The Halal Food Market size was valued at USD 2631.48 Billion in 2024 and the total Halal Food revenue is expected to grow at a CAGR of 12.5% from 2025 to 2032, reaching nearly USD 6751.82 Billion. The Global Halal Food Market is driven by the growing global Muslim population as well as growing concerns about food safety, dependability, and hygiene throughout the forecast period. Because of these factors, the halal food market is growing in various countries and also increasing the market’s revenue. As of April 2019, according to MMR Research, there were 1.6 billion Muslims worldwide. In 2024, this population reached approximately 2 billion. With this ongoing increase, the number of Muslims is forecast to reach 2.9 billion by 2030. An increasing number of consumers are exhibiting a higher interest in Halal Food Market products in addition to this demographic trend. Owing to an increase in demand, manufacturers have broadened their product lines to include a variety of high-quality halal foods, like pasta, veggies, dairy, yogurt, and cheese. Customers will also witness an increase in products available due to significant expansion. The Global Halal Food Market is experiencing growth due to a surge in commercial launches like hotels, restaurants, cafes, and quick-service restaurants. Additionally, international companies are introducing halal food options in response to regional consumers’ spiritual inclinations. This trend aligns with the increasing popularity of ready-to-eat and convenient halal food products such as hummus, fruit juices, milk, coffee, smoothies, hot dogs, nuggets, soups, candies, cookies, and pizzas. This development reflects a positive Halal Food Market outlook driven by a diverse range of halal food offerings and catering to the preferences of a broader end-user base.To know about the Research Methodology :- Request Free Sample Report

Halal Food Market Dynamics:

Growing Population All Over the Globe Implements Market Growth: The Global Halal Food Market is growing due in large part to the increasing population of the world. Global population growth is causing a corresponding increase in demand for halal food items. The Global Halal Food Market is growing and progressing in large part due to this demographic trend. Moreover, this population also has non-Islamic consumers. Demand for halal products is rising as a result of non-Muslim customers' growing interest in halal food due to its perceived health and safety benefits. In 2020, the Global Halal Food Market drove up demand for premium halal items like organic halal beef in the United States and boosted the appeal of halal-certified restaurants in non-Muslim nations like the U.K., U.S., Asia Pacific, and the Halal Food Festival. Government Rules & Program Initiatives as well as Standardization for Food Propels the Market Progression To attract new players into the Global Halal Food Market, a number of countries, both Islamic and non-Islamic, are putting in place strict regulatory frameworks that incorporate internationally recognized norms. Today's consumers prefer halal food because the Indonesian government imposed mandatory halal labelling and certification regulations in 2019. Food standardization certification procedures are one of the major obstacles facing the international halal food sector. Different nations have different halal certification requirements, which can be confusing and difficult for firms looking to enter the Global Halal Food Market. This lack of consistency makes operations more difficult to run smoothly and can obstruct the growth of companies in the Global Halal Food Market. Limited availability impedes the growth of the Global Halal Food Market because halal foods are available commercially in very few places, especially in non-Islamic countries. Improving Technical Developments in Halal Food Items: One significant trend that is growing in popularity in the Global Halal Food Market is the use of technological developments in halal food products. The demand for halal food is rising, and halal laboratories are actively involved in ensuring food safety. These labs are dedicated to the analysis of food goods to uphold quality standards and identify any traces of gelatin, alcohol, or porcine material that could potentially undermine the Global Halal Food Market.Halal Food Market Segment Analysis:

Based on Product Type, the Global Halal Food Market is segmented into cereals and grains, fruits and vegetables, milk and dairy products, meat and poultry and seafood, etc. The meat food segment held the largest Halal Food Market share of 7% in 2024. According to the expanding Islamic population, halal-labelled beef products are expected to become more and more popular. The Organization of Islamic Cooperation (OIC) is in a strong position to lead the charge in creating a global standard for these foods because of its foundation. Global Halal Food Market players have experienced significant success in increasing customer loyalty and boosting product portfolio penetration to even higher levels due to the establishment of these types of organizational figures. Within the product segment, the meat and alternatives category claimed the largest Halal Food Market share at 51% in 2021 and is growing to sustain its dominance throughout the forecast period. The increasing consumer inclination towards bacteria-free meat due to concerns related to health, hygiene, and safety is expected to drive the demand for these products in the foreseeable future. As of June 2020, 70% of consumers in England preferred halal meat over conventional meat. Additionally, factors such as consideration for animal welfare and a level of acculturation significantly influence the growth of this product segment.Based on Distribution Type, convenience stores, specialty stores, e-commerce, supermarkets & hypermarkets, and others make up the segments of the Global Halal Food Market. In 2024, with a 56% share in the Global Halal Food Market by distribution channel, the supermarkets & hypermarkets category held the largest share. Around 54% of people live in cities, according to statistics from the United Nations. Therefore, the rising development of urbanization is the main factor boosting the growth of the hypermarket and supermarket industries. Additionally, in 2024, the e-commerce or online sales category had the second-largest market share of 21%, due to the wide variety of halal items available and the rising popularity of internet shopping.

By product Base, There are many types of starch rare available in market but halal food market and food manufacturers are certified only Native and modified Starch. Halal Modified or native Starch is a kind of refined starch that is sold as white powder and is made from corn or other crops Like Maize, this Modified Starch are replace with Arabic Gum. This food additive is generally accepted to be halal because it is made of plant-derived substances and beneficial to people who are health conscious following the plant based diet, and this Key plays a vital role in Global Market.

Halal Food Market Regional Insights:

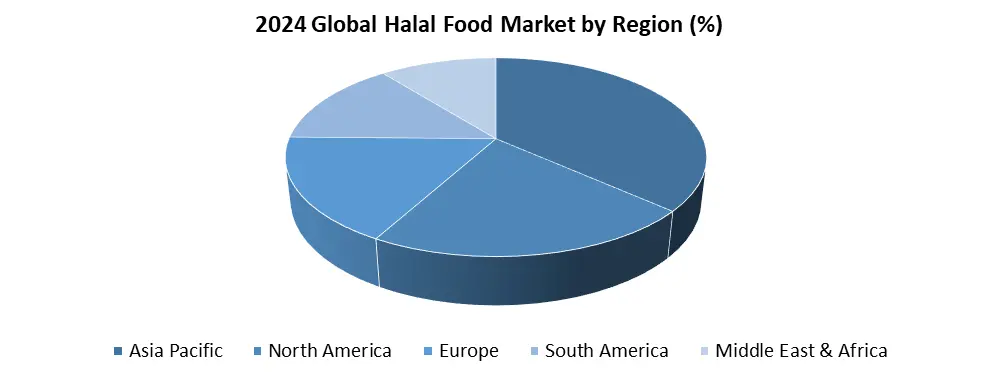

Asia Pacific led the global halal food market and is expected to continue to maintain its trend during the forecast period. The existence of Halal Certification authority in Asia Pacific, who are winning over customers' trust, is credited with the rise of the halal food business in that region The Asia-Pacific area is expected to gain a great deal from the growth and innovation of the global halal food market, growing concerns regarding the nutritional value of halal food, and China's adoption of halal food regulations. Additionally, the South East Asia country like Malaysia and Indonesia are known for the Muslim populated country this reason is stimulate the local as well as Global market, Due to religious requirements, there is a large demand for halal food products. In Islamic nations like Saudi Arabia, the United Arab Emirates, Kuwait, Bahrain, Oman, and Qatar. This is generate a substantial amount of cash for these nations as well as the Middle East and Africa. The global market is expected to remain largely controlled by North America and European nations over the forecast period because of increased health consciousness and rising currency values in North America, which includes the US and Europe. Europe is in second position in market with 21 % of share in Global Market.

Competitive Landscapes:

Halal food is becoming an increasing part of the Western diet and has become a multi-billion dollar Global Market involving multinationals like Tesco, Unilever, and Nestlé who have aggressively expanded their halal-certified product lines. Nestle is the biggest food manufacturer in the Market sector, with annual sales of more than USD 5 billion. Halal food accounts for about 35% of Nestlé’s global sales. One of Malaysia's top exporters and the world's biggest producer of frozen Asian treats, Kawan Culinary Berhad invested US$ 0.0258 billion in January 2016 to expand its product demand at its manufacturing plant at Selangor Halal Hub in Pulau Indah, Malaysia. Meeting the growing demand for its food goods was the aim. In Global Halal Food Market Al Islami Foods Co. which is located in Dubai declared in August 2024 that its premium products will be grandly reintroduced in Qatar's prestigious markets. Al Islami is offering a range of cuts, including drumsticks, breasts, thighs, and more. It also has brought back its well-known Chicken Griller and Chicken Parts. Al Islami's commitment to the highest Halal standards is unwavering. Also, in 2021, Crescent Foods, (U.S.) provides hand-cut halal meat and poultry products and launched in Global Halal Food Market program for college and university dining halls around the country.Halal Food Market Scope: Inquire before buying

Halal Food Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 2631.48 Bn. Forecast Period 2025 to 2032 CAGR: 12.5% Market Size in 2032: USD 6751.83 Bn. Segments Covered: by Product Meat, Poultry, and Seafood Fruits and Vegetables Dairy Products Cereals and Grains Confectionery Oil, Fats, and Waxes Others by Distribution Channel Supermarkets & Hypermarkets Convenience Stores Specialty Stores E-Commerce Others by Product Base Modified Starch Native Starch Sweeteners Others Halal Food Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Halal Food Market, Key Players:

1. Nestle S.A. Nestlé S.A. (Switzerland) 2. Cargill, Incorporated (U.S.) 3. Al Islami Food (Dubai) 4. BRF S.A. 5. QL Foods Sdn Bhd 6. Yildiz Holding 7. Kellogg’s Company 8. WH Groups Ltd. 9. Neema Food Company 10. Kawan Food Manufacturing Sdn Bhd (Malaysia) 11. Midamar Corporation 12. Saffron Road Industries (U.S.) 13. Sierra Meat Industries 14. Tahira Food 15. Chicken Cottage (UK) 16. Beijing Shunxin Agriculture 17. Jingyitai Halal Food 18. Humza Foods 19. Raj Foods 20. Azzayt SLU 21. Forward Farma BV 22. Udine 23. Al Kabeer Group (UAE) 24. Al-Falah Foods (Pakistan) 25. Isla Délice (France) 26. Tahira Halal (UK) 27. Janan Meat Ltd. (UK) 28. DagangHalal Group (Malaysia) 29. Al-Faisal Bakery & Sweets (Saudi Arabia) 30. Qibbla Meat Processing Company (Kuwait) 31.OthersFAQs:

1. Which region has the largest share in Global Halal Food Market? Ans: Asia Pacific region held the highest share in 2024. 2. What was the Global Halal Food Market size in 2024? Ans: The Global Halal Food Market size was USD 2631.48 Billion in 2024. 3. What is scope of the Global market report? Ans: Global Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global market? Ans: The important key players in the Global Market are – Islami Foods, QL Foods, Saffron Road Food, Dagang Halal, Janan Meat, Kawan Foods, Cargill, Prima Agri-Products, Nestle, BRF, Al-Falah Halal Foods, Tahira Food, Beijing Shunxin Agriculture, Jingyitai Halal Food, Humza Foods, Raj Foods, Azzayt SLU, Forward Farma BV, and Udine. 5. What is the study period of this market? Ans: The Global Market is studied from 2024 to 2032.

1. Halal Food Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Halal Food Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Halal Food Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Halal Food Market: Dynamics 3.1. Halal Food Market Trends by Region 3.1.1. North America Halal Food Market Trends 3.1.2. Europe Halal Food Market Trends 3.1.3. Asia Pacific Halal Food Market Trends 3.1.4. Middle East and Africa Halal Food Market Trends 3.1.5. South America Halal Food Market Trends 3.2. Halal Food Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Halal Food Market Drivers 3.2.1.2. North America Halal Food Market Restraints 3.2.1.3. North America Halal Food Market Opportunities 3.2.1.4. North America Halal Food Market Challenges 3.2.2. Europe 3.2.2.1. Europe Halal Food Market Drivers 3.2.2.2. Europe Halal Food Market Restraints 3.2.2.3. Europe Halal Food Market Opportunities 3.2.2.4. Europe Halal Food Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Halal Food Market Drivers 3.2.3.2. Asia Pacific Halal Food Market Restraints 3.2.3.3. Asia Pacific Halal Food Market Opportunities 3.2.3.4. Asia Pacific Halal Food Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Halal Food Market Drivers 3.2.4.2. Middle East and Africa Halal Food Market Restraints 3.2.4.3. Middle East and Africa Halal Food Market Opportunities 3.2.4.4. Middle East and Africa Halal Food Market Challenges 3.2.5. South America 3.2.5.1. South America Halal Food Market Drivers 3.2.5.2. South America Halal Food Market Restraints 3.2.5.3. South America Halal Food Market Opportunities 3.2.5.4. South America Halal Food Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Halal Food Industry 3.8. Analysis of Government Schemes and Initiatives For Halal Food Industry 3.9. Halal Food Market Trade Analysis 3.10. The Global Pandemic Impact on Halal Food Market 4. Halal Food Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Halal Food Market Size and Forecast, by Product (2024-2032) 4.1.1. Meat, Poultry, and Seafood 4.1.2. Fruits and Vegetables 4.1.3. Dairy Products 4.1.4. Cereals and Grains 4.1.5. Confectionery 4.1.6. Oil, Fats, and Waxes 4.1.7. Others 4.2. Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 4.2.1. Supermarkets & Hypermarkets 4.2.2. Convenience Stores Specialty Stores 4.2.3. E-Commerce 4.2.4. Others 4.3. Halal Food Market Size and Forecast, by Product Base (2024-2032) 4.3.1. Modified Starch 4.3.2. Native Starch 4.3.3. Sweeteners 4.3.4. Others 4.4. Halal Food Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Halal Food Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Halal Food Market Size and Forecast, by Product (2024-2032) 5.1.1. Meat, Poultry, and Seafood 5.1.2. Fruits and Vegetables 5.1.3. Dairy Products 5.1.4. Cereals and Grains 5.1.5. Confectionery 5.1.6. Oil, Fats, and Waxes 5.1.7. Others 5.2. North America Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 5.2.1. Supermarkets & Hypermarkets 5.2.2. Convenience Stores Specialty Stores 5.2.3. E-Commerce 5.2.4. Others 5.3. North America Halal Food Market Size and Forecast, by Product Base (2024-2032) 5.3.1. Modified Starch 5.3.2. Native Starch 5.3.3. Sweeteners 5.3.4. Others 5.4. North America Halal Food Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Halal Food Market Size and Forecast, by Product (2024-2032) 5.4.1.1.1. Meat, Poultry, and Seafood 5.4.1.1.2. Fruits and Vegetables 5.4.1.1.3. Dairy Products 5.4.1.1.4. Cereals and Grains 5.4.1.1.5. Confectionery 5.4.1.1.6. Oil, Fats, and Waxes 5.4.1.1.7. Others 5.4.1.2. United States Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.1.2.1. Supermarkets & Hypermarkets 5.4.1.2.2. Convenience Stores Specialty Stores 5.4.1.2.3. E-Commerce 5.4.1.2.4. Others 5.4.1.3. United States Halal Food Market Size and Forecast, by Product Base (2024-2032) 5.4.1.3.1. Modified Starch 5.4.1.3.2. Native Starch 5.4.1.3.3. Sweeteners 5.4.1.3.4. Others 5.4.2. Canada 5.4.2.1. Canada Halal Food Market Size and Forecast, by Product (2024-2032) 5.4.2.1.1. Meat, Poultry, and Seafood 5.4.2.1.2. Fruits and Vegetables 5.4.2.1.3. Dairy Products 5.4.2.1.4. Cereals and Grains 5.4.2.1.5. Confectionery 5.4.2.1.6. Oil, Fats, and Waxes 5.4.2.1.7. Others 5.4.2.2. Canada Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.2.2.1. Supermarkets & Hypermarkets 5.4.2.2.2. Convenience Stores Specialty Stores 5.4.2.2.3. E-Commerce 5.4.2.2.4. Others 5.4.2.3. Canada Halal Food Market Size and Forecast, by Product Base (2024-2032) 5.4.2.3.1. Modified Starch 5.4.2.3.2. Native Starch 5.4.2.3.3. Sweeteners 5.4.2.3.4. Others 5.4.3. Mexico 5.4.3.1. Mexico Halal Food Market Size and Forecast, by Product (2024-2032) 5.4.3.1.1. Meat, Poultry, and Seafood 5.4.3.1.2. Fruits and Vegetables 5.4.3.1.3. Dairy Products 5.4.3.1.4. Cereals and Grains 5.4.3.1.5. Confectionery 5.4.3.1.6. Oil, Fats, and Waxes 5.4.3.1.7. Others 5.4.3.2. Mexico Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.3.2.1. Supermarkets & Hypermarkets 5.4.3.2.2. Convenience Stores Specialty Stores 5.4.3.2.3. E-Commerce 5.4.3.2.4. Others 5.4.3.3. Mexico Halal Food Market Size and Forecast, by Product Base (2024-2032) 5.4.3.3.1. Modified Starch 5.4.3.3.2. Native Starch 5.4.3.3.3. Sweeteners 5.4.3.3.4. Others 6. Europe Halal Food Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Halal Food Market Size and Forecast, by Product (2024-2032) 6.2. Europe Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 6.3. Europe Halal Food Market Size and Forecast, by Product Base (2024-2032) 6.4. Europe Halal Food Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Halal Food Market Size and Forecast, by Product (2024-2032) 6.4.1.2. United Kingdom Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.1.3. United Kingdom Halal Food Market Size and Forecast, by Product Base (2024-2032) 6.4.2. France 6.4.2.1. France Halal Food Market Size and Forecast, by Product (2024-2032) 6.4.2.2. France Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.2.3. France Halal Food Market Size and Forecast, by Product Base (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Halal Food Market Size and Forecast, by Product (2024-2032) 6.4.3.2. Germany Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.3.3. Germany Halal Food Market Size and Forecast, by Product Base (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Halal Food Market Size and Forecast, by Product (2024-2032) 6.4.4.2. Italy Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.4.3. Italy Halal Food Market Size and Forecast, by Product Base (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Halal Food Market Size and Forecast, by Product (2024-2032) 6.4.5.2. Spain Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.5.3. Spain Halal Food Market Size and Forecast, by Product Base (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Halal Food Market Size and Forecast, by Product (2024-2032) 6.4.6.2. Sweden Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.6.3. Sweden Halal Food Market Size and Forecast, by Product Base (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Halal Food Market Size and Forecast, by Product (2024-2032) 6.4.7.2. Austria Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.7.3. Austria Halal Food Market Size and Forecast, by Product Base (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Halal Food Market Size and Forecast, by Product (2024-2032) 6.4.8.2. Rest of Europe Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.8.3. Rest of Europe Halal Food Market Size and Forecast, by Product Base (2024-2032) 7. Asia Pacific Halal Food Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Halal Food Market Size and Forecast, by Product (2024-2032) 7.2. Asia Pacific Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 7.3. Asia Pacific Halal Food Market Size and Forecast, by Product Base (2024-2032) 7.4. Asia Pacific Halal Food Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Halal Food Market Size and Forecast, by Product (2024-2032) 7.4.1.2. China Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.1.3. China Halal Food Market Size and Forecast, by Product Base (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Halal Food Market Size and Forecast, by Product (2024-2032) 7.4.2.2. S Korea Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.2.3. S Korea Halal Food Market Size and Forecast, by Product Base (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Halal Food Market Size and Forecast, by Product (2024-2032) 7.4.3.2. Japan Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.3.3. Japan Halal Food Market Size and Forecast, by Product Base (2024-2032) 7.4.4. India 7.4.4.1. India Halal Food Market Size and Forecast, by Product (2024-2032) 7.4.4.2. India Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.4.3. India Halal Food Market Size and Forecast, by Product Base (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Halal Food Market Size and Forecast, by Product (2024-2032) 7.4.5.2. Australia Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.5.3. Australia Halal Food Market Size and Forecast, by Product Base (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Halal Food Market Size and Forecast, by Product (2024-2032) 7.4.6.2. Indonesia Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.6.3. Indonesia Halal Food Market Size and Forecast, by Product Base (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Halal Food Market Size and Forecast, by Product (2024-2032) 7.4.7.2. Malaysia Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.7.3. Malaysia Halal Food Market Size and Forecast, by Product Base (2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam Halal Food Market Size and Forecast, by Product (2024-2032) 7.4.8.2. Vietnam Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.8.3. Vietnam Halal Food Market Size and Forecast, by Product Base (2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan Halal Food Market Size and Forecast, by Product (2024-2032) 7.4.9.2. Taiwan Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.9.3. Taiwan Halal Food Market Size and Forecast, by Product Base (2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Halal Food Market Size and Forecast, by Product (2024-2032) 7.4.10.2. Rest of Asia Pacific Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.10.3. Rest of Asia Pacific Halal Food Market Size and Forecast, by Product Base (2024-2032) 8. Middle East and Africa Halal Food Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Halal Food Market Size and Forecast, by Product (2024-2032) 8.2. Middle East and Africa Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 8.3. Middle East and Africa Halal Food Market Size and Forecast, by Product Base (2024-2032) 8.4. Middle East and Africa Halal Food Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Halal Food Market Size and Forecast, by Product (2024-2032) 8.4.1.2. South Africa Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 8.4.1.3. South Africa Halal Food Market Size and Forecast, by Product Base (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Halal Food Market Size and Forecast, by Product (2024-2032) 8.4.2.2. GCC Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 8.4.2.3. GCC Halal Food Market Size and Forecast, by Product Base (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Halal Food Market Size and Forecast, by Product (2024-2032) 8.4.3.2. Nigeria Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 8.4.3.3. Nigeria Halal Food Market Size and Forecast, by Product Base (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Halal Food Market Size and Forecast, by Product (2024-2032) 8.4.4.2. Rest of ME&A Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 8.4.4.3. Rest of ME&A Halal Food Market Size and Forecast, by Product Base (2024-2032) 9. South America Halal Food Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Halal Food Market Size and Forecast, by Product (2024-2032) 9.2. South America Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 9.3. South America Halal Food Market Size and Forecast, by Product Base(2024-2032) 9.4. South America Halal Food Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Halal Food Market Size and Forecast, by Product (2024-2032) 9.4.1.2. Brazil Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 9.4.1.3. Brazil Halal Food Market Size and Forecast, by Product Base (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Halal Food Market Size and Forecast, by Product (2024-2032) 9.4.2.2. Argentina Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 9.4.2.3. Argentina Halal Food Market Size and Forecast, by Product Base (2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Halal Food Market Size and Forecast, by Product (2024-2032) 9.4.3.2. Rest Of South America Halal Food Market Size and Forecast, by Distribution Channel (2024-2032) 9.4.3.3. Rest Of South America Halal Food Market Size and Forecast, by Product Base (2024-2032) 10. Company Profile: Key Players 10.1. Nestle S.A. Nestlé S.A. (Switzerland) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Cargill, Incorporated (U.S.) 10.3. Al Islami Food (Dubai) 10.4. BRF S.A. 10.5. QL Foods Sdn Bhd 10.6. Yildiz Holding 10.7. Kellogg’s Company 10.8. WH Groups Ltd. 10.9. Neema Food Company 10.10. Kawan Food Manufacturing Sdn Bhd (Malaysia) 10.11. Midamar Corporation 10.12. Saffron Road Industries (U.S.) 10.13. Sierra Meat Industries 10.14. Tahira Food 10.15. Chicken Cottage (UK) 10.16. Beijing Shunxin Agriculture 10.17. Jingyitai Halal Food 10.18. Humza Foods 10.19. Raj Foods 10.20. Azzayt SLU 10.21. Forward Farma BV 10.22. Udine 10.23. Al Kabeer Group (UAE) 10.24. Al-Falah Foods (Pakistan) 10.25. Isla Délice (France) 10.26. Tahira Halal (UK) 10.27. Janan Meat Ltd. (UK) 10.28. DagangHalal Group (Malaysia) 10.29. Al-Faisal Bakery & Sweets (Saudi Arabia) 10.30. Qibbla Meat Processing Company (Kuwait) 10.31. Others 11. Key Findings 12. Industry Recommendations 13. Halal Food Market: Research Methodology 14. Terms and Glossary