Global Laundry Detergent Market size was valued at USD 170.08 Bn in 2023 and is expected to reach USD 260.85 Bn by 2030, at a CAGR of 6.3%.Laundry Detergent Market Overview

Laundry detergent is a cleaning agent specifically formulated for washing clothes and removing dirt, stains, and odors. Typically available in liquid, powder, or pod form, laundry detergents contain surfactants that help lift dirt and grime from fabrics, as well as enzymes and other ingredients to target specific stains. Detergent soaps, including brighteners and fragrances, are a subset of the Laundry Detergent Market, catering to various cleaning preferences. Laundry detergents are designed to work effectively in both high-efficiency (HE) and traditional washing machines, providing a wide range of laundry requirements. With various formulations available for different fabric types and washing conditions, consumers choose from a diverse selection of laundry detergents to achieve optimal cleaning results for their clothing and linens.To know about the Research Methodology :- Request Free Sample Report Urbanization and population expansion contribute significantly as more people reside in urban areas with access to washing machines. With rising disposable incomes, consumers are inclined to invest in higher-quality detergents and laundry care products. Technological advancements, including the development of concentrated and eco-friendly formulations, provide environmentally conscious consumers and foster innovation. Shifting consumer lifestyles, characterized by busier schedules and a greater demand for convenience, increase reliance on laundry detergents to efficiently clean clothes which boosts the Laundry Detergent Market. Marketing and advertising campaigns are essential, in shaping consumer preferences and developing brand loyalty. Globalization facilitates market growth into new regions and emerging economies, tapping into increasing demand for laundry products. The growing awareness of hygiene, especially in light of public health concerns such as the COVID-19 pandemic, stimulates demand as consumers prioritize cleanliness and sanitation.

Laundry Detergent Market Trend

The rapid growth of concentrated and ultra-concentrated detergent products Concentrated and ultra-concentrated detergents represent a departure from traditional formulations, offering higher levels of cleaning power in smaller doses. This innovation aligns with the growing prominence of sustainability and resource efficiency in consumer goods. By reducing the volume of water and packaging required per load of laundry, these products reduce environmental impact throughout their lifecycle, from production to disposal. Manufacturers and consumers alike recognize the importance of minimizing waste and conserving resources in the face of mounting ecological challenges. From a manufacturing perspective, the development of concentrated detergents leverages advancements in formulation science and production processes which drive the Laundry Detergent Market growth. Through the refinement of ingredients and manufacturing techniques, companies create highly effective cleaning agents that require smaller quantities peruse. This not only reduces material costs but also streamlines logistics and distribution, leading to more efficient supply chains and lower carbon footprints. Consumer preferences help to increase the adoption of concentrated and ultra-concentrated detergents. In busy lifestyles and urban living, consumers increasingly value convenience and space-saving solutions. Compact detergent products provide greater portability and ease of storage, making them particularly appealing to urban dwellers and individuals with limited living space. The smaller packaging sizes and reduced product volumes align with minimalist trends and the desire for clutter-free living spaces. Beyond convenience, concentrated detergents also offer tangible benefits in terms of performance and cost-effectiveness which boost the Laundry Detergent Market growth. The concentrated nature of these detergents allows for more precise dosing, minimizing the risk of overuse and ensuring optimal cleaning performance with each load of laundry. 1. For Instance, concentrated detergents are the Tide brand, which has introduced various products in this category over the years. One such product is Tide Ultra Oxi High Efficiency Liquid Laundry Detergent. This detergent is designed to deliver exceptional cleaning power while requiring smaller doses compared to traditional formulations. Tide Ultra Oxi is formulated with advanced cleaning ingredients that are highly effective in removing tough stains, even in cold water.Laundry Detergent Market Dynamics

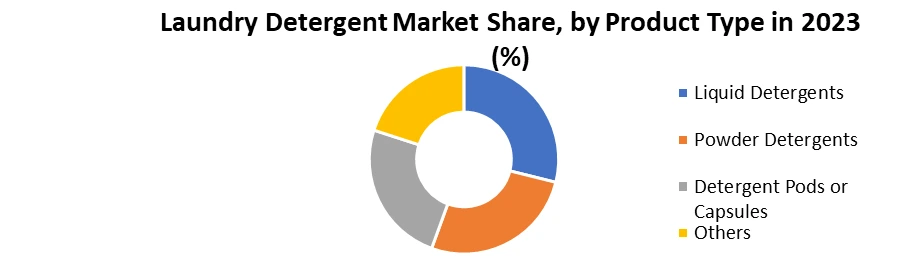

Increasing consumer demand for eco-friendly and sustainable products to Boost Market Growth As consumers become more conscious of their environmental footprint and health implications, they are seeking alternatives to traditional detergents that are harmful to the planet and human health. This shift in consumer preferences has become a driving force behind the growth of eco-friendly laundry detergents. The awareness surrounding environmental issues, such as pollution and climate change, has prompted consumers to reevaluate their purchasing decisions, which drives the Laundry Detergent Market growth. They are now more inclined to choose products that minimize harm to the environment. Traditional laundry detergents often contain chemicals that are harmful to aquatic life and contribute to water pollution. As consumers become more informed about these environmental impacts, they are actively seeking alternatives that are biodegradable and less harmful. There is a growing concern about the health effects of exposure to chemicals found in traditional laundry detergents. Ingredients such as phosphates, sulfates and synthetic fragrances have been linked to various health issues, including skin irritation, respiratory problems, and hormone disruption. With increased awareness about these potential risks, consumers are seeking safer alternatives for themselves and their families. Eco-friendly laundry detergents, which are made from natural and non-toxic ingredients, provide a solution to these health concerns. The rise of eco-friendly consumerism has also been driven by the desire for transparency and ethical sourcing which also help to boost Laundry Detergent Market growth. Modern consumers are more interested in understanding where and how products are made, as well as the impact of their production processes. They are looking for brands that prioritize ethical and sustainable practices throughout their supply chain. Eco-friendly laundry detergents often come from companies that prioritize sustainable sourcing, renewable energy, and ethical labor practices. This transparency and commitment to sustainability resonate with consumers who value ethical consumption. Regulatory Compliance to Hamper Market Growth The stringent regulations often dictate the ingredients, labeling requirements, and environmental impact of laundry detergents, thereby increasing manufacturing costs and limiting the availability of certain chemicals. Compliance with these regulations necessitates extensive testing, documentation, and sometimes reformulation of products to meet standards, which is time-consuming and costly for manufacturers. The restrictions on certain chemicals, such as phosphates and surfactants, limit the formulation options for detergent manufacturers, potentially hindering product effectiveness and innovation which hamper the Laundry Detergent Market growth. Failure to comply with regulations leads to hefty fines and damage to brand reputation. Navigating regulatory requirements poses a significant challenge for companies in the Laundry Detergents Market, constraining their ability to introduce new products and adapt to changing consumer preferences while maintaining compliance. 1. For Instance, the regulatory landscape, exemplified by the Detergents Regulation (EC) No 648/2004 and its subsequent updates, poses a significant restraint on the laundry detergents market's growth. Mandates for fully biodegradable surfactants and bans on inorganic phosphates constrain formulation options and increase production costs. Compliance requirements for ingredient disclosure and dosage information add complexity to product labeling and hinder consumer understanding. The manufacturers navigate evolving guidelines and provide input to regulatory reviews, diverting resources from innovation and market growth efforts. These regulatory hurdles limit flexibility and innovation in the laundry detergents market, impeding its growth potential. Based on Product Type, the market is segmented into Liquid Detergents, Powder Detergents, Detergent Pods or Capsules and Others. Liquid Detergents dominated the Laundry Detergent Market in 2023. Liquid detergents have emerged in the laundry detergent industry due to a combination of factors that have contributed to their widespread popularity and market success. From their convenience and versatility to their effectiveness and evolving formulations, liquid detergents have captured a significant share of consumer preferences, shaping the landscape of the laundry detergent industry. Unlike powdered detergents, which are easy to handle and leave residues on clothing if not properly dissolved, liquid detergents offer a hassle-free laundry experience. With liquid detergents, consumers simply pour the desired amount directly into the washing machine or dispenser, eliminating the need for measuring and reducing the risk of spillage or waste. This convenience factor resonates with busy consumers seeking efficient and time-saving solutions for their laundry needs. The liquid detergents are highly versatile and suitable for various washing machine types, including both top-loading and front-loading machines. Their liquid form allows for better dispersion and penetration into fabrics, ensuring thorough cleaning and stain removal. This versatility appeals to a broad spectrum of consumers with different washing machine preferences, making liquid detergents a go-to choice for households across the globe. liquid detergents are renowned for their effectiveness in tackling a wide range of stains and soils which boost Laundry Detergent Market growth. Manufacturers have formulated liquid detergents with advanced cleaning agents, enzymes, and surfactants that target specific types of stains, such as grease, oil, dirt, and food residues. This superior cleaning performance has earned the trust of consumers who prioritize cleanliness and laundry results. Whether dealing with everyday laundry or stubborn stains, liquid detergents offer reliable and efficient cleaning power, solidifying their position as the preferred choice among consumers.

Laundry Detergent Market Regional Insights

Asia Pacific held the largest Laundry Detergent Market share in 2023 and is expected to continue its dominance over the forecast period. The Asia-Pacific region's prominence in the global laundry detergent industry is driven by several factors, including demographic shifts, economic dynamics and cultural norms. The region's sheer magnitude and densely populated nature contribute significantly. The rapid urbanization and rising disposable incomes in many countries across the Asia-Pacific region have fueled the demand for laundry detergents. As more people migrate to urban areas, the demand for convenient and effective cleaning solutions increases. The growing middle class in countries such as China, India, and Indonesia has led to increased spending on household goods, including laundry detergents. This demographic shift has created a substantial market opportunity for both local as well as international detergent manufacturers. In many Asian cultures, cleanliness is highly valued, and there is a cultural emphasis on maintaining immaculate personal hygiene and cleanliness in households. This cultural norm translates into a consistent demand for laundry detergents across the region. The prevalence of large, extended families in many Asian societies means that laundry is a frequent and essential household chore, driving the demand for laundry products. The competitive landscape of the Asia-Pacific laundry detergent market is also shaped by the presence of both local and global players. While multinational corporations such as Procter & Gamble, Unilever and Henkel have a significant market share, there are also numerous local brands catering to specific regional preferences and price points. These local players often have a better understanding of local consumer preferences and offer products tailored to meet the unique requirements of different markets within the region. The region is witnessing a shift towards more sustainable and eco-friendly laundry detergents, boosted by increasing environmental awareness among consumers. These lead Laundry Detergent manufacturers are innovative and introduce products with eco-friendly formulations, such as biodegradable ingredients and packaging.Laundry Detergent Market Scope: Inquire before buying

Global Laundry Detergent Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 170.08 Bn. Forecast Period 2024 to 2030 CAGR: 6.3% Market Size in 2030: USD 260.85 Bn. Segments Covered: by Product Type Liquid Detergents Powder Detergents Detergent Pods or Capsules Others by Application Household Commercial Industrial Others by Distribution Channel Retail Stores Online Retail Specialty Stores Others Laundry Detergent Market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Laundry Detergent Key Players

Global 1. Procter & Gamble Co. (United States) 2. Unilever (Netherlands/United Kingdom) 3. Henkel AG & Co. KGaA (Germany) 4. Church & Dwight Co., Inc. (United States) 5. Kao Corporation (Japan) North America 1. Colgate-Palmolive Company (New York City, New York) 2. S. C. Johnson & Son, Inc. (Racine, Wisconsin) 3. Nakoma Products, LLC (Gurnee, Illinois) 4. Nefco (Columbus, Ohio) 5. Phoenix Brands, LLC (Stamford, Connecticut) Europe 1. Reckitt Benckiser Group plc (Slough, United Kingdom) 2. McBride plc (Manchester, United Kingdom) 3. Werner & Mertz GmbH (Mainz, Germany) 4. Dalli-Werke GmbH & Co. KG (Stolberg, Germany) Asia Pacific 1. Lion Corporation (Tokyo, Japan) 2. Guangzhou Liby Enterprise Group Co., Ltd. (Guangzhou, China) 3. Nice Group Co., Ltd. (Guangzhou, China) 4. RSPL Group (Kanpur, India) 5. Godrej Consumer Products Limited (Mumbai, India) 6. Walch (Guangzhou, China) 7. Jyothy Laboratories Limited (Mumbai, India) 8. Nirma Limited (Ahmedabad, India) 9. ACS Manufacturing Corporation (Quezon City, Philippines) Frequently Asked Questions: 1] What is the growth rate of the Global Laundry Detergent Market? Ans. The Global Laundry Detergent Market is growing at a significant rate of 6.3% during the forecast period. 2] Which region is expected to dominate the Global Laundry Detergent Market? Ans. Asia Pacific is expected to dominate the Laundry Detergent Market during the forecast period. 3] What is the expected Global Laundry Detergent Market size by 2030? Ans. The Laundry Detergent Market size is expected to reach USD 260.85 Billion by 2030. 4] Which are the top players in the Global Laundry Detergent Market? Ans. The major top players in the Global Laundry Detergent Market are Procter & Gamble Co. (United States), Unilever (Netherlands/United Kingdom), Henkel AG & Co. KGaA (Germany), church & Dwight Co., Inc. (United States), Kao Corporation (Japan), Colgate-Palmolive Company (New York City, New York) and Others. 5] What are the factors driving the Global Laundry Detergent Market growth? Ans. Population Growth and Urbanization and increasing disposable income are expected to drive market growth during the forecast period.

1. Laundry Detergent Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Laundry Detergent Market: Dynamics 2.1. Laundry Detergent Market Trends by Region 2.1.1. North America Laundry Detergent Market Trends 2.1.2. Europe Laundry Detergent Market Trends 2.1.3. Asia Pacific Laundry Detergent Market Trends 2.1.4. Middle East and Africa Laundry Detergent Market Trends 2.1.5. South America Laundry Detergent Market Trends 2.2. Laundry Detergent Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Laundry Detergent Market Drivers 2.2.1.2. North America Laundry Detergent Market Restraints 2.2.1.3. North America Laundry Detergent Market Opportunities 2.2.1.4. North America Laundry Detergent Market Challenges 2.2.2. Europe 2.2.2.1. Europe Laundry Detergent Market Drivers 2.2.2.2. Europe Laundry Detergent Market Restraints 2.2.2.3. Europe Laundry Detergent Market Opportunities 2.2.2.4. Europe Laundry Detergent Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Laundry Detergent Market Drivers 2.2.3.2. Asia Pacific Laundry Detergent Market Restraints 2.2.3.3. Asia Pacific Laundry Detergent Market Opportunities 2.2.3.4. Asia Pacific Laundry Detergent Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Laundry Detergent Market Drivers 2.2.4.2. Middle East and Africa Laundry Detergent Market Restraints 2.2.4.3. Middle East and Africa Laundry Detergent Market Opportunities 2.2.4.4. Middle East and Africa Laundry Detergent Market Challenges 2.2.5. South America 2.2.5.1. South America Laundry Detergent Market Drivers 2.2.5.2. South America Laundry Detergent Market Restraints 2.2.5.3. South America Laundry Detergent Market Opportunities 2.2.5.4. South America Laundry Detergent Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Laundry Detergent Industry 2.8. Analysis of Government Schemes and Initiatives For Laundry Detergent Industry 2.9. Laundry Detergent Market Trade Analysis 2.10. The Global Pandemic Impact on Laundry Detergent Market 3. Laundry Detergent Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 3.1.1. Liquid Detergents 3.1.2. Powder Detergents 3.1.3. Detergent Pods or Capsules 3.1.4. Others 3.2. Laundry Detergent Market Size and Forecast, by Application (2023-2030) 3.2.1. Household 3.2.2. Commercial 3.2.3. Industrial 3.2.4. Others 3.3. Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 3.3.1. Retail Stores 3.3.2. Online Retail 3.3.3. Specialty Stores 3.3.4. Others 3.4. Laundry Detergent Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Laundry Detergent Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 4.1.1. Liquid Detergents 4.1.2. Powder Detergents 4.1.3. Detergent Pods or Capsules 4.1.4. Others 4.2. North America Laundry Detergent Market Size and Forecast, by Application (2023-2030) 4.2.1. Household 4.2.2. Commercial 4.2.3. Industrial 4.2.4. Others 4.3. North America Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.1. Retail Stores 4.3.2. Online Retail 4.3.3. Specialty Stores 4.3.4. Others 4.4. North America Laundry Detergent Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 4.4.1.1.1. Liquid Detergents 4.4.1.1.2. Powder Detergents 4.4.1.1.3. Detergent Pods or Capsules 4.4.1.1.4. Others 4.4.1.2. United States Laundry Detergent Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Household 4.4.1.2.2. Commercial 4.4.1.2.3. Industrial 4.4.1.2.4. Others 4.4.1.3. United States Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.1.3.1. Retail Stores 4.4.1.3.2. Online Retail 4.4.1.3.3. Specialty Stores 4.4.1.3.4. Others 4.4.2. Canada 4.4.2.1. Canada Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 4.4.2.1.1. Liquid Detergents 4.4.2.1.2. Powder Detergents 4.4.2.1.3. Detergent Pods or Capsules 4.4.2.1.4. Others 4.4.2.2. Canada Laundry Detergent Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Household 4.4.2.2.2. Commercial 4.4.2.2.3. Industrial 4.4.2.2.4. Others 4.4.2.3. Canada Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.2.3.1. Retail Stores 4.4.2.3.2. Online Retail 4.4.2.3.3. Specialty Stores 4.4.2.3.4. Others 4.4.3. Mexico 4.4.3.1. Mexico Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 4.4.3.1.1. Liquid Detergents 4.4.3.1.2. Powder Detergents 4.4.3.1.3. Detergent Pods or Capsules 4.4.3.1.4. Others 4.4.3.2. Mexico Laundry Detergent Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Household 4.4.3.2.2. Commercial 4.4.3.2.3. Industrial 4.4.3.2.4. Others 4.4.3.3. Mexico Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.3.3.1. Retail Stores 4.4.3.3.2. Online Retail 4.4.3.3.3. Specialty Stores 4.4.3.3.4. Others 5. Europe Laundry Detergent Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 5.2. Europe Laundry Detergent Market Size and Forecast, by Application (2023-2030) 5.3. Europe Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 5.4. Europe Laundry Detergent Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 5.4.1.2. United Kingdom Laundry Detergent Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.2. France 5.4.2.1. France Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 5.4.2.2. France Laundry Detergent Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 5.4.3.2. Germany Laundry Detergent Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 5.4.4.2. Italy Laundry Detergent Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 5.4.5.2. Spain Laundry Detergent Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 5.4.6.2. Sweden Laundry Detergent Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 5.4.7.2. Austria Laundry Detergent Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 5.4.8.2. Rest of Europe Laundry Detergent Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 6. Asia Pacific Laundry Detergent Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 6.2. Asia Pacific Laundry Detergent Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 6.4. Asia Pacific Laundry Detergent Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 6.4.1.2. China Laundry Detergent Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 6.4.2.2. S Korea Laundry Detergent Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 6.4.3.2. Japan Laundry Detergent Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.4. India 6.4.4.1. India Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 6.4.4.2. India Laundry Detergent Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 6.4.5.2. Australia Laundry Detergent Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 6.4.6.2. Indonesia Laundry Detergent Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 6.4.7.2. Malaysia Laundry Detergent Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 6.4.8.2. Vietnam Laundry Detergent Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 6.4.9.2. Taiwan Laundry Detergent Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Laundry Detergent Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 7. Middle East and Africa Laundry Detergent Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 7.2. Middle East and Africa Laundry Detergent Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 7.4. Middle East and Africa Laundry Detergent Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 7.4.1.2. South Africa Laundry Detergent Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 7.4.2.2. GCC Laundry Detergent Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 7.4.3.2. Nigeria Laundry Detergent Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 7.4.4.2. Rest of ME&A Laundry Detergent Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 8. South America Laundry Detergent Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 8.2. South America Laundry Detergent Market Size and Forecast, by Application (2023-2030) 8.3. South America Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 8.4. South America Laundry Detergent Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 8.4.1.2. Brazil Laundry Detergent Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 8.4.2.2. Argentina Laundry Detergent Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Laundry Detergent Market Size and Forecast, by Product Type (2023-2030) 8.4.3.2. Rest Of South America Laundry Detergent Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Laundry Detergent Market Size and Forecast, by Distribution Channel (2023-2030) 9. Global Laundry Detergent Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Laundry Detergent Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Procter & Gamble Co. (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Unilever (Netherlands/United Kingdom) 10.3. Henkel AG & Co. KGaA (Germany) 10.4. Church & Dwight Co., Inc. (United States) 10.5. Kao Corporation (Japan) 10.6. Colgate-Palmolive Company (New York City, New York) 10.7. S. C. Johnson & Son, Inc. (Racine, Wisconsin) 10.8. Nakoma Products, LLC (Gurnee, Illinois) 10.9. Nefco (Columbus, Ohio) 10.10. Phoenix Brands, LLC (Stamford, Connecticut) 10.11. Reckitt Benckiser Group plc (Slough, United Kingdom) 10.12. McBride plc (Manchester, United Kingdom) 10.13. Werner & Mertz GmbH (Mainz, Germany) 10.14. Dalli-Werke GmbH & Co. KG (Stolberg, Germany) 10.15. Lion Corporation (Tokyo, Japan) 10.16. Guangzhou Liby Enterprise Group Co., Ltd. (Guangzhou, China) 10.17. Nice Group Co., Ltd. (Guangzhou, China) 10.18. RSPL Group (Kanpur, India) 10.19. Godrej Consumer Products Limited (Mumbai, India) 10.20. Walch (Guangzhou, China) 10.21. Jyothy Laboratories Limited (Mumbai, India) 10.22. Nirma Limited (Ahmedabad, India) 10.23. ACS Manufacturing Corporation (Quezon City, Philippines) 11. Key Findings 12. Industry Recommendations 13. Laundry Detergent Market: Research Methodology 14. Terms and Glossary