The Global Recruitment Process Outsourcing (RPO) size was valued at USD 7.20 Billion in 2023 and the total Recruitment Process Outsourcing (RPO) revenue is expected to grow at a CAGR of 16.2 % from 2024 to 2030, reaching nearly USD 20.6 Billion by 2030.Recruitment Process Outsourcing (RPO) Market Overview

Recruitment Process Outsourcing (RPO) is a strategic business practice wherein organizations engage external service providers to manage some or all aspects of their recruitment processes. The adoption of AI and automation streamlines and accelerates various stages of the recruitment process, from resume screening to interview scheduling. Recruitment Process Outsourcing (RPO) providers equipped with these technologies have been offering faster and more efficient services, leading to improved client satisfaction and competitive advantages. RPO providers equipped with these technologies have offered faster and more efficient services, improving client satisfaction and competitive advantages. RPO providers are more competitive when they use modern technology. Technology-savvy RPO companies stand to earn more Recruitment Process Outsourcing (RPO) market share as clients look for innovative solutions.To know about the Research Methodology :- Request Free Sample Report Technology integration becomes a key factor in Recruitment Process Outsourcing (RPO) market differentiation. RPO providers at the lead of technological innovation have positioned themselves as industry leaders, distinguishing their services in a competitive landscape. A crucial element in differentiating a product in the market is technology integration. Leading RPO companies in the field to set themselves apart from the competition by showcasing their innovative technological innovations. Focusing on improving the overall candidate experience throughout the recruitment journey presents a significant opportunity for Recruitment Process Outsourcing (RPO) providers. Ongoing advancements in technology, such as AI-driven chatbots and virtual reality (VR) for virtual interviews, are expected to reshape the way candidates interact with the recruitment process. RPO providers incorporating these innovations have been creating engaging and technologically advanced candidate experiences, setting them apart in the Recruitment Process Outsourcing (RPO) market.

Recruitment Process Outsourcing (RPO) Market Dynamics

Integration of Artificial Intelligence (AI) and Automation The integration of AI and automation in the RPO market represents a significant trend that enhances the effectiveness of talent acquisition processes. Resume screening, interview scheduling, and other routine processes have been executed at a faster pace, reducing the overall time-to-hire. Automation contributes to a more streamlined and candidate-friendly recruitment experience. For example, AI-driven chatbots provide instant responses to candidate queries, ensuring timely communication and improving overall satisfaction. AI allows Recruitment Process Outsourcing (RPO) providers to create more personalized and data-driven recruitment strategies. Machine learning algorithms have been adapting to changing client needs, industry trends, and candidate preferences, ensuring a more customized approach to talent acquisition. AI applications are expected to grow beyond the present use cases in the forecast period. Recruitment Process Outsourcing (RPO) Industries have the option to look into novel methods to use AI for workforce planning, talent analytics, and other critical areas of hiring. The need for ethical AI practices will grow as AI becomes more widely used. It is going to be the responsibility of RPO providers to guarantee that AI algorithms follow moral hiring practices and are impartial and transparent. The United States is a leader in technology and innovation, making it a strong base for the integration of AI and automation in RPO services. Many tech-driven RPO firms are based in the U.S., influencing advanced technologies. Germany is known for its industrial and technological expertise and is witnessing increased adoption of AI in various sectors, including recruitment. RPO providers in Germany have focused on technology to enhance efficiency and stay competitive in the global Recruitment Process Outsourcing (RPO) Market. Digital Transformation in HR Digital transformation in HR involves the integration of digital technologies to streamline and enhance human resource processes. It includes various aspects, including recruitment, talent management, employee engagement, and data analytics. Future developments are expected to focus on enhancing the overall employee experience, from recruitment to onboarding and beyond. Recruitment Process Outsourcing (RPO) providers are influenced by digital tools to create a seamless and positive experience for both candidates and clients. Augmented Reality and Virtual Reality technologies find applications in recruitment processes. Virtual job fairs, immersive assessment experiences, and virtual workplace tours become integral components of the Recruitment Process Outsourcing (RPO) market digital transformation. Several governments have introduced or updated legislation to support remote work. This includes provisions for digital onboarding, secure data management, and the recognition of virtual signatures, making it easier for HR processes to go digital. The Expected growth of the Recruitment Process Outsourcing (RPO) market involves AI-driven innovations in talent acquisition. This includes advancements in candidate matching algorithms, video interviewing technologies, and predictive analytics for workforce planning.Talent Scarcity and Competition Talent scarcity and competition often lead to longer time-to-fill positions, as finding suitable candidates becomes a more challenging task. It impacts the overall efficiency of the recruitment process. Recruitment Process Outsourcing (RPO) providers have overcome talent scarcity by engaging in proactive talent pipelining. Building and maintaining relationships with potential candidates before positions become vacant ensures a ready pool of qualified talent. Enhancing and promoting the employer brand is capable of improving an organization's value towards prospective employees. RPO companies have been working closely with clients to build their employer brand so that it stands out in a crowded labor market. Advanced technologies, including artificial intelligence (AI) and data analytics, have helped RPO providers identify and attract candidates more efficiently. Automation streamlines processes, allowing recruiters to focus on strategic aspects of talent acquisition.

Recruitment Process Outsourcing (RPO) Market Segment Analysis

By Type, the Managed Recruitment Process Outsourcing (MCRPO) segment dominates the Recruitment Process Outsourcing (RPO) Market and is expected to experience substantial growth throughout the forecast period. Managed Recruitment Process Outsourcing (MCRPO) is a specialized segment within the broader Recruitment Process Outsourcing (RPO) market. Integration of advanced technologies in recruitment processes drives the growth of the MCRPO segment. The adoption of AI, automation, and analytics within MCRPO enhances efficiency, reduces time-to-fill, and ensures that technological advancements are Influenced to provide strategic value to clients. Organizations increasingly prioritize focusing on core business functions, driving the demand for MCRPO. It allows industries to concentrate on their core competencies while outsourcing the entire recruitment process. The growth of this segment is influenced by the strategic decision of companies to delegate non-core functions to specialized providers. Expected growth in the MCRPO segment is estimated as organizations continue to seek cost-efficient solutions for recruitment. There is going to be a strong demand for suppliers who offer clear pricing structures and efficient budget optimization. Throughout the forecast period, the segment's growth is expected to be largely dependent on the degree of flexibility offered by service delivery models, which allows clients to select the level of outsourcing that best suits their organizational structure.Recruitment Process Outsourcing (RPO) Market Regional Insights

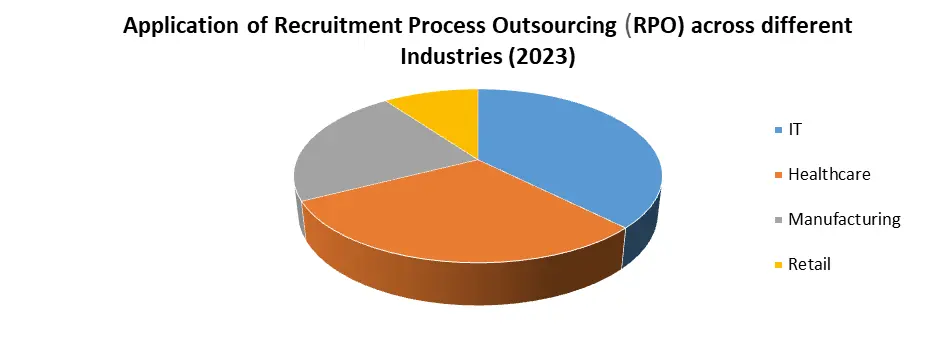

North America shows its dominance in the Recruitment Process Outsourcing (RPO) market as it emerges as the establishing region and secures the biggest revenue among other areas. RPO services in North America are extensively used across various industries, including IT and technology, healthcare, finance, and manufacturing. North America is a technology leader in recruitment process outsourcing (RPO), using analytics platforms and AI-driven recruitment solutions. By improving the efficiency of talent acquisition procedures, this tech-forward strategy gives companies an advantage over their competitors. Canada has observed a consistent upward trend in the Recruitment Process Outsourcing (RPO) industry. The growth of RPO services is being driven by businesses in the nation realizing the benefits of outsourcing talent acquisition to specialist providers. The Recruitment Process Outsourcing (RPO) market in Canada is distinguished by a deliberate approach to outsourcing. Employers use RPO services to improve their entire talent acquisition strategies by coordinating hiring procedures with the aims and objectives of the company. Mexico's participation in the Recruitment Process Outsourcing market contributes significantly to the regional growth of recruitment outsourcing. The country's offerings, including language proficiency and proximity advantages, make it a valuable contributor to the overall dynamics of North American Recruitment Process Outsourcing (RPO). Recent developments in the North American Recruitment Process Outsourcing (RPO) market include the increased integration of advanced technologies. AI-powered chatbots for candidate engagement, predictive analytics for talent pipelining, and automation for administrative tasks are becoming standard practices. Predictive analytics is gaining prominence in North American RPO to do in advance future talent needs. By analyzing historical data, Recruitment Process Outsourcing (RPO) market trends, and candidate behaviors, RPO providers have been proactively building talent pipelines, ensuring a readily available pool of qualified candidates. For Example, A large RPO provider implements automation in resume screening. Using machine learning algorithms, the system scans resumes for key qualifications and ranks candidates based on relevance. Recruiters focus their attention on the shortlisted candidates, improving overall productivity.Competitive Landscape of the Recruitment Process Outsourcing (RPO) Market The competitiveness in the Recruitment Process Outsourcing (RPO) market is influenced by various factors that contribute to the success of outsourcing recruitment services. Such as market trends, key players, Services offered, and Industry Dynamics. RPO providers incorporating advanced technologies, such as AI, automation, and analytics, enhance their efficiency and offer innovative solutions to clients. Technologically advanced platforms contribute to better candidate sourcing, improved communication, and streamlined processes. Mergers and acquisitions have enhanced the client portfolio of RPO providers by bringing in new clients and industries also it diversified client base helps mitigate risks associated with dependence on specific sectors. In January 2023, Wilson HCG, an RPO business, successfully acquired Personify, an RPO firm with an importance on healthcare and life sciences. The goal of this partnership is to strengthen market penetration and establish the company as the go-to global source for talent solutions in the biotechnology, life sciences, healthcare, and other fields. In November 2022, The RPO provider AMS finalized the acquisition of the Canadian RPO company HirePower. The purpose of this acquisition is to fortify AMS's technological and digital recruitment know-how and increase its market share in North America. In May 2021, ADP Workforce Now, a complete payroll and HR management solution, and TrackTik Software, a cloud-based security workforce management firm, announced their integration. By removing the need for manual data entry, this integration seeks to expedite the payroll process and save money, time, and mistakes.

Recruitment Process Outsourcing (RPO) Market Scope: Inquire before buying

Recruitment Process Outsourcing Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2022 Market Size in 2023: US $ 7.20 Bn. Forecast Period 2024 to 2030 CAGR: 16.2% Market Size in 2030: US $ 20.6 Bn. Segments Covered: by Type MCRPO Blended RPO by Engagement Models On-demand End-to-end RPO models by Application IT and Telecom Healthcare Energy Manufacturing BFSI Recruitment Process Outsourcing (RPO) Market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Manufacturers of Recruitment Process Outsourcing (RPO) Market

1. AlexanderMann Solutions 2. AllegisTalent2 (U.S.) 3. Aon Hewitt (U.K.) 5. Hays (U.K) 6. Hudson (U.S.) 7. IBM (U.S.) 8. Infosys (India) 9. KellyOCG(India) 10. Kenexa (U.S.) 11. ManpowerGroup (U.S.) 12. Randstad Sourceright (U.S.) 13. Korn Ferry (U.S.) 15. ADP, LLC (U.S.) 16. Cielo, Inc.(U.S.) 17. Atterro Human Capital Group (U.S.) 18. Accolo Inc.(U.S.) FAQs: 1. What are the growth drivers for the Recruitment Process Outsourcing (RPO) market? Ans. Widespread talent shortages across industries drive organizations to seek external assistance for efficient and effective recruitment processes. RPO providers are in demand to help companies navigate and overcome challenges related to finding and attracting qualified candidates. 2. What is the major restraint for the Recruitment Process Outsourcing (RPO) market growth? Ans. Economic uncertainties, fluctuations in Recruitment Process Outsourcing (RPO) market conditions, and global economic downturns have been impacting hiring budgets and prompted organizations to reevaluate their recruitment strategies. During periods of economic uncertainty, businesses are expected to become more cautious in their hiring decisions, leading to a reduction in recruitment budgets and a decreased demand for RPO services. 3. Which region is expected to lead the global Recruitment Process Outsourcing (RPO) market during the forecast period? Ans. North America is expected to lead the global Recruitment Process Outsourcing (RPO) market during the forecast period. 4. What is the projected market size & and growth rate of the Recruitment Process Outsourcing (RPO) Market? Ans. The Global Recruitment Process Outsourcing (RPO) Market size was valued at USD 7.20 Billion in 2023 and the total Recruitment Process Outsourcing (RPO) Market revenue is expected to grow at a CAGR of 16.2 % from 2024 to 2030, reaching nearly USD 20.6 Billion. 5. What segments are covered in the Recruitment Process Outsourcing (RPO) Market report? Ans. The segments covered in the Recruitment Process Outsourcing (RPO) market report are Technology Type, and Engagement Model, Application.

1. Recruitment Process Outsourcing Market: Research Methodology 2. Recruitment Process Outsourcing Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Recruitment Process Outsourcing Market: Dynamics 3.1. Recruitment Process Outsourcing Market Trends by Region 3.1.1. North America Recruitment Process Outsourcing Market Trends 3.1.2. Europe Recruitment Process Outsourcing Market Trends 3.1.3. Asia Pacific Recruitment Process Outsourcing Market Trends 3.1.4. Middle East and Africa Recruitment Process Outsourcing Market Trends 3.1.5. South America Recruitment Process Outsourcing Market Trends 3.2. Recruitment Process Outsourcing Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Recruitment Process Outsourcing Market Drivers 3.2.1.2. North America Recruitment Process Outsourcing Market Restraints 3.2.1.3. North America Recruitment Process Outsourcing Market Opportunities 3.2.1.4. North America Recruitment Process Outsourcing Market Challenges 3.2.2. Europe 3.2.2.1. Europe Recruitment Process Outsourcing Market Drivers 3.2.2.2. Europe Recruitment Process Outsourcing Market Restraints 3.2.2.3. Europe Recruitment Process Outsourcing Market Opportunities 3.2.2.4. Europe Recruitment Process Outsourcing Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Recruitment Process Outsourcing Market Drivers 3.2.3.2. Asia Pacific Recruitment Process Outsourcing Market Restraints 3.2.3.3. Asia Pacific Recruitment Process Outsourcing Market Opportunities 3.2.3.4. Asia Pacific Recruitment Process Outsourcing Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Recruitment Process Outsourcing Market Drivers 3.2.4.2. Middle East and Africa Recruitment Process Outsourcing Market Restraints 3.2.4.3. Middle East and Africa Recruitment Process Outsourcing Market Opportunities 3.2.4.4. Middle East and Africa Recruitment Process Outsourcing Market Challenges 3.2.5. South America 3.2.5.1. South America Recruitment Process Outsourcing Market Drivers 3.2.5.2. South America Recruitment Process Outsourcing Market Restraints 3.2.5.3. South America Recruitment Process Outsourcing Market Opportunities 3.2.5.4. South America Recruitment Process Outsourcing Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis for Recruitment Process Outsourcing (RPO) Industry 3.8. Analysis of Government Schemes and Initiatives for Recruitment Process Outsourcing (RPO) Industry 3.9. The Global Pandemic Impact on Recruitment Process Outsourcing Market 4. Recruitment Process Outsourcing Market: Global Market Size and Forecast (by Value in USD Million) (2023-2030) 4.1. Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 4.1.1. MICRPO 4.1.2. Blended RPO 4.2. Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 4.2.1. On-demand 4.2.2. End-to-end RPO models 4.3. Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 4.3.1. IT and Telecom 4.3.2. Healthcare 4.3.3. Energy 4.3.4. Manufacturing 4.3.5. BFSI 4.4. Recruitment Process Outsourcing Market Size and Forecast, by Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Recruitment Process Outsourcing Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 5.1.1. MICRPO 5.1.2. Blended RPO 5.2. North America Recruitment Process Outsourcing Market Size and Forecast, by Engagement Model (2023-2030) 5.2.1. On-demand 5.2.2. End-to-end RPO models 5.3. North America Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 5.3.1. IT and Telecom 5.3.2. Healthcare 5.3.3. Energy 5.3.4. Manufacturing 5.3.5. BFSI 5.4. North America Recruitment Process Outsourcing Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 5.4.1.1.1. MICRPO 5.4.1.1.2. Blended RPO 5.4.1.2. United States Recruitment Process Outsourcing Market Size and Forecast, by Engagement Model (2023-2030) 5.4.1.2.1. On-demand 5.4.1.2.2. End-to-end RPO models 5.4.1.3. United States Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 5.4.1.3.1. IT and Telecom 5.4.1.3.2. Healthcare 5.4.1.3.3. Energy 5.4.1.3.4. Manufacturing 5.4.1.3.5. BFSI 5.4.2. Canada 5.4.2.1. Canada Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 5.4.2.1.1. MICRPO 5.4.2.1.2. Blended RPO 5.4.2.2. Canada Recruitment Process Outsourcing Market Size and Forecast, by Engagement Model (2023-2030) 5.4.2.2.1. On-demand 5.4.2.2.2. End-to-end RPO models 5.4.2.3. Canada Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 5.4.2.3.1. IT and Telecom 5.4.2.3.2. Healthcare 5.4.2.3.3. Energy 5.4.2.3.4. Manufacturing 5.4.2.3.5. BFSI 5.4.3. Mexico 5.4.3.1. Mexico Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 5.4.3.1.1. Hardware 5.4.3.1.2. Software 5.4.3.1.3. Connectivity 5.4.3.1.4. Analytics 5.4.3.2. Mexico Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 5.4.3.2.1. On-demand 5.4.3.2.2. End-to-end RPO models 5.4.3.3. Mexico Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 5.4.3.3.1. IT and Telecom 5.4.3.3.2. Healthcare 5.4.3.3.3. Energy 5.4.3.3.4. Manufacturing 5.4.3.3.5. BFSI 6. Europe Recruitment Process Outsourcing Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 6.2. Europe Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 6.3. Europe Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 6.4. Europe Recruitment Process Outsourcing Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 6.4.1.2. United Kingdom Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 6.4.1.3. United Kingdom Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 6.4.2. France 6.4.2.1. France Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 6.4.2.2. France Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 6.4.2.3. France Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Germany Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 6.4.3.3. Germany Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 6.4.4.2. Italy Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 6.4.4.3. Italy Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Spain Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 6.4.5.3. Spain Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Sweden Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 6.4.6.3. Sweden Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 6.4.7. Austria 6.4.7.1. Austria Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Austria Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 6.4.7.3. Austria Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Rest of Europe Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 6.4.8.3. Rest of Europe Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 7. Asia Pacific Recruitment Process Outsourcing Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 7.2. Asia Pacific Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 7.3. Asia Pacific Recruitment Process Outsourcing Market Size and Forecast, by End User (2023-2030) 7.4. Asia Pacific Recruitment Process Outsourcing Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 7.4.1.2. China Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 7.4.1.3. China Recruitment Process Outsourcing Market Size and Forecast, by End User (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 7.4.2.2. S Korea Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 7.4.2.3. S Korea Recruitment Process Outsourcing Market Size and Forecast, by End User (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Japan Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 7.4.3.3. Japan Recruitment Process Outsourcing Market Size and Forecast, by End User (2023-2030) 7.4.4. India 7.4.4.1. India Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 7.4.4.2. India Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 7.4.4.3. India Recruitment Process Outsourcing Market Size and Forecast, by End User (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 7.4.5.2. Australia Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 7.4.5.3. Australia Recruitment Process Outsourcing Market Size and Forecast, by End User (2023-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 7.4.6.2. Indonesia Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 7.4.6.3. Indonesia Recruitment Process Outsourcing Market Size and Forecast, by End User (2023-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 7.4.7.2. Malaysia Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 7.4.7.3. Malaysia Recruitment Process Outsourcing Market Size and Forecast, by End User (2023-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 7.4.8.2. Vietnam Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 7.4.8.3. Vietnam Recruitment Process Outsourcing Market Size and Forecast, by End User (2023-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 7.4.9.2. Taiwan Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 7.4.9.3. Taiwan Recruitment Process Outsourcing Market Size and Forecast, by End User(2023-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 7.4.10.2. Rest of Asia Pacific Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 7.4.10.3. Rest of Asia Pacific Recruitment Process Outsourcing Market Size and Forecast, by End User(2023-2030) 8. Middle East and Africa Recruitment Process Outsourcing Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2030) 8.1. Middle East and Africa Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 8.2. Middle East and Africa Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 8.3. Middle East and Africa Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 8.4. Middle East and Africa Recruitment Process Outsourcing Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 8.4.1.2. South Africa Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 8.4.1.3. South Africa Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 8.4.1.4. South Africa Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 8.4.2.2. GCC Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 8.4.2.3. GCC Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Nigeria Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 8.4.3.3. Nigeria Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 8.4.4.2. Rest of ME&A Recruitment Process Outsourcing Market Size and Forecast, by Engagement Models (2023-2030) 8.4.4.3. Rest of ME&A Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 9. South America Recruitment Process Outsourcing Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. South America Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 9.2. South America Recruitment Process Outsourcing Market Size and Forecast, by Technology (2023-2030) 9.3. South America Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 9.4. South America Recruitment Process Outsourcing Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 9.4.1.2. Brazil Recruitment Process Outsourcing Market Size and Forecast, by Technology (2023-2030) 9.4.1.3. Brazil Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 9.4.2.2. Argentina Recruitment Process Outsourcing Market Size and Forecast, by Technology (2023-2030) 9.4.2.3. Argentina Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Recruitment Process Outsourcing Market Size and Forecast, by Type (2023-2030) 9.4.3.2. Rest Of South America Recruitment Process Outsourcing Market Size and Forecast, by Technology (2023-2030) 9.4.3.3. Rest Of South America Recruitment Process Outsourcing Market Size and Forecast, by Application (2023-2030) 10. Global Recruitment Process Outsourcing Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Recruitment Process Outsourcing Market Companies, by market capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. AlexanderMann Solutions 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (small, medium, and large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. AllegisTalent2 11.3. Aon Hewitt 11.4. Futurestep 11.5. Hays 11.6. Hudson 11.7. IBM 11.8. Infosys 11.9. KellyOCG 11.10. Kenexa 11.11. ManpowerGroup 11.12. Randstad Sourceright 11.13. Korn Ferry 11.14. Accolo, Inc. 11.15. ADP, LLC 11.16. Cielo, Inc. 11.17. Atterro Human Capital Group 11.18. Accolo Inc. 12. Key Findings 13. Industry Recommendations