The Global Poultry Feed Market is not merely an agricultural input market—it is the economic backbone of the global poultry protein industry. Feed determines production cost, bird health, mortality rate, feed conversion ratio (FCR), regulatory compliance, and ultimately profit margins for integrators and farmers. According to Maximize Market Research (MMR), the global poultry feed market was valued at USD 244.02 Bn in 2025 and is projected to reach USD 339.07 Bn by 2032, growing at a CAGR of 4.8% (2025–2032). This growth is not purely demand-led. Instead, it is driven by a multi-layered interaction of protein consumption growth, feed conversion efficiency economics, regulatory pressure on antibiotic usage, raw material price volatility, and rapid industrialization of poultry farming in emerging markets. What differentiates this market is not “growth”, but who captures value, who absorbs risk, and where margins are migrating. This report is designed for feed manufacturers, additive suppliers, poultry integrators, and investors seeking to understand where value is shifting in global poultry protein economics. Volume Economics & Consumption Reality: The Core Engine of the MarketTo know about the Research Methodology :- Request Free Sample Report Globally, poultry feed consumption exceeds 600–650 million metric tons per year, making it the largest segment within compound animal feed, ahead of cattle and swine feed. Why Volume Is Structurally Locked In • Poultry is the fastest-growing animal protein due to:

o Lowest feed-to-protein conversion o Short production cycle o Cultural and religious acceptability

• Feed constitutes 60–70% of total poultry production cost • Every 1% improvement in feed conversion ratio (FCR) directly impacts farm EBITDA • Poultry meat consumption continues to rise due to:o Urbanization o Price sensitivity vs red meat o Protein affordability

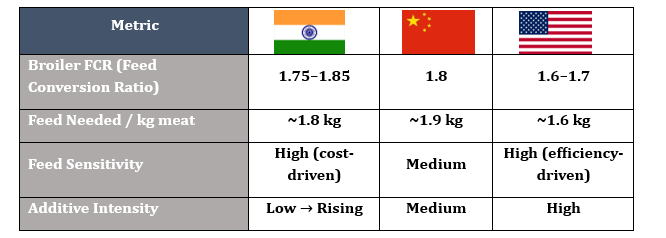

Consumption Intensity with Volume Logic • Broilers: ~3.0–3.6 kg feed per kg live weight • Layers: ~110–120 g feed/bird/day (~40–44 kg/bird/year) • Turkeys: Higher protein density → higher feed cost per ton A single commercial broiler consumes ~3.8 kg of feed over a 42-day cycle. At global production exceeding 75 billion birds annually, poultry feed demand structurally exceeds 285–300 million metric tons per year. This makes feed demand inelastic: even during disease outbreaks or price spikes, baseline feed consumption does not collapse—it recalibrates.

Segment Intelligence: Where the Real Profit Pools Exist

By Poultry Type• Broilers dominate volume but suffer margin compression due to price sensitivity. • Layers offer stable recurring demand, predictable intake cycles, and better pricing power. • Turkey feed, though niche, delivers high additive intensity and premium pricing. By Feed Form & Ingredient (Value Migration) • Pellets & Crumbles dominate due to superior digestibility and lower wastage • Additives (enzymes, amino acids, probiotics) are the fastest-growing value segment (7–9% CAGR) • Antibiotic growth promoters are structurally replaced by enzymes, organic acids, and phytogenics

Key Economic Shift:

Value is migrating from bulk feed tonnage to formulation intelligence. DROCT Framework: Strategic Market Drivers

Dimension Market Impact Drivers Rising protein demand, urbanization, integrator farming Restraints Raw material price volatility, disease outbreaks Opportunities Additives, insect protein, precision nutrition Challenges Regulatory pressure, margin squeeze Trends Antibiotic-free feed, digital formulation, sustainability Market Structure: Who Controls Value vs Who Carries Risk

Supply Side Reality • Feed milling is fragmented • Raw material sourcing and additives are highly concentrated • Additive suppliers often capture disproportionate margins Demand Side Reality • Thousands of farms, but buying power increasingly shifts to large integrators • Small farmers remain price-takers • Integrated poultry companies increasingly:o Backward integrate into feed o Lock long-term supply contracts

This creates a “margin squeeze funnel”: Raw material volatility + regulatory pressure → margins compress downstream → innovation shifts upstream. Table Suggestion: Value chain margin distribution: raw materials → additives → feed mills → poultry integrators Cost Pressure & Feedstock Economics (Real Industry Pain) Raw Material Volatility • Corn, soybean meal, wheat = 70–75% of feed formulation cost • Price swings driven by:o Climate volatility o Trade restrictions o Currency depreciation (Asia, Africa)

Impact on Feed Economics • Every 10% increase in soybean meal price can:o Increase feed cost by 4–6% o Reduce farmer margins by 8–12% if not passed on

This is why: • Amino acids substitute crude protein • Enzymes reduce nutrient wastage • Alternative grains gain traction Regulatory Pressure Is Reshaping the Market Contrary to common belief, regulation is not suppressing poultry feed growth—it is redistributing value. Key Regulatory Forces • Antibiotic Growth Promoter (AGP) bans • Feed hygiene & traceability norms • Carbon and sustainability reporting Resulting Market Shift • Higher additive intensity per ton of feed • Premium pricing for compliant formulations • Exit of small, non-compliant mills • Consolidation around technology-ready players The market is moving from “cheapest feed” to “lowest cost per kg of meat.”Regional Power Dynamics: Where Volume vs Value Plays Out

Asia Pacific – Volume Anchor • ~32–35% global feed volume • China & India dominate poultry population • Rapid shift from backyard to integrated farms • Largest poultry feed consuming region • Feed demand growth driven by:o Population o Urban protein demand o Government-backed poultry expansion

North America – Efficiency Play • High adoption of precision nutrition • Strong regulation-driven additive penetration • Captive feed mills dominate economics Europe – Regulation-Driven Innovation • Antibiotic bans accelerate enzyme & probiotic demand • Higher feed cost, but premium meat economics Competition: Why This Is Not a Commodity Market Anymore The poultry feed market looks fragmented, but competitive advantage is concentrated.Winning Capabilities • Scale in raw material sourcing • Proprietary formulations • Regulatory readiness • Advisory & on-farm technical support • Digital feed optimization tools Competitive Structure • Integrated giants: CP Group, Cargill, New Hope • Additive powerhouses: DSM, Evonik, BASF • Regional champions: De Heus, ForFarmers Fig: Competitive Positioning Matrix: scale × formulation capability × compliance readiness

Player Type Strategic Advantage Integrated Poultry Giants Cost control, captive feed Multinational Feed Majors R&D, additives, scale Regional / Local Mills Flexibility, proximity Additive Specialists Margin leadership

Recent Developments & Industry Impact

• Expansion of enzyme portfolios (DSM–Novonesis, Evonik) • Rapid feed mill capacity addition in India & Southeast Asia • Regulatory tightening on antimicrobial resistance • Rising investment in insect protein and synthetic amino acids These developments structurally increase entry barriers, accelerating market consolidation. Import Dependence & Raw Material RiskInnovation & White Spaces Despite rapid innovation in enzymes, precision nutrition, and alternative proteins, the poultry feed market continues to exhibit structural white spaces. Adoption remains concentrated among large integrators, while mid-sized farms, smallholders, and emerging markets face cost, scalability, and integration barriers—creating untapped opportunities in climate-specific feeds, antibiotic-free formulations, digital feed-advisory bundling, and private-label manufacturing models. Strategic Takeaway • Volume is structurally guaranteed • Margins migrate toward technology and compliance • Feed economics decide poultry profitability • Additives outperform base feed growth • Consolidation favors serious players Poultry feed is no longer about feeding birds—it is about controlling protein economics.

Poultry Feed Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Poultry Feed Market Scope: Inquiry Before Buying

Poultry Feed Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 233.02 Bn. Forecast Period 2026 to 2032 CAGR: 4.8% Market Size in 2032: USD 339.07 Bn. Segments Covered: by Poultry Type Layer Feed Broiler Feed Turkey Feed Others by Form Pellets Crumbles Mashed Others by Ingredient Type Cereals Oilseed Meal Molasses Fish Oil Fish Meal Additives by Feed Type Complete Feed Concentrates Premix Others by Nature Conventional Organic by Additive Antibiotics Vitamins Antioxidants Amino Acid Feed Enzymes Feed Acidifiers Others by Distribution Channel Online Offline by End-User Type Independent Feed Mills Integrated Poultry Companies Contract Farmers (Integrator-backed) Cooperatives On-farm Mixers (declining share) Company Profile: Key Players – Global Poultry Feed Market

Global Integrated & Multinational Leaders 1. Cargill Inc. – Global scale, vertically integrated nutrition & grains 2. Archer Daniels Midland (ADM) – Feedstock sourcing + formulation leadership 3. Land O’Lakes, Inc. – Cooperative-led nutrition & premix expertise 4. Charoen Pokphand Group (CP Group) – Captive feed + poultry integration (Asia) 5. Tyson Foods, Inc. – Integrated poultry operations with in-house feed 6. Associated British Foods plc (AB Agri) – Europe-focused compound feed strength 7. Nutreco N.V. (SHV Holdings) – Animal nutrition & sustainability-driven feed 8. ForFarmers B.V. – Europe’s largest compound feed producer 9. De Heus Animal Nutrition (De Heus Voeders B.V.) – Rapidly expanding global footprint 10. New Hope Liuhe Group – China’s largest feed & poultry integrator Additives, Nutrition & Technology Specialists 11. DSM-Firmenich (Royal DSM N.V.) – Enzymes, vitamins, precision nutrition 12. Evonik Industries AG – Amino acids (methionine), additive margin leadership 13. Alltech Inc. – Probiotics, enzymes, antibiotic-free solutions 14. Kemin Industries, Inc. – Feed additives, preservatives, nutrition science 15. Novus International Inc. – Methionine & specialty poultry nutrition 16. BASF SE – Feed enzymes, vitamins, and functional additives 17. Chr. Hansen Holding A/S – Probiotics & microbial solutions for poultry feed Regional & Domestic Feed Powerhouses 18. Wen’s Food Group – China-focused integrated poultry & feed player 19. Kent Nutrition Group, Inc. – US-based regional feed strength 20. Hi-Pro Feeds, Inc. – North American livestock & poultry feed 21. Southern States Cooperative – Cooperative-based feed distribution (US) 22. Weston Milling Animal Nutrition – Australia & Oceania regional leader 23. EWOS Group – Specialized nutrition (now under Cargill, legacy relevance) 24. Balance Agri-Nutrients Ltd. – India-based regional poultry feed supplier 25. DeKalb Feeds, Inc. – Localized feed mill operator (US) 26. Godrej Agrovet Ltd. – India’s integrated feed & poultry platform 27. Japfa Ltd. – Southeast Asia-focused poultry & feed integrator 28. BRF S.A. – Brazil-based integrated poultry & feed player 29. Perdue Farms Inc. – US integrated poultry producer with captive feed 30. Suguna Foods Pvt. Ltd. – India’s largest contract poultry integratorFAQs

Q1. Why is poultry feed considered a volume-driven market? Because consumption is tied directly to bird population and biological feed requirements, not discretionary demand. Q2. What is the biggest cost driver in poultry feed? Corn and soybean meal, accounting for ~70% of formulation cost. Q3. Why are additives growing faster than total feed volume? They improve FCR, replace antibiotics, and help manage cost volatility. Q4. Which region offers maximum long-term growth? Asia Pacific, due to population, protein demand, and industrial farming adoption. Q5. Is poultry feed becoming more profitable? Profitability is shifting upstream to formulation, additives, and integrated models. Lead Analyst Profile (EXCLUDED FROM WORD COUNT) Lead Analyst – Global Feedstock & Animal Nutrition Markets This research is authored by analysts with deep experience in poultry feed economics, feedstock volatility modeling, animal nutrition science, and agri-value-chain strategy, advising feed manufacturers, integrators, ingredient suppliers, and institutional investors across Asia, Europe, and the Americas.

1. Poultry Feedstock Market Introduction 1.1. Executive Summary 1.2. Market Size (2025) & Forecast (2026–2032) 1.3. Market Size (Value in USD Billion) and Market Share (%) – By Segments, Regions, and Country 2. Global Poultry Feedstock Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Global Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarters 2.3.3. Feedstock & Product Portfolio 2.3.4. Poultry Type Served (Broiler/Layer/Turkey) 2.3.5. End-user Focus (Integrators / Feed Mills / Farmers) 2.3.6. Pricing Strategy 2.3.7. Additive & Formulation Innovation Rate 2.3.8. R&D Investment 2.3.9. Revenue (2024) by Region 2.3.10. Revenue Growth Rate (Y-O-Y) 2.3.11. Profit Margin (%) 2.3.12. Market Share (%) by Region 2.3.13. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers, Acquisitions & Strategic Alliances 3. Poultry Feedstock Market: Dynamics 3.1. Poultry Feedstock Market Trends 3.2. Poultry Feedstock Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region (Antibiotics, Feed Safety, Sustainability) 4. Production Analysis 4.1. Global Poultry Feedstock Production Volumes by Feed Type 4.2. Production Capacity & Utilization by Region 4.3. Feed Milling Footprint of Leading Players 4.4. Emerging Feedstock Production Hubs & Investments 4.5. Seasonal Production Trends & Cyclicality 4.6. Technological Advancements in Feed Processing & Formulation 5. Consumption Analysis 5.1. Global Poultry Feed Consumption Volumes & Value 5.2. Consumption Patterns by Poultry Type (Broiler, Layer, Turkey) 5.3. Industrial vs Smallholder Consumption Patterns 5.4. Integrator-led vs Independent Farm Consumption 5.5. Feed Conversion Ratio (FCR) Trends & Impact 5.6. Growth Drivers for Feed Consumption 6. Trade Analysis (2025) 6.1. Global Feedstock Export & Import Volumes by Ingredient 6.2. Key Exporting & Importing Countries 6.3. Regional Trade Flow Patterns 6.4. Impact of Tariffs, Trade Policies & Biosecurity Regulations 6.5. Emerging Export Opportunities 6.6. Cross-border Feedstock Supply Chain Challenges 7. Pricing Analysis (2020–2025) 7.1. Average Feedstock Prices by Ingredient & Region 7.2. Price Trends of Corn, Soybean Meal & Alternative Proteins 7.3. Impact of Raw Material & Energy Costs 7.4. Regional Price Differentials 7.5. Additive Pricing & Premiumization Trends 7.6. Price–Margin Correlation Analysis 8. Supply Chain Analysis 8.1. Raw Material Sourcing & Procurement Trends 8.2. Feed Milling, Storage & Logistics Efficiency 8.3. Distribution Challenges Across Regions 8.4. Sustainability & Low-Carbon Feed Initiatives 8.5. Supplier Consolidation & Strategic Partnerships 8.6. Risk Management & Feedstock Security 9. End-user Behavior Analysis 9.1. Integrator Procurement Behavior 9.2. Independent Farmer Purchasing Preferences 9.3. Antibiotic-free & Performance-driven Adoption Trends 9.4. Digital Advisory & Feed Bundling Adoption 9.5. Brand Loyalty vs Private-label Feed Adoption 10. Demand Landscape 10.1. Global Poultry Feed Demand Drivers 10.2. Poultry Type-wise & Regional Demand Analysis 10.3. Demand Forecast & Emerging Opportunities 10.4. Impact of Protein Consumption & Population Growth 10.5. Demand Sensitivity to Meat Prices & Disease Outbreaks 10.6. Future Demand Scenarios 11. Technology & Product Innovation 11.1. Precision Nutrition & Formulation Technologies 11.2. Enzymes, Probiotics & Antibiotic Alternatives 11.3. Alternative Proteins (Insect Meal, Algae, Fermentation) 11.4. Digital Feed Optimization & Traceability 11.5. R&D Trends & New Product Launches 11.6. Collaboration Between Additive Players & Feed Mills 12. Distribution Channel Analysis 12.1. Direct Sales to Integrators 12.2. Distributor-led Feed Supply 12.3. Online & Digital Feed Platforms 12.4. Contract Farming-linked Distribution 12.5. Regional Channel Mix & Emerging Models 13. Global Poultry Feedstock Market Size & Forecast by Segmentation (USD Billion) (2025–2032) 13.1. By Poultry Type • Broiler Feed • Layer Feed • Turkey Feed • Others 13.2. By Feed Form • Pellets • Crumbles • Mash • Others 13.3. By Ingredient Type • Cereals • Oilseed Meal • Molasses • Fish Meal • Fish Oil • Additives 13.4. By Nature • Conventional • Organic 13.5. By Additive Type • Antibiotics • Vitamins • Amino Acids • Antioxidants • Feed Enzymes • Feed Acidifiers • Others 13.6. By Distribution Channel • Online • Offline 13.7. By End-user Type • Independent Feed Mills • Integrated Poultry Companies • Contract Farmers • Cooperatives • On-farm Mixers 14. North America Poultry Feedstock Market Size & Forecast (2025–2032) (Country-wise: US, Canada, Mexico – full segmentation) 15. Europe Poultry Feedstock Market Size & Forecast (2025–2032) (UK, Germany, France, Italy, Spain, Rest of Europe) 16. Asia Pacific Poultry Feedstock Market Size & Forecast (2025–2032) (China, India, Japan, ASEAN, Australia, Rest of APAC) 17. Middle East & Africa Poultry Feedstock Market Size & Forecast (2025–2032) 18. South America Poultry Feedstock Market Size & Forecast (2025–2032) 19. Company Profiles – Key Players (Cargill, ADM, CP Group, DSM-Firmenich, Evonik, BASF, Nutreco, De Heus, ForFarmers, Charoen Pokphand, New Hope, etc.) Each profile includes: • Overview • Product Portfolio • Financials • SWOT • Strategy • Recent Developments 20. Key Findings 21. Strategic Moves & Industry Outlook 22. Research Methodology