Global Gum Arabic Market size was valued at USD 547.09 Mn in 2024 and the total Gum Arabic Market revenue is expected to grow by 6.1% from 2025 to 2032, reaching nearly USD 878.58 Mn.Gum Arabic Market Overview :

Gum arabic is a valuable natural hydrocolloid that is sourced from the hardened sap of acacia trees. Gum arabic can be utilized as an emulsifier, stabilizer, and dietary fiber in food and beverage, pharmaceutical, cosmetic, and printing applications as a multi-functional bio-based product. Gum Arabic is a highly valued ingredient due to its excellent solubility, non-toxicity, and clean-label nature. It enhances gastrointestinal comfort, improves mouthfeel, and reduces syneresis, while providing softness and extending the shelf life of products. It is commonly used in soft drinks, jelly beans, nutritional supplements, and pastilles. As consumer preference drives toward clean-label, naturally sourced, functional ingredients, change is propelling such products made with gum arabic for acceptance and importance to be used as a natural substitute for synthetic additives. The marketplace is showing an interest in the prebiotic and dietary fiber properties of gum arabic with applications in functional foods and gut health. Gum arabic is creating opportunities for low-calorie beverages and high-fiber functional nutritional products due to its low glycemic index (GI < 35) and non-FODMAP characteristics.To know about the Research Methodology :- Request Free Sample Report The report also gives a detailed look at the market drivers like clean-label food stabilizers, the functional food trends, and growth in nutraceuticals and pharmaceuticals. In the global market, some identified players include Nexira, Alland & Robert, Kerry Group, Farbest Brands, and Agrigum International. These companies are investing in sustainable harvesting characteristics and traceability and launching organic certifications to respond to regulatory requirements or consumer needs. Key trends in the Gum Arabic market include the development of carbon-neutral acacia fiber products, the geopolitical impact on sourcing, particularly from Sudan, and the growing demand for FODMAP-friendly formulations and high-polarity gum arabic for advanced food and health applications.

Gum Arabic Market Dynamics

Increasing Application as a Natural Emulsifier to Drive Gum Arabic Market Growth The need for natural and clean label ingredients is rising in the food and beverage industry and is driving up the gum Arabic market. Gum arabic is a natural stabilizer and emulsifier comprised of polysaccharides, which is used widely in soft drinks, confectionery, flavored syrups, and bakery products as a stabilizer, emulsifier, and thickener with texture, structural stability, shelf-life, and consistency. Gum arabic is preferable to synthetic additives because it is plant-based and provides dietary fiber. The desire for clean-label and functional products is increasing the momentum for gum arabic in the food and beverage sector, which is expected to continue for years to come. Health-Conscious Consumers and Functional Food Trends to Create Growth Opportunities in the Gum Arabic Market People are choosing healthier options and becoming more aware of preventative health strategies. This shift provides an avenue for diet-rich and functional foods and a potential opportunity for gum arabic growth. Gum arabic is a source of soluble fiber and has proven to have prebiotic characteristics that are reflected in the categories of health-oriented food products (yogurt, meal replacements, nutrition bars, and functional beverages) utilizing gum arabic. The consumers prioritize gut health, digestive health, and clean label nutrition. Manufacturers can utilize the naturally occurring component of gum arabic to elevate the nutrition of their products. This trend of health-oriented populations opting for dietary functional foods can facilitate further usage of gum arabic in the developing functional food space. Limited Scientific Validation of Health Claims Poses Challenges for Gum Arabic Market Expansion The gum arabic is becoming increasingly popular due to its potential health claims; the lack of robust scientific evidence or positive scientific validation to support many of these claims creates difficulties for the gum Arabic market. Gum arabic is anecdotal and traditionally utilized to manage health conditions that are commonly managed, such as type 2 diabetes, mouth plaque, and Irritable Bowel Syndrome (IBS). most applications of gum arabic have either limited or early-stage scientific evidence that backs these health-related outcomes. The absence of significant clinical trials and acceptance as scientific validation makes healthcare professionals skeptical, and consumers cautious. Scientific uncertainty considers the wide-scale industry acceptance in pharmaceutical and functional food applications, a dynamic that ultimately contains the full potential.Global Gum Arabic Market Segment Analysis

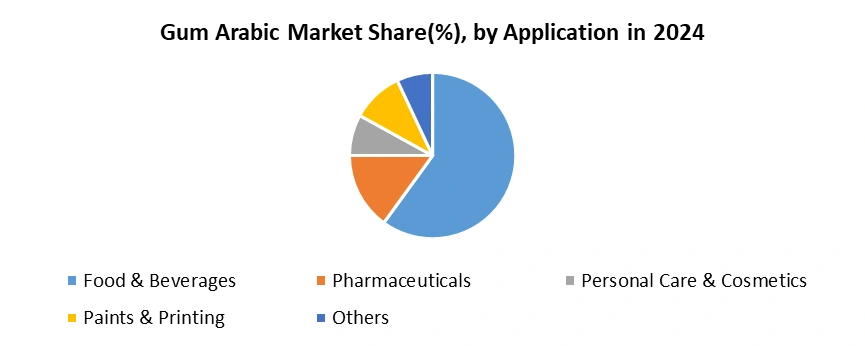

Based on type, the global gum arabic market is segmented into Acacia Seyal and Acacia Senegal. the acacia Senegal has dominated the market in recent years due to its increased use in the skincare and pharma industry. Some key applications of this tree include making essential oil and soil improvers. Though there is little evidence to prove the claims, it helps in controlling cholesterol levels in the blood, blood sugar and soothing the skin. Studies have also shown that gum arabic helps in keeping the scalp hydrated and maintains the flow of water in the scalp, due to which this segment is anticipated to grow in the forecast period. Based on application, the gum arabic market is segmented into pharmaceuticals, food & beverages, personal care & cosmetics, paints, and others. The food and beverage segment is expected to hold the largest Gum Arabic Market share over the forecast period. In beverages, gum Arabic helps to stop sugar in liquid form in soft drinks from breaking down. In the food industry, it acts as a stabilizing, binding, and thickener agent to maintain flavors and sweetness in drinks. It is also used in the production of ice cream, liquid milk products, Sherbets, etc. Due to which the market segment is anticipated to register substantial growth. Followed by personal care and pharmaceuticals because of their benefits to skin, hair and other health issues.

Gum Arabic Market Regional Insights

North America dominated the Gum Arabic market in the forecast period with the largest market share. Due to the increased use of gum arabic in end-use applications, primarily in the pharmaceutical and food and beverage industries. Gum arabic helps in stabilizing food and drink by maintaining sugar levels in liquid forms and thus giving a longer shelf life. it was also observed that it is a good color preservative and inhibitor and is stable in acidic conditions, preferably used as an emulsifier in the production of cola flavor oils and concentrated citrus for its application in soft drinks. Due to this, North America is expected to dominate the market in the forecast period. The Asia Pacific is the fastest-growing market in the forecast period due to an increase in the sales of dairy products and the expansion of confectionery manufacturing industries in the region. Gum Arabic helps in bowel movement and irregular constipation problems due to its high rich in fiber required for the body. When added to the milk, gum arabic gives the desired dish or beverage. Japan, India, and China are the major contributors in the region and are expected to lead the market growth in the region. The European region is also witnessing a rise in market growth, primarily due to increased usage of gum arabic in the food and beverage industry. European population are more inclined towards consumption of bakery product. Availability of raw materials as the tree of acacia Senegal grows in all seasons and innovative means of productions are fueling the market growth in the region. Italy, England, Spain, Portugal and Germany are the most contributing countries in the market growth of the European region. Middle East & Africa have shown signs of growth as well in recent years because of increased awareness and usage of gum arabic in food & beverages and pharmaceutical industry. Consumption of drinks and beverages are high in the region and has fueled the overall market growth. However, the growth in this region is projected to be at a slow rate due to the high cost of production and not favorable weather for the plantation of gum arabic plant. Gum Arabic Market Competitive Landscape The Gum Arabic Market remains competitive with continued growth and stronger demand for clean-label ingredients, digestive health solutions, and sustainable sourcing. Nexira (France) and Kerry Group (Ireland), are the two major players shaping market trends through innovation and global presence. Nexira has positioned itself within the industry as a true pioneer in organic and carbon-neutral acacia fiber with the Inavea brand. They recently launched new prebiotic beverage solutions focused on gut health, received multiple sustainability awards in 2025, and focused heavily on environmentally responsible alternatives to synthetic ingredients in their quest for clean-label functionality. Kerry Group emphasizes functional nutrition and digestive health through its extensive B2B partnership network and offers its Emulgold acacia gum; throughout the pandemic, its strong financial and supply-chain capabilities supported additional food and beverage applications globally. Both companies were first to market with clean-label innovations and sustainable operations, and promote healthier, natural ingredient solutions to a market where functionality and traceability are now prerequisites for brands and consumers. Gum Arabic Market Recent Development • In August 2024, Agrigum International Limited partnered with Ampak to expand gum arabic distribution in the U.S., leveraging Ampak’s distribution channels to increase reach within the food & beverage, pharmaceutical, and cosmetics sectors. • In July 2025, at IFT FIRST, Nexira (France) showcased new functional beverage innovations, including prebiotic sodas enriched with acacia fiber, focus-enhancing sparkling drinks, and relaxation RTDs, highlighting gum arabic’s role in clean-label beverage development. • In April 2024, Farbest Brands introduced Beyond Acacia, developed in collaboration with Alland & Robert, featuring an improved gum acacia format engineered for cleaner processing (less dust and foam) and enhanced sustainability in manufacturing. Gum Arabic Market Recent Trends

Category Key Trend Example Product Market Impact Clean-Label Ingredients Growing demand for natural, additive-free stabilizers and emulsifiers Nexira inavea Pure Acacia (Organic, Carbon-Neutral Acacia Gum) Reinforces gum arabic’s position as a clean-label, plant-based alternative to synthetic additives Sustainable Sourcing Emphasis on traceability and ethical harvesting amid geopolitical tensions Farbest & Alland & Robert’s Beyond Acacia Builds consumer trust and ensures continued supply despite disruptions in major producing regions Nutraceuticals & Pharma Increased inclusion in nutraceutical formulations for health applications Gum Arabic in sugar-free lozenges and diabetic supplements Opens new growth channels in health supplements and functional pharma segments Gum Arabic Industry Ecosystem

Gum Arabic Market Scope: Inquire before buying

Global Gum Arabic Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 547.09 Mn. Forecast Period 2025 to 2032 CAGR: 6.1% Market Size in 2032: USD 878.58 Mn. Segments Covered: by Type Acacia Seyal Acacia Senegal by Function Thickener Fat Replacer Stabilizer Gelling Agent Coating Agent Texturing Others by Form Crystals liquid powder Others by Property Viscocity Solubility Fiber Stabilizer by Application Pharmaceutical Food & Beverages Personal care & Cosmetics Paints Others by Distribution Channel Direct Sales Distributors / Wholesalers E-commerce Others Gum Arabic Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Gum Arabic Market, Key Players

North America 1. Tic Gums Inc. (USA) 2. Farbest Brands (USA) 3. Archer Daniels Midland Company (USA) 4. Ashland Inc. (USA) 5. AEP Colloids (USA) 6. SmartyPants Inc. (U.S.) 7. Makers Nutrition, LLC (U.S.) 8. Nature's Way Products, LLC (U.S.) 9. Vitakem Nutraceutical Inc. (U.S.) 10. OLLY Vitamins & Supplements (U.S.) Europe 1. Nexira (France) 2. Kerry Group (Ireland) 3. Agrigum International Limited (UK) 4. Hawkins Watts (UK) 5. CARAGUM International (France) Asia Pacific 1. KANTILAL BROTHERS (India) 2. Foodchem International Corporation (China) 3. Eco Agri (Asia) 4. Agrigum International Limited (Australia) 5. Caragum International S.A.( Pakistan)Frequently Asked Questions :

1. What was the Global Gum Arabic Market size in 2024? Ans. The Global Gum Arabic Market size was USD 547.09 Mn in 2024. 2. What are the different segments of the Global GUM Arabic Market? Ans. The Global GUM Arabic Market is divided into Type, Form, Property, Application, Function, and Distribution Channel. 3. What is the study period of this market? Ans. The Global GUM Arabic Market will be studied from 2024 to 2032. 4. Which region is expected to hold the highest Global GUM Arabic Market share? Ans. North America dominates the Global GUM Arabic market share in the market. 5. What is the Forecast Period of the Global GUM Arabic Market? Ans. The Forecast Period of the market is 2025-2032 in the market.

1. Gum Arabic Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Gum Arabic Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Gum Arabic Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Gum Arabic Market: Dynamics 3.1. Gum Arabic Market Trends by Region 3.1.1. North America Gum Arabic Market Trends 3.1.2. Europe Gum Arabic Market Trends 3.1.3. Asia Pacific Gum Arabic Market Trends 3.1.4. Middle East and Africa Gum Arabic Market Trends 3.1.5. South America Gum Arabic Market Trends 3.2. Gum Arabic Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Gum Arabic Market Drivers 3.2.1.2. North America Gum Arabic Market Restraints 3.2.1.3. North America Gum Arabic Market Opportunities 3.2.1.4. North America Gum Arabic Market Challenges 3.2.2. Europe 3.2.2.1. Europe Gum Arabic Market Drivers 3.2.2.2. Europe Gum Arabic Market Restraints 3.2.2.3. Europe Gum Arabic Market Opportunities 3.2.2.4. Europe Gum Arabic Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Gum Arabic Market Drivers 3.2.3.2. Asia Pacific Gum Arabic Market Restraints 3.2.3.3. Asia Pacific Gum Arabic Market Opportunities 3.2.3.4. Asia Pacific Gum Arabic Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Gum Arabic Market Drivers 3.2.4.2. Middle East and Africa Gum Arabic Market Restraints 3.2.4.3. Middle East and Africa Gum Arabic Market Opportunities 3.2.4.4. Middle East and Africa Gum Arabic Market Challenges 3.2.5. South America 3.2.5.1. South America Gum Arabic Market Drivers 3.2.5.2. South America Gum Arabic Market Restraints 3.2.5.3. South America Gum Arabic Market Opportunities 3.2.5.4. South America Gum Arabic Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Gum Arabic Industry 3.8. Analysis of Government Schemes and Initiatives For Gum Arabic Industry 3.9. Gum Arabic Market Trade Analysis 3.10. The Global Pandemic Impact on Gum Arabic Market 4. Gum Arabic Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Gum Arabic Market Size and Forecast, by Type (2024-2032) 4.1.1. Acacia Seyal 4.1.2. Acacia Senegal 4.2. Gum Arabic Market Size and Forecast, by Function (2024-2032) 4.2.1. Thickener 4.2.2. Fat Replacer 4.2.3. Stabilizer 4.2.4. Gelling Agent 4.2.5. Coating Agent 4.2.6. Texturing 4.2.7. Others 4.3. Gum Arabic Market Size and Forecast, by Form (2024-2032) 4.3.1. Crystals 4.3.2. liquid 4.3.3. powder 4.3.4. Others 4.4. Gum Arabic Market Size and Forecast, by Property (2024-2032) 4.4.1. Viscocity 4.4.2. Solubility 4.4.3. Fiber 4.4.4. Stabilizer 4.5. Gum Arabic Market Size and Forecast, by Application (2024-2032) 4.5.1. Pharmaceutical 4.5.2. Food & Beverages 4.5.3. Personal care & Cosmetics 4.5.4. Paints 4.5.5. Others 4.6. Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 4.6.1. Direct Sales 4.6.2. Distributors / Wholesalers 4.6.3. E-commerce 4.6.4. Others 4.7. Gum Arabic Market Size and Forecast, by Region (2024-2032) 4.7.1. North America 4.7.2. Europe 4.7.3. Asia Pacific 4.7.4. Middle East and Africa 4.7.5. South America 5. North America Gum Arabic Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Gum Arabic Market Size and Forecast, by Type (2024-2032) 5.1.1. Acacia Seyal 5.1.2. Acacia Senegal 5.2. North America Gum Arabic Market Size and Forecast, by Function (2024-2032) 5.2.1. Thickener 5.2.2. Fat Replacer 5.2.3. Stabilizer 5.2.4. Gelling Agent 5.2.5. Coating Agent 5.2.6. Texturing 5.2.7. Others 5.3. North America Gum Arabic Market Size and Forecast, by Form (2024-2032) 5.3.1. Crystals 5.3.2. liquid 5.3.3. powder 5.3.4. Others 5.4. North America Gum Arabic Market Size and Forecast, by Property (2024-2032) 5.4.1. Viscocity 5.4.2. Solubility 5.4.3. Fiber 5.4.4. Stabilizer 5.5. North America Gum Arabic Market Size and Forecast, by Application (2024-2032) 5.5.1. Pharmaceutical 5.5.2. Food & Beverages 5.5.3. Personal care & Cosmetics 5.5.4. Paints 5.5.5. Others 5.6. North America Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 5.6.1. Direct Sales 5.6.2. Distributors / Wholesalers 5.6.3. E-commerce 5.6.4. Others 5.7. North America Gum Arabic Market Size and Forecast, by Country (2024-2032) 5.7.1. United States 5.7.1.1. United States Gum Arabic Market Size and Forecast, by Type (2024-2032) 5.7.1.1.1. Acacia Seyal 5.7.1.1.2. Acacia Senegal 5.7.1.2. United States Gum Arabic Market Size and Forecast, by Function (2024-2032) 5.7.1.2.1. Thickener 5.7.1.2.2. Fat Replacer 5.7.1.2.3. Stabilizer 5.7.1.2.4. Gelling Agent 5.7.1.2.5. Coating Agent 5.7.1.2.6. Texturing 5.7.1.2.7. Others 5.7.1.3. United States Gum Arabic Market Size and Forecast, by Form (2024-2032) 5.7.1.3.1. Crystals 5.7.1.3.2. liquid 5.7.1.3.3. powder 5.7.1.3.4. Others 5.7.1.4. United States Gum Arabic Market Size and Forecast, by Property (2024-2032) 5.7.1.4.1. Viscocity 5.7.1.4.2. Solubility 5.7.1.4.3. Fiber 5.7.1.4.4. Stabilizer 5.7.1.5. United States Gum Arabic Market Size and Forecast, by Application (2024-2032) 5.7.1.5.1. Pharmaceutical 5.7.1.5.2. Food & Beverages 5.7.1.5.3. Personal care & Cosmetics 5.7.1.5.4. Paints 5.7.1.5.5. Others 5.7.1.6. United States Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 5.7.1.6.1. Direct Sales 5.7.1.6.2. Distributors / Wholesalers 5.7.1.6.3. E-commerce 5.7.1.6.4. Others 5.7.2. Canada 5.7.2.1. Canada Gum Arabic Market Size and Forecast, by Type (2024-2032) 5.7.2.1.1. Acacia Seyal 5.7.2.1.2. Acacia Senegal 5.7.2.2. Canada Gum Arabic Market Size and Forecast, by Function (2024-2032) 5.7.2.2.1. Thickener 5.7.2.2.2. Fat Replacer 5.7.2.2.3. Stabilizer 5.7.2.2.4. Gelling Agent 5.7.2.2.5. Coating Agent 5.7.2.2.6. Texturing 5.7.2.2.7. Others 5.7.2.3. Canada Gum Arabic Market Size and Forecast, by Form (2024-2032) 5.7.2.3.1. Crystals 5.7.2.3.2. liquid 5.7.2.3.3. powder 5.7.2.3.4. Others 5.7.2.4. Canada Gum Arabic Market Size and Forecast, by Property (2024-2032) 5.7.2.4.1. Viscocity 5.7.2.4.2. Solubility 5.7.2.4.3. Fiber 5.7.2.4.4. Stabilizer 5.7.2.5. Canada Gum Arabic Market Size and Forecast, by Application (2024-2032) 5.7.2.5.1. Pharmaceutical 5.7.2.5.2. Food & Beverages 5.7.2.5.3. Personal care & Cosmetics 5.7.2.5.4. Paints 5.7.2.5.5. Others 5.7.2.6. Canada Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 5.7.2.6.1. Direct Sales 5.7.2.6.2. Distributors / Wholesalers 5.7.2.6.3. E-commerce 5.7.2.6.4. Others 5.7.3. Mexico 5.7.3.1. Mexico Gum Arabic Market Size and Forecast, by Type (2024-2032) 5.7.3.1.1. Acacia Seyal 5.7.3.1.2. Acacia Senegal 5.7.3.2. Mexico Gum Arabic Market Size and Forecast, by Function (2024-2032) 5.7.3.2.1. Thickener 5.7.3.2.2. Fat Replacer 5.7.3.2.3. Stabilizer 5.7.3.2.4. Gelling Agent 5.7.3.2.5. Coating Agent 5.7.3.2.6. Texturing 5.7.3.2.7. Others 5.7.3.3. Mexico Gum Arabic Market Size and Forecast, by Form (2024-2032) 5.7.3.3.1. Crystals 5.7.3.3.2. liquid 5.7.3.3.3. powder 5.7.3.3.4. Others 5.7.3.4. Mexico Gum Arabic Market Size and Forecast, by Property (2024-2032) 5.7.3.4.1. Viscocity 5.7.3.4.2. Solubility 5.7.3.4.3. Fiber 5.7.3.4.4. Stabilizer 5.7.3.5. Mexico Gum Arabic Market Size and Forecast, by Application (2024-2032) 5.7.3.5.1. Pharmaceutical 5.7.3.5.2. Food & Beverages 5.7.3.5.3. Personal care & Cosmetics 5.7.3.5.4. Paints 5.7.3.5.5. Others 5.7.3.6. Mexico Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 5.7.3.6.1. Direct Sales 5.7.3.6.2. Distributors / Wholesalers 5.7.3.6.3. E-commerce 5.7.3.6.4. Others 6. Europe Gum Arabic Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Gum Arabic Market Size and Forecast, by Type (2024-2032) 6.2. Europe Gum Arabic Market Size and Forecast, by Function (2024-2032) 6.3. Europe Gum Arabic Market Size and Forecast, by Form (2024-2032) 6.4. Europe Gum Arabic Market Size and Forecast, by Property (2024-2032) 6.5. Europe Gum Arabic Market Size and Forecast, by Application (2024-2032) 6.6. Europe Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 6.7. Europe Gum Arabic Market Size and Forecast, by Country (2024-2032) 6.7.1. United Kingdom 6.7.1.1. United Kingdom Gum Arabic Market Size and Forecast, by Type (2024-2032) 6.7.1.2. United Kingdom Gum Arabic Market Size and Forecast, by Function (2024-2032) 6.7.1.3. United Kingdom Gum Arabic Market Size and Forecast, by Form (2024-2032) 6.7.1.4. United Kingdom Gum Arabic Market Size and Forecast, by Property (2024-2032) 6.7.1.5. United Kingdom Gum Arabic Market Size and Forecast, by Application (2024-2032) 6.7.1.6. United Kingdom Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 6.7.2. France 6.7.2.1. France Gum Arabic Market Size and Forecast, by Type (2024-2032) 6.7.2.2. France Gum Arabic Market Size and Forecast, by Function (2024-2032) 6.7.2.3. France Gum Arabic Market Size and Forecast, by Form (2024-2032) 6.7.2.4. France Gum Arabic Market Size and Forecast, by Property (2024-2032) 6.7.2.5. France Gum Arabic Market Size and Forecast, by Application (2024-2032) 6.7.2.6. France Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 6.7.3. Germany 6.7.3.1. Germany Gum Arabic Market Size and Forecast, by Type (2024-2032) 6.7.3.2. Germany Gum Arabic Market Size and Forecast, by Function (2024-2032) 6.7.3.3. Germany Gum Arabic Market Size and Forecast, by Form (2024-2032) 6.7.3.4. Germany Gum Arabic Market Size and Forecast, by Property (2024-2032) 6.7.3.5. Germany Gum Arabic Market Size and Forecast, by Application (2024-2032) 6.7.3.6. Germany Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 6.7.4. Italy 6.7.4.1. Italy Gum Arabic Market Size and Forecast, by Type (2024-2032) 6.7.4.2. Italy Gum Arabic Market Size and Forecast, by Function (2024-2032) 6.7.4.3. Italy Gum Arabic Market Size and Forecast, by Form (2024-2032) 6.7.4.4. Italy Gum Arabic Market Size and Forecast, by Property (2024-2032) 6.7.4.5. Italy Gum Arabic Market Size and Forecast, by Application (2024-2032) 6.7.4.6. Italy Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 6.7.5. Spain 6.7.5.1. Spain Gum Arabic Market Size and Forecast, by Type (2024-2032) 6.7.5.2. Spain Gum Arabic Market Size and Forecast, by Function (2024-2032) 6.7.5.3. Spain Gum Arabic Market Size and Forecast, by Form (2024-2032) 6.7.5.4. Spain Gum Arabic Market Size and Forecast, by Property (2024-2032) 6.7.5.5. Spain Gum Arabic Market Size and Forecast, by Application (2024-2032) 6.7.5.6. Spain Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 6.7.6. Sweden 6.7.6.1. Sweden Gum Arabic Market Size and Forecast, by Type (2024-2032) 6.7.6.2. Sweden Gum Arabic Market Size and Forecast, by Function (2024-2032) 6.7.6.3. Sweden Gum Arabic Market Size and Forecast, by Form (2024-2032) 6.7.6.4. Sweden Gum Arabic Market Size and Forecast, by Property (2024-2032) 6.7.6.5. Sweden Gum Arabic Market Size and Forecast, by Application (2024-2032) 6.7.6.6. Sweden Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 6.7.7. Austria 6.7.7.1. Austria Gum Arabic Market Size and Forecast, by Type (2024-2032) 6.7.7.2. Austria Gum Arabic Market Size and Forecast, by Function (2024-2032) 6.7.7.3. Austria Gum Arabic Market Size and Forecast, by Form (2024-2032) 6.7.7.4. Austria Gum Arabic Market Size and Forecast, by Property (2024-2032) 6.7.7.5. Austria Gum Arabic Market Size and Forecast, by Application (2024-2032) 6.7.7.6. Austria Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 6.7.8. Rest of Europe 6.7.8.1. Rest of Europe Gum Arabic Market Size and Forecast, by Type (2024-2032) 6.7.8.2. Rest of Europe Gum Arabic Market Size and Forecast, by Function (2024-2032) 6.7.8.3. Rest of Europe Gum Arabic Market Size and Forecast, by Form (2024-2032) 6.7.8.4. Rest of Europe Gum Arabic Market Size and Forecast, by Property (2024-2032) 6.7.8.5. Rest of Europe Gum Arabic Market Size and Forecast, by Application (2024-2032) 6.7.8.6. Rest of Europe Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 7. Asia Pacific Gum Arabic Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Gum Arabic Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Gum Arabic Market Size and Forecast, by Function (2024-2032) 7.3. Asia Pacific Gum Arabic Market Size and Forecast, by Form (2024-2032) 7.4. Asia Pacific Gum Arabic Market Size and Forecast, by Property (2024-2032) 7.5. Asia Pacific Gum Arabic Market Size and Forecast, by Application (2024-2032) 7.6. Asia Pacific Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 7.7. Asia Pacific Gum Arabic Market Size and Forecast, by Country (2024-2032) 7.7.1. China 7.7.1.1. China Gum Arabic Market Size and Forecast, by Type (2024-2032) 7.7.1.2. China Gum Arabic Market Size and Forecast, by Function (2024-2032) 7.7.1.3. China Gum Arabic Market Size and Forecast, by Form (2024-2032) 7.7.1.4. China Gum Arabic Market Size and Forecast, by Property (2024-2032) 7.7.1.5. China Gum Arabic Market Size and Forecast, by Application (2024-2032) 7.7.1.6. China Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 7.7.2. S Korea 7.7.2.1. S Korea Gum Arabic Market Size and Forecast, by Type (2024-2032) 7.7.2.2. S Korea Gum Arabic Market Size and Forecast, by Function (2024-2032) 7.7.2.3. S Korea Gum Arabic Market Size and Forecast, by Form (2024-2032) 7.7.2.4. S Korea Gum Arabic Market Size and Forecast, by Property (2024-2032) 7.7.2.5. S Korea Gum Arabic Market Size and Forecast, by Application (2024-2032) 7.7.2.6. S Korea Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 7.7.3. Japan 7.7.3.1. Japan Gum Arabic Market Size and Forecast, by Type (2024-2032) 7.7.3.2. Japan Gum Arabic Market Size and Forecast, by Function (2024-2032) 7.7.3.3. Japan Gum Arabic Market Size and Forecast, by Form (2024-2032) 7.7.3.4. Japan Gum Arabic Market Size and Forecast, by Property (2024-2032) 7.7.3.5. Japan Gum Arabic Market Size and Forecast, by Application (2024-2032) 7.7.3.6. Japan Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 7.7.4. India 7.7.4.1. India Gum Arabic Market Size and Forecast, by Type (2024-2032) 7.7.4.2. India Gum Arabic Market Size and Forecast, by Function (2024-2032) 7.7.4.3. India Gum Arabic Market Size and Forecast, by Form (2024-2032) 7.7.4.4. India Gum Arabic Market Size and Forecast, by Property (2024-2032) 7.7.4.5. India Gum Arabic Market Size and Forecast, by Application (2024-2032) 7.7.4.6. India Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 7.7.5. Australia 7.7.5.1. Australia Gum Arabic Market Size and Forecast, by Type (2024-2032) 7.7.5.2. Australia Gum Arabic Market Size and Forecast, by Function (2024-2032) 7.7.5.3. Australia Gum Arabic Market Size and Forecast, by Form (2024-2032) 7.7.5.4. Australia Gum Arabic Market Size and Forecast, by Property (2024-2032) 7.7.5.5. Australia Gum Arabic Market Size and Forecast, by Application (2024-2032) 7.7.5.6. Australia Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 7.7.6. Indonesia 7.7.6.1. Indonesia Gum Arabic Market Size and Forecast, by Type (2024-2032) 7.7.6.2. Indonesia Gum Arabic Market Size and Forecast, by Function (2024-2032) 7.7.6.3. Indonesia Gum Arabic Market Size and Forecast, by Form (2024-2032) 7.7.6.4. Indonesia Gum Arabic Market Size and Forecast, by Property (2024-2032) 7.7.6.5. Indonesia Gum Arabic Market Size and Forecast, by Application (2024-2032) 7.7.6.6. Indonesia Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 7.7.7. Malaysia 7.7.7.1. Malaysia Gum Arabic Market Size and Forecast, by Type (2024-2032) 7.7.7.2. Malaysia Gum Arabic Market Size and Forecast, by Function (2024-2032) 7.7.7.3. Malaysia Gum Arabic Market Size and Forecast, by Form (2024-2032) 7.7.7.4. Malaysia Gum Arabic Market Size and Forecast, by Property (2024-2032) 7.7.7.5. Malaysia Gum Arabic Market Size and Forecast, by Application (2024-2032) 7.7.7.6. Malaysia Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 7.7.8. Vietnam 7.7.8.1. Vietnam Gum Arabic Market Size and Forecast, by Type (2024-2032) 7.7.8.2. Vietnam Gum Arabic Market Size and Forecast, by Function (2024-2032) 7.7.8.3. Vietnam Gum Arabic Market Size and Forecast, by Form (2024-2032) 7.7.8.4. Vietnam Gum Arabic Market Size and Forecast, by Property (2024-2032) 7.7.8.5. Vietnam Gum Arabic Market Size and Forecast, by Application (2024-2032) 7.7.8.6. Vietnam Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 7.7.9. Taiwan 7.7.9.1. Taiwan Gum Arabic Market Size and Forecast, by Type (2024-2032) 7.7.9.2. Taiwan Gum Arabic Market Size and Forecast, by Function (2024-2032) 7.7.9.3. Taiwan Gum Arabic Market Size and Forecast, by Form (2024-2032) 7.7.9.4. Taiwan Gum Arabic Market Size and Forecast, by Property (2024-2032) 7.7.9.5. Taiwan Gum Arabic Market Size and Forecast, by Application (2024-2032) 7.7.9.6. Taiwan Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 7.7.10. Rest of Asia Pacific 7.7.10.1. Rest of Asia Pacific Gum Arabic Market Size and Forecast, by Type (2024-2032) 7.7.10.2. Rest of Asia Pacific Gum Arabic Market Size and Forecast, by Function (2024-2032) 7.7.10.3. Rest of Asia Pacific Gum Arabic Market Size and Forecast, by Form (2024-2032) 7.7.10.4. Rest of Asia Pacific Gum Arabic Market Size and Forecast, by Property (2024-2032) 7.7.10.5. Rest of Asia Pacific Gum Arabic Market Size and Forecast, by Application (2024-2032) 7.7.10.6. Rest of Asia Pacific Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 8. Middle East and Africa Gum Arabic Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Gum Arabic Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Gum Arabic Market Size and Forecast, by Function (2024-2032) 8.3. Middle East and Africa Gum Arabic Market Size and Forecast, by Form (2024-2032) 8.4. Middle East and Africa Gum Arabic Market Size and Forecast, by Property (2024-2032) 8.5. Middle East and Africa Gum Arabic Market Size and Forecast, by Application (2024-2032) 8.6. Middle East and Africa Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 8.7. Middle East and Africa Gum Arabic Market Size and Forecast, by Country (2024-2032) 8.7.1. South Africa 8.7.1.1. South Africa Gum Arabic Market Size and Forecast, by Type (2024-2032) 8.7.1.2. South Africa Gum Arabic Market Size and Forecast, by Function (2024-2032) 8.7.1.3. South Africa Gum Arabic Market Size and Forecast, by Form (2024-2032) 8.7.1.4. South Africa Gum Arabic Market Size and Forecast, by Property (2024-2032) 8.7.1.5. South Africa Gum Arabic Market Size and Forecast, by Application (2024-2032) 8.7.1.6. South Africa Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 8.7.2. GCC 8.7.2.1. GCC Gum Arabic Market Size and Forecast, by Type (2024-2032) 8.7.2.2. GCC Gum Arabic Market Size and Forecast, by Function (2024-2032) 8.7.2.3. GCC Gum Arabic Market Size and Forecast, by Form (2024-2032) 8.7.2.4. GCC Gum Arabic Market Size and Forecast, by Property (2024-2032) 8.7.2.5. GCC Gum Arabic Market Size and Forecast, by Application (2024-2032) 8.7.2.6. GCC Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 8.7.3. Nigeria 8.7.3.1. Nigeria Gum Arabic Market Size and Forecast, by Type (2024-2032) 8.7.3.2. Nigeria Gum Arabic Market Size and Forecast, by Function (2024-2032) 8.7.3.3. Nigeria Gum Arabic Market Size and Forecast, by Form (2024-2032) 8.7.3.4. Nigeria Gum Arabic Market Size and Forecast, by Property (2024-2032) 8.7.3.5. Nigeria Gum Arabic Market Size and Forecast, by Application (2024-2032) 8.7.3.6. Nigeria Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 8.7.4. Rest of ME&A 8.7.4.1. Rest of ME&A Gum Arabic Market Size and Forecast, by Type (2024-2032) 8.7.4.2. Rest of ME&A Gum Arabic Market Size and Forecast, by Function (2024-2032) 8.7.4.3. Rest of ME&A Gum Arabic Market Size and Forecast, by Form (2024-2032) 8.7.4.4. Rest of ME&A Gum Arabic Market Size and Forecast, by Property (2024-2032) 8.7.4.5. Rest of ME&A Gum Arabic Market Size and Forecast, by Application (2024-2032) 8.7.4.6. Rest of ME&A Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 9. South America Gum Arabic Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Gum Arabic Market Size and Forecast, by Type (2024-2032) 9.2. South America Gum Arabic Market Size and Forecast, by Function (2024-2032) 9.3. South America Gum Arabic Market Size and Forecast, by Form(2024-2032) 9.4. South America Gum Arabic Market Size and Forecast, by Property (2024-2032) 9.5. South America Gum Arabic Market Size and Forecast, by Application (2024-2032) 9.6. South America Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 9.7. South America Gum Arabic Market Size and Forecast, by Country (2024-2032) 9.7.1. Brazil 9.7.1.1. Brazil Gum Arabic Market Size and Forecast, by Type (2024-2032) 9.7.1.2. Brazil Gum Arabic Market Size and Forecast, by Function (2024-2032) 9.7.1.3. Brazil Gum Arabic Market Size and Forecast, by Form (2024-2032) 9.7.1.4. Brazil Gum Arabic Market Size and Forecast, by Property (2024-2032) 9.7.1.5. Brazil Gum Arabic Market Size and Forecast, by Application (2024-2032) 9.7.1.6. Brazil Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 9.7.2. Argentina 9.7.2.1. Argentina Gum Arabic Market Size and Forecast, by Type (2024-2032) 9.7.2.2. Argentina Gum Arabic Market Size and Forecast, by Function (2024-2032) 9.7.2.3. Argentina Gum Arabic Market Size and Forecast, by Form (2024-2032) 9.7.2.4. Argentina Gum Arabic Market Size and Forecast, by Property (2024-2032) 9.7.2.5. Argentina Gum Arabic Market Size and Forecast, by Application (2024-2032) 9.7.2.6. Argentina Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 9.7.3. Rest Of South America 9.7.3.1. Rest Of South America Gum Arabic Market Size and Forecast, by Type (2024-2032) 9.7.3.2. Rest Of South America Gum Arabic Market Size and Forecast, by Function (2024-2032) 9.7.3.3. Rest Of South America Gum Arabic Market Size and Forecast, by Form (2024-2032) 9.7.3.4. Rest Of South America Gum Arabic Market Size and Forecast, by Property (2024-2032) 9.7.3.5. Rest Of South America Gum Arabic Market Size and Forecast, by Application (2024-2032) 9.7.3.6. Rest Of South America Gum Arabic Market Size and Forecast, by Distribution Channel (2024-2032) 10. Company Profile: Key Players 10.1. Tic Gums Inc. (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Farbest Brands (USA) 10.3. Archer Daniels Midland Company (USA) 10.4. Ashland Inc. (USA) 10.5. AEP Colloids (USA) 10.6. SmartyPants Inc. (U.S.) 10.7. Makers Nutrition, LLC (U.S.) 10.8. Nature's Way Products, LLC (U.S.) 10.9. Vitakem Nutraceutical Inc. (U.S.) 10.10. OLLY Vitamins & Supplements (U.S.) 10.11. Nexira (France) 10.12. Kerry Group (Ireland) 10.13. Agrigum International Limited (UK) 10.14. Hawkins Watts (UK) 10.15. CARAGUM International (France) 10.16. KANTILAL BROTHERS (India) 10.17. Foodchem International Corporation (China) 10.18. Eco Agri (Asia) 10.19. Agrigum International Limited (Australia) 10.20. Caragum International S.A.( Pakistan) 11. Key Findings 12. Industry Recommendations 13. Gum Arabic Market: Research Methodology 14. Terms and Glossary