Global Non-GMO Soybean Market size was valued at USD 25.88 Bn in 2023 and is expected to reach USD 44.35 Bn by 2030, at a CAGR of 8 %.Overview

Non-GMO (Genetically Modified Organisms) soybeans offer a myriad of benefits, making them a staple in healthy diets. With superior nutritional profiles and versatile applications, they provide a valuable alternative to dairy products and meat substitutes. Non-GMO soybeans boast higher protein content, lower saturated fats, and zero cholesterol, promoting heart health and aiding in weight management. Rich in fiber, isoflavones, and essential vitamins and minerals, they support bone health, pregnancy, and overall well-being. Additionally, their role in reducing LDL cholesterol levels underscores their significance in maintaining cardiovascular health. Incorporating non-GMO soybeans into diets not only enhances nutritional intake but also contributes to a healthier lifestyle. Soybeans serve a variety of applications in the food business. From use as edible oil to nutrient-rich supplementary food, Soybean has a wide range of applications in the Food & Beverages Market. It is observed that the shift of preference from conventional to the organic genre has resulted in demand for food products to be free from chemicals and should not cause any damage to the environment. This has resulted in demand for Non-GMO Soybean products. Non-GMO products are produced without genetic engineering and are of the purest form in nature. Rising health concerns and demand for organic food have resulted in the growth of the Non-GMO Soybean market. With a wide range of applications from food to medicines and an extensive range of non-GMO soybean varieties, meticulously selected for their superior nutritional characteristics, the Global Non-GMO Soybean Market is growing. SB&B is a family-owned company dedicated to supplying premium non-GMO soybeans globally. With over 30 years of experience, we specialize in producing a variety of soybean types, including natto, soymilk, tofu, and more. Their commitment to quality extends from production to processing, ensuring that each bean meets the highest standards for size, taste, and texture. As the demand for non-GMO soy products continues to rise, we take pride in our role as a trusted supplier to food manufacturers worldwide.To know about the Research Methodology :- Request Free Sample Report

Non-GMO Soybean Market Dynamics: Drivers, Restraints, Opportunities and Trends

Consumer Demand for Healthier Options: The growing awareness among consumers about the potential health risks associated with genetically modified organisms (GMOs) has been a significant driver of the non-GMO soybean market. Concerns regarding allergenicity, antibiotic resistance, and environmental impact have prompted many individuals to seek out non-GMO alternatives. Healthy foods are on the rise. Covid crisis highlighted the importance of healthy food for consumers. Consumers realized that having a healthy, balanced, and diversified diet is important to stay healthy. with the inflation 84%1 of consumers still consider health and wellness when purchasing fresh food. Moreover, 55%1 of consumers say they are willing to pay a premium for the right healthy foods because they contribute to their health and wellness. In Europe, the number of product launches considered healthy increased by 149%. As a result, there has been an increasing demand for non-GMO soybeans, particularly among health-conscious consumers, driving market growth. Regulatory Support and Labeling Requirements: Regulatory bodies in various countries have implemented stringent regulations and labeling requirements for GMO products. This includes mandatory labeling of foods containing GMO ingredients, which has led to increased transparency in the food industry. The support from regulatory authorities for non-GMO products has provided a favorable environment for the expansion of the non-GMO soybean market, as consumers can easily identify and choose non-GMO options. The U.S. Food and Drug Administration (FDA) mandates labeling of genetically modified (GM) foods only if they pose significant differences in nutrition or safety, such as containing allergens not expected. However, voluntary labeling exists for companies perceiving market opportunities. Mandatory labeling, opposed by some, would require all products with GM ingredients to be labeled, increasing costs for all consumers. Conversely, proponents argue for consumers' right to know and avoid certain ingredients, with surveys showing widespread support. The USDA Organic label indicates absence of GM ingredients. Implementing mandatory labeling faces complexities, including determining the threshold percentage of GM content necessitating labeling, which varies globally. Expansion of Organic and Sustainable Agriculture: The growing trend towards organic and sustainable farming practices has also driven the demand for non-GMO soybeans. Many farmers are transitioning to non-GMO and organic cultivation methods to meet the increasing consumer demand for healthier and environmentally friendly products. This shift towards sustainable agriculture not only benefits the environment but also contributes to the growth of the non-GMO soybean industry by ensuring a steady supply of non-GMO soybeans to meet market demand.With the increasing consumer demand for healthier and more sustainable food options, the Non-GMO soybean market presents a compelling opportunity for stakeholders. Non-GMO soybeans, free from genetic modification, cater to a growing segment of health-conscious consumers who prioritize natural and organic products. This trend is bolstered by rising concerns over the potential health risks associated with GMO foods and the desire for transparency in the food supply chain. Organic farming, deeply rooted in India's agricultural heritage, saw a resurgence amid concerns over sustainability and the agrarian crisis. Government initiatives to promote organic farming and Zero Budget Natural Farming find traction among farmers due to their low-cost techniques and lucrative yields. India leads in organic cotton production, contributing 47% to the global output. With over 1.14 million organic producers, representing 41% of the global total, the country's organic farming movement continues to gain momentum, offering a promising alternative to conventional agriculture. Consumer Demand and Awareness to Boost the Market Growth Consumer demand and awareness stand as pivotal factors in driving the growth of the Non-GMO soybean market. With an increasing focus on health-conscious consumption and environmental sustainability, consumers are actively seeking out Non-GMO products. Heightened awareness regarding the potential health risks and environmental impacts associated with genetically modified organisms (GMOs) has spurred this trend. Consumers are displaying a preference for products that are perceived as natural, wholesome, and free from genetic modification. This shift in consumer behavior has prompted food manufacturers and retailers to expand their offerings of Non-GMO soybean-based products, creating significant opportunities for growth within the market. Non-GMO Soybean Market Restraints: Technological Advancements in Seed Development: Technological advancements in seed development play a pivotal role in shaping the non-GMO soybean market. Innovations in breeding techniques and genetic research enable the creation of high-yielding, disease-resistant non-GMO soybean varieties. Access to superior seeds empowers farmers to enhance productivity while meeting the demand for non-GMO products, driving market growth and competitiveness. International Trade and Market Access: Global trade agreements and geopolitical factors significantly influence the non-GMO soybean market. Tariffs, trade barriers, and shifting trade policies can impact market dynamics and export opportunities for producers. Navigating international trade regulations and securing market access in key regions are essential considerations for stakeholders aiming to expand their presence in the global non-GMO soybean industry. Consumer Education and Marketing Initiatives: Effective consumer education and marketing initiatives play a pivotal role in driving adoption and growth in the non-GMO soybean market. Brands and producers invest in educational campaigns to raise awareness about the benefits of non-GMO products, addressing consumer concerns and dispelling misconceptions. Strategic marketing efforts that emphasize the unique selling points of non-GMO soybeans, such as taste, nutritional value, and environmental sustainability, are key drivers of market expansion and consumer adoption.

Non-GMO Soybean Market Segment Analysis

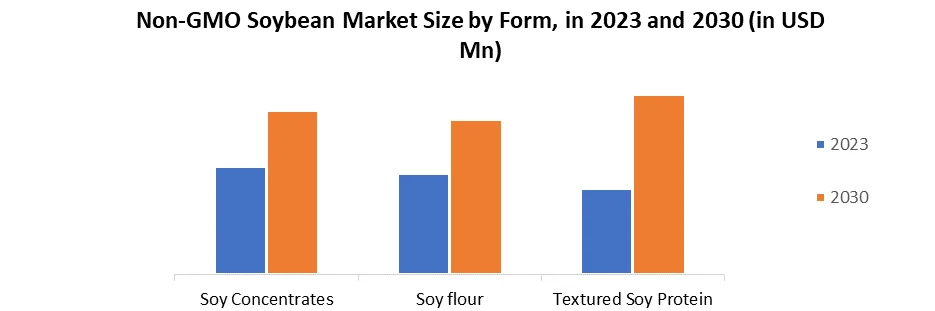

By Product: The Global Non-GMO Soybean Market is categorized into Crushed Soybeans and Whole Soybeans by product type. The crushed soybeans segment held the largest market share in 2023 and is expected to maintain dominance throughout the forecast period. This dominance stems from the widespread cultivation of soybeans globally, resulting in various soybean types available in the market. Over 85% of the world's soybeans are crushed to produce soy meal and oil. Approximately 80% of the crushed soy meal is utilized in animal feed production, while the remainder is processed into soy flour and proteins. The majority (around 89%) of the oil fraction is transformed into edible oil, with the remaining fraction used in the production of fatty acids, soaps, and biodiesel. The soybean supply chain is complex and includes many sectors, however a small group of big companies control large volumes of production at key points in the supply chain. Also, the increasing demand for complex feed further boosts the need for soy oil in soy meal production for animal feeds. These factors collectively contribute to the high demand for non-GMO soybeans, particularly for soy oil production and subsequent product processing. By Form: In the Global Non-GMO Soybean Market, the Crushed Soybean Format is segmented into Soy Concentrates, Soy Flour, and Textured Soy Protein. Among these segments, Soy Concentrates held the largest market share in the market during the forecast period. This dominance is attributed to the high protein and fiber content inherent in non-GMO soybeans, which are key components of soy concentrates. Manufacturing processes involve dehulling non-GMO soybeans and extracting sugars and carbohydrates, resulting in a concentrated protein-rich product. Soy concentrates find extensive use in the production of functional food products due to their rich nutrient profile. Their easy digestibility makes them a preferred ingredient in various food items, health supplements, and dietary products. Consequently, the increasing demand for non-GMO soybeans is driving market growth, particularly in the segment focused on soy concentrates.

Non-GMO Soybean Market Regional Insight

North America stands out as the primary market for Non-GMO soybean products, particularly for medicinal applications. The region demonstrates a strong inclination towards incorporating soybeans into medicinal formulations, whether in powdered or oil forms. With a health-conscious population, North Americans prioritize protein-rich diets, making soybean protein a popular choice. Additionally, the fitness culture prevalent in this region contributes to the widespread consumption of soybean-based beverages. In 2023, North America held the largest market share. The Asia-Pacific Non-GMO Soybean Market is expected to experience the highest growth rate during the forecast period. This growth is driven by the region's large population and extensive consumption of soybean-derived vegetable oil, favored for its economic viability. Rising awareness of the health benefits associated with protein-rich diets drives consumers towards herbal protein sources, including non-GMO soybean products like oil, beverages, and meals. Moreover, the demand for Non-GMO soybeans is bolstered by their use as protein supplements in animal feed, particularly for livestock growth and development, further stimulating market growth. Asia and EU policies heavily influence soybean imports. Other major soybean importers in Asia, including Japan, Korea, and Taiwan, support their oilseed crushing industries by maintaining higher tariffs on soybean oil imports. The region’s soybean imports have been trending downward partly because of declining populations and a continual shift from importing feedstuffs for livestock production to importing meat and other livestock products. Over the next 10 years, Japan’s annual soybean imports are expected to decline from 2.8 million to 2.5 million tons. Environmental regulations affecting the hog industry in markets such as the EU, Taiwan, and Korea also limited the growth of their livestock and feed industries, affecting their soybean imports. Soybean imports from the EU, Taiwan, and Korea are expected to remain steady over the projection period at 13.7 million tons, 2.4 million tons, and 1.4 million tons, respectively. Europe also exhibits a notable growth trajectory in the Non-GMO soybean market, driven by increasing demand for organic protein foods. The region's preference for organic and natural products propels market expansion, with consumers actively seeking out Non-GMO soybean products for their nutritional benefits. This trend is expected to continue driving market growth in the years ahead.Non-GMO Soybean Market Scope:Inquire before buying

Global Non-GMO Soybean Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 25.88 Bn. Forecast Period 2024 to 2030 CAGR: 8% Market Size in 2030: US $ 44.35 Bn. Segments Covered: by Product Whole Beans Crushed Beans by Form Soy Concentrates Soy flour Textured Soy Protein by Application Soybean Meal Soy Oil Livestock Feed Pharmaceutical Others by End-User Food and Beverages Animal Feed Others Non-GMO Soybean Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Non-GMO Soybean Market Key Players:

North America 1. Grain Millers, Inc. (USA) 2. World Food Processing, LLC (USA) 3. Zeeland Farm Services, Inc. (USA) 4. Laura Soybeans (USA) Asia Pacific 5. Sans Inc. (South Korea) 6. Divine Soya & Agro Food (India) 7. Vantage Organic Foods Private Ltd. (India) 8. AVI Agri Business Pvt., Ltd. (India) 9. Others Europe 10. Granos AG Co. (Switzerland) 11. TPK Varna, LLC (Bulgaria) 12. NOWAKO AS (Norway) 13. Eurofit (Germany) 14. Soya Trading S.L. (Spain) 15. FI Farm (Poland) 16. Green Snail Food Company Ltd. (United Kingdom) 17. ACIASSYSTEM (Uruguay) 18. 2PRC (France) 19. EFOS (Croatia) 20. Private Enterprise Victor & K (Belarus) 21. Agro Olga (Brazil) Frequently Asked Questions: 1] What is the growth rate of the Global Non-GMO Soybean Market? Ans. The Global Non-GMO Soybean Market is growing at a significant rate of 8 % during the forecast period. 2] Which region is expected to dominate the Global Non-GMO Soybean Market? Ans. North America is expected to dominate the Non-GMO Soybean Market during the forecast period. 3] What is the expected Global Non-GMO Soybean Market size by 2030? Ans. The Non-GMO Soybean Market size is expected to reach USD 25.88 Bn by 2030. 4] Which are the top players in the Global Non-GMO Soybean Market? Ans. The major top players in the Global Non-GMO Soybean Market are Grain Millers, Inc. (USA), World Food Processing, LLC (USA)and others. 5] What are the factors driving the Global Non-GMO Soybean Market growth? Ans. Growing awareness regarding the potential health risks associated with genetically modified organisms (GMOs) has led consumers to seek non-GMO alternatives is expected to drive the Non-GMO Soybean Market growth. 6] Which country held the largest Global Non-GMO Soybean Market share in 2023? Ans. The United States held the largest Non-GMO Soybean Market share in 2023.

1. Non-GMO Soybean Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Non-GMO Soybean Market: Dynamics 2.1. Non-GMO Soybean Market Trends by Region 2.1.1. North America Non-GMO Soybean Market Trends 2.1.2. Europe Non-GMO Soybean Market Trends 2.1.3. Asia Pacific Non-GMO Soybean Market Trends 2.1.4. Middle East and Africa Non-GMO Soybean Market Trends 2.1.5. South America Non-GMO Soybean Market Trends 2.2. Non-GMO Soybean Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Non-GMO Soybean Market Drivers 2.2.1.2. North America Non-GMO Soybean Market Restraints 2.2.1.3. North America Non-GMO Soybean Market Opportunities 2.2.1.4. North America Non-GMO Soybean Market Challenges 2.2.2. Europe 2.2.2.1. Europe Non-GMO Soybean Market Drivers 2.2.2.2. Europe Non-GMO Soybean Market Restraints 2.2.2.3. Europe Non-GMO Soybean Market Opportunities 2.2.2.4. Europe Non-GMO Soybean Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Non-GMO Soybean Market Drivers 2.2.3.2. Asia Pacific Non-GMO Soybean Market Restraints 2.2.3.3. Asia Pacific Non-GMO Soybean Market Opportunities 2.2.3.4. Asia Pacific Non-GMO Soybean Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Non-GMO Soybean Market Drivers 2.2.4.2. Middle East and Africa Non-GMO Soybean Market Restraints 2.2.4.3. Middle East and Africa Non-GMO Soybean Market Opportunities 2.2.4.4. Middle East and Africa Non-GMO Soybean Market Challenges 2.2.5. South America 2.2.5.1. South America Non-GMO Soybean Market Drivers 2.2.5.2. South America Non-GMO Soybean Market Restraints 2.2.5.3. South America Non-GMO Soybean Market Opportunities 2.2.5.4. South America Non-GMO Soybean Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Analysis of Government Schemes and Initiatives For the Non-GMO Soybean Industry 2.8. The Covid-19 Pandemic's Impact on the Non-GMO Soybean Market 3. Non-GMO Soybean Market: Global Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030) 3.1. Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 3.1.1. Whole Beans 3.1.2. Crushed Beans 3.2. Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 3.2.1. Soy Concentrates 3.2.2. Soy flour 3.2.3. Textured Soy Protein 3.3. Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 3.3.1. Soybean Meal 3.3.2. Soy Oil 3.3.3. Livestock Feed 3.3.4. Pharmaceutical 3.3.5. Others 3.4. Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 3.4.1. Food and Beverages 3.4.2. Animal Feed 3.4.3. Others 3.5. Non-GMO Soybean Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Non-GMO Soybean Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 4.1. North America Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 4.1.1. Whole Beans 4.1.2. Crushed Beans 4.2. North America Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 4.2.1. Soy Concentrates 4.2.2. Soy flour 4.2.3. Textured Soy Protein 4.3. North America Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 4.3.1. Soybean Meal 4.3.2. Soy Oil 4.3.3. Livestock Feed 4.3.4. Pharmaceutical 4.3.5. Others 4.4. North America Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 4.4.1. Food and Beverages 4.4.2. Animal Feed 4.4.3. Others 4.5. North America Non-GMO Soybean Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 4.5.1.1.1. Whole Beans 4.5.1.1.2. Crushed Beans 4.5.1.2. United States Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 4.5.1.2.1. Soy Concentrates 4.5.1.2.2. Soy flour 4.5.1.2.3. Textured Soy Protein 4.5.1.3. United States Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 4.5.1.3.1. Soybean Meal 4.5.1.3.2. Soy Oil 4.5.1.3.3. Livestock Feed 4.5.1.3.4. Pharmaceutical 4.5.1.3.5. Others 4.5.1.4. United States Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 4.5.1.4.1. Food and Beverages 4.5.1.4.2. Animal Feed 4.5.1.4.3. Others 4.5.2. Canada 4.5.2.1. Canada Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 4.5.2.1.1. Whole Beans 4.5.2.1.2. Crushed Beans 4.5.2.2. Canada Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 4.5.2.2.1. Soy Concentrates 4.5.2.2.2. Soy flour 4.5.2.2.3. Textured Soy Protein 4.5.2.3. Canada Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 4.5.2.3.1. Soybean Meal 4.5.2.3.2. Soy Oil 4.5.2.3.3. Livestock Feed 4.5.2.3.4. Pharmaceutical 4.5.2.3.5. Others 4.5.2.4. Canada Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 4.5.2.4.1. Food and Beverages 4.5.2.4.2. Animal Feed 4.5.2.4.3. Others 4.5.3. Mexico 4.5.3.1. Mexico Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 4.5.3.1.1. Whole Beans 4.5.3.1.2. Crushed Beans 4.5.3.2. Mexico Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 4.5.3.2.1. Soy Concentrates 4.5.3.2.2. Soy flour 4.5.3.2.3. Textured Soy Protein 4.5.3.3. Mexico Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 4.5.3.3.1. Soybean Meal 4.5.3.3.2. Soy Oil 4.5.3.3.3. Livestock Feed 4.5.3.3.4. Pharmaceutical 4.5.3.3.5. Others 4.5.3.4. Mexico Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 4.5.3.4.1. Food and Beverages 4.5.3.4.2. Animal Feed 4.5.3.4.3. Others 5. Europe Non-GMO Soybean Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 5.1. Europe Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 5.2. Europe Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 5.3. Europe Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 5.4. Europe Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 5.5. Europe Non-GMO Soybean Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 5.5.1.2. United Kingdom Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 5.5.1.3. United Kingdom Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 5.5.1.4. United Kingdom Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 5.5.2. France 5.5.2.1. France Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 5.5.2.2. France Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 5.5.2.3. France Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 5.5.2.4. France Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 5.5.3.2. Germany Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 5.5.3.3. Germany Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 5.5.3.4. Germany Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 5.5.4.2. Italy Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 5.5.4.3. Italy Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 5.5.4.4. Italy Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 5.5.5.2. Spain Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 5.5.5.3. Spain Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 5.5.5.4. Spain Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 5.5.6.2. Sweden Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 5.5.6.3. Sweden Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 5.5.6.4. Sweden Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 5.5.7.2. Austria Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 5.5.7.3. Austria Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 5.5.7.4. Austria Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 5.5.8.2. Rest of Europe Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 5.5.8.3. Rest of Europe Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 5.5.8.4. Rest of Europe Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Non-GMO Soybean Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 6.1. Asia Pacific Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 6.2. Asia Pacific Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 6.3. Asia Pacific Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 6.5. Asia Pacific Non-GMO Soybean Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 6.5.1.2. China Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 6.5.1.3. China Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 6.5.1.4. China Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 6.5.2.2. S Korea Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 6.5.2.3. S Korea Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 6.5.2.4. S Korea Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 6.5.3.2. Japan Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 6.5.3.3. Japan Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 6.5.3.4. Japan Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 6.5.4. India 6.5.4.1. India Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 6.5.4.2. India Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 6.5.4.3. India Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 6.5.4.4. India Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 6.5.5.2. Australia Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 6.5.5.3. Australia Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 6.5.5.4. Australia Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 6.5.6.2. Indonesia Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 6.5.6.3. Indonesia Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 6.5.6.4. Indonesia Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 6.5.7.2. Malaysia Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 6.5.7.3. Malaysia Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 6.5.7.4. Malaysia Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 6.5.8.2. Vietnam Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 6.5.8.3. Vietnam Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 6.5.8.4. Vietnam Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 6.5.9.2. Taiwan Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 6.5.9.3. Taiwan Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 6.5.9.4. Taiwan Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 6.5.10.2. Rest of Asia Pacific Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 6.5.10.3. Rest of Asia Pacific Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 6.5.10.4. Rest of Asia Pacific Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Non-GMO Soybean Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 7.1. Middle East and Africa Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 7.2. Middle East and Africa Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 7.3. Middle East and Africa Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 7.5. Middle East and Africa Non-GMO Soybean Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 7.5.1.2. South Africa Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 7.5.1.3. South Africa Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 7.5.1.4. South Africa Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 7.5.2.2. GCC Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 7.5.2.3. GCC Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 7.5.2.4. GCC Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 7.5.3.2. Nigeria Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 7.5.3.3. Nigeria Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 7.5.3.4. Nigeria Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 7.5.4.2. Rest of ME&A Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 7.5.4.3. Rest of ME&A Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 7.5.4.4. Rest of ME&A Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 8. South America Non-GMO Soybean Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn)(2023-2030) 8.1. South America Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 8.2. South America Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 8.3. South America Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 8.4. South America Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 8.5. South America Non-GMO Soybean Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 8.5.1.2. Brazil Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 8.5.1.3. Brazil Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 8.5.1.4. Brazil Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 8.5.2.2. Argentina Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 8.5.2.3. Argentina Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 8.5.2.4. Argentina Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Non-GMO Soybean Market Size and Forecast, by Product Type (2023-2030) 8.5.3.2. Rest Of South America Non-GMO Soybean Market Size and Forecast, by Form (2023-2030) 8.5.3.3. Rest Of South America Non-GMO Soybean Market Size and Forecast, by Application (2023-2030) 8.5.3.4. Rest Of South America Non-GMO Soybean Market Size and Forecast, by End User (2023-2030) 9. Global Non-GMO Soybean Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.4. Leading Non-GMO Soybean Market Companies, by Market Capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Grain Millers, Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. World Food Processing, LLC & B 10.3. Zeeland Farm Services, Inc. 10.4. Sans Inc. 10.5. Laura Soybeans 10.6. Divine Soya & Agro Food 10.7. Vantage Organic Foods Private Ltd. 10.8. Granos AG Co. 10.9. TPK Varna, LLC 10.10. NOWAKO AS 10.11. Eurofit 10.12. AVI Agri Business Pvt., Ltd. 10.13. Soya Trading S.L. 10.14. FI Farm 10.15. Green Snail Food Company Ltd. 10.16. ACIASSYSTEM 10.17. 2PRC 10.18. EFOS 10.19. Private Enterprise Victor & K 10.20. Agro Olga 11. Key Findings 12. Analyst Recommendations 13. Non-GMO Soybean Market: Research Methodology