Global Medical Equipment Maintenance Market size was valued at USD 53.78 Billion in 2024 and the total Medical Equipment Maintenance Market revenue is expected to grow at a CAGR of 10.2% from 2025 to 2032, reaching nearly USD 116.97 Billion.Global Medical Equipment Maintenance Market Overview

Medical equipment maintenance involves the regular inspection, calibration, repair, and servicing of healthcare devices to ensure optimal performance, accuracy, and safety. It helps prevent equipment failures, extends device lifespan, supports regulatory compliance, and enhances patient care by maintaining reliable functionality across diagnostic, therapeutic, and monitoring systems in medical facilities. Medical Equipment Maintenance refers to the systematic process of ensuring the optimal functionality, safety and compliance of medical devices through regular inspection, repair, calibration and software updates. Preventive, corrective, and predictive maintenance help minimize downtime, extend equipment lifespan, and ensure accurate diagnostics and patient safety in healthcare facilities. In the Medical Equipment Maintenance Market, these services support regulatory compliance and improve operational efficiency for hospitals, clinics, and specialized medical service providers.To know about the Research Methodology:-Request Free Sample Report Demand for Global Medical Equipment Maintenance is increasing due to healthcare infrastructure, aging medical equipment, and stringent regulatory standards. the supply is growing with special service providers, OEMS, and third-party vendors, which offer cost-effective, technology-powered solutions such as IOT and AI-operated future maintenance to meet the growing needs. Top Medical Equipment Maintenance major players include GE Healthcare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems, and Agfa-Gevaert, leveraging technology and service networks to lead the Medical Equipment Maintenance Market.

Global Medical Equipment Maintenance Market Dynamics

Technological Advancements boost the Medical Equipment Maintenance Market Growth As medical devices become more intricate, the demand for specialized maintenance and servicing escalates. Advanced technologies such as IoT, AI, and predictive analytics are used to enable proactive maintenance strategies. By leveraging these technologies, healthcare facilities predict potential equipment failures, thereby reducing downtime and prolonging the lifespan of medical devices. IoT and AI facilitate remote monitoring, allowing technicians to diagnose issues and perform maintenance tasks from virtually anywhere. This remote capability enhances efficiency and minimizes the need for on-site interventions, thereby reducing operational costs, which boosts the Medical Equipment Maintenance Market growth. The healthcare facilities are increasingly investing in maintenance services to ensure optimal equipment performance and compliance with stringent regulatory standards. This trend is expected to persist and even accelerate, as healthcare providers recognize the importance of proactive maintenance in improving patient outcomes and operational efficiency. The ongoing technological advancements and the increasing adoption of proactive maintenance strategies across the healthcare sector drive the Medical Equipment Maintenance Market growth. Budget Constraints to restrain in the Medical Equipment Maintenance Market The Budget constraints stem from various factors, including limited funding allocations, competing financial priorities within healthcare organizations, and the rising costs associated with equipment maintenance. Healthcare facilities, particularly those in resource-limited settings and under financial strain, frequently face difficult decisions when allocating budgets for maintenance activities. With the high upfront costs of purchasing medical equipment, funds allocated for ongoing maintenance and servicing are insufficient to meet the evolving needs of an aging equipment inventory. Preventive maintenance schedules are deferred or reduced, increasing the risk of equipment failure, downtime, and compromised patient care. The complex landscape of healthcare financing and reimbursement exacerbates budget constraints. Reimbursement policies not fully cover the costs of maintenance services, leaving healthcare providers to absorb additional expenses or prioritize other critical expenditures. Additionally, fluctuations in healthcare funding at local, regional, or national levels impact the predictability and stability of maintenance budgets, making long-term planning and investment challenging. Increasing Demand for Healthcare Services Creates Lucrative Growth Opportunities for The Medical Equipment Maintenance Market Growth The rising demand for healthcare services is a significant driver of growth opportunities in the medical equipment maintenance market. As global populations age and healthcare needs increase, there is a corresponding surge in the utilization of medical equipment across various healthcare settings. This heightened demand necessitates regular maintenance and servicing to ensure the reliable performance and safety of medical devices, creating a lucrative market for maintenance providers. Healthcare facilities are increasingly recognizing the importance of proactive maintenance practices to minimize equipment downtime, enhance operational efficiency, and uphold patient care standards. There is a growing willingness among healthcare providers to invest in comprehensive maintenance contracts and outsourced maintenance services to meet their evolving equipment maintenance needs.Medical Equipment Maintenance Market Segment Analysis

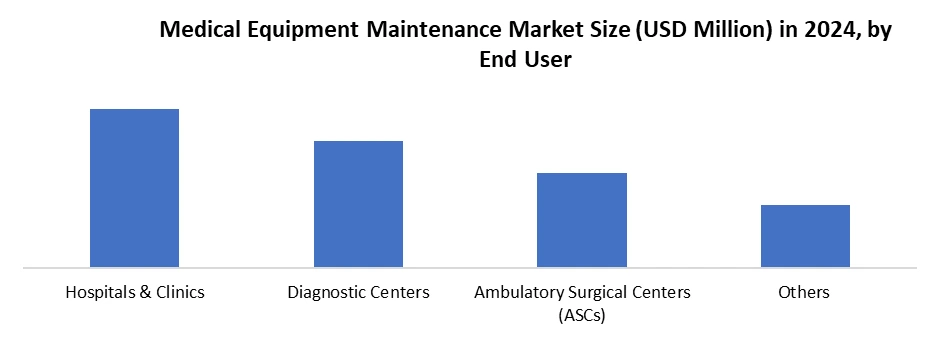

Based on Service Provider, the Global Medical Equipment Maintenance Market is segmented into Original Equipment Manufacturers (OEMs), Third-party Vendors, and In-house Maintenance Teams. The Original Equipment Manufacturers segment dominates the Medical Equipment Maintenance Market in 2024 and is expected to hold the largest market share over the forecast period. The technical expertise, access to proprietary tools/software, and strong brand trust among healthcare providers. Hospitals prefer OEM services for high-end imaging systems (MRI, CT) and complex equipment, as manufacturers ensure compliance with strict regulatory standards (FDA, CE) and provide warranty support. However, third-party sellers are receiving traction with rapid response time and multi-sector abilities, especially for mid-tier equipment, by providing cost-effective, flexible maintenance solutions. Meanwhile, in-house maintenance teams are prevalent in large hospital networks, offer immediate on-site support for regular servicing, reduce downtime, and control long-term costs. While OEM premiums, technology-operated maintenance, and third-party vendors thrive in sensitive markets, and give in-house teams excellent operating efficiency. The dominance of each provider depends on equipment complexity, budget constraints, and institutional preferences, with OEMs remaining the gold standard for critical, high-value devices.Based on End User Global Medical Equipment Maintenance Market is segmented into Hospitals & Clinics, Diagnostic Centers, and Ambulatory Surgical Centers (ASCs) and others. Hospitals & Clinics segment dominates the Medical Equipment Maintenance Market in 2024 and is expected to hold the largest market share over the forecast period. Dominance due to their widespread inventories of complex devices such as MRI machines, ventilators, and surgical robots that require frequent, specialized servicing. Diagnostic centers follow as main maintenance consumers, depending on the exact imaging equipment (CT/PET scanner, X-rays), where the calibration accuracy directly affects clinical quality. The ambulatory surgical centers (ASCS) represent the fastest growing section, which is operated by shift to outpatient care and requiring the cost-skilled maintenance of minimally invasive surgical tools and anesthesia devices. These facilities account for over 80% of maintenance spending, with hospitals leading due to scale, regulatory pressures, and 24/7 equipment utilization rates that necessitate preventive and emergency servicing. The trend toward predictive maintenance and AI-driven monitoring further solidifies their market dominance.

Global Medical Equipment Maintenance Market Regional Insights

North America dominated the Medical Equipment Maintenance Market in 2024 and is expected to continue its dominance during the forecast period. The region boasts advanced healthcare infrastructure and a high adoption rate of sophisticated medical equipment, driving robust demand for maintenance services. Additionally, stringent regulatory standards mandate regular maintenance and compliance checks for medical equipment, driving the Medical Equipment Maintenance Market growth. The presence of major players emphasizing technological innovation and service quality has contributed to the region's leadership position, offering comprehensive maintenance solutions tailored to diverse healthcare facility needs. North America's proactive healthcare management approach and increasing investments in healthcare facilities have also boosted demand for efficient maintenance services, ensuring the uninterrupted operation of critical medical equipment. The combination of advanced healthcare infrastructure, regulatory requirements, presence of key market players, and growing investments in healthcare has solidified North America's dominance in the Medical Equipment Maintenance Market. Global Medical Equipment Maintenance Market Competitive Landscape The global Medical Equipment Maintenance Market is dominated by leading OEMs and specialized service providers, with Siemens Healthineers leading the competitive landscape, reporting about USD 24.44 billion in revenue for 2024, after which GE Healthcare is followed by USD 19.7 billion, with its comprehensive installed base and predictive maintenance solutions. The market dominance hinges on technological sophistication, via compliance with IoT-enabled remote monitoring, OEM-authorized parts with top players, and compliance with strict FDA/EU-MDR standards. Competitive intensity is carried forward by regional top players and ISO-ISO-independent providers to inhibit traditional service paradigms, although Siemens, GE, and Philips maintain an edge through end-to-end life cycle organization contracts with links to large hospitals. Global Medical Equipment Maintenance Market Recent Development March 18, 2025- During Nvidia’s GTC 2025 conference, the two companies announced a significant expansion of their long-standing partnership to develop autonomous X-ray and ultrasound technologies. GE HealthCare is leveraging the newly introduced NVIDIA Isaac for Healthcare platform, an advanced simulation and robotics toolkit to train, test, and validate AI-enabled imaging systems in virtual environments before real-world deployment. Jun. 19, 2025 - Extending a partnership of over 30 years, GE HealthCare has renewed its research collaboration with Stanford Medicine, focusing on the development and advancement of cutting-edge total body PET/CT technology. This initiative aims to explore new clinical pathways and improve patient outcomes through innovative imaging solutions. 2025-01-24, Siemens Healthineers - The range of solutions features the virtually helium-free, Dry Cool technology-enabled 1.5T MAGNETOM Flow MRI, the SOMATOM Pro. Pulse Dual Source CT scanner, MULTIX Impact E Digital X-ray systems, and advanced AI-powered ultrasound systems, including the ACUSON Maple and ACUSON Sequoia. On June 25, 2025, Johnson & Johnson MedTech, a global leader in surgical technologies, announced the launch of the Polyphonic AI Fund for Surgery, an initiative aimed at accelerating the development of AI-driven solutions that address surgical challenges across the entire care continuum: before, during, and after procedures. Backed by a coalition of industry leaders, including NVIDIA and Amazon Web Services (AWS), the fund reinforces J&J MedTech’s commitment to transforming surgical practices through advanced artificial intelligence to ultimately enhance patient outcomes. On March 1, 2024, Boston Scientific Corporation announced that it had received approval from the U.S. Food and Drug Administration (FDA) for its AGENT Drug-Coated Balloon (DCB). This device is designed for the treatment of coronary in-stent restenosis (ISR), a condition in which previously stented arteries become narrowed or obstructed again due to plaque buildup or scar tissue in patients with coronary artery disease. Global Medical Equipment Maintenance Market Recent Trends • In January 2025, SpineGuard announced the strengthening of its strategic partnership with Omnia Medical to expand its collaboration to other products and countries. The collaboration was made to reallocate SpineGuard resources to support Omnia’s product launches, including PsiFGuard, in the U.S. • In January 2025, Harsoria Healthcare Pvt. Ltd., a leading vascular access devices manufacturer, announced that it raised USD 20 million in investment led by Tata Capital Healthcare Fund II. The investment was raised to increase manufacturing capacities, enhance research and development efforts, and support business development initiatives. • In August 2023, Japan launched Japan Health, an international exhibition for medical devices and healthcare. The exhibition was launched to encourage competitiveness and innovation, stimulating the Japanese medical and healthcare industries overall.Medical Equipment Maintenances Industry Ecosystem

Medical Equipment Maintenance Market Scope: Inquire before buying

Global Medical Equipment Maintenance Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 53.78 Bn. Forecast Period 2025 to 2032 CAGR: 10.2% Market Size in 2032: USD 116.97 Bn. Segments Covered: by Service Type Preventive Maintenance Corrective Maintenance Operational Maintenance by Equipment Type Imaging Equipment MRI CT X-ray Others Electromedical Equipment Endoscopic Devices Surgical Instruments Others by Service Provider Original Equipment Manufacturers Third-party Vendors In-house Maintenance Teams by End-User Hospitals & Clinics Diagnostic Centers Ambulatory Surgical Centers (ASCs) Others Medical Equipment Maintenance Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Medical Equipment Maintenance Market Key Players:

The Medical Equipment Maintenance market features leading companies like GE Healthcare, Siemens Healthineers, and Philips Healthcare, each driving innovation with advanced maintenance technologies. These companies focus on enhancing equipment reliability, safety, and efficiency through significant R&D investments. Their strategic partnerships and comprehensive service offerings ensure they meet diverse healthcare needs. Their continuous innovation positions them strongly in the global medical equipment maintenance industry. 1. GE HealthCare (USA) 2. Stryker Corporation (USA) 3. Medtronic plc (USA ) 4. Johnson & Johnson MedTech (USA) 5. Boston Scientific Corporation (USA) 6. Stryker Corporation (USA) 7. Varian Medical Systems (USA) 8. Hill-Rom Holdings, Inc. (USA) 9. Carestream Health, Inc. (USA) 10. Zoll Medical Corporation (USA) 11. Intuitive Surgical, Inc. (USA) Europe 1. Siemens Healthineers (Germany) 2. Philips Healthcare (Netherlands) 3. Dragerwerk AG & Co. KGaA (Germany) 4. Agfa-Gevaert Group (Belgium) 5. Getinge AB (Sweden) 6. Sartorius AG (Germany) 7. Elekta AB (Sweden) 8. Smith+Nephew plc (UK) 9. B. Braun Melsungen AG (Germany) Asia Pacific 1. Canon Medical Systems Corporation (Japan) 2. Fujifilm Holdings Corporation (Japan) 3. Hitachi Medical Systems (Japan) 4. Samsung Medison Co., Ltd. (South Korea) 5. Mindray Medical International Limited (China) 6. Shimadzu Corporation (Japan) 7. Terumo Corporation (Japan) 8. Nihon Kohden Corporation (Japan) 9. Hoya Corporation – Pentax Medical (Japan)Frequently Asked questions

1] What segments are covered in the Global Medical Equipment Maintenance Market report? Ans. The segments covered in the Medical Equipment Maintenance Market report are based on, Product, Provider, Service, End-User, and Regions. 2] Which region is expected to hold the highest share of the Global Medical Equipment Maintenance Market? Ans. The North America region is expected to hold the largest share of the Medical Equipment Maintenance Market. 3] What is the market size of the Global Medical Equipment Maintenance Market by 2032? Ans. The market size of the Medical Equipment Maintenance Market by 2032 is expected to reach USD 116.97 Bn. 4] What was the market size of the Global Medical Equipment Maintenance Market in 2024? Ans. The Medical Equipment Maintenance Market Size in 2024 was valued at USD 53.78 Bn. 5] Key players in the Medical Equipment Maintenance Market. Ans. GE Healthcare - United States, Carestream Health - United States, Stryker Corporation - United States, Varian Medical Systems - United States, Hill-Rom Holdings, Inc. - United States

1. Medical Equipment Maintenance Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Medical Equipment Maintenance Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Medical Equipment Maintenance Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Medical Equipment Maintenance Market: Dynamics 3.1. Medical Equipment Maintenance Market Trends by Region 3.1.1. North America Medical Equipment Maintenance Market Trends 3.1.2. Europe Medical Equipment Maintenance Market Trends 3.1.3. Asia Pacific Medical Equipment Maintenance Market Trends 3.1.4. Middle East and Africa Medical Equipment Maintenance Market Trends 3.1.5. South America Medical Equipment Maintenance Market Trends 3.2. Medical Equipment Maintenance Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Medical Equipment Maintenance Market Drivers 3.2.1.2. North America Medical Equipment Maintenance Market Restraints 3.2.1.3. North America Medical Equipment Maintenance Market Opportunities 3.2.1.4. North America Medical Equipment Maintenance Market Challenges 3.2.2. Europe 3.2.2.1. Europe Medical Equipment Maintenance Market Drivers 3.2.2.2. Europe Medical Equipment Maintenance Market Restraints 3.2.2.3. Europe Medical Equipment Maintenance Market Opportunities 3.2.2.4. Europe Medical Equipment Maintenance Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Medical Equipment Maintenance Market Drivers 3.2.3.2. Asia Pacific Medical Equipment Maintenance Market Restraints 3.2.3.3. Asia Pacific Medical Equipment Maintenance Market Opportunities 3.2.3.4. Asia Pacific Medical Equipment Maintenance Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Medical Equipment Maintenance Market Drivers 3.2.4.2. Middle East and Africa Medical Equipment Maintenance Market Restraints 3.2.4.3. Middle East and Africa Medical Equipment Maintenance Market Opportunities 3.2.4.4. Middle East and Africa Medical Equipment Maintenance Market Challenges 3.2.5. South America 3.2.5.1. South America Medical Equipment Maintenance Market Drivers 3.2.5.2. South America Medical Equipment Maintenance Market Restraints 3.2.5.3. South America Medical Equipment Maintenance Market Opportunities 3.2.5.4. South America Medical Equipment Maintenance Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Medical Equipment Maintenance Industry 3.8. Analysis of Government Schemes and Initiatives For Medical Equipment Maintenance Industry 3.9. Medical Equipment Maintenance Market Trade Analysis 3.10. The Global Pandemic Impact on Medical Equipment Maintenance Market 4. Medical Equipment Maintenance Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 4.1.1. Preventive Maintenance 4.1.2. Corrective Maintenance 4.1.3. Operational Maintenance 4.2. Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 4.2.1. Imaging Equipment 4.2.2. Electromedical Equipment 4.2.3. Endoscopic Devices 4.2.4. Surgical Instruments 4.2.5. Others 4.3. Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 4.3.1. Original Equipment Manufacturers 4.3.2. Third-party Vendors 4.3.3. In-house Maintenance Teams 4.4. Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 4.4.1. Hospitals & Clinics 4.4.2. Diagnostic Centers 4.4.3. Ambulatory Surgical Centers (ASCs) 4.4.4. Others 4.5. Medical Equipment Maintenance Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Medical Equipment Maintenance Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 5.1.1. Preventive Maintenance 5.1.2. Corrective Maintenance 5.1.3. Operational Maintenance 5.2. North America Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 5.2.1. Imaging Equipment 5.2.2. Electromedical Equipment 5.2.3. Endoscopic Devices 5.2.4. Surgical Instruments 5.2.5. Others 5.3. North America Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 5.3.1. Original Equipment Manufacturers 5.3.2. Third-party Vendors 5.3.3. In-house Maintenance Teams 5.4. North America Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 5.4.1. Hospitals & Clinics 5.4.2. Diagnostic Centers 5.4.3. Ambulatory Surgical Centers (ASCs) 5.4.4. Others 5.5. North America Medical Equipment Maintenance Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 5.5.1.1.1. Preventive Maintenance 5.5.1.1.2. Corrective Maintenance 5.5.1.1.3. Operational Maintenance 5.5.1.2. United States Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 5.5.1.2.1. Imaging Equipment 5.5.1.2.2. Electromedical Equipment 5.5.1.2.3. Endoscopic Devices 5.5.1.2.4. Surgical Instruments 5.5.1.2.5. Others 5.5.1.3. United States Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 5.5.1.3.1. Original Equipment Manufacturers 5.5.1.3.2. Third-party Vendors 5.5.1.3.3. In-house Maintenance Teams 5.5.1.4. United States Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 5.5.1.4.1. Hospitals & Clinics 5.5.1.4.2. Diagnostic Centers 5.5.1.4.3. Ambulatory Surgical Centers (ASCs) 5.5.1.4.4. Others 5.5.2. Canada 5.5.2.1. Canada Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 5.5.2.1.1. Preventive Maintenance 5.5.2.1.2. Corrective Maintenance 5.5.2.1.3. Operational Maintenance 5.5.2.2. Canada Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 5.5.2.2.1. Imaging Equipment 5.5.2.2.2. Electromedical Equipment 5.5.2.2.3. Endoscopic Devices 5.5.2.2.4. Surgical Instruments 5.5.2.2.5. Others 5.5.2.3. Canada Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 5.5.2.3.1. Original Equipment Manufacturers 5.5.2.3.2. Third-party Vendors 5.5.2.3.3. In-house Maintenance Teams 5.5.2.4. Canada Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 5.5.2.4.1. Hospitals & Clinics 5.5.2.4.2. Diagnostic Centers 5.5.2.4.3. Ambulatory Surgical Centers (ASCs) 5.5.2.4.4. Others 5.5.3. Mexico 5.5.3.1. Mexico Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 5.5.3.1.1. Preventive Maintenance 5.5.3.1.2. Corrective Maintenance 5.5.3.1.3. Operational Maintenance 5.5.3.2. Mexico Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 5.5.3.2.1. Imaging Equipment 5.5.3.2.2. Electromedical Equipment 5.5.3.2.3. Endoscopic Devices 5.5.3.2.4. Surgical Instruments 5.5.3.2.5. Others 5.5.3.3. Mexico Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 5.5.3.3.1. Original Equipment Manufacturers 5.5.3.3.2. Third-party Vendors 5.5.3.3.3. In-house Maintenance Teams 5.5.3.4. Mexico Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 5.5.3.4.1. Hospitals & Clinics 5.5.3.4.2. Diagnostic Centers 5.5.3.4.3. Ambulatory Surgical Centers (ASCs) 5.5.3.4.4. Others 6. Europe Medical Equipment Maintenance Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 6.2. Europe Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 6.3. Europe Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 6.4. Europe Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 6.5. Europe Medical Equipment Maintenance Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 6.5.1.2. United Kingdom Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 6.5.1.3. United Kingdom Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 6.5.1.4. United Kingdom Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 6.5.2. France 6.5.2.1. France Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 6.5.2.2. France Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 6.5.2.3. France Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 6.5.2.4. France Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 6.5.3.2. Germany Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 6.5.3.3. Germany Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 6.5.3.4. Germany Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 6.5.4.2. Italy Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 6.5.4.3. Italy Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 6.5.4.4. Italy Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 6.5.5.2. Spain Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 6.5.5.3. Spain Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 6.5.5.4. Spain Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 6.5.6.2. Sweden Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 6.5.6.3. Sweden Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 6.5.6.4. Sweden Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 6.5.7.2. Austria Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 6.5.7.3. Austria Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 6.5.7.4. Austria Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 6.5.8.2. Rest of Europe Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 6.5.8.3. Rest of Europe Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 6.5.8.4. Rest of Europe Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 7. Asia Pacific Medical Equipment Maintenance Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 7.2. Asia Pacific Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 7.3. Asia Pacific Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 7.4. Asia Pacific Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 7.5. Asia Pacific Medical Equipment Maintenance Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 7.5.1.2. China Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 7.5.1.3. China Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 7.5.1.4. China Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 7.5.2.2. S Korea Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 7.5.2.3. S Korea Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 7.5.2.4. S Korea Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 7.5.3.2. Japan Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 7.5.3.3. Japan Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 7.5.3.4. Japan Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 7.5.4. India 7.5.4.1. India Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 7.5.4.2. India Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 7.5.4.3. India Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 7.5.4.4. India Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 7.5.5.2. Australia Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 7.5.5.3. Australia Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 7.5.5.4. Australia Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 7.5.6.2. Indonesia Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 7.5.6.3. Indonesia Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 7.5.6.4. Indonesia Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 7.5.7.2. Malaysia Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 7.5.7.3. Malaysia Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 7.5.7.4. Malaysia Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 7.5.8.2. Vietnam Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 7.5.8.3. Vietnam Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 7.5.8.4. Vietnam Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 7.5.9.2. Taiwan Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 7.5.9.3. Taiwan Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 7.5.9.4. Taiwan Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 7.5.10.2. Rest of Asia Pacific Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 7.5.10.3. Rest of Asia Pacific Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 7.5.10.4. Rest of Asia Pacific Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa Medical Equipment Maintenance Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 8.2. Middle East and Africa Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 8.3. Middle East and Africa Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 8.4. Middle East and Africa Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 8.5. Middle East and Africa Medical Equipment Maintenance Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 8.5.1.2. South Africa Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 8.5.1.3. South Africa Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 8.5.1.4. South Africa Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 8.5.2.2. GCC Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 8.5.2.3. GCC Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 8.5.2.4. GCC Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 8.5.3.2. Nigeria Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 8.5.3.3. Nigeria Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 8.5.3.4. Nigeria Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 8.5.4.2. Rest of ME&A Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 8.5.4.3. Rest of ME&A Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 8.5.4.4. Rest of ME&A Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 9. South America Medical Equipment Maintenance Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 9.2. South America Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 9.3. South America Medical Equipment Maintenance Market Size and Forecast, by Service Provider(2024-2032) 9.4. South America Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 9.5. South America Medical Equipment Maintenance Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 9.5.1.2. Brazil Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 9.5.1.3. Brazil Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 9.5.1.4. Brazil Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 9.5.2.2. Argentina Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 9.5.2.3. Argentina Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 9.5.2.4. Argentina Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Medical Equipment Maintenance Market Size and Forecast, by Service Type (2024-2032) 9.5.3.2. Rest Of South America Medical Equipment Maintenance Market Size and Forecast, by Equipment Type (2024-2032) 9.5.3.3. Rest Of South America Medical Equipment Maintenance Market Size and Forecast, by Service Provider (2024-2032) 9.5.3.4. Rest Of South America Medical Equipment Maintenance Market Size and Forecast, by End User (2024-2032) 10. Company Profile: Key Players 10.1. GE HealthCare (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Stryker Corporation (USA) 10.3. Medtronic plc (USA ) 10.4. Johnson & Johnson MedTech (USA) 10.5. Boston Scientific Corporation (USA) 10.6. Stryker Corporation (USA) 10.7. Varian Medical Systems (USA) 10.8. Hill-Rom Holdings, Inc. (USA) 10.9. Carestream Health, Inc. (USA) 10.10. Zoll Medical Corporation (USA) 10.11. Intuitive Surgical, Inc. (USA) 10.12. Siemens Healthineers (Germany) 10.13. Philips Healthcare (Netherlands) 10.14. Dragerwerk AG & Co. KGaA (Germany) 10.15. Agfa-Gevaert Group (Belgium) 10.16. Getinge AB (Sweden) 10.17. Sartorius AG (Germany) 10.18. Elekta AB (Sweden) 10.19. Smith+Nephew plc (UK) 10.20. B. Braun Melsungen AG (Germany) 10.21. Canon Medical Systems Corporation (Japan) 10.22. Fujifilm Holdings Corporation (Japan) 10.23. Hitachi Medical Systems (Japan) 10.24. Samsung Medison Co., Ltd. (South Korea) 10.25. Mindray Medical International Limited (China) 10.26. Shimadzu Corporation (Japan) 10.27. Terumo Corporation (Japan) 10.28. Nihon Kohden Corporation (Japan) 10.29. Hoya Corporation – Pentax Medical (Japan) 11. Key Findings 12. Industry Recommendations 13. Medical Equipment Maintenance Market: Research Methodology 14. Terms and Glossary