Contactless Payment Market size was valued at US$ 1641.6 Billion in 2022 and the total Contactless Payment revenue is expected to grow at 20% through 2022 to 2029, reaching nearly US$ 5882 Billion.Contactless Payment Market Overview:

Contactless payment system examples are credit and debit cards, websites, or other examples including smartphones and other mobile apps, that employ radio-frequency identification or near field communication methods e.g. Ali pay, Apple Pay, Google Pay, or any other bank mobile app that enables the contactless system to ensure secure online payments. Nearly more than three-quarters of corporations and financial institutions now offer online payment systems to their consumers as customers are most likely to spend their money using apps or cards due to the ease of use factor. A report by Westpac Banking Corporation in Australia stated that contactless payment saturated their regional market by being used in over 90% of purchases.To know about the Research Methodology :- Request Free Sample Report The contactless payment market's growth reasons, as well as the market's many segments, are discussed. Data has been given by market participants, regions, and specific requirements. This market-ready study proposal includes a comprehensive overview of all the significant improvements that are presently prevailing in all market segments. Key data analysis is presented in the form of statistics, infographics, and presentations. The study discusses the contactless payment market's Drivers, Restraints, Opportunities, and Challenges. The report helps to assess the market growth drivers and determines how to use these drivers as a tool. The report also helps to rectify and resolve issues related to the contactless payment market condition.

Contactless Payment Market Dynamics:

The major driver in the global contactless payment market is the growing endorsement of near communication payment methods by corporations and retailers around the globe. The NFC technology is equipped with short-distance communication between different electronic gadgets. The NFC solutions ensure fast transactions, customer satisfaction, and secure payment facilities. Furthermore, the development of various technologies like biometric smart cards is expected to be the key driver of the global contactless payment methods in the forecast period (2023-2029). A major restraint in the global contactless payment method market is the constant threat of online fraud. Payment fraud is already a billion-dollar industry and it is increasing day by day. Online sellers are projected to lose over US$200 billion in the aforementioned forecast period and it costs global corporations over 2% of their total revenue. These factors are projected to hamper the overall market growth in the same forecast period. A key opportunity in the global contactless payment market is the increased government regulations and initiatives in the field of online payment security as well as their increased spending in the advancements of NFC-based payment systems. In 2022, the Department of Justice and the FBI completed their fourth annual Money Mule Initiative which was targeted at networks of individuals through which global level fraudsters use as an intermediary for their illicit money transfers.Contactless Payment Market Segment Analysis:

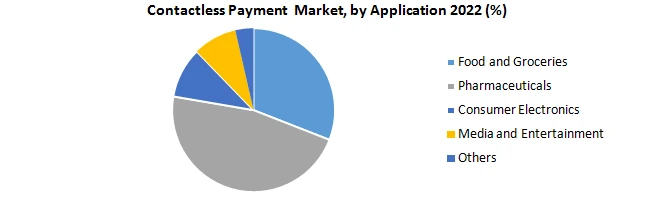

By Type, the smartphones and Wearables segment dominated the global market in the year 2022. This segment is projected to witness the highest CAGR of 9.5% in the forecast period (2023-2029). This is due to the emergence of many NFC-based mobile payment apps like Paytm and Ali Pay in developing countries like India and China. The restraining factor in the growth factor of this segment is the rise of online scams in these countries. The smart card segment is projected to witness a significant CAGR of 7.8% in the same forecast period. This can be attributed to the hassle-free nature of debit or credit card payments. Also, credit cards are the most common form of payment in online E-Commerce transactions. However smart cards are susceptible to identity theft among their users. The Federal Trade Commission reported of over 70% increase in identity theft cases in 2022 alone. The point of Sale terminal is projected to witness moderate growth in the forecast period (2023-2029). Companies are adopting rapidly to Point of Sale methods for their transactions. The retail industry is one of the primary users of POS terminals. This is the key driver for the growth of this segment in the same forecast period. By Application, the Food and Groceries segment dominated the global market in the year 2022. This segment is projected to witness the highest growth in the forecast period (2023-2029) with 8.7% of the CAGR. Online food Ordering companies like Swiggy and Zomato also have online payment facilities in their apps like G-pay or Amazon Pay. Therefore these companies indirectly drive the growth of the contactless payment systems market around the globe. The pharmaceuticals segment is expected to follow the Food and Groceries segment in terms of growth in the same forecast period. This can be attributed to the substantial growth in the number of patients in the COVID-19 pandemic in the years 2022 and 2022. This trend is expected to continue due to the emergence of new variants around the world. The media and entertainment segment is projected to witness a CAGR of 7.5% in the forecast period. This is due to the rise in the consumers of online OTT content in the lockdowns that followed the pandemic in 2022. Furthermore, online media platforms like Hulu and Netflix also contain in-built online payment features on their platforms like a card or NFC-based payments which result in the growth of all sorts of contactless payments.

Contactless Payment Market Regional Insights:

The APAC region dominated the global market in terms of shares in the year 2022. This can be attributed to China's most popular payment apps Alipay and Wechat despite being only popular in their home country, managed to leave a significant impact on the global market because of the higher population of the country. Another reason behind this high growth is the higher adoption rates of mobile payments apps in this region. The adoption rate of China in 2022 was 87%. South Korea stood at second place with 45% followed by the US, Denmark, and India with 43%, 40%, and 40% respectively. The United States contactless payments market was dominated by Apple Pay in the year 2022 with 43% of the country’s total shares. Even though Google Pay was thought to acquire the second position in the regional market. It was not the case. The second position was held by Starbuck instead with 31% of total shares in the same year. This implies the prominence of Starbucks in the contactless payment market in the country even though it is not primarily an online transaction service. The objective of the report is to present a comprehensive analysis of the Contactless Payment market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analysed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Contactless Payment market dynamics, structure by analyzing the market segments and project the Contactless Payment market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Contactless Payment market make the report investor’s guide.Contactless Payment Market Scope: Inquire before buying

Global Contactless Payment Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 1641.6 Billion. Forecast Period 2023 to 2029 CAGR: 20 % Market Size in 2029: US $ 5882 Billion. Segments Covered: by Type Smartphones and Wearables Smart Cards Point-of-sale (POS) Terminals by Application Food and Groceries Pharmaceuticals Consumer Electronics Media and Entertainment Others by Industry BFSI Retail IT & Telecom Transportation Hospitality Government Others by Payment Mode Mobile Handsets Smart Cards Point of Sale Terminals NFC Chips Smart Watches Others Contactless Payment Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Contactless Payment Market Key Players

1. Mobeewave 2. Alcineo 3. Castles 4. SumUp 5. PayCore 6. PVERIMATRIX 7. PGoogle 8. PAmazon 9. PApple Inc. 10.PHeartland Payment Systems,Inc. 11.Gemalto 12.Infineon 13.Ingenico 14.Wirecard 15.Verifone 16.Giesecke+Devrient 17.IDEMIA 18.On Track Innovations 19.Identiv 20.CPI Card Group 21.Bitel 22.Setomatic Systems 23.Valitor 24.PAX Global Technology 25.MYPINPADFAQs:

1. Which is the potential market for Contactless Payment in terms of the region? Ans. The APAC region dominated the global market in terms of shares in the year 2022. 2. What are the opportunities for new market entrants? Ans. A key opportunity in the global contactless payment market is the increased government regulations and initiatives 3. What is expected to drive the growth of the Contactless Payment market in the forecast period (2023-2029)? Ans. The major driver in the global contactless payment market is the growing endorsement of near communication payment methods by corporations and retailers around the globe. 4. What is the projected market size & growth rate of the Contactless Payment Market? Ans. Contactless Payment Market size was valued at US$ 1641.6 Billion in 2022 and the total Contactless Payment revenue is expected to grow at 20% through 2022 to 2029, reaching nearly US$ 5882 Billion. 5. What segments are covered in the Contactless Payment Market report? Ans. The segments covered are Type, Application and Region.

1. Global Contactless Payment Market: Research Methodology 2. Global Contactless Payment Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Contactless Payment Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Contactless Payment Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Contactless Payment Market Segmentation 4.1 Global Contactless Payment Market, by Type (2022-2029) • Smartphones and Wearables • Smart Cards • Point-of-sale (POS) Terminals 4.2 Global Contactless Payment Market, by Application (2022-2029) • Food and Groceries • Pharmaceuticals • Consumer Electronics • Media and Entertainment • Others 4.3 Global Contactless Payment Market, by Industry (2022-2029) • BFSI • Retail • IT & Telecom • Transportation • Hospitality • Government • Others 4.4 Global Contactless Payment Market, by Payment Mode (2022-2029) • Mobile Handsets • Smart Cards • Point of Sale Terminals • NFC Chips • Smart Watches • Others 5. North America Contactless Payment Market(2022-2029) 5.1 North America Contactless Payment Market, by Type (2022-2029) • Smartphones and Wearables • Smart Cards • Point-of-sale (POS) Terminals 5.2 North America Contactless Payment Market, by Application (2022-2029) • Food and Groceries • Pharmaceuticals • Consumer Electronics • Media and Entertainment • Others 5.3 North America Contactless Payment Market, by Industry (2022-2029) • BFSI • Retail • IT & Telecom • Transportation • Hospitality • Government • Others 5.4 North America Contactless Payment Market, by Payment Mode (2022-2029) • Mobile Handsets • Smart Cards • Point of Sale Terminals • NFC Chips • Smart Watches • Others 5.5 North America Contactless Payment Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Contactless Payment Market (2022-2029) 6.1. European Contactless Payment Market, by Type (2022-2029) 6.2. European Contactless Payment Market, by Application (2022-2029) 6.3. European Contactless Payment Market, by Industry (2022-2029) 6.4. European Contactless Payment Market, by Payment Mode (2022-2029) 6.5. European Contactless Payment Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Contactless Payment Market (2022-2029) 7.1. Asia Pacific Contactless Payment Market, by Type (2022-2029) 7.2. Asia Pacific Contactless Payment Market, by Application (2022-2029) 7.3. Asia Pacific Contactless Payment Market, by Industry (2022-2029) 7.4. Asia Pacific Contactless Payment Market, by Payment Mode (2022-2029) 7.5. Asia Pacific Contactless Payment Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Contactless Payment Market (2022-2029) 8.1 Middle East and Africa Contactless Payment Market, by Type (2022-2029) 8.2. Middle East and Africa Contactless Payment Market, by Application (2022-2029) 8.3. Middle East and Africa Contactless Payment Market, by Industry (2022-2029) 8.4. Middle East and Africa Contactless Payment Market, by Payment Mode (2022-2029) 8.5. Middle East and Africa Contactless Payment Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Contactless Payment Market (2022-2029) 9.1. South America Contactless Payment Market, by Type (2022-2029) 9.2. South America Contactless Payment Market, by Application (2022-2029) 9.3. South America Contactless Payment Market, by Industry (2022-2029) 9.4. South America Contactless Payment Market, by Payment Mode (2022-2029) 9.5. South America Contactless Payment Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Mobeewave 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Alcineo 10.3 Castles 10.4 SumUp 10.5 PayCore 10.6 PVERIMATRIX 10.7 PGoogle 10.8 PAmazon 10.9 PApple Inc. 10.10 PHeartland Payment Systems,Inc. 10.11 Gemalto 10.12 Infineon 10.13 Ingenico 10.14 Wirecard 10.15 Verifone 10.16 Giesecke+Devrient 10.17 IDEMIA 10.18 On Track Innovations 10.19 Identiv 10.20 CPI Card Group 10.21 Bitel 10.22 Setomatic Systems 10.23 Valitor 10.24 PAX Global Technology 10.25 MYPINPAD