Global Immunoprecipitation Market size was valued at USD 787.73 Million in 2024, and the total Immunoprecipitation Market revenue is expected to grow by 6.04% from 2025 to 2032, reaching nearly USD 1259.32 MillionImmunoprecipitation Market Overview

Immunoprecipitation (IP) is a widely used technique in molecular biology and proteomics that isolates and analyzes specific proteins, nucleic acids, or complexes using targeted antibodies. It enables the study of protein–protein, protein–DNA, and protein–RNA interactions, supporting biomarker discovery, drug development, and disease mechanism research across life sciences and biotechnology. As laboratories and pharmaceutical companies increasingly focus on targeted therapies, biomarker discovery, and personalized drug development, immunoprecipitation has become an indispensable tool for analyzing protein interactions, chromatin modifications, and RNA-binding events. Advanced techniques such as chromatin immunoprecipitation (ChIP), co-immunoprecipitation (Co-IP), and RNA immunoprecipitation (RIP) are gaining traction in oncology, immunology, and neuroscience, which boosts the Immunoprecipitation Market growth.To know about the Research Methodology:-Request Free Sample Report The integration of IP with high-throughput platforms like mass spectrometry (IP-MS) and next-generation sequencing is enhancing its sensitivity, reproducibility, and scalability, making it a key enabler in translational research and biomarker validation. Immunoprecipitation key players are innovating with high-affinity antibodies, magnetic bead-based kits, and automated workflows to streamline protocols, reduce variability, and improve throughput, thereby broadening adoption in both academic and industrial settings. North America dominates due to strong research infrastructure and biopharma activity, while Asia-Pacific is emerging as a fast-growing region supported by government-funded R&D and rising biotechnology investments.

Immunoprecipitation Market Dynamics

Role of Immunoprecipitation in Precision Medicine and Proteomics to drive the Immunoprecipitation Market The global life sciences industry is shifting from generalized therapeutic strategies toward highly targeted, patient-specific interventions, and immunoprecipitation has emerged as a vital enabling technology in this paradigm. Researchers are increasingly using IP-based techniques, such as co-immunoprecipitation (Co-IP) and chromatin immunoprecipitation (ChIP), to study complex biological mechanisms and detect post-translational modifications. These methods help map intricate protein–protein and protein–nucleic acid interactions, providing critical insights into cellular processes, driving the Immunoprecipitation Market growth. Such information is essential for developing next-generation therapies, including antibody–drug conjugates (ADCs), immune checkpoint inhibitors, and targeted small-molecule drugs. The integration of IP with cutting-edge mass spectrometry (IP-MS) is significantly enhancing sensitivity, reproducibility, and throughput, allowing scientists to detect even low-abundance proteins and transient complexes. In oncology, immunology, and neurology, such advanced applications are transforming drug discovery pipelines by accelerating biomarker validation and providing mechanistic clarity on therapeutic targets. High Cost and Technical Complexity of Immunoprecipitation Workflows to hamper the Immunoprecipitation Market The process requires not only high-quality antibodies and beads but also specialized instruments for centrifugation, magnetic separation, and downstream analysis with mass spectrometry, all of which add significant expense. The price of reliable antibodies and optimized kits is prohibitive, especially when multiple antibodies are required for validation studies or when working with low-abundance proteins, leading to higher experimental costs per sample. The immunoprecipitation is a skill-intensive technique, where non-specific binding, antibody cross-reactivity, and inconsistent elution compromise reproducibility and data quality, which hamper the Immunoprecipitation Market growth. Variations in antibody affinity or sample preparation methods contribute to inconsistent outcomes, making it difficult for laboratories with limited expertise to achieve robust results.Immunoprecipitation Market Segment Analysis

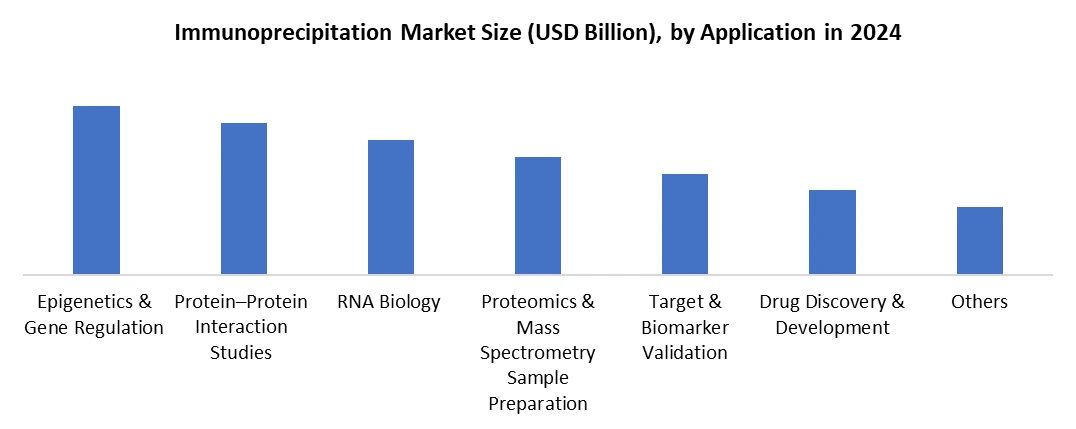

Based on Type, the Individual Protein, Protein Complex, Chromatin, Ribonucleoprotein, Tagged Proteins and Others. Chromatin Immunoprecipitation (ChIP) dominated the Immunoprecipitation Market in 2024. The increasing demand for epigenetic studies, gene regulation analysis, and chromatin structure mapping across biomedical and pharmaceutical research. ChIP allows researchers to investigate protein-DNA interactions, histone modifications, and transcription factor binding, which are crucial in understanding disease mechanisms such as cancer, autoimmune disorders, and neurological conditions. Increasing use of ChIP-sequencing (ChIP-seq) is increasing the Immunoprecipitation Market growth, as it enables high-throughput genome-wide analysis, making it a standard tool in next-generation sequencing (NGS) workflows. While ChIP leads, individual protein IP and protein complex IP also hold significant shares, especially in proteomics, biomarker discovery, and protein interaction studies. RNA immunoprecipitation (RIP) is steadily expanding due to the growing importance of RNA biology and non-coding RNAs in disease pathogenesis. Based on Application, the market is categorized into the Epigenetics & Gene Regulation, Protein–Protein Interaction Studies, RNA Biology, Proteomics & Mass Spectrometry Sample Preparation, Target & Biomarker Validation, Drug Discovery & Development and Others. The epigenetics and gene regulation segment dominates the Immunoprecipitation Market, reflecting the widespread use of chromatin immunoprecipitation (ChIP) in studying DNA–protein interactions, histone modifications, and transcriptional regulation. The rise of next-generation sequencing (NGS) technologies has amplified the adoption of ChIP-seq, making epigenetic analysis an essential component of cancer biology, stem cell research, and precision medicine. Growing investments in large-scale genome and epigenome mapping projects by governments and research consortia reinforce this segment’s dominance. Beyond epigenetics, proteomics and mass spectrometry, sample preparation represents another high-growth area, as immunoprecipitation is increasingly integrated with LC-MS/MS platforms to isolate and analyze post-translationally modified proteins, driving discoveries in drug targets and disease biomarkers.

Immunoprecipitation Market Regional Analysis

North America dominated the Immunoprecipitation Market in 2024 and is expected to continue its dominance over the forecast period. The region’s advanced life sciences research ecosystem, strong funding for proteomics and epigenetics, and a concentration of key biotechnology and pharmaceutical companies. The widespread adoption of high-specificity antibodies, bead systems, and integration of IP with proteomic tools such as IP-MS and ChIP-seq has strengthened North America Immunoprecipitation Market edge. Growing emphasis on personalized medicine, cancer immunotherapy, and automation in laboratories further accelerates demand. With universities, research institutes, and industry leaders driving innovation, North America is positioned to remain at the forefront of immunoprecipitation technology and commercialization. The strong academic research institutions, government-backed grants (such as NIH funding), and high adoption of innovative proteomic tools integrating IP with mass spectrometry (IP-MS), chromatin immunoprecipitation sequencing (ChIP-seq), and RNA immunoprecipitation (RIP) in the United States. Demand is further propelled by growing investments in personalized medicine, cancer immunotherapy, and biomarker discovery. The shift from agarose-based to magnetic bead-based IP kits, alongside automation-enabled high-throughput workflows, enhances efficiency and reproducibility, making them increasingly preferred in large-scale laboratory settings. Immunoprecipitation Key players such as Thermo Fisher Scientific, Merck KGaA (MilliporeSigma), and Bio-Rad dominate the regional market, supported by a strong distribution network and collaborations with academic and clinical research centers. Immunoprecipitation Market Competitive Landscape: The competitive landscape of the Immunoprecipitation Market is characterized by intense innovation, strategic collaborations, and a strong focus on developing high-specificity reagents and advanced platforms. Leading players such as Thermo Fisher Scientific, Merck KGaA, Abcam, and Bio-Rad Laboratories dominate with comprehensive portfolios of antibodies, magnetic beads, and kits tailored for diverse applications, including ChIP, IP-MS, and co-immunoprecipitation. North America and Europe serve as hubs for established global companies, while Asia-Pacific players are increasingly expanding their presence with cost-effective reagents and localized research solutions. Partnerships between biotechnology firms, academic institutes, and pharmaceutical companies are accelerating the development of next-generation immunoprecipitation tools, particularly in precision proteomics and cancer immunotherapy research. The market is witnessing rising investments in automation and high-throughput systems, enabling reproducibility and scalability for large proteome studies and clinical applications. Companies are also differentiating through antibody engineering, recombinant technologies, and improved bead chemistries to capture rare proteins and subtle post-translational modifications. Immunoprecipitation Market Key Developments: • July 2024 – Thermo Fisher Scientific completed the acquisition of Olink for $3.1 billion, marking a major development in the immunoprecipitation (IP) market and next-generation proteomics. This move strengthens biomarker discovery and translational research capabilities, reflecting the growing integration of IP with advanced proteomics and precision medicine. Recent innovations, including high-specificity antibodies, magnetic bead–based IP kits, and automation-ready workflows, are enhancing reproducibility and scalability for large-scale applications. The coupling of IP with mass spectrometry (IP-MS) and sequencing technologies is enabling unprecedented insights into protein–protein and protein–nucleic acid interactions. • August 28, 2023 – Danaher Corporation announced its acquisition of Abcam for USD 24 per share, marking a significant development in the immunoprecipitation (IP) and life sciences market. Abcam, a leading supplier of highly validated antibodies, reagents, and assays, supports over 750,000 researchers globally in protein analysis, biomarker discovery, and drug development. This strategic move strengthens the availability of high-specificity IP reagents, automation-compatible kits, and integrated solutions, accelerating research in precision medicine, protein–protein interactions, and biomarker validation. Immunoprecipitation Market Key Trends:

Trend Description High-Specificity Immunoprecipitation Reagents Demand is rising for highly specific antibodies and bead systems to capture rare proteins and detect subtle post-translational modifications (PTMs). Advances in monoclonal antibody production, recombinant antibodies, and improved protein A/G magnetic beads are enabling more reliable protein interaction studies. Integration with Precision Proteomics & Targeted Therapy Research Advanced IP methods such as IP-MS (Immunoprecipitation–Mass Spectrometry) and ChIP (Chromatin Immunoprecipitation) are increasingly used in oncology, immunotherapy, and drug development. They help map protein interactions, identify biomarkers, and optimize therapies like ADCs and immune checkpoint inhibitors. Automation & High-Throughput Immunoprecipitation Platforms Growing need for faster, reproducible, and large-scale IP experiments is pushing adoption of automated systems. Robotic liquid handling, bead-based multiplex assays, and high-throughput IP platforms are reducing manual errors and improving lab efficiency. Immunoprecipitation Market Scope: Inquire before buying

Global Immunoprecipitation Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 787.73 Mn. Forecast Period 2025 to 2032 CAGR: 6.04% Market Size in 2032: USD 1259.32 Mn. Segments Covered: by Product Type Kits Reagents Antibodies Beads Others Instruments & Accessories by Type Individual Protein Protein Complex Chromatin Ribonucleoprotein Tagged Proteins Others by Application Epigenetics & Gene Regulation Protein–Protein Interaction Studies RNA Biology Proteomics & Mass Spectrometry Sample Preparation Target & Biomarker Validation Drug Discovery & Development Others by End-User Academic & Research Institutes Pharmaceutical & Biotechnology Companies Contract Research Organizations Others Immunoprecipitation Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest) South America (Brazil, Argetina and Rest of South America)Immunoprecipitation Key Players

North America 1. Thermo Fisher Scientific Inc. (US) 2. Merck Millipore (US) 3. Bio-Rad Laboratories Inc. (US) 4. Agilent Technologies Inc. (US) 5. Abcam plc (US) 6. GenScript Biotech Corporation (US) 7. Cell Signaling Technology Inc. (US) 8. Santa Cruz Biotechnology Inc. (US) 9. Novus Biologicals (US) 10. Rockland Immunochemicals Inc. (US) Europe 1. Merck KGaA (Germany) 2. Abcam plc (UK) 3. Proteintech Group (UK) 4. BioLegend (Germany) 5. ChromoTek GmbH (Germany) 6. Miltenyi Biotec (Germany) 7. Expedeon AG (Germany) 8. Synaptic Systems GmbH (Germany) 9. Oxford Expression Technologies Ltd. (UK) Asia-Pacific 1. Takara Bio Inc. (Japan) 2. Medical & Biological Laboratories Co., Ltd. (Japan) 3. Wuxi Biotech (China) 4. Sino Biological Inc. (China) 5. GeneTex Inc. (Taiwan) 6. Cell Signaling Technology Asia-Pacific (China) 7. Abnova Corporation (Taiwan) 8. BioVision Inc. (China) 9. OriGene Technologies (China) 10. FUJIFILM Wako Pure Chemical Corporation (Japan)FAQ’S

1] What Key players are in the Global Immunoprecipitation Market report? Ans. The Immunoprecipitation Key players are Thermo Fisher Scientific Inc. (US), Merck Millipore (US), Bio-Rad Laboratories Inc. (US), Agilent Technologies Inc. (US), Abcam plc (US ) and Others. 2] Which region is expected to hold the largest share in the Global Immunoprecipitation Market? Ans. The North America region is expected to hold the largest share in the Immunoprecipitation Market. 3] What is the market size of the Global Immunoprecipitation Market by 2032? Ans. The market size of the Immunoprecipitation Market by 2032 is expected to reach USD 1259.32 Million. 4] What is the forecast period for the Global Immunoprecipitation Market? Ans. The forecast period for the Immunoprecipitation Market is 2025-2032. 5] What was the market size of the Global Immunoprecipitation Market in 2024? Ans. The market size of the Immunoprecipitation Market in 2024 was valued at USD 787.73 Million.

1. Immunoprecipitation Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Immunoprecipitation Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Immunoprecipitation Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Immunoprecipitation Market: Dynamics 3.1. Immunoprecipitation Market Trends by Region 3.1.1. North America Immunoprecipitation Market Trends 3.1.2. Europe Immunoprecipitation Market Trends 3.1.3. Asia Pacific Immunoprecipitation Market Trends 3.1.4. Middle East and Africa Immunoprecipitation Market Trends 3.1.5. South America Immunoprecipitation Market Trends 3.2. Immunoprecipitation Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Immunoprecipitation Market Drivers 3.2.1.2. North America Immunoprecipitation Market Restraints 3.2.1.3. North America Immunoprecipitation Market Opportunities 3.2.1.4. North America Immunoprecipitation Market Challenges 3.2.2. Europe 3.2.2.1. Europe Immunoprecipitation Market Drivers 3.2.2.2. Europe Immunoprecipitation Market Restraints 3.2.2.3. Europe Immunoprecipitation Market Opportunities 3.2.2.4. Europe Immunoprecipitation Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Immunoprecipitation Market Drivers 3.2.3.2. Asia Pacific Immunoprecipitation Market Restraints 3.2.3.3. Asia Pacific Immunoprecipitation Market Opportunities 3.2.3.4. Asia Pacific Immunoprecipitation Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Immunoprecipitation Market Drivers 3.2.4.2. Middle East and Africa Immunoprecipitation Market Restraints 3.2.4.3. Middle East and Africa Immunoprecipitation Market Opportunities 3.2.4.4. Middle East and Africa Immunoprecipitation Market Challenges 3.2.5. South America 3.2.5.1. South America Immunoprecipitation Market Drivers 3.2.5.2. South America Immunoprecipitation Market Restraints 3.2.5.3. South America Immunoprecipitation Market Opportunities 3.2.5.4. South America Immunoprecipitation Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Immunoprecipitation Industry 3.8. Analysis of Government Schemes and Initiatives For Immunoprecipitation Industry 3.9. Immunoprecipitation Market Trade Analysis 3.10. The Global Pandemic Impact on Immunoprecipitation Market 4. Immunoprecipitation Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 4.1.1. Kits 4.1.2. Reagents 4.1.3. Instruments & Accessories 4.2. Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 4.2.1. Individual Protein 4.2.2. Protein Complex 4.2.3. Chromatin 4.2.4. Ribonucleoprotein 4.2.5. Tagged Proteins 4.2.6. Others 4.3. Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 4.3.1. Epigenetics & Gene Regulation 4.3.2. Protein–Protein Interaction Studies 4.3.3. RNA Biology 4.3.4. Proteomics & Mass Spectrometry Sample Preparation 4.3.5. Target & Biomarker Validation 4.3.6. Drug Discovery & Development 4.3.7. Others 4.4. Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 4.4.1. Academic & Research Institutes 4.4.2. Pharmaceutical & Biotechnology Companies 4.4.3. Contract Research Organizations 4.4.4. Others 4.5. Immunoprecipitation Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Immunoprecipitation Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 5.1.1. Kits 5.1.2. Reagents 5.1.3. Instruments & Accessories 5.2. North America Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 5.2.1. Individual Protein 5.2.2. Protein Complex 5.2.3. Chromatin 5.2.4. Ribonucleoprotein 5.2.5. Tagged Proteins 5.2.6. Others 5.3. North America Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 5.3.1. Epigenetics & Gene Regulation 5.3.2. Protein–Protein Interaction Studies 5.3.3. RNA Biology 5.3.4. Proteomics & Mass Spectrometry Sample Preparation 5.3.5. Target & Biomarker Validation 5.3.6. Drug Discovery & Development 5.3.7. Others 5.4. North America Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 5.4.1. Academic & Research Institutes 5.4.2. Pharmaceutical & Biotechnology Companies 5.4.3. Contract Research Organizations 5.4.4. Others 5.5. North America Immunoprecipitation Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 5.5.1.1.1. Kits 5.5.1.1.2. Reagents 5.5.1.1.3. Instruments & Accessories 5.5.1.2. United States Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 5.5.1.2.1. Individual Protein 5.5.1.2.2. Protein Complex 5.5.1.2.3. Chromatin 5.5.1.2.4. Ribonucleoprotein 5.5.1.2.5. Tagged Proteins 5.5.1.2.6. Others 5.5.1.3. United States Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 5.5.1.3.1. Epigenetics & Gene Regulation 5.5.1.3.2. Protein–Protein Interaction Studies 5.5.1.3.3. RNA Biology 5.5.1.3.4. Proteomics & Mass Spectrometry Sample Preparation 5.5.1.3.5. Target & Biomarker Validation 5.5.1.3.6. Drug Discovery & Development 5.5.1.3.7. Others 5.5.1.4. United States Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 5.5.1.4.1. Academic & Research Institutes 5.5.1.4.2. Pharmaceutical & Biotechnology Companies 5.5.1.4.3. Contract Research Organizations 5.5.1.4.4. Others 5.5.2. Canada 5.5.2.1. Canada Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 5.5.2.1.1. Kits 5.5.2.1.2. Reagents 5.5.2.1.3. Instruments & Accessories 5.5.2.2. Canada Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 5.5.2.2.1. Individual Protein 5.5.2.2.2. Protein Complex 5.5.2.2.3. Chromatin 5.5.2.2.4. Ribonucleoprotein 5.5.2.2.5. Tagged Proteins 5.5.2.2.6. Others 5.5.2.3. Canada Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 5.5.2.3.1. Epigenetics & Gene Regulation 5.5.2.3.2. Protein–Protein Interaction Studies 5.5.2.3.3. RNA Biology 5.5.2.3.4. Proteomics & Mass Spectrometry Sample Preparation 5.5.2.3.5. Target & Biomarker Validation 5.5.2.3.6. Drug Discovery & Development 5.5.2.3.7. Others 5.5.2.4. Canada Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 5.5.2.4.1. Academic & Research Institutes 5.5.2.4.2. Pharmaceutical & Biotechnology Companies 5.5.2.4.3. Contract Research Organizations 5.5.2.4.4. Others 5.5.3. Mexico 5.5.3.1. Mexico Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 5.5.3.1.1. Kits 5.5.3.1.2. Reagents 5.5.3.1.3. Instruments & Accessories 5.5.3.2. Mexico Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 5.5.3.2.1. Individual Protein 5.5.3.2.2. Protein Complex 5.5.3.2.3. Chromatin 5.5.3.2.4. Ribonucleoprotein 5.5.3.2.5. Tagged Proteins 5.5.3.2.6. Others 5.5.3.3. Mexico Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 5.5.3.3.1. Epigenetics & Gene Regulation 5.5.3.3.2. Protein–Protein Interaction Studies 5.5.3.3.3. RNA Biology 5.5.3.3.4. Proteomics & Mass Spectrometry Sample Preparation 5.5.3.3.5. Target & Biomarker Validation 5.5.3.3.6. Drug Discovery & Development 5.5.3.3.7. Others 5.5.3.4. Mexico Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 5.5.3.4.1. Academic & Research Institutes 5.5.3.4.2. Pharmaceutical & Biotechnology Companies 5.5.3.4.3. Contract Research Organizations 5.5.3.4.4. Others 6. Europe Immunoprecipitation Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 6.2. Europe Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 6.3. Europe Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 6.4. Europe Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 6.5. Europe Immunoprecipitation Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 6.5.1.2. United Kingdom Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 6.5.1.3. United Kingdom Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 6.5.1.4. United Kingdom Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 6.5.2. France 6.5.2.1. France Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 6.5.2.2. France Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 6.5.2.3. France Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 6.5.2.4. France Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 6.5.3.2. Germany Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 6.5.3.3. Germany Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 6.5.3.4. Germany Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 6.5.4.2. Italy Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 6.5.4.3. Italy Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 6.5.4.4. Italy Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 6.5.5.2. Spain Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 6.5.5.3. Spain Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 6.5.5.4. Spain Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 6.5.6.2. Sweden Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 6.5.6.3. Sweden Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 6.5.6.4. Sweden Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 6.5.7.2. Austria Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 6.5.7.3. Austria Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 6.5.7.4. Austria Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 6.5.8.2. Rest of Europe Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 6.5.8.3. Rest of Europe Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 6.5.8.4. Rest of Europe Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 7. Asia Pacific Immunoprecipitation Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 7.2. Asia Pacific Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 7.3. Asia Pacific Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 7.4. Asia Pacific Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 7.5. Asia Pacific Immunoprecipitation Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 7.5.1.2. China Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 7.5.1.3. China Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 7.5.1.4. China Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 7.5.2.2. S Korea Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 7.5.2.3. S Korea Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 7.5.2.4. S Korea Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 7.5.3.2. Japan Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 7.5.3.3. Japan Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 7.5.3.4. Japan Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 7.5.4. India 7.5.4.1. India Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 7.5.4.2. India Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 7.5.4.3. India Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 7.5.4.4. India Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 7.5.5.2. Australia Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 7.5.5.3. Australia Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 7.5.5.4. Australia Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 7.5.6.2. Indonesia Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 7.5.6.3. Indonesia Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 7.5.6.4. Indonesia Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 7.5.7.2. Malaysia Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 7.5.7.3. Malaysia Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 7.5.7.4. Malaysia Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 7.5.8.2. Vietnam Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 7.5.8.3. Vietnam Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 7.5.8.4. Vietnam Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 7.5.9.2. Taiwan Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 7.5.9.3. Taiwan Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 7.5.9.4. Taiwan Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 7.5.10.2. Rest of Asia Pacific Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 7.5.10.3. Rest of Asia Pacific Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 7.5.10.4. Rest of Asia Pacific Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa Immunoprecipitation Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 8.2. Middle East and Africa Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 8.3. Middle East and Africa Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 8.4. Middle East and Africa Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 8.5. Middle East and Africa Immunoprecipitation Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 8.5.1.2. South Africa Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 8.5.1.3. South Africa Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 8.5.1.4. South Africa Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 8.5.2.2. GCC Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 8.5.2.3. GCC Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 8.5.2.4. GCC Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 8.5.3.2. Nigeria Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 8.5.3.3. Nigeria Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 8.5.3.4. Nigeria Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 8.5.4.2. Rest of ME&A Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 8.5.4.3. Rest of ME&A Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 8.5.4.4. Rest of ME&A Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 9. South America Immunoprecipitation Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 9.2. South America Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 9.3. South America Immunoprecipitation Market Size and Forecast, by Application(2024-2032) 9.4. South America Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 9.5. South America Immunoprecipitation Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 9.5.1.2. Brazil Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 9.5.1.3. Brazil Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 9.5.1.4. Brazil Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 9.5.2.2. Argentina Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 9.5.2.3. Argentina Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 9.5.2.4. Argentina Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Immunoprecipitation Market Size and Forecast, by Product Type (2024-2032) 9.5.3.2. Rest Of South America Immunoprecipitation Market Size and Forecast, by Type (2024-2032) 9.5.3.3. Rest Of South America Immunoprecipitation Market Size and Forecast, by Application (2024-2032) 9.5.3.4. Rest Of South America Immunoprecipitation Market Size and Forecast, by End User (2024-2032) 10. Company Profile: Key Players 10.1. Thermo Fisher Scientific Inc. (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Merck Millipore (US) 10.3. Bio-Rad Laboratories Inc. (US) 10.4. Agilent Technologies Inc. (US) 10.5. Abcam plc (US) 10.6. GenScript Biotech Corporation (US) 10.7. Cell Signaling Technology Inc. (US) 10.8. Santa Cruz Biotechnology Inc. (US) 10.9. Novus Biologicals (US) 10.10. Rockland Immunochemicals Inc. (US) 10.11. Merck KGaA (Germany) 10.12. Abcam plc (UK) 10.13. Proteintech Group (UK) 10.14. BioLegend (Germany) 10.15. ChromoTek GmbH (Germany) 10.16. Miltenyi Biotec (Germany) 10.17. Expedeon AG (Germany) 10.18. Synaptic Systems GmbH (Germany) 10.19. Oxford Expression Technologies Ltd. (UK) 10.20. Takara Bio Inc. (Japan) 10.21. Medical & Biological Laboratories Co., Ltd. (Japan) 10.22. Wuxi Biotech (China) 10.23. Sino Biological Inc. (China) 10.24. GeneTex Inc. (Taiwan) 10.25. Cell Signaling Technology Asia-Pacific (China) 10.26. Abnova Corporation (Taiwan) 10.27. BioVision Inc. (China) 10.28. OriGene Technologies (China) 10.29. FUJIFILM Wako Pure Chemical Corporation (Japan) 11. Key Findings 12. Industry Recommendations 13. Immunoprecipitation Market: Research Methodology 14. Terms and Glossary