Global Motor Monitoring Market size was valued at USD 2.95 Bn in 2024, and the total Motor Monitoring Market revenue is expected to grow by 7.24% from 2025 to 2032, reaching nearly USD 5.16 Bn.Motor Monitoring Market Overview

The Motor Monitoring Market is witnessing significant growth, driven by the rising demand for predictive maintenance, improved energy efficiency, and enhanced machinery reliability across various industrial sectors, including manufacturing, oil and gas, electric power generation, water treatment, and automotive. Motor monitoring solutions, encompassing both hardware and software, such as vibration sensors, thermal imaging systems, current analyzers, and IoT-enabled platforms, are designed to detect faults early, reduce unplanned downtime, and extend the operational lifespan of motors. The integration of Industry 4.0 practices has further accelerated the adoption of the Motor Monitoring Market, with AI, machine learning, cloud analytics, and digital twin technologies enabling remote diagnostics, performance optimization, and predictive fault detection.To know about the Research Methodology:-Request Free Sample Report The Motor Monitoring Market is also being fueled by the expanding use of electric motors across electric vehicles, HVAC systems, and industrial automation. This growing demand underscores the need for continuous condition monitoring to ensure operational efficiency, safety, and compliance. Stricter global energy efficiency standards, sustainability initiatives, and regulatory compliance requirements in both public and private sectors have encouraged greater investment in smart motor monitoring solutions. The Motor Monitoring Market is particularly experiencing robust growth in Asia-Pacific, North America, and parts of Europe, where industrial automation, smart factory adoption, and infrastructure modernization are strategic priorities. Additionally, advancements in wireless sensors and edge computing have made motor monitoring solutions increasingly accessible and cost-effective, creating new opportunities for adoption among small and medium-sized enterprises (SMEs).

Motor Monitoring Market Dynamics

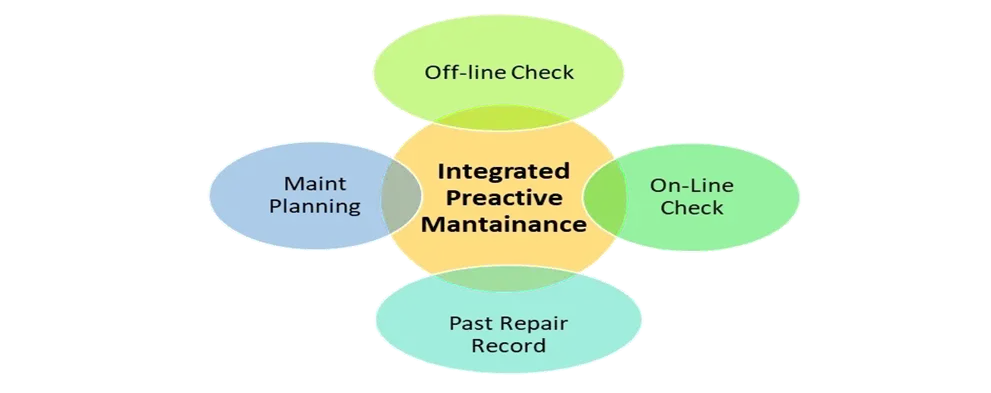

Industry 4.0 Integration to Drive the Motor Monitoring Market Growth Motor monitoring market growth industry is inspired by the integration of 4.0 technologies, which are re -shaping traditional industrial processes and changing equipment management. The fourth industrial revolution, also known as industry 4.0, aims to automate data using digital technologies, share data and improve manufacturing. As a result of this revolution, motorized devices require advanced monitoring solutions based on Internet of Things, Artificial Intelligence and Machine Learning. Motorized equipment now allows manufacturers and industrial operators to collect large amounts of data in real time. IOT sensor monitors embedded at frequent temperatures, vibrations and energy consumption in motors. Using machine learning algorithms, manufacturers and operators get actionable insights about the health and performance of their motors. These advanced monitoring systems detect irregularities, predict potential malfunctions, and recommend maintenance tasks to avoid expensive downturn and manufacturing losses. Future-staging maintenance strategies based on industry 4.0 enable organizations to move away from reactive maintenance practices and lead to position-based and future maintenance attitudes.The industry is beyond 4.0 integration operational capacity. By implementing advanced motor monitoring solutions, industry feels low maintenance costs, better energy efficiency and extended equipment through life. Demonstrating remote monitoring motors and predictive maintenance activities improves the activist safety by reducing contact with dangerous conditions and eliminating manual inspections. Industry 4.0 integrates the motor monitoring market by responding to the changing demands of modern industries for increased efficiency, dependence and stability. Manufacturers and industrial operators continued to adopt digital change efforts, demanding refined motor monitoring solutions that are expected to define the future for IOT, AI, and machine learning advantage of machine learning, raising, innovation and defines the future for industrial automation. High Initial Cost to Restrain the Motor Monitoring Market Growth Investment costs associated with applying full motor monitoring solutions represent a restraint for the cost organizations, especially small and medium -sized enterprises (SMEs), as they navigate the route towards adopting advanced monitoring technologies. While the benefits of these systems are obvious, including better operating efficiency, low, and increase in productivity leads to hesitation and reluctance to invest from perceived financial burden. The alleged high costs are expenses associated with obtaining and deploying refined monitoring systems, which significantly prevent the motor monitoring market. These solutions include integration of various hardware components such as sensors, data acquisition devices and networking infrastructure with software platforms for data analysis and visualization. The purchase and installation of these components enters the adequate initial capital outlay, which prevents organizations with limited financial resources by advancing such investments. The complexity of integrating motor monitoring solutions in the existing infrastructure is an important challenge, which leads to the alleged cost barrier. Inheritance machinery with sensor technology and IOT connectivity requires careful planning and execution for retrofitting, including frequent ongoing operations and production programs. This factor prevents motor monitoring market growth significantly. Emphasis on Energy Efficiency to create lucrative growth opportunities for the Motor Monitoring Market This trend reflects a change towards active energy management strategies, taking advantage of motor monitoring solutions to customize business resource usage and reduce environmental impact. By checking motor performance data in real time, organizations identify areas of energy wast, streamlin the operational processes, and apply targeted interventions to increase overall efficiency, which offers an important opportunity for the development of the motor monitoring market. Integration of future maintenance abilities enables preventive measures to address issues related to potential energy, making expensive downtime and asset to maximize lifespan. Adopting the motor monitoring system aligns with a comprehensive stability agenda, with organizations to increase simultaneous operating flexibility and competition as the environment responsible stewers. In addition, the emphasis on energy efficiency presents opportunities for innovation and cooperation within the motor monitoring ecosystem, runs the development of novel technologies and is designed to solve the challenges of stability. As businesses recognize the tangible benefits of energy optimization, the demand for advanced monitoring technologies is expected to increase to promote a dynamic and growth-oriented landscape within the motor monitoring market. Shift Towards Predictive Maintenance to Create Opportunity for Motor Monitoring Market This change represents a departure from the traditional, time-based maintenance perspective to make data-operated decisions. By adding the power of future analysis, organizations analyse historical performance data, detect patterns, and predict the malfunction of potential equipment. Armed, maintenance teams with actionable insights executed targeted interventions, such as components replacement and adjustment, before issues increase in expensive breakdowns. Reactive maintenance dependence decreases, as organizations adopt an active stance above the device. Integration of condition-monitoring technologies further carries forward maintenance strategies. Through the continuous monitoring of motor parameters, such as temperature, vibration and lubrication conditions, deviations from normal operating conditions are immediately detected. This enables potential defects and initial identity of deteriorating performance, which can apply corrective tasks on time. Progress in sensor technology and connectivity facilitates remote monitoring capabilities, which enables real -time insights from anywhere to the equipment health, and increases operational agility and accountability. Since organizations prefer operating efficiency and cost optimization, the demand for future maintenance solutions continues. By reducing the risk of unpredictable downtime and maximizing the use of the asset, the future stating maintenance reduces operating disruption and increases overall productivity and competition. This trend driving innovation and investment within the motor monitoring market.

Motor Monitoring Market Segment Analysis

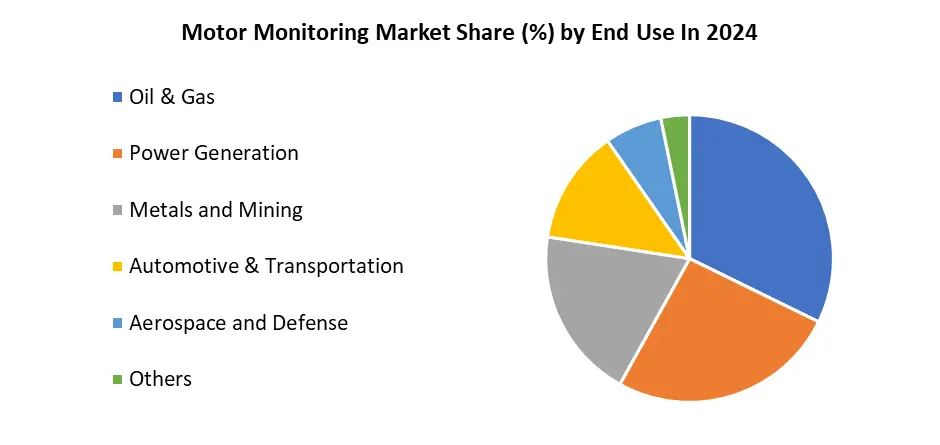

Based on the Offering Type, the hardware segment dominated the motor monitoring market in the year 2024. Hardware solutions provide physical equipment such as sensors, controller and data acquisition systems, which provide real monitoring and diagnosis of motors. This direct interface with machinery allows for accurate data collection, enables preventive maintenance, reduces downtime, and increases operational efficiency. In addition, hardware solutions often increase strength, reliability and compatibility with existing infrastructure, which gives them a favourite option for industries that prefer stability and longevity, which greatly promote the development of motor monitoring market. Their tangible nature also simplifies implementation and troubleshooting, which appeals to users in search of direct solutions. Therefore, dominance of the hardware segment is due to providing actionable insights, reducing risks and adopting motor performance, due to its required role in their operation, to closely align with the demands of industries for credibility and efficiency in their operations. Based On the End Use, the oil & gas sector dominated the motor monitoring market in 2024, due to its extensive use of large, mission-critical motors in exploration, drilling, refining, and transportation processes, where unplanned downtime can lead to massive financial losses and safety risks. The industry operates in harsh and remote environments, making predictive and condition-based monitoring essential to ensure reliability, reduce maintenance costs, and prevent catastrophic failures. Additionally, stringent safety regulations, high equipment replacement costs, and the need for continuous operations drive significant investment in advanced motor monitoring technologies, securing oil & gas as the leading end-user segment.

Motor Monitoring Market Regional Analysis

Asia Pacific Region Dominated the Motor Monitoring Market in the year 2024. The Indian manufacturing sector is one of the prominent sectors. According to MMR Study Report India's manufacturing sector is on the rise, poised to make a significant impact globally by adding over US$ xx billion to the economy by 2032. The government's Initiatives like Make in India, Digital India, and Startup India have given much-needed thrust to the Electronics System Design and Manufacturing (ESDM) sector in India. Which makes India equally strong for domestic and foreign players and gives recognition to the Indian economy at a global level. The rising manufacturing sector needs advancement in manufacturing equipment this factor is significantly responsible for the growth of the Motor Monitoring Market as well. China's prominent manufacturing hub and massive population increase investments in power and infrastructure, with plans to develop 110 nuclear power plants by 2030, signalling a push towards modernization and technology adoption such as vibration monitoring for motor condition-based monitoring. Despite fluctuating energy prices, China's focus on oil & gas exploration for self-sufficiency, particularly in shale oil reserves, creates a strong demand for monitoring solutions. Also, the rise of Industry 4.0 in Asian countries such as Japan, and S. Korea fosters Motor Monitoring Market growth, emphasizing the importance of IoT in online condition monitoring for industrial plants and electrical machines. Motor Monitoring Market Competitive Landscape: In the competitive scenario of motor surveillance and industrial automation, Siemens AG and Rockwell Automation stand out as two global leaders with separate strength. Siemens located in Germany offers a broad and depth integrated portfolio that includes Simkode, Serious Monitor, and Mindspere Industrial IOT platform, which enables advanced motor diagnostics, predictive maintenance and system optimization. The process focuses on industries, digital twins and AI integration, via the complex, large -scale industrial settings through the Semence Excellerator. In contrast, Rockwell Automation, U.S. In the headquarters, smart motor control systems such as Alan-Bradley E300 and Intellicer, with spontaneous integration in its factritock and plex mes platforms. Rockwell leads in discomfort manufacturing, including automotive and food and beverages sectors, taking advantage of edge computing and predictive analytics to run their connected enterprise strategy. While the semence dominates the depth of the scale and the system, the rockwell competes effectively through the modularity, ease of deployment and the strength of the North American market. Motor Monitoring Market Recent Developments: March 2025, Tata Power engaged to work with Schneider Electric to help support India’s initiative to create sustainable and efficient urban power distribution. The parties will facilitate the installation of SF6 - free Ring Main Units (RMUs), taking a step to decrease the total greenhouse gases across the electrical grid. Installation will take place in Mumbai and Delhi and will replace traditional units that utilized sulphur hexafluoride (SF6), a very high impact greenhouse gas. The installation of these new units aligns with India’s clean energy targets and move towards greener, safer, and smarter electrical infrastructure in urban areas to improve reliability and environmental performance in the largest metropolitan centres in India. July 2025, Schneider Electric bolstered its India hub strategy when it acquired the remaining 35% interest in Schneider Electric India Pvt. Ltd. from Temasek for approximately 6 billion USD. With this transfer, Schneider Electric now has 100% agreement of this entity in India, making the Indian operation more agile in the decision-making process and establishing India as a strategic global hub for R and D, manufacturing, and supply chain. Part of this transaction and its timing is motivated by Schneider Electric's long-standing vision for enabling its India operation to grow 2.5 to 3 times more, in alignment with India's own rapid growth and digital transformation aspirations concerning energy management and automation. In November 2024, Schneider Electric announced that it would show its groundbreaking 2025 Automation Prasad at SPS Fair, which exposes innovations to the purpose of re -shaping industrial automation. The key launch includes Modicon Edge I/O NTS, Altivar Process ATV6100 Altivar predict, laxium 38i, and compact Laksium Scar Robot. These solutions integrate advanced AI, digital twin capabilities, forecasting analysis, and cyber security, which enhance efficiency, security and stability in industries. Schneider’s ecostruxure designed for spontaneous integration in architecture, these products mark a significant jump towards the alignment, flexible, intelligent and connected automation systems aligning with global trends in smart manufacturing. Motor Monitoring Market Key Trends: Growth of Predictive Maintenance Use Both advanced and developing markets are ramping up engaging in a predictive maintenance program as they look to improve asset lifespan and better mitigate downtime. Motor monitoring systems that offer real-time diagnostics, trend and anomaly analysis, and fault prediction have been trending into a variety of sectors including energy generation and water treatment, as well as manufacturing. These systems equip businesses with advanced tools to proactively share and diagnose faults before failure. Once those faults are identified, scheduling can be done to perform smart maintenance scheduling, all the while, minimizing unplanned outages in mission critical applications. Shift Towards Energy Efficiency and Financial Regulatory Compliance In addition to advancing with better platforms for motor performance feedback and monitoring, industries are actively seeking motor monitoring applications that effect energy consumption for the global sustainability initiative and increasingly stringent energy efficiency regulatory environment. Newer generation motor monitoring platforms advance industry along their journey of assessing power quality, load efficiency, heat generation, opening the door for industrial companies to assess their potential to improve efficient operational engineering, as well as, realize advanced integration of motors with eco-sensitive design, smart load balancing, and usage assessments, all which become a method of demonstrating strategic corporate ESG (Environmental, Social, Governance) goals and regulatory compliance, in the name of energy and sustainability. Motor Monitoring Industry Ecosystem

Scope of the Global Motor Monitoring Market: Inquire before buying

Global Motor Monitoring Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 2.95 Bn. Forecast Period 2025 to 2032 CAGR: 7.24% Market Size in 2032: USD 5.16 Bn. Segments Covered: by Offering Software Hardware by Process Portable Online by Deployment On-premise Cloud by End-User Oil & Gas Automotive & Transportation Power Generation Metals and Mining Aerospace and Defense Others Motor Monitoring Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Motor Monitoring Market, Key Players

North America 1. Rockwell Automation, Inc. (USA) 2. Eaton Corporation plc (USA) 3. Fluke Corporation (USA) 4. General Electric Company (GE) (USA) 5. Honeywell International Inc. (USA) 6. Emerson Electric Co. (USA) 7. National Instruments Corporation (USA) 8. Banner Engineering Corp. (USA) 9. Qualitrol Company LLC (USA) 10. Parker Hannifin Corporation (USA) Europe 1. ABB Ltd. (Switzerland) 2. Danfoss A/S (Denmark)Siemens AG (Germany) 3. Schneider Electric SE (France) 4. WEG S.A. (Brazil/Europe Operations) 5. SKF Group (Sweden) 6. Bachmann electronic GmbH (Germany) 7. Dynapar Corporation (UK/Europe presence) 8. Phoenix Contact GmbH & Co. KG (Germany) Asia Pacific 1. Mitsubishi Electric Corporation (Japan) 2. Advantech Co., Ltd. (Taiwan)Frequently Asked Questions

1] What segments are covered in the Global Motor Monitoring Market report? Ans. The segments covered in the Motor Monitoring Market report are based on Offerings, Process, Deployment, End-use, and Regions. 2] Which region is expected to hold the highest share of the Global Motor Monitoring Market? Ans. The Asia Pacific region is expected to hold the highest share of the Motor Monitoring Market. 3] What was the market size of the Global Motor Monitoring Market in 2024? Ans. The market size of the Motor Monitoring Market by 2024 is USD 2.95 Bn. 4] What is the market size of the Global Motor Monitoring Market by 2032? Ans. The market size of the Motor Monitoring Market by 2032 is valued at USD 5.16 Bn. 5] Who are the Key players in the Motor Monitoring Market. Ans. General Electric Company (GE) (Boston, Massachusetts, USA), Rockwell Automation, Inc. (Milwaukee, Wisconsin, USA), Honeywell International Inc. (Charlotte, North Carolina, USA), Emerson Electric Co. (St. Louis, Missouri, USA), Parker Hannifin Corporation (Cleveland, Ohio, USA), Fluke Corporation (Everett, Washington, USA)

1. Motor Monitoring Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Motor Monitoring Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-User Segment 2.4.4. Revenue (2024) 2.4.5. Company Location 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Motor Monitoring Market: Dynamics 3.1. Region-wise Trends of Motor Monitoring Market 3.1.1. North America Motor Monitoring Market Trends 3.1.2. Europe Motor Monitoring Market Trends 3.1.3. Asia Pacific Motor Monitoring Market Trends 3.1.4. Middle East and Africa Motor Monitoring Market Trends 3.1.5. South America Motor Monitoring Market Trends 3.2. Motor Monitoring Market Dynamics 3.2.1. Motor Monitoring Market Drivers 3.2.1.1. Predictive Maintenance Demand 3.2.1.2. Industry 4.0 Adoption 3.2.1.3. Energy Efficient Regulations 3.2.2. Motor Monitoring Market Opportunity 3.2.2.1. Expansion in Emerging Economies with Industrial Growth 3.2.3. Motor Monitoring Market Challenges 3.2.3.1. High Initial Investment Cost for monitoring Systems 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Regulatory approvals for new allergy drugs and biologics 3.4.2. Advancements in biologics and immunotherapy (SCIT, SLIT) 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Motor Monitoring Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 4.1. Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 4.1.1. Software 4.1.2. Hardware 4.2. Motor Monitoring Market Size and Forecast, By Process (2024-2032) 4.2.1. Portable 4.2.2. Online 4.3. Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 4.3.1. On-premise 4.3.2. Cloud 4.4. Motor Monitoring Market Size and Forecast, By End User (2024-2032) 4.4.1. Oil and Gas 4.4.2. Automotive and Transportation 4.4.3. Power Generation 4.4.4. Metals and Mining 4.4.5. Aerospace and Defense 4.4.6. Others 4.5. Motor Monitoring Market Size and Forecast, By region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Motor Monitoring Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 5.1. North America Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 5.1.1. Software 5.1.2. Hardware 5.2. North America Motor Monitoring Market Size and Forecast, By Process (2024-2032) 5.2.1. Portable 5.2.2. Online 5.3. North America Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 5.3.1. On-premise 5.3.2. Cloud 5.4. North America Motor Monitoring Market Size and Forecast, By End User (2024-2032) 5.4.1. Oil and Gas 5.4.2. Automotive and Transportation 5.4.3. Power Generation 5.4.4. Metals and Mining 5.4.5. Aerospace and Defense 5.4.6. Others 5.5. North America Motor Monitoring Market Size and Forecast, By Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 5.5.1.1.1. Software 5.5.1.1.2. Hardware 5.5.1.2. United States Motor Monitoring Market Size and Forecast, By Process (2024-2032) 5.5.1.2.1. Portable 5.5.1.2.2. Online 5.5.1.3. United States Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 5.5.1.3.1. On-premise 5.5.1.3.2. Cloud 5.5.1.4. United States Motor Monitoring Market Size and Forecast, By End User (2024-2032) 5.5.1.4.1. Oil and Gas 5.5.1.4.2. Automotive and Transportation 5.5.1.4.3. Power generation 5.5.1.4.4. Metals and Mining 5.5.1.4.5. Aerospace and Defense 5.5.1.4.6. Others 5.5.2. Canada 5.5.2.1. Canada Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 5.5.2.1.1. Software 5.5.2.1.2. Hardware 5.5.2.2. Canada Motor Monitoring Market Size and Forecast, By Process (2024-2032) 5.5.2.2.1. Portable 5.5.2.2.2. Online 5.5.2.3. Canada Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 5.5.2.3.1. On-premise 5.5.2.3.2. Cloud 5.5.2.4. Canada Motor Monitoring Market Size and Forecast, By End User (2024-2032) 5.5.2.4.1. Oil and Gas 5.5.2.4.2. Automotive and Transportation 5.5.2.4.3. Power Generation 5.5.2.4.4. Metals and Mining 5.5.2.4.5. Aerospace and Defense 5.5.2.4.6. Others 5.5.3. Mexico 5.5.3.1. Mexico Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 5.5.3.1.1. Software 5.5.3.1.2. Hardware 5.5.3.2. Mexico Motor Monitoring Market Size and Forecast, By Process (2024-2032) 5.5.3.2.1. Portable 5.5.3.2.2. Online 5.5.3.3. Mexico Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 5.5.3.3.1. On-premise 5.5.3.3.2. Cloud 5.5.3.4. Mexico Motor Monitoring Market Size and Forecast, By End User (2024-2032) 5.5.3.4.1. Oil and Gas 5.5.3.4.2. Automotive and Transportation 5.5.3.4.3. Power Generation 5.5.3.4.4. Metals and Mining 5.5.3.4.5. Aerospace and Defense 5.5.3.4.6. Others 6. Europe Motor Monitoring Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 6.1. Europe Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 6.2. Europe Motor Monitoring Market Size and Forecast, By Process (2024-2032) 6.3. Europe Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 6.4. Europe Motor Monitoring Market Size and Forecast, By End User (2024-2032) 6.5. Europe Motor Monitoring Market Size and Forecast, By Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 6.5.1.2. United Kingdom Motor Monitoring Market Size and Forecast, By Process (2024-2032) 6.5.1.3. United Kingdom Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 6.5.1.4. United Kingdom Motor Monitoring Market Size and Forecast, By End User (2024-2032) 6.5.2. France 6.5.2.1. France Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 6.5.2.2. France Motor Monitoring Market Size and Forecast, By Process (2024-2032) 6.5.2.3. France Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 6.5.2.4. France Motor Monitoring Market Size and Forecast, By End User (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 6.5.3.2. Germany Motor Monitoring Market Size and Forecast, By Process (2024-2032) 6.5.3.3. Germany Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 6.5.3.4. Germany Motor Monitoring Market Size and Forecast, By End User (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 6.5.4.2. Italy Motor Monitoring Market Size and Forecast, By Process (2024-2032) 6.5.4.3. Italy Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 6.5.4.4. Italy Motor Monitoring Market Size and Forecast, By End User (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 6.5.5.2. Spain Motor Monitoring Market Size and Forecast, By Process (2024-2032) 6.5.5.3. Spain Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 6.5.5.4. Spain Motor Monitoring Market Size and Forecast, By End User (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 6.5.6.2. Sweden Motor Monitoring Market Size and Forecast, By Process (2024-2032) 6.5.6.3. Sweden Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 6.5.6.4. Sweden Motor Monitoring Market Size and Forecast, By End User (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 6.5.7.2. Austria Motor Monitoring Market Size and Forecast, By Process (2024-2032) 6.5.7.3. Austria Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 6.5.7.4. Austria Motor Monitoring Market Size and Forecast, By End User (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 6.5.8.2. Rest of Europe Motor Monitoring Market Size and Forecast, By Process (2024-2032) 6.5.8.3. Rest of Europe Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 6.5.8.4. Rest of Europe Motor Monitoring Market Size and Forecast, By End User (2024-2032) 7. Asia Pacific Motor Monitoring Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 7.1. Asia Pacific Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 7.2. Asia Pacific Motor Monitoring Market Size and Forecast, By Process (2024-2032) 7.3. Asia Pacific Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 7.4. Asia Pacific Motor Monitoring Market Size and Forecast, By End User (2024-2032) 7.5. Asia Pacific Motor Monitoring Market Size and Forecast, By Country (2024-2032) 7.5.1. China 7.5.1.1. China Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 7.5.1.2. China Motor Monitoring Market Size and Forecast, By Process (2024-2032) 7.5.1.3. China Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 7.5.1.4. China Motor Monitoring Market Size and Forecast, By End User (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 7.5.2.2. S Korea Motor Monitoring Market Size and Forecast, By Process (2024-2032) 7.5.2.3. S Korea Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 7.5.2.4. S Korea Motor Monitoring Market Size and Forecast, By End User (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 7.5.3.2. Japan Motor Monitoring Market Size and Forecast, By Process (2024-2032) 7.5.3.3. Japan Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 7.5.3.4. Japan Motor Monitoring Market Size and Forecast, By End User (2024-2032) 7.5.4. India 7.5.4.1. India Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 7.5.4.2. India Motor Monitoring Market Size and Forecast, By Process (2024-2032) 7.5.4.3. India Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 7.5.4.4. India Motor Monitoring Market Size and Forecast, By End User (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 7.5.5.2. Australia Motor Monitoring Market Size and Forecast, By Process (2024-2032) 7.5.5.3. Australia Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 7.5.5.4. Australia Motor Monitoring Market Size and Forecast, By End User (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 7.5.6.2. Indonesia Motor Monitoring Market Size and Forecast, By Process (2024-2032) 7.5.6.3. Indonesia Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 7.5.6.4. Indonesia Motor Monitoring Market Size and Forecast, By End User (2024-2032) 7.5.7. Philippines 7.5.7.1. Philippines Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 7.5.7.2. Philippines Motor Monitoring Market Size and Forecast, By Process (2024-2032) 7.5.7.3. Philippines Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 7.5.7.4. Philippines Motor Monitoring Market Size and Forecast, By End User (2024-2032) 7.5.8. Malaysia 7.5.8.1. Malaysia Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 7.5.8.2. Malaysia Motor Monitoring Market Size and Forecast, By Process (2024-2032) 7.5.8.3. Malaysia Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 7.5.8.4. Malaysia Motor Monitoring Market Size and Forecast, By End User (2024-2032) 7.5.9. Vietnam 7.5.9.1. Vietnam Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 7.5.9.2. Vietnam Motor Monitoring Market Size and Forecast, By Process (2024-2032) 7.5.9.3. Vietnam Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 7.5.9.4. Vietnam Motor Monitoring Market Size and Forecast, By End User (2024-2032) 7.5.10. Thailand 7.5.10.1. Thailand Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 7.5.10.2. Thailand Motor Monitoring Market Size and Forecast, By Process (2024-2032) 7.5.10.3. Thailand Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 7.5.10.4. Thailand Motor Monitoring Market Size and Forecast, By End User (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 7.5.11.2. Rest of Asia Pacific Motor Monitoring Market Size and Forecast, By Process (2024-2032) 7.5.11.3. Rest of Asia Pacific Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 7.5.11.4. Rest of Asia Pacific Motor Monitoring Market Size and Forecast, By End User (2024-2032) 8. Middle East and Africa Motor Monitoring Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 8.1. Middle East and Africa Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 8.2. Middle East and Africa Motor Monitoring Market Size and Forecast, By Process (2024-2032) 8.3. Middle East and Africa Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 8.4. Middle East and Africa Motor Monitoring Market Size and Forecast, By End User (2024-2032) 8.5. Middle East and Africa Motor Monitoring Market Size and Forecast, By Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 8.5.1.2. South Africa Motor Monitoring Market Size and Forecast, By Process (2024-2032) 8.5.1.3. South Africa Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 8.5.1.4. South Africa Motor Monitoring Market Size and Forecast, By End User (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 8.5.2.2. GCC Motor Monitoring Market Size and Forecast, By Process (2024-2032) 8.5.2.3. GCC Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 8.5.2.4. GCC Motor Monitoring Market Size and Forecast, By End User (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 8.5.3.2. Nigeria Motor Monitoring Market Size and Forecast, By Process (2024-2032) 8.5.3.3. Nigeria Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 8.5.3.4. Nigeria Motor Monitoring Market Size and Forecast, By End User (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 8.5.4.2. Rest of ME&A Motor Monitoring Market Size and Forecast, By Process (2024-2032) 8.5.4.3. Rest of ME&A Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 8.5.4.4. Rest of ME&A Motor Monitoring Market Size and Forecast, By End User (2024-2032) 9. South America Motor Monitoring Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 9.1. South America Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 9.2. South America Motor Monitoring Market Size and Forecast, By Process (2024-2032) 9.3. South America Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 9.4. South America Motor Monitoring Market Size and Forecast, By End User (2024-2032) 9.5. South America Motor Monitoring Market Size and Forecast, By Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 9.5.1.2. Brazil Motor Monitoring Market Size and Forecast, By Process (2024-2032) 9.5.1.3. Brazil Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 9.5.1.4. Brazil Motor Monitoring Market Size and Forecast, By End User (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 9.5.2.2. Argentina Motor Monitoring Market Size and Forecast, By Process (2024-2032) 9.5.2.3. Argentina Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 9.5.2.4. Argentina Motor Monitoring Market Size and Forecast, By End User (2024-2032) 9.5.3. Rest of South America 9.5.3.1. Rest of South America Motor Monitoring Market Size and Forecast, By Offering (2024-2032) 9.5.3.2. Rest of South America Motor Monitoring Market Size and Forecast, By Process (2024-2032) 9.5.3.3. Rest of South America Motor Monitoring Market Size and Forecast, By Deployment (2024-2032) 9.5.3.4. Rest of South America Motor Monitoring Market Size and Forecast, By End User (2024-2032) 10. Company Profile (Detailed Profile for all Major Industry Players) 10.1. Rockwell Automation, Inc. (USA)Company Overview 10.1.1. Business Portfolio 10.1.2. Financial Overview 10.1.3. SWOT Analysis 10.1.4. Strategic Analysis 10.1.5. Recent Developments 10.2. Rockwell Automation, Inc. (USA) 10.3. Eaton Corporation plc (USA) 10.4. Fluke Corporation (USA) 10.5. General Electric Company (GE) (USA) 10.6. Honeywell International Inc. (USA) 10.7. Emerson Electric Co. (USA) 10.8. National Instruments Corporation (USA) 10.9. Banner Engineering Corp. (USA) 10.10. Qualitrol Company LLC (USA) 10.11. Parker Hannifin Corporation (USA) 10.12. ABB Ltd. (Switzerland) 10.13. Danfoss A/S (Denmark)Siemens AG (Germany) 10.14. Schneider Electric SE (France) 10.15. WEG S.A. (Brazil/Europe Operations) 10.16. SKF Group (Sweden) 10.17. Bachmann electronic GmbH (Germany) 10.18. Dynapar Corporation (UK/Europe presence) 10.19. Phoenix Contact GmbH & Co. KG (Germany) 10.20. Mitsubishi Electric Corporation (Japan) 10.21. Advantech Co., Ltd. (Taiwan) 11. Analyst Recommendations 12. Motor Monitoring Market: Research Methodology