Pulse Ingredients Market size was valued at USD 22.9 Billion in 2023 and the Pulse Ingredients Market revenue is expected to reach USD 27.4 Billion by 2030, at a CAGR of 5.1 % over the forecast period.Pulse Ingredients Market Overview

Pulse ingredients are edible seeds from the legume family that grow in pods and come in a wide range of forms, sizes, and colors. They include lentils, peas, chickpeas, field beans, and cowpeas. Pulses are known for their high protein and nutritional values and are incorporated in many foods we enjoy today such as meatless burgers and hummus.To know about the Research Methodology :- Request Free Sample Report Pulse Ingredients is not limited to a specific geographical region. The market has a global presence, with consumers across different continents interested in these supplements. This Pulse Ingredients Market Report offers a specific and detailed market overview with statistical as well as pre-sized trendy data. This Pulse Ingredients Market report showcases the Pulse Ingredients market situation with Dynamics, Market Segment, Regional Analysis, and Top Competitor's Market Position.

Pulse Ingredients Market Dynamics

Growing demand for pulse starch in the food industry is a key factor for driving the growth of the Pulse Ingredients market An increase in the population of health awareness and growing disposable income as well as urbanization is expected to expressively stimulate the market for pulse ingredients. Pulse components are in great demand due to the existence of altered proteins like iron and fibers. Pulse flour can be used in the variability of approaches, containing cookies and sweets. Improved pulse flour uses in many industries, including food and beverages and animal feed products, would further help to boost the pulse ingredient market. Pulse flours in the food industry are highly nutritious for the human body have a low glycaemic index and are also considered gluten-free. The growing demand for healthy food products among users is helping to boost the Pulse Ingredients Market. Proliferation in vapor production in the inferior colon is restraining the market Pulses are considered to be a heart-healthy food choice, but eating a huge number of pulses can lower blood cholesterol, reduce blood pressure, and also boost body weight which is so dangerous for diseases like heart attack. All food containing celluloses can embolden the creation of gas in the intestine which creates sugars, fibers, and thickener, and it proportionally affects the Pulse Ingredients Market which is a major restraining factor for this scenario. The availability of pulse flour in a wide range is a key opportunity for the Pulse Ingredient market Due to the occurrence of different proteins like iron, and fibers pulse flour is in great demand. Pulse flour can be used in the variability of recipes, containing cookies, spaghetti, and puddings. In addition, the rising use of pulse flour in various industries such as food and beverages, as well as animal feed products, would help the market's expansion. Plant-based protein sources provide huge benefits among consumers in pulse flour plays a vital role in boosting the Pulse Ingredients Market. Consumption of pulses like beans, lentils, and peas can improve gastrointestinal (GI) symptoms like bloating, gas, and stomach cramps. Due to this effect, pulses contain a lot of indigestible carbohydrates (fibers) that are agitated in the GI territory and effect gas to develop.Pulse Ingredients Market Segment Analysis

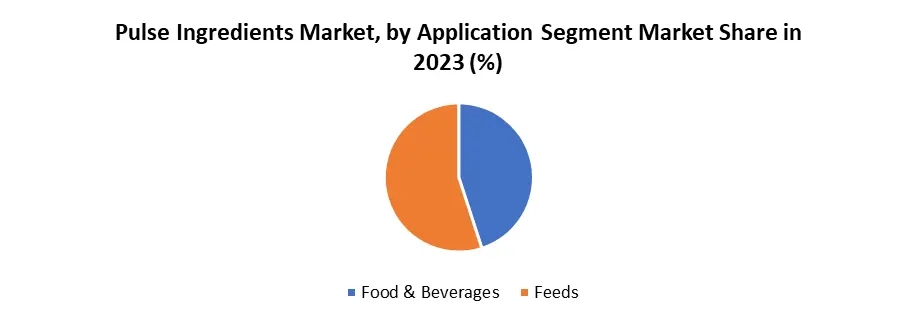

Based on the Application, the Pulse Ingredients Market is segmented as Food & Beverages, Feeds, and Others. The Food & Beverage segment is expected to dominate the Pulse Ingredients Market in 2023. The growth of the food and beverage products in the Asia Pacific region is anticipated to increase pulse ingredient auctions in the forecast period, remaining to consumers' rising choice for food products with health compensations and their variation to a residential lifestyle. Apart from that, growing health concerns among consumers in countries like the United States are anticipated to enhance pulse ingredient sales as customers pursue food choices with sanitary tags and low-fat content. However, Feed Segment is expected to grow at a CAGR of xx% through the forecast period in the Pulse Ingredients Market. The feed-in pulse ingredient is also considered to be healthy for the human body as it gives a highly nutritional diet that usually maintains the health of the human body system diet. It is also used to improve the taste and quality of food in confectionery and bakery foods such as sweets, ice creams, lentils, etc. Feed segments also contain high levels of protein such as fibers. Based on Source, the Pulse Ingredients Market is segmented as Lentils, Peas, Beans, and Chickpeas. Chickpeas are expected to grow at a CAGR of 4.7% during the forecast period. Peas are great in minerals comprising iron, zinc, magnesium, and phosphorus, which encourages complete wellness. They are also supposed to be utility in the reduction of cholesterol and the parameter of blood sugar levels due to their high fiber, please. Chickpeas derived from various foods such as pea starches, pea proteins, and pea flours, are usually consumed as key mechanisms in baked goods, sauces, soups, and other food products. The Lentils and Peas Segment is expected to grow at a CAGR of 3.8% during the forecast period in the Pulse Ingredients Market. Lentils contain high-protein edible pulses that are produced in shells. They are characteristically ended dried and also look petite covering a slight and plain flavor as well. Apart from that peas are most usually the small spherical seed that contains sodium. Peas are a bean, although the statistic is that it's called a pea. Peas and beans are both leguminous plants that consume edible seeds and shells. They are remarkably healthy spuds for both people and the land because they are legumes.

Pulse Ingredients Market Regional Analysis

The Asia Pacific region is dominating with a major share of 35% in 2023. As a result, of the increase in urbanization and the growing impact of Western lifestyles among consumers, Asia Pacific is expected to hold the highest share of the worldwide Pulse Ingredients Market during the forecast period. Additionally, the escalation in admiration of convenience meals increased per capita consumption of baked products, and the existence of momentous participants in these regions are all subsidizing the positive growth of the market. The increasing need for high-protein foods, as well as consumer inclinations for vegan and vegetarian diets, are driving the global market. Countries like India and China are assumed to be the largest market of pulse ingredients in terms of production. 71% Chickpea and 34% lentils are produced in India which is driving the growth of the pulse ingredient market. However, the North American region is expected to hold a Pulse Ingredients Market larger share by 2030. Rising demand for Confectionary Foods and disposable income are the major reasons for driving the growth of the pulse ingredient market in this region. U.S., Mexico, and Canada are major countries that produce a wide range of pulse ingredient products in this region.

Pulse Ingredients Market Scope: Inquiry Before Buying

Pulse Ingredients Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 22.9 Bn. Forecast Period 2024 to 2030 CAGR: 5.1% Market Size in 2030: US $ 27.4 Bn. Segments Covered: by Application Food & Beverages Feeds by Source Chickpeas Lentils Peas Beans Pulse Ingredients Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Pulse Ingredients Key Players Include

1. Ingredion Inc. 2. Cargill Inc. 3. Roquette Frères 4. Emsland Group 5. ADM 6. The Scoular Company 7. Coscura 8. Puris 9. Axiom Foods, Inc. 10. AGT Food & Ingredients 11. AM Nutrition Frequently Asked Questions in the Market: 1] What segments are covered in the Market report? Ans. The segments covered in the Market report are based on Application and Source. 2] Which region is expected to hold the highest share in the Market? Ans. The Asia Pacific region is expected to hold the highest share of the Market. 3] What is the market size of the Market by 2030? Ans. The market size of the Market by 2030 is USD 27.4 Bn. 4] What is the forecast period for the Market? Ans. The Forecast period for the Market is 2024-2030. 5] What was the market size of the Market in 2023? Ans. The market size of the Market in 2023 was USD 22.9 Bn.

1. Pulse Ingredients Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Pulse Ingredients Market: Dynamics 2.1. Pulse Ingredients Market Trends by Region 2.1.1. North America Pulse Ingredients Market Trends 2.1.2. Europe Pulse Ingredients Market Trends 2.1.3. Asia Pacific Pulse Ingredients Market Trends 2.1.4. Middle East and Africa Pulse Ingredients Market Trends 2.1.5. South America Pulse Ingredients Market Trends 2.2. Pulse Ingredients Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Pulse Ingredients Market Drivers 2.2.1.2. North America Pulse Ingredients Market Restraints 2.2.1.3. North America Pulse Ingredients Market Opportunities 2.2.1.4. North America Pulse Ingredients Market Challenges 2.2.2. Europe 2.2.2.1. Europe Pulse Ingredients Market Drivers 2.2.2.2. Europe Pulse Ingredients Market Restraints 2.2.2.3. Europe Pulse Ingredients Market Opportunities 2.2.2.4. Europe Pulse Ingredients Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Pulse Ingredients Market Drivers 2.2.3.2. Asia Pacific Pulse Ingredients Market Restraints 2.2.3.3. Asia Pacific Pulse Ingredients Market Opportunities 2.2.3.4. Asia Pacific Pulse Ingredients Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Pulse Ingredients Market Drivers 2.2.4.2. Middle East and Africa Pulse Ingredients Market Restraints 2.2.4.3. Middle East and Africa Pulse Ingredients Market Opportunities 2.2.4.4. Middle East and Africa Pulse Ingredients Market Challenges 2.2.5. South America 2.2.5.1. South America Pulse Ingredients Market Drivers 2.2.5.2. South America Pulse Ingredients Market Restraints 2.2.5.3. South America Pulse Ingredients Market Opportunities 2.2.5.4. South America Pulse Ingredients Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Pulse Ingredients Industry 2.8. Analysis of Government Schemes and Initiatives For Pulse Ingredients Industry 2.9. Pulse Ingredients Market Trade Analysis 2.10. The Global Pandemic Impact on Pulse Ingredients Market 3. Pulse Ingredients Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 3.1.1. Food & Beverages 3.1.2. Feeds 3.2. Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 3.2.1. Chickpeas 3.2.2. Lentils 3.2.3. Peas 3.2.4. Beans 3.3. Pulse Ingredients Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Pulse Ingredients Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 4.1.1. Food & Beverages 4.1.2. Feeds 4.2. North America Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 4.2.1. Chickpeas 4.2.2. Lentils 4.2.3. Peas 4.2.4. Beans 4.3. North America Pulse Ingredients Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 4.3.1.1.1. Food & Beverages 4.3.1.1.2. Feeds 4.3.1.2. United States Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 4.3.1.2.1. Chickpeas 4.3.1.2.2. Lentils 4.3.1.2.3. Peas 4.3.1.2.4. Beans 4.3.2. Canada 4.3.2.1. Canada Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 4.3.2.1.1. Food & Beverages 4.3.2.1.2. Feeds 4.3.2.2. Canada Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 4.3.2.2.1. Chickpeas 4.3.2.2.2. Lentils 4.3.2.2.3. Peas 4.3.2.2.4. Beans 4.3.3. Mexico 4.3.3.1. Mexico Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 4.3.3.1.1. Food & Beverages 4.3.3.1.2. Feeds 4.3.3.2. Mexico Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 4.3.3.2.1. Chickpeas 4.3.3.2.2. Lentils 4.3.3.2.3. Peas 4.3.3.2.4. Beans 5. Europe Pulse Ingredients Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 5.2. Europe Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 5.3. Europe Pulse Ingredients Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 5.3.1.2. United Kingdom Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 5.3.2. France 5.3.2.1. France Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 5.3.2.2. France Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 5.3.3.2. Germany Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 5.3.4.2. Italy Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 5.3.5.2. Spain Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 5.3.6.2. Sweden Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 5.3.7.2. Austria Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 5.3.8.2. Rest of Europe Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 6. Asia Pacific Pulse Ingredients Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 6.2. Asia Pacific Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 6.3. Asia Pacific Pulse Ingredients Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 6.3.1.2. China Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 6.3.2.2. S Korea Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 6.3.3.2. Japan Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 6.3.4. India 6.3.4.1. India Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 6.3.4.2. India Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 6.3.5.2. Australia Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 6.3.6.2. Indonesia Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 6.3.7.2. Malaysia Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 6.3.8.2. Vietnam Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 6.3.9.2. Taiwan Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 6.3.10.2. Rest of Asia Pacific Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 7. Middle East and Africa Pulse Ingredients Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 7.2. Middle East and Africa Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 7.3. Middle East and Africa Pulse Ingredients Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 7.3.1.2. South Africa Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 7.3.2.2. GCC Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 7.3.3.2. Nigeria Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 7.3.4.2. Rest of ME&A Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 8. South America Pulse Ingredients Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 8.2. South America Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 8.3. South America Pulse Ingredients Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 8.3.1.2. Brazil Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 8.3.2.2. Argentina Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Pulse Ingredients Market Size and Forecast, by Application (2023-2030) 8.3.3.2. Rest Of South America Pulse Ingredients Market Size and Forecast, by Source (2023-2030) 9. Global Pulse Ingredients Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Pulse Ingredients Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Ingredion Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Cargill Inc. 10.3. Roquette Frères 10.4. Emsland Group 10.5. ADM 10.6. The Scoular Company 10.7. Coscura 10.8. Puris 10.9. Axiom Foods, Inc. 10.10. AGT Food & Ingredients 10.11. AM Nutrition 11. Key Findings 12. Industry Recommendations 13. Pulse Ingredients Market: Research Methodology 14. Terms and Glossary