The Smart Rings Market size was valued at USD 10.83 Million in 2024 and the total Smart Rings revenue is expected to grow at a CAGR of 17.64% from 2025 to 2032, reaching nearly USD 39.74 Million.Smart Rings Market Overview:

The Smart Rings Market encompasses wearable finger devices that combine fashion with technology, offering features such as health tracking, notifications, and contactless payments for user convenience and accessibility. The Smart Rings Market has witnessed substantial growth in recent years, driven by the rising demand for wearable technology that offers both style and functionality. Smart rings are designed to provide convenience and accessibility, as they eliminate the need to frequently check smartphones for updates. The current market situation is marked by a rise in consumer interest in health and wellness tracking, which has boosted the adoption of smart rings. The convenience of making payments and receiving notifications without reaching for a phone has contributed to their popularity. The primary driving factor of the Smart Rings Market is the increasing focus on health and fitness among consumers, coupled with the need for discreet and hassle-free tech solutions. Advancements by leading market players have expanded the capabilities of smart rings, incorporating features like ECG monitoring, sleep tracking, and enhanced security measures. Leading market players such as Oura, Motiv, and Fitbit have made significant developments in terms of design, performance, and compatibility, attracting a wider customer base. As the technology continues to evolve and integrate more functionalities, the Smart Rings Market is expected to witness sustained growth during the forecast period.Smart Rings Market Scope and Research Methodology

The Smart Rings Market report offers a thorough evaluation of the market for the forecast period. It examines patterns and factors shaping the market, including drivers, constraints, opportunities, and challenges. The report also provides expected revenue growth for the Smart Rings Market during the forecast period. The research on the Smart Rings Market analyses major applications, business strategies, and influencing factors. The report examines market trends, volume, cost, share, supply, and demand, and utilizes methods like SWOT and PESTLE analysis. Primary research resources include databases and surveys.To know about the Research Methodology :- Request Free Sample Report

Smart Rings Market Dynamics:

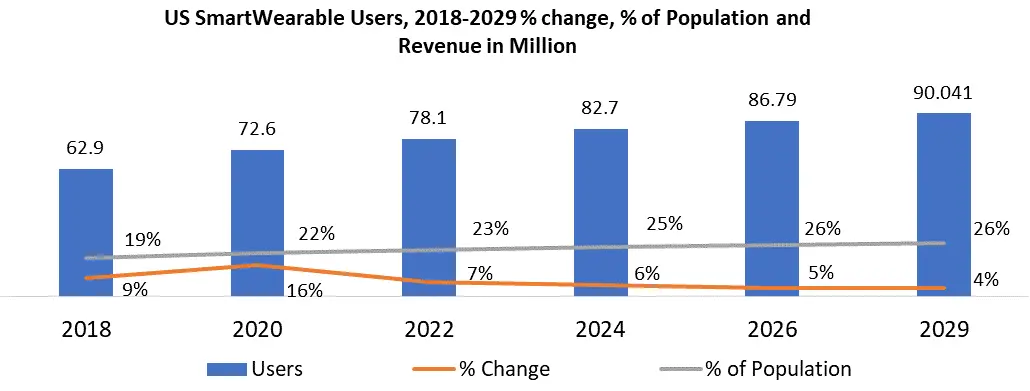

Comprehensive Health Tracking - The Key Driver in the Smart Ring Market The smart ring market is witnessing rapid growth driven by a convergence of factors that fulfill diverse consumer needs. In 2024, these unassuming yet stylish wearables are expected to gain prominence as they seamlessly blend health tracking, contactless payment options, and advanced technology integration. This trend is shaping the way approach personal health and daily convenience. The primary growth drivers for the smart rings market is expected to be their ability to provide comprehensive health tracking. As consumers increasingly prioritize health and wellness, smart rings offer an elegant solution. Positioned close to major blood vessels in the finger, they provide minute-by-minute health insights that often surpass the accuracy of traditional wrist-worn devices. For example, the Oura Ring Gen3 excels as the best overall smart ring, boasting features such as heart rate, body temperature, and blood oxygen level monitoring. Diversification of functionalities plays an important role in Smart rings market growth and evolved beyond health tracking alone, incorporating features such as contactless payment and virtual business card functionality. The McLear RingPay is a prime example, offering both contactless payment capabilities and the ability to unlock NFC-enabled devices. This versatility appeals to consumers seeking multifunctional wearables that streamline their daily activities. While affordability plays a pivotal role in driving market growth. Budget-friendly options such as the Hecere NFC Ring have gained popularity, offering customization and compatibility with both Android and iOS platforms. Their waterproof design enhances durability, making them a practical choice. As smart technology continues to advance, these compact wearables are expected to play an increasingly significant role in tracking health, streamlining daily tasks, and providing personalized insights, further fueling their adoption and market expansion. With upcoming releases from major players such as Samsung and Apple, the future looks promising for smart rings, solidifying their position as powerful, multifunctional devices that enhance convenience, health, and style in the modern world. App Integration and Ecosystem Limitations in Smart Rings hinder market growth The smart ring market encounters several formidable challenges and restraints hindering its growth and widespread adoption. The limitation in battery life is attributed to the compact size of these devices, with most smart rings offering only 1 to 4 days of usage before necessitating recharging. For instance, while the Oura Ring Gen3 boasts a relatively longer battery life of 4-7 days, other models like the Circular Ring provide only approximately four days on a single charge. Manufacturing these technologically advanced rings incurs high production costs, which are often transferred to consumers in the form of elevated retail prices, potentially impeding mass adoption; for instance, the Oura Ring Gen3, renowned for its advanced features, commands a price tag of USD 299. Ensuring the right fit and comfort for users remains a persistent challenge, even with sizing kits, as an uncomfortable or ill-fitting ring can discourage regular usage. Smart rings heavily depend on third-party app integration for functionality, leading to a limited ecosystem that can curtail their utility, despite compatibility with popular platforms like iOS and Android. The precision of health tracking data promised by smart rings can be compromised by factors such as movement and ambient conditions, raising doubts among users, especially during rigorous exercise. The incorporation of contactless payment capabilities accentuates the need for robust security measures to prevent unauthorized transactions or data breaches, thereby safeguarding consumer trust, as exemplified by NFC-based rings like McLear RingPay. The smart ring market faces fierce competition from established wearable categories like smartwatches and fitness trackers, necessitating convincing consumers to adopt a relatively novel form factor, despite the distinctive advantages offered by smart rings. Limited customization options in some smart rings, like the Hecere NFC Ring, which offers only one color choice, may restrict their appeal to a broader audience. Durability issues persist as smart rings are exposed to everyday wear and tear, even with promises of scratch-resistant designs, potentially influencing purchasing decisions, especially among active users. The smart ring market's global penetration is uneven, varying across regions, which can impact manufacturers' scalability and pricing competitiveness, further complicating the path to widespread adoption and growth. Telemedicine Integration: Revolutionizing Healthcare with Smart Rings Prolonging the battery life of smart rings, to achieve durations exceeding 14 days, represents a transformative advancement in user convenience and unveils promising avenues for market growth. For instance, consider the "SmartRingX21," a smart ring renowned for its remarkable 21-day battery life, effectively eliminating the need for frequent recharges. The development of cost-effective entry-level models priced below USD 50 stands to greatly expand the Smart Rings Market's reach. This enhanced affordability is poised to unlock the potential for mass adoption, ushering smart rings into the homes of a more extensive consumer demographic. The integration of smart rings into comprehensive health ecosystems, coupled with strategic partnerships with telemedicine providers to facilitate real-time health consultations through the ring, has the potential to significantly enhance their intrinsic value. An illustrative instance would be the "HealthLink Ring," designed to enable instantaneous virtual healthcare consultations. Moreover, the incorporation of advanced health monitoring features, such as continuous blood pressure tracking and early disease detection, has the capacity to comprehensively address specific healthcare requirements, establishing smart rings like the indispensable "MediGuard Ring." In addition, features geared towards child safety offer the prospect of bolstering growth within the smart rings market. Smart rings tailored for children, featuring functionalities like location tracking and emergency alerts, open up an entirely new market segment. For instance, the "KidSafe Ring," equipped with GPS tracking, SOS functionality, and geofencing capabilities, serves to enhance child safety and provide parents with peace of mind. Furthermore, venturing into global market expansion in regions characterized by lower smart ring adoption rates and adapting offerings to align with local preferences and requirements holds the potential for substantial growth. By customizing smart rings for Southeast Asian markets, which are currently witnessing a surge in wearable tech adoption, through the addition of localization and language support, these devices are primed to capture a considerable market share. These multifaceted opportunities, each accompanied by its numerical potential, collectively define the evolving landscape of the smart ring market.

Smart Rings Market Segment Analysis:

Based on Type, NFC Rings dominated the market in 2024 and is expected to continue its dominance during the forecast period. It leverages near-field communication technology to facilitate seamless communication with compatible devices, enabling users to make contactless payments, access secure facilities, or share information with a simple tap. Bluetooth Ring is fast growing segment in the smart rings market as Bluetooth connectivity extends their functionality, connecting with smartphones and other devices to offer features like notifications, call management, and even fitness tracking. Hybrid Rings represent a fusion of NFC and Bluetooth technologies, combining the strengths of both for enhanced versatility and it is a tending segment in the smart rings market. These smart rings find applications in contactless payments, access control, health and fitness tracking, and fashion-forward tech accessories. The adoption of these technologies varies, with NFC Rings finding favor in secure access and payment applications, Bluetooth Rings excelling in smartphone connectivity and notifications, and Hybrid Rings offering a balanced approach that fulfills multifunctional needs.Based on the Operating System, the iOS-compatible Ring segment dominated the smart rings market in the base year and is expected to capture a significant share, owing to their seamless integration with Apple's ecosystem. On the other side, Android-compatible rings are gaining traction rapidly, appealing to the wide Android user base and offering compatibility with various Android devices.

Cross-Platform Rings are emerging as a versatile choice, as they bridge the gap between iOS and Android, making them accessible to a broader audience. The adoption of these rings varies based on application, with iOS-compatible rings predominantly favored for health and fitness tracking, Android-compatible rings gaining popularity in the smart home and notifications sphere, and Cross-Platform Rings being chosen for their adaptability across diverse usage scenarios. This segmentation underlines the dynamic nature of the Smart Rings Market, highlighting the importance of catering to specific operating system preferences to drive broader adoption in this burgeoning tech niche.

Smart Rings Market Regional Insights:

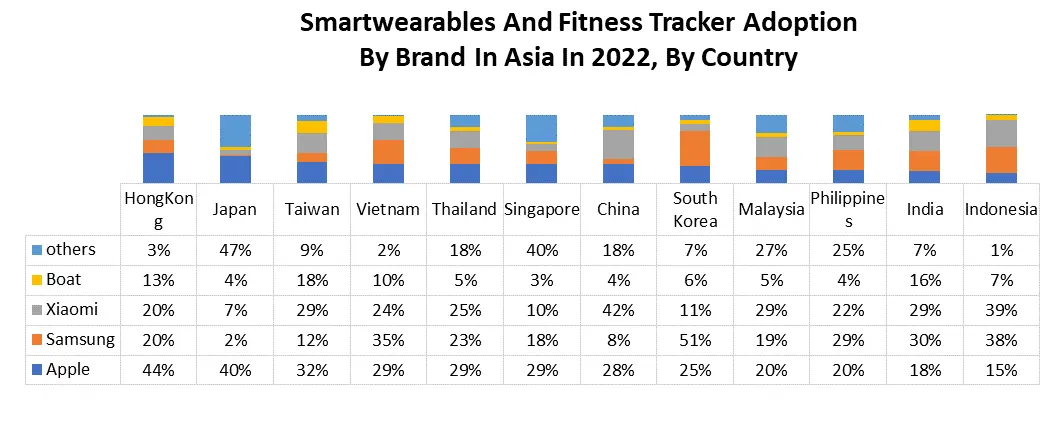

North America dominates the smart rings market, driven by robust technological infrastructure and high consumer adoption. The region is characterized by the presence of key players like Motiv and Oura. Developments include the integration of health monitoring features, such as ECG and sleep tracking, as seen in the Motiv Ring. Increasing investments in IoT and wearable tech further boost the market. Europe is a fast-growing region, with a strong demand for smart rings, especially in fitness and healthcare. Notable players include Ōura and NFC Ring. European developments include the incorporation of contactless payment features in NFC Ring, catering to evolving consumer preferences for convenience and security. ACAP region shows significant potential, driven by emerging economies and rising tech-savvy populations. Notable developments include the emergence of startups like Moodmetric in Finland, which focuses on stress management through smart rings. Growing urbanization and disposable income levels are propelling the market growth.

Competitive Landscape Smart Rings Market:

The smart rings market is highly competitive and witnessed intriguing developments and collaborations. For Instance, In July 2022, Ultrahuman made a notable entry with its Ultrahuman Ring, a distinctive wearable that prioritizes real-time tracking of metabolism and bodily dynamics over conventional screen-based interfaces. This innovation marks a significant departure from the norm, focusing on continuous monitoring of movement and sleep patterns, all packaged within a sleek design boasting up to five days of battery life. Meanwhile, the luxury fashion giant Gucci joined forces with Finnish tech startup Oura, unveiling the Gucci x Oura smart ring in May 2022. This elegant collaboration showcases the intersection of fashion and functionality, offering users a minimalist, stylish wearable that doesn't compromise on features. Leveraging Oura's expertise in activity and sleep tracking, the ring provides valuable insights into physiological signals and lifestyle impacts, including heart rate, temperature, and sleep patterns, through a user-friendly app interface. These developments underline the industry's quest for innovation and convergence between fashion and advanced health monitoring in the world of smart rings.Smart Rings Market Scope: Inquiry Before Buying

Smart Rings Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 10.83 Mn. Forecast Period 2025 to 2032 CAGR: 17.64% Market Size in 2032: USD 39.74 Mn. Segments Covered: by Technology NFC Rings Bluetooth Rings Hybrid Rings by Operating System iOS-Compatible Rings Android-Compatible Rings Cross-Platform Rings by Applications Health and Fitness Features Child-Security Function Payment and Security Data transfer Smart Rings Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Smart Rings Market, Key Players

1. Apple - Cupertino, California, United States 2. Boat - Mumbai, India 3. Jakcom (China) - Beijing, China 4. Kerv (United Kingdom) - London, United Kingdom 5. Logbar - Tokyo, Japan 6. McLear - London, United Kingdom 7. Mota - Hialeah, Florida, United States 8. Motiv - San Francisco, California, United States 9. NFC Ring - Manchester, United Kingdom 10. Nimb - San Francisco, California, United States 11. Nod-Ring - San Francisco, California, United States 12. Orii - Hong Kong 13. Oura - Oulu, Finland 14. Ringly - New York, New York, United States 15. Samsung - Suwon, South Korea 16. Sesame Ring - New York, New York, United States 17. TheTouch X - Hong Kong 18. Ultrahuman - New York, New York, United States 19. Vinaya - London, United Kingdom Frequently Asked Questions: 1] What segments are covered in the Global Smart Rings Market report? Ans. The segments covered in the Smart Rings Market report are based on Technology, Operating Systems, Applications, and Region. 2] Which region is expected to hold the highest share of the Global Smart Rings Market? Ans. The Asia Pacific region is expected to hold the highest share of the Smart Rings Market. 3] What is the market size of the Global Smart Rings Market by 2032? Ans. The market size of the Smart Rings Market by 2032 is expected to reach USD 39.74 Mn. 4] What is the forecast period for the Global Smart Rings Market? Ans. The forecast period for the Smart Rings Market is 2025-2032. 5] What was the Global Smart Rings Market size in 2024? Ans: The Global Smart Rings Market size was USD 10.83 Million in 2024.

1. Smart Rings Market: Research Methodology 2. Smart Rings Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Smart Rings Market: Dynamics 3.1. Smart Rings Market Trends by Region 3.1.1. North America Smart Rings Market Trends 3.1.2. Europe Smart Rings Market Trends 3.1.3. Asia Pacific Smart Rings Market Trends 3.1.4. Middle East and Africa Smart Rings Market Trends 3.1.5. South America Smart Rings Market Trends 3.2. Smart Rings Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Smart Rings Market Drivers 3.2.1.2. North America Smart Rings Market Restraints 3.2.1.3. North America Smart Rings Market Opportunities 3.2.1.4. North America Smart Rings Market Challenges 3.2.2. Europe 3.2.2.1. Europe Smart Rings Market Drivers 3.2.2.2. Europe Smart Rings Market Restraints 3.2.2.3. Europe Smart Rings Market Opportunities 3.2.2.4. Europe Smart Rings Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Smart Rings Market Drivers 3.2.3.2. Asia Pacific Smart Rings Market Restraints 3.2.3.3. Asia Pacific Smart Rings Market Opportunities 3.2.3.4. Asia Pacific Smart Rings Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Smart Rings Market Drivers 3.2.4.2. Middle East and Africa Smart Rings Market Restraints 3.2.4.3. Middle East and Africa Smart Rings Market Opportunities 3.2.4.4. Middle East and Africa Smart Rings Market Challenges 3.2.5. South America 3.2.5.1. South America Smart Rings Market Drivers 3.2.5.2. South America Smart Rings Market Restraints 3.2.5.3. South America Smart Rings Market Opportunities 3.2.5.4. South America Smart Rings Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For the Smart Rings Industry 3.8. Analysis of Government Schemes and Initiatives For the Smart Rings Industry 3.9. The Global Pandemic Impact on the Smart Rings Market 4. Smart Rings Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2024-2032) 4.1. Smart Rings Market Size and Forecast, by Technology (2024-2032) 4.1.1. NFC Rings 4.1.2. Bluetooth Rings 4.1.3. Hybrid Rings 4.2. Smart Rings Market Size and Forecast, by Operating System (2024-2032) 4.2.1. iOS-Compatible Rings 4.2.2. Android-Compatible Rings 4.2.3. Cross-Platform Rings 4.3. Smart Rings Market Size and Forecast, by Applications (2024-2032) 4.3.1. Health and Fitness Features 4.3.2. Child-Security Function 4.3.3. Payment and Security 4.3.4. Data transfer 4.4. Smart Rings Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Smart Rings Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2024-2032) 5.1. North America Smart Rings Market Size and Forecast, by Technology (2024-2032) 5.1.1. NFC Rings 5.1.2. Bluetooth Rings 5.1.3. Hybrid Rings 5.2. North America Smart Rings Market Size and Forecast, by Operating System (2024-2032) 5.2.1. iOS-Compatible Rings 5.2.2. Android-Compatible Rings 5.2.3. Cross-Platform Rings 5.3. North America Smart Rings Market Size and Forecast, by Applications (2024-2032) 5.3.1. Health and Fitness Features 5.3.2. Child-Security Function 5.3.3. Payment and Security 5.3.4. Data transfer 5.4. North America Smart Rings Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Smart Rings Market Size and Forecast, by Technology (2024-2032) 5.4.1.1.1. NFC Rings 5.4.1.1.2. Bluetooth Rings 5.4.1.1.3. Hybrid Rings 5.4.1.2. United States Smart Rings Market Size and Forecast, by Operating System (2024-2032) 5.4.1.2.1. iOS-Compatible Rings 5.4.1.2.2. Android-Compatible Rings 5.4.1.2.3. Cross-Platform Rings 5.4.1.3. United States Smart Rings Market Size and Forecast, by Applications (2024-2032) 5.4.1.3.1. Health and Fitness Features 5.4.1.3.2. Child-Security Function 5.4.1.3.3. Payment and Security 5.4.1.3.4. Data transfer 5.4.2. Canada 5.4.2.1. Canada Smart Rings Market Size and Forecast, by Technology (2024-2032) 5.4.2.1.1. NFC Rings 5.4.2.1.2. Bluetooth Rings 5.4.2.1.3. Hybrid Rings 5.4.2.2. Canada Smart Rings Market Size and Forecast, by Operating System (2024-2032) 5.4.2.2.1. iOS-Compatible Rings 5.4.2.2.2. Android-Compatible Rings 5.4.2.2.3. Cross-Platform Rings 5.4.2.3. Canada Smart Rings Market Size and Forecast, by Applications (2024-2032) 5.4.2.3.1. Health and Fitness Features 5.4.2.3.2. Child-Security Function 5.4.2.3.3. Payment and Security 5.4.2.3.4. Data transfer 5.4.3. Mexico 5.4.3.1. Mexico Smart Rings Market Size and Forecast, by Technology (2024-2032) 5.4.3.1.1. NFC Rings 5.4.3.1.2. Bluetooth Rings 5.4.3.1.3. Hybrid Rings 5.4.3.2. Mexico Smart Rings Market Size and Forecast, by Operating System (2024-2032) 5.4.3.2.1. iOS-Compatible Rings 5.4.3.2.2. Android-Compatible Rings 5.4.3.2.3. Cross-Platform Rings 5.4.3.3. Mexico Smart Rings Market Size and Forecast, by Applications (2024-2032) 5.4.3.3.1. Health and Fitness Features 5.4.3.3.2. Child-Security Function 5.4.3.3.3. Payment and Security 5.4.3.3.4. Data transfer 6. Europe Smart Rings Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2024-2032) 6.1. Europe Smart Rings Market Size and Forecast, by Technology (2024-2032) 6.2. Europe Smart Rings Market Size and Forecast, by Operating System (2024-2032) 6.3. Europe Smart Rings Market Size and Forecast, by Applications (2024-2032) 6.4. Europe Smart Rings Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Smart Rings Market Size and Forecast, by Technology (2024-2032) 6.4.1.2. United Kingdom Smart Rings Market Size and Forecast, by Operating System (2024-2032) 6.4.1.3. United Kingdom Smart Rings Market Size and Forecast, by Applications (2024-2032) 6.4.2. France 6.4.2.1. France Smart Rings Market Size and Forecast, by Technology (2024-2032) 6.4.2.2. France Smart Rings Market Size and Forecast, by Operating System (2024-2032) 6.4.2.3. France Smart Rings Market Size and Forecast, by Applications (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Smart Rings Market Size and Forecast, by Technology (2024-2032) 6.4.3.2. Germany Smart Rings Market Size and Forecast, by Operating System (2024-2032) 6.4.3.3. Germany Smart Rings Market Size and Forecast, by Applications (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Smart Rings Market Size and Forecast, by Technology (2024-2032) 6.4.4.2. Italy Smart Rings Market Size and Forecast, by Operating System (2024-2032) 6.4.4.3. Italy Smart Rings Market Size and Forecast, by Applications (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Smart Rings Market Size and Forecast, by Technology (2024-2032) 6.4.5.2. Spain Smart Rings Market Size and Forecast, by Operating System (2024-2032) 6.4.5.3. Spain Smart Rings Market Size and Forecast, by Applications (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Smart Rings Market Size and Forecast, by Technology (2024-2032) 6.4.6.2. Sweden Smart Rings Market Size and Forecast, by Operating System (2024-2032) 6.4.6.3. Sweden Smart Rings Market Size and Forecast, by Applications (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Smart Rings Market Size and Forecast, by Technology (2024-2032) 6.4.7.2. Austria Smart Rings Market Size and Forecast, by Operating System (2024-2032) 6.4.7.3. Austria Smart Rings Market Size and Forecast, by Applications (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Smart Rings Market Size and Forecast, by Technology (2024-2032) 6.4.8.2. Rest of Europe Smart Rings Market Size and Forecast, by Operating System (2024-2032) 6.4.8.3. Rest of Europe Smart Rings Market Size and Forecast, by Applications (2024-2032) 7. Asia Pacific Smart Rings Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2024-2032) 7.1. Asia Pacific Smart Rings Market Size and Forecast, by Technology (2024-2032) 7.2. Asia Pacific Smart Rings Market Size and Forecast, by Operating System (2024-2032) 7.3. Asia Pacific Smart Rings Market Size and Forecast, by Applications (2024-2032) 7.4. Asia Pacific Smart Rings Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Smart Rings Market Size and Forecast, by Technology (2024-2032) 7.4.1.2. China Smart Rings Market Size and Forecast, by Operating System (2024-2032) 7.4.1.3. China Smart Rings Market Size and Forecast, by Applications (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Smart Rings Market Size and Forecast, by Technology (2024-2032) 7.4.2.2. S Korea Smart Rings Market Size and Forecast, by Operating System (2024-2032) 7.4.2.3. S Korea Smart Rings Market Size and Forecast, by Applications (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Smart Rings Market Size and Forecast, by Technology (2024-2032) 7.4.3.2. Japan Smart Rings Market Size and Forecast, by Operating System (2024-2032) 7.4.3.3. Japan Smart Rings Market Size and Forecast, by Applications (2024-2032) 7.4.4. India 7.4.4.1. India Smart Rings Market Size and Forecast, by Technology (2024-2032) 7.4.4.2. India Smart Rings Market Size and Forecast, by Operating System (2024-2032) 7.4.4.3. India Smart Rings Market Size and Forecast, by Applications (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Smart Rings Market Size and Forecast, by Technology (2024-2032) 7.4.5.2. Australia Smart Rings Market Size and Forecast, by Operating System (2024-2032) 7.4.5.3. Australia Smart Rings Market Size and Forecast, by Applications (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Smart Rings Market Size and Forecast, by Technology (2024-2032) 7.4.6.2. Indonesia Smart Rings Market Size and Forecast, by Operating System (2024-2032) 7.4.6.3. Indonesia Smart Rings Market Size and Forecast, by Applications (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Smart Rings Market Size and Forecast, by Technology (2024-2032) 7.4.7.2. Malaysia Smart Rings Market Size and Forecast, by Operating System (2024-2032) 7.4.7.3. Malaysia Smart Rings Market Size and Forecast, by Applications (2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam Smart Rings Market Size and Forecast, by Technology (2024-2032) 7.4.8.2. Vietnam Smart Rings Market Size and Forecast, by Operating System (2024-2032) 7.4.8.3. Vietnam Smart Rings Market Size and Forecast, by Applications (2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan Smart Rings Market Size and Forecast, by Technology (2024-2032) 7.4.9.2. Taiwan Smart Rings Market Size and Forecast, by Operating System (2024-2032) 7.4.9.3. Taiwan Smart Rings Market Size and Forecast, by Applications (2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Smart Rings Market Size and Forecast, by Technology (2024-2032) 7.4.10.2. Rest of Asia Pacific Smart Rings Market Size and Forecast, by Operating System (2024-2032) 7.4.10.3. Rest of Asia Pacific Smart Rings Market Size and Forecast, by Applications (2024-2032) 8. Middle East and Africa Smart Rings Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2024-2032 8.1. Middle East and Africa Smart Rings Market Size and Forecast, by Technology (2024-2032) 8.2. Middle East and Africa Smart Rings Market Size and Forecast, by Operating System (2024-2032) 8.3. Middle East and Africa Smart Rings Market Size and Forecast, by Applications (2024-2032) 8.4. Middle East and Africa Smart Rings Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Smart Rings Market Size and Forecast, by Technology (2024-2032) 8.4.1.2. South Africa Smart Rings Market Size and Forecast, by Operating System (2024-2032) 8.4.1.3. South Africa Smart Rings Market Size and Forecast, by Applications (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Smart Rings Market Size and Forecast, by Technology (2024-2032) 8.4.2.2. GCC Smart Rings Market Size and Forecast, by Operating System (2024-2032) 8.4.2.3. GCC Smart Rings Market Size and Forecast, by Applications (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Smart Rings Market Size and Forecast, by Technology (2024-2032) 8.4.3.2. Nigeria Smart Rings Market Size and Forecast, by Operating System (2024-2032) 8.4.3.3. Nigeria Smart Rings Market Size and Forecast, by Applications (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Smart Rings Market Size and Forecast, by Technology (2024-2032) 8.4.4.2. Rest of ME&A Smart Rings Market Size and Forecast, by Operating System (2024-2032) 8.4.4.3. Rest of ME&A Smart Rings Market Size and Forecast, by Applications (2024-2032) 9. South America Smart Rings Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2024-2032 9.1. South America Smart Rings Market Size and Forecast, by Technology (2024-2032) 9.2. South America Smart Rings Market Size and Forecast, by Operating System (2024-2032) 9.3. South America Smart Rings Market Size and Forecast, by Applications (2024-2032) 9.4. South America Smart Rings Market Size and Forecast, by %%% (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Smart Rings Market Size and Forecast, by Technology (2024-2032) 9.4.1.2. Brazil Smart Rings Market Size and Forecast, by Operating System (2024-2032) 9.4.1.3. Brazil Smart Rings Market Size and Forecast, by Applications (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Smart Rings Market Size and Forecast, by Technology (2024-2032) 9.4.2.2. Argentina Smart Rings Market Size and Forecast, by Operating System (2024-2032) 9.4.2.3. Argentina Smart Rings Market Size and Forecast, by Applications (2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Smart Rings Market Size and Forecast, by Technology (2024-2032) 9.4.3.2. Rest Of South America Smart Rings Market Size and Forecast, by Operating System (2024-2032) 9.4.3.3. Rest Of South America Smart Rings Market Size and Forecast, by Applications (2024-2032) 10. Global Smart Rings Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Smart Rings Market Companies, by market capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Apple - Cupertino, California, United States 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (small, medium, and large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Boat - Mumbai, India 11.3. Jakcom (China) - Beijing, China 11.4. Kerv (United Kingdom) - London, United Kingdom 11.5. Logbar - Tokyo, Japan 11.6. McLear - London, United Kingdom 11.7. Mota - Hialeah, Florida, United States 11.8. Motiv - San Francisco, California, United States 11.9. NFC Ring - Manchester, United Kingdom 11.10. Nimb - San Francisco, California, United States 11.11. Nod-Ring - San Francisco, California, United States 11.12. Orii - Hong Kong 11.13. Oura - Oulu, Finland 11.14. Ringly - New York, New York, United States 11.15. Samsung - Suwon, South Korea 11.16. Sesame Ring - New York, New York, United States 11.17. TheTouch X - Hong Kong 11.18. Ultrahuman - New York, New York, United States 11.19. Vinaya - London, United Kingdom 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary