Microcontroller Market was valued at USD 35.51 Bn in 2023 and is expected to reach USD 59.68 Bn by 2030, at a CAGR of 7.7 % during the forecast period.Microcontroller Market Overview

A microcontroller is a compact integrated circuit (IC) that includes a processor core, memory, and programmable input/output peripherals. It is designed to execute specific tasks and control devices in embedded systems. Microcontrollers are commonly used in various applications such as industrial automation, consumer electronics, automotive systems, medical devices, and more. The automotive sector is a significant consumer of microcontrollers, with applications ranging from engine control units (ECUs) to infotainment systems and advanced driver assistance systems (ADAS). The increasing adoption of electric vehicles (EVs), autonomous vehicles, and connected car technologies has further fueled the demand for microcontrollers, which significantly boost the Microcontroller Market growth. Emerging technologies such as artificial intelligence (AI), machine learning (ML), edge computing, and 5G networks are influencing the design requirements of microcontrollers. There is a growing need for microcontrollers capable of handling complex algorithms, sensor fusion, and real-time data processing for AI-powered applications.To know about the Research Methodology :- Request Free Sample Report

Microcontroller Market Dynamics

Advancements in Automotive Industry to boost the Microcontroller Market growth The automotive industry is a significant consumer of microcontrollers, driving demand for advanced features in vehicles. Microcontrollers are used in engine control units (ECUs), infotainment systems, advanced driver assistance systems (ADAS), and vehicle connectivity solutions. The rising adoption of electric vehicles (EVs), autonomous driving technologies, and connected car platforms is fueling the demand for microcontrollers with enhanced processing power, real-time capabilities, and robust security features. The proliferation of Internet of Things (IoT) devices is a major driver of the microcontroller market. IoT devices require small, low-power microcontrollers with integrated connectivity options to enable communication and data processing. The growing adoption of IoT across industries such as smart homes, smart cities, industrial automation, healthcare, and agriculture has led to increased demand for microcontrollers. Consumer electronics products such as smartphones, tablets, wearables, smart home devices, gaming consoles, and home appliances utilize microcontrollers for various functions. The continuous innovation and introduction of new features in consumer electronics drive the demand for microcontrollers with higher computational performance, energy efficiency, and integration of sensors and connectivity options. The adoption of Industry 4.0 technologies, including smart factories, robotics, and industrial IoT, is driving the demand for microcontrollers in industrial automation and control systems. Microcontrollers play a crucial role in monitoring and controlling processes, equipment, and production lines. The need for real-time processing, advanced communication protocols, and integration with sensors and actuators fuels the demand for high-performance microcontrollers in industrial applications, which is expected to boost the Microcontroller Market growth. Microcontrollers are essential components in medical devices and healthcare equipment for patient monitoring, diagnostics, imaging systems, and medical instrumentation. The increasing demand for portable and wearable medical devices, remote patient monitoring solutions, and point-of-care diagnostics drives the need for low-power microcontrollers with high computational performance, sensor integration, and connectivity options. Microcontrollers are used in renewable energy systems such as solar inverters, wind turbines, energy storage systems, and energy management solutions. The transition towards clean energy sources and the integration of renewable energy into the power grid drive the demand for microcontrollers with advanced power management capabilities, real-time monitoring, and control features. Complexity of Design and Cost Constraints to limit the Microcontroller Market growth Designing and developing systems with microcontrollers is complex and requires specialized expertise in embedded systems programming, hardware design, and system integration. The complexity of designing custom microcontroller-based solutions act as a barrier for small and medium-sized enterprises (SMEs) or organizations lacking in-house technical resources and expertise. Cost is a significant factor influencing the adoption of microcontrollers, especially in price-sensitive markets. While microcontrollers offer cost-effective solutions for many applications, the integration of advanced features, higher processing power, and additional peripherals can increase the overall cost. This limit the adoption of microcontrollers in budget-constrained projects or industries where cost is a primary concern. While microcontrollers offer sufficient processing power for many embedded applications, they may not always meet the computational requirements of high-performance computing tasks or resource-intensive applications. This limitation constrain the use of microcontrollers in applications requiring advanced algorithms, complex data processing, or real-time analytics. Security vulnerabilities pose a significant challenge for microcontroller-based systems, especially in applications where data integrity, confidentiality, and system reliability are critical. Microcontrollers may be susceptible to various security threats such as unauthorized access, data breaches, malware attacks, and physical tampering. Addressing security concerns requires robust encryption mechanisms, secure authentication protocols, and secure firmware update mechanisms, which increase system complexity and cost. The microcontroller market is characterized by a wide range of manufacturers, architectures, and development platforms, leading Microcontroller market landscape. This fragmentation can result in compatibility issues, interoperability challenges, and lack of standardized development tools and ecosystems. Developers may face difficulties in selecting the right microcontroller platform, migrating between different architectures, or accessing comprehensive support and documentation.Microcontroller Market Segment Analysis

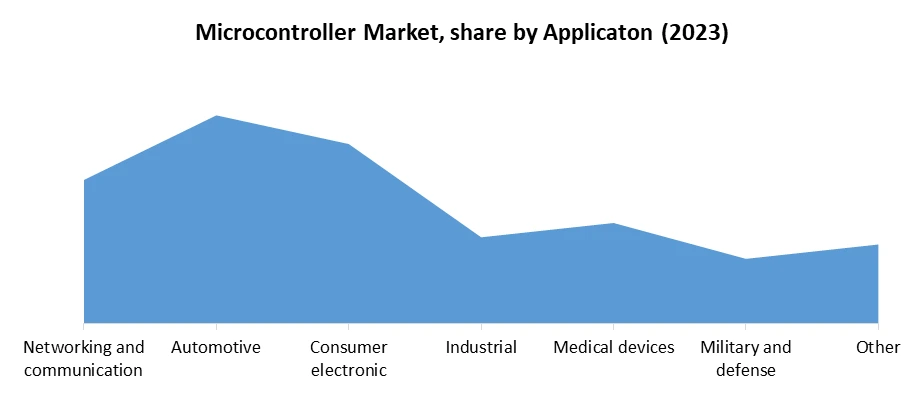

Based on Product, the market is segmented into 8 Bit, 16 Bit, and 32 Bit. 16 Bit segment dominated the market in 2023 and is expected to hold the largest Microcontroller Market share over the forecast period. Microcontrollers with a 16-bit data bus width offer higher processing capabilities compared to their 8-bit counterparts. The wider data bus allows for faster data manipulation and arithmetic operations, making these microcontrollers suitable for applications that require moderate computational power, such as industrial control systems, consumer electronics, automotive electronics, and medical devices. The 16-bit architecture allows for larger addressable memory space compared to 8-bit microcontrollers. This enables the handling of larger programs and data sets, making 16-bit microcontrollers suitable for applications that require more complex algorithms, multitasking, and data storage, which boosts the 16 Bit segment growth in Microcontroller Market growth. The 16-bit microcontroller segment finds applications across various industries, including industrial automation, home automation, consumer electronics, automotive electronics, medical devices, smart meters, IoT devices, and white goods. These microcontrollers are used in a wide range of products such as smart thermostats, motor control systems, digital cameras, printers, and electronic appliances.Based on Application, the market is segmented into Networking and communication, Automotive, Consumer electronics, Industrial, Medical devices, Military and defense, and Others. Automotive segment dominated the market in 2023 and is expected to hold the largest Microcontroller Market share over the forecast period. The automotive segment within the microcontroller industry refers to the specific application of microcontrollers within vehicles. Microcontrollers play a crucial role in modern automotive systems, providing the necessary intelligence and control for various functions ranging from basic engine management to advanced driver assistance systems (ADAS) and infotainment. Microcontrollers are extensively used in engine control units, which manage fuel injection, ignition timing, emission control, and other critical functions of the internal combustion engine. These microcontrollers process sensor data from various engine sensors to optimize engine performance, fuel efficiency, and emissions compliance. ADAS features such as adaptive cruise control, lane departure warning, automatic emergency braking, blind-spot detection, and parking assistance rely on microcontrollers for data processing, sensor fusion, decision-making, and actuation. Microcontrollers enable the integration of sensors such as radar, lidar, cameras, and ultrasonic sensors to enhance driver safety and convenience.

Microcontroller Market Regional Insight

Rapid Industrialization and Automation to boost Asia Pacific Microcontroller Market growth Asia Pacific dominated the market in 2023 and is expected to hold the largest Microcontroller Market share over the forecast period. APAC countries, particularly China, India, Japan, South Korea, and Taiwan, are experiencing rapid industrialization and are key manufacturing hubs for electronics, automotive, and industrial automation industries. The demand for microcontrollers in industrial automation, process control, robotics, and smart manufacturing applications is increasing to improve operational efficiency, productivity, and quality control. The automotive industry in APAC is witnessing significant growth due to rising disposable incomes, urbanization, and infrastructure development. Microcontrollers are essential components in automotive electronics, including engine control units (ECUs), infotainment systems, advanced driver assistance systems (ADAS), and vehicle connectivity solutions. The increasing adoption of electric vehicles (EVs), autonomous driving technologies, and connected car platforms further drives the demand for microcontrollers in the automotive sector. Asia Pacific is a leading market for consumer electronics products such as smartphones, tablets, wearables, smart home devices, and gaming consoles. Microcontrollers are integral to these devices, providing processing power, connectivity, and sensor integration. The growing demand for advanced features, enhanced connectivity, and energy-efficient solutions in consumer electronics fuels the demand for microcontrollers in the APAC region, which significantly boosts the Asia Pacific Microcontroller Market growth over the forecast period. Governments in APAC countries are implementing policies and initiatives to promote domestic manufacturing, innovation, and technological development. Incentives such as tax benefits, subsidies, and research grants encourage investment in semiconductor manufacturing, electronics design, and embedded systems development, boosting the microcontroller market in the region. APAC countries are investing in renewable energy sources such as solar, wind, and hydropower to meet growing energy demands and address environmental concerns. Microcontrollers play a crucial role in renewable energy systems for monitoring, control, and optimization of power generation, storage, and distribution. The adoption of microcontrollers in renewable energy applications contributes to the growth of the Microcontroller market in the APAC region.Microcontroller Market Scope: Inquire before buying

Global Microcontroller Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 35.51 Bn. Forecast Period 2024 to 2030 CAGR: 7.7% Market Size in 2030: US $ 59.68 Bn. Segments Covered: by Product 8 Bit 16 Bit 32 Bit by Application Networking and communication Automotive Consumer electronic Industrial Medical devices Military and defense Other Microcontroller Market, by region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Microcontroller Manufacturers:

North America: 1. Microchip Technology Inc. - Chandler, Arizona, USA 2. Texas Instruments - Dallas, Texas, USA 3. Silicon Labs - Austin, Texas, USA 4. NXP Semiconductors - Eindhoven, Netherlands 5. Maxim Integrated - San Jose, California, USA Europe: 6. STMicroelectronics: Geneva, Switzerland 7. Infineon Technologies - Neubiberg, Germany 8. Renesas Electronics Corporation – Tokyo, Japan (Global HQ); 9. Cypress Semiconductor Corporation - Munich, Germany (Current HQ) 10. Dialog Semiconductor (A Renesas Company) - Reading, United Kingdom Asia Pacific: 11. Samsung Semiconductor - Suwon, South Korea 12. Toshiba Electronic Devices & Storage Corporation Kawasaki, Japan 13. ROHM Semiconductor - Kyoto, Japan 14. MediaTek Inc. - Hsinchu, Taiwan 15. Realtek Semiconductor Corp. - Hsinchu, Taiwan 16. Shanghai Fudan Microelectronics Group Co., Ltd. - Shanghai, China 17. Holtek Semiconductor Inc. – Hsinchu, Taiwan (Global HQ) 18. Espressif Systems - Shanghai, China 19. Allwinner Technology Co., Ltd. - Zhuhai, China 20. ZLG (ZiLOG) Microcontrollers - Suzhou, China 21. Microsemi Corporation - Aliso Viejo, California, USA (Previous HQ) 22. Atmel Corporation (A Microchip Technology Company) - San Jose, California 23. LG Semiconductor - Seoul, South Korea 24. GigaDevice Semiconductor (Beijing) Inc. - Beijing, China 25. ASE Group - Kaohsiung, Taiwan 26. Macronix International Co., Ltd. - Hsinchu, Taiwan 27. MegaChips Corporation – Osaka, Japan 28. Novoton Technology Limited - Shenzhen, China Frequently Asked Questions: 1. What is a microcontroller? Ans: Microcontroller is a compact integrated circuit (IC) that includes a processor core, memory, and programmable input/output peripherals. It is designed to execute specific tasks and control devices in embedded systems. 2. What are the primary applications of microcontrollers? Ans: Microcontrollers are commonly used in various applications such as industrial automation, consumer electronics, automotive systems, medical devices, and more. 3. Why is the automotive sector a significant consumer of microcontrollers? Ans: The automotive sector extensively uses microcontrollers in applications ranging from engine control units (ECUs) to infotainment systems and advanced driver assistance systems (ADAS). The increasing adoption of electric vehicles (EVs), autonomous vehicles, and connected car technologies has fueled the demand for microcontrollers in this sector. 4. How do emerging technologies influence microcontroller design requirements? Ans: Emerging technologies such as artificial intelligence (AI), machine learning (ML), edge computing, and 5G networks are driving the need for microcontrollers capable of handling complex algorithms, sensor fusion, and real-time data processing for AI-powered applications. 5. What drives the growth of the microcontroller market in the Asia Pacific region? Ans: The rapid industrialization, growing automotive industry, increasing demand for consumer electronics, adoption of Industry 4.0 technologies, government initiatives, and investments in renewable energy sources are key drivers of the microcontroller market in the Asia Pacific region.

1. Microcontroller Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Microcontroller Market: Dynamics 2.1. Microcontroller Market Trends by Region 2.1.1. North America Microcontroller Market Trends 2.1.2. Europe Microcontroller Market Trends 2.1.3. Asia Pacific Microcontroller Market Trends 2.1.4. Middle East and Africa Microcontroller Market Trends 2.1.5. South America Microcontroller Market Trends 2.2. Microcontroller Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Microcontroller Market Drivers 2.2.1.2. North America Microcontroller Market Restraints 2.2.1.3. North America Microcontroller Market Opportunities 2.2.1.4. North America Microcontroller Market Challenges 2.2.2. Europe 2.2.2.1. Europe Microcontroller Market Drivers 2.2.2.2. Europe Microcontroller Market Restraints 2.2.2.3. Europe Microcontroller Market Opportunities 2.2.2.4. Europe Microcontroller Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Microcontroller Market Drivers 2.2.3.2. Asia Pacific Microcontroller Market Restraints 2.2.3.3. Asia Pacific Microcontroller Market Opportunities 2.2.3.4. Asia Pacific Microcontroller Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Microcontroller Market Drivers 2.2.4.2. Middle East and Africa Microcontroller Market Restraints 2.2.4.3. Middle East and Africa Microcontroller Market Opportunities 2.2.4.4. Middle East and Africa Microcontroller Market Challenges 2.2.5. South America 2.2.5.1. South America Microcontroller Market Drivers 2.2.5.2. South America Microcontroller Market Restraints 2.2.5.3. South America Microcontroller Market Opportunities 2.2.5.4. South America Microcontroller Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Microcontroller Industry 2.8. Analysis of Government Schemes and Initiatives For Microcontroller Industry 2.9. Microcontroller Market Trade Analysis 2.10. The Global Pandemic Impact on Microcontroller Market 3. Microcontroller Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Microcontroller Market Size and Forecast, by Product (2023-2030) 3.1.1. 8 Bit 3.1.2. 16 Bit 3.1.3. 32 Bit 3.2. Microcontroller Market Size and Forecast, by Application (2023-2030) 3.2.1. Networking and communication 3.2.2. Automotive 3.2.3. Consumer electronic 3.2.4. Industrial 3.2.5. Medical devices 3.2.6. Military and defense 3.2.7. Other 3.3. Microcontroller Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Microcontroller Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Microcontroller Market Size and Forecast, by Product (2023-2030) 4.1.1. 8 Bit 4.1.2. 16 Bit 4.1.3. 32 Bit 4.2. North America Microcontroller Market Size and Forecast, by Application (2023-2030) 4.2.1. Networking and communication 4.2.2. Automotive 4.2.3. Consumer electronic 4.2.4. Industrial 4.2.5. Medical devices 4.2.6. Military and defense 4.2.7. Other 4.3. North America Microcontroller Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Microcontroller Market Size and Forecast, by Product (2023-2030) 4.3.1.1.1. 8 Bit 4.3.1.1.2. 16 Bit 4.3.1.1.3. 32 Bit 4.3.1.2. United States Microcontroller Market Size and Forecast, by Application (2023-2030) 4.3.1.2.1. Networking and communication 4.3.1.2.2. Automotive 4.3.1.2.3. Consumer electronic 4.3.1.2.4. Industrial 4.3.1.2.5. Medical devices 4.3.1.2.6. Military and defense 4.3.1.2.7. Other 4.3.2. Canada 4.3.2.1. Canada Microcontroller Market Size and Forecast, by Product (2023-2030) 4.3.2.1.1. 8 Bit 4.3.2.1.2. 16 Bit 4.3.2.1.3. 32 Bit 4.3.2.2. Canada Microcontroller Market Size and Forecast, by Application (2023-2030) 4.3.2.2.1. Networking and communication 4.3.2.2.2. Automotive 4.3.2.2.3. Consumer electronic 4.3.2.2.4. Industrial 4.3.2.2.5. Medical devices 4.3.2.2.6. Military and defense 4.3.2.2.7. Other 4.3.3. Mexico 4.3.3.1. Mexico Microcontroller Market Size and Forecast, by Product (2023-2030) 4.3.3.1.1. 8 Bit 4.3.3.1.2. 16 Bit 4.3.3.1.3. 32 Bit 4.3.3.2. Mexico Microcontroller Market Size and Forecast, by Application (2023-2030) 4.3.3.2.1. Networking and communication 4.3.3.2.2. Automotive 4.3.3.2.3. Consumer electronic 4.3.3.2.4. Industrial 4.3.3.2.5. Medical devices 4.3.3.2.6. Military and defense 4.3.3.2.7. Other 5. Europe Microcontroller Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Microcontroller Market Size and Forecast, by Product (2023-2030) 5.2. Europe Microcontroller Market Size and Forecast, by Application (2023-2030) 5.3. Europe Microcontroller Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Microcontroller Market Size and Forecast, by Product (2023-2030) 5.3.1.2. United Kingdom Microcontroller Market Size and Forecast, by Application (2023-2030) 5.3.2. France 5.3.2.1. France Microcontroller Market Size and Forecast, by Product (2023-2030) 5.3.2.2. France Microcontroller Market Size and Forecast, by Application (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Microcontroller Market Size and Forecast, by Product (2023-2030) 5.3.3.2. Germany Microcontroller Market Size and Forecast, by Application (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Microcontroller Market Size and Forecast, by Product (2023-2030) 5.3.4.2. Italy Microcontroller Market Size and Forecast, by Application (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Microcontroller Market Size and Forecast, by Product (2023-2030) 5.3.5.2. Spain Microcontroller Market Size and Forecast, by Application (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Microcontroller Market Size and Forecast, by Product (2023-2030) 5.3.6.2. Sweden Microcontroller Market Size and Forecast, by Application (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Microcontroller Market Size and Forecast, by Product (2023-2030) 5.3.7.2. Austria Microcontroller Market Size and Forecast, by Application (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Microcontroller Market Size and Forecast, by Product (2023-2030) 5.3.8.2. Rest of Europe Microcontroller Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Microcontroller Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Microcontroller Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Microcontroller Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Microcontroller Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Microcontroller Market Size and Forecast, by Product (2023-2030) 6.3.1.2. China Microcontroller Market Size and Forecast, by Application (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Microcontroller Market Size and Forecast, by Product (2023-2030) 6.3.2.2. S Korea Microcontroller Market Size and Forecast, by Application (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Microcontroller Market Size and Forecast, by Product (2023-2030) 6.3.3.2. Japan Microcontroller Market Size and Forecast, by Application (2023-2030) 6.3.4. India 6.3.4.1. India Microcontroller Market Size and Forecast, by Product (2023-2030) 6.3.4.2. India Microcontroller Market Size and Forecast, by Application (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Microcontroller Market Size and Forecast, by Product (2023-2030) 6.3.5.2. Australia Microcontroller Market Size and Forecast, by Application (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Microcontroller Market Size and Forecast, by Product (2023-2030) 6.3.6.2. Indonesia Microcontroller Market Size and Forecast, by Application (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Microcontroller Market Size and Forecast, by Product (2023-2030) 6.3.7.2. Malaysia Microcontroller Market Size and Forecast, by Application (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Microcontroller Market Size and Forecast, by Product (2023-2030) 6.3.8.2. Vietnam Microcontroller Market Size and Forecast, by Application (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Microcontroller Market Size and Forecast, by Product (2023-2030) 6.3.9.2. Taiwan Microcontroller Market Size and Forecast, by Application (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Microcontroller Market Size and Forecast, by Product (2023-2030) 6.3.10.2. Rest of Asia Pacific Microcontroller Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Microcontroller Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Microcontroller Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Microcontroller Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Microcontroller Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Microcontroller Market Size and Forecast, by Product (2023-2030) 7.3.1.2. South Africa Microcontroller Market Size and Forecast, by Application (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Microcontroller Market Size and Forecast, by Product (2023-2030) 7.3.2.2. GCC Microcontroller Market Size and Forecast, by Application (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Microcontroller Market Size and Forecast, by Product (2023-2030) 7.3.3.2. Nigeria Microcontroller Market Size and Forecast, by Application (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Microcontroller Market Size and Forecast, by Product (2023-2030) 7.3.4.2. Rest of ME&A Microcontroller Market Size and Forecast, by Application (2023-2030) 8. South America Microcontroller Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Microcontroller Market Size and Forecast, by Product (2023-2030) 8.2. South America Microcontroller Market Size and Forecast, by Application (2023-2030) 8.3. South America Microcontroller Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Microcontroller Market Size and Forecast, by Product (2023-2030) 8.3.1.2. Brazil Microcontroller Market Size and Forecast, by Application (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Microcontroller Market Size and Forecast, by Product (2023-2030) 8.3.2.2. Argentina Microcontroller Market Size and Forecast, by Application (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Microcontroller Market Size and Forecast, by Product (2023-2030) 8.3.3.2. Rest Of South America Microcontroller Market Size and Forecast, by Application (2023-2030) 9. Global Microcontroller Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Microcontroller Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Microchip Technology Inc. - Chandler, Arizona, USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Texas Instruments - Dallas, Texas, USA 10.3. Silicon Labs - Austin, Texas, USA 10.4. NXP Semiconductors - Eindhoven, Netherlands 10.5. Maxim Integrated - San Jose, California, USA 10.6. STMicroelectronics: Geneva, Switzerland 10.7. Infineon Technologies - Neubiberg, Germany 10.8. Renesas Electronics Corporation – Tokyo, Japan (Global HQ); 10.9. Cypress Semiconductor Corporation - Munich, Germany (Current HQ) 10.10. Dialog Semiconductor (A Renesas Company) - Reading, United Kingdom 10.11. Samsung Semiconductor - Suwon, South Korea 10.12. Toshiba Electronic Devices & Storage Corporation Kawasaki, Japan 10.13. ROHM Semiconductor - Kyoto, Japan 10.14. MediaTek Inc. - Hsinchu, Taiwan 10.15. Realtek Semiconductor Corp. - Hsinchu, Taiwan 10.16. Shanghai Fudan Microelectronics Group Co., Ltd. - Shanghai, China 10.17. Holtek Semiconductor Inc. – Hsinchu, Taiwan (Global HQ) 10.18. Espressif Systems - Shanghai, China 10.19. Allwinner Technology Co., Ltd. - Zhuhai, China 10.20. ZLG (ZiLOG) Microcontrollers - Suzhou, China 10.21. Microsemi Corporation - Aliso Viejo, California, USA (Previous HQ) 10.22. Atmel Corporation (A Microchip Technology Company) - San Jose, California 10.23. LG Semiconductor - Seoul, South Korea 10.24. GigaDevice Semiconductor (Beijing) Inc. - Beijing, China 10.25. ASE Group - Kaohsiung, Taiwan 10.26. Macronix International Co., Ltd. - Hsinchu, Taiwan 10.27. MegaChips Corporation – Osaka, Japan 10.28. Novoton Technology Limited - Shenzhen, China 11. Key Findings 12. Industry Recommendations 13. Microcontroller Market: Research Methodology 14. Terms and Glossary