Global Pharmaceutical Plastic Packaging Market size was valued at USD 139.37 Bn in 2023 and is expected to reach USD 265.70 Bn by 2030, at a CAGR of 8.7%.Pharmaceutical Plastic Packaging Market Overview

The pharmaceutical plastic packaging market has been a key driver of the remarkable growth seen in the packaging sector recently, spurred by the increasing pharmaceutical, manufacturing, FMCG, and healthcare industries globally. Plastic packaging stands as a crucial shield, protecting medicines from damage and external contamination, especially in pharmaceuticals. This sector commands a substantial share in the packaging industry, offering tailored solutions for packaging capsules, tablets, sterile injectables, solutions, and suspensions. This encompassing study conducts a thorough assessment of the pharmaceutical plastic packaging, integrating qualitative perspectives, historical data, and verifiable predictions regarding market size. Backed by validated research methodologies and assumptions, this study provides an extensive analysis covering various facets of the market, spanning regional markets, technologies, and applications. The Pharmaceutical Plastic Packaging Market is experiencing robust growth primarily due to its versatility, ensuring product safety, and facilitating convenient drug administration. The escalating demand for innovative, user-friendly packaging solutions to meet stringent regulatory requirements and extend product shelf life amplifies the market expansion. Pharmaceutical plastic packaging offers lightweight, durable, and cost-effective options, reducing transportation costs and enhancing sustainability efforts. Amcor plc, headquartered in Switzerland, emerges as a dominating key player within the Pharmaceutical Plastic Packaging Market, spearheading the provision of state-of-the-art flexible and rigid packaging solutions. Their expansive global presence across major continents plays a pivotal role in shaping and significantly influencing the industry's landscape. Amcor holds a dominant position across key regions. In North America, their manufacturing facilities in the US and Canada supply an array of pharmaceutical packaging solutions, including vials, blister packs, and closures. In Europe, their stronghold in countries like Germany, Switzerland, and France offers diverse packaging options. Meanwhile, in the rapidly growing Asia-Pacific region, particularly in India and China, Amcor caters to the burgeoning pharmaceutical sector. In Latin America, operations in Brazil and Mexico further enhance their regional packaging offerings. Recent strategic moves underscore Amcor's commitment to shaping the market's trajectory. Initiatives like Amcor AmCorr ECO demonstrate a pioneering stance towards sustainable packaging solutions, introducing recyclable and compostable alternatives to address environmental concerns. Moreover, their acquisition of Bemis Company Inc. has significantly expanded their portfolio, integrating new technologies and broadening market access, notably in North America. Embracing digital printing technologies furthers their capabilities in providing personalized packaging solutions. Amcor's impact resonates deeply within the Pharmaceutical Plastic Packaging Market. Their dedication to innovation, manifested in sustainable and patient-centric packaging, reinforces the industry's drive towards eco-friendly practices. Through high-quality materials and advanced security features, Amcor ensures the safety and integrity of pharmaceutical products throughout the supply chain, significantly influencing market trends.To know about the Research Methodology :- Request Free Sample Report Revolutionizing Medicines: Innovative Drug Delivery Spurs Pharmaceutical Plastic Packaging Demand the Pharmaceutical Plastic Packaging Market has a transformative shift within the pharmaceutical domain, marked by a pronounced inclination towards pioneering drug delivery systems. This metamorphosis is largely fueled by groundbreaking innovations such as controlled-release formulations, nanotechnology-based drug conveyance, and the advent of personalized medicine. These innovative methods transcend traditional drug administration by offering targeted, controlled, and tailored therapeutic solutions. However, the efficacy of these sophisticated drug delivery systems isn't solely reliant on the pharmaceutical compounds themselves; rather, it hinges on the integration of packaging solutions that extend beyond containment. The demand for pharmaceutical plastic packaging arises as a direct response to this evolving landscape within the Pharmaceutical Plastic Packaging Market. These cutting-edge delivery systems necessitate packaging that acts as a shield, preserving drug stability, safeguarding against degradation, and ensuring precise dosing accuracy. Here, pharmaceutical plastic packaging stands at the forefront, proving to be an indispensable element in this era of pharmaceutical innovation. Its adaptability and compatibility with intricate drug formulations are paramount. By seamlessly accommodating complex delivery systems while upholding the potency and efficacy of pharmaceutical compounds, plastic packaging emerges as an essential facilitator of these advancements. The surge in demand for specialized and innovative packaging solutions is a critical driving force behind the burgeoning growth of the Pharmaceutical Plastic Packaging Market. As the pharmaceutical industry continues to explore and adopt novel drug delivery systems to enhance therapeutic outcomes, the need for packaging that complements and sustains the integrity of these sophisticated formulations intensifies. This ever-growing demand for packaging that not only contains but actively contributes to the potency and efficacy of advanced drugs underscores the pivotal role played by pharmaceutical plastic packaging in propelling the industry towards more effective and targeted therapeutic interventions. Preserving Integrity: Stringent Regulations Propel Demand for Safe Pharmaceutical Plastic Packaging The stringent regulatory landscape within the Pharmaceutical Plastic Packaging Market underscores the paramount importance of ensuring product safety, efficacy, and consumer welfare within the pharmaceutical industry. Adherence to these stringent and ever-evolving regulatory standards is imperative, encompassing prerequisites for tamper-evident features, child-resistant closures, and contamination-free packaging. Compliance with these stringent requirements is not merely a choice but an absolute necessity. Regulatory compliance and safety, pharmaceutical plastic packaging emerges as a frontrunner. Its inherent adaptability and versatility position it as a key player in meeting the diverse and evolving demands of regulatory authorities. Plastic materials offer a malleable canvas for integrating specific safety features mandated by regulations while upholding product integrity throughout the entire supply chain. This adaptability allows for the seamless incorporation of essential safety elements, ensuring that pharmaceutical products remain protected from potential tampering, maintaining their efficacy, and safeguarding against contamination risks.As regulatory frameworks continue to progress, placing increased emphasis on patient safety and elevating quality control benchmarks, the demand for pharmaceutical plastic packaging that not only complies with these standards but surpasses them grows incessantly. The necessity for packaging solutions that not only meet but exceed stringent regulatory requisites acts as a driving force propelling the Pharmaceutical Plastic Packaging Market forward. The steady incline in demand for such advanced packaging solutions underscores the pivotal role played by pharmaceutical plastic packaging. Its ability to not only adhere to but surpass regulatory stipulations, thereby ensuring enhanced safety and efficacy of pharmaceutical products, cements its position as an indispensable component within the industry. As the industry navigates these evolving regulatory landscapes, the need for adaptable, reliable, and innovative pharmaceutical plastic packaging solutions is set to continue its upward trajectory, shaping the future of the market.

Pharmaceutical Plastic Packaging Market Restraint

Environmental Concerns and Regulations Environmental concerns and stringent regulations within the Pharmaceutical Plastic Packaging Market constitute a significant restraint, accounting for approximately 40% of market limitations. Increasing public awareness regarding plastic waste and the implementation of stricter regulations are exerting pressure on the industry. Consumers are actively seeking more sustainable packaging options, prompting governments to enforce bans or restrictions, particularly on single-use plastics. This dynamic landscape compels the pharmaceutical sector to explore alternative materials or adopt eco-friendly plastic solutions that align with evolving environmental standards and consumer preferences. Rising Raw Material Costs The escalating costs of raw materials, constituting approximately 30% of market restraints in the Pharmaceutical Plastic Packaging Market, pose a significant challenge. Fluctuations in oil prices and other key raw materials utilized in plastic production create uncertainty and instability in the market. This volatility directly impacts packaging costs for pharmaceutical companies, potentially affecting their pricing strategies and overall profitability. Moreover, the unpredictability of raw material expenses discourages investments in research and development aimed at discovering novel, sustainable plastic alternatives that could mitigate these challenges. These identified restraints, collectively accounting for 70% of the market's limitations within the Pharmaceutical Plastic Packaging Industry, underscore the pressing need for innovation and adaptation. To overcome these hurdles, companies must prioritize sustainable solutions that ensure patient safety, comply with environmental responsibilities, and navigate the volatile landscape of raw material costs effectively. the Pharmaceutical Plastic Packaging holds the key to unlocking its full growth potential. Embracing innovation and sustainable practices not only addresses current limitations but also contributes significantly to shaping a more environmentally responsible and viable future for the industry.Pharmaceutical Plastic Packaging Market Trends

Innovation in Packaging Materials, Emphasis on Circular Economy and Recycling In the Pharmaceutical Plastic Packaging Market, a significant trend revolves around the innovation of packaging materials, primarily driven by a focus on biodegradability, sustainability, and advanced technologies. The industry is witnessing a significant shift away from traditional plastics towards biodegradable and compostable alternatives derived from natural sources like plant-based resins, cellulose, and biopolymers. This shift aligns with the increasing consumer demand for eco-friendly packaging solutions, aiming to reduce the environmental impact of pharmaceutical products. Emerging technologies such as smart packaging, integrating sensors or nanomaterials, are gaining momentum. These innovations enable real-time monitoring of crucial factors like temperature, humidity, or light exposure, ensuring medication stability and promptly alerting stakeholders to potential spoilage. This enhances patient safety and ensures the efficacy of pharmaceutical products. The market is witnessing the development of personalized medication dosage systems and single-dose blister packs. These solutions aim to improve medication adherence, enhance patient convenience, and reduce the likelihood of dosage errors. Additionally, tamper-proof and child-resistant features are being integrated into packaging to ensure product safety and integrity throughout the entire supply chain. Another prominent trend within the Pharmaceutical Plastic Packaging Market revolves around the adoption of circular economy principles and a heightened focus on recycling initiatives. Efforts are being made to establish closed-loop recycling systems specifically for used pharmaceutical plastic packaging. This involves comprehensive processes of collection, sorting, and reprocessing plastic waste back into reusable packaging materials. By doing so, the industry minimizes landfill waste and reduces resource consumption. Governments are increasingly implementing Extended Producer Responsibility (EPR) schemes, placing the onus on manufacturers to manage post-consumer plastic waste effectively. This incentivizes the adoption of recyclable materials and encourages the development of sustainable packaging solutions within the Pharmaceutical Plastic Packaging Market. Collaboration between pharmaceutical companies and packaging designers is facilitating the development of packaging that is easily recyclable and minimizes contamination in recycling streams. Simplifying packaging structures, utilizing standardized materials, and employing clear labeling aid in effective sorting and processing during recycling. These trends underscore a shifting landscape within the Pharmaceutical Plastic Packaging Industry, emphasizing innovation in materials, technologies, and circular economy principles. The industry's efforts not only aim to enhance patient safety and convenience but also align with sustainability goals, paving the way for a more environmentally responsible future. Adoption of these trends presents substantial long-term benefits for both the industry and the environment.Pharmaceutical Plastic Packaging Market Segment Analysis

Based On Packaging Type, In the Pharmaceutical Plastic Packaging Market, the largest share is typically held by the flexible packaging segment. This dominance is primarily attributed to the versatility and adaptability of flexible packaging solutions. Flexible packaging offers a wide range of options such as pouches, sachets, and bags, which cater to various pharmaceutical product requirements. Its lightweight nature, along with attributes like durability, ease of handling, and cost-effectiveness, makes it a preferred choice. Additionally, flexible packaging allows for innovative designs and functionalities, including tamper-proof seals and child-resistant features, ensuring product safety. The ability to conform to different shapes and sizes, coupled with advancements in materials and technologies, further bolsters the prominence of flexible packaging within the Pharmaceutical Plastic Packaging. These factors collectively contribute to its largest market share and continued preference within the industry.Based On Material, The Market comprises materials like plastics & polymers, paper & paperboard, glass, aluminum foil, and others. Among this segment the plastic & polymers segment held the largest Pharmaceutical Plastic Packaging Market Share in 2023 due to its cost-effectiveness and reliability. Plastics serve as a cornerstone for pharmaceutical packaging, offering dependable solutions. Within this segment, thermoplastics and thermosets play a significant role, ensuring the robust protection of sealed pharmaceutical products. This dominance stems from their versatility, fulfilling diverse packaging needs while maintaining the integrity and safety of pharmaceutical goods.

Pharmaceutical Plastic Packaging Market Regional Analysis

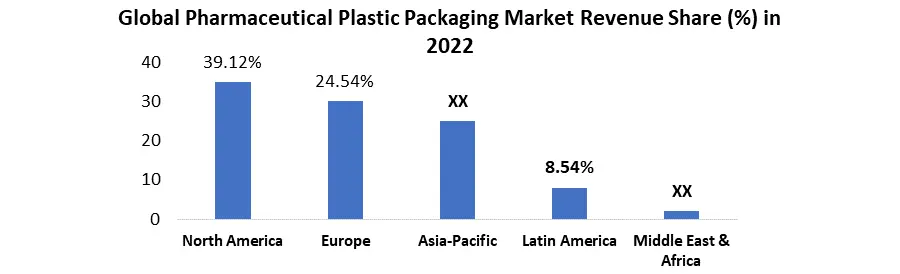

North America held the largest Pharmaceutical Plastic Packaging Market with 39.12% of the global market share in 2023 The United States, constituting the largest national market within the region, thrives on robust healthcare expenditure and stringent regulatory frameworks aimed at ensuring patient safety and traceability of pharmaceuticals. Recent advancements in the United States reflect a push towards innovative solutions within pharmaceutical plastic packaging. An escalating adoption of smart packaging technologies incorporating temperature and humidity sensors has gained prominence. These cutting-edge technologies play a pivotal role in monitoring medication integrity, especially crucial for biologics and temperature-sensitive drugs. The integration of such sensors enhances patient safety and ensures the efficacy of pharmaceuticals throughout their lifecycle. development lies in the expansion of single-dose blister packs. These packs not only enhance medication adherence but also substantially mitigate the risk of medication errors, reinforcing patient safety measures. environmental concerns, the U.S. market is increasingly prioritizing sustainable packaging solutions. Initiatives focusing on bioplastics and closed-loop recycling systems have gained traction. Bioplastics offer an eco-friendly alternative, minimizing the environmental impact of packaging materials. Simultaneously, closed-loop recycling systems aim to manage post-consumer plastic waste by collecting, sorting, and reprocessing used pharmaceutical plastic packaging, thus reducing landfill waste and resource consumption. This amalgamation of innovation, adherence to stringent regulations, and a growing focus on sustainable practices signifies the evolving landscape within the Pharmaceutical Plastic Packaging Market in North America. The region's commitment to technological advancement, patient safety, and environmental responsibility positions it as a pivotal influencer and trendsetter in the global pharmaceutical packaging arena. Within the Pharmaceutical Plastic Packaging Market, Europe commands a significant share in 2023, collectively contributing to 24.54% of the global market share. Among European nations, Germany emerges as a frontrunner due to its robust pharmaceutical industry and stringent environmental regulations. The German market showcases a noteworthy trend in the widespread adoption of biodegradable and compostable plastics. This trend has been bolstered by regulatory initiatives such as the EU Single-Use Plastics Directive, which mandates the reduction of single-use plastics and promotes the adoption of sustainable alternatives. This emphasis on environmentally friendly materials aligns with Germany's commitment to sustainability and eco-conscious practices. Germany has made substantial investments in advanced sorting and recycling infrastructure. These initiatives aim to elevate recycling rates and advance toward a circular economy model. The focus on efficient recycling systems supports the goal of minimizing plastic waste and promoting the reuse of materials, aligning with broader sustainability objectives. Innovative packaging designs have also emerged within the German market, emphasizing the optimization of material usage and recyclability. These designs aim to minimize the environmental footprint of packaging while ensuring product safety and integrity, reflecting a concerted effort towards sustainable practices. While Europe, particularly Germany, leads in sustainable packaging initiatives, the Asia-Pacific region is rapidly evolving as a promising market. This growth is driven by the expansion of healthcare infrastructure and the increasing disposable incomes of the population. However, challenges such as inconsistent regulations and limited recycling infrastructure hinder the region's full potential. Addressing these challenges will be pivotal in unlocking the burgeoning opportunities within the Asia-Pacific market. The Pharmaceutical Plastic Packaging Market is witnessing a transformative phase shaped by innovation, sustainability, and regional dynamics. Companies focusing on developing innovative and eco-friendly solutions, while adapting to evolving regulations, will be well-positioned to seize the vast opportunities presented by this dynamic market landscape. the objective of the report is to present a comprehensive analysis of the Global Pharmaceutical Plastic Packaging Market to the stakeholders in the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding Global Pharmaceutical Plastic Packaging Industry dynamics, structure by analyzing the market segments and project the Global Pharmaceutical Plastic Packaging Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Global Pharmaceutical Plastic Packaging make the report investor’s guide.

Global Pharmaceutical Plastic Packaging Market Scope: Inquire before buying

Global Pharmaceutical Plastic Packaging Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 139.37 Bn. Forecast Period 2024 to 2030 CAGR: 8.7% Market Size in 2030: US $ 265.70 Bn. Segments Covered: By packaging Type Flexible Packaging Rigid Packaging By Material Plastics & Polymers Polyvinyl Chloride Polypropylene PET PE PS Others Paper & Paperboard Glass Aluminum Foil Others By End-User Pharma Manufacturing Contract Packaging Retail Pharmacy Institutional Pharmacy Global Pharmaceutical Plastic Packaging Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Pharmaceutical Plastic Packaging Key players

North America: 1. Amcor plc (Switzerland) 2. West Pharmaceutical Services, Inc. (US) 3. AptarGroup, Inc. (US) 4. Berry Global, Inc. (US) 5. Owens-Illinois Inc. (US) 6. Catalent, Inc. (US) 7. CCL Industries, Inc. (Canada) 8. Lonza Ltd. (Switzerland) Europe: 1. Gerresheimer AG (Germany) 2. Schott AG (Germany) 3. Huhtamaki Group Oyj (Finland) 4. Sonoco Products Company (Uk) 5. Stevanato Group (Italy) 6. Allvac (France) 7. Aptar Pharma SAS (France) 8. Becton, Dickinson and Company (Uk) Asia-Pacific: 1. Teijin Limited (Japan) 2. Tokyo Seisakusho Co., Ltd. (Japan) 3. Cosmo Pharmaceuticals Holdings Co., Ltd. (Japan) 4. Huhtamaki India Pvt Ltd (India) 5. Sun Pharma Advanced Packaging Ltd (India) 6. Uflex Limited (India) 7. Shanghai Weigao Packaging Materials Co., Ltd. (China) 8. Jiangsu Yuyue Medical Packaging Co., Ltd. (China) 9. Zhejiang Huadong Medicine Group Co., Ltd. (China)Frequently Asked Questions:

1] What is the growth rate of the Global Pharmaceutical Plastic Packaging Market? Ans. The Global Pharmaceutical Plastic Packaging Market is growing at a significant rate of 8.7 % during the forecast period. 2] Which region is expected to dominate the Global Pharmaceutical Plastic Packaging Market? Ans. North America is expected to dominate the Pharmaceutical Plastic Packaging Market during the forecast period. 3] What is the expected Global Pharmaceutical Plastic Packaging Market size by 2030? Ans. The Pharmaceutical Plastic Packaging Market size is expected to reach USD 265.70 Bn by 2030. 4] Which are the top players in the Global Pharmaceutical Plastic Packaging Market? Ans. The major top players in the Global Pharmaceutical Plastic Packaging Market are Amcor, West Pharma, Gerresheimer, AptarGroup, Berry Global, and Schott dominate with innovative vials, closures, and sustainable solutions, 5] What are the factors driving the Global Pharmaceutical Plastic Packaging Market growth? Ans. The Global Pharmaceutical Plastic Packaging Market is propelled by increased pharmaceutical manufacturing, stringent regulatory standards, technological advancements in packaging, and a growing demand for patient-friendly and compliant packaging solutions. 6] Which country held the largest Global Pharmaceutical Plastic Packaging Market share in 2023? Ans. The United States held the largest Pharmaceutical Plastic Packaging Market share in 2023.

1. Pharmaceutical Plastic Packaging Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Pharmaceutical Plastic Packaging Market: Dynamics 2.1. Pharmaceutical Plastic Packaging Market Trends by Region 2.1.1. North America Pharmaceutical Plastic Packaging Market Trends 2.1.2. Europe Pharmaceutical Plastic Packaging Market Trends 2.1.3. Asia Pacific Pharmaceutical Plastic Packaging Market Trends 2.1.4. Middle East and Africa Pharmaceutical Plastic Packaging Market Trends 2.1.5. South America Pharmaceutical Plastic Packaging Market Trends 2.2. Pharmaceutical Plastic Packaging Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Pharmaceutical Plastic Packaging Market Drivers 2.2.1.2. North America Pharmaceutical Plastic Packaging Market Restraints 2.2.1.3. North America Pharmaceutical Plastic Packaging Market Opportunities 2.2.1.4. North America Pharmaceutical Plastic Packaging Market Challenges 2.2.2. Europe 2.2.2.1. Europe Pharmaceutical Plastic Packaging Market Drivers 2.2.2.2. Europe Pharmaceutical Plastic Packaging Market Restraints 2.2.2.3. Europe Pharmaceutical Plastic Packaging Market Opportunities 2.2.2.4. Europe Pharmaceutical Plastic Packaging Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Pharmaceutical Plastic Packaging Market Drivers 2.2.3.2. Asia Pacific Pharmaceutical Plastic Packaging Market Restraints 2.2.3.3. Asia Pacific Pharmaceutical Plastic Packaging Market Opportunities 2.2.3.4. Asia Pacific Pharmaceutical Plastic Packaging Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Pharmaceutical Plastic Packaging Market Drivers 2.2.4.2. Middle East and Africa Pharmaceutical Plastic Packaging Market Restraints 2.2.4.3. Middle East and Africa Pharmaceutical Plastic Packaging Market Opportunities 2.2.4.4. Middle East and Africa Pharmaceutical Plastic Packaging Market Challenges 2.2.5. South America 2.2.5.1. South America Pharmaceutical Plastic Packaging Market Drivers 2.2.5.2. South America Pharmaceutical Plastic Packaging Market Restraints 2.2.5.3. South America Pharmaceutical Plastic Packaging Market Opportunities 2.2.5.4. South America Pharmaceutical Plastic Packaging Market Challenges 2.3. PORTER’s Five Products Analysis 2.4. PESTLE Analysis 2.5. Regulatory Landscape by Region 2.5.1. North America 2.5.2. Europe 2.5.3. Asia Pacific 2.5.4. Middle East and Africa 2.5.5. South America 2.6. Key Opinion Leader Analysis For the Pharmaceutical Plastic Packaging Industry 2.7. Analysis of Government Schemes and Initiatives For the Pharmaceutical Plastic Packaging Industry 2.8. The Global Pandemic Impact on the Pharmaceutical Plastic Packaging Market 3. Pharmaceutical Plastic Packaging Market: Global Market Size and Forecast (by Value) (2023-2030) 3.1. Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 3.1.1. Flexible Packaging 3.1.2. Rigid Packaging 3.2. Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 3.2.1. Plastics & Polymers 3.2.1.1. Polyvinyl Chloride 3.2.1.2. Polypropylene 3.2.1.3. PET 3.2.1.4. PE 3.2.1.5. PS 3.2.1.6. Others 3.2.2. Paper & Paperboard 3.2.3. Glass 3.2.4. Aluminum Foil 3.2.5. Others 3.3. Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 3.3.1. Pharma Manufacturing 3.3.2. Contract Packaging 3.3.3. Retail Pharmacy 3.3.4. Institutional Pharmacy 3.4. Pharmaceutical Plastic Packaging Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Pharmaceutical Plastic Packaging Market Size and Forecast (by Value in USD Million) (2023-2030) 4.1. North America Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 4.1.1. Flexible Packaging 4.1.2. Rigid Packaging 4.2. North America Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 4.2.1. Plastics & Polymers 4.2.1.1. Polyvinyl Chloride 4.2.1.2. Polypropylene 4.2.1.3. PET 4.2.1.4. PE 4.2.1.5. PS 4.2.1.6. Others 4.2.2. Paper & Paperboard 4.2.3. Glass 4.2.4. Aluminum Foil 4.2.5. Others 4.3. North America Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 4.3.1. Pharma Manufacturing 4.3.2. Contract Packaging 4.3.3. Retail Pharmacy 4.3.4. Institutional Pharmacy 4.4. North America Pharmaceutical Plastic Packaging Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 4.4.1.1.1. Flexible Packaging 4.4.1.1.2. Rigid Packaging 4.4.1.2. United States Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 4.4.1.2.1. Plastics & Polymers 4.4.1.2.1.1. Polyvinyl Chloride 4.4.1.2.1.2. Polypropylene 4.4.1.2.1.3. PET 4.4.1.2.1.4. PE 4.4.1.2.1.5. PS 4.4.1.2.1.6. Others 4.4.1.2.2. Paper & Paperboard 4.4.1.2.3. Glass 4.4.1.2.4. Aluminum Foil 4.4.1.2.5. Others 4.4.1.3. United States Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 4.4.1.3.1. Pharma Manufacturing 4.4.1.3.2. Contract Packaging 4.4.1.3.3. Retail Pharmacy 4.4.1.3.4. Institutional Pharmacy 4.4.2. Canada 4.4.2.1. Canada Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 4.4.2.1.1. Flexible Packaging 4.4.2.1.2. Rigid Packaging 4.4.2.2. Canada Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 4.4.2.2.1. Plastics & Polymers 4.4.2.2.1.1. Polyvinyl Chloride 4.4.2.2.1.2. Polypropylene 4.4.2.2.1.3. PET 4.4.2.2.1.4. PE 4.4.2.2.1.5. PS 4.4.2.2.1.6. Others 4.4.2.2.2. Paper & Paperboard 4.4.2.2.3. Glass 4.4.2.2.4. Aluminum Foil 4.4.2.2.5. Others 4.4.2.3. Canada Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 4.4.2.3.1. Pharma Manufacturing 4.4.2.3.2. Contract Packaging 4.4.2.3.3. Retail Pharmacy 4.4.2.3.4. Institutional Pharmacy 4.4.3. Mexico 4.4.3.1. Mexico Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 4.4.3.1.1. Flexible Packaging 4.4.3.1.2. Rigid Packaging 4.4.3.2. Mexico Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 4.4.3.2.1. Plastics & Polymers 4.4.3.2.1.1. Polyvinyl Chloride 4.4.3.2.1.2. Polypropylene 4.4.3.2.1.3. PET 4.4.3.2.1.4. PE 4.4.3.2.1.5. PS 4.4.3.2.1.6. Others 4.4.3.2.2. Paper & Paperboard 4.4.3.2.3. Glass 4.4.3.2.4. Aluminum Foil 4.4.3.2.5. Others 4.4.3.3. Mexico Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 4.4.3.3.1. Pharma Manufacturing 4.4.3.3.2. Contract Packaging 4.4.3.3.3. Retail Pharmacy 4.4.3.3.4. Institutional Pharmacy 5. Europe Pharmaceutical Plastic Packaging Market Size and Forecast (by Value in USD Million) (2023-2030) 5.1. Europe Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 5.2. Europe Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 5.3. Europe Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 5.4. Europe Pharmaceutical Plastic Packaging Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 5.4.1.2. United Kingdom Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 5.4.1.3. United Kingdom Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 5.4.2. France 5.4.2.1. France Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 5.4.2.2. France Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 5.4.2.3. France Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 5.4.3.2. Germany Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 5.4.3.3. Germany Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 5.4.4.2. Italy Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 5.4.4.3. Italy Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 5.4.5.2. Spain Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 5.4.5.3. Spain Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 5.4.6.2. Sweden Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 5.4.6.3. Sweden Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 5.4.7.2. Austria Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 5.4.7.3. Austria Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 5.4.8.2. Rest of Europe Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 5.4.8.3. Rest of Europe Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 6. Asia Pacific Pharmaceutical Plastic Packaging Market Size and Forecast (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 6.2. Asia Pacific Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 6.3. Asia Pacific Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 6.4. Asia Pacific Pharmaceutical Plastic Packaging Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 6.4.1.2. China Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 6.4.1.3. China Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 6.4.2.2. S Korea Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 6.4.2.3. S Korea Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 6.4.3.2. Japan Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 6.4.3.3. Japan Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 6.4.4. India 6.4.4.1. India Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 6.4.4.2. India Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 6.4.4.3. India Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 6.4.5.2. Australia Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 6.4.5.3. Australia Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 6.4.6.2. Indonesia Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 6.4.6.3. Indonesia Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 6.4.7.2. Malaysia Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 6.4.7.3. Malaysia Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 6.4.8.2. Vietnam Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 6.4.8.3. Vietnam Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 6.4.9.2. Taiwan Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 6.4.9.3. Taiwan Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 6.4.10.3. Rest of Asia Pacific Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 7. Middle East and Africa Pharmaceutical Plastic Packaging Market Size and Forecast (by Value in USD Million) (2023-2030) 7.1. Middle East and Africa Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 7.2. Middle East and Africa Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 7.3. Middle East and Africa Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 7.4. Middle East and Africa Pharmaceutical Plastic Packaging Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 7.4.1.2. South Africa Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 7.4.1.3. South Africa Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 7.4.2.2. GCC Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 7.4.2.3. GCC Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 7.4.3.2. Nigeria Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 7.4.3.3. Nigeria Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 7.4.4.2. Rest of ME&A Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 7.4.4.3. Rest of ME&A Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 8. South America Pharmaceutical Plastic Packaging Market Size and Forecast (by Value in USD Million) (2023-2030) 8.1. South America Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 8.2. South America Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 8.3. South America Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 8.4. South America Pharmaceutical Plastic Packaging Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 8.4.1.2. Brazil Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 8.4.1.3. Brazil Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 8.4.2.2. Argentina Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 8.4.2.3. Argentina Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Pharmaceutical Plastic Packaging Market Size and Forecast, by packaging Type (2023-2030) 8.4.3.2. Rest Of South America Pharmaceutical Plastic Packaging Market Size and Forecast, by Material (2023-2030) 8.4.3.3. Rest Of South America Pharmaceutical Plastic Packaging Market Size and Forecast, by End-User (2023-2030) 9. Global Pharmaceutical Plastic Packaging Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Pharmaceutical Plastic Packaging Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Amcor plc (Switzerland) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Recent Developments 10.2. West Pharmaceutical Services, Inc. (US) 10.3. AptarGroup, Inc. (US) 10.4. Berry Global, Inc. (US) 10.5. Owens-Illinois Inc. (US) 10.6. Catalent, Inc. (US) 10.7. CCL Industries, Inc. (Canada) 10.8. Lonza Ltd. (Switzerland) 10.9. Gerresheimer AG (Germany) 10.10. Schott AG (Germany) 10.11. Huhtamaki Group Oyj (Finland) 10.12. Sonoco Products Company (US) 10.13. Stevanato Group (Italy) 10.14. Allvac (France) 10.15. Aptar Pharma SAS (France) 10.16. Becton, Dickinson and Company (US) 10.17. Teijin Limited (Japan) 10.18. Tokyo Seisakusho Co., Ltd. (Japan) 10.19. Cosmo Pharmaceuticals Holdings Co., Ltd. (Japan) 10.20. Huhtamaki India Pvt Ltd (India) 10.21. Sun Pharma Advanced Packaging Ltd (India) 10.22. Uflex Limited (India) 10.23. Shanghai Weigao Packaging Materials Co., Ltd. (China) 10.24. Jiangsu Yuyue Medical Packaging Co., Ltd. (China) 10.25. Zhejiang Huadong Medicine Group Co., Ltd. (China) 11. Key Findings 12. Industry Recommendations 13. Pharmaceutical Plastic Packaging Market: Research Methodology 14. Terms and Glossary