The Industrial Rubber Market size was valued at US$ 132.81 Bn. in 2022 and the total revenue is expected to grow at a CAGR of 6.2% through 2023 to 2029, reaching nearly US$ 202.36 Bn.Industrial Rubber Market Overview:

Industrial Rubber is used in many industries such as mining, automotive, buildings and construction, paper industries, power generation, agriculture, and others. Tires and tubes are the main consumers of rubber, followed by other rubber goods. Rubber is also used in hoses, belts, matting, flooring, medical gloves, and many other applications. Rubber is also utilized as an adhesive in a variety of products and industries. Mechanical Rubber Good, Rubber Belt, Rubber Hose, and Rubber Roofing are some of the types of the industrial rubber product. Synthetic and natural are the two types of the industrial rubber. Tires, crap tubes, adhesives, hoses, gaskets, and roll coatings are among the products made with it. One of the significant industrial rubber market trends is the growing demand for tyre and non-tire applications from the automobile industry.To know about the Research Methodology :- Request Free Sample Report

Industrial Rubber Market Dynamics:

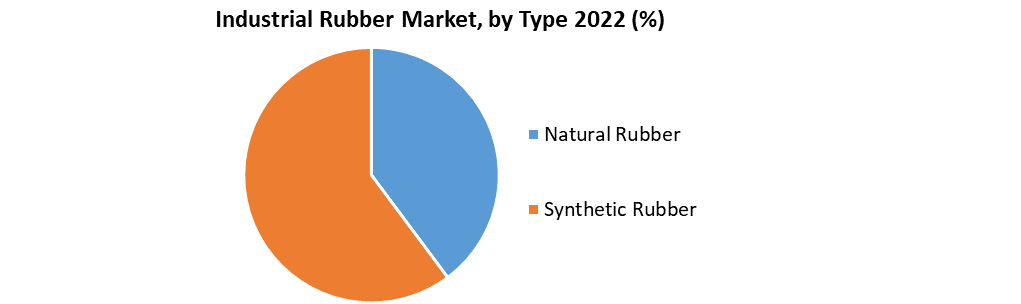

Gaskets, belts, and other applications of industrial rubber are common in the automotive sector. The growth in automobile production in China, boosted by increased demand for electric vehicles, is driving the growth of the automotive sector in the Asia Pacific region. Several foreign corporations are investing in China and India in order to serve the local markets, which are expected to be the largest and fastest-growing in the forecast period. To meet local demand from automobile businesses, major industrial rubber fabricators are building manufacturing bases in Asia Pacific. Furthermore, as their customers, such as Volkswagen, Mercedes-Benz, and other multinationals, are increasingly building vehicles locally, industrial rubber manufacturing businesses are establishing manufacturing units in the region. The production of several types of industrial rubbers has been restricted due to strict environmental rules. Rubber processing, rubber goods manufacturing facilities, and sealant applications have all been identified as substantial sources of Hazardous Air Pollutants (HAP) emissions by the Environmental Protection Agency (EPA). For example, during the manufacturing process of BR (butyl rubber), a form of industrial rubber, hazardous compounds such as carbon dioxide, carbon monoxide, and other poisonous fumes and vapors are produced. The industrial rubber market is governed by a number of rules; for example, butadiene was designated as a dangerous material under the Canadian Environmental Protection Act of 1999. Such regulations have restrained the global industrial rubber market growth during the forecast period 2023-2029. In the automotive, electrical and electronics, construction, and medical industries, industrial rubber is being commercialized at an increasing rate. Industrial rubber is typically synthesized and made, to some extent, from raw ingredients derived from fossil fuels. However, the industrial rubber business is adopting sustainable and green programmes as a result of rising environmental consciousness and an unpredictable tendency in petroleum costs. In order to develop environmentally friendly products, Europe, North America, and Japan have developed criteria that give priority treatment to bio-preferred products procured by public institutions that fulfil minimum renewable raw material content standards. Due to this factors, industrial rubber manufacturers are creating bio-based materials made from renewable resources and streamlined by environmental laws as a viable alternative. Industrial Rubber Market Segment Analysis: The Global Industrial Rubber Market is segmented by Type, Product, and Application. Based on the Type, the market is segmented into Natural Rubber, and Synthetic Rubber. Synthetic Rubber type segment is expected to hold the largest market share of xx% by 2029. The widespread usage of synthetic rubber in many applications is responsible for the segment's rise. Synthetic rubber is widely utilized in the automotive industry as an abrasion-resistant alternative to natural rubber. In carpet manufacture, latex-based synthetic rubber is utilized as a rubbery glue. Drive couplings, haul-off pads, conveyor belts, adhesives, roll coverings, and a variety of other molded rubber goods are among the additional uses for synthetic rubber. Based on the Application, the market is segmented intoAutomotive, Industrial Manufacturing, Building & Construction, Polymer Modification, Electrical & Electronics, and Others. Automotive application segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. Industrial rubbers are also replacing other materials in a variety of applications due to their rigidity and abrasion resistance, making them appropriate for metal, glass, and wood parts used in automotive and other industrial applications. Synthetic rubber is the most often used type of industrial rubber in the automobile industry due to its ease of manufacturing and superior performance.

Regional Insights:

Asia Pacific dominates the Global Industrial Rubber market during the forecast period 2023-2029. Asia Pacific is expected to hold the largest market share of xx% by 2029. The Asia Pacific industrial rubber market is being driven by rising demand for industrial rubber from automotive, building & construction, industrial manufacturing, and other applications in countries like China and India. These are the major factors that drive the growth of this region in the Global market during the forecast period 2023-2029. North America is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. This is due to the growing demand for industrial rubber such as synthetic rubber and natural rubber in the various industries like automotive, industrial manufacturing, building and construction in the North America region. This is the key major driver that is expected to boost the growth of the North America region in the global industrial rubber market during the forecast period 2023-2029. The objective of the report is to present a comprehensive analysis of the Global Industrial Rubber Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global Industrial Rubber Market dynamic, structure by analyzing the market segments and project the Global Industrial Rubber Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Global Industrial Rubber Market make the report investor’s guide.Industrial Rubber Market Scope: Inquire before buying

Industrial Rubber Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 132.81 Bn. Forecast Period 2023 to 2029 CAGR: 6.2% Market Size in 2029: US $ 202.36 Bn. Segments Covered: by Type Natural Rubber Synthetic Rubber by Product Mechanical Rubber Good Rubber Belt Rubber Hose Rubber Roofing Others by Application Automotive Industrial Manufacturing Building & Construction Polymer Modification Electrical & Electronics Others Global Industrial Rubber Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest)Key Players are :

1. Lanxess 2. Sinopec 3. The Goodyear Tire and Rubber Company 4. Kumho Petrochemical 5. TSRC Corporation 6. JSR Corporation 7. LG Chem 8. Versalis S.P.A. 9. Zeon Corporation 10.Petrochina 11.ExxonMobil 12.Sibur 13.Group Dynasol 14.Kraton Corporation 15.Bridgestone Corporation 16.Bando Chemical Industries, Ltd 17.Trelleborg ABFrequently Asked Questions:

1] What segments are covered in Global Industrial Rubber Market report? Ans. The segments covered in Global Industrial Rubber Market report are based on Type, Product, and Application. 2] Which region is expected to hold the highest share in the Global Industrial Rubber Market? Ans. Asia Pacific is expected to hold the highest share in the Global Industrial Rubber Market. 3] Who are the top key players in the Global Industrial Rubber Market? Ans. Lanxess, Sinopec, The Goodyear Tire and Rubber Company, Kumho Petrochemical, TSRC Corporation, and JSR Corporationare the top key players in the Global Industrial Rubber Market. 4] Which segment holds the largest market share in the Global Industrial Rubber market by 2029? Ans. Synthetic Rubber Type segment hold the largest market share in the Global Industrial Rubber market by 2029. 5] What is the market size of the Global Industrial Rubber market by 2029? Ans. The market size of the Global Industrial Rubber market is US $ 202.36 Bn. by 2029. 6] What was the market size of the Global Industrial Rubber market in 2022? Ans. The market size of the Global Industrial Rubber market was worth US $ 132.81 Bn. in 2022.

1. Global Industrial Rubber Market: Research Methodology 2. Global Industrial Rubber Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Industrial Rubber Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Global Industrial Rubber Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12 COVID-19 Impact 4. Global Industrial Rubber Market Segmentation 4.1 Global Industrial Rubber Market, by Type (2022-2029) • Natural Rubber • Synthetic Rubber 4.2 Global Industrial Rubber Market, by Product (2022-2029) • Mechanical Rubber Good • Rubber Belt • Rubber Hose • Rubber Roofing • Others 4.3 Global Industrial Rubber Market, by Application (2022-2029) • Automotive • Industrial Manufacturing • Building & Construction • Polymer Modification • Electrical & Electronics • Others 5. North America Industrial Rubber Market (2022-2029) 5.1 Global Industrial Rubber Market, by Type (2022-2029) • Natural Rubber • Synthetic Rubber 5.2 Global Industrial Rubber Market, by Product (2022-2029) • Mechanical Rubber Good • Rubber Belt • Rubber Hose • Rubber Roofing • Others 5.3 Global Industrial Rubber Market, by Application (2022-2029) • Automotive • Industrial Manufacturing • Building & Construction • Polymer Modification • Electrical & Electronics • Others 5.4 North America Industrial Rubber Market, by Country (2022-2029) • United States • Canada • Mexico 6. Asia Pacific Industrial Rubber Market (2022-2029) 6.1. Asia Pacific Industrial Rubber Market, by Type (2022-2029) 6.2. Asia Pacific Industrial Rubber Market, by Product (2022-2029) 6.3. Asia Pacific Industrial Rubber Market, by Application (2022-2029) 6.4. Asia Pacific Industrial Rubber Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. Middle East and Africa Industrial Rubber Market (2022-2029) 7.1 Middle East and Africa Industrial Rubber Market, by Type (2022-2029) 7.2. Middle East and Africa Industrial Rubber Market, by Product (2022-2029) 7.3. Middle East and Africa Industrial Rubber Market, by Application (2022-2029) 7.4. Middle East and Africa Industrial Rubber Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 8. Latin America Industrial Rubber Market (2022-2029) 8.1. Latin America Industrial Rubber Market, by Type (2022-2029) 8.2. Latin America Industrial Rubber Market, by Product (2022-2029) 8.3. Latin America Industrial Rubber Market, by Application (2022-2029) 8.4. Latin America Industrial Rubber Market, by Country (2022-2029) • Brazil • Argentina • Rest Of Latin America 9. European Industrial Rubber Market (2022-2029) 9.1. European Industrial Rubber Market, by Type (2022-2029) 9.2. European Industrial Rubber Market, by Product (2022-2029) 9.3. European Industrial Rubber Market, by Application (2022-2029) 9.4. European Industrial Rubber Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 10. Company Profile: Key players 10.1. Lanxess 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Sinopec 10.3. The Goodyear Tire and Rubber Company 10.4. Kumho Petrochemical 10.5. TSRC Corporation 10.6. JSR Corporation 10.7. LG Chem 10.8. Versalis S.P.A. 10.9. Zeon Corporation 10.10. Petrochina 10.11. ExxonMobil 10.12. Sibur 10.13. Group Dynasol 10.14. Kraton Corporation 10.15. Bridgestone Corporation 10.16. Bando Chemical Industries, Ltd 10.17. Trelleborg AB