Elevators Market was valued at USD 96.81 Bn in 2023 and is expected to reach USD 151.43 Bn by 2030, at a CAGR of 6.6 % during the forecast period.Elevators Market Overview

Elevators, also known as lifts in some regions, are vertical transportation devices used to move people or goods between different floors or levels within a building or structure. They consist of a car (or platform) that travels along vertical rails or shafts, usually enclosed within a shaft or hoistway. Elevators are powered by electric motors or hydraulic systems and are controlled by various mechanisms such as push buttons, keycard readers, or destination dispatch systems. Elevators are essential in modern buildings, especially tall structures such as skyscrapers, where stairs are impractical or insufficient for vertical transportation, which is expected to boost the Elevators Market growth. They improve accessibility, convenience, and efficiency within buildings, facilitating the movement of people, goods, and equipment between floors. Elevators are widely used in residential buildings, commercial complexes, hospitals, hotels, airports, and other public spaces to provide efficient vertical transportation and enhance overall building functionality and usability. The elevator industry is transforming with the integration of advanced technologies such as IoT (Internet of Things), AI (Artificial Intelligence), and smart sensors. These innovations were aimed at improving efficiency, safety, and user experience. Emerging markets, particularly in Asia-Pacific and Latin America, represented significant growth opportunities for elevator manufacturers. Rapid urbanization, population growth, and infrastructure development in these regions are demand for vertical transportation solutions.To know about the Research Methodology :- Request Free Sample Report

Elevators Market Dynamics

High-rise Construction to boost the Elevators Market growth The construction of tall buildings, skyscrapers, and mixed-use developments is a major driver of the elevators market. Urban planners and developers are increasingly focusing on vertical growth to optimize land use and accommodate growing populations in urban centers. Advances in technology are driving significant innovation in the elevator industry. Smart elevators equipped with IoT sensors, AI-powered predictive maintenance systems, and destination dispatching algorithms are becoming increasingly common. These technologies improve efficiency, reduce downtime, and enhance passenger experience. Energy efficiency has become a critical consideration in elevator design and operation. Manufacturers are developing eco-friendly solutions that minimize energy consumption through regenerative drives, LED lighting, and energy-efficient components. Energy-efficient elevators not only reduce operational costs but also align with sustainability goals. Stringent safety regulations and standards govern the design, installation, and operation of elevators. Compliance with codes such as EN 81, ASME A17.1, and ANSI/ASME A17.3 is essential to ensure the safety of passengers and personnel. Elevator manufacturers invest in safety features such as redundant systems, emergency brakes, and safety sensors to meet regulatory requirements, which is expected to boost the Elevators Market growth. Elevators play a crucial role in urban mobility, providing access to transportation hubs, commercial centers, and residential buildings. With the rise of smart cities and mobility-as-a-service (MaaS) concepts, there is increasing emphasis on seamless vertical transportation integration within urban infrastructure. Emerging markets, particularly in Asia-Pacific, Latin America, and the Middle East, offer significant growth opportunities for elevator manufacturers. Rapid urbanization, population growth, and infrastructure development drive demand for elevators in residential, commercial, and industrial sectors in these regions. High Initial Costs to restrain Elevators Market growth High initial cost associated with elevator installation, particularly for advanced systems with smart features and energy-efficient components limits the Elevators Market growth. The upfront investment required for elevator infrastructure, including construction, equipment, and installation, is substantial, especially for large-scale projects such as high-rise buildings. Elevator projects often have long development cycles, from initial planning and design to installation and commissioning. Delays in project timelines due to factors such as permitting issues, regulatory approvals, and construction challenges prolong the time-to-market for elevator manufacturers and developers, impacting revenue generation and profitability. Elevator projects face technical challenges related to design complexity, integration with building systems, and compatibility with existing infrastructure. Designing and engineering elevators for tall buildings, complex architectural structures, and unique environments require specialized expertise and advanced simulation tools to address factors such as load capacity, speed, and vibration control, which significantly limits the Elevators Market growth. Economic volatility, fluctuations in construction activity, and geopolitical risks impact demand for elevators and infrastructure investments. Uncertainty surrounding macroeconomic factors such as GDP growth, inflation rates, and currency exchange rates influence purchasing decisions, project financing, and investment in vertical transportation solutions.Elevators Market Segment Analysis

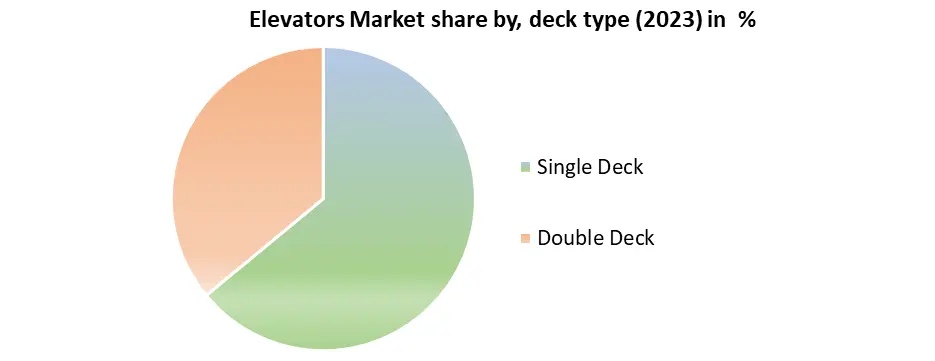

Based on type, the market is segmented into Residential elevator, Freight elevator, and Passenger elevator. The residential Elevator segment dominated the market in 2023 and is expected to hold the largest Elevators market share over the forecast period. The residential elevators segment in the elevators industry focuses specifically on elevators designed and installed in residential buildings, including single-family homes, and apartment complexes. This segment caters to homeowners who desire improved accessibility, convenience, and luxury within their homes. Residential elevators come in various designs, sizes, and configurations to complement different architectural styles and spatial requirements. They are customized to match the aesthetics and interior design of the home. Modern residential elevators are designed to be space-efficient, requiring minimal footprint and installation space within the home.Based on Deck Type, the market is segmented into Single Deck and Double Deck. Single Deck segment dominated the market in 2023 and is expected to the largest Elevators Market share over the forecast period. The single deck elevators that have a single elevator car serving one level or floor at a time. This segment represents the most common and widely used type of elevator configuration across various residential, commercial, and institutional settings. Single deck elevators are designed with a single elevator car that moves vertically within a shaft to transport passengers or goods between different levels or floors of a building. These elevators come in various designs, sizes, and configurations to accommodate different building types, traffic demands, and architectural requirements.

Elevators Market Regional Insight

Infrastructure Development to boost Asia Pacific Elevators Market growth Governments across the APAC region are investing heavily in infrastructure development projects, including transportation networks, commercial hubs, and smart cities. The construction of new airports, railway stations, and mixed-use developments requires advanced elevator systems to ensure efficient vertical mobility within these facilities. The demand for elevators in the Asia-Pacific (APAC) region has surged due to robust expansion in the building industry and increasing outputs in nations such as India, China, and South Korea. The rapid population growth, rural-to-urban migration, and industrial development in recent years have contributed to significant growth in the regional elevators market. With growing concerns about environmental sustainability, there is a growing focus on energy-efficient elevator solutions in the APAC region. Elevator manufacturers are developing eco-friendly designs incorporating regenerative drives, LED lighting, and energy management systems to reduce energy consumption and operational costs. For example, forecasts from the American Institute of Architects indicate that by 2025, China have developed approximately the equivalent of 10 cities the size of New York. This development is fueled by ongoing improvements in socioeconomic conditions in countries like China, Indonesia, and other Southeast Asian markets. The aging of the baby boomer generation is also expected to drive demand for elevators, leading to an increase in the elderly population and individuals with disabilities. In Europe, governments have recommended implementing national measures to ensure accessibility in both completed and under-construction buildings. For instance, regulations stipulate that each new building should include at least one elevator suitable for people in wheelchairs.Elevators Market Scope: Inquiry Before Buying

Elevators Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 96.81 Bn. Forecast Period 2024 to 2030 CAGR: 6.6% Market Size in 2030: US $ 151.43 Bn. Segments Covered: by Type Residential elevator Freight elevator Passenger elevator by Deck Type Single Deck Double Deck by Application Residential Commercial Industrial Elevators Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Elevators manufacturers include:

Europe: 1. KONE - Helsinki, Finland 2. Schindler - Ebikon, Switzerland 3. Thyssenkrupp - Essen, Germany 4. Garaventa - Goldau, Switzerland 5. Cibes Lift - Gävle, Sweden Asia-Pacific: 6. Hyundai Elevator - Seoul, South Korea 7. Mitsubishi Electric - Tokyo, Japan 8. Hitachi - Tokyo, Japan 9. Toshiba - Tokyo, Japan 10. KLEEMANN - Kilkis, Greece 11. AVT Beckett - Melbourne, Australia 12. Fujitec - Tokyo, Japan 13. Dazen Elevator - Suzhou, China 14. Johnson Lifts - Coimbatore, India 15. Orison Elevators - Ahmedabad, India 16. Fujitec - Tokyo, Japan North America: 17. Otis - Farmington, Connecticut, USA 18. Delta Elevator - Kitchener, Ontario, Canada 19. Adams Elevator Equipment Company - Niles, Illinois, USA 20. McKinley Elevator Corporation - Irvine, California, USA 21. True Canadian Elevator - Stoney Creek, Ontario, Canada 22. Delaware Elevator Manufacturing Product - Salisbury, Maryland, USA 23. Dover Corporation - Downers Grove, Illinois, USAFrequently asked Questions:

1. What are elevators? Ans: Elevators, also known as lifts in some regions, are vertical transportation devices used to move people or goods between different floors or levels within a building or structure. They consist of a car (or platform) that travels along vertical rails or shafts, usually enclosed within a shaft or hoistway. 2. How is the elevator industry evolving? Ans: The elevator industry is transforming with the integration of advanced technologies such as IoT (Internet of Things), AI (Artificial Intelligence), and smart sensors. These innovations aim to improve efficiency, safety, and user experience, leading to enhanced elevator systems and services. 3. What are the key drivers of the elevators market? Ans: High-rise construction, technological advancements, energy efficiency, safety regulations, urban mobility solutions, and market expansion in emerging economies are among the key drivers of the elevators market. These factors contribute to the growing demand for elevators in various residential, commercial, and industrial sectors worldwide. 4. What are the challenges faced by the elevators market? Ans: High initial costs, long development cycles, technical challenges, economic uncertainty, and regulatory compliance are some of the challenges faced by the elevators market. These factors impact the growth and profitability of elevator manufacturers and developers, requiring them to navigate complex market dynamics effectively. 5. How is the elevators market segmented? Ans: The elevators market is segmented based on type (residential, freight, passenger), deck type (single deck, double deck), and geography (region-wise). Each segment represents distinct market opportunities and dynamics within the elevator industry, catering to different customer needs and preferences across various applications and regions.

1. Elevators Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Elevators Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2023) 2.3.5. Company Locations 2.4. Elevators Market Companies, share% 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Elevators Market: Dynamics 3.1. Elevators Market Trends by Region 3.1.1. North America Elevators Market Trends 3.1.2. Europe Elevators Market Trends 3.1.3. Asia Pacific Elevators Market Trends 3.1.4. Middle East and Africa Elevators Market Trends 3.1.5. South America Elevators Market Trends 3.2. Elevators Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Elevators Market Drivers 3.2.1.2. North America Elevators Market Restraints 3.2.1.3. North America Elevators Market Opportunities 3.2.1.4. North America Elevators Market Challenges 3.2.2. Europe 3.2.2.1. Europe Elevators Market Drivers 3.2.2.2. Europe Elevators Market Restraints 3.2.2.3. Europe Elevators Market Opportunities 3.2.2.4. Europe Elevators Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Elevators Market Drivers 3.2.3.2. Asia Pacific Elevators Market Restraints 3.2.3.3. Asia Pacific Elevators Market Opportunities 3.2.3.4. Asia Pacific Elevators Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Elevators Market Drivers 3.2.4.2. Middle East and Africa Elevators Market Restraints 3.2.4.3. Middle East and Africa Elevators Market Opportunities 3.2.4.4. Middle East and Africa Elevators Market Challenges 3.2.5. South America 3.2.5.1. South America Elevators Market Drivers 3.2.5.2. South America Elevators Market Restraints 3.2.5.3. South America Elevators Market Opportunities 3.2.5.4. South America Elevators Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Elevators Industry 3.8. Analysis of Government Schemes and Initiatives For Elevators Industry 3.9. Elevators Market Trade Analysis 3.10. The Global Pandemic Impact on Elevators Market 4. Elevators Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Elevators Market Size and Forecast, By Type (2023-2030) 4.1.1. Residential elevator 4.1.2. Freight elevator 4.1.3. Passenger elevator 4.2. Elevators Market Size and Forecast, By Deck Type (2023-2030) 4.2.1. Single Deck 4.2.2. Double Deck 4.3. Elevators Market Size and Forecast, By Application (2023-2030) 4.3.1. Residential 4.3.2. Commercial 4.3.3. Industrial 4.4. Elevators Market Size and Forecast, by Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Elevators Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Elevators Market Size and Forecast, By Type (2023-2030) 5.1.1. Residential elevator 5.1.2. Freight elevator 5.1.3. Passenger elevator 5.2. North America Elevators Market Size and Forecast, By Deck Type (2023-2030) 5.2.1. Single Deck 5.2.2. Double Deck 5.3. North America Elevators Market Size and Forecast, By Application (2023-2030) 5.3.1.1. Residential 5.3.1.2. Commercial 5.3.1.3. Industrial 5.4. North America Elevators Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Elevators Market Size and Forecast, By Type (2023-2030) 5.4.1.1.1. Residential elevator 5.4.1.1.2. Freight elevator 5.4.1.1.3. Passenger elevator 5.4.1.2. United States Elevators Market Size and Forecast, By Deck Type (2023-2030) 5.4.1.2.1. Single Deck 5.4.1.2.2. Double Deck 5.4.1.3. United States Elevators Market Size and Forecast, By Application (2023-2030) 5.4.1.3.1. Online 5.4.1.3.2. Offline 5.4.1.3.2.1. Specialty Stores 5.4.1.3.2.2. Shopping Malls 5.4.1.3.2.3. Gift Shops 5.4.2. Canada 5.4.2.1. Canada Elevators Market Size and Forecast, By Type (2023-2030) 5.4.2.1.1. Residential elevator 5.4.2.1.2. Freight elevator 5.4.2.1.3. Passenger elevator 5.4.2.2. Canada Elevators Market Size and Forecast, By Deck Type (2023-2030) 5.4.2.2.1. Single Deck 5.4.2.2.2. Double Deck 5.4.2.3. Canada Elevators Market Size and Forecast, By Application (2023-2030) 5.4.2.3.1.1. Residential 5.4.2.3.1.2. Commercial 5.4.2.3.1.3. Industrial 5.4.3. Mexico 5.4.3.1. Mexico Elevators Market Size and Forecast, By Type (2023-2030) 5.4.3.1.1. Residential elevator 5.4.3.1.2. Freight elevator 5.4.3.1.3. Passenger elevator 5.4.3.2. Mexico Elevators Market Size and Forecast, By Deck Type (2023-2030) 5.4.3.2.1. Single Deck 5.4.3.2.2. Double Deck 5.4.3.3. Mexico Elevators Market Size and Forecast, By Application (2023-2030) 5.4.3.3.1.1. Residential 5.4.3.3.1.2. Commercial 5.4.3.3.1.3. Industrial 6. Europe Elevators Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Elevators Market Size and Forecast, By Type (2023-2030) 6.2. Europe Elevators Market Size and Forecast, By Deck Type (2023-2030) 6.3. Europe Elevators Market Size and Forecast, By Application (2023-2030) 6.4. Europe Elevators Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Elevators Market Size and Forecast, By Type (2023-2030) 6.4.1.2. United Kingdom Elevators Market Size and Forecast, By Deck Type (2023-2030) 6.4.1.3. United Kingdom Elevators Market Size and Forecast, By Application(2023-2030) 6.4.2. France 6.4.2.1. France Elevators Market Size and Forecast, By Type (2023-2030) 6.4.2.2. France Elevators Market Size and Forecast, By Deck Type (2023-2030) 6.4.2.3. France Elevators Market Size and Forecast, By Application(2023-2030) 6.4.3. Germany 6.4.3.1. Germany Elevators Market Size and Forecast, By Type (2023-2030) 6.4.3.2. Germany Elevators Market Size and Forecast, By Deck Type (2023-2030) 6.4.3.3. Germany Elevators Market Size and Forecast, By Application (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Elevators Market Size and Forecast, By Type (2023-2030) 6.4.4.2. Italy Elevators Market Size and Forecast, By Deck Type (2023-2030) 6.4.4.3. Italy Elevators Market Size and Forecast, By Application(2023-2030) 6.4.5. Spain 6.4.5.1. Spain Elevators Market Size and Forecast, By Type (2023-2030) 6.4.5.2. Spain Elevators Market Size and Forecast, By Deck Type (2023-2030) 6.4.5.3. Spain Elevators Market Size and Forecast, By Application (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Elevators Market Size and Forecast, By Type (2023-2030) 6.4.6.2. Sweden Elevators Market Size and Forecast, By Deck Type (2023-2030) 6.4.6.3. Sweden Elevators Market Size and Forecast, By Application (2023-2030) 6.4.7. Austria 6.4.7.1. Austria Elevators Market Size and Forecast, By Type (2023-2030) 6.4.7.2. Austria Elevators Market Size and Forecast, By Deck Type (2023-2030) 6.4.7.3. Austria Elevators Market Size and Forecast, By Application (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Elevators Market Size and Forecast, By Type (2023-2030) 6.4.8.2. Rest of Europe Elevators Market Size and Forecast, By Deck Type (2023-2030) 6.4.8.3. Rest of Europe Elevators Market Size and Forecast, By Application (2023-2030) 7. Asia Pacific Elevators Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Elevators Market Size and Forecast, By Type (2023-2030) 7.2. Asia Pacific Elevators Market Size and Forecast, By Deck Type (2023-2030) 7.3. Asia Pacific Elevators Market Size and Forecast, By Application (2023-2030) 7.4. Asia Pacific Elevators Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Elevators Market Size and Forecast, By Type (2023-2030) 7.4.1.2. China Elevators Market Size and Forecast, By Deck Type (2023-2030) 7.4.1.3. China Elevators Market Size and Forecast, By Application (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Elevators Market Size and Forecast, By Type (2023-2030) 7.4.2.2. S Korea Elevators Market Size and Forecast, By Deck Type (2023-2030) 7.4.2.3. S Korea Elevators Market Size and Forecast, By Application (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Elevators Market Size and Forecast, By Type (2023-2030) 7.4.3.2. Japan Elevators Market Size and Forecast, By Deck Type (2023-2030) 7.4.3.3. Japan Elevators Market Size and Forecast, By Application (2023-2030) 7.4.4. India 7.4.4.1. India Elevators Market Size and Forecast, By Type (2023-2030) 7.4.4.2. India Elevators Market Size and Forecast, By Deck Type (2023-2030) 7.4.4.3. India Elevators Market Size and Forecast, By Application (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Elevators Market Size and Forecast, By Type (2023-2030) 7.4.5.2. Australia Elevators Market Size and Forecast, By Deck Type (2023-2030) 7.4.5.3. Australia Elevators Market Size and Forecast, By Application (2023-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Elevators Market Size and Forecast, By Type (2023-2030) 7.4.6.2. Indonesia Elevators Market Size and Forecast, By Deck Type (2023-2030) 7.4.6.3. Indonesia Elevators Market Size and Forecast, By Application (2023-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Elevators Market Size and Forecast, By Type (2023-2030) 7.4.7.2. Malaysia Elevators Market Size and Forecast, By Deck Type (2023-2030) 7.4.7.3. Malaysia Elevators Market Size and Forecast, By Application (2023-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Elevators Market Size and Forecast, By Type (2023-2030) 7.4.8.2. Vietnam Elevators Market Size and Forecast, By Deck Type (2023-2030) 7.4.8.3. Vietnam Elevators Market Size and Forecast, By Application(2023-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Elevators Market Size and Forecast, By Type (2023-2030) 7.4.9.2. Taiwan Elevators Market Size and Forecast, By Deck Type (2023-2030) 7.4.9.3. Taiwan Elevators Market Size and Forecast, By Application (2023-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Elevators Market Size and Forecast, By Type (2023-2030) 7.4.10.2. Rest of Asia Pacific Elevators Market Size and Forecast, By Deck Type (2023-2030) 7.4.10.3. Rest of Asia Pacific Elevators Market Size and Forecast, By Application (2023-2030) 8. Middle East and Africa Elevators Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Elevators Market Size and Forecast, By Type (2023-2030) 8.2. Middle East and Africa Elevators Market Size and Forecast, By Deck Type (2023-2030) 8.3. Middle East and Africa Elevators Market Size and Forecast, By Application (2023-2030) 8.4. Middle East and Africa Elevators Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Elevators Market Size and Forecast, By Type (2023-2030) 8.4.1.2. South Africa Elevators Market Size and Forecast, By Deck Type (2023-2030) 8.4.1.3. South Africa Elevators Market Size and Forecast, By Application (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Elevators Market Size and Forecast, By Type (2023-2030) 8.4.2.2. GCC Elevators Market Size and Forecast, By Deck Type (2023-2030) 8.4.2.3. GCC Elevators Market Size and Forecast, By Application (2023-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Elevators Market Size and Forecast, By Type (2023-2030) 8.4.3.2. Nigeria Elevators Market Size and Forecast, By Deck Type (2023-2030) 8.4.3.3. Nigeria Elevators Market Size and Forecast, By Application (2023-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Elevators Market Size and Forecast, By Type (2023-2030) 8.4.4.2. Rest of ME&A Elevators Market Size and Forecast, By Deck Type (2023-2030) 8.4.4.3. Rest of ME&A Elevators Market Size and Forecast, By Application (2023-2030) 9. South America Elevators Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. South America Elevators Market Size and Forecast, By Type (2023-2030) 9.2. South America Elevators Market Size and Forecast, By Deck Type (2023-2030) 9.3. South America Elevators Market Size and Forecast, By Application(2023-2030) 9.4. South America Elevators Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Elevators Market Size and Forecast, By Type (2023-2030) 9.4.1.2. Brazil Elevators Market Size and Forecast, By Deck Type (2023-2030) 9.4.1.3. Brazil Elevators Market Size and Forecast, By Application (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Elevators Market Size and Forecast, By Type (2023-2030) 9.4.2.2. Argentina Elevators Market Size and Forecast, By Deck Type (2023-2030) 9.4.2.3. Argentina Elevators Market Size and Forecast, By Application (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Elevators Market Size and Forecast, By Type (2023-2030) 9.4.3.2. Rest Of South America Elevators Market Size and Forecast, By Deck Type (2023-2030) 9.4.3.3. Rest Of South America Elevators Market Size and Forecast, By Application (2023-2030) 10. Company Profile: Key Players 10.1. KONE - Helsinki, Finland 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Schindler - Ebikon, Switzerland 10.3. Thyssenkrupp - Essen, Germany 10.4. Garaventa - Goldau, Switzerland 10.5. Cibes Lift - Gävle, Sweden 10.6. Hyundai Elevator - Seoul, South Korea 10.7. Mitsubishi Electric - Tokyo, Japan 10.8. Hitachi - Tokyo, Japan 10.9. Toshiba - Tokyo, Japan 10.10. KLEEMANN - Kilkis, Greece 10.11. AVT Beckett - Melbourne, Australia 10.12. Fujitec - Tokyo, Japan 10.13. Dazen Elevator - Suzhou, China 10.14. Johnson Lifts - Coimbatore, India 10.15. Orison Elevators - Ahmedabad, India 10.16. Fujitec - Tokyo, Japan 10.17. Otis - Farmington, Connecticut, USA 10.18. Delta Elevator - Kitchener, Ontario, Canada 10.19. Adams Elevator Equipment Company - Niles, Illinois, USA 10.20. McKinley Elevator Corporation - Irvine, California, USA 10.21. True Canadian Elevator - Stoney Creek, Ontario, Canada 10.22. Delaware Elevator Manufacturing Product - Salisbury, Maryland, USA 10.23. Dover Corporation - Downers Grove, Illinois, USA 11. Key Findings 12. Analyst Recommendations 13. Elevators Market: Research Methodology