The LPG Market size was valued at USD 176.52 Billion in 2025 and the total LPG revenue is expected to grow at a CAGR of 6.6% from 2025 to 2032, reaching nearly USD 276.13 Billion by 2032.LPG Market Overview:

Liquefied petroleum gas (LPG) is a low-carbon, long-lasting, and energy-efficient fuel. It benefits consumers, businesses, and the environment because it is a green, low-carbon, efficient, and innovative energy source. The ranking of LPG in the Product complexity index is 950th. LPG world trade in 2023 is US$ 300 Bn, the top importers were China (US $ 47.8 Bn), Japan (US $ 42.3 Bn), and India (the US $ 16.4 Bn). The top exporter was Qatar (US $ 44.2 Bn), Australia (US $ 34.1 Bn), and the United States (the US $ 32.3 Bn). LPG is more cost-effective than other traditional fuels since most of its energy is converted to heat, and it can be transported, stored, and utilised in a variety of applications, including cooking, heating, air conditioning, and transportation, as well as cigarette lighters and the Olympic torch.To know about the Research Methodology :- Request Free Sample Report

LPG Market Dynamics:

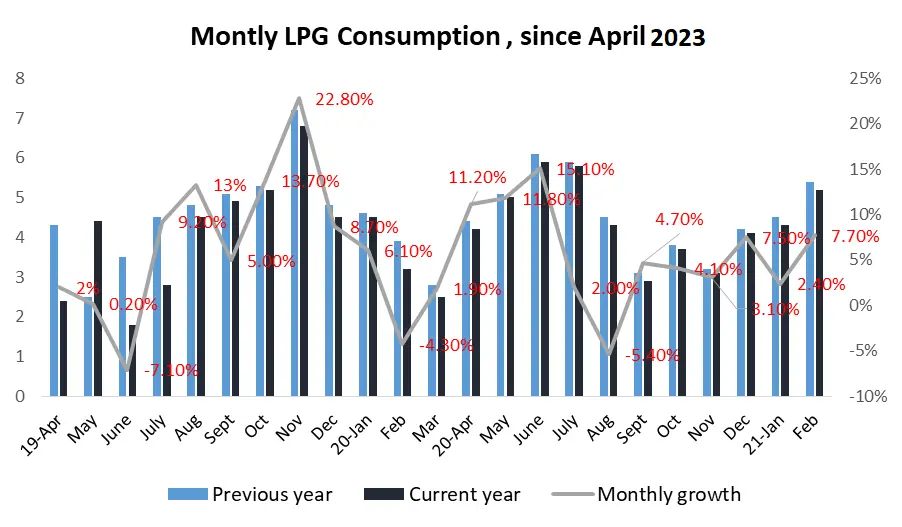

In 2023 the total LPG consumption growth recorded is 7.7% and cumulative growth is 5.4% in April 20-Feb 21. In Feb 2023 Out of all five regions, North America has the highest share in LPG sales of 31.8%. The global liquefied petroleum gas industry is expanding due to increased demand for LPG from various operations. Furthermore, from 2024 to 2032, the implementation of strict government environmental rules will be a major driver of market growth. However, the LPG market's growth is being hampered by the rapid development of the renewable energy sector and the inconsistency of domestic LPG supplies. Government measures to promote the use of LPG over traditional fuels and the increased usage of gas in automobiles, on the other hand, are expected to create lucrative growth prospects for key companies to maintain their market positions in the future years. Increasing car gas usage, as well as huge semi-urban and rural populations in Africa, Latin America, and Asia-Pacific, is some of the factors driving LPG demand. This product is used as cooking fuel by the indigenous population in these areas. In India, for example, LPG is used as cooking fuel by over 80% of all home households. Government schemes (such as the Pradhan Mantri Ujjwala Yojna) and initiatives such as streamlining subscription processes and payments, cylinder delivery, and cylinder subsidies to wean people off of hazardous cooking fuels like firewood and coal have resulted in increased adoption of the gas mix as a dome.The combustible nature of LPG is a key stumbling block for the market. As a result, it is kept in enormous pressurised cylindrical or spherical tanks. Furthermore, the gas's flammability adds to the expenses of storage, transportation, and distribution to end-users. Another aspect that has a negative impact on the market is the price volatility of crude oil feedstock, which has hampered market growth. The expansion of marine commerce of this fuel is predicted to be driven by the construction of petrochemical projects (propane dehydrogenation project [PDH] and steam crackers) and new production lines. Moreover, other LPG-producing regions, including Canada, Australia, and Angola, are projected to start up new gas exploration and production projects. This is estimated to support gas exports, creating market opportunities on the worldwide stage.

LPG Market Segments Analysis:

Based on the Source, the LPG market is sub-segmented into Refineries, Associated Gas, and Non-Associated Gas. In 2025, the Non-Associated Gas segment was dominant and held the largest market share of 54%. For example, natural gas processing units make for the majority of gas production in North America, whereas refineries make for the majority of gas production in Asia-Pacific. Refineries are one of the most important sources of different gases production on a global platform. In the future years, rising refining capacity, particularly in Saudi Arabia, Brazil, India, and China, is expected to increase the supply of the product. Based on Application, the LPG market is segmented into Automobile Fuel, Residential, Commercial, Industrial, and Others. In 2025, the Residential segment was dominant and held the largest market share of 51.20%. The segment's growth has been driven by promising government subsidies and initiatives to promote the product as a feasible alternative to traditional fuels like wood and coal. Due to a little impact on ozone depletion, liquefied petroleum gas is also replacing chlorofluorocarbon and hydrofluorocarbon as a refrigerant. This has resulted in increased application opportunities in the residential/commercial segment, particularly in the areas of ventilation and heating, in addition to cooking.Regional Insights:

LPG is generated naturally, intermingled with petroleum and natural gas deposits. Natural gas contains LPG, water vapour, and other impurities that must be removed before it can be transferred as a saleable product through pipelines. Natural gas purification accounts for approximately 55% of LPG processed in the United States. The remaining 45 percent is derived from crude oil refining. Because a significant portion of US LPG is sourced from petroleum, LPG contributes less to reduce the country's reliance on foreign oil than certain other alternative fuels. However, because more than 90% of the LPG used in the country is manufactured here, LPG does contribute to addressing the national security component of the country's total petroleum reliance problem. In 2023, Asia Pacific accounted for a major portion of the market. The primary aspects driving regional market expansion have been population increase, abundant resource availability, and high energy needs, as well as easy affordability thanks to government discounts on LPG cylinders. Increased petrochemical capacity in India, China, India, Thailand, and South Korea helps to maintain this trend. The expansion of marine commerce of this fuel is predicted to be driven by the construction of petrochemical projects (propane dehydrogenation project [PDH] and steam crackers) and new production lines. Moreover, other LPG-producing regions, including Canada, Australia, and Angola, are projected to start up new gas exploration and production projects. This is estimated to support gas exports, creating market opportunities on the worldwide stage. The mature economies of Europe and North America are expected to grow significantly in the coming years as people become more aware of the need to reduce carbon emissions. In terms of revenue, Germany is predicted to grow at a CAGR of 4.0 %in Europe. The objective of the report is to present a comprehensive analysis of the global LPG market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the global LPG market dynamics, structure by analyzing the market segments and projecting the global LPG market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global LPG market make the report investor’s guide.LPG Market Scope: Inquire before buying

Global LPG Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 176.52 Bn. Forecast Period 2026 to 2032 CAGR: 6.6% Market Size in 2032: USD 276.13 Bn. Segments Covered: by Source Refiners Associated gas Non-Associated gas by Cylinder Capacity Small cylinders (5-10 kg) Medium sizes (10-20 kg) Large cylinders (20-50 kg) by Application Automobile fuel Residential Commercial Industrial Others LPG Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest)LPG Market, key player

1.Saudi Aramco 2.Sinopec 3.ADNOC 4.CNPC 5.Exxon Mobil 6.Reliance Industries 7.KNPC 8.Phillips66 9.Bharat Petroleum Corporation Ltd. 10.Pemex 11.Total Corp. 12.Qatar Petroleum 13.Equinor 14.BP Corp. 15.Gazprom Corp. 16.Chevron 17.ConocoPhillips Company 18.SHV Energy (NL) 19.Valero Energy 20.UGI Corporation 21.Royal Dutch Shell PLC 22.OthersFrequently Asked Questions:

1) What was the market size of the Global LPG Market in 2025? Ans - Global LPG Market was worth USD 176.52 Bn in 2025. 2) What is the market segment of the LPG Market? Ans -The market segments are based on Source, cylinder capacity and Application. 3) What is the forecast period considered for the Global LPG Market? Ans -The forecast period for the Global LPG Market is 2026 to 2032. 4) What is the market size of the Global LPG Market in 2032? Ans – Global LPG Market is estimated as worth USD 276.13 Bn 5) Which region is dominant in the Global LPG Market? Ans -In 2025, the Asia Pacific region dominated the Global LPG Market.

1. LPG Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global LPG Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2025) 2.3.5. Company Locations 2.4. Leading LPG Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. LPG Market: Dynamics 3.1. LPG Market Trends by Region 3.1.1. North America LPG Market Trends 3.1.2. Europe LPG Market Trends 3.1.3. Asia Pacific LPG Market Trends 3.1.4. Middle East and Africa LPG Market Trends 3.1.5. South America LPG Market Trends 3.2. LPG Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America LPG Market Drivers 3.2.1.2. North America LPG Market Restraints 3.2.1.3. North America LPG Market Opportunities 3.2.1.4. North America LPG Market Challenges 3.2.2. Europe 3.2.2.1. Europe LPG Market Drivers 3.2.2.2. Europe LPG Market Restraints 3.2.2.3. Europe LPG Market Opportunities 3.2.2.4. Europe LPG Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific LPG Market Drivers 3.2.3.2. Asia Pacific LPG Market Restraints 3.2.3.3. Asia Pacific LPG Market Opportunities 3.2.3.4. Asia Pacific LPG Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa LPG Market Drivers 3.2.4.2. Middle East and Africa LPG Market Restraints 3.2.4.3. Middle East and Africa LPG Market Opportunities 3.2.4.4. Middle East and Africa LPG Market Challenges 3.2.5. South America 3.2.5.1. South America LPG Market Drivers 3.2.5.2. South America LPG Market Restraints 3.2.5.3. South America LPG Market Opportunities 3.2.5.4. South America LPG Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For LPG Industry 3.8. Analysis of Government Schemes and Initiatives For LPG Industry 3.9. LPG Market Trade Analysis 3.10. The Global Pandemic Impact on LPG Market 4. LPG Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2025-2032 4.1. LPG Market Size and Forecast, by Source (2025-2032) 4.1.1. Refiners 4.1.2. Associated gas 4.1.3. Non-Associated gas 4.2. LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 4.2.1. Small cylinders (5-10 kg) 4.2.2. Medium sizes (10-20 kg) 4.2.3. Large cylinders (20-50 kg) 4.3. LPG Market Size and Forecast, by Application (2025-2032) 4.3.1. Automobile fuel 4.3.2. Residential 4.3.3. Commercial 4.3.4. Industrial 4.3.5. Others 4.4. LPG Market Size and Forecast, by Region (2025-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America LPG Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 5.1. North America LPG Market Size and Forecast, by Source (2025-2032) 5.1.1. Refiners 5.1.2. Associated gas 5.1.3. Non-Associated gas 5.2. North America LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 5.2.1. Small cylinders (5-10 kg) 5.2.2. Medium sizes (10-20 kg) 5.2.3. Large cylinders (20-50 kg) 5.3. North America LPG Market Size and Forecast, by Application (2025-2032) 5.3.1. Automobile fuel 5.3.2. Residential 5.3.3. Commercial 5.3.4. Industrial 5.3.5. Others 5.4. North America LPG Market Size and Forecast, by Country (2025-2032) 5.4.1. United States 5.4.1.1. United States LPG Market Size and Forecast, by Source (2025-2032) 5.4.1.1.1. Refiners 5.4.1.1.2. Associated gas 5.4.1.1.3. Non-Associated gas 5.4.1.2. United States LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 5.4.1.2.1. Small cylinders (5-10 kg) 5.4.1.2.2. Medium sizes (10-20 kg) 5.4.1.2.3. Large cylinders (20-50 kg) 5.4.1.3. United States LPG Market Size and Forecast, by Application (2025-2032) 5.4.1.3.1. Automobile fuel 5.4.1.3.2. Residential 5.4.1.3.3. Commercial 5.4.1.3.4. Industrial 5.4.1.3.5. Others 5.4.2. Canada 5.4.2.1. Canada LPG Market Size and Forecast, by Source (2025-2032) 5.4.2.1.1. Refiners 5.4.2.1.2. Associated gas 5.4.2.1.3. Non-Associated gas 5.4.2.2. Canada LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 5.4.2.2.1. Small cylinders (5-10 kg) 5.4.2.2.2. Medium sizes (10-20 kg) 5.4.2.2.3. Large cylinders (20-50 kg) 5.4.2.3. Canada LPG Market Size and Forecast, by Application (2025-2032) 5.4.2.3.1. Automobile fuel 5.4.2.3.2. Residential 5.4.2.3.3. Commercial 5.4.2.3.4. Industrial 5.4.2.3.5. Others 5.4.3. Mexico 5.4.3.1. Mexico LPG Market Size and Forecast, by Source (2025-2032) 5.4.3.1.1. Refiners 5.4.3.1.2. Associated gas 5.4.3.1.3. Non-Associated gas 5.4.3.2. Mexico LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 5.4.3.2.1. Small cylinders (5-10 kg) 5.4.3.2.2. Medium sizes (10-20 kg) 5.4.3.2.3. Large cylinders (20-50 kg) 5.4.3.3. Mexico LPG Market Size and Forecast, by Application (2025-2032) 5.4.3.3.1. Automobile fuel 5.4.3.3.2. Residential 5.4.3.3.3. Commercial 5.4.3.3.4. Industrial 5.4.3.3.5. Others 6. Europe LPG Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 6.1. Europe LPG Market Size and Forecast, by Source (2025-2032) 6.2. Europe LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 6.3. Europe LPG Market Size and Forecast, by Application (2025-2032) 6.4. Europe LPG Market Size and Forecast, by Country (2025-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom LPG Market Size and Forecast, by Source (2025-2032) 6.4.1.2. United Kingdom LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 6.4.1.3. United Kingdom LPG Market Size and Forecast, by Application (2025-2032) 6.4.2. France 6.4.2.1. France LPG Market Size and Forecast, by Source (2025-2032) 6.4.2.2. France LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 6.4.2.3. France LPG Market Size and Forecast, by Application (2025-2032) 6.4.3. Germany 6.4.3.1. Germany LPG Market Size and Forecast, by Source (2025-2032) 6.4.3.2. Germany LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 6.4.3.3. Germany LPG Market Size and Forecast, by Application (2025-2032) 6.4.4. Italy 6.4.4.1. Italy LPG Market Size and Forecast, by Source (2025-2032) 6.4.4.2. Italy LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 6.4.4.3. Italy LPG Market Size and Forecast, by Application (2025-2032) 6.4.5. Spain 6.4.5.1. Spain LPG Market Size and Forecast, by Source (2025-2032) 6.4.5.2. Spain LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 6.4.5.3. Spain LPG Market Size and Forecast, by Application (2025-2032) 6.4.6. Sweden 6.4.6.1. Sweden LPG Market Size and Forecast, by Source (2025-2032) 6.4.6.2. Sweden LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 6.4.6.3. Sweden LPG Market Size and Forecast, by Application (2025-2032) 6.4.7. Austria 6.4.7.1. Austria LPG Market Size and Forecast, by Source (2025-2032) 6.4.7.2. Austria LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 6.4.7.3. Austria LPG Market Size and Forecast, by Application (2025-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe LPG Market Size and Forecast, by Source (2025-2032) 6.4.8.2. Rest of Europe LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 6.4.8.3. Rest of Europe LPG Market Size and Forecast, by Application (2025-2032) 7. Asia Pacific LPG Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 7.1. Asia Pacific LPG Market Size and Forecast, by Source (2025-2032) 7.2. Asia Pacific LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 7.3. Asia Pacific LPG Market Size and Forecast, by Application (2025-2032) 7.4. Asia Pacific LPG Market Size and Forecast, by Country (2025-2032) 7.4.1. China 7.4.1.1. China LPG Market Size and Forecast, by Source (2025-2032) 7.4.1.2. China LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 7.4.1.3. China LPG Market Size and Forecast, by Application (2025-2032) 7.4.2. S Korea 7.4.2.1. S Korea LPG Market Size and Forecast, by Source (2025-2032) 7.4.2.2. S Korea LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 7.4.2.3. S Korea LPG Market Size and Forecast, by Application (2025-2032) 7.4.3. Japan 7.4.3.1. Japan LPG Market Size and Forecast, by Source (2025-2032) 7.4.3.2. Japan LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 7.4.3.3. Japan LPG Market Size and Forecast, by Application (2025-2032) 7.4.4. India 7.4.4.1. India LPG Market Size and Forecast, by Source (2025-2032) 7.4.4.2. India LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 7.4.4.3. India LPG Market Size and Forecast, by Application (2025-2032) 7.4.5. Australia 7.4.5.1. Australia LPG Market Size and Forecast, by Source (2025-2032) 7.4.5.2. Australia LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 7.4.5.3. Australia LPG Market Size and Forecast, by Application (2025-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia LPG Market Size and Forecast, by Source (2025-2032) 7.4.6.2. Indonesia LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 7.4.6.3. Indonesia LPG Market Size and Forecast, by Application (2025-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia LPG Market Size and Forecast, by Source (2025-2032) 7.4.7.2. Malaysia LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 7.4.7.3. Malaysia LPG Market Size and Forecast, by Application (2025-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam LPG Market Size and Forecast, by Source (2025-2032) 7.4.8.2. Vietnam LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 7.4.8.3. Vietnam LPG Market Size and Forecast, by Application (2025-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan LPG Market Size and Forecast, by Source (2025-2032) 7.4.9.2. Taiwan LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 7.4.9.3. Taiwan LPG Market Size and Forecast, by Application (2025-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific LPG Market Size and Forecast, by Source (2025-2032) 7.4.10.2. Rest of Asia Pacific LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 7.4.10.3. Rest of Asia Pacific LPG Market Size and Forecast, by Application (2025-2032) 8. Middle East and Africa LPG Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 8.1. Middle East and Africa LPG Market Size and Forecast, by Source (2025-2032) 8.2. Middle East and Africa LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 8.3. Middle East and Africa LPG Market Size and Forecast, by Application (2025-2032) 8.4. Middle East and Africa LPG Market Size and Forecast, by Country (2025-2032) 8.4.1. South Africa 8.4.1.1. South Africa LPG Market Size and Forecast, by Source (2025-2032) 8.4.1.2. South Africa LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 8.4.1.3. South Africa LPG Market Size and Forecast, by Application (2025-2032) 8.4.2. GCC 8.4.2.1. GCC LPG Market Size and Forecast, by Source (2025-2032) 8.4.2.2. GCC LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 8.4.2.3. GCC LPG Market Size and Forecast, by Application (2025-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria LPG Market Size and Forecast, by Source (2025-2032) 8.4.3.2. Nigeria LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 8.4.3.3. Nigeria LPG Market Size and Forecast, by Application (2025-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A LPG Market Size and Forecast, by Source (2025-2032) 8.4.4.2. Rest of ME&A LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 8.4.4.3. Rest of ME&A LPG Market Size and Forecast, by Application (2025-2032) 9. South America LPG Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 9.1. South America LPG Market Size and Forecast, by Source (2025-2032) 9.2. South America LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 9.3. South America LPG Market Size and Forecast, by Application(2025-2032) 9.4. South America LPG Market Size and Forecast, by Country (2025-2032) 9.4.1. Brazil 9.4.1.1. Brazil LPG Market Size and Forecast, by Source (2025-2032) 9.4.1.2. Brazil LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 9.4.1.3. Brazil LPG Market Size and Forecast, by Application (2025-2032) 9.4.2. Argentina 9.4.2.1. Argentina LPG Market Size and Forecast, by Source (2025-2032) 9.4.2.2. Argentina LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 9.4.2.3. Argentina LPG Market Size and Forecast, by Application (2025-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America LPG Market Size and Forecast, by Source (2025-2032) 9.4.3.2. Rest Of South America LPG Market Size and Forecast, by Cylinder Capacity (2025-2032) 9.4.3.3. Rest Of South America LPG Market Size and Forecast, by Application (2025-2032) 10. Company Profile: Key Players 10.1. Saudi Aramco 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Sinopec 10.3. ADNOC 10.4. CNPC 10.5. Exxon Mobil 10.6. Reliance Industries 10.7. KNPC 10.8. Phillips66 10.9. Bharat Petroleum Corporation Ltd. 10.10. Pemex 10.11. Total Corp. 10.12. Qatar Petroleum 10.13. Equinor 10.14. BP Corp. 10.15. Gazprom Corp. 10.16. Chevron 10.17. ConocoPhillips Company 10.18. SHV Energy (NL) 10.19. Valero Energy 10.20. UGI Corporation 10.21. Royal Dutch Shell PLC 11. Key Findings 12. Industry Recommendations 13. LPG Market: Research Methodology 14. Terms and Glossary