany Road Safety Market Size and Forecast, by Services(2022-2029) 5.4.3.3. Germany Road Safety Market Size and Forecast, by Type (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Road Safety Market Size and Forecast, by Solution (2022-2029) 5.4.4.2. Italy Road Safety Market Size and Forecast, by Services(2022-2029) 5.4.4.3. Italy Road Safety Market Size and Forecast, by Type (2022-2029) 5.4.5. Spain 5.4.5.1. Spain Road Safety Market Size and Forecast, by Solution (2022-2029) 5.4.5.2. Spain Road Safety Market Size and Forecast, by Services(2022-2029) 5.4.5.3. Spain Road Safety Market Size and Forecast, by Type (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Road Safety Market Size and Forecast, by Solution (2022-2029) 5.4.6.2. Sweden Road Safety Market Size and Forecast, by Services(2022-2029) 5.4.6.3. Sweden Road Safety Market Size and Forecast, by Type (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Road Safety Market Size and Forecast, by Solution (2022-2029) 5.4.7.2. Austria Road Safety Market Size and Forecast, by Services(2022-2029) 5.4.7.3. Austria Road Safety Market Size and Forecast, by Type (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Road Safety Market Size and Forecast, by Solution (2022-2029) 5.4.8.2. Rest of Europe Road Safety Market Size and Forecast, by Services(2022-2029) 5.4.8.3. Rest of Europe Road Safety Market Size and Forecast, by Type (2022-2029) 6. Asia Pacific Road Safety Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 6.1. Asia Pacific Road Safety Market Size and Forecast, by Solution (2022-2029) 6.2. Asia Pacific Road Safety Market Size and Forecast, by Services(2022-2029) 6.3. Asia Pacific Road Safety Market Size and Forecast, by Type (2022-2029) 6.4. Asia Pacific Road Safety Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Road Safety Market Size and Forecast, by Solution (2022-2029) 6.4.1.2. China Road Safety Market Size and Forecast, by Services(2022-2029) 6.4.1.3. China Road Safety Market Size and Forecast, by Type (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Road Safety Market Size and Forecast, by Solution (2022-2029) 6.4.2.2. S Korea Road Safety Market Size and Forecast, by Services(2022-2029) 6.4.2.3. S Korea Road Safety Market Size and Forecast, by Type (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Road Safety Market Size and Forecast, by Solution (2022-2029) 6.4.3.2. Japan Road Safety Market Size and Forecast, by Services(2022-2029) 6.4.3.3. Japan Road Safety Market Size and Forecast, by Type (2022-2029) 6.4.4. India 6.4.4.1. India Road Safety Market Size and Forecast, by Solution (2022-2029) 6.4.4.2. India Road Safety Market Size and Forecast, by Services(2022-2029) 6.4.4.3. India Road Safety Market Size and Forecast, by Type (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Road Safety Market Size and Forecast, by Solution (2022-2029) 6.4.5.2. Australia Road Safety Market Size and Forecast, by Services(2022-2029) 6.4.5.3. Australia Road Safety Market Size and Forecast, by Type (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Road Safety Market Size and Forecast, by Solution (2022-2029) 6.4.6.2. Indonesia Road Safety Market Size and Forecast, by Services(2022-2029) 6.4.6.3. Indonesia Road Safety Market Size and Forecast, by Type (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Road Safety Market Size and Forecast, by Solution (2022-2029) 6.4.7.2. Malaysia Road Safety Market Size and Forecast, by Services(2022-2029) 6.4.7.3. Malaysia Road Safety Market Size and Forecast, by Type (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Road Safety Market Size and Forecast, by Solution (2022-2029) 6.4.8.2. Vietnam Road Safety Market Size and Forecast, by Services(2022-2029) 6.4.8.3. Vietnam Road Safety Market Size and Forecast, by Type (2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Road Safety Market Size and Forecast, by Solution (2022-2029) 6.4.9.2. Taiwan Road Safety Market Size and Forecast, by Services(2022-2029) 6.4.9.3. Taiwan Road Safety Market Size and Forecast, by Type (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Road Safety Market Size and Forecast, by Solution (2022-2029) 6.4.10.2. Rest of Asia Pacific Road Safety Market Size and Forecast, by Services(2022-2029) 6.4.10.3. Rest of Asia Pacific Road Safety Market Size and Forecast, by Type (2022-2029) 7. Middle East and Africa Road Safety Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 7.1. Middle East and Africa Road Safety Market Size and Forecast, by Solution (2022-2029) 7.2. Middle East and Africa Road Safety Market Size and Forecast, by Services(2022-2029) 7.3. Middle East and Africa Road Safety Market Size and Forecast, by Type (2022-2029) 7.4. Middle East and Africa Road Safety Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Road Safety Market Size and Forecast, by Solution (2022-2029) 7.4.1.2. South Africa Road Safety Market Size and Forecast, by Services(2022-2029) 7.4.1.3. South Africa Road Safety Market Size and Forecast, by Type (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Road Safety Market Size and Forecast, by Solution (2022-2029) 7.4.2.2. GCC Road Safety Market Size and Forecast, by Services(2022-2029) 7.4.2.3. GCC Road Safety Market Size and Forecast, by Type (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Road Safety Market Size and Forecast, by Solution (2022-2029) 7.4.3.2. Nigeria Road Safety Market Size and Forecast, by Services(2022-2029) 7.4.3.3. Nigeria Road Safety Market Size and Forecast, by Type (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Road Safety Market Size and Forecast, by Solution (2022-2029) 7.4.4.2. Rest of ME&A Road Safety Market Size and Forecast, by Services(2022-2029) 7.4.4.3. Rest of ME&A Road Safety Market Size and Forecast, by Type (2022-2029) 8. South America Road Safety Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 8.1. South America Road Safety Market Size and Forecast, by Solution (2022-2029) 8.2. South America Road Safety Market Size and Forecast, by Services(2022-2029) 8.3. South America Road Safety Market Size and Forecast, by Type (2022-2029) 8.4. South America Road Safety Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Road Safety Market Size and Forecast, by Solution (2022-2029) 8.4.1.2. Brazil Road Safety Market Size and Forecast, by Services(2022-2029) 8.4.1.3. Brazil Road Safety Market Size and Forecast, by Type (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Road Safety Market Size and Forecast, by Solution (2022-2029) 8.4.2.2. Argentina Road Safety Market Size and Forecast, by Services(2022-2029) 8.4.2.3. Argentina Road Safety Market Size and Forecast, by Type (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Road Safety Market Size and Forecast, by Solution (2022-2029) 8.4.3.2. Rest Of South America Road Safety Market Size and Forecast, by Services(2022-2029) 8.4.3.3. Rest Of South America Road Safety Market Size and Forecast, by Type (2022-2029) 9. Global Road Safety Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. Services Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Road Safety Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. 3M 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Aabmatica 10.3. Altumint 10.4. Cubic Corporation 10.5. Conduent 10.6. Continental Ag 10.7. Clearview Intelligence Limited 10.8. Dahua Technology Co. Ltd. 10.9. Flir Systems 10.10. Idemia 10.11. Jenoptik 10.12. Kapsch 10.13. Kria S.R.L. 10.14. Laser Technology, Inc. 10.15. Redflex Holdings 10.16. Swarco 10.17. Siemens 10.18. Sensys Gatso Group 10.19. Syntell 10.20. Traffic Management Technologies (Kapsch Group) 10.21. Truvelo 10.22. Veera Mobility 10.23. Vitronic 11. Key Findings 12. Industry Recommendations 13. Road Safety Market: Research Methodology 14. Terms and Glossary