Global Office Peripherals and Products Market was worth US$ 40.61 Bn in 2022, and overall revenue is anticipated to rise at a rate of 4.3 % from 2023 to 2029, reaching almost US$ 54.54 Bn In 2029.Global Office Peripherals and Products Market Overview:

With the increasing demand for critical supplies such as shredders, scanners, and counterfeit detectors, the worldwide market is expected to grow US $ 50.14 Bn throughout the forecast period. In commercial settings, the need for multifunctional equipment such as printers, photocopiers, and scanners has been steadily increasing.To know about the Research Methodology :- Request Free Sample Report

Global Office Peripherals and Products Market Dynamics:

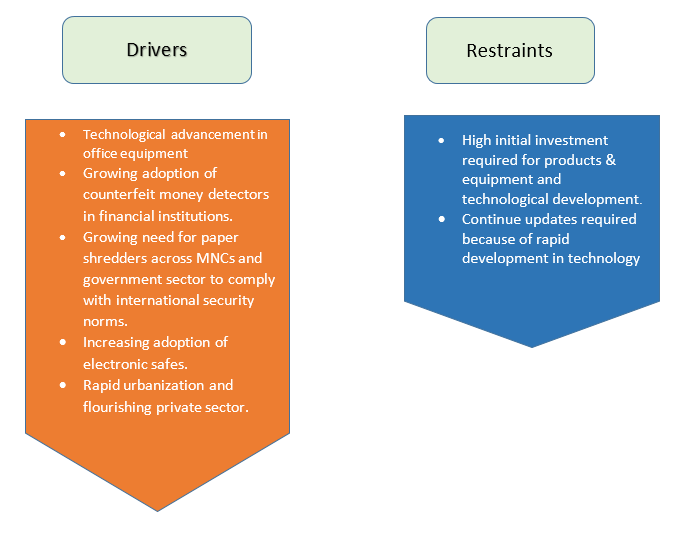

The growth of Office Peripherals and product market is driven by Technological developments in office equipment as the technology is updated every day. Financial organizations are increasingly using counterfeit money detectors. Growing demand for paper shredders in MNCs and the government sector to meet international security standards, rising use of electronic equipment, and rapid urbanization and a growing private sector The high initial investment required for products and equipment, as well as technology development, these two conditions currently hampering the growth of the Global Office Peripherals and Products Market.

Global Office Peripherals and Products Market Segment Analysis:

The market segment of the Office Peripherals and Products Market is based on various types of products and applications. Based on product, Bill counters, coin sorters, counterfeit detectors, safes, deposit boxes, and cash handlers, shredders (plastic and paper), laminators, printers, scanners and photocopiers are the different types of products on the market. In 2019, the printers, scanners, and photocopiers segment had the majority of the market share, and this is expected to continue in the future years. Banks and financial organisations deploy counterfeit money detectors to prevent cash counterfeiting and identify fake currency denominations. Counterfeit detectors are in high demand due to the growing need to combat and overcome worries about fake currencies and illegal money laundering throughout the world. Over the forecast period, the segment is expected to develop at a fast rate. In the office peripherals and goods market, the paper shredder segment accounted for a large share, especially in the BFSI sector, stock market businesses, and government organisations. This is due to growing concern about the security of classified and sensitive information. Based on application, the Office Peripheral and Product Market is divided into Business use, Governmental use and personal use. The use of office peripherals in the business segment is dominated because of the increasing demand for printers, scanners, coin sorters and others in business applications. The growth rate is xx% in the forecast period.Global Office Peripherals and Products Market Regional Insights:

North America, Europe, Asia Pacific (APAC), South America, and the Middle East and Africa are the regions in which the market is divided (MEA). In terms of income and shipping of printers, shredders, and counterfeit detectors, North America and the Asia Pacific are the most important markets. In the Asia Pacific region, the increasing literacy rate, growing population, rapid urbanisation, and stable economic situations of various nations are projected to drive demand for office supplies. Two of the most important production centres for these items are Japan and China. The Southeast Asian industry has been fuelled by the rising use of office components, favourable demographics, and governmental reforms. Increased government initiatives are projected to support the formation of new businesses in Europe, driving this regional market forward. Furthermore, advantageous government measures such as legal protection and programmes and policies to support start-ups are making it easier to do business. The expansion of the regional market is also aided by financial perks such as tax returns and favourable taxation systems. The objective of the report is to present a comprehensive analysis of the Office Peripherals and Products Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Market dynamics, structure by analyzing the market segments and project the Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Market make the report investor’s guide.Global Office Peripherals and Products Market Scope: Inquire before buying

Global Office Peripherals and Products Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 40.61 Bn. Forecast Period 2023 to 2029 CAGR: 4.3% Market Size in 2029: US $ 54.54 Bn. Segments Covered: by Product Bill counter Coin sorter Counter detector Safe-deposit boxes Shredders Laminator Printer, scanner and photocopies by Application Business use Government use Personal use Global Office Peripherals and Products Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Global Office Peripherals and Products Market, Key Players are

1. Crayon tech 2.Cannon 3. Dell 4.Epson 5. Gcc printer 6. AccBanker LED 420 7.ZY Tech Co., Ltd.; 8.International Empire Traders 9.Ozone Group; 10.Yale (ASSA ABLOY); 11.American Shredder, Inc.; Ameri-Shred; 12.Aurora Corp of America; 13.Dahle North America, Inc.; 14.Brother International Corporation; 15.Konica Minolta Business Solution U.S.A., Inc. 16.Ricoh Company Ltd.Frequently Asked Questions:

1) What was the market size of market in 2022? Ans - Office Peripherals and Products Market was worth US$ 40.61 Bn in 2022. 2) What are the market segment of the Office peripheral and product market? Ans -The market segments are based on product and application of Office peripheral and product market. 3) What is the forecast period considered for Office peripheral and product market? Ans – The forecast period for Office Peripherals and Products Market is 2023 to 2029. 4) Which are the worldwide major key players covered for Office peripheral and product market report? Ans – The major key players in the Unified Communication and Business Headsets across the globe are as follows Crayon tech, Cannon, Dell, Epson, Gcc printeter, AccBanker LED 420 5) Which region is dominated in Unified Communication and Business Headsets Market? Ans – In 2022, the Asia Pacific region dominated the Unified Communication and Business Headsets Market.

1. Office Peripherals and Products Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Office Peripherals and Products Market: Dynamics 2.1. Office Peripherals and Products Market Trends by Region 2.1.1. North America Office Peripherals and Products Market Trends 2.1.2. Europe Office Peripherals and Products Market Trends 2.1.3. Asia Pacific Office Peripherals and Products Market Trends 2.1.4. Middle East and Africa Office Peripherals and Products Market Trends 2.1.5. South America Office Peripherals and Products Market Trends 2.2. Office Peripherals and Products Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Office Peripherals and Products Market Drivers 2.2.1.2. North America Office Peripherals and Products Market Restraints 2.2.1.3. North America Office Peripherals and Products Market Opportunities 2.2.1.4. North America Office Peripherals and Products Market Challenges 2.2.2. Europe 2.2.2.1. Europe Office Peripherals and Products Market Drivers 2.2.2.2. Europe Office Peripherals and Products Market Restraints 2.2.2.3. Europe Office Peripherals and Products Market Opportunities 2.2.2.4. Europe Office Peripherals and Products Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Office Peripherals and Products Market Drivers 2.2.3.2. Asia Pacific Office Peripherals and Products Market Restraints 2.2.3.3. Asia Pacific Office Peripherals and Products Market Opportunities 2.2.3.4. Asia Pacific Office Peripherals and Products Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Office Peripherals and Products Market Drivers 2.2.4.2. Middle East and Africa Office Peripherals and Products Market Restraints 2.2.4.3. Middle East and Africa Office Peripherals and Products Market Opportunities 2.2.4.4. Middle East and Africa Office Peripherals and Products Market Challenges 2.2.5. South America 2.2.5.1. South America Office Peripherals and Products Market Drivers 2.2.5.2. South America Office Peripherals and Products Market Restraints 2.2.5.3. South America Office Peripherals and Products Market Opportunities 2.2.5.4. South America Office Peripherals and Products Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Office Peripherals and Products Industry 2.8. Analysis of Government Schemes and Initiatives For Office Peripherals and Products Industry 2.9. Office Peripherals and Products Market Trade Analysis 2.10. The Global Pandemic Impact on Office Peripherals and Products Market 3. Office Peripherals and Products Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 3.1.1. Bill counter 3.1.2. Coin sorter 3.1.3. Counter detector 3.1.4. Safe-deposit boxes 3.1.5. Shredders 3.1.6. Laminator 3.1.7. Printer, scanner and photocopies 3.2. Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 3.2.1. Business use 3.2.2. Government use 3.2.3. Personal use 3.3. Office Peripherals and Products Market Size and Forecast, by Region (2022-2029) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Office Peripherals and Products Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 4.1.1. Bill counter 4.1.2. Coin sorter 4.1.3. Counter detector 4.1.4. Safe-deposit boxes 4.1.5. Shredders 4.1.6. Laminator 4.1.7. Printer, scanner and photocopies 4.2. North America Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 4.2.1. Business use 4.2.2. Government use 4.2.3. Personal use 4.3. North America Office Peripherals and Products Market Size and Forecast, by Country (2022-2029) 4.3.1. United States 4.3.1.1. United States Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 4.3.1.1.1. Bill counter 4.3.1.1.2. Coin sorter 4.3.1.1.3. Counter detector 4.3.1.1.4. Safe-deposit boxes 4.3.1.1.5. Shredders 4.3.1.1.6. Laminator 4.3.1.1.7. Printer, scanner and photocopies 4.3.1.2. United States Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 4.3.1.2.1. Business use 4.3.1.2.2. Government use 4.3.1.2.3. Personal use 4.3.2. Canada 4.3.2.1. Canada Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 4.3.2.1.1. Bill counter 4.3.2.1.2. Coin sorter 4.3.2.1.3. Counter detector 4.3.2.1.4. Safe-deposit boxes 4.3.2.1.5. Shredders 4.3.2.1.6. Laminator 4.3.2.1.7. Printer, scanner and photocopies 4.3.2.2. Canada Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 4.3.2.2.1. Business use 4.3.2.2.2. Government use 4.3.2.2.3. Personal use 4.3.3. Mexico 4.3.3.1. Mexico Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 4.3.3.1.1. Bill counter 4.3.3.1.2. Coin sorter 4.3.3.1.3. Counter detector 4.3.3.1.4. Safe-deposit boxes 4.3.3.1.5. Shredders 4.3.3.1.6. Laminator 4.3.3.1.7. Printer, scanner and photocopies 4.3.3.2. Mexico Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 4.3.3.2.1. Business use 4.3.3.2.2. Government use 4.3.3.2.3. Personal use 5. Europe Office Peripherals and Products Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 5.2. Europe Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 5.3. Europe Office Peripherals and Products Market Size and Forecast, by Country (2022-2029) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 5.3.1.2. United Kingdom Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 5.3.2. France 5.3.2.1. France Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 5.3.2.2. France Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 5.3.3. Germany 5.3.3.1. Germany Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 5.3.3.2. Germany Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 5.3.4. Italy 5.3.4.1. Italy Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 5.3.4.2. Italy Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 5.3.5. Spain 5.3.5.1. Spain Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 5.3.5.2. Spain Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 5.3.6. Sweden 5.3.6.1. Sweden Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 5.3.6.2. Sweden Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 5.3.7. Austria 5.3.7.1. Austria Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 5.3.7.2. Austria Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 5.3.8.2. Rest of Europe Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 6. Asia Pacific Office Peripherals and Products Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 6.2. Asia Pacific Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 6.3. Asia Pacific Office Peripherals and Products Market Size and Forecast, by Country (2022-2029) 6.3.1. China 6.3.1.1. China Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 6.3.1.2. China Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 6.3.2. S Korea 6.3.2.1. S Korea Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 6.3.2.2. S Korea Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 6.3.3. Japan 6.3.3.1. Japan Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 6.3.3.2. Japan Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 6.3.4. India 6.3.4.1. India Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 6.3.4.2. India Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 6.3.5. Australia 6.3.5.1. Australia Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 6.3.5.2. Australia Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 6.3.6. Indonesia 6.3.6.1. Indonesia Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 6.3.6.2. Indonesia Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 6.3.7. Malaysia 6.3.7.1. Malaysia Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 6.3.7.2. Malaysia Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 6.3.8. Vietnam 6.3.8.1. Vietnam Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 6.3.8.2. Vietnam Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 6.3.9. Taiwan 6.3.9.1. Taiwan Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 6.3.9.2. Taiwan Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 6.3.10.2. Rest of Asia Pacific Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 7. Middle East and Africa Office Peripherals and Products Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 7.2. Middle East and Africa Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 7.3. Middle East and Africa Office Peripherals and Products Market Size and Forecast, by Country (2022-2029) 7.3.1. South Africa 7.3.1.1. South Africa Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 7.3.1.2. South Africa Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 7.3.2. GCC 7.3.2.1. GCC Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 7.3.2.2. GCC Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 7.3.3. Nigeria 7.3.3.1. Nigeria Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 7.3.3.2. Nigeria Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 7.3.4.2. Rest of ME&A Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 8. South America Office Peripherals and Products Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 8.2. South America Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 8.3. South America Office Peripherals and Products Market Size and Forecast, by Country (2022-2029) 8.3.1. Brazil 8.3.1.1. Brazil Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 8.3.1.2. Brazil Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 8.3.2. Argentina 8.3.2.1. Argentina Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 8.3.2.2. Argentina Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Office Peripherals and Products Market Size and Forecast, by Product (2022-2029) 8.3.3.2. Rest Of South America Office Peripherals and Products Market Size and Forecast, by Application (2022-2029) 9. Global Office Peripherals and Products Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Office Peripherals and Products Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Crayon tech 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Cannon 10.3. Dell 10.4. Epson 10.5. Gcc printer 10.6. AccBanker LED 420 10.7. ZY Tech Co., Ltd.; 10.8. International Empire Traders 10.9. Ozone Group; 10.10. Yale (ASSA ABLOY); 10.11. American Shredder, Inc.; Ameri-Shred; 10.12. Aurora Corp of America; 10.13. Dahle North America, Inc.; 10.14. Brother International Corporation; 10.15. Konica Minolta Business Solution U.S.A., Inc. 10.16. Ricoh Company Ltd 11. Key Findings 12. Industry Recommendations 13. Office Peripherals and Products Market: Research Methodology 14. Terms and Glossary