The Global Gesture Recognition Market size was valued at USD 17.30 Bn. In 2022 the total Gesture Recognition Market revenue is growing by 19.1% from 2023 to 2029, reaching nearly USD 58.81 Bn.Gesture Recognition Market Overview

Gesture recognition is the ability of a computer or device to detect and interpret human gestures as input. Such gestures include hand movements and even finger-written symbols. Gesture recognition technology relies on cameras or sensors to capture human gestures, and then employs advanced machine learning algorithms to meticulously analyze and decipher the collected data. This innovative technology finds versatile applications in daily life, from enhancing entertainment experiences including video games and virtual reality environments to making interactions more intuitive and immersive. Gesture recognition also provides novel ways of interacting with interfaces, for example controlling a presentation and playing music by gesturing at a device. The ease of adoption for end-users thanks to minimal technological complexity is accelerating its acceptance across the consumer electronics industry. The Gesture Recognition Market is growing as consumer electronics and the Internet of Things become more popular, as well as the demand for comfort and simplicity in product use driving the Market growth.To know about the Research Methodology :- Request Free Sample Report

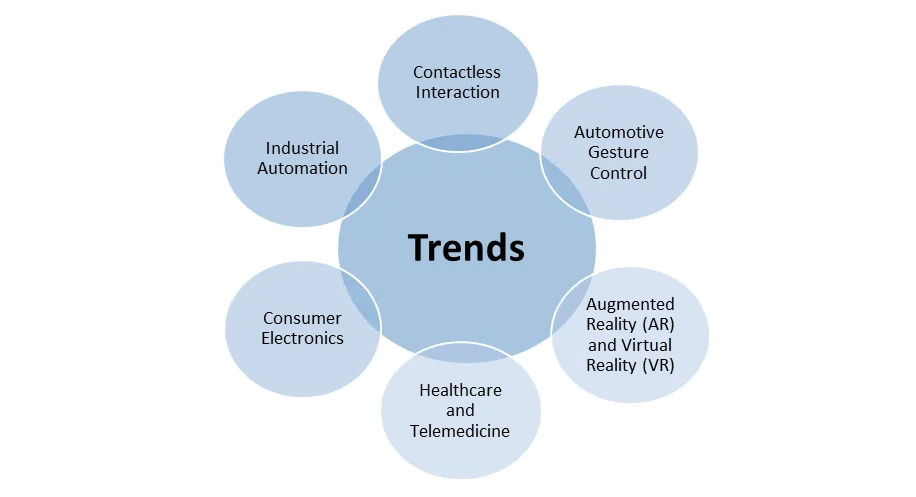

Gesture Recognition Market Trends:

Contactless Interaction The COVID-19 pandemic has spurred an increase in demand for contactless interaction, with gesture recognition technology taking center stage. It's now widely embraced in industries such as retail, healthcare, and hospitality, offering touchless engagement with screens and devices. As technology evolves, contactless interaction is set to become more precise, incorporating expanded voice command capabilities and seamless integration with augmented and virtual reality for immersive experiences. This transformation is not a passing response to the pandemic; it's here to stay. Safety, convenience, and hygiene have become paramount, shaping the future of digital interactions for both companies and consumers. This trend is a defining force, promising enduring changes in the digital world.

New Technologies in Gesture Recognition

The Sixth Sense Device: The SixthSense wearable gestural interface innovatively combines hardware and software. This pendant-like device incorporates a pocket projector, mirror, and camera, all linked to a mobile computing device. The projector transforms surfaces into interactive interfaces, while the camera tracks hand gestures and objects through computer vision. Software processes the camera data, recognizing fingertip markers as gestural commands for projected application interfaces. Remarkably, the system accommodates multi-touch and multi-user interactions. SixthSense showcases its utility through various applications, including map navigation via hand gestures and drawing on any surface by tracking finger movements. It also identifies the user's freehand gestures, such as framing to capture photos, and allows easy photo browsing on any available surface. This convergence of hardware and software augments human-computer interaction, heralding a promising future for intuitive and immersive technology experiences. Gesture Tek The sensing gesture control interface enables users to navigate interactive content effortlessly on various platforms, including floating panels, multimedia kiosks, multi-touch surface screens, interactive tables, and interactive windows. These surfaces are configured with a multi-touch interface, facilitating multi-touch and multi-point interactions. There are no visible projectors or hardware components, creating an unforgettable experience as GestureTek's dynamic interactive displays respond to every touch or hand gesture, offering a rich and immersive interactive experience. The hand-tracking system empowers users to control multimedia content in novel ways, effectively transforming ordinary surfaces into interactive multi-touch computing platforms. GestureTek offers illuminated surfaces in the form of interactive multi-touch display panels, windows, kiosks, and multi-touch tables. These multi-touch interactive surface displays are available as turnkey solutions and customized to suit nearly any desired shape or size.Gesture Recognition Market Dynamics:

Rising Digitalization to Boost the Gesture Recognition Market The rising trend of digitalization is set to significantly boost the Gesture Recognition Market. As more aspects become interconnected and reliant on digital technology, the demand for intuitive and hands-free interfaces is on the rise. Gesture recognition technology allows users to interact with devices and systems using simple hand movements or body gestures, eliminating the need for physical contact or traditional input methods Including keyboards or touchscreens. This technology finds applications in various sectors, including consumer electronics, healthcare, automotive, and gaming, offering enhanced user experiences, convenience, and safety. With the increasing adoption of smart homes and IoT devices, the Gesture Recognition Market is expected to substantial growth. The need for touchless interfaces in public spaces and workplaces further drives the market's growth. The digitalization wave is propelling gesture recognition technology to play an essential role in shaping the increasingly interconnected and touch-free digital world. After the COVID-19 pandemic, most countries adopted Digitalization this factor is significantly responsible for the rise in demand for Gesture Recognition. For Example, in the year 2022, Denmark secured the top position as the world's leader in digital competitiveness. These rankings assess a country's capacity to embrace digital technologies and effectively integrate them into both businesses and government institutions. Several Nordic nations performed exceptionally well, with Sweden, Finland, and Norway also securing prominent positions within the top fifteen. The United States earned the second-place ranking.Growing Adoption of Smartphones and Tablets to Drive the Market Growth The increasing adoption of smartphones and tablets is transforming the way people interact with technology. This trend is driving the growth of the Gesture Recognition Market, which enables computers and devices to interpret human gestures as commands. Smartphones and tablets become essential tools, offering unmatched convenience and portability. The continuous advancements in mobile technology, including faster processors, enhanced displays, and improved battery life, have contributed to their widespread adoption. The availability of diverse operating systems and app ecosystems further enriches the user experience, providing to various preferences and needs. The COVID-19 pandemic accelerated the adoption of smartphones and tablets, as remote work, virtual learning, and telehealth services became essential. These devices enable seamless connectivity, collaboration, and access to critical resources from virtually anywhere, fostering greater flexibility and productivity. Smartphones and tablets are equipped with built-in gesture recognition capabilities. This integration means people use their hands and fingers to control their devices. People engage in activities such as navigating their screens, playing interactive games, and switching between various content while using smartphones and tablets. The widespread use of these devices has accelerated a surge in the fascination with gesture recognition technology. As an example, in 2022, China led the globe with the highest number of smartphone users, exceeding 974 million individuals, while India followed closely as the second-largest smartphone user base, totaling approximately 659 million users. This trend underscores the growing interest in and demand for gesture-based control systems. These two countries are expected to continue to lead the smartphone user ranking, as China and India also rank one and two regarding the largest populations worldwide and still have strong growth potential due to a relatively low smartphone penetration rate.

Technical Challenges Limit the Gesture Recognition Market Growth Technical challenges are a significant factor limiting the growth of the Gesture Recognition Market. These challenges primarily revolve around the complexity and precision required in interpreting human gestures accurately. Achieving high accuracy in gesture recognition, especially in noisy or complex environments, remains a persistent challenge. Variability in lighting conditions, background clutter, and user-specific nuances lead to errors in gesture interpretation. The development and integration of sophisticated sensors, cameras, and software algorithms necessary for gesture recognition is costly. This cost prevents companies from adopting the technology, particularly in price-sensitive markets. Maintaining consistent and reliable performance across a wide range of gestures and user interactions technically demanding. Technical challenges hinder the continuous and widespread adoption of gesture recognition technology, requiring ongoing research and development efforts to overcome these obstacles and drive market growth. Rising Adoption of Virtual and Augmented Reality Create Lucrative Growth Opportunities for the Market The interaction between gesture recognition technology and Virtual and Augmented Reality has unlocked growth opportunities. Allowing users to naturally interact with virtual environments and objects through intuitive hand and body movements, gesture recognition enhances immersion and engagement in VR/AR experiences. This technology reduces reliance on physical controllers, simplifying setups and broadening accessibility, while also finding applications in training, simulation, gaming, education, and healthcare. In these fields, gesture recognition enriches training programs, revolutionizes learning, improves medical training and therapy, and facilitates collaborative design. It enhances accessibility for individuals with disabilities. VR/AR technologies continue to advance and gain traction in various industries, the demand for gesture recognition solutions is composed of strong growth, making it a lucrative market for innovators and technology providers. This combination not only elevates user experiences but also helps innovation and market growth in the area of immersive technologies.

Gesture Recognition Challenges

Gesture recognition software encounters numerous challenges that impact its accuracy and utility, particularly in the area of image-based gesture recognition. These challenges arise from limitations in equipment and the presence of image noise. Inconsistent lighting conditions and varying locations disrupt the quality of images or videos, making it difficult to achieve consistent recognition. Factors such as background elements and unique user features further complicate recognition processes. The diverse range of implementations for image-based gesture recognition introduces compatibility issues an algorithm calibrated for one camera not function effectively with another. The prevalence of background noise exacerbates tracking and recognition difficulties, particularly when obstructions occur. Variables such as camera distance, resolution, and quality contribute to variations in recognition accuracy. To effectively capture human gestures using visual sensors, strong computer vision techniques are imperative, encompassing hand tracking, hand posture recognition, and the capture of head movements, facial expressions, and gaze direction.Gesture Recognition Market Segment Analysis

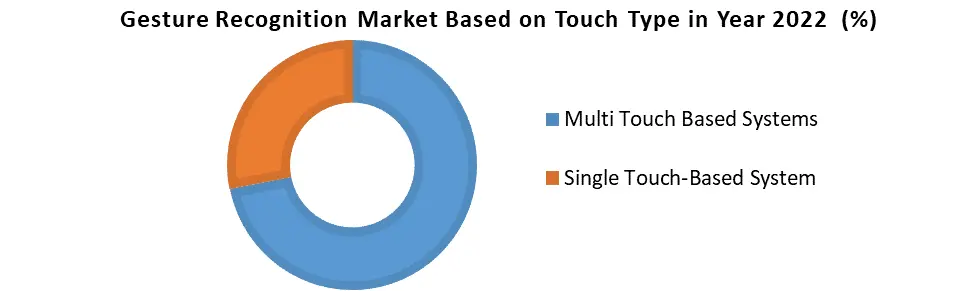

Based on the Authentication Type, the Face Recognition segment dominates the Gesture Recognition Market in the year 2022. Facial recognition represents a biometric software solution that meticulously scrutinizes and assesses facial features to establish an individual's unique identity or confirm their identity. Although its predominant application lies in the realm of security, there is a burgeoning fascination with its diverse potential. The realm of facial recognition software has garnered significant attention due to its countless possibilities in sectors including law enforcement and various industries. This technology finds extensive utilization in the domains of biometric authentication and security, encompassing tasks such as unlocking smartphones, granting access to secure facilities, and confirming individuals' identities. Its security applications have driven its adoption in various sectors, such as finance, healthcare, and government. This factor is responsible for the growth of this segment.Based on the Touch Type, The Multi-Touch Systems segment dominated the Gesture Recognition Market in the year 2022. In smartphones, functions including zoom-in, zoom-out, and three-finger screenshots utilize multi-touch-based gesture recognition. On the trackpads of laptops, features such as desktop swap and navigation to the menu in Windows 10 were found. Smartphone manufacturers are currently releasing phones with touch-based gesture detection features such as double tapping to sleep and wake. Multi-touch systems provide an intuitive and user-friendly interface, allowing users to engage with devices through actions including tapping, pinching, swiping, and zooming. This makes them exceptionally accessible and straightforward to operate. Enhanced display technologies, such as capacitive and in-cell touchscreens, improved the overall user experience.

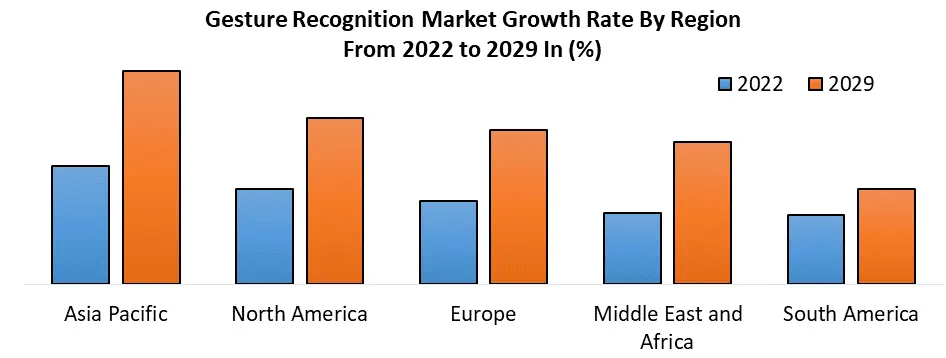

Gesture Recognition Market Regional Analysis

North America dominated the Global Gesture Recognition market in the year 2022. With the presence of large IT companies and start-ups in the country, the United States leads the North American market for gesture recognition. The US spends a lot of money on research and development. The country produces the highest-level science and engineering degrees as well as high-impact scientific articles. It is the world's largest information services supplier. High consumer technology adoption, strong presence of tech giants, and demand for advanced human-machine interfaces. The United States is helping to set the ground for record sales of the latest consumer devices in terms of demand. In 2022, disposable personal income rise by 1.8%, and it is expected to rise by more than 2.0% in 2022. As a result, sales in the consumer electronics industry in the United States are expected to reach USD 72,443 million in 2022. These are the major factors that drive the growth of this region in the Global Gesture Recognition Market.

Gesture Recognition Market Scope: Inquiry Before Buying

Gesture Recognition Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 17.30 Bn. Forecast Period 2023 to 2029 CAGR: 19.1% Market Size in 2029: US $ 58.81 Bn. Segments Covered: by Authentication Type Finger Print Recognition Face Recognition Vision and IRIS Recognition Hand and Leg Recognition by Touch Type Single Touch-Based System Multi-Touch Based Systems by Application Gaming Aerospace and Defense Automotive Hospitality Education Medical Centers Gesture Recognition Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Gesture Recognition Market Key Players

1. Microsoft (Washington, USA) 2. Intel Corporation (California, USA) 3. Qualcomm Incorporated (California, USA) 4. Leap Motion, Inc.( California, USA) 5. EyeSight Technologies (Herzliya, Israel) 6. GestureTek (Ontario, Canada) 7. XYZ Interactive (Ontario, Canada) 8. Microchip Technology Inc.( Arizona, USA) 9. Alphabet Inc.( California, USA) 10. Apple Inc.( California, USA) 11. Infineon Technologies AG (Germany) 12. Synaptics Incorporated (California, USA) 13. Microchip Technology Incorporated (Arizona, USA) 14. eyeSight Technologies Ltd (Israel) 15. OMRON Corporation (Japan) 16. Jabil Inc.( Florida)FAQ

1] What segments are covered in the Global Gesture Recognition Market report? Ans. The segments covered in the Gesture Recognition Market report are based on Authentication Type, Touch Type, Application, and Regions. 2] What is the growth driver for the Gesture Recognition Market? Ans. The increasing Digital Transformation is the major driver for the Software market. 2] Which region is expected to hold the highest share in the Global Gesture Recognition Market? Ans. The North American region is expected to hold the highest share of the Gesture Recognition Market. 3] What is the market size of the Global Gesture Recognition Market by 2029? Ans. The Gesture Recognition Market size was valued at USD 17.30 Bn. In 2022 the total Gesture Recognition Market revenue is growing by 19.1 % from 2023 to 2029, reaching nearly USD 58.8 Bn. 5] Which are the worldwide major key players covered in the Global Gesture Recognition Market report? Ans. Microsoft (Washington, USA), Intel Corporation (California, USA), Qualcomm Incorporated (California, USA), Leap Motion, Inc.( California, USA), EyeSight Technologies (Herzliya, Israel), GestureTek (Ontario, Canada), XYZ Interactive (Ontario, Canada), Microchip Technology Inc.( Arizona, USA), Alphabet Inc.( California, USA), Apple Inc.( California, USA)

1. Gesture Recognition Market: Research Methodology 2. Gesture Recognition Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Gesture Recognition Market: Dynamics 3.1. Gesture Recognition Market Trends by Region 3.1.1. North America Gesture Recognition Market Trends 3.1.2. Europe Gesture Recognition Market Trends 3.1.3. Asia Pacific Gesture Recognition Market Trends 3.1.4. Middle East and Africa Gesture Recognition Market Trends 3.1.5. South America Gesture Recognition Market Trends 3.2. Gesture Recognition Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Gesture Recognition Market Drivers 3.2.1.2. North America Gesture Recognition Market Restraints 3.2.1.3. North America Gesture Recognition Market Opportunities 3.2.1.4. North America Gesture Recognition Market Challenges 3.2.2. Europe 3.2.2.1. Europe Gesture Recognition Market Drivers 3.2.2.2. Europe Gesture Recognition Market Restraints 3.2.2.3. Europe Gesture Recognition Market Opportunities 3.2.2.4. Europe Gesture Recognition Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Gesture Recognition Market Drivers 3.2.3.2. Asia Pacific Gesture Recognition Market Restraints 3.2.3.3. Asia Pacific Gesture Recognition Market Opportunities 3.2.3.4. Asia Pacific Gesture Recognition Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Gesture Recognition Market Drivers 3.2.4.2. Middle East and Africa Gesture Recognition Market Restraints 3.2.4.3. Middle East and Africa Gesture Recognition Market Opportunities 3.2.4.4. Middle East and Africa Gesture Recognition Market Challenges 3.2.5. South America 3.2.5.1. South America Gesture Recognition Market Drivers 3.2.5.2. South America Gesture Recognition Market Restraints 3.2.5.3. South America Gesture Recognition Market Opportunities 3.2.5.4. South America Gesture Recognition Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Touch Type Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Gesture Recognition Industry 3.8. Analysis of Government Schemes and Initiatives For the Gesture Recognition Industry 3.9. The Global Pandemic Impact on the Gesture Recognition Market 4. Gesture Recognition Market: Global Market Size and Forecast by (by Value in USD Million) (2022-2029) 4.1. Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 4.1.1. Finger Print Recognition 4.1.2. Face Recognition 4.1.3. Vision and IRIS Recognition 4.1.4. Hand and Leg Recognition 4.2. Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 4.2.1. Single Touch-Based System 4.2.2. Multi-Touch-Based Systems 4.3. Gesture Recognition Market Size and Forecast, by Application (2022-2029) 4.3.1. Gaming 4.3.2. Aerospace and Defense 4.3.3. Automotive 4.3.4. Hospitality 4.3.5. Education 4.3.6. Medical Centers 4.4. Gesture Recognition Market Size and Forecast, by Region (2022-2029) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Gesture Recognition Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 5.1. North America Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 5.1.1. Finger Print Recognition 5.1.2. Face Recognition 5.1.3. Vision and IRIS Recognition 5.1.4. Hand and Leg Recognition 5.2. North America Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 5.2.1. Single Touch-Based System 5.2.2. Multi-Touch-Based Systems 5.3. North America Gesture Recognition Market Size and Forecast, by Application(2022-2029) 5.3.1. Gaming 5.3.2. Aerospace and Defense 5.3.3. Automotive 5.3.4. Hospitality 5.3.5. Education 5.3.6. Medical Centers 5.4. North America Gesture Recognition Market Size and Forecast, by Country (2022-2029) 5.4.1. United States 5.4.1.1. United States Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 5.4.1.1.1. Finger Print Recognition 5.4.1.1.2. Face Recognition 5.4.1.1.3. Vision and IRIS Recognition 5.4.1.1.4. Hand and Leg Recognition 5.4.1.2. United States Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 5.4.1.2.1. Single Touch-Based System 5.4.1.2.2. Multi-Touch-Based Systems 5.4.1.3. United States Gesture Recognition Market Size and Forecast, by Application(2022-2029) 5.4.1.3.1. Gaming 5.4.1.3.2. Aerospace and Defense 5.4.1.3.3. Automotive 5.4.1.3.4. Hospitality 5.4.1.3.5. Education 5.4.1.3.6. Medical Centers 5.4.2. Canada 5.4.2.1. Canada Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 5.4.2.1.1. Finger Print Recognition 5.4.2.1.2. Face Recognition 5.4.2.1.3. Vision and IRIS Recognition 5.4.2.1.4. Hand and Leg Recognition 5.4.2.2. Canada Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 5.4.2.2.1. Single Touch-Based System 5.4.2.2.2. Multi-Touch-Based Systems 5.4.2.3. Canada Gesture Recognition Market Size and Forecast, by Application(2022-2029) 5.4.2.3.1. Gaming 5.4.2.3.2. Aerospace and Defense 5.4.2.3.3. Automotive 5.4.2.3.4. Hospitality 5.4.2.3.5. Education 5.4.2.3.6. Medical Centers 5.4.3. Mexico 5.4.3.1. Mexico Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 5.4.3.1.1. Finger Print Recognition 5.4.3.1.2. Face Recognition 5.4.3.1.3. Vision and IRIS Recognition 5.4.3.1.4. Hand and Leg Recognition 5.4.3.2. Mexico Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 5.4.3.2.1. Single Touch-Based System 5.4.3.2.2. Multi-Touch-Based System 5.4.3.3. Mexico Gesture Recognition Market Size and Forecast, by Application(2022-2029) 5.4.3.3.1. Gaming 5.4.3.3.2. Aerospace and Defense 5.4.3.3.3. Automotive 5.4.3.3.4. Hospitality 5.4.3.3.5. Education 5.4.3.3.6. Medical Centers 6. Europe Gesture Recognition Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 6.1. Europe Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 6.2. Europe Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 6.3. Europe Gesture Recognition Market Size and Forecast, by End User(2022-2029) 6.4. Europe Gesture Recognition Market Size and Forecast, by Country (2022-2029) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 6.4.1.2. United Kingdom Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 6.4.1.3. United Kingdom Gesture Recognition Market Size and Forecast, by End User(2022-2029) 6.4.2. France 6.4.2.1. France Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 6.4.2.2. France Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 6.4.2.3. France Gesture Recognition Market Size and Forecast, by End User(2022-2029) 6.4.3. Germany 6.4.3.1. Germany Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 6.4.3.2. Germany Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 6.4.3.3. Germany Gesture Recognition Market Size and Forecast, by End User(2022-2029) 6.4.4. Italy 6.4.4.1. Italy Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 6.4.4.2. Italy Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 6.4.4.3. Italy Gesture Recognition Market Size and Forecast, by End User(2022-2029) 6.4.5. Spain 6.4.5.1. Spain Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 6.4.5.2. Spain Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 6.4.5.3. Spain Gesture Recognition Market Size and Forecast, by End User(2022-2029) 6.4.6. Sweden 6.4.6.1. Sweden Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 6.4.6.2. Sweden Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 6.4.6.3. Sweden Gesture Recognition Market Size and Forecast, by End User(2022-2029) 6.4.7. Austria 6.4.7.1. Austria Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 6.4.7.2. Austria Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 6.4.7.3. Austria Gesture Recognition Market Size and Forecast, by End User(2022-2029) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 6.4.8.2. Rest of Europe Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 6.4.8.3. Rest of Europe Gesture Recognition Market Size and Forecast, by End User(2022-2029) 7. Asia Pacific Gesture Recognition Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 7.1. Asia Pacific Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 7.2. Asia Pacific Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 7.3. Asia Pacific Gesture Recognition Market Size and Forecast, by End User(2022-2029) 7.4. Asia Pacific Gesture Recognition Market Size and Forecast, by Country (2022-2029) 7.4.1. China 7.4.1.1. China Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 7.4.1.2. China Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 7.4.1.3. China Gesture Recognition Market Size and Forecast, by End User(2022-2029) 7.4.2. S Korea 7.4.2.1. S Korea Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 7.4.2.2. S Korea Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 7.4.2.3. S Korea Gesture Recognition Market Size and Forecast, by End User(2022-2029) 7.4.3. Japan 7.4.3.1. Japan Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 7.4.3.2. Japan Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 7.4.3.3. Japan Gesture Recognition Market Size and Forecast, by End User(2022-2029) 7.4.4. India 7.4.4.1. India Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 7.4.4.2. India Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 7.4.4.3. India Gesture Recognition Market Size and Forecast, by End User(2022-2029) 7.4.5. Australia 7.4.5.1. Australia Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 7.4.5.2. Australia Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 7.4.5.3. Australia Gesture Recognition Market Size and Forecast, by End User(2022-2029) 7.4.6. Indonesia 7.4.6.1. Indonesia Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 7.4.6.2. Indonesia Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 7.4.6.3. Indonesia Gesture Recognition Market Size and Forecast, by End User(2022-2029) 7.4.7. Malaysia 7.4.7.1. Malaysia Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 7.4.7.2. Malaysia Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 7.4.7.3. Malaysia Gesture Recognition Market Size and Forecast, by End User(2022-2029) 7.4.8. Vietnam 7.4.8.1. Vietnam Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 7.4.8.2. Vietnam Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 7.4.8.3. Vietnam Gesture Recognition Market Size and Forecast, by End User(2022-2029) 7.4.9. Taiwan 7.4.9.1. Taiwan Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 7.4.9.2. Taiwan Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 7.4.9.3. Taiwan Gesture Recognition Market Size and Forecast, by End User(2022-2029) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 7.4.10.2. Rest of Asia Pacific Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 7.4.10.3. Rest of Asia Pacific Gesture Recognition Market Size and Forecast, by End User(2022-2029) 8. Middle East and Africa Gesture Recognition Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029 8.1. Middle East and Africa Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 8.2. Middle East and Africa Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 8.3. Middle East and Africa Gesture Recognition Market Size and Forecast, by End User(2022-2029) 8.4. Middle East and Africa Gesture Recognition Market Size and Forecast, by Country (2022-2029) 8.4.1. South Africa 8.4.1.1. South Africa Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 8.4.1.2. South Africa Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 8.4.1.3. South Africa Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 8.4.1.4. South Africa Gesture Recognition Market Size and Forecast, by End User(2022-2029) 8.4.2. GCC 8.4.2.1. GCC Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 8.4.2.2. GCC Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 8.4.2.3. GCC Gesture Recognition Market Size and Forecast, by End User(2022-2029) 8.4.3. Nigeria 8.4.3.1. Nigeria Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 8.4.3.2. Nigeria Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 8.4.3.3. Nigeria Gesture Recognition Market Size and Forecast, by End User(2022-2029) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 8.4.4.2. Rest of ME&A Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 8.4.4.3. Rest of ME&A Gesture Recognition Market Size and Forecast, by End User(2022-2029) 9. South America Gesture Recognition Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029 9.1. South America Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 9.2. South America Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 9.3. South America Gesture Recognition Market Size and Forecast, by End User(2022-2029) 9.4. South America Gesture Recognition Market Size and Forecast, by Country (2022-2029) 9.4.1. Brazil 9.4.1.1. Brazil Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 9.4.1.2. Brazil Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 9.4.1.3. Brazil Gesture Recognition Market Size and Forecast, by End User(2022-2029) 9.4.2. Argentina 9.4.2.1. Argentina Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 9.4.2.2. Argentina Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 9.4.2.3. Argentina Gesture Recognition Market Size and Forecast, by End User(2022-2029) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Gesture Recognition Market Size and Forecast, by Authentication Type (2022-2029) 9.4.3.2. Rest Of South America Gesture Recognition Market Size and Forecast, by Touch Type (2022-2029) 9.4.3.3. Rest Of South America Gesture Recognition Market Size and Forecast, by End User(2022-2029) 10. Global Gesture Recognition Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Gesture Recognition Market Companies, by market capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Microsoft (Washington, USA 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (small, medium, and large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Intel Corporation (California, USA) 11.3. Qualcomm Incorporated (California, USA) 11.4. Leap Motion, Inc.( California, USA) 11.5. EyeSight Technologies (Herzliya, Israel) 11.6. GestureTek (Ontario, Canada) 11.7. XYZ Interactive (Ontario, Canada) 11.8. Microchip Technology Inc.( Arizona, USA) 11.9. Alphabet Inc.( California, USA) 11.10. Apple Inc.( California, USA) 11.11. Infineon Technologies AG (Germany) 11.12. Synaptics Incorporated (California, USA) 11.13. Microchip Technology Incorporated (Arizona, USA) 11.14. eyeSight Technologies Ltd (Israel) 11.15. OMRON Corporation (Japan) 11.16. Jabil Inc.( Florida) 11.17. Key Findings 12. Industry Recommendations 13. Terms and Glossary