The Particleboard Market was valued at USD 18.2 Billion in 2024 and is projected to reach USD 28.57 Billion by 2032, expanding at an impressive CAGR of 5.8% during the forecast period.Global Particleboard Market

The rising demand for engineered wood panels, modular furniture, green construction materials, and laminated particleboard. To drive the Global Particleboard Market .In India, more than 220 new furniture manufacturing units adopted automated particleboard lines in 2024 to meet fast-growing residential and commercial interior demand. China increased its production capacity by over 12% through expansions in Jiangsu and Guangxi, focusing on low-emission E0 and E1 particleboard for home décor brands. In Europe, Germany and Poland upgraded over 15 major particleboard plants with biomass boilers and AI-enabled thickness control, improving energy efficiency by up to 18%. North America is witnessing growth as the U.S. and Canada invest in recycled-wood processing, adding 1.4 million cubic meters of annual output capacity in 2024. Technological innovations include continuous-press systems, moisture-resistant MUPB boards, digital-surface embossing, zero-formaldehyde resins, and robotic edge-finishing, redefining quality and sustainability.To know about the Research Methodology :- Request Free Sample Report

Global Particleboard Market Dynamics

Growing Demand for Engineered Wood Panels in Furniture & Construction to drive the Particleboard Market The growing demand for engineered wood panels is a major driver of the Global Particleboard Market, supporting rapid adoption across residential, commercial, and modular interior applications. Particleboard now represents more than 53% of furniture material usage, dominating wardrobes, cabinets, desks, shelving, and modular kitchen systems. The surge in modular and RTA (ready-to-assemble) furniture has further strengthened demand, as manufacturers prefer pre-laminated particleboard for its durability, smooth surface, and modern aesthetic in urban apartments and office interiors. In the construction sector, particleboard is increasingly used in interior wall panels, partitions, cladding, and ceiling systems due to its lightweight properties and cost efficiency. Temporary housing such as student dormitories, emergency shelters, and site accommodations relies on particleboard for cabinetry and storage, proving its suitability for fast, budget-friendly building solutions. Global trends such as urbanization, sustainability goals, and rising preference for recycled wood particleboard are reshaping material choices. Innovations showcased at events such as LIGNA 2025 highlight how modular and prefabricated building systems now integrate decorative and moisture-resistant particleboard, reinforcing its role as a key driver of market growth. Fluctuating Raw Material Availability to limits the Particleboard Market Fluctuating raw material availability has become one of the most critical restraints in the Global Particleboard Market, directly affecting production stability and pricing. The disruptions such as the explosion at Tafisa Canada’s Lac-Mégantic particleboard plant, which damaged its 10-foot continuous press line, significantly reduced regional capacity and created particleboard shortages across North America. Similar supply pressures emerged from Georgia-Pacific’s Gaylord facility closure, where operational accidents caused long recovery timelines and tightened particleboard supply for furniture and construction manufacturers. Persistent shortages of essential inputs wood chips, sawdust, and recycled wood residues have intensified volatility, especially as industry cycles influence the availability and cost of these materials. Pandemic-related logistics delays, resin import challenges, and U.S. tariff policies further escalated costs of adhesives, pulp, and engineered wood inputs, straining supply chains in North American and European markets. Canada experienced a 20–30% production decline due to raw material scarcity and currency fluctuations, while Europe faced higher prices and reduced availability in markets like Germany and Poland. These disruptions have increased production costs, tightened inventories, and pushed manufacturers to shift toward alternative sources such as plantation wood and recycled wood particleboard, highlighting a major restraint on global market growth. Growth of Modular & Smart Furniture Market creates lucrative growth opportunities to the Particleboard Market The rapid expansion of the modular and smart furniture market is creating significant opportunities for the Global Particleboard Market, driven by urbanization, sustainability priorities, and the integration of advanced technologies in modern furniture design. In Asia-Pacific, India’s surge in modular housing and interior projects is a major growth catalyst, with over 1.8 million affordable housing units from 2022 to 2024 adopting particleboard-based interiors. The country’s modular furniture output grew by 19% year-over-year, supporting an annual demand of 7.2 million units. China, a leading producer of engineered wood panels, consumed more than 14 million cubic meters of particleboard in 2023 due to strong demand for modular residential and commercial furniture. Italy leads Modular Furniture adoption, with 78% of office desks made from laminated particleboard, supported by sustainability and customization trends. North America shows similar momentum, where Canada installed over 2.2 million square meters of particleboard subflooring and modular housing components in 2023. The rise of smart furniture, featuring wireless charging, integrated lighting, and IoT-enabled features, strengthens particleboard’s relevance due to its easy machining and adaptability. Collectively, these factors position decorative particleboard, pre-laminated boards, and moisture-resistant particleboard as key beneficiaries of global modular and smart furniture growth.Global Particleboard Market Segment Analysis

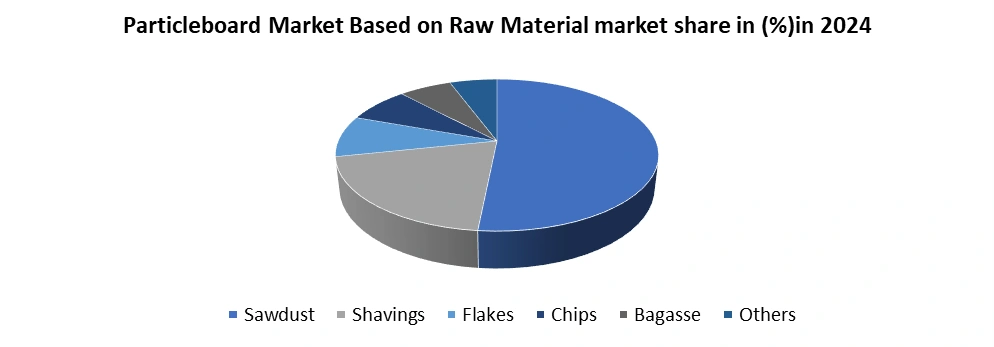

Based On Raw Material, Particleboard Market is dominated into Sawdust, Shavings, Flakes, Chips, Bagasse, Others. The sawdust segment dominates the Global Particleboard Market Due to its wide availability, low cost, and superior performance in engineered wood manufacturing. As a fine, uniform byproduct from sawmills, sawdust delivers excellent bonding strength, smooth surface finish, and higher density consistency making it ideal for laminated particleboard, furniture-grade particleboard, and interior panels. Countries such as China, India, Germany, and the U.S. rely heavily on sawdust-based particleboard to support rising demand in modular furniture, smart furniture, flooring, and construction applications. Compared with shavings, flakes, chips, and bagasse, sawdust enables faster processing, reduced waste, and better compatibility with veneers and decorative laminates. With growing trends in sustainable furniture, green building materials, and cost-efficient home décor, sawdust remains the most preferred and eco-friendly raw material, reinforcing its leadership in the global particleboard manufacturing market.

Global Particleboard Market Regional Analysis

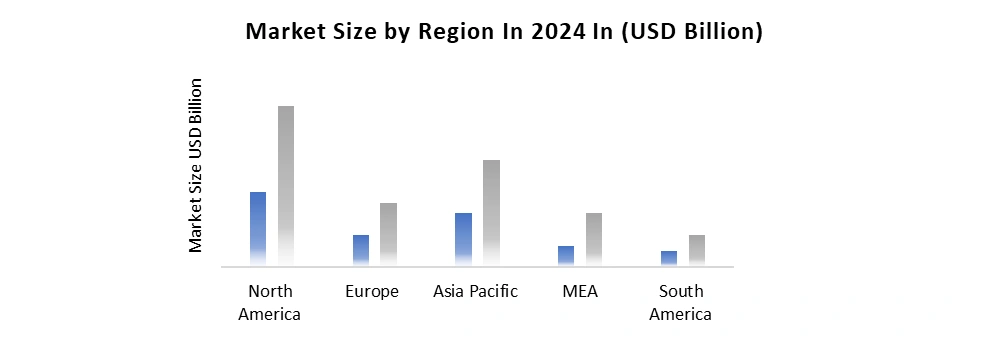

Asia Pacific dominated the Global Particleboard Market in 2024. Due to rapid industrial expansion, strong demand for engineered wood panels, and large-scale capacity additions across major producing countries. China remained the region’s growth engine, supported by its extensive wood-based panel industry, efficient supply chains, and rising consumption of particleboard in construction, modular furniture, and ready-to-assemble (RTA) furniture. The country also continued adding new particleboard manufacturing lines to meet domestic needs and export demand. Southeast Asian nations such as Vietnam, Malaysia, and Indonesia strengthened regional leadership with booming furniture manufacturing and export activities, where laminated particleboard and pre-laminated boards are widely used. Vietnam’s strong furniture export growth in 2024 further boosted particleboard consumption. India also played a key role, driven by rising residential construction, urbanization, and the growing modular furniture market. For Instance, Century Plyboards commissioning India’s largest particleboard production facility in July 2025, highlighting the region’s aggressive expansion. The abundant raw materials, cost-efficient production, and strong demand for decorative particleboard, moisture-resistant boards, and sustainable wood products enabled Asia-Pacific to lead the global market.

Global Particleboard Market Competitive Analysis

The Particleboard Market is increasingly competitive as global manufacturers expand capacity, adopt recycling technologies, and introduce high-value engineered wood panels. EGGER strengthened its presence in the wood-based panel industry with a EUR 200 million upgrade to its Markt Bibart plant in Germany, focusing on recycled wood particleboard, advanced processing systems, and premium laminated particleboard production. Its Timberpak collection site further supports sustainable sourcing and reduces dependence on virgin timber. In India, Century Plyboards enhanced its leadership by commissioning the country’s largest particleboard manufacturing facility in July 2025 near Chennai, adding 800 cubic metres of annual production to meet rising demand for furniture-grade boards and pre-laminated particleboard in domestic and export markets. Kronospan continues aggressive expansion through acquisitions and modernisation in North America to strengthen supply chains and boost production of value-added particleboard for furniture and construction. Companies such as Sonae Arauco and Kastamonu Entegre are investing in circular manufacturing, new recycling lines, and specialty products such as moisture-resistant and fire-rated particleboard. With sustainability, automation, energy-efficient continuous pressing, and decorative particleboard surfaces becoming key differentiators, market leaders are focusing on technology-driven growth and high-performance product portfolios.Global Particleboard Market Recent Development

1. In July 2025, Century Plyboards (India) Ltd commissioned India’s largest particle board manufacturing facility at Therovy Kandigai near Chennai, Tamil Nadu. The plant has an annual production capacity of 800 cubic metres and is designed to meet the rising demand for engineered wood panels across domestic and international markets. 2. In November 2024, EGGER announced an investment of EUR 200 million (USD 214 million) to upgrade its particleboard plant in Markt Bibart, Germany. The investment focuses on processing recycled wood and expanding laminated particleboard production. The project also includes a Timberpak collection site to ensure a steady supply of recycled wood, with the first phase of construction already in progress. 3. In May 2024, Action TESA introduced MOIST-MASTER, a high moisture-resistant particle board engineered for long-lasting performance in humid and coastal regions. With a density exceeding 700, the board provides strong resistance to borers and termites while maintaining low formaldehyde emissions, offering an advanced solution for durable and eco-friendly applications.Particleboard Market Scope: Inquiry Before Buying

Global Particleboard Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 18.2 Bn. Forecast Period 2025 to 2032 CAGR: 5.8% Market Size in 2032: USD 28.57 Bn. Segments Covered: by Raw Material Sawdust Shavings Flakes Chips Bagasse Others by Application Construction Furniture Infrastructure Others by End Use Residential Commercial Industrial by Sales Channel Offline Wholesale Distributors Retail Stores Direct Sales Online Particleboard Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Particleboard Key Players

1. ARAUCO 2. Associate Decor 3. Boise Cascade Company 4. Century Plyboards (India) Ltd 5. EGGER 6. Georgia-Pacific 7. Kastamonu Entegre 8. Krifour Industries Pvt. Ltd. 9. Kronoplus Limited 10. Roseburg Forest Products 11. Siam Riso Wood Products Co., Ltd 12. Sonae Arauco 13. SWISS KRONO Group 14. Timber Products Company 15. West Fraser Timber Co. 16. Daewon Industrial 17. Duratex 18. Finsa 19. Homanit 20. Masonite 21. Nelson Pine 22. Pfleiderer 23. Sumitomo Forestry 24. Swedish Wood 25. UniboardFrequently Asked Questions:

1. What is the growth rate of Global Particleboard Market? Ans: The Global Particleboard Market is growing at a CAGR of 5.8 % during forecasting period 2025-2032. 2. What is scope of the Global Particleboard Market report? Ans: Global Particleboard Market report helps with the PESTEL, PORTER, Recommendations for Investors & Leaders, and market estimation of the forecast period. 3. Who are the key players in Global Particleboard Market? Ans: The important key players in the Global Particleboard Market are ARAUCO,Associate Décor,Boise Cascade Company,Century Plyboards (India) Ltd, and EGGER 4. What is the study period of this Market? Ans: The Global Particleboard Market is studied from 2024 to 2032.

1. Particleboard Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion) - By Segments, Regions, and Country 2. Particleboard Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Application Segment 2.3.4. End User Segment 2.3.5. Total Company Revenue (2024) 2.3.6. Market Share (%) 2.3.7. Profit Margin (%) 2.3.8. Growth Rate (%) 2.3.9. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Particleboard Market: Dynamics 3.1. Particleboard Market Trends 3.2. Particleboard Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Particleboard Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Particleboard Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Particleboard Market Size and Forecast, By Raw Material (2024-2032) 4.1.1. Sawdust 4.1.2. Shavings 4.1.3. Flakes 4.1.4. Chips 4.1.5. Bagasse 4.1.6. Others 4.2. Particleboard Market Size and Forecast, By Application (2024-2032) 4.2.1. Construction 4.2.2. Furniture 4.2.3. Infrastructure 4.2.4. Others 4.3. Particleboard Market Size and Forecast, By End Use (2024-2032) 4.3.1. Residential 4.3.2. Commercial 4.3.3. Industrial 4.4. Particleboard Market Size and Forecast, By Sales Channel (2024-2032) 4.4.1. Offline 4.4.1.1. Wholesale Distributors 4.4.1.2. Retail Stores 4.4.1.3. Direct Sales 4.4.2. Online 4.5. Particleboard Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Particleboard Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Particleboard Market Size and Forecast, By Raw Material (2024-2032) 5.1.1. Sawdust 5.1.2. Shavings 5.1.3. Flakes 5.1.4. Chips 5.1.5. Bagasse 5.1.6. Other 5.2. North America Particleboard Market Size and Forecast, By Application (2024-2032) 5.2.1. Construction 5.2.2. Furniture 5.2.3. Infrastructure 5.2.4. Others 5.3. North America Particleboard Market Size and Forecast, By End Use (2024-2032) 5.3.1. Residential 5.3.2. Commercial 5.3.3. Industrial 5.4. North America Particleboard Market Size and Forecast, By Sales Channel (2024-2032) 5.4.1. Offline 5.4.1.1. Wholesale Distributors 5.4.1.2. Retail Stores 5.4.1.3. Direct Sales 5.4.2. Online 5.5. North America Particleboard Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Particleboard Market Size and Forecast, By Raw Material (2024-2032) 5.5.1.2. United States Particleboard Market Size and Forecast, By Application (2024-2032) 5.5.1.3. United States Particleboard Market Size and Forecast, By End Use 5.5.1.4. United States Particleboard Market Size and Forecast, By Sales Channel (2024-2032) 5.5.2. Canada 5.5.2.1. Canada Particleboard Market Size and Forecast, By Raw Material (2024-2032) 5.5.2.2. Canada Particleboard Market Size and Forecast, By Application (2024-2032) 5.5.2.3. Canada Particleboard Market Size and Forecast, By End Use (2024-2032) 5.5.2.4. Canada Particleboard Market Size and Forecast, By Sales Channel (2024-2032) 5.5.3. Mexico 5.5.3.1. Mexico Particleboard Market Size and Forecast, By Raw Material (2024-2032) 5.5.3.2. Mexico Particleboard Market Size and Forecast, By Application (2024-2032) 5.5.3.3. Mexico Particleboard Market Size and Forecast, By End Use (2024-2032) 5.5.3.4. Mexico Particleboard Market Size and Forecast, By Sales Channel (2024-2032) 6. Europe Particleboard Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Particleboard Market Size and Forecast, By Raw Material (2024-2032) 6.2. Europe Particleboard Market Size and Forecast, By Application (2024-2032) 6.3. Europe Particleboard Market Size and Forecast, By End Use (2024-2032) 6.4. Europe Particleboard Market Size and Forecast, By Sales Channel (2024-2032) 6.5. Europe Particleboard Market Size and Forecast, By Country (2024-2032) 6.5.1. United Kingdom 6.5.2. France 6.5.3. Germany 6.5.4. Italy 6.5.5. Spain 6.5.6. Sweden 6.5.7. Russia 6.5.8. Rest of Europe 7. Asia Pacific Particleboard Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Particleboard Market Size and Forecast, By Raw Material (2024-2032) 7.2. Asia Pacific Particleboard Market Size and Forecast, By Application (2024-2032) 7.3. Asia Pacific Particleboard Market Size and Forecast, By End Use (2024-2032) 7.4. Asia Pacific Particleboard Market Size and Forecast, By Sales Channel (2024-2032) 7.5. Asia Pacific Particleboard Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.2. S Korea 7.5.3. Japan 7.5.4. India 7.5.5. Australia 7.5.6. Indonesia 7.5.7. Malaysia 7.5.8. Philippines 7.5.9. Thailand 7.5.10. Vietnam 7.5.11. Rest of Asia Pacific 8. Middle East and Africa Particleboard Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Particleboard Market Size and Forecast, By Raw Material (2024-2032) 8.2. Middle East and Africa Particleboard Market Size and Forecast, By Application (2024-2032) 8.3. Middle East and Africa Particleboard Market Size and Forecast, By End Use (2024-2032) 8.4. Middle East and Africa Particleboard Market Size and Forecast, By Sales Channel (2024-2032) 8.5. Middle East and Africa Particleboard Market Size and Forecast, By Country (2024-2032) 8.5.1. South Africa 8.5.2. GCC 8.5.3. Nigeria 8.5.4. Rest of ME&A 9. South America Particleboard Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America Particleboard Market Size and Forecast, By Raw Material (2024-2032) 9.2. South America Particleboard Market Size and Forecast, By Application (2024-2032) 9.3. South America Particleboard Market Size and Forecast, By End Use (2024-2032) 9.4. South America Particleboard Market Size and Forecast, By Sales Channel (2024-2032) 9.5. South America Particleboard Market Size and Forecast, By Country (2024-2032) 9.5.1. Brazil 9.5.2. Argentina 9.5.3. Colombia 9.5.4. Chile 9.5.5. Rest of South America 10. Company Profile: Key Players 10.1. ARAUCO 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.2. Associate Decor 10.3. Boise Cascade Company 10.4. Century Prowud 10.5. Century Plyboards (India) Ltd 10.6. EGGER 10.7. Georgia-Pacific 10.8. Kastamonu Entegre 10.9. Krifour Industries Pvt. Ltd. 10.10. Kronoplus Limited 10.11. Roseburg Forest Products 10.12. Siam Riso Wood Products Co., Ltd 10.13. Sonae Arauco 10.14. SWISS KRONO Group 10.15. Timber Products Company 10.16. West Fraser Timber Co. 10.17. Daewon Industrial 10.18. Duratex 10.19. Finsa 10.20. Homanit 10.21. Masonite 10.22. Nelson Pine 10.23. Pfleiderer 10.24. Sumitomo Forestry 10.25. Swedish Wood 10.26. Uniboard 11. Key Findings 12. Analyst Recommendations 13. Particleboard Market – Research Methodology