PET Packaging Market was valued at USD 48.44 billion in 2024, and total global PET Packaging Market revenue is expected to grow at a CAGR of 5.6% from 2025 to 2032, reaching nearly USD 74.91 billion.PET Packaging Market Overview

Polyethylene Terephthalate (PET) packaging is a leading solution in the global packaging industry, widely utilized across food, beverages, pharmaceuticals, personal care, and consumer goods. Produced by combining terephthalic acid and mono-ethylene glycol, PET offers lightweight design, durability, recyclability, and excellent barrier properties that preserve product quality and extend shelf life. Its lower carbon footprint in comparison to glass and metals has positioned PET as a sustainable and cost-efficient alternative.To know about the Research Methodology :- Request Free Sample Report PET Packaging Market growth is strongly supported by rising sustainability initiatives and recycling practices. For instance, Europe reports PET recycling rates above 50%, while Japan achieved 93.5% in 2022. In the U.S., nearly 1.9 billion pounds of PET bottles were recycled in 2021, showcasing increasing demand for eco-friendly packaging. The food and beverage sector remains the largest end-user, consuming over 65 billion PET-packaged servings annually in North America alone, with bottled water surpassing soft drinks as the dominant beverage. The pharmaceutical industry relies heavily on PET, with approximately 40% of medicinal liquid preparations packaged in PET due to its clarity and chemical stability. The Healthcare Plastics Recycling Council reported a 17% rise in PET use between 2019 and 2023. Technological advancements, including AI-driven production, automation, and bio-based PET innovations such as bottles made from renewable feedstocks like used cooking oil, are further transforming the market. Emerging economies in Asia-Pacific, supported by urbanization and rising disposable incomes, present significant opportunities for future growth.

PET Packaging Market Dynamics

Rising Demand for Sustainable Packaging Solutions to Drive PET Packaging Market Growth The global PET packaging market is witnessing strong growth, driven by rising demand for sustainable, lightweight, and recyclable packaging materials. Polyethylene Terephthalate (PET) is a durable, transparent, and semi-crystalline plastic widely used in the production of bottles, jars, containers, and various packaging formats. Its non-toxic nature, safety, and excellent barrier properties make it the preferred material for packaging beverages, food, pharmaceuticals, and personal care products. In the food and beverage industry, PET dominates as it is inert, lightweight, and damage-resistant, ensuring freshness and extended shelf life. It is extensively used in packaging bottled water, carbonated drinks, cooking oils, salad dressings, and sauces. Moreover, the personal care sector also relies heavily on PET for shampoos, liquid soaps, and cosmetics, further fueling demand. Sustainability initiatives are accelerating PET adoption, particularly through recycled PET (rPET). For example, in 2024, Indorama Ventures, along with Suntory and partners, launched the world’s first commercial-scale bio-PET bottle made from used cooking oil, marking a breakthrough in eco-friendly packaging innovation. With growing consumer awareness, regulatory push for recyclability, and expansion of FMCG and e-commerce sectors, PET packaging is expected to remain a vital and sustainable solution, driving global PET Packaging Market growth during forecast period. Environmental Concerns over Plastic Waste to limits the growth of PET Packaging Market Environmental concerns represent is significant restraints on the PET packaging market, largely driven by regulatory, infrastructural, and consumer-related challenges. Governments across the globe, particularly in Europe and North America, have enacted stringent regulations to curb plastic waste. The EU Single-Use Plastics Directive, for instance, requires PET bottles to contain at least 25% recycled plastic by 2025 and 30% by 2030. While these policies encourage sustainability, they increase compliance costs, as manufacturers must source high-quality recycled PET (rPET), retool production lines, and overcome supply shortages. Another limitation is the inadequate global recycling infrastructure. Although PET is highly recyclable, only about 14% of plastic packaging is collected for recycling worldwide, and just 2% is recycled in a closed loop to maintain food-grade quality. This results in significant plastic waste leakage into landfills and oceans, drawing public and regulatory scrutiny. The industry also faces resistance to mandated recycled content due to quality concerns and performance issues in sensitive applications like food and beverage packaging. Extended Producer Responsibility (EPR) obligations are met with pushback in regions where recycling capacity is insufficient, delaying adoption of sustainable practices. Growing consumer awareness and advocacy group pressure amplify the challenge. Negative perceptions of plastics drive demand for alternatives such as paper, bioplastics, and aluminum, further restraining PET packaging growth. Europe’s Packaging and Packaging Waste Regulation (PPWR), set for enforcement in 2025, highlights this trend by mandating stricter recycled content targets and waste reduction measures raising both opportunities and barriers for the PET packaging industry.PET Packaging Market Segment Analysis

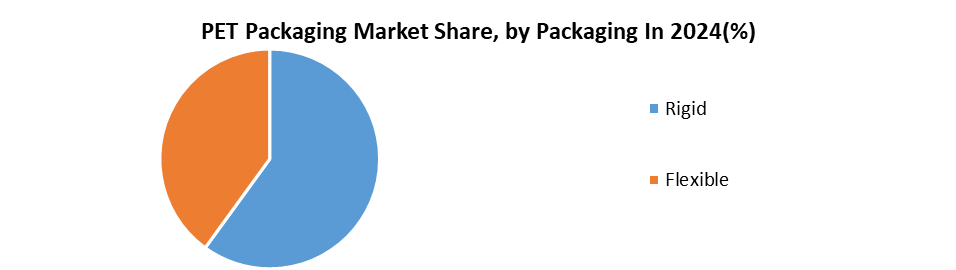

Based on Product, PET Packaging Market is segmented into Bottles & Jars, Caps & Closures, Trays & Clamshells, Bags & Pouches, Films & Wraps and Others. Bottles and jars dominate the segment, driven by extensive use in beverages, packaged water, pharmaceuticals, and personal care products. PET’s lightweight, transparency, and shatter-resistance make it the preferred alternative to glass in mass consumption markets. Caps and closures follow as essential components, ensuring product safety, extended shelf life, and leak prevention. Trays and clamshells are gaining traction in ready-to-eat meals and fresh produce packaging, fueled by urbanization and convenience-driven lifestyles. Bags and pouches offer flexibility and space efficiency, increasingly used in snacks, sauces, and frozen food packaging. Meanwhile, films and wraps are widely adopted in food, e-commerce, and retail for superior barrier protection and cost-effectiveness. The versatility of PET across these product categories is supported by recyclability, rising demand for sustainable packaging, and growth in FMCG, healthcare, and e-commerce industries.Based on Packaging, PET Packaging Market is segmented into rigid and Flexible. Rigid segment dominated the PET Packaging Market in 2024. Due to its extensive use in beverages, food, pharmaceuticals, and personal care products. Rigid PET packaging, including bottles, jars, and containers, is favored for its durability, strength, transparency, and excellent barrier properties that preserve freshness and extend shelf life. The beverage industry remains the key driver, as PET bottles are widely adopted for packaged water, carbonated soft drinks, juices, and dairy products. The segment also benefits from growing demand in pharmaceuticals and healthcare, where PET’s chemical stability and clarity make it suitable for liquid medicines and vitamin packaging. Additionally, rigid PET containers are highly recyclable, aligning with global sustainability goals. While flexible packaging is expanding in pouches and wraps, rigid PET packaging continues to dominate due to its versatility, cost-effectiveness, and strong consumer

PET Packaging Market Regional Analysis

North America dominated the PET Packaging Market in 2024. North America dominated the PET packaging market, supported by strong demand across beverages, food, healthcare, and personal care sectors, alongside well-established recycling infrastructure. The region’s leadership is primarily attributed to the high consumption of packaged beverages. The U.S. beverage industry alone accounts for more than 65 billion servings annually, with over 70% packaged in PET bottles. Bottled water consumption has surpassed carbonated soft drinks for six consecutive years, making PET bottles the most preferred format. The advanced recycling initiatives and regulatory frameworks that encourage the use of recycled PET (rPET). The U.S. recycled nearly 1.9 billion pounds of PET bottles in 2021, while Canada has expanded deposit return systems to improve collection rates. These efforts support the production of food-grade rPET, reducing reliance on virgin plastics and aligning with sustainability goals. In 2024, Coca-Cola North America launched 100% rPET bottles across multiple brands, reducing plastic waste and supporting circular economy initiatives. Similarly, PepsiCo and Nestlé Waters have invested heavily in rPET supply chains within the region. The combination of high consumer demand, corporate sustainability commitments, and robust recycling infrastructure has solidified North America’s dominance in the global PET packaging market, with continued growth expected in beverage, FMCG, and healthcare applications. PET Packaging Market Competitive Landscape PET packaging market is evolving rapidly due to rising sustainability demands and strict government regulations. For example, the EU mandates 25% recycled content in PET bottles by 2025, while India requires 20% by the same year. These policies are driving major players to invest in recycling infrastructure, sustainable materials, and strategic acquisitions. As a result, the competitive landscape is shifting toward innovation, compliance and circular economy models to maintain market leadership and meet global environmental goals. Leading players in PET packaging market include Amcor plc, Indorama Ventures, Berry Global Inc. and ALPLA Group, each dominating by strategic innovation and sustainability. Amcor excels with lightweight, recyclable PET bottles and global partnerships. Indorama Ventures leads in PET resin production and has built a vast recycling network by acquisitions. Berry Global focuses on post-consumer recycled PET and expands via strategic takeovers. ALPLA Group stands out for its closed-loop recycling and high-quality rPET packaging solutions. PET Packaging Market Key TrendsPET Packaging Market Recent Developments In May 2022, TekniPlex Consumer Products launched a new line of 100% PET Processor Trays designed to address packaging challenges faced by poultry processors, especially premium products labeled organic, non-GMO, or sustainably sourced. These trays are made from 100% PET with up to 50% post-industrial recycled content, making them fully recyclable. The innovation not only enhances packaging durability but also appeals to consumers seeking eco-friendly, sustainable packaging solutions in the poultry and food industry. In May 2022, Alpla Group, in collaboration with Austrian mineral water bottler Vöslauer, introduced a returnable PET bottle aimed at reducing carbon emissions by around 30%. The innovative PET mono-material bottle, weighing only 55 grams, is approximately 90% lighter than traditional returnable glass bottles. Fully recyclable, the bottle supports circular economy principles while improving transport efficiency, lowering environmental impact, and aligning with the growing global demand for sustainable beverage packaging solutions. In April 2022, Sidel unveiled PressureSAFE, a breakthrough PET aerosol container developed for home and personal care products. Unlike aluminum alternatives, PressureSAFE is compatible with existing PET recycling streams, ensuring greater sustainability and circularity. This lightweight design offers a significantly lower carbon footprint while meeting performance and safety standards for pressurized packaging. The innovation highlights Sidel’s commitment to driving eco-friendly packaging technologies that reduce environmental impact without compromising functionality or consumer convenience. In December 2021, LanzaTech, in partnership with Migros, Switzerland’s largest retailer, introduced the world’s first PET bottle made from captured carbon dioxide emissions. Instead of releasing CO₂ into the atmosphere, the process converts emissions into a sustainable raw material for PET production. This breakthrough demonstrates a significant advancement in carbon recycling technology, offering an innovative pathway to reduce greenhouse gas emissions while promoting sustainable packaging in the global food and beverage industry. In February 2020, Quinn Packaging launched Orbital, a food packaging solution made entirely from 100% recycled PET, eliminating reliance on non-recycled plastics common in most PET packaging. Certified by the European Food Safety Authority, Orbital is fully suitable for direct food applications, ensuring safety and sustainability. The development supports circular economy goals, reduces plastic waste, and provides food manufacturers with an environmentally responsible alternative to traditional plastic-based food packaging.

Key Trend Market Implication Closed-Loop Recycling Initiatives Boosts demand for recycled PET (rPET); supports government sustainability targets; encourages circular economy. Partnership-Driven Sustainability Enhances brand ESG positioning; opens up joint ventures for infrastructure and tech development. Functional & Emotional Packaging Design Drives premiumization and brand loyalty; creates market differentiation in saturated packaging segments. Portfolio Diversification via Acquisition Increases market share and pricing power; improves customization for various sectors including pharma and F&B. Regional Production Expansion Improves regional supply chains; lowers logistics cost; strengthens presence in emerging markets. PET Packaging Market Scope: Inquire before buying

PET Packaging Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 48.44 Bn. Forecast Period 2025 to 2032 CAGR: 5.6% Market Size in 2032: USD 74.91 Bn. Segments Covered: by Product Bottles & Jars Caps & Closures Trays & Clamshells Bags & Pouches Films & Wraps Others by Packaging Rigid Flexible by End-User Food & Beverage Pharmaceutical Personal Care & Cosmetics Automotive Electricals & Electronics Chemicals Building & Construction Agriculture Household Others PET Packaging Market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)PET Packaging Market, Key Players

North America 1. Berry Global (USA) 2. Plastipak Holdings (USA) 3. Silgan Holdings (USA) 4. Graham Packaging (USA) 5. ProAmpac (USA) 6. Sealed Air (USA) 7. Sonoco Products (USA) 8. CCL Industries (Canada) 9. Winpak (Canada) 10. Printpack (USA) Europe 11. Amcor (UK) 12. ALPLA (Austria) 13. Huhtamaki (Finland) 14. Gerresheimer (Germany) 15. Klöckner Pentaplast (Germany) 16. Constantia Flexibles (Austria) 17. Resilux (Belgium) 18. DS Smith (UK) 19. Mondi Group (UK) 20. Smurfit Kappa (Ireland) 21. Coveris (Austria) 22. Schur Flexibles (Austria) 23. Clondalkin Group (Netherlands) 24. NNZ Group (Netherlands) Asia Pacific 25. Indorama Ventures (Thailand) 26. Essel Propack (India) 27. Zijiang Enterprise Group (China) 28. Daibochi / Scientex (Malaysia) 29. Visy (Australia) South America 30. C-Pack Packaging (Brazil)Frequently Asked Questions

1] What segments are covered in the PET Packaging Market report? Ans. The segments covered in the PET Packaging Market report are based on Product Type, Packaging, End-User. 2] Which region is expected to hold the highest share in the PET Packaging Market? Ans. The Asia Pacific Region is expected to hold the highest share in the PET Packaging Market. 3] What is the market size of the PET Packaging Market by 2032? Ans. The market size of PET Packaging Market by 2032 is USD 74.91 Bn. 4] Who are the top key players in the PET Packaging Market? Ans. Amcor Limited, Graham Packaging Company, Resilux NV, Gerresheimer AG, GTX Hanex Plastic Sp., Dunmore Corporation, Comar LLC, Berry Global Inc., Silgan Holdings Inc., Sonoco Products Company, Huhtamaki OYJ, Nampak Limited, CCL Industries Inc., Du Pont De Nemours and Company, Smurfit Kappa Group PLC. 5] What was the market size of the PET Packaging Market in 2024? Ans. The market size of the PET Packaging Market in 2024 was USD 48.44 Bn.

1. PET Packaging Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global PET Packaging Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading PET Packaging Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. PET Packaging Market: Dynamics 3.1. PET Packaging Market Trends by Region 3.1.1. North America PET Packaging Market Trends 3.1.2. Europe PET Packaging Market Trends 3.1.3. Asia Pacific PET Packaging Market Trends 3.1.4. Middle East and Africa PET Packaging Market Trends 3.1.5. South America PET Packaging Market Trends 3.2. PET Packaging Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America PET Packaging Market Drivers 3.2.1.2. North America PET Packaging Market Restraints 3.2.1.3. North America PET Packaging Market Opportunities 3.2.1.4. North America PET Packaging Market Challenges 3.2.2. Europe 3.2.2.1. Europe PET Packaging Market Drivers 3.2.2.2. Europe PET Packaging Market Restraints 3.2.2.3. Europe PET Packaging Market Opportunities 3.2.2.4. Europe PET Packaging Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific PET Packaging Market Drivers 3.2.3.2. Asia Pacific PET Packaging Market Restraints 3.2.3.3. Asia Pacific PET Packaging Market Opportunities 3.2.3.4. Asia Pacific PET Packaging Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa PET Packaging Market Drivers 3.2.4.2. Middle East and Africa PET Packaging Market Restraints 3.2.4.3. Middle East and Africa PET Packaging Market Opportunities 3.2.4.4. Middle East and Africa PET Packaging Market Challenges 3.2.5. South America 3.2.5.1. South America PET Packaging Market Drivers 3.2.5.2. South America PET Packaging Market Restraints 3.2.5.3. South America PET Packaging Market Opportunities 3.2.5.4. South America PET Packaging Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For PET Packaging Industry 3.8. Analysis of Government Schemes and Initiatives For PET Packaging Industry 3.9. PET Packaging Market Trade Analysis 3.10. The Global Pandemic Impact on PET Packaging Market 4. PET Packaging Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. PET Packaging Market Size and Forecast, by Product (2024-2032) 4.1.1. Bottles & Jars 4.1.2. Caps & Closures 4.1.3. Trays & Clamshells 4.1.4. Bags & Pouches 4.1.5. Films & Wraps 4.1.6. Others 4.2. PET Packaging Market Size and Forecast, by Packaging (2024-2032) 4.2.1. Rigid 4.2.2. Flexible 4.3. PET Packaging Market Size and Forecast, by End Use (2024-2032) 4.3.1. Food & Beverage 4.3.2. Pharmaceutical 4.3.3. Personal Care & Cosmetics 4.3.4. Automotive 4.3.5. Electricals & Electronics 4.3.6. Chemicals 4.3.7. Building & Construction 4.3.8. Agriculture 4.3.9. Household 4.3.10. Others 4.4. PET Packaging Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America PET Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America PET Packaging Market Size and Forecast, by Product (2024-2032) 5.1.1. Bottles & Jars 5.1.2. Caps & Closures 5.1.3. Trays & Clamshells 5.1.4. Bags & Pouches 5.1.5. Films & Wraps 5.1.6. Others 5.2. North America PET Packaging Market Size and Forecast, by Packaging (2024-2032) 5.2.1. Rigid 5.2.2. Flexible 5.3. North America PET Packaging Market Size and Forecast, by End Use (2024-2032) 5.3.1. Food & Beverage 5.3.2. Pharmaceutical 5.3.3. Personal Care & Cosmetics 5.3.4. Automotive 5.3.5. Electricals & Electronics 5.3.6. Chemicals 5.3.7. Building & Construction 5.3.8. Agriculture 5.3.9. Household 5.3.10. Others 5.4. North America PET Packaging Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States PET Packaging Market Size and Forecast, by Product (2024-2032) 5.4.1.1.1. Bottles & Jars 5.4.1.1.2. Caps & Closures 5.4.1.1.3. Trays & Clamshells 5.4.1.1.4. Bags & Pouches 5.4.1.1.5. Films & Wraps 5.4.1.1.6. Others 5.4.1.2. United States PET Packaging Market Size and Forecast, by Packaging (2024-2032) 5.4.1.2.1. Rigid 5.4.1.2.2. Flexible 5.4.1.3. United States PET Packaging Market Size and Forecast, by End Use (2024-2032) 5.4.1.3.1. Food & Beverage 5.4.1.3.2. Pharmaceutical 5.4.1.3.3. Personal Care & Cosmetics 5.4.1.3.4. Automotive 5.4.1.3.5. Electricals & Electronics 5.4.1.3.6. Chemicals 5.4.1.3.7. Building & Construction 5.4.1.3.8. Agriculture 5.4.1.3.9. Household 5.4.1.3.10. Others 5.4.2. Canada 5.4.2.1. Canada PET Packaging Market Size and Forecast, by Product (2024-2032) 5.4.2.1.1. Bottles & Jars 5.4.2.1.2. Caps & Closures 5.4.2.1.3. Trays & Clamshells 5.4.2.1.4. Bags & Pouches 5.4.2.1.5. Films & Wraps 5.4.2.1.6. Others 5.4.2.2. Canada PET Packaging Market Size and Forecast, by Packaging (2024-2032) 5.4.2.2.1. Rigid 5.4.2.2.2. Flexible 5.4.2.3. Canada PET Packaging Market Size and Forecast, by End Use (2024-2032) 5.4.2.3.1. Food & Beverage 5.4.2.3.2. Pharmaceutical 5.4.2.3.3. Personal Care & Cosmetics 5.4.2.3.4. Automotive 5.4.2.3.5. Electricals & Electronics 5.4.2.3.6. Chemicals 5.4.2.3.7. Building & Construction 5.4.2.3.8. Agriculture 5.4.2.3.9. Household 5.4.2.3.10. Others 5.4.3. Mexico 5.4.3.1. Mexico PET Packaging Market Size and Forecast, by Product (2024-2032) 5.4.3.1.1. Bottles & Jars 5.4.3.1.2. Caps & Closures 5.4.3.1.3. Trays & Clamshells 5.4.3.1.4. Bags & Pouches 5.4.3.1.5. Films & Wraps 5.4.3.1.6. Others 5.4.3.2. Mexico PET Packaging Market Size and Forecast, by Packaging (2024-2032) 5.4.3.2.1. Rigid 5.4.3.2.2. Flexible 5.4.3.3. Mexico PET Packaging Market Size and Forecast, by End Use (2024-2032) 5.4.3.3.1. Food & Beverage 5.4.3.3.2. Pharmaceutical 5.4.3.3.3. Personal Care & Cosmetics 5.4.3.3.4. Automotive 5.4.3.3.5. Electricals & Electronics 5.4.3.3.6. Chemicals 5.4.3.3.7. Building & Construction 5.4.3.3.8. Agriculture 5.4.3.3.9. Household 5.4.3.3.10. Others 6. Europe PET Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe PET Packaging Market Size and Forecast, by Product (2024-2032) 6.2. Europe PET Packaging Market Size and Forecast, by Packaging (2024-2032) 6.3. Europe PET Packaging Market Size and Forecast, by End Use (2024-2032) 6.4. Europe PET Packaging Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom PET Packaging Market Size and Forecast, by Product (2024-2032) 6.4.1.2. United Kingdom PET Packaging Market Size and Forecast, by Packaging (2024-2032) 6.4.1.3. United Kingdom PET Packaging Market Size and Forecast, by End Use (2024-2032) 6.4.2. France 6.4.2.1. France PET Packaging Market Size and Forecast, by Product (2024-2032) 6.4.2.2. France PET Packaging Market Size and Forecast, by Packaging (2024-2032) 6.4.2.3. France PET Packaging Market Size and Forecast, by End Use (2024-2032) 6.4.3. Germany 6.4.3.1. Germany PET Packaging Market Size and Forecast, by Product (2024-2032) 6.4.3.2. Germany PET Packaging Market Size and Forecast, by Packaging (2024-2032) 6.4.3.3. Germany PET Packaging Market Size and Forecast, by End Use (2024-2032) 6.4.4. Italy 6.4.4.1. Italy PET Packaging Market Size and Forecast, by Product (2024-2032) 6.4.4.2. Italy PET Packaging Market Size and Forecast, by Packaging (2024-2032) 6.4.4.3. Italy PET Packaging Market Size and Forecast, by End Use (2024-2032) 6.4.5. Spain 6.4.5.1. Spain PET Packaging Market Size and Forecast, by Product (2024-2032) 6.4.5.2. Spain PET Packaging Market Size and Forecast, by Packaging (2024-2032) 6.4.5.3. Spain PET Packaging Market Size and Forecast, by End Use (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden PET Packaging Market Size and Forecast, by Product (2024-2032) 6.4.6.2. Sweden PET Packaging Market Size and Forecast, by Packaging (2024-2032) 6.4.6.3. Sweden PET Packaging Market Size and Forecast, by End Use (2024-2032) 6.4.7. Austria 6.4.7.1. Austria PET Packaging Market Size and Forecast, by Product (2024-2032) 6.4.7.2. Austria PET Packaging Market Size and Forecast, by Packaging (2024-2032) 6.4.7.3. Austria PET Packaging Market Size and Forecast, by End Use (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe PET Packaging Market Size and Forecast, by Product (2024-2032) 6.4.8.2. Rest of Europe PET Packaging Market Size and Forecast, by Packaging (2024-2032) 6.4.8.3. Rest of Europe PET Packaging Market Size and Forecast, by End Use (2024-2032) 7. Asia Pacific PET Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific PET Packaging Market Size and Forecast, by Product (2024-2032) 7.2. Asia Pacific PET Packaging Market Size and Forecast, by Packaging (2024-2032) 7.3. Asia Pacific PET Packaging Market Size and Forecast, by End Use (2024-2032) 7.4. Asia Pacific PET Packaging Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China PET Packaging Market Size and Forecast, by Product (2024-2032) 7.4.1.2. China PET Packaging Market Size and Forecast, by Packaging (2024-2032) 7.4.1.3. China PET Packaging Market Size and Forecast, by End Use (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea PET Packaging Market Size and Forecast, by Product (2024-2032) 7.4.2.2. S Korea PET Packaging Market Size and Forecast, by Packaging (2024-2032) 7.4.2.3. S Korea PET Packaging Market Size and Forecast, by End Use (2024-2032) 7.4.3. Japan 7.4.3.1. Japan PET Packaging Market Size and Forecast, by Product (2024-2032) 7.4.3.2. Japan PET Packaging Market Size and Forecast, by Packaging (2024-2032) 7.4.3.3. Japan PET Packaging Market Size and Forecast, by End Use (2024-2032) 7.4.4. India 7.4.4.1. India PET Packaging Market Size and Forecast, by Product (2024-2032) 7.4.4.2. India PET Packaging Market Size and Forecast, by Packaging (2024-2032) 7.4.4.3. India PET Packaging Market Size and Forecast, by End Use (2024-2032) 7.4.5. Australia 7.4.5.1. Australia PET Packaging Market Size and Forecast, by Product (2024-2032) 7.4.5.2. Australia PET Packaging Market Size and Forecast, by Packaging (2024-2032) 7.4.5.3. Australia PET Packaging Market Size and Forecast, by End Use (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia PET Packaging Market Size and Forecast, by Product (2024-2032) 7.4.6.2. Indonesia PET Packaging Market Size and Forecast, by Packaging (2024-2032) 7.4.6.3. Indonesia PET Packaging Market Size and Forecast, by End Use (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia PET Packaging Market Size and Forecast, by Product (2024-2032) 7.4.7.2. Malaysia PET Packaging Market Size and Forecast, by Packaging (2024-2032) 7.4.7.3. Malaysia PET Packaging Market Size and Forecast, by End Use (2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam PET Packaging Market Size and Forecast, by Product (2024-2032) 7.4.8.2. Vietnam PET Packaging Market Size and Forecast, by Packaging (2024-2032) 7.4.8.3. Vietnam PET Packaging Market Size and Forecast, by End Use (2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan PET Packaging Market Size and Forecast, by Product (2024-2032) 7.4.9.2. Taiwan PET Packaging Market Size and Forecast, by Packaging (2024-2032) 7.4.9.3. Taiwan PET Packaging Market Size and Forecast, by End Use (2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific PET Packaging Market Size and Forecast, by Product (2024-2032) 7.4.10.2. Rest of Asia Pacific PET Packaging Market Size and Forecast, by Packaging (2024-2032) 7.4.10.3. Rest of Asia Pacific PET Packaging Market Size and Forecast, by End Use (2024-2032) 8. Middle East and Africa PET Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa PET Packaging Market Size and Forecast, by Product (2024-2032) 8.2. Middle East and Africa PET Packaging Market Size and Forecast, by Packaging (2024-2032) 8.3. Middle East and Africa PET Packaging Market Size and Forecast, by End Use (2024-2032) 8.4. Middle East and Africa PET Packaging Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa PET Packaging Market Size and Forecast, by Product (2024-2032) 8.4.1.2. South Africa PET Packaging Market Size and Forecast, by Packaging (2024-2032) 8.4.1.3. South Africa PET Packaging Market Size and Forecast, by End Use (2024-2032) 8.4.2. GCC 8.4.2.1. GCC PET Packaging Market Size and Forecast, by Product (2024-2032) 8.4.2.2. GCC PET Packaging Market Size and Forecast, by Packaging (2024-2032) 8.4.2.3. GCC PET Packaging Market Size and Forecast, by End Use (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria PET Packaging Market Size and Forecast, by Product (2024-2032) 8.4.3.2. Nigeria PET Packaging Market Size and Forecast, by Packaging (2024-2032) 8.4.3.3. Nigeria PET Packaging Market Size and Forecast, by End Use (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A PET Packaging Market Size and Forecast, by Product (2024-2032) 8.4.4.2. Rest of ME&A PET Packaging Market Size and Forecast, by Packaging (2024-2032) 8.4.4.3. Rest of ME&A PET Packaging Market Size and Forecast, by End Use (2024-2032) 9. South America PET Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America PET Packaging Market Size and Forecast, by Product (2024-2032) 9.2. South America PET Packaging Market Size and Forecast, by Packaging (2024-2032) 9.3. South America PET Packaging Market Size and Forecast, by End Use(2024-2032) 9.4. South America PET Packaging Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil PET Packaging Market Size and Forecast, by Product (2024-2032) 9.4.1.2. Brazil PET Packaging Market Size and Forecast, by Packaging (2024-2032) 9.4.1.3. Brazil PET Packaging Market Size and Forecast, by End Use (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina PET Packaging Market Size and Forecast, by Product (2024-2032) 9.4.2.2. Argentina PET Packaging Market Size and Forecast, by Packaging (2024-2032) 9.4.2.3. Argentina PET Packaging Market Size and Forecast, by End Use (2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America PET Packaging Market Size and Forecast, by Product (2024-2032) 9.4.3.2. Rest Of South America PET Packaging Market Size and Forecast, by Packaging (2024-2032) 9.4.3.3. Rest Of South America PET Packaging Market Size and Forecast, by End Use (2024-2032) 10. Company Profile: Key Players 10.1. Berry Global (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Plastipak Holdings (USA) 10.3. Silgan Holdings (USA) 10.4. Graham Packaging (USA) 10.5. ProAmpac (USA) 10.6. Sealed Air (USA) 10.7. Sonoco Products (USA) 10.8. CCL Industries (Canada) 10.9. Winpak (Canada) 10.10. Printpack (USA) 10.11. Amcor (UK) 10.12. ALPLA (Austria) 10.13. Huhtamaki (Finland) 10.14. Gerresheimer (Germany) 10.15. Klöckner Pentaplast (Germany) 10.16. Constantia Flexibles (Austria) 10.17. Resilux (Belgium) 10.18. DS Smith (UK) 10.19. Mondi Group (UK) 10.20. Smurfit Kappa (Ireland) 10.21. Coveris (Austria) 10.22. Schur Flexibles (Austria) 10.23. Clondalkin Group (Netherlands) 10.24. NNZ Group (Netherlands) 10.25. Indorama Ventures (Thailand) 10.26. Essel Propack (India) 10.27. Zijiang Enterprise Group (China) 10.28. Daibochi / Scientex (Malaysia) 10.29. Visy (Australia) 10.30. C-Pack Packaging (Brazil) 11. Key Findings 12. Industry Recommendations 13. PET Packaging Market: Research Methodology 14. Terms and Glossary