Occlusion Device Market size was valued at US$ 3.03 Bn. in 2022, and the total Occlusion Devices revenue is expected to grow at 4.8% from 2023 to 2029, reaching nearly US$ 4.21 Bn.Occlusion Device Market Overview:

Occlusion is a medical term that refers to the blockage or closing of blood vessels or hollow organs. Occlusion devices are medical devices that are used in the treatment of several defects of the body parts of a Patient. Occlusion devices have been preferred mostly for treating cardiovascular defects, retinal defects, neurological defects, gynecological defects, oncological defects, etc. The devices used for treating occlusion, i.e., blockage or closing of blood vessels or hollow organs, are clinically tested and are effective for the removal of the occlusion from different parts of the body of the patient. Further, the Occlusion devices market is mainly driven by the prevalence of the huge demand for treatment and diagnosis of a patient. The report explores the Occlusion Devices market's segments (Type, Product, Application, End-User, and Region). Data has been provided by market participants and regions (North America, Asia Pacific, Europe, Middle East & Africa, and South America). It provides a thorough analysis of the rapid advances that are currently taking place across all industry sectors. Facts and figures, illustrations, and presentations are used to provide key data analysis for the historical period from 2017 to 2022. The report investigates the Occlusion Devices market's drivers, limitations, prospects, and barriers. This MMR report includes investor recommendations based on a thorough examination of the Occlusion Devices market's contemporary competitive scenario.To know about the Research Methodology:- Request Free Sample Report

Occlusion Devices Market Dynamics:

The increasing geriatric population and an increase in the adoption of minimally invasive surgeries help to boost the occlusion devices market growth. Less post-operative pain is caused by minimally invasive surgeries (MIS). Other major factors which are responsible for the growth of the occlusion devices market include the rising prevalence of chronic diseases such as cancer and cardiovascular diseases, along with technological advancements. According to the World Health Organization (WHO), by 2050, the world's population will be aged 60 years and is expected to reach nearly 2 billion. Thus, Effective reimbursement policies are the second large factor responsible for the market growth of the Occlusion medical devices market by 2029. Furthermore, increasing the awareness, distribution, and manufacturing level of these devices in developing countries helps to grow the Occlusion device market. The higher prices of occlusion devices are one of the major restraining factors affecting the growth of the market. Moreover, the technical advancements, technical challenges, regulatory requirements, and the situations arrived within the surgery situations faced by the doctors and surgeons are some of the restraints for the Occlusion devices market. It affected the demand for Occlusion devices. Another key restraint for the Occlusion device market is insufficiently skilled professionals for minimally invasive procedures, which is expected to restrain the market growth. The increased expenses in the healthcare sector and increased spending on research and development across the developing countries are expected to provide potential opportunities for growth in the occlusion devices market during the forecast period. Apart from that, within the targeted market, the opportunity of acquiring by the major market players to enhance the growth of the market has been idealized as well. One of the key challenging factors for the Occlusion Devices market is the high cost of the devices, and it is harsh for many people to afford the Occlusion Devices. Furthermore, lack of awareness of the devices among the population, lack of availability, lack of trained surgeons, and supply chain management are some of the major challenging factors. Hence, these factors have affected the market globally.Occlusion Devices Market Segment Analysis:

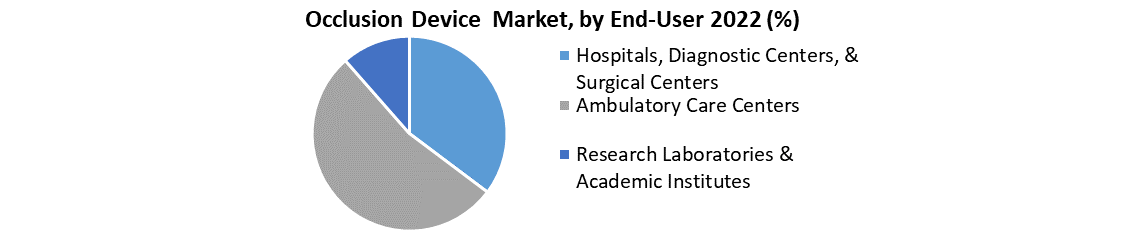

Based on the Product, the occlusion removal devices segment is expected to dominate the market in 2029. To remove vascular occlusion present in the vascular lumen in the body, Occlusion removal devices are used. The occlusion removal devices segment grows significantly due to the major key factors like the rise in the number of cardiovascular patients, which creates the demand for diagnostic and treatments. Based on the application, the neurology segment is expected to dominate the market in terms of the market size in 2029. The major factors which are responsible for the growth of the occlusion devices market for neurology applications are the increasing number of targeting neurological procedures across a multitude of countries, increased research in the field of interventional neurology, reinforcement of the research facilities of major device manufacturers, and favorable scenarios for neurovascular treatment, diagnosis, surgeries, etc. across developed countries. Based on end-users, hospitals, diagnostic centers, and surgical centers are expected to account for the largest share of the market in the occlusion device market in 2029. The major key factors which are responsible for the growth of the segment are the growing adoption of minimally invasive surgical procedures, the increasing purchasing power of end-users across major countries, and the availability of reimbursements for target procedures and diagnoses in developed countries.

Occlusion Devices Market Regional Insights:

North America is expected to dominate the occlusion devices market at the end of the forecast period, the major driving factor is the increasing population of patients who are suffering from chronic diseases, the rising in a number of the incidence of auspicious reimbursement scenarios for minimally invasive surgeries, and Technological advancement. Furthermore, the growth in the investment in healthcare, government initiatives, and an increase in the geriatric population help in the growth of the market. Apart from that, the US is considered the largest market in North America, and Canada is considered to be the fastest-growing market. Moreover, the prevalence of major key players is further anticipated to drive the market growth in the occlusion devices market in the region by 2029. The European market is also expected to witness favorable growth prospects during the forecast period. Hence, this region is the major contributor to the growth of the Occlusion devices market. This market revenue growth is mainly attributed to factors such as increasing incidences rate of fatal accidents and sports injuries, increasing prevalence of neurological disorders, and rising number of neurosurgical procedures. In addition, Asia-Pacific is the large region for growth in the occlusion devices market due to the rise in the need for global occlusion devices by 2029. The objective of the report is to present a comprehensive analysis of the Occlusion Devices market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear, futuristic view of the industry to the decision-makers. The report also helps in understanding the Occlusion Devices market dynamics, and structure by analyzing the market segments and projecting the Occlusion Devices market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Occlusion Devices market make the report investor’s guide.Occlusion Devices Market Scope: Inquire before buying

Occlusion Devices Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 3.03 Bn. Forecast Period 2023 to 2029 CAGR: 4.8% Market Size in 2029: US $ 4.21 Bn. Segments Covered: by Type • Cylindrical • Cone by Product • Occlusion Removal Devices o Stent Retrievers o Coil Retrievers o Balloon Occlusion Devices o Suction & Aspiration Devices • Embolization Devices o Embolic Coils o Liquid Embolic Agents o Tubal Occlusion Devices • Support Devices o Microcatheters o Guidewires by Application • Neurology • Cardiology • Urology • Oncology • Gynecology • Other by End-User • Hospitals, Diagnostic Centers, & Surgical Centers • Ambulatory Care Centers • Research Laboratories & Academic Institutes Occlusion Devices Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Occlusion Devices Market Key Players

• Boston Scientific • Medtronic • Stryker Corporation • Terumo • Penumbra • KYOTO MEDICAL • Meril Life Sciences Pvt. Ltd • DePuy Synthes • Abbott Laboratories • Acrostak Int. Distr. Sàrl • ASAHI INTECC CO • Elixir Medical Corporation • Cardinal Health • Edwards Lifesciences • Boston Scientific Corporation Frequently Asked Questions: 1. Which region has the largest share in Global Occlusion Devices Market? Ans: North America region held the highest share in 2022. 2. What is the growth rate of Global Occlusion Devices Market? Ans: The Global Occlusion Devices Market is growing at a CAGR of 4.8% during forecasting period 2023-2029. 3. What is scope of the Global Occlusion Devices Market report? Ans: Global Occlusion Devices Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Occlusion Devices Market? Ans: The important key players in the Global Occlusion Devices Market are – Boston Scientific, Medtronic, Stryker Corporation, Terumo, Penumbra, KYOTO MEDICAL, Meril Life Sciences Pvt. Ltd, DePuy Synthes, Abbott Laboratories, Acrostak Int. Distr. Sàrl, ASAHI INTECC CO, Elixir Medical Corporation, Cardinal Health, Edwards Lifesciences, Boston Scientific Corporation, 5. What is the study period of this Market? Ans: The Global Occlusion Devices Market is studied from 2022 to 2029.

1. Occlusion Device Market: Research Methodology 2. Occlusion Device Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Occlusion Device Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Occlusion Device Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Occlusion Device Market Segmentation 4.1 Occlusion Device Market, by Type (2022-2029) • Cylindrical • Cone 4.2 Occlusion Device Market, by Product (2022-2029) • Occlusion Removal Devices o Stent Retrievers o Coil Retrievers o Balloon Occlusion Devices o Suction & Aspiration Devices • Embolization Devices o Embolic Coils o Liquid Embolic Agents o Tubal Occlusion Devices • Support Devices o Microcatheters o Guidewires 4.3 Occlusion Device Market, by Application (2022-2029) • Neurology • Cardiology • Urology • Oncology • Gynecology • Other 4.4 Occlusion Device Market, by End-user (2022-2029) • Hospitals, Diagnostic Centers, & Surgical Centers • Ambulatory Care Centers • Research Laboratories & Academic Institutes 5 North America Occlusion Device Market(2022-2029) 5.1 North America Occlusion Device Market, by Type (2022-2029) • Cylindrical • Cone 5.2 North America Occlusion Device Market, by Product (2022-2029) • Occlusion Removal Devices o Stent Retrievers o Coil Retrievers o Balloon Occlusion Devices o Suction & Aspiration Devices • Embolization Devices o Embolic Coils o Liquid Embolic Agents o Tubal Occlusion Devices • Support Devices o Microcatheters o Guidewires 5.3 North America Occlusion Device Market, by Application (2022-2029) • Neurology • Cardiology • Urology • Oncology • Gynecology • Other 5.4 North America Occlusion Device Market, by End-user (2022-2029) • Hospitals, Diagnostic Centers, & Surgical Centers • Ambulatory Care Centers • Research Laboratories & Academic Institutes 5.5 North America Occlusion Device Market, by Country (2022-2029) • United States • Canada • Mexico 6 Europe Occlusion Device Market (2022-2029) 6.1. European Occlusion Device Market, by Type (2022-2029) 6.2. European Occlusion Device Market, by Product (2022-2029) 6.3. European Occlusion Device Market, by Application (2022-2029) 6.4. European Occlusion Device Market, by End-user (2022-2029) 6.5. European Occlusion Device Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7 Asia Pacific Occlusion Device Market (2022-2029) 7.1. Asia Pacific Occlusion Device Market, by Type (2022-2029) 7.2. Asia Pacific Occlusion Device Market, by Product (2022-2029) 7.3. Asia Pacific Occlusion Device Market, by Application (2022-2029) 7.4. Asia Pacific Occlusion Device Market, by End-user (2022-2029) 7.5. Asia Pacific Occlusion Device Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8 Middle East and Africa Occlusion Device Market (2022-2029) 8.1 Middle East and Africa Occlusion Device Market, by Type (2022-2029) 8.2. Middle East and Africa Occlusion Device Market, by Product (2022-2029) 8.3. Middle East and Africa Occlusion Device Market, by Application (2022-2029) 8.4. Middle East and Africa Occlusion Device Market, by End-user (2022-2029) 8.5. Middle East and Africa Occlusion Device Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9 South America Occlusion Device Market (2022-2029) 9.1. South America Occlusion Device Market, by Type (2022-2029) 9.2. South America Occlusion Device Market, by Product (2022-2029) 9.3. South America Occlusion Device Market, by Application (2022-2029) 9.4. South America Occlusion Device Market, by End-user (2022-2029) 9.5. South America Occlusion Device Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10 Company Profile: Key players 10.1 Boston Scientific 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Medtronic 10.3 Stryker Corporation 10.4 Terumo 10.5 Penumbra 10.6 KYOTO MEDICAL 10.7 Meril Life Sciences Pvt. Ltd 10.8 DePuy Synthes 10.9 Abbott Laboratories 10.10 Acrostak Int. Distr. Sàrl 10.11 ASAHI INTECC CO 10.12 Elixir Medical Corporation 10.13 Cardinal Health 10.14 Edwards Lifesciences 10.15 Boston Scientific Corporation