Marble Market size was valued at USD 20.58 Bn. in 2023 and the total Marble Market revenue is expected to grow at 5.5 % from 2024 to 2030, reaching nearly USD 29.94 Bn.Marble Market Overview:

Dolomite and calcite, which make up the majority of the recrystallized carbonate minerals in marble, are metamorphic rocks. Because it typically comes in colors like white, yellow, red, black, and others, it can be used in decorative applications. Marble is typically utilized in sculptures and is inferred to be metamorphosed limestone by geology, constructing applications, etc. Marble is being more widely used in the building industry for bathroom applications, flooring, and kitchen counters. The exceptional aesthetic qualities of marble and its accessibility in a variety of colors make it a suitable material for interior design. Additionally, it is expected that the abundance of marble quarries around the world will have a favorable impact on the market. Marble, which is used to make aesthetic objects used in both home and commercial uses, is produced and consumed in large quantities across Asia Pacific. Around the globe, there are numerous sources of marble. Over the past few years, there has been a tremendous increase in marble production. One of the major producers of marble and marble-related goods is China.Research Methodology:

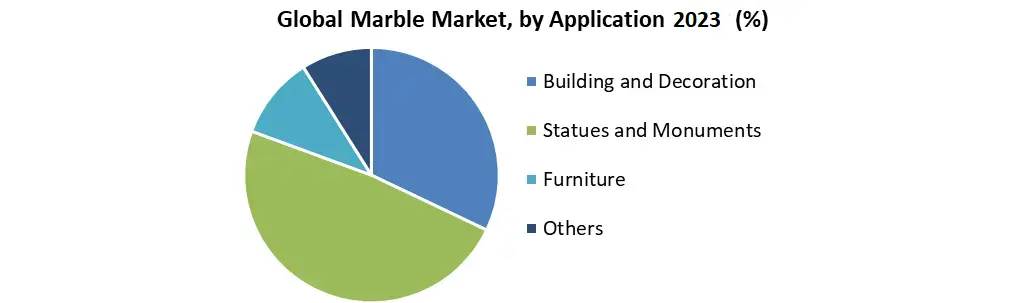

In order to evaluate and forecast the Marble Market, MMR first collected information on the revenues of the major players. Vendors' products are evaluated using the following parameters to segment the market: by Color (White, Black, Yellow, Red, Others) Product (Tiles Slabs , Blocks) Application (Building and Decoration, Statues and Monuments, Furniture, Others). Later, in order to corroborate these divisions through primary research, in-depth interviews with prominent individuals, including chief executive officers (CEOs), vice presidents (VPs), directors, and executives, were undertaken. Market size is determined by using the bottom-up technique. Primary and secondary research is carried out to identify the major market participants in the marble sector and to calculate their market revenues. Instead of using secondary research, a primary research strategy was used, which involved reading the annual and financial reports of the major manufacturers and speaking with prominent opinion and business leaders in the field, such as CEOs and marketing executives Levantina y Asociados de Minerales, S.A., Temmer Marble, Tekma Pakistan Onyx Marble, Dimpomar Sciences are a few of the major competitors in the global marble industry. They will continue to plan mergers and acquisitions to boost their market shares and growth potential during the forecast period.To know about the Research Methodology:-Request Free Sample Report

Report scope:

The goal of the research is to give market participants a detailed understanding of the Marble Market. In the research, the market's recent ongoing, and estimated future developments are examined. It also offers an easy analysis of complicated data. One of the main factors who actively and thoroughly conduct research is new entrants, market leaders, and followers. The research shows the outputs of the PORTER and PESTEL assessments in addition to potential outcomes of the microeconomic market components. Decision-makers will have a clear futuristic perspective of the market after taking into account internal and external factors that could have a positive or negative impact on the organization. Investors can better grasp the dynamics and structure of the marble market thanks to the market segmentation analysis and market size forecast in the study. By clearly laying out the comparative study of the top marble enterprises by price, financial status, product, product portfolio, growth strategies, and regional presence, the research serves as a buyer's guide.Marble Market Dynamics:

Market Drivers: It is essential to build market acceptance before pitching products in India. Blocks used in construction are being given better physical qualities using marble powder. The raw polished and tumbled stone finishes that are becoming popular in interior design are boosting the demand for marble. However, a lot of people mistake marble for granite. As a result, manufacturers in the marble industry are becoming more conscious that whereas granite has a gritty appearance, marble has veins. The capacity of marble to absorb more moisture is another benefit. Manufacturers are increasing their capacity for production in order to diversify their marble inventory with new hues, patterns, and styles. Manufacturers can tailor their pricing in accordance with various marble patterns, giving them a cost advantage. But because the marble market in India is so disorganized, it can be difficult for business owners to find raw materials. As a result, Indian manufacturers are stepping up their R&D efforts and efforts to make their products more marketable. India's top-performing marble slabs Rise to the Top of Residential Projects. Companies in the marble industry are discounting white marble slabs in order to increase product demand. White marble slabs are in high demand for both commercial and residential construction projects. Architects favor marbles with a variety of hardness, toughness, and color possibilities. On the other side, India is seeing an increase in demand for high-quality marble slabs. This is clear given that the Asia Pacific, where India is one of the most populous nations, is also one of the main markets for marble. China is one of the countries that produce the most marble goods. To spread the word about new marble product launches, businesses in the industry are stepping up their marketing efforts. Because the marble market in India is so fragmented, firms are offering their goods at reasonable costs. Market Restraints: There are inexpensive natural stone alternatives like granite and kaoline that are readily available on the market. This is expected to hamper the market growth. The disadvantages of the marble market include surface stripping, offset coloration, and affordability. Natural stone materials are a fierce competitor to marble, which is also prone to coloring and surface peeling in the presence of very acidic substances. However, its aesthetic qualities for premium interior design usually outweigh its drawbacks. Kitchen countertops, flooring, and bathroom fixtures are increasingly using marble. The demand for marble is growing as people become more knowledgeable about interior design approaches. Marble is a preferred material for real estate projects because it is also cheaper than the majority of natural stones. Market Opportunities: Manufacturers Invest in Machinery to Take Advantage of CNC Cutting Business Opportunities. Even startups are looking into value-grab opportunities in the marble market since it is so fragmented. For instance, a brand-new marble supplier in Paola, Malta, called Marble Innovation, is spending money on equipment that sustainably produces marble. Modern technology with CNC (Computer Numerical Control) cutting is being purchased by businesses in the marble industry. They are growing their capacity to produce, among other things, facades, stairways, kitchen tops, and shower trays. Manufacturers are working with regional distributors to grow their business through exports to numerous nations. Surfaces for kitchen countertops are often made of high-quality materials. Manufacturers are enhancing customer service before and after the installation of marble products to gain a reputation in regional marketplaces. They are working harder to meet rigorous deadlines for product delivery and cut down on consumer wait times. Indian Exporters Pay Attention to Incremental Opportunities in UAE. Key characteristics of marble include its robust construction, slick finish, and unparalleled grandeur. Marble helps to provide a timeless appeal in construction projects, from antique structures to modern commercial spaces. In marble items, organic leaf-like designs are becoming more and more fashionable. On the other hand, Rollza Granito, an Indian tile producer in the Gujarat region, is expanding its selection of white marble tile slabs. Businesses operating in the marble industry are working harder to fortify their supply networks in the United Arab Emirates (UAE). The UAE's engineers, building owners, and architects have a variety of needs, and manufacturers in the marble industry are providing services to satisfy those needs. As a result, businesses should take advantage of the income potential in other Middle Eastern nations. They are concentrating on providing marble floor tiles to merchants in the UAE for use in residential and commercial applications.Marble Market Segment Analysis:

Based on Color, The White segment is expected to grow at the highest CAGR during the forecast period. Purity and peace are symbolised by white marble. White marble is frequently used by architects as flooring or wall coverings to enlarge and brighten a space. White also has the benefit of being timeless and perennially fashionable. Kitchen worktops, kitchen islands, kitchen backsplashes, bathroom floors, tub and shower surrounds, wall caps and half-walls, entryway floors, and fireplace surrounds are the most common applications for white marble.Based on Product, The Tiles Slabs segment is expected to grow at the highest CAGR during the forecast period. Table tops, staircases in kitchens or living rooms, custom countertops, and indoor flooring are the principal uses for statuary marble slabs. Statuary marble slabs have resistance to stains and scratches, but they are more expensive than other types of marble slabs, which is a drawback. In terms of the growth rate, the block segment is expected to follow the tile slabs. Marble blocks are used for many different things, including stair treads, floor tiles, face stones, gravestones, window sills, ashlars, sculptures, benches, and paving stones. Based on Application, The Building and Decoration segment is expected to grow at the highest CAGR during the forecast period. In the architecture and construction sector, marble is frequently employed for structural and adornment reasons, including in outdoor sculptures, walls, veneers, floors, ornamental elements, stairways, and pathways. Marble is used in novelty products, interior, and external paving, fireplace facing and hearths, and interior and exterior wall cladding. Different types of marble are mostly utilized for flooring and vertical wall covering in interior and external spaces. With funeral art making up the majority of their use, their use as masonry, statues, epitaphs, cemeteries, etc. is quantitatively less common. Aside from being utilized for outdoor sculptures, marble is also frequently used for walls, veneers, floors, ornamental features, stairways, and walkways. Marble is increasingly in demand for a variety of uses, from big DIY home restorations to use in huge construction projects. Along with historic markets that have long used marble, contemporary markets in the Middle East and Southeast Asia are increasingly becoming more conscious of its advantages. The demand for marble in construction and decoration applications is expected to increase in the forecast period owing to the growing construction industry. By 2030, countries like India, China, and the United States are likely to be the main drivers of the global construction sector, which is anticipated to reach USD 8.5 trillion. China is experiencing a massive boom in development. The nation has the largest construction market in the world, accounting for 20% of all worldwide construction investments. As a result, the building and decoration sector is expected to rule the market.

Marble Market Regional Insights:

Asia-Pacific is estimated to dominate the market during the forecast period. Owing to increased government investment in the building and construction sector there, the Asia-Pacific region is expected to be the leading and fastest-growing market during the forecast period.China is the single-largest market for growth in the construction sector. Globally, China has the greatest market for new buildings, adding an average of 1.85 to 2.2 billion m2 (19 to 21 billion ft2) each year. By 2020, it was expected that the total floor area of Chinese buildings will be around 69.5 billion m2 (742 billion ft2), and by 2030, it is expected to be 80.1 billion m2 (861 billion ft2). In the top 30 cities in China, there will be 1,446 malls total (with a gross floor area over 10,050 m2 and not operating on a strata-titled basis), representing a 13.5 % annual growth rate. The growth of the real estate industry in India, which is primarily concerned with residential and commercial properties, is essential. The sector is being driven by the growing individual townships. The industry is being boosted by the construction of the Palva Industrial Township, the Zaheerabad Integrated Industrial Township, and numerous other projects involving public and private investments totaling USD 29.40 billion. Owing to rapid urbanization and rising household wealth, residential housing is in high demand in India. Additionally, the Indian government has permitted FDI up to 100% for township and settlement development projects. The country's residential housing building is expected to rise as a result. Therefore, during the forecast period, all such market trends are expected to fuel demand for marble in the region.Marble Market Scope: Inquire before buying

Marble Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 20.58 Bn. Forecast Period 2024 to 2030 CAGR: 5.5% Market Size in 2030: US $ 29.94 Bn. Segments Covered: by Color White Black Yellow Red Others by Product Tiles Slabs Blocks by Application Building and Decoration Statues and Monuments Furniture Others Marble Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Marble Market, Key Players are

1. Levantina Asociados de Minerales, S.A. 2. Temmer Marble 3. Tekma 4. Pakistan Onyx Marble 5. Dimpomar 6. Mumal Marbles 7. Can Simsekler Construction 8. Mármoles Marín S.A. 9. Aurangzeb Marble Industry 10. Etgran 11. Amso International 12. Universal Mrble & Granite 13. Best Cheer Stone Group 14. Fujian Fengshan Stone Group 15. Xiamen Wanlistone stock 16. Kangli Stone Group 17. Hongfa 18. Xishi Group 19. Jin Long Run Yu 20. Xinpengfei Industry FAQs: 1. Which is the potential market for the Marble Market in terms of the region? Ans. In APAC region, the growing business and educational sectors are expected to help drive the use of collaborative screens. 2. What are the opportunities for new market entrants? Ans. The key opportunity in the market is new initiatives from governments that provide funding for Marble Markets in educational institutes 3. What is expected to drive the growth of the Marble Market in the forecast period? Ans. A major driver in the Marble Market is the prevalence of work from home and remote collaboration created by the COVID-19 pandemic 4. What is the projected market size & growth rate of the Marble Market? Ans. The Marble Market size was valued at US$ 20.58 Billion in 2023 and the total Marble Market revenue is expected to grow at 5.5 % through 2024 to 2030, reaching nearly US$ 29.94 Billion. 5. What segments are covered in the Marble Market report? Ans. The segments covered are Color, Product, Application, and, Region.

1. Marble Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Marble Market: Dynamics 2.1. Marble Market Trends by Region 2.1.1. North America Marble Market Trends 2.1.2. Europe Marble Market Trends 2.1.3. Asia Pacific Marble Market Trends 2.1.4. Middle East and Africa Marble Market Trends 2.1.5. South America Marble Market Trends 2.2. Marble Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Marble Market Drivers 2.2.1.2. North America Marble Market Restraints 2.2.1.3. North America Marble Market Opportunities 2.2.1.4. North America Marble Market Challenges 2.2.2. Europe 2.2.2.1. Europe Marble Market Drivers 2.2.2.2. Europe Marble Market Restraints 2.2.2.3. Europe Marble Market Opportunities 2.2.2.4. Europe Marble Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Marble Market Drivers 2.2.3.2. Asia Pacific Marble Market Restraints 2.2.3.3. Asia Pacific Marble Market Opportunities 2.2.3.4. Asia Pacific Marble Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Marble Market Drivers 2.2.4.2. Middle East and Africa Marble Market Restraints 2.2.4.3. Middle East and Africa Marble Market Opportunities 2.2.4.4. Middle East and Africa Marble Market Challenges 2.2.5. South America 2.2.5.1. South America Marble Market Drivers 2.2.5.2. South America Marble Market Restraints 2.2.5.3. South America Marble Market Opportunities 2.2.5.4. South America Marble Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Marble Industry 2.8. Analysis of Government Schemes and Initiatives For Marble Industry 2.9. Marble Market Trade Analysis 2.10. The Global Pandemic Impact on Marble Market 3. Marble Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Marble Market Size and Forecast, by color (2023-2030) 3.1.1. White 3.1.2. Black 3.1.3. Yellow 3.1.4. Red 3.1.5. Others 3.2. Marble Market Size and Forecast, by Product (2023-2030) 3.2.1. Tiles Slabs 3.2.2. Blocks 3.3. Marble Market Size and Forecast, by Application (2023-2030) 3.3.1. Building and Decoration 3.3.2. Statues and Monuments 3.3.3. Furniture 3.3.4. Others 3.4. Marble Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Marble Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Marble Market Size and Forecast, by color (2023-2030) 4.1.1. White 4.1.2. Black 4.1.3. Yellow 4.1.4. Red 4.1.5. Others 4.2. North America Marble Market Size and Forecast, by Product (2023-2030) 4.2.1. Tiles Slabs 4.2.2. Blocks 4.3. North America Marble Market Size and Forecast, by Application (2023-2030) 4.3.1. Building and Decoration 4.3.2. Statues and Monuments 4.3.3. Furniture 4.3.4. Others 4.4. North America Marble Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Marble Market Size and Forecast, by color (2023-2030) 4.4.1.1.1. White 4.4.1.1.2. Black 4.4.1.1.3. Yellow 4.4.1.1.4. Red 4.4.1.1.5. Others 4.4.1.2. United States Marble Market Size and Forecast, by Product (2023-2030) 4.4.1.2.1. Tiles Slabs 4.4.1.2.2. Blocks 4.4.1.3. United States Marble Market Size and Forecast, by Application (2023-2030) 4.4.1.3.1. Building and Decoration 4.4.1.3.2. Statues and Monuments 4.4.1.3.3. Furniture 4.4.1.3.4. Others 4.4.2. Canada 4.4.2.1. Canada Marble Market Size and Forecast, by color (2023-2030) 4.4.2.1.1. White 4.4.2.1.2. Black 4.4.2.1.3. Yellow 4.4.2.1.4. Red 4.4.2.1.5. Others 4.4.2.2. Canada Marble Market Size and Forecast, by Product (2023-2030) 4.4.2.2.1. Tiles Slabs 4.4.2.2.2. Blocks 4.4.2.3. Canada Marble Market Size and Forecast, by Application (2023-2030) 4.4.2.3.1. Building and Decoration 4.4.2.3.2. Statues and Monuments 4.4.2.3.3. Furniture 4.4.2.3.4. Others 4.4.3. Mexico 4.4.3.1. Mexico Marble Market Size and Forecast, by color (2023-2030) 4.4.3.1.1. White 4.4.3.1.2. Black 4.4.3.1.3. Yellow 4.4.3.1.4. Red 4.4.3.1.5. Others 4.4.3.2. Mexico Marble Market Size and Forecast, by Product (2023-2030) 4.4.3.2.1. Tiles Slabs 4.4.3.2.2. Blocks 4.4.3.3. Mexico Marble Market Size and Forecast, by Application (2023-2030) 4.4.3.3.1. Building and Decoration 4.4.3.3.2. Statues and Monuments 4.4.3.3.3. Furniture 4.4.3.3.4. Others 5. Europe Marble Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Marble Market Size and Forecast, by color (2023-2030) 5.2. Europe Marble Market Size and Forecast, by Product (2023-2030) 5.3. Europe Marble Market Size and Forecast, by Application (2023-2030) 5.4. Europe Marble Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Marble Market Size and Forecast, by color (2023-2030) 5.4.1.2. United Kingdom Marble Market Size and Forecast, by Product (2023-2030) 5.4.1.3. United Kingdom Marble Market Size and Forecast, by Application(2023-2030) 5.4.2. France 5.4.2.1. France Marble Market Size and Forecast, by color (2023-2030) 5.4.2.2. France Marble Market Size and Forecast, by Product (2023-2030) 5.4.2.3. France Marble Market Size and Forecast, by Application(2023-2030) 5.4.3. Germany 5.4.3.1. Germany Marble Market Size and Forecast, by color (2023-2030) 5.4.3.2. Germany Marble Market Size and Forecast, by Product (2023-2030) 5.4.3.3. Germany Marble Market Size and Forecast, by Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Marble Market Size and Forecast, by color (2023-2030) 5.4.4.2. Italy Marble Market Size and Forecast, by Product (2023-2030) 5.4.4.3. Italy Marble Market Size and Forecast, by Application(2023-2030) 5.4.5. Spain 5.4.5.1. Spain Marble Market Size and Forecast, by color (2023-2030) 5.4.5.2. Spain Marble Market Size and Forecast, by Product (2023-2030) 5.4.5.3. Spain Marble Market Size and Forecast, by Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Marble Market Size and Forecast, by color (2023-2030) 5.4.6.2. Sweden Marble Market Size and Forecast, by Product (2023-2030) 5.4.6.3. Sweden Marble Market Size and Forecast, by Application (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Marble Market Size and Forecast, by color (2023-2030) 5.4.7.2. Austria Marble Market Size and Forecast, by Product (2023-2030) 5.4.7.3. Austria Marble Market Size and Forecast, by Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Marble Market Size and Forecast, by color (2023-2030) 5.4.8.2. Rest of Europe Marble Market Size and Forecast, by Product (2023-2030) 5.4.8.3. Rest of Europe Marble Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Marble Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Marble Market Size and Forecast, by color (2023-2030) 6.2. Asia Pacific Marble Market Size and Forecast, by Product (2023-2030) 6.3. Asia Pacific Marble Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Marble Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Marble Market Size and Forecast, by color (2023-2030) 6.4.1.2. China Marble Market Size and Forecast, by Product (2023-2030) 6.4.1.3. China Marble Market Size and Forecast, by Application (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Marble Market Size and Forecast, by color (2023-2030) 6.4.2.2. S Korea Marble Market Size and Forecast, by Product (2023-2030) 6.4.2.3. S Korea Marble Market Size and Forecast, by Application (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Marble Market Size and Forecast, by color (2023-2030) 6.4.3.2. Japan Marble Market Size and Forecast, by Product (2023-2030) 6.4.3.3. Japan Marble Market Size and Forecast, by Application (2023-2030) 6.4.4. India 6.4.4.1. India Marble Market Size and Forecast, by color (2023-2030) 6.4.4.2. India Marble Market Size and Forecast, by Product (2023-2030) 6.4.4.3. India Marble Market Size and Forecast, by Application (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Marble Market Size and Forecast, by color (2023-2030) 6.4.5.2. Australia Marble Market Size and Forecast, by Product (2023-2030) 6.4.5.3. Australia Marble Market Size and Forecast, by Application (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Marble Market Size and Forecast, by color (2023-2030) 6.4.6.2. Indonesia Marble Market Size and Forecast, by Product (2023-2030) 6.4.6.3. Indonesia Marble Market Size and Forecast, by Application (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Marble Market Size and Forecast, by color (2023-2030) 6.4.7.2. Malaysia Marble Market Size and Forecast, by Product (2023-2030) 6.4.7.3. Malaysia Marble Market Size and Forecast, by Application (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Marble Market Size and Forecast, by color (2023-2030) 6.4.8.2. Vietnam Marble Market Size and Forecast, by Product (2023-2030) 6.4.8.3. Vietnam Marble Market Size and Forecast, by Application(2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Marble Market Size and Forecast, by color (2023-2030) 6.4.9.2. Taiwan Marble Market Size and Forecast, by Product (2023-2030) 6.4.9.3. Taiwan Marble Market Size and Forecast, by Application (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Marble Market Size and Forecast, by color (2023-2030) 6.4.10.2. Rest of Asia Pacific Marble Market Size and Forecast, by Product (2023-2030) 6.4.10.3. Rest of Asia Pacific Marble Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Marble Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Marble Market Size and Forecast, by color (2023-2030) 7.2. Middle East and Africa Marble Market Size and Forecast, by Product (2023-2030) 7.3. Middle East and Africa Marble Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Marble Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Marble Market Size and Forecast, by color (2023-2030) 7.4.1.2. South Africa Marble Market Size and Forecast, by Product (2023-2030) 7.4.1.3. South Africa Marble Market Size and Forecast, by Application (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Marble Market Size and Forecast, by color (2023-2030) 7.4.2.2. GCC Marble Market Size and Forecast, by Product (2023-2030) 7.4.2.3. GCC Marble Market Size and Forecast, by Application (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Marble Market Size and Forecast, by color (2023-2030) 7.4.3.2. Nigeria Marble Market Size and Forecast, by Product (2023-2030) 7.4.3.3. Nigeria Marble Market Size and Forecast, by Application (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Marble Market Size and Forecast, by color (2023-2030) 7.4.4.2. Rest of ME&A Marble Market Size and Forecast, by Product (2023-2030) 7.4.4.3. Rest of ME&A Marble Market Size and Forecast, by Application (2023-2030) 8. South America Marble Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Marble Market Size and Forecast, by color (2023-2030) 8.2. South America Marble Market Size and Forecast, by Product (2023-2030) 8.3. South America Marble Market Size and Forecast, by Application(2023-2030) 8.4. South America Marble Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Marble Market Size and Forecast, by color (2023-2030) 8.4.1.2. Brazil Marble Market Size and Forecast, by Product (2023-2030) 8.4.1.3. Brazil Marble Market Size and Forecast, by Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Marble Market Size and Forecast, by color (2023-2030) 8.4.2.2. Argentina Marble Market Size and Forecast, by Product (2023-2030) 8.4.2.3. Argentina Marble Market Size and Forecast, by Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Marble Market Size and Forecast, by color (2023-2030) 8.4.3.2. Rest Of South America Marble Market Size and Forecast, by Product (2023-2030) 8.4.3.3. Rest Of South America Marble Market Size and Forecast, by Application (2023-2030) 9. Global Marble Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Marble Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Levantina Asociados de Minerales, S.A. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Temmer Marble 10.3. Tekma 10.4. Pakistan Onyx Marble 10.5. Dimpomar 10.6. Mumal Marbles 10.7. Can Simsekler Construction 10.8. Mármoles Marín S.A. 10.9. Aurangzeb Marble Industry 10.10. Etgran 10.11. Amso International 10.12. Universal Mrble & Granite 10.13. Best Cheer Stone Group 10.14. Fujian Fengshan Stone Group 10.15. Xiamen Wanlistone stock 10.16. Kangli Stone Group 10.17. Hongfa 10.18. Xishi Group 10.19. Jin Long Run Yu 10.20. Xinpengfei Industry 11. Key Findings 12. Industry Recommendations 13. Marble Market: Research Methodology 14. Terms and Glossary