The Radiation-Hardened Electronics Market was valued at USD 1.9 billion in 2024. The market is expected to reach USD 2.83 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.1 % from 2025 to 2032. Radiation-hardened electronics are specialized types of electronic components that function properly in the presence of harmful radiation, such as in space, near nuclear reactors, or in military equipment. They are designed to encounter radiation damage and prevent failures, and help to make important systems functional in a difficult environment. The Radiation-Hardened Electronics Market is growing steadily with the increasing requirement for reliable electronic systems under severe environments such as outer space, military use, and nuclear reactors. These electronics are designed to operate reliably under ionizing radiation, a requirement for satellites, military equipment, and reactor controls to function properly. Increased deployment of satellites, advances in the domain of space exploration, and improvements in nuclear power are all contributing to higher demand. Government and industrial investment in research and development is also fast-tracking these more affordable and efficient Product Types of radiation-resistant technology. Defense modernization and persistent geopolitical tensions are additionally driving demand within the military market.To know about the Research Methodology:-Request Free Sample Report The report provides an in-depth analysis of the major growth factors in the global radiation-hardened electronics market, such as the expanding use of multi-orbit satellite constellations, rising defense expenditure on space-based ISR systems, and growing investments in hybrid radiation-hardening technologies. Major industry players like Microchip Technology, Infineon Technologies, BAE Systems, Analog Devices, and Teledyne e2v are developing breakthroughs in radiation-tolerant ICs, modular power solutions, and resilient memory architectures to address changing space and defense mission requirements. They are committed to providing scalable, cost-effective, and long-lifetime electronics for commercial, military, and scientific applications in LEO, MEO, GEO, and deep-space missions. In January 2025, Infineon Technologies AG announced that its 512 Mbit radiation-hardened QSPI NOR Flash memory has attained QML-V and QML-P certification from the U.S. Defense Logistics Agency. This is the first and sole QML-qualified rad-hard NOR flash designed for use in space. Characterizing the speed of 133 MHz, high density, and excellent radiation performance, it can support space-grade FPGA and processor in a rigid environment.

Global Radiation-Hardened Electronics Market Dynamics:

Gains Momentum for Multi-Orbit Missions to boost the Hybrid Radiation-Hardened Electronics Market Growth The global radiation-hardened electronics market is experiencing accelerated growth driven by the rising demand for multi-orbit space missions, which include Low Earth Orbit (LEO), Medium Earth Orbit (MEO), Geostationary Orbit (GEO), and deep-space explorations. With increased mission complexity and cost-sensitivity, the market is shifting strategically towards hybrid radiation-hardened and radiation-tolerant electronics. This tendency is contributing immensely to radiation-hardened electronics market growth, with hybrid systems offer the optimal balance between resilience and affordability, addressing mission needs without excessive overengineering. • For instance, in June 2025, as the need increases for cost-effective, radiation-hard electronics in space, firms such as Renesas, Spirit Electronics, and Vorago Technologies are venturing out of Low Earth Orbit (LEO). They're now providing scalable, hybrid rad-hard and rad-tolerant devices for MEO, GEO, lunar, and deep-space missions. Flexible packaging, redundancy, and software voting offer quicker, less expensive solutions for complicated mission requirements. Increased Deployment of Radiation-Hardened Electronics Market in Deep-Space Missions The increased application of radiation-hardened electronics in advanced space missions beyond Earth orbit. As space agencies move to lunar exploration and deep-space investigation, there is a need for highly reliable electronic components that can withstand extreme radiation conditions. Such systems are a requirement for advanced scientific operations, accurate landing technologies, and extended period missions. This maximum inclusion of red-hard parts indicates their significant contributions towards the next generation of exploration missions and guarantees the success of the mission in an uncertain space environment. • For instance, in January 2024, Renesas Electronics Corporation announced that its radiation-hardened ICS flew on JAXA's smart lander to investigate the Moon (SLIM), which successfully landed near the Shioli Crater on 20 January 2024. This historic milestone makes Japan the fifth country to land and work on the moon. SLIM's precise landing was facilitated by leading vision-based systems and lightweight construction. The mission will research the Moon's origin through a multi-band spectral camera processing mantle-derived lunar rock material. Rising Defense & ISR Missions to Drive Radiation-Hardened Electronics Market Growth The increasing focus on defense and ISR (Intelligence, Surveillance, and Reconnaissance) operations is a major driver for the global radiation-hardened electronics market. As space is seen more and more as an important domain for military operations, defense institutions are speeding up the deployment of ISR satellites and secure space communications. These missions depend upon rugged, radiation-hardened parts that can function in hostile environments. As military defense activities grow in size and complexity, the need for reliable rad-hard technologies also grows, validating their role in existing military systems as well as future space defense programs. • For instance, Novaspace's 24th annual Government Space Programs report, government space spending hit a record USD 135 billion in 2024, a 10% increase from 2023. The increase in defense-related spending to USD 73 billion highlights the growing apprehension about space as a disputed military area. This pattern demonstrates how leading spacefaring nations' global goals are changing and how space is becoming more militarized.Global Radiation-Hardened Electronics Market Segment Analysis: -

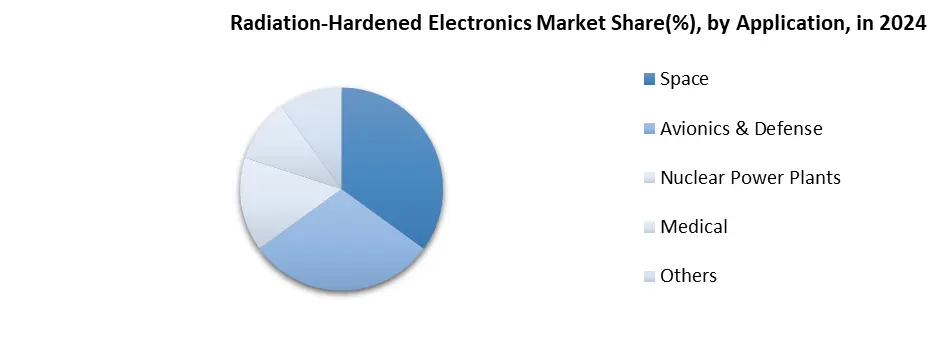

By Component Based on component, the Radiation-Hardened Electronics Market is segmented into Integrated Circuits, Memory, Microcontrollers and Microprocessors, Power Management, and Others. The Integrated Circuits segment dominated the Radiation-Hardened Electronics market in 2024 and is expected to capture the largest market share during the forecast period due to its critical function of controlling, processing, and regulating systems in space, defense, and nuclear sectors. ICs are designed to be radiation-hard, which provides reliability to mission-critical operations. An increasing demand for highly miniaturized, high-performance systems has resulted in the increased application of rad-hard ICs such as ASICs, FPGAs, and mixed-signal devices. With the growth in technology, ICs that are developed through rad-hard by design and process methods are increasingly used, affirming their leadership in application as well as in market management throughout high-radiation scenarios. By Product Based on Product, the Radiation Hardened Electronics Market is segmented into Commercial off-the-Shelf, Custom Made. The commercial off-the-shelf segment dominated the market in 2024 and is expected to capture the largest market share during the forecast period due to its cost benefits, accelerated development cycle, and expandability. Commercial off-the-shelf less expensive than specially designed space-grade components and are available off the shelf, which makes them perfect for nimble programs like CubeSats and LEO missions. SpaceX and OneWeb, among others, prefer COTS due to its high performance-to-price ratio and ease of deployment. Advanced methods such as Radiation-Hardening-by-Design (RHBD) and error correction have improved COTS robustness, allowing for use in radiation-hard environments. With the expansion of mega-constellations, COTS solutions provide cheap mass deployment, surpassing the needs for conventional custom-built components in commercial and dual-use applications.By Application Based on application, the Radiation Hardened Electronics Market is segmented into Space, Avionics & Defense, Nuclear Power Plants, Medical, and Others (Research & Institutes, Test & Measurement, etc.). Space segment dominated the Radiation-Hardened Electronics market in 2024 and is expected to capture the largest market share during the forecast period due to extreme radiation conditions in outer space, where only specially designed components can function reliably. Satellites, exploration rovers, and deep-space missions all require electronics that can tolerate acute radiation and temperature shifts. The demand for satellite constellations, lunar landers, and interplanetary missions, both by government agencies and private space firms, the demand for radiation-hardened systems also continues to rise.

Global Radiation-Hardened Electronics Market Regional Insights:

North America was a dominant region in 2024 and is expected to hold the largest market share in the Radiation-Hardened Electronics Market over the forecast period due to the prominence of the region in the aerospace, defense, and space exploration industries. In the region, for a long time, high government investment and a strong space infrastructure have been on the verge of adopting technology development and radiation-hardened technologies. The region has major players of industry players such as Microchip Technology, Honeywell, and Texas Instruments, which also fuel innovation in the region. These firms are constructing and creating hard-to-make components for military satellites, deep space missions, and nuclear applications, making North America the most technically advanced and major sector in this extended market. • For instance, Austin, TX, in June 2025, Vorago Technologies has partnered with Sidus Space to pursue their next-generation radiation-hardened microcontroller through the Alpha Customer Program. Known for its ownership of HARDSIL technology, the company continues to provide a high-process semiconductor solution for extreme environments. This cooperation system underlines the company’s commitment to initial association with the system integrators, which aligns its innovation roadmap with developed demands from the space and defense industries. This partnership boosts North America's market growth by advancing domestic innovation in next-gen radiation-hardened microcontrollers for space and defense.Competitive Landscape

Microchip Technology is a prominent player in the space-grade radiation-hardened electronics market, providing resilient microcontrollers, FPGAs, analog, and memory products specifically designed for harsh space and defense environments. Low power usage and onboard error correction are the hallmark features of Microchip's solutions, which also meet strict space-grade certifications such as QML-V and QML-Q. The strategic acquisition of Microsemi has vastly expanded its portfolio and penetrated deeper into the aerospace and satellite communications markets. Microchip, with its established partnerships throughout NASA, ESA, and commercial space providers, has a key role in empowering next-generation constellations in LEO and deep space exploration. Microchip provides radiation-hardened FPGAs such as the RT PolarFire, which integrate high performance with power efficiency. Infineon Technologies provides radiation-hardened power semiconductors and ICS for aerospace and defense, including satellites and spacecraft. The rad-hard MOSFETs, IGBTs, and regulators are created using proprietary technology for better radiation tolerance. The company focuses on GAN and SIC innovations for efficient power management and works with global OEMS to support satellites and space missions. Recent Developments • On June 2025, Microchip Technology Inc. increased its portfolio of space-grade products with the release of SA15-28, a 15W radiation-hardened DC power converter, paired with SF100-28 EMI filter. Built for challenging space conditions, both components meet MIL-STD-461 standards and are designed to work with a 28V satellite power bus. Offered as off-the-shelf, provide strong reliability and efficient performance for demanding aerospace applications. • On April 2025, Microchip Technology Inc. completed its radiation hardened power MOSFET lineup with Jansf2N8587U3, a 100V N-CHANNEL device that is JANSF-qualified to MIL-PRF-19500/746 and is rated for 300 KRAD (SI) TID. This achievement underscores the dedication of Microchip to high-reliability semiconductors for aerospace, defense, and spaceflight applications.Radiation-Hardened Electronics Market Scope: Inquire before buying

Global Radiation-Hardened Electronics Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1.9 Bn. Forecast Period 2025 to 2032 CAGR: 5.1% Market Size in 2032: USD 2.83 Bn. Segments Covered: by Component Integrated Circuits Memory Microcontrollers and Microprocessors Power Management Others by Product Type Commercial off-the-Shelf Custom Made by Technique Rad-Hard by Design (RHBD) Rad-Hard by Process (RHBP) Others (Rad-Hard by Shielding (RHBS), etc.) by Application Space Avionics & Defense Nuclear Power Plants Medical Others (Research & Institutes, Test & Measurement, etc.) Global Radiation-Hardened Electronics Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Global Radiation-Hardened Electronics Market, Key Players

1. Microchip Technology Inc. (US) 2. BAE Systems (UK) 3. Renesas Electronics Corporation (Japan) 4. Infineon Technologies AG (Germany) 5. STMicroelectronics (Switzerland) 6. AMD (US) 7. Texas Instruments Incorporated (US) 8. Honeywell International Inc. (US) 9. Teledyne Technologies Inc. (US) 10. TTM Technologies, Inc. (US) 11. Analog Devices, Inc (US) 12. Data Devices Corporation (US) 13. 3D Plus (France) 14. Mercury Systems, Inc. (US) 15. PCB Piezotronics, Inc (US) 16. Vorago Technologies (US) 17. Micropac Industries, Inc (US) 18. GSI technology, Inc (US) 19. Everspin Technologies Inc (US) 20. Semiconductor Components Industries, LLC (US) 21. AiTech (US) 22. Microelectronics Research Development Corporation (US) 23. Space Micro, Inc (US) 24. Triad Semiconductor (US) 25. Other Players Frequently Asked Questions: 1. Which region has the largest share in the Global Radiation-Hardened Electronics Market? Ans: The North America region held the highest share in 2024. 2. What is the growth rate of the Global Radiation-Hardened Electronics Market? Ans: The Global Market is expected to grow at a CAGR of 5.1 % during the forecast period 2025-2032. 3. Who are the key players in the Global Radiation-Hardened Electronics Market? Ans: The important key players in the Global Radiation-Hardened Electronics Market are Microchip Technology Inc., Vorago Technologies, Renesas Electronics Corporation, Texas Instruments Incorporated, etc. 4. What is the study period of this market? Ans: The Global Radiation-Hardened Electronics is studied from 2025 to 2032.

1. Global Radiation-Hardened Electronics Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Radiation-Hardened Electronics Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquartere 2.3.3. Business Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 2.6. KANO Model Analysis 3. Global Radiation-Hardened Electronics Market: Dynamics 3.1.1. North America Radiation-Hardened Electronics Market Trends 3.1.2. Europe Radiation-Hardened Electronics Market Trends 3.1.3. Asia Pacific Radiation-Hardened Electronics Market Trends 3.1.4. Middle East and Africa Radiation-Hardened Electronics Market Trends 3.1.5. South America Radiation-Hardened Electronics Market Trends 3.2. Global Radiation-Hardened Electronics Market Dynamics 3.2.1. Global Radiation-Hardened Electronics Market Drivers 3.2.2. Global Radiation-Hardened Electronics Market Opportunity 3.2.3. Global Radiation-Hardened Electronics Market Restraints 3.3. PORTER’s Five Forces Analysis 3.4. Regulatory Landscape By Region 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. Global Cord Blood Banking Services: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 4.1. Global Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 4.1.1. Integrated Circuits 4.1.2. Memory 4.1.3. Microcontrollers and Microprocessors 4.1.4. Power Management 4.1.5. Others 4.2. Global Radiation-Hardened Electronics Market and Forecast, By Product Type (2024-2032) 4.2.1. Commercial off-the-Shelf 4.2.2. Custom Made 4.3. Global Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 4.3.1. Rad-Hard by Design (RHBD) 4.3.2. Rad-Hard by Process (RHBP) 4.3.3. Others (Rad-Hard by Shielding (RHBS), etc.) 4.4. Global Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 4.4.1. Space 4.4.2. Avionics & Defense 4.4.3. Nuclear Power Plants 4.4.4. Medical 4.4.5. Others (Research & Institutes, Test & Measurement, etc.) 4.5. Global Radiation-Hardened Electronics Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Radiation-Hardened Electronics Market and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 5.1. North America Radiation-Hardened Electronics Market and Forecast, By Component (2024-2032) 5.1.1. Integrated Circuits 5.1.2. Memory 5.1.3. Microcontrollers and Microprocessors 5.1.4. Power Management 5.1.5. Others 5.2. North America Radiation-Hardened Electronics Market and Forecast, By Product Type (2024-2032) 5.2.1. Commercial off-the-Shelf 5.2.2. Custom Made 5.3. North America Radiation-Hardened Electronics Market and Forecast, By Technique (2024-2032) 5.3.1. Rad-Hard by Design (RHBD) 5.3.2. Rad-Hard by Process (RHBP) 5.3.3. Others (Rad-Hard by Shielding (RHBS), etc.) 5.4. North America Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 5.4.1. Space 5.4.2. Avionics & Defense 5.4.3. Nuclear Power Plants 5.4.4. Medical 5.4.5. Others (Research & Institutes, Test & Measurement, etc.) 5.5. North America Radiation-Hardened Electronics Market Size and Forecast, By Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 5.5.1.1.1. Integrated Circuits 5.5.1.1.2. Memory 5.5.1.1.3. Microcontrollers and Microprocessors 5.5.1.1.4. Power Management 5.5.1.1.5. Others 5.5.1.2. United States Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 5.5.1.2.1. Commercial off-the-Shelf 5.5.1.2.2. Custom Made 5.5.1.3. United States Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 5.5.1.3.1. Rad-Hard by Design (RHBD) 5.5.1.3.2. Rad-Hard by Process (RHBP) 5.5.1.3.3. Others (Rad-Hard by Shielding (RHBS), etc.) 5.5.1.4. United States Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 5.5.1.4.1. Space 5.5.1.4.2. Avionics Defense 5.5.1.4.3. Nuclear Power Plants 5.5.1.4.4. Medical 5.5.1.4.5. Others (Research & Institutes, Test & Measurement, etc.) 5.5.2. Canada 5.5.2.1. Canada Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 5.5.2.1.1. Integrated Circuits 5.5.2.1.2. Memory 5.5.2.1.3. Microcontrollers and Microprocessors 5.5.2.1.4. Power Management 5.5.2.1.5. Others 5.5.2.2. Canada Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 5.5.2.2.1. Commercial off-the-shelf 5.5.2.2.2. Custom Made 5.5.2.3. Canada Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 5.5.2.3.1. Rad-Hard by Design (RHBD) 5.5.2.3.2. Rad-Hard by Process (RHBP) 5.5.2.3.3. Others (Rad-Hard by Shielding (RHBS), etc.) 5.5.2.4. Canada Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 5.5.2.4.1. Space 5.5.2.4.2. Avionics & Defense 5.5.2.4.3. Nuclear Power Plants 5.5.2.4.4. Medical 5.5.2.4.5. Others (Research & Institutes, Test & Measurement, etc.) 5.5.3. Mexico 5.5.3.1. Mexico Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 5.5.3.1.1. Integrated Circuits 5.5.3.1.2. Memory 5.5.3.1.3. Microcontrollers and Microprocessors 5.5.3.1.4. Power Management 5.5.3.1.5. Others 5.5.3.2. Mexico Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 5.5.3.2.1. Commercial off-the-Shelf 5.5.3.2.2. Custom Made 5.5.3.3. Mexico Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 5.5.3.3.1. Rad-Hard by Design (RHBD) 5.5.3.3.2. Rad-Hard by Process (RHBP) 5.5.3.3.3. Others (Rad-Hard by Shielding (RHBS), etc.) 5.5.3.4. Mexico Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 5.5.3.4.1. Space 5.5.3.4.2. Avionics & Defense 5.5.3.4.3. Nuclear Power Plants 5.5.3.4.4. Medical 5.5.3.4.5. Others (Research & Institutes, Test & Measurement, etc.) 6. Europe Radiation-Hardened Electronics Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 6.1. Europe Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 6.2. Europe Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 6.3. Europe Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 6.4. Europe Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 6.5. Europe Radiation-Hardened Electronics Market Size and Forecast, By Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 6.5.1.2. United Kingdom Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 6.5.1.3. United Kingdom Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 6.5.1.4. United Kingdom Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 6.5.2. France 6.5.2.1. France Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 6.5.2.2. France Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 6.5.2.3. France Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 6.5.2.4. France Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 6.5.3.2. Germany Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 6.5.3.3. Germany Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 6.5.3.4. Germany Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 6.5.4.2. Italy Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 6.5.4.3. Italy Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 6.5.4.4. Italy Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 6.5.5.2. Spain Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 6.5.5.3. Spain Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 6.5.5.4. Spain Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 6.5.6.2. Sweden Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 6.5.6.3. Sweden Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 6.5.6.4. Sweden Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 6.5.7.2. Austria Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 6.5.7.3. Austria Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 6.5.7.4. Austria Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 6.5.8.2. Rest of Europe Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 6.5.8.3. Rest of Europe Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 6.5.8.4. Rest of Europe Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 7. Asia Pacific Radiation-Hardened Electronics Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 7.1. Asia Pacific Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 7.2. Asia Pacific Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 7.3. Asia Pacific Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 7.4. Asia Pacific Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 7.5. Asia Pacific Radiation-Hardened Electronics Market Size and Forecast, By Country (2024-2032) 7.5.1. China 7.5.1.1. China Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 7.5.1.2. China Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 7.5.1.3. China Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 7.5.1.4. China Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 7.5.2.2. S Korea Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 7.5.2.3. S Korea Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 7.5.2.4. S Korea Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 7.5.3.2. Japan Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 7.5.3.3. Japan Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 7.5.3.4. Japan Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 7.5.4. India 7.5.4.1. India Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 7.5.4.2. India Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 7.5.4.3. India Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 7.5.4.4. India Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 7.5.5.2. Australia Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 7.5.5.3. Australia Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 7.5.5.4. Australia Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 7.5.6.2. Indonesia Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 7.5.6.3. Indonesia Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 7.5.6.4. Indonesia Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 7.5.7. Philippines 7.5.7.1. Philippines Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 7.5.7.2. Philippines Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 7.5.7.3. Philippines Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 7.5.7.4. Philippines Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 7.5.8. Malaysia 7.5.8.1. Malaysia Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 7.5.8.2. Malaysia Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 7.5.8.3. Malaysia Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 7.5.8.4. Malaysia Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 7.5.9. Vietnam 7.5.9.1. Vietnam Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 7.5.9.2. Vietnam Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 7.5.9.3. Vietnam Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 7.5.9.4. Vietnam Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 7.5.10. Thailand 7.5.10.1. Thailand Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 7.5.10.2. Thailand Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 7.5.10.3. Thailand Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 7.5.10.4. Thailand Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 7.5.11.2. Rest of Asia Pacific Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 7.5.11.3. Rest of Asia Pacific Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 7.5.11.4. Rest of Asia Pacific Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 8. Middle East and Africa Radiation-Hardened Electronics Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 8.1. Middle East and Africa Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 8.2. Middle East and Africa Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 8.3. Middle East and Africa Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 8.4. Middle East and Africa Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 8.5. Middle East and Africa Radiation-Hardened Electronics Market Size and Forecast, By Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 8.5.1.2. South Africa Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 8.5.1.3. South Africa Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 8.5.1.4. South Africa Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 8.5.2.2. GCC Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 8.5.2.3. GCC Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 8.5.2.4. GCC Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 8.5.3.2. Nigeria Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 8.5.3.3. Nigeria Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 8.5.3.4. Nigeria Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 8.5.4.2. Rest of ME&A Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 8.5.4.3. Rest of ME&A Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 8.5.4.4. Rest of ME&A Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 9. South America Radiation-Hardened Electronics Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 9.1. South America Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 9.2. South America Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 9.3. South America Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 9.4. South America Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 9.5. South America Radiation-Hardened Electronics Market Size and Forecast, By Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 9.5.1.2. Brazil Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 9.5.1.3. Brazil Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 9.5.1.4. Brazil Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 9.5.2.2. Argentina Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 9.5.2.3. Argentina Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 9.5.2.4. Argentina Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 9.5.3. Rest of South America 9.5.3.1. Rest of South America Radiation-Hardened Electronics Market Size and Forecast, By Component (2024-2032) 9.5.3.2. Rest of South America Radiation-Hardened Electronics Market Size and Forecast, By Product Type (2024-2032) 9.5.3.3. Rest of South America Radiation-Hardened Electronics Market Size and Forecast, By Technique (2024-2032) 9.5.3.4. Rest of South America Radiation-Hardened Electronics Market Size and Forecast, By Application (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. Microchip Technology Inc. (US) 10.1.1.1. Company Overview 10.1.1.2. Business Portfolio 10.1.1.3. Financial Overview 10.1.1.4. SWOT Analysis 10.1.1.5. Strategic Analysis 10.1.1.6. Recent Developments 10.2. BAE Systems (UK) 10.3. Renesas Electronics Corporation (Japan) 10.4. Infineon Technologies AG (Germany) 10.5. STMicroelectronics (Switzerland) 10.6. AMD (US) 10.7. Texas Instruments Incorporated (US) 10.8. Honeywell International Inc. (US) 10.9. Teledyne Technologies Inc. (US) 10.10. TTM Technologies, Inc. (US) 10.11. Analog Devices, Inc (US) 10.12. Data Devices Corporation (US) 10.13. 3D Plus (France) 10.14. Mercury Systems, Inc. (US) 10.15. PCB Piezotronics, Inc (US) 10.16. Vorago Technologies (US) 10.17. Micropac Industries, Inc (US) 10.18. GSI technology, Inc (US) 10.19. Everspin Technologies Inc (US) 10.20. Semiconductor Components Industries, LLC (US) 10.21. AiTech (US) 10.22. Microelectronics Research Development Corporation (US) 10.23. Space Micro, Inc (US) 10.24. Triad Semiconductor (US) 10.25. Other Players 11. Key Findings 12. Analyst Recommendations 13. Global Radiation-Hardened Electronics Market: Research Methodology