The Personal Care Wipes Market size was valued at USD 12.46 Million in 2023 and the total Personal Care Wipes Market revenue is expected to grow at a CAGR of 5.8 % from 2024 to 2030, reaching nearly USD 18.49 Million. Personal care wipes refer to pre-moistened or dry disposable cloths designed for personal hygiene purposes. These wipes are used for various applications, including cleansing, refreshing, and sanitizing the skin. Personal care wipes come in different forms, such as baby wipes, facial wipes, hand wipes, and body wipes, and are available in a wide range of formulations tailored to specific needs, including sensitive skin, antibacterial, and eco-friendly options. They offer convenience and portability, making them popular for on-the-go use and in situations where access to water and traditional cleansing products is limited.To know about the Research Methodology :- Request Free Sample Report The increasing emphasis is on hygiene and sanitation, particularly in response to public health crises like the COVID-19 pandemic. Consumers are seeking convenient and portable hygiene solutions, driving demand for personal care wipes. Additionally, changing lifestyles, urbanization, and the rise of the middle class in emerging economies are contributing to Personal Care Wipes Market growth. Moreover, advancements in product formulations and packaging technologies are enhancing the efficacy and convenience of personal care wipes, further driving Personal Care Wipes industry growth. The growing demand for eco-friendly and sustainable products is a significant trend driving market growth. Consumers are increasingly opting for biodegradable and compostable wipes, leading to innovations in materials and formulations to meet this demand. Moreover, the rise of premium and niche personal care wipes, including those targeting specific skin types or concerns, is driving Personal Care Wipes Market growth. Another notable trend is the increasing adoption of online retail channels for purchasing personal care wipes, providing consumers with greater accessibility and convenience. The personal care wipes market presents several opportunities for growth and innovation. Manufacturers are focusing on product diversification and expanding their product portfolios to cater to evolving consumer preferences. Opportunities exist for developing innovative formulations, such as wipes infused with natural ingredients or those targeting specific skin concerns like acne or aging. Furthermore, partnerships and collaborations within the industry are facilitating market growth and driving product innovation. Recent developments in the Personal Care Wipes Market include the introduction of biodegradable and flushable wipes, as well as advancements in packaging technology to improve product freshness and sustainability. Key players are also investing in research and development to enhance product performance and address emerging consumer trends.

Market Dynamics:

Innovative Product Offerings Driving Personal Care Wipes Market Growth: The personal care wipes market is experiencing growth due to innovative product offerings catering to diverse consumer needs. Brands like Kimberly-Clark Corporation with its Cottonelle Fresh Rollwipes have introduced revolutionary products, combining the convenience of pre-moistened wipes with the disposability of traditional toilet paper. This innovation addresses consumer demands for efficient and hygienic cleansing solutions, driving Personal Care Wipes Market growth and capturing incremental sales within the $4.8 billion U.S. toilet paper market. Increasing consumer awareness of environmental sustainability is driving demand for eco-friendly personal care wipes. Initiatives like Rockline Industries' collaboration with Walmart to bring production back to the U.S. aim to support domestic manufacturing while reducing the carbon footprint associated with overseas production and transportation. Additionally, products like water-dissolvable wipes and USDA's washable antimicrobial wipes offer sustainable alternatives to single-use wipes, appealing to environmentally conscious consumers and fostering Personal Care Wipes Market growth. Partnerships between skincare brands, such as Conserving Beauty, facilitate market growth by leveraging each other's expertise and resources. Collaborations enable the development of innovative products like Micellar Oil Cleansing Wipes, which cater to evolving consumer preferences for effective and sustainable skincare solutions. By combining forces, brands penetrate new markets, drive product adoption, and capitalize on emerging trends, contributing to overall Personal Care Wipes Market growth. The global emphasis on hygiene, particularly in response to public health crises like the COVID-19 pandemic, has led to heightened demand for personal care wipes. Consumers seek convenient and portable hygiene solutions for on-the-go use, fueling Personal Care Wipes Market growth. Products like Wet Ones Hand Wipes capitalize on this trend by offering convenient and effective hand-cleaning options, addressing consumer concerns about cleanliness, and contributing to market growth. Brands are diversifying their product portfolios and targeting specific consumer segments to drive market growth. Kimberly-Clark Corporation's introduction of Cottonelle Fresh Rollwipes targets consumers looking for efficient and refreshing toilet paper alternatives. Similarly, initiatives like Kimberly-Clark's partnership with Walmart to produce facial wipes in the U.S. cater to consumer preferences for locally manufactured, high-quality personal care products, driving sales and Personal Care Wipes Market growth.Consumer Education Driving Demand for Responsible Wipe Products: The increasing focus on environmental sustainability presents an opportunity for the personal care wipes market to develop sustainable alternatives. For instance, USDA's development of natural, washable antimicrobial wipes offers a sustainable solution to reducing single-use plastic waste in landfills. These reusable wipes cater to eco-conscious consumers and address concerns about plastic pollution. Regulatory initiatives, such as the proposed ban on wet wipes containing plastic in the UK and bipartisan legislation like the WIPPES Act in the US, are driving innovation in the personal care wipes market. Manufacturers are incentivized to develop flushable and biodegradable alternatives to comply with regulations and address concerns about wastewater infrastructure and environmental pollution. Increased consumer education and awareness regarding the safe and responsible use of wet wipes presents an opportunity for market growth. Initiatives like urging producers to reconsider labeling wet wipes as "flushable" help educate consumers about proper disposal methods, reducing sewer blockages and environmental pollution. Educated consumers are more likely to choose environmentally friendly and responsibly labeled products, driving demand for sustainable options. Diversification and growth of product offerings, including wipes targeting specific consumer segments like infants or the elderly, can drive Personal Care Wipes Market growth. Despite concerns about hygiene and safety, personal care wipes remain popular for daily use. Manufacturers can capitalize on this demand by introducing innovative products with improved safety standards and targeted functionalities, appealing to a wider consumer base. Technological advancements in materials and manufacturing processes present opportunities for product innovation and differentiation. For example, the development of wipes with improved antibacterial properties or enhanced biodegradability can attract environmentally conscious consumers. Investing in research and development to improve wipe performance and sustainability drives Personal Care Wipes Market growth and maintains a competitive advantage.

Personal Care Wipes Market Segment Analysis:

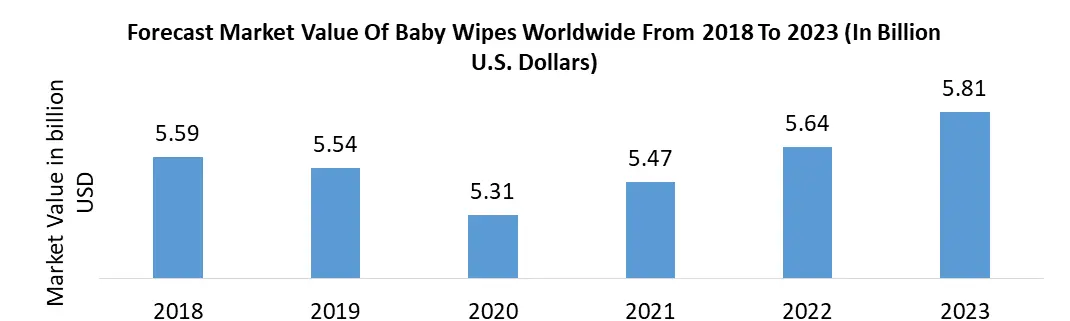

Based on Product, Baby Wipes currently dominate the market, driven by their widespread application in infant care for diaper changes and general hygiene. With the growing emphasis on infant health and hygiene, coupled with the convenience factor for parents, the demand for baby wipes is expected to continue dominating the Personal Care Wipes Market. Facial & Cosmetic Wipes follow closely, fueled by increasing consumer interest in skincare routines and makeup removal. These wipes offer convenience and effectiveness in cleansing the skin, contributing to their significant adoption across demographics. The Hand & Body Wipes segment, while growing, currently holds a smaller market share compared to Baby Wipes and Facial & Cosmetic Wipes. Nonetheless, the adoption of Hand & Body Wipes is increasing, driven by factors such as on-the-go hygiene needs and the demand for convenient cleansing solutions in various settings. In terms of dominance, Baby Wipes are expected to maintain their lead due to their essential role in infant care and continuous innovation in this segment to address specific needs such as sensitive skin and eco-friendly alternatives. Facial & Cosmetic Wipes are anticipated to see significant growth due to the rising focus on skincare and beauty routines among consumers of all ages, contributing to their increasing dominance in the Personal Care Wipes Market.

Personal Care Wipes Market Regional Insights:

The global personal care wipes market exhibits varying degrees of dominance across different regions, with North America currently leading in market share. North America's dominance is attributed to factors such as high consumer awareness, disposable income levels, and a preference for convenience products. For instance, in the United States, the personal care wipes market has witnessed steady growth, driven by busy lifestyles and an aging population that seeks convenient hygiene solutions. Europe follows closely behind, with a significant Personal Care Wipes Market share, fueled by increasing demand for premium and eco-friendly personal care wipes. Countries like Germany and the UK are key contributors to market growth, driven by consumer preferences for natural and sustainable products. In Asia-Pacific, particularly in countries like China and India, the personal care wipes market is experiencing rapid growth. Rising urbanization, changing lifestyles, and increasing disposable incomes are driving demand for personal care wipes in this region. Moreover, the COVID-19 pandemic has further accelerated market growth in Asia-Pacific, as consumers prioritize hygiene and sanitation. Competitive Landscape These developments collectively drive market growth by addressing key consumer needs and industry challenges. Kimberly-Clark's Cottonelle Fresh Rollwipes and Rockline Industries' U.S. production initiative respond to increasing demand for convenient and sustainable hygiene products, boosting sales and job creation in the respective markets. Meanwhile, the USDA's introduction of washable antimicrobial wipes aligns with growing environmental consciousness, offering eco-friendly alternatives to single-use wipes. The UK's proposed ban on plastic-containing wet wipes and the WIPPES Act in the U.S. foster regulatory environments favoring sustainable and flushable products, encouraging innovation and Personal Care Wipes Market growth towards more environmentally responsible practices. On October 12, 2023, Rockline Industries announced its initiative to bring the production of facial wipes back to the U.S. in collaboration with Walmart's U.S. Manufacturing initiative. The company will increase manufacturing capacity for Walmart at its Springdale, Ark. Plant, investing $15 million in capital for expansion and construction of a new facial wipes line. This move aims to support domestic manufacturing and create over 50 Arkansas manufacturing jobs within the next year, aligning with Walmart's commitment to purchasing an additional $250 billion by 2023 to bolster U.S. jobs and production. To commemorate this transfer of production from Europe to Arkansas, Rockline Industries and Walmart will host a dedication event at the Springdale plant on October 1, coinciding with Manufacturing Day. On January 16, 2023, Kimberly-Clark Corporation introduced Cottonelle Fresh Rollwipes, marking America's inaugural dispersible pre-moistened wipe on a roll. This revolutionary product combines the cleansing and refreshing attributes of pre-moistened wipes with the convenience and disposability of traditional toilet paper, representing a breakthrough in the toilet paper category since its inception in 1890. Anticipated to generate $150 million in retail sales within its initial year and potentially surpass $500 million over the following six years, Cottonelle Fresh Rollwipes is poised to significantly elevate the $4.8 billion U.S. toilet paper market. On April 11, 2023, USDA researchers unveiled natural, washable antimicrobial wipes, a breakthrough in sustainability. Traditionally, single-use wipes contribute to environmental pollution due to their synthetic materials. However, the newly developed wipes, crafted by the USDA's Agricultural Research Service, offer a solution by being machine washable and reusable up to 30 times. This innovation presents a significant step towards reducing waste and promoting eco-friendly cleaning practices. On October 14, 2023, the UK launched a consultation to ban wet wipes containing plastic, aiming to combat plastic pollution in waterways and reduce microplastics in wastewater treatment plants. This initiative aligns with the government's Plan for Water, emphasizing increased investment, stricter regulations, and enhanced enforcement to address plastic and microplastic pollution. Banning plastic-containing wet wipes would mitigate environmental and health risks, encouraging retailers to offer plastic-free alternatives like those already available at Boots, Tesco, and Aldi. On May 1, 2023, Senators Susan Collins and Jeff Merkley introduced the bipartisan WIPPES Act to combat the adverse effects of non-flushable wet wipes on health, ecosystems, and wastewater infrastructure. The legislation mandates "Do Not Flush" labeling on products like baby wipes, aiming to educate consumers and prevent plumbing and environmental damage. This proactive measure seeks to alleviate the financial burden on homeowners and taxpayers caused by the improper disposal of wet wipes.Scope of Global Personal Care Wipes Market: Inquire before buying

Global Personal Care Wipes Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 12.46 Bn. Forecast Period 2024 to 2030 CAGR: 5.8% Market Size in 2030: US $ 18.49 Bn. Segments Covered: By Product Baby Wipes Facial & Cosmetic Wipes Hand & Body Wipes Flushable Wipes Others By Distribution Channel Online Supermarket/Hypermarket Specialty Store Pharmacy Others Global Personal Care Wipes Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Personal Care Wipes Market Key Players:

Key Players in North America: 1. Diamond Wipes International Inc. (USA) 2. Medline Industries (USA) 3. The Honest Company, Inc. (USA) 4. Procter and Gamble Co. (USA) 5. Edgewell Personal Care Co. (USA) 6.Johnson & Johnson Services, Inc. (USA) 7. Rockline Industries (USA) 8. KCWW (USA) 9. Nice-Pak International (USA) Key Players in Europe: 10. Henkel AG & Co. KGaA (Germany) 11. Pluswipes (England) 12. Edana (Belgium) 13. Unilever (United Kingdom) Key Players in Asia Pacific: 14. Unicharm Corporation (Japan) 15. Kao Corporation (Japan) 16. Hengan International Group Company Limited (China) 17. Kimberly-Clark Asia Pacific (South Korea) 18. Vinda International Holdings Limited (Hong Kong) FAQs: 1. What are the growth drivers for the Personal Care Wipes Market? Ans. Innovative Product Offerings Driving Personal Care Wipes Market Growth and is expected to be the major driver for the Personal Care Wipes Market. 2. What is the major Opportunity for the Personal Care Wipes Market growth? Ans. Consumer Education Drives Demand for Responsible Wipe Products is expected to be the major Opportunity in the Personal Care Wipes Market. 3. Which country is expected to lead the global Personal Care Wipes Market during the forecast period? Ans. North America is expected to lead the Personal Care Wipes Market during the forecast period. 4. What is the projected market size and growth rate of the Personal Care Wipes Market? Ans. The Personal Care Wipes Market size was valued at USD 12.46 Million in 2023 and the total Personal Care Wipes Market revenue is expected to grow at a CAGR of 5.8 % from 2024 to 2030, reaching nearly USD 18.49 Million. 5. What segments are covered in the Personal Care Wipes Market report? Ans. The segments covered in the Personal Care Wipes Market report are by Product, Distribution Channel, and Region.

1. Personal Care Wipes Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Personal Care Wipes Market: Dynamics 2.1. Personal Care Wipes Market Trends by Region 2.1.1. North America Personal Care Wipes Market Trends 2.1.2. Europe Personal Care Wipes Market Trends 2.1.3. Asia Pacific Personal Care Wipes Market Trends 2.1.4. Middle East and Africa Personal Care Wipes Market Trends 2.1.5. South America Personal Care Wipes Market Trends 2.2. Personal Care Wipes Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Personal Care Wipes Market Drivers 2.2.1.2. North America Personal Care Wipes Market Restraints 2.2.1.3. North America Personal Care Wipes Market Opportunities 2.2.1.4. North America Personal Care Wipes Market Challenges 2.2.2. Europe 2.2.2.1. Europe Personal Care Wipes Market Drivers 2.2.2.2. Europe Personal Care Wipes Market Restraints 2.2.2.3. Europe Personal Care Wipes Market Opportunities 2.2.2.4. Europe Personal Care Wipes Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Personal Care Wipes Market Drivers 2.2.3.2. Asia Pacific Personal Care Wipes Market Restraints 2.2.3.3. Asia Pacific Personal Care Wipes Market Opportunities 2.2.3.4. Asia Pacific Personal Care Wipes Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Personal Care Wipes Market Drivers 2.2.4.2. Middle East and Africa Personal Care Wipes Market Restraints 2.2.4.3. Middle East and Africa Personal Care Wipes Market Opportunities 2.2.4.4. Middle East and Africa Personal Care Wipes Market Challenges 2.2.5. South America 2.2.5.1. South America Personal Care Wipes Market Drivers 2.2.5.2. South America Personal Care Wipes Market Restraints 2.2.5.3. South America Personal Care Wipes Market Opportunities 2.2.5.4. South America Personal Care Wipes Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Personal Care Wipes Industry 2.8. Analysis of Government Schemes and Initiatives For Personal Care Wipes Industry 2.9. Personal Care Wipes Market Trade Analysis 2.10. The Global Pandemic Impact on Personal Care Wipes Market 3. Personal Care Wipes Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 3.1.1. Baby Wipes 3.1.2. Facial & Cosmetic Wipes 3.1.3. Hand & Body Wipes 3.1.4. Flushable Wipes 3.1.5. Others 3.2. Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 3.2.1. Online 3.2.2. Supermarket/Hypermarket 3.2.3. Specialty Store 3.2.4. Pharmacy 3.2.5. Others 3.3. Personal Care Wipes Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Personal Care Wipes Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 4.1.1. Baby Wipes 4.1.2. Facial & Cosmetic Wipes 4.1.3. Hand & Body Wipes 4.1.4. Flushable Wipes 4.1.5. Others 4.2. North America Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 4.2.1. Online 4.2.2. Supermarket/Hypermarket 4.2.3. Specialty Store 4.2.4. Pharmacy 4.2.5. Others 4.3. North America Personal Care Wipes Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 4.3.1.1.1. Baby Wipes 4.3.1.1.2. Facial & Cosmetic Wipes 4.3.1.1.3. Hand & Body Wipes 4.3.1.1.4. Flushable Wipes 4.3.1.1.5. Others 4.3.1.2. United States Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.1.2.1. Online 4.3.1.2.2. Supermarket/Hypermarket 4.3.1.2.3. Specialty Store 4.3.1.2.4. Pharmacy 4.3.1.2.5. Others 4.3.2. Canada 4.3.2.1. Canada Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 4.3.2.1.1. Baby Wipes 4.3.2.1.2. Facial & Cosmetic Wipes 4.3.2.1.3. Hand & Body Wipes 4.3.2.1.4. Flushable Wipes 4.3.2.1.5. Others 4.3.2.2. Canada Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.2.2.1. Online 4.3.2.2.2. Supermarket/Hypermarket 4.3.2.2.3. Specialty Store 4.3.2.2.4. Pharmacy 4.3.2.2.5. Others 4.3.3. Mexico 4.3.3.1. Mexico Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 4.3.3.1.1. Baby Wipes 4.3.3.1.2. Facial & Cosmetic Wipes 4.3.3.1.3. Hand & Body Wipes 4.3.3.1.4. Flushable Wipes 4.3.3.1.5. Others 4.3.3.2. Mexico Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.3.2.1. Online 4.3.3.2.2. Supermarket/Hypermarket 4.3.3.2.3. Specialty Store 4.3.3.2.4. Pharmacy 4.3.3.2.5. Others 5. Europe Personal Care Wipes Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 5.2. Europe Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 5.3. Europe Personal Care Wipes Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 5.3.1.2. United Kingdom Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 5.3.2. France 5.3.2.1. France Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 5.3.2.2. France Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 5.3.3.2. Germany Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 5.3.4.2. Italy Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 5.3.5.2. Spain Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 5.3.6.2. Sweden Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 5.3.7.2. Austria Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 5.3.8.2. Rest of Europe Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 6. Asia Pacific Personal Care Wipes Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 6.3. Asia Pacific Personal Care Wipes Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 6.3.1.2. China Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 6.3.2.2. S Korea Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 6.3.3.2. Japan Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.4. India 6.3.4.1. India Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 6.3.4.2. India Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 6.3.5.2. Australia Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 6.3.6.2. Indonesia Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 6.3.7.2. Malaysia Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 6.3.8.2. Vietnam Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 6.3.9.2. Taiwan Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 6.3.10.2. Rest of Asia Pacific Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 7. Middle East and Africa Personal Care Wipes Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 7.3. Middle East and Africa Personal Care Wipes Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 7.3.1.2. South Africa Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 7.3.2.2. GCC Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 7.3.3.2. Nigeria Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 7.3.4.2. Rest of ME&A Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 8. South America Personal Care Wipes Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 8.2. South America Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 8.3. South America Personal Care Wipes Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 8.3.1.2. Brazil Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 8.3.2.2. Argentina Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Personal Care Wipes Market Size and Forecast, by Product (2023-2030) 8.3.3.2. Rest Of South America Personal Care Wipes Market Size and Forecast, by Distribution Channel (2023-2030) 9. Global Personal Care Wipes Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Personal Care Wipes Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Diamond Wipes International Inc. (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Medline Industries (USA) 10.3. The Honest Company, Inc. (USA) 10.4. Procter and Gamble Co. (USA) 10.5. Edgewell Personal Care Co. (USA) 10.6. Johnson & Johnson Services, Inc. (USA) 10.7. Rockline Industries (USA) 10.8. KCWW (USA) 10.9. Nice-Pak International (USA) 10.10. Henkel AG & Co. KGaA (Germany) 10.11. Pluswipes (England) 10.12. Edana (Belgium) 10.13. Unilever (United Kingdom) 10.14. Unicharm Corporation (Japan) 10.15. Kao Corporation (Japan) 10.16. Hengan International Group Company Limited (China) 10.17. Kimberly-Clark Asia Pacific (South Korea) 10.18. Vinda International Holdings Limited (Hong Kong) 11. Key Findings 12. Industry Recommendations 13. Personal Care Wipes Market: Research Methodology 14. Terms and Glossary