Global Private LTE in Mining Industry Market size was valued at US$ 5.03 Bn. in 2022 and is expected to reach US$ 10.38 Bn. by 2029 at a CAGR of 10.9% during the forecast period. The global Private LTE in Mining Industry market report is a comprehensive analysis of the industry, market, and key players. The report has covered the market by demand and supply-side by segments. The global Private LTE in Mining Industry report also provides trends by market segments, technology, and investment with a competitive landscape.Overview of Private LTE in Mining Industry:

Several wireless communications systems, such as Wi-Fi, have been introduced during the last decade, but their limits in terms of capacity, coverage, and security have proven unsatisfactory. Users require dependable broadband communications networks wherever and whenever they operate to integrate machines, sensors, people, and vehicles. With wireless networks that are purpose-built for the organization's specific communications and coverage requirements, private LTE can provide the connectivity and performance mining needs. Private LTE solutions allow connectivity for the Internet of Things devices and human end-users by providing broadband data with mobility and roaming capabilities, SIM-based security, and other features.To know about the Research Methodology :- Request Free Sample Report

Global Private LTE in Mining Industry Market Dynamics:

The increased need for the Internet of Things in the mining industry is one of the major reasons driving the worldwide private LTE in the mining sector market. Because mining sites are typically located in remote areas with limited cellphone coverage, mining processes have several connectivity challenges. As a result, powerful communication networks are in higher demand. The mining industry's private LTE market is additionally strengthened by the market's strong ecosystem. With over 500 billion dollars in sales, the mining industry is a major source of international economic activity. To move tons of rocks on equipment, minute precision is required, and any error in the highly tuned process might have serious effects on the mining operations. To increase profitability in the mining business, consistent efficiency, transportation, and metal extraction are required. Incremental improvements, on the other hand, are yielding diminishing returns, and the industry is increasingly shifting its focus to automation as the next area of opportunity. The adoption of better connectivity in the mines in general, including mobile connectivity, is one condition for automation. The introduction of LTE (long-term evolution) improves automation and wireless networking capabilities. When it comes to network issues in open pit and underground mining, LTE offers a considerable advantage.Several mines are using this technique because of its primary advantages, such as:

Predictability: Complexity is one of predictability's major critics since it increases the number of potential failure spots. When a mine has many networks, each of which uses a different communications technology, the difficulty of managing, maintaining, and securing the many networks increases. Because LTE operates on regulated airwaves, it provides a high level of predictability. The complexity of running all applications on a single LTE network is reduced, and operational continuity is improved. Connectivity: LTE gives connectivity to every remote area of the mine because of its high-speed connectivity and minimal latency. Bring-Your-Own-Coverage (BYOC) allows the LTE base station to be readily placed in a variety of locations, such as a miner's backpack or a truck, assuring coverage in the mine's hard-to-reach areas. Speed: The LTE solution provides the greatest voice quality and high-speed data, allowing miners to participate in video conference conversations or conduct research while on the go. As a result, mining personnel may work more efficiently and accurately.Global Private LTE in Mining Industry Market Segmentation:

Based on technology, FDD i.e., Frequency Division Duplex is characterized by separate uplink and downlink frequencies and is widely adopted in mining for its reliability in real-time data transmission. It ensures seamless communication for critical applications like remote machinery control and safety monitoring, making it a preferred choice for enhancing operational efficiency and worker safety. Time Division Duplex technology, which shares the same frequency for uplink and downlink, is gaining traction for applications such as data transfer and video surveillance, owing to its spectrum efficiency. Its flexibility and cost-effectiveness make it an attractive option for non-real-time applications, supporting functions like asset tracking and environmental monitoring. Based on the deployment Model, The Centralized deployment model dominated the market with a 48% market share in 2022 and is expected to continue its dominance during the forecast period. It involves a consolidated core network, offering robust security and efficient management. The centralized deployment model finds prominent use in mining applications requiring high levels of data processing and centralized control, such as autonomous mining equipment and real-time mine management systems. The Distributed deployment model decentralizes network components to reduce latency and enhance local data processing. This model is increasingly favored for applications like fleet management, where low-latency communication is pivotal. As mining operations evolve, the adoption of either model depends on the specific needs of the application.

In the mining business, there are some private LTE deployments:

1. Telefónica and Nokia contracted by Minera Las Bambas in Peru, the world's ninth-largest copper mine, to install a private mobile broadband network and "digitize" its operations. 2. Telstra and Ericsson partnered with South32, a Perth-based mining and metals company, to build "one of the world's largest underground mining LTE networks." The new private LTE network was created at South32's Cannington silver, lead, and zinc mine in northwest Queensland, employing Ericsson network equipment and Telstra radio spectrum. For full autonomy and complete management of the network, the Cannington mine is expected to have its equipment, SIM cards, and unique network codes, which are likely to be separate from public networks, including Telstra's.Recent Deployment:

Ericsson and Mobile TeleSystems PJSC (MTS) teamed up in February 2021 to install a commercial LTE/5G-ready private network at EVRAZ's digital Sheregeshskaya mine in south-central Russia. The private network is likely to build using Ericsson's Dedicated Networks technology. The private network solution, according to Ericsson, is expected to be integrated with the mine's existing communication network and IT infrastructure and then include a system for video broadcasting, positioning, and autonomous mining equipment control.Global Private LTE in Mining Industry Market Regional Insights:

North America had a large market share in 2022 and is expected to continue to do so throughout the projected period. This is owing to government measures to make spectrum available for business uses. Due to a robust ecosystem in this region, the private LTE in the mining sector market in Canada is also predicted to grow at a high CAGR. Because of the growing demand for secure and dedicated networks across industrial verticals, the private LTE in the mining sector market in European countries is predicted to grow at a substantial CAGR. Increased usage of private LTE in the mining industry and 5G networks for Internet of Things (IoT), and smart city applications are among the primary drivers of the global private LTE mining market growth. Mining industries are increasingly installing private network infrastructure as the number of IoT applications in energy, manufacturing, public safety, and transportation grows. Furthermore, demand for private networks is being driven by use cases such as Automated Guided Vehicles (AGV), collaborative robots/cloud robots, industrial sensors, and heavy machinery automation, among others.Spectrum Availability:

LTE operates on licensed spectrums, which ensures its high level of predictability. The difficulty has been obtaining the spectrum needed to build an LTE network. The entire spectrum set out for LTE in North America is held by the LTE service providers, resulting in challenging spectrum access, limited coverage, and high usage costs. LTE is becoming more of a reality for North American miners because of the recent introduction of the CBRS spectrum (band 48) in the United States, which is projected to be available in Canada by the end of 2019. The objective of the report is to present a comprehensive analysis of the Global Private LTE in Mining Industry Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. Porter, svor, pestel analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analysed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Global Private LTE in Mining Industry Market dynamics, structure by analyzing the market segments and project the global Private LTE in Mining Industry market size. Clear representation of competitive analysis of key players By Solution, price, financial position, product portfolio, growth strategies, and regional presence in the Global Private LTE in Mining Industry Market make the report investor’s guide.Private LTE in Mining Industry Market Scope: Inquire before buying

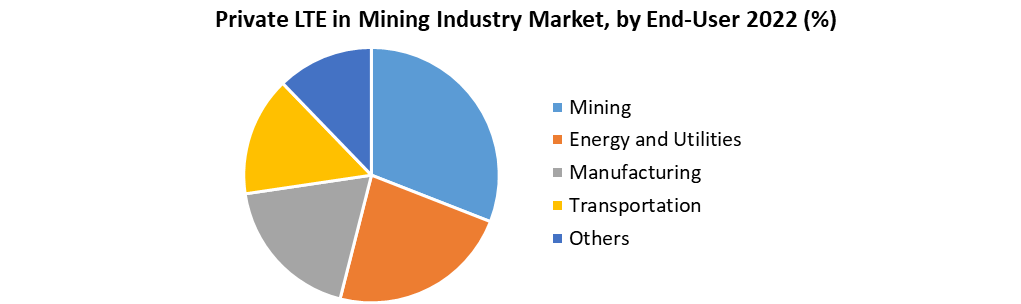

Private LTE in Mining Industry Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 5.03 Bn. Forecast Period 2023 to 2029 CAGR: 10.9% Market Size in 2029: US $ 10.38 Bn. Segments Covered: by Technology Frequency Division Duplex Time Division Duplex by Deployment Model Centralized Distributed by End-User Mining Energy and Utilities Manufacturing Transportation Others Global Private LTE in Mining Industry Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argetina and Rest of South America)Global Private LTE in Mining Industry Market Key Players

1. Nokia Corporation 2. Ericsson AB 3. NEC Corporation 4. Squire Technologies 5. Quortus Limited 6. NetNumber Inc. 7. Redline Communications 8. SpiderCloud Wireless 9. Ruckus Networks 10. Sercomm Corporation 11. Intel Corporation 12. Future Technologies LLC 13. HCL Technologies Limited 14. ADVA Optical Networking SE 15. Mavenir Systems 16. pdvWireless 17. Deutsche Telekom AG. 18. Canaan Inc. 19. Cynosure Technologies Co. Ltd. 20. Halong Mining 21. INNOSILICON Technology Ltd. 22. Shenzhen MicroBT Electronics Technology Co. Ltd. 23. Other Key PlayersFrequently Asked Questions:

1. Which region has the largest share in Global Private LTE in Mining Industry Market? Ans: North America region held the highest share in 2022. 2. What is the growth rate of Global Private LTE in Mining Industry Market? Ans: The Global Private LTE in Mining Industry Market is growing at a CAGR of 10.9% during forecasting period 2023-2029. 3. What is scope of the Global Private LTE in Mining Industry Market report? Ans: Global Private LTE in Mining Industry Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. What is the study period of this Market? Ans: The Global Private LTE in Mining Industry Market is studied from 2022 to 2029.

1. Private LTE in Mining Industry Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Private LTE in Mining Industry Market: Dynamics 2.1. Private LTE in Mining Industry Market Trends by Region 2.1.1. North America Private LTE in Mining Industry Market Trends 2.1.2. Europe Private LTE in Mining Industry Market Trends 2.1.3. Asia Pacific Private LTE in Mining Industry Market Trends 2.1.4. Middle East and Africa Private LTE in Mining Industry Market Trends 2.1.5. South America Private LTE in Mining Industry Market Trends 2.2. Private LTE in Mining Industry Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Private LTE in Mining Industry Market Drivers 2.2.1.2. North America Private LTE in Mining Industry Market Restraints 2.2.1.3. North America Private LTE in Mining Industry Market Opportunities 2.2.1.4. North America Private LTE in Mining Industry Market Challenges 2.2.2. Europe 2.2.2.1. Europe Private LTE in Mining Industry Market Drivers 2.2.2.2. Europe Private LTE in Mining Industry Market Restraints 2.2.2.3. Europe Private LTE in Mining Industry Market Opportunities 2.2.2.4. Europe Private LTE in Mining Industry Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Private LTE in Mining Industry Market Drivers 2.2.3.2. Asia Pacific Private LTE in Mining Industry Market Restraints 2.2.3.3. Asia Pacific Private LTE in Mining Industry Market Opportunities 2.2.3.4. Asia Pacific Private LTE in Mining Industry Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Private LTE in Mining Industry Market Drivers 2.2.4.2. Middle East and Africa Private LTE in Mining Industry Market Restraints 2.2.4.3. Middle East and Africa Private LTE in Mining Industry Market Opportunities 2.2.4.4. Middle East and Africa Private LTE in Mining Industry Market Challenges 2.2.5. South America 2.2.5.1. South America Private LTE in Mining Industry Market Drivers 2.2.5.2. South America Private LTE in Mining Industry Market Restraints 2.2.5.3. South America Private LTE in Mining Industry Market Opportunities 2.2.5.4. South America Private LTE in Mining Industry Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Private LTE in Mining Industry Industry 2.8. Analysis of Government Schemes and Initiatives For Private LTE in Mining Industry Industry 2.9. Private LTE in Mining Industry Market Trade Analysis 2.10. The Global Pandemic Impact on Private LTE in Mining Industry Market 3. Private LTE in Mining Industry Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 3.1.1. Frequency Division Duplex 3.1.2. Time Division Duplex 3.2. Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 3.2.1. Centralized 3.2.2. Distributed 3.3. Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 3.3.1. Mining 3.3.2. Energy and Utilities 3.3.3. Manufacturing 3.3.4. Transportation 3.3.5. Others 3.4. Private LTE in Mining Industry Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Private LTE in Mining Industry Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 4.1.1. Frequency Division Duplex 4.1.2. Time Division Duplex 4.2. North America Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 4.2.1. Centralized 4.2.2. Distributed 4.3. North America Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 4.3.1. Mining 4.3.2. Energy and Utilities 4.3.3. Manufacturing 4.3.4. Transportation 4.3.5. Others 4.4. North America Private LTE in Mining Industry Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 4.4.1.1.1. Frequency Division Duplex 4.4.1.1.2. Time Division Duplex 4.4.1.2. United States Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 4.4.1.2.1. Centralized 4.4.1.2.2. Distributed 4.4.1.3. United States Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 4.4.1.3.1. Mining 4.4.1.3.2. Energy and Utilities 4.4.1.3.3. Manufacturing 4.4.1.3.4. Transportation 4.4.1.3.5. Others 4.4.2. Canada 4.4.2.1. Canada Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 4.4.2.1.1. Frequency Division Duplex 4.4.2.1.2. Time Division Duplex 4.4.2.2. Canada Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 4.4.2.2.1. Centralized 4.4.2.2.2. Distributed 4.4.2.3. Canada Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 4.4.2.3.1. Mining 4.4.2.3.2. Energy and Utilities 4.4.2.3.3. Manufacturing 4.4.2.3.4. Transportation 4.4.2.3.5. Others 4.4.3. Mexico 4.4.3.1. Mexico Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 4.4.3.1.1. Frequency Division Duplex 4.4.3.1.2. Time Division Duplex 4.4.3.2. Mexico Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 4.4.3.2.1. Centralized 4.4.3.2.2. Distributed 4.4.3.3. Mexico Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 4.4.3.3.1. Mining 4.4.3.3.2. Energy and Utilities 4.4.3.3.3. Manufacturing 4.4.3.3.4. Transportation 4.4.3.3.5. Others 5. Europe Private LTE in Mining Industry Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 5.2. Europe Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 5.3. Europe Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 5.4. Europe Private LTE in Mining Industry Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 5.4.1.2. United Kingdom Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 5.4.1.3. United Kingdom Private LTE in Mining Industry Market Size and Forecast, by End-User(2022-2029) 5.4.2. France 5.4.2.1. France Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 5.4.2.2. France Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 5.4.2.3. France Private LTE in Mining Industry Market Size and Forecast, by End-User(2022-2029) 5.4.3. Germany 5.4.3.1. Germany Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 5.4.3.2. Germany Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 5.4.3.3. Germany Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 5.4.4.2. Italy Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 5.4.4.3. Italy Private LTE in Mining Industry Market Size and Forecast, by End-User(2022-2029) 5.4.5. Spain 5.4.5.1. Spain Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 5.4.5.2. Spain Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 5.4.5.3. Spain Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 5.4.6.2. Sweden Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 5.4.6.3. Sweden Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 5.4.7.2. Austria Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 5.4.7.3. Austria Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 5.4.8.2. Rest of Europe Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 5.4.8.3. Rest of Europe Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 6. Asia Pacific Private LTE in Mining Industry Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 6.2. Asia Pacific Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 6.3. Asia Pacific Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 6.4. Asia Pacific Private LTE in Mining Industry Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 6.4.1.2. China Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 6.4.1.3. China Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 6.4.2.2. S Korea Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 6.4.2.3. S Korea Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 6.4.3.2. Japan Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 6.4.3.3. Japan Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 6.4.4. India 6.4.4.1. India Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 6.4.4.2. India Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 6.4.4.3. India Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 6.4.5.2. Australia Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 6.4.5.3. Australia Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 6.4.6.2. Indonesia Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 6.4.6.3. Indonesia Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 6.4.7.2. Malaysia Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 6.4.7.3. Malaysia Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 6.4.8.2. Vietnam Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 6.4.8.3. Vietnam Private LTE in Mining Industry Market Size and Forecast, by End-User(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 6.4.9.2. Taiwan Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 6.4.9.3. Taiwan Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 6.4.10.2. Rest of Asia Pacific Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 6.4.10.3. Rest of Asia Pacific Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 7. Middle East and Africa Private LTE in Mining Industry Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 7.2. Middle East and Africa Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 7.3. Middle East and Africa Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 7.4. Middle East and Africa Private LTE in Mining Industry Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 7.4.1.2. South Africa Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 7.4.1.3. South Africa Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 7.4.2.2. GCC Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 7.4.2.3. GCC Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 7.4.3.2. Nigeria Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 7.4.3.3. Nigeria Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 7.4.4.2. Rest of ME&A Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 7.4.4.3. Rest of ME&A Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 8. South America Private LTE in Mining Industry Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 8.2. South America Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 8.3. South America Private LTE in Mining Industry Market Size and Forecast, by End-User(2022-2029) 8.4. South America Private LTE in Mining Industry Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 8.4.1.2. Brazil Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 8.4.1.3. Brazil Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 8.4.2.2. Argentina Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 8.4.2.3. Argentina Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Private LTE in Mining Industry Market Size and Forecast, by Technology (2022-2029) 8.4.3.2. Rest Of South America Private LTE in Mining Industry Market Size and Forecast, by Deployment Model (2022-2029) 8.4.3.3. Rest Of South America Private LTE in Mining Industry Market Size and Forecast, by End-User (2022-2029) 9. Global Private LTE in Mining Industry Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Private LTE in Mining Industry Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Nokia Corporation 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Ericsson AB 10.3. NEC Corporation 10.4. Squire Technologies 10.5. Quortus Limited 10.6. NetNumber Inc. 10.7. Redline Communications 10.8. SpiderCloud Wireless 10.9. Ruckus Networks 10.10. Sercomm Corporation 10.11. Intel Corporation 10.12. Future Technologies LLC 10.13. HCL Technologies Limited 10.14. ADVA Optical Networking SE 10.15. Mavenir Systems 10.16. pdvWireless 10.17. Deutsche Telekom AG. 10.18. Canaan Inc. 10.19. Cynosure Technologies Co. Ltd. 10.20. Halong Mining 10.21. INNOSILICON Technology Ltd. 10.22. Shenzhen MicroBT Electronics Technology Co. Ltd. 10.23. Other Key Players 11. Key Findings 12. Industry Recommendations 13. Private LTE in Mining Industry Market: Research Methodology 14. Terms and Glossary