The Plastic Market size was valued at USD 532.82 Billion in 2024 and the total Plastic revenue is expected to grow at a CAGR of 5% from 2025 to 2032, reaching nearly USD 787.22 Billion in 2032.Plastic Market Overview:

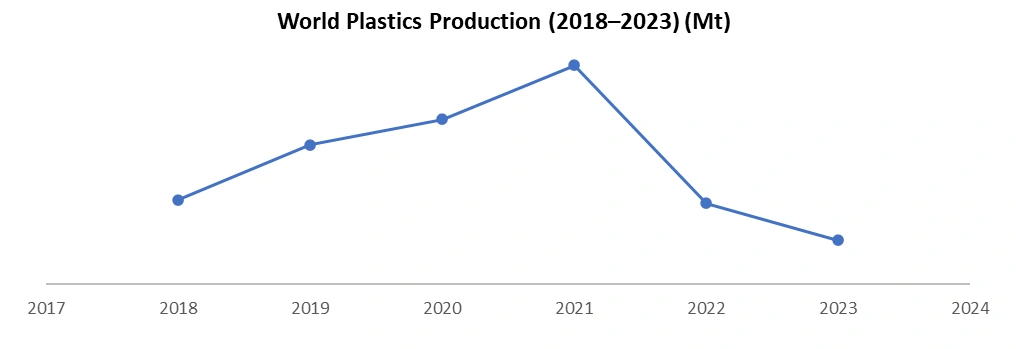

Plastics are synthetic or semi-synthetic materials made from long-chain polymers derived mainly from petrochemicals, though bio-based alternatives have been increasing gradually. Their versatility lightweight, durable, moldable, and cost-efficient made plastics one of the world’s most widely used materials. Global plastic production reached around 400 million tonnes per year, with packaging accounting for 40% of total plastic consumption globally. Commodity plastics such as polyethylene (PE), polypropylene (PP), and PVC historically represented over 70% of total plastic usage due to their low cost and ease of processing. Engineering plastics like ABS and polycarbonate captured about 15–18%, while high-performance polymers such as PEEK and PPS remained below 2–3% of total demand due to their specialized applications.To know about the Research Methodology :- Request Free Sample Report

Plastic Market Dynamics:

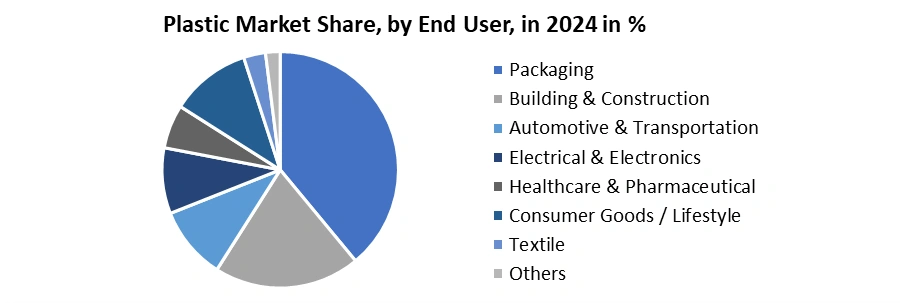

Sustainability, Material Innovation, Industrial Expansion & Technological Advancements Boosts the Plastic Market Growth The global Plastic Market is being driven by a combination of industrial expansion, performance-oriented material innovation, and mounting sustainability mandates across economies. Packaging remains the dominant force, accounting for around 40% of total plastic consumption worldwide (EMF). This dominance has strengthened due to the rapid expansion of e-commerce, which has grown by 20%+ annually across major Asian economies such as India, Indonesia, and China. As online retail expands, so does the demand for lightweight plastic films, flexible pouches, bubble packaging, and rigid protective formats making plastics indispensable for last-mile logistics. The automotive and transportation industries are also major driving sectors. Plastics support substantial lightweighting benefits, enabling 10–15% vehicle weight reduction compared with metallic components. Such weight reduction directly enhances fuel efficiency in conventional vehicles and extends driving range for electric vehicles (EVs). Engineering plastics—including ABS, PC, nylon (PA), PEEK, and PPS—are being increasingly adopted as OEMs transition from metal parts to advanced polymers. This shift has intensified as EV adoption accelerates, pushing manufacturers to integrate lightweight, thermally stable, and durable plastics into battery casings, cable connectors, sensors, and interior components. The construction sector has emerged as another powerful demand driver. PVC remains one of the most widely used polymers in the sector, accounting for nearly 60% of all global plastic pipe usage. Rapid urbanization in India, China, Bangladesh, Vietnam, and Southeast Asia fuels large-scale demand for plumbing systems, insulation foams, waterproofing membranes, and window profiles. Construction and infrastructure activities collectively account for around 20% of total global polymer consumption, reflecting the critical role plastics play in modern building technologies. Material innovation also significantly contributes to plastic market momentum. Global production of biodegradable plastics reached 2.2 million tonnes in 2023 and is expected to exceed 6 million tonnes by 2030, driven by regulatory pushes, compostable packaging adoption, and bio-based resin development. High-performance polymers—such as PEEK, PPS, PTFE, fluoropolymers, and advanced nylon grades—are seeing rising use in aerospace, renewable energy, medical implants, surgical devices, and high-temperature electronic components. Their ability to replace metals in extreme-performance environments strengthens long-term growth. Sustainability pressures remain one of the most powerful driving factors. According to OECD, only around 9% of global plastic waste is recycled, while more than 400 million tonnes of plastic waste are generated each year. This imbalance has forced governments and corporations to enforce strict circular-economy policies. Over 75 countries have enacted bans, restrictions, or taxes on single-use plastics, accelerating demand for recyclable, compostable, and reusable materials. Global brands—including Coca-Cola, Unilever, PepsiCo, and Nestlé—have committed to 25–50% recycled content in packaging by 2025, making post-consumer recycled (PCR) plastics a high-priority requirement for packaging suppliers. This regulatory and corporate shift toward sustainable plastics continues to reshape demand patterns across industries. The integration of Industry 4.0 technologies into plastics manufacturing is improving efficiency and strengthening competitiveness. AI-enabled quality monitoring, robotics, and digital simulation tools have allowed manufacturers to reduce material waste by 20–30% in injection molding and extrusion. These technological enhancements strengthen the plastic market by lowering costs, reducing defects, and boosting throughput. Bioplastics, Recycling Technologies, High-Performance Polymers & Smart Manufacturing Emerging Opportunities in the Global Plastic Market The plastics industry is entering a transformative phase where sustainability, advanced materials, and manufacturing innovation are creating large-scale opportunities across the global value chain. One of the strongest opportunities lies in bio-based plastics, which currently represent about 1% of total global plastic production—approximately 2.2 million tonnes in 2023 are growing rapidly. With more than 75 countries enforcing bans or taxes on single-use plastics, demand for materials such as PLA, PHA, and bio-PET is expected to multiply. Global consumer brands are targeting 30–60% recyclable or bio-based content by 2030, making bio-resins a high-growth, high-margin segment for producers. Recycling and circular economy systems represent another major opportunity. With global plastic waste generation surpassing 400 million tonnes annually, and recycling rates hovering below 10%, the plastic market holds vast potential for innovation. Chemical recycling technologies including pyrolysis, depolymerization, and solvent-based recovery can process up to 90% of mixed waste, far more than traditional mechanical recycling systems. As FMCG brands and retailers commit to 50–100% recyclable or reusable packaging, demand is quickly rising for high-purity PCR materials, food-grade rPET, and advanced recycled polypropylene. High-value sectors such as aerospace, EV manufacturing, electronics, and medical devices present significant growth prospects. Engineering plastics currently account for less than 5% of total polymer demand, yet they deliver superior margins due to their performance in demanding environments. PEEK, PPS, flame-retardant PC, carbon-fiber reinforced nylon, and high-temperature fluoropolymers are increasingly used in battery modules, semiconductor components, lightweight aircraft parts, and medical implants. The rapidly expanding EV sector expected to produce over 40 million units annually by 2032 will substantially increase demand for lightweight, heat-resistant polymer solutions. Smart manufacturing represents opportunity for Plastic Market. The adoption of robotics, automated handling systems, and real-time sensor monitoring in plastics factories improves accuracy and reduces production defects by 15–20%. 3D printing in plastics has grown by more than 300% over the past decade, enabling rapid prototyping, mass customization, and medical device fabrication. AI-driven material optimization is helping plastic companies innovate faster, reduce downtime, and minimize waste.

Plastic Market Segment Analysis:

Based on Product Type, the Plastic Market is segmented into Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polyester (PET), Acrylonitrile Butadiene Styrene (ABS), and Polyurethane (PU). Among these, Polyethylene (PE) dominated the Plastic Market in 2024 and is expected to maintain its leading position throughout the forecast period. PE accounts for over 30–32% of total Plastic Market consumption, driven by its versatility, durability, and cost-efficiency. The Plastic Market benefits significantly from the widespread use of HDPE and LDPE films in packaging, where PE offers superior flexibility, moisture resistance, and excellent processing behavior. More than 55% of global flexible packaging films are PE-based, making it the foundational polymer of the Plastic Market. Beyond packaging, the Plastic Market also sees strong PE demand in construction films, geomembranes, household goods, and agricultural products, reinforcing its dominance. The fastest-growing product segment in the Plastic Market is Polypropylene (PP), driven by its rising adoption in automotive, healthcare devices, and consumer goods. PP is gaining market share due to its lightweight nature, high fatigue resistance, and suitability for replacing metals and engineering plastics in advanced applications. The Plastic Market increasingly relies on PP for injection-molded components, which now represent millions of tonnes of annual PP output. In the automotive sector, PP’s role is expanding as manufacturers incorporate more lightweight polymers for dashboards, battery housings, and structural parts. With rising demand for recyclable and high-performance materials, PP is becoming the fastest-expanding segment within the Plastic Market.Based on End-User, the Plastic Market is segmented into Packaging, Automotive & Transportation, Building & Construction, Electrical & Electronics, and Healthcare & Pharmaceutical. Among these, the Packaging segment dominated the Plastic Market in 2024, accounting for approximately 40% of global plastic consumption. The Plastic Market is heavily driven by demand for food packaging, protective films, beverage bottles, and e-commerce packaging materials. Rapid growth in online retail—recording 20%+ annual expansion in major Asian markets—has further strengthened the dominance of packaging in the Plastic Market. Plastics such as PE, PP, and PET remain essential due to their superior barrier properties, lightweight nature, and cost advantage. Additionally, the Plastic Market is witnessing strong innovation trends in recyclable packaging, such as rPET bottles and bio-based films, supported by global sustainability mandates and EPR regulations. The fastest-growing end-user segment in the Plastic Market is Healthcare & Pharmaceutical, supported by increasing consumption of disposable medical devices, diagnostic components, and sterile packaging. The Plastic Market benefits significantly from heightened demand for syringes, IV sets, catheters, inhaler components, and laboratory consumables. With rising healthcare expenditure, expanded hospital infrastructure, and increased preference for single-use medical plastics for infection control, this segment is rapidly accelerating. The Plastic Market is experiencing substantial growth from 3D-printed medical plastics, which have increased by more than 300% over the last decade, enabling patient-specific implants and surgical tools. As biotechnology applications and advanced drug-delivery systems expand, the Healthcare & Pharmaceutical segment continues to be the fastest-emerging sector within the Plastic Market.

Plastic Market Regional Analysis:

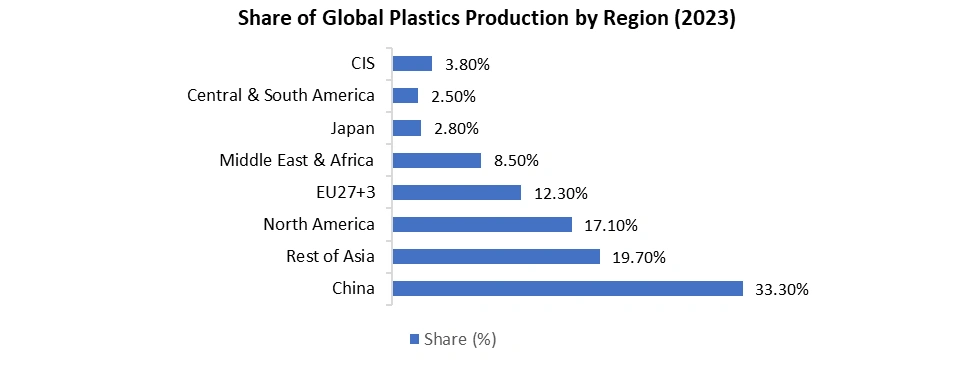

Asia-Pacific dominated the Plastic Market in 2024, accounting for the largest share globally, driven due to rapid industrialization, strong manufacturing output, and a massive consumer base. China remains the world’s largest producer and consumer of plastics, supported by large-scale petrochemical capacity, cost-effective labor, and extensive downstream industries. India and Southeast Asian economies including Indonesia, Vietnam, Thailand, and Malaysia continue to expand their plastic consumption due to booming packaging demand, rising infrastructure development, and growth in electronics manufacturing. The e-commerce surge across the region has increased the use of plastic films, pouches, and protective packaging. Moreover, APAC is a global hub for automotive and electrical manufacturing, which significantly boosts demand for PP, ABS, PC, and engineering plastics. Government-led initiatives promoting Make-in-Asia manufacturing, coupled with increasing investments in polymer recycling and bioplastic production, strengthen APAC’s leadership in the Plastic Market.

Recent Development

INNATE TF 220 Precision Packaging Resin On June 30, 2025, Dow declared the launch of INNATE TF 220 Precision Packaging Resin, designed for high-performance biaxially oriented polyethylene (BOPE) films to improve recyclability in flexible packaging. The development supports mono-material designs and integrates post-consumer recycled (PCR) content via partnership with Chinese detergent brand Liby. This innovation addresses low recycling rates for flexible packaging by enhancing processability, extrusion stability, stiffness and heat resistance, while aligning with circular-economy goals. It marks a key step for Dow in shifting the Plastic Market toward circular, high-value packaging solutions. Expansion of Advanced Recycling Capacity On November 21, 2024, ExxonMobil declared a USD 200 million investment to expand its advanced recycling operations at its Baytown and Beaumont sites in Texas. The goal: achieve a global chemical-recycling capacity of 1 billion pounds of plastic waste per year by 2027. The move further positions ExxonMobil in the Plastic Market amid rising demand for circular plastics. The expansion will increase the processing of hard-to-recycle plastics into raw materials via pyrolysis, supporting brand owners’ sustainability goals for certified-circular plastics. Plan to Triple Chemical Recycling Capacity (MoReTec) On November 15, 2024, LyondellBasell unveiled its plans to build a second chemical-recycling plant using its proprietary MoReTec technology at its Houston refinery, potentially tripling its chemical-recycling capacity. The new facility would have approximately twice the capacity of the plant under construction in Germany. This development signals a material shift in the Plastic Market toward high-volume recycling of post-consumer plastic waste. The initiative is part of LyondellBasell’s strategy to convert plastic waste back into feedstock for new polymers and contribute to a circular plastics economy.Plastic Market Scope: Inquire before buying

Global Plastic Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 532.82 Bn. Forecast Period 2025 to 2032 CAGR: 5% Market Size in 2032: USD 787.22 Bn. Segments Covered: by Product Type Polyethylene (PE) Polypropylene (PP) Polyvinyl Chloride (PVC) Polyester (PET) Acrylonitrile Butadiene Styrene (ABS) Polyurethane (PU) by Additives Plasticizers Flame Retardants Stabilizers Fillers by Resin Types Thermoplastics Thermosetting Plastics Bioplastics by End-User Packaging Automotive & Transportation Building & Construction Electrical & Electronics Healthcare & Pharmaceutical Plastic Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Plastic Market, Key Players

1. Dow Inc. 2. BASF SE 3. SABIC (Saudi Basic Industries Corporation) 4. INEOS Group 5. ExxonMobil Chemical 6. LG Chem 7. LyondellBasell Industries 8. DuPont de Nemours, Inc. 9. Chevron Phillips Chemical Company 10. Formosa Plastics Corporation 11. Borealis AG 12. Borouge 13. ALPLA Group 14. Amcor Plc 15. Berry Global Group, Inc. 16. Covestro AG 17. Solvay S.A. 18. Mitsubishi Chemical Group 19. Toray Industries, Inc. 20. Evonik Industries AG 21. Huntsman Corporation 22. Westlake Chemical Corporation 23. INEOS Olefins & Polymers 24. INEOS Styrolution 25. Sumitomo Chemical Co., Ltd. 26. Mitsui Chemicals, Inc. 27. Kuraray Co., Ltd. 28. Ube Industries, Ltd. 29. Trinseo S.A. 30. Celanese CorporationFAQs:

1) What was the Global Plastic Market size in 2024? Ans: The Global Plastic Market size was USD 532.82 Billion in 2024. 2) What is the market segment of Global Plastic Market? Ans -The market segments are based on Product and Application. 3) What is forecast period consider for Global Plastic Market? Ans -The forecast period Global Plastic Market is 2025 to 2032. 4) Which region is dominated in Global Plastic Market? Ans - In 2024, Asia Pacific region dominated the Global Plastic Market. 5) What was the market size of Global Plastic Market in 2032? Ans - Global Plastic Market size is estimated to reach USD 787.22 Bn in 2032.

1. Plastic Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion) - By Segments, Regions, and Country 2. Plastic Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning Of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Segment 2.3.4. End User Segment 2.3.5. Total Company Revenue (2024) 2.3.6. Market Share (%) 2.3.7. Profit Margin (%) 2.3.8. Growth Rate (%) 2.3.9. Integration Capabilities 2.3.10. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Plastic Market: Dynamics 3.1. Plastic Market Trends 3.2. Plastic Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Plastic Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Consumer Preference Analysis 4.1. Preference for lightweight and durable plastic materials 4.2. Rising demand for recyclable and eco-friendly plastic products 4.3. Increased consumption of flexible packaging formats 4.4. Growing adoption of high-performance and engineering plastics 4.5. Shift toward sustainable, mono-material packaging solutions 5. Import Analysis 5.1. Dependence on imported resins in non-petrochemical regions 5.2. Rising imports of specialty polymers and engineering plastics 5.3. Increasing cross-border trade of recycled plastic pellets 5.4. Higher import volumes in emerging manufacturing economies 5.5. Regulatory influence on import tariffs and trade compliance 6. Export Analysis 6.1. Large-scale resin exports from petrochemical-rich countries 6.2. Strong export demand for PE, PP, and PVC across global markets 6.3. Growth in export of advanced high-performance polymers 6.4. Rising global trade of PCR (post-consumer recycled) plastics 6.5. Export competitiveness driven by production capacity and feedstock availability 7. Production Analysis 7.1. Concentrated production hubs in Asia-Pacific and the Middle East 7.2. Expansion of polymer plants and petrochemical complexes 7.3. Growth in manufacturing of thermoplastics and engineered polymers 7.4. Increasing automation and Industry 4.0 adoption in plastic processing 7.5. Rising output of recyclable and bio-based plastic materials 8. Plastic Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Tonness) (2024-2032) 8.1. Plastic Market Size and Forecast, By Type (2024-2032) 8.1.1.1. Polyethylene (PE) 8.1.1.2. Polypropylene (PP) 8.1.1.3. Polyvinyl Chloride (PVC) 8.1.1.4. Polyester (PET) 8.1.1.5. Acrylonitrile Butadiene Styrene (ABS) 8.1.1.6. Polyurethane (PU) 8.2. Plastic Market Size and Forecast, By Additives (2024-2032) 8.2.1.1. Plasticizers 8.2.1.2. Flame Retardants 8.2.1.3. Stabilizers 8.2.1.4. Fillers 8.3. Plastic Market Size and Forecast, By Resin Types (2024-2032) 8.3.1.1. Thermoplastics 8.3.1.2. Thermosetting Plastics 8.3.1.3. Bioplastics 8.4. Plastic Market Size and Forecast, By End-User (2024-2032) 8.4.1.1. Packaging 8.4.1.2. Automotive & Transportation 8.4.1.3. Building & Construction 8.4.1.4. Electrical & Electronics 8.4.1.5. Healthcare & Pharmaceutical 8.5. Plastic Market Size and Forecast, By Region (2024-2032) 8.5.1. North America 8.5.2. Europe 8.5.3. Asia Pacific 8.5.4. Middle East and Africa 8.5.5. South America 9. North America Plastic Market Size and Forecast by Segmentation (by Value in USD Billion and and Volume in Tonness) (2024-2032) 9.1. North America Plastic Market Size and Forecast, By Product Type (2024-2032) 9.1.1.1. Polyethylene (PE) 9.1.1.2. Polypropylene (PP) 9.1.1.3. Polyvinyl Chloride (PVC) 9.1.1.4. Polyester (PET) 9.1.1.5. Acrylonitrile Butadiene Styrene (ABS) 9.1.1.6. Polyurethane (PU) 9.2. North America Plastic Market Size and Forecast, By Additives (2024-2032) 9.2.1.1. Plasticizers 9.2.1.2. Flame Retardants 9.2.1.3. Stabilizers 9.2.1.4. Fillers 9.3. North America Plastic Market Size and Forecast, By Resin Types (2024-2032) 9.3.1.1. Thermoplastics 9.3.1.2. Thermosetting Plastics 9.3.1.3. Bioplastics 9.4. North America Plastic Market Size and Forecast, By End-User (2024-2032) 9.4.1.1. Packaging 9.4.1.2. Automotive & Transportation 9.4.1.3. Building & Construction 9.4.1.4. Electrical & Electronics 9.4.1.5. Healthcare & Pharmaceutical 9.5. North America Plastic Market Size and Forecast, by Country (2024-2032) 9.5.1.1. United States 9.5.1.2. Canada 9.5.1.3. Mexico 10. Europe Plastic Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Tonness) (2024-2032) 10.1. Europe Plastic Market Size and Forecast, By Product Type (2024-2032) 10.2. Europe Plastic Market Size and Forecast, By Additives (2024-2032) 10.3. Europe Plastic Market Size and Forecast, By Resin Types (2024-2032) 10.4. Europe Plastic Market Size and Forecast, By End-User (2024-2032) 10.5. Europe Plastic Market Size and Forecast, By Country (2024-2032) 10.5.1. United Kingdom 10.5.2. France 10.5.3. Germany 10.5.4. Italy 10.5.5. Spain 10.5.6. Sweden 10.5.7. Russia 10.5.8. Rest of Europe 11. Asia Pacific Plastic Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Tonness) (2024-2032) 11.1. Asia Pacific Plastic Market Size and Forecast, By Product Type (2024-2032) 11.2. Asia Pacific Plastic Market Size and Forecast, By Additives (2024-2032) 11.3. Asia Pacific Plastic Market Size and Forecast, By Resin Types (2024-2032) 11.4. Asia Pacific Plastic Market Size and Forecast, By End-User (2024-2032) 11.5. Asia Pacific Plastic Market Size and Forecast, by Country (2024-2032) 11.5.1. China 11.5.2. S Korea 11.5.3. Japan 11.5.4. India 11.5.5. Australia 11.5.6. Indonesia 11.5.7. Malaysia 11.5.8. Philippines 11.5.9. Thailand 11.5.10. Vietnam 11.5.11. Rest of Asia Pacific 12. Middle East and Africa Plastic Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Tonness) (2024-2032) 12.1. Middle East and Africa Plastic Market Size and Forecast, By Product Type (2024-2032) 12.2. Middle East and Africa Plastic Market Size and Forecast, By Additives (2024-2032) 12.3. Middle East and Africa Plastic Market Size and Forecast, By Resin Types (2024-2032) 12.4. Middle East and Africa Plastic Market Size and Forecast, By End-User (2024-2032) 12.5. Middle East and Africa Plastic Market Size and Forecast, By Country (2024-2032) 12.5.1. South Africa 12.5.2. GCC 12.5.3. Nigeria 12.5.4. Rest of ME&A 13. South America Plastic Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Tonness) (2024-2032) 13.1. South America Plastic Market Size and Forecast, By Product Type (2024-2032) 13.2. South America Plastic Market Size and Forecast, By Additives (2024-2032) 13.3. South America Plastic Market Size and Forecast, By Resin Types (2024-2032) 13.4. South America Plastic Market Size and Forecast, By End-User (2024-2032) 13.5. South America Plastic Market Size and Forecast, By Country (2024-2032) 13.5.1. Brazil 13.5.2. Argentina 13.5.3. Colombia 13.5.4. Chile 13.5.5. Rest of South America 14. Company Profile: Key Players 14.1. Dow Inc. 14.1.1. Company Overview 14.1.2. Business Portfolio 14.1.3. Financial Overview 14.1.4. SWOT Analysis 14.1.5. Strategic Analysis 14.2. BASF SE 14.3. SABIC (Saudi Basic Industries Corporation) 14.4. INEOS Group 14.5. ExxonMobil Chemical 14.6. LG Chem 14.7. LyondellBasell Industries 14.8. DuPont de Nemours, Inc. 14.9. Chevron Phillips Chemical Company 14.10. Formosa Plastics Corporation 14.11. Borealis AG 14.12. Borouge 14.13. ALPLA Group 14.14. Amcor Plc 14.15. Berry Global Group, Inc. 14.16. Covestro AG 14.17. Solvay S.A. 14.18. Mitsubishi Chemical Group 14.19. Toray Industries, Inc. 14.20. Evonik Industries AG 14.21. Huntsman Corporation 14.22. Westlake Chemical Corporation 14.23. INEOS Olefins & Polymers 14.24. INEOS Styrolution 14.25. Sumitomo Chemical Co., Ltd. 14.26. Mitsui Chemicals, Inc. 14.27. Kuraray Co., Ltd. 14.28. Ube Industries, Ltd. 14.29. Trinseo S.A. 14.30. Celanese Corporation 15. Key Findings 16. Analyst Recommendations 17. Plastic Market – Research Methodology