The Global Commercial Boilers Market is forecasted at a CAGR of 4.6% during 2023-2029. A detailed description of the factors and market trends pertaining to different regions is given in detail in the report. Commercial boilers, specifically designed for large buildings, cater to the heating and hot water needs of commercial and industrial spaces. Advancements in technology, including smart controls and remote monitoring, are enhancing boiler efficiency, performance, and convenience of operation. The Commercial Boilers Market is fuelled by the rising demand for space heating, stringent energy efficiency regulations, and the need for boiler replacements and retrofits. Europe dominates the market, followed by North America and Asia Pacific. Key players such as Bosch Thermotechnology, Viessmann Group, and A. O. Smith Corporation are focusing on innovation and strategic partnerships to strengthen their market presence. Overall, the Commercial Boilers Market is poised for continued growth, driven by the demand for energy-efficient and sustainable heating solutions in commercial spaces.To know about the Research Methodology :- Request Free Sample Report

Commercial Boilers Market Research Methodology:

The research conducted for Commercial Boilers Market utilized both primary and secondary data sources to ensure that all possible factors affecting the market were thoroughly examined and validated. The market size for top-level markets and sub-segments is normalized and the impact of inflation, economic downturns, regulatory & policy changes, and other variables is factored into the market forecast. The bottom-up approach and multiple data triangulation methodologies are used to estimate the market size and forecasts. The percentage splits, market shares, and breakdowns of the segments are derived based on weights assigned to each of the segments on their utilization rate and average sale price. The country-wise analysis of the overall market and its sub-segments are based on the percentage adoption or utilization of the given market Size in the respective region or country. Major players in the market are identified through secondary research based on indicators that include market revenue, price, services offered, advancements, mergers and acquisitions, and joint. Extensive primary research was conducted to acquire information and verify and confirm the crucial numbers arrived at after comprehensive market engineering and calculations for market statistics, market size estimations, market forecasts, market breakdown, and data triangulation.Commercial Boilers Market dynamics

Commercial Boilers Market Drivers: Increasing Demand for Energy-Efficient Heating Solutions: The rising focus on energy efficiency and environmental sustainability is a key driver for the Commercial Boilers Market. Governments and regulatory bodies worldwide have implemented stringent energy efficiency standards, incentivizing businesses to adopt efficient heating systems. For instance, in Europe, the Energy Performance of Buildings Directive (EPBD) sets requirements for energy performance in buildings, spurring the demand for energy-efficient commercial boilers. Replacement and Retrofit Activities: The need to replace aging and inefficient commercial boilers presents a significant growth opportunity. Many existing boiler systems are reaching the end of their operational lives, prompting businesses to upgrade to modern, energy-efficient models. Retrofit projects also play a crucial role, where older systems are retrofitted with advanced components or controls to improve efficiency. For example, in 2020, the New York State Energy Research and Development Authority (NYSERDA) provided incentives for commercial boiler replacements and retrofits to encourage energy efficiency and emissions reduction. Commercial Boilers Market Restraints: High Initial Investment Costs: The primary challenge for businesses considering commercial boiler installations is the high upfront investment required. Commercial boilers are larger and more complex than residential systems, leading to higher costs. The initial investment can be a significant barrier, particularly for small and medium-sized enterprises (SMEs). However, government initiatives, such as tax credits and rebates, can help offset these costs. For instance, in the United States, the federal Business Energy Investment Tax Credit (ITC) provides a financial incentive for businesses investing in energy-efficient technologies, including commercial boilers. Commercial Boilers Market Opportunities: Technological Advancements and Innovations: The Commercial Boilers Market presents numerous opportunities for technological advancements and innovations. Manufacturers are continually improving boiler designs and integrating advanced features such as condensing technology, smart controls, and remote monitoring. These innovations enhance the energy efficiency, operational performance, and ease of maintenance, thereby attracting customers looking for modern and intelligent heating solutions. For instance, in 2021, Bosch Thermotechnology introduced the Buderus SSB Industrial Stainless-Steel Boiler, offering high-efficiency condensing technology for commercial applications. Commercial Boilers Market Challenges: Stringent Environmental Regulations: The commercial boiler industry faces challenges associated with ever-increasing environmental regulations aimed at reducing greenhouse gas emissions. Compliance with emissions standards, such as the European Union's Ecodesign Directive and the U.S. Environmental Protection Agency's (EPA) emissions requirements, necessitates the development and adoption of low-emission boiler technologies. Manufacturers must invest in research and development to meet these regulatory requirements while ensuring cost-effectiveness and maintaining competitive pricing.Commercial Boilers Market Segment Analysis

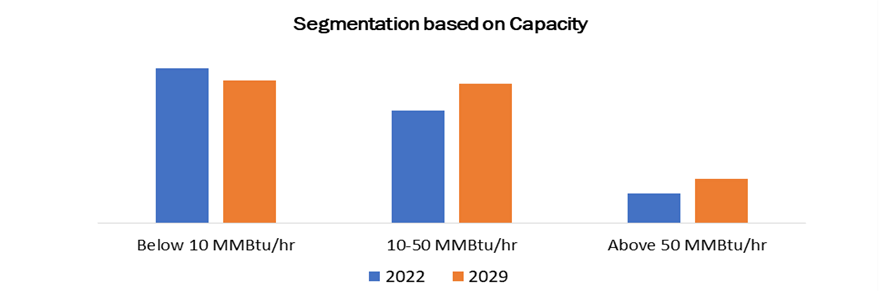

By Fuel Type, The Commercial Boilers Market is categorized into natural gas, oil, coal, and others. Currently, natural gas holds a significant share of the Commercial Boilers Market. Its low emissions, cost-effectiveness, and availability make it a preferred choice for commercial heating applications. However, the market for renewable fuels and low-carbon alternatives, such as biomass and hydrogen, shows potential for growth in the future. With increasing emphasis on sustainability and reducing carbon footprint, the adoption of renewable fuels is expected to rise, offering an opportunity for market players to expand their offerings in this segment. By Boiler Type, The Commercial Boilers Market is categorized into water-tube boilers and fire-tube boilers. Water-tube boilers are currently witnessing increasing adoption. These boilers offer higher efficiency, compact size, and the ability to handle high-pressure applications. Fire-tube boilers, on the other hand, are traditional and continue to hold a considerable market share. They are known for their reliability, ease of maintenance, and suitability for smaller-scale applications. Fire-tube boilers, although traditional, continue to hold a considerable share due to their reliability and ease of maintenance. By Technology, The Commercial Boilers Market is categorized into Condensing and Non-Condensing Boilers. Condensing boilers are designed to maximize energy efficiency by capturing and reusing heat from flue gases that would otherwise be wasted in traditional boilers. Condensing boilers are widely used in commercial applications due to their energy-saving capabilities and reduced carbon emissions. Non-condensing boilers are traditional boilers that do not incorporate condensing technology. While they are less energy-efficient compared to condensing boilers, they are still widely used in certain applications where lower upfront costs and simplicity of operation are priorities. By Application, The Commercial Boilers Market is categorized into offices, healthcare facilities, educational institutions, lodging, retail, and others. Currently, the office sector represents a significant share of the market followed by healthcare. Hospitals, clinics, and other healthcare facilities require reliable and efficient heating systems to maintain patient comfort and safety leading to the growth of the Commercial Boilers Market. The lodging segment also holds substantial potential for growth, driven by the expanding hospitality industry. The rise in tourism and the construction of new hotels and resorts contribute to the demand for commercial boilers in lodging applications. Additionally, the growing focus on energy efficiency and sustainable heating solutions across all sectors presents opportunities for market players to cater to various applications. By Capacity, The Commercial boilers market is categorized below 10 MMBtu/hr, 10-50 MMBtu/hr, and above 50 MMBtu/hr. Currently, the below 10 MMBtu/hr segment holds the largest market share. The segment benefits from its versatility, cost-effectiveness, and suitability for applications with lower heating demands. However, the 10-50 MMBtu/hr segment also holds a significant market share and is expected to exhibit considerable growth in the future. This capacity range is commonly utilized in medium to large commercial buildings, including educational institutions, hospitals, and hotels, where higher heating requirements exist. Furthermore, the above 50 MMBtu/hr segment has the potential to grow in the coming years, particularly in industrial applications that require boilers with larger capacities to meet substantial heat demand.

Commercial Boilers Market Regional analysis:

The Commercial Boilers Market exhibits regional variations, with each geographical region influenced by factors such as market size, government initiatives, and key drivers. Currently, Europe holds the highest market share in the Commercial Boilers Market. Europe places a strong emphasis on energy efficiency and sustainability, which drives the adoption of energy-efficient commercial boilers. Stringent regulations, such as the European Union's Energy Performance of Buildings Directive, mandate the use of efficient heating systems in commercial buildings. Additionally, the region's focus on renovating existing infrastructure and constructing new energy-efficient buildings further fuels market growth in Europe. North America is another significant market for commercial boilers. The United States, in particular, contributes significantly to the region's market share. The replacement of aging boiler systems, increasing focus on energy efficiency, and government initiatives supporting sustainable heating solutions drive the demand for commercial boilers in North America. For instance, programs like ENERGY STAR and tax incentives for energy-efficient equipment encourage businesses to invest in energy-efficient heating systems. The region's growing investments in commercial construction projects and the need for efficient heating in sectors such as healthcare, hospitality, and manufacturing also contribute to Commercial Boilers Market expansion in North America. Looking ahead, the Asia Pacific region is expected to lead the Commercial Boilers Market in the near future. Rapid urbanization, industrialization, and commercialization in countries like China, India, and Japan are driving market growth. Rising disposable incomes, expansion of the manufacturing sector, and increasing adoption of energy-efficient technologies create a favorable market environment in Asia Pacific. Governments in the region are actively promoting clean energy and sustainable development initiatives, which support the adoption of energy-efficient commercial boilers. For instance, China's Energy Conservation and Emission Reduction Plan and India's National Mission for Enhanced Energy Efficiency aim to improve energy efficiency in buildings and industrial sectors, thereby driving the demand for commercial boilers. The Middle East and Africa and the Southern America region also exhibit promising growth opportunities in the Commercial Boilers Market.Commercial Boiler Industry Competitive Landscape

The Commercial Boilers Market is highly competitive, characterized by the presence of established manufacturers, technological advancements, and strategic collaborations. This section provides an overview of the competitive landscape, highlighting key players, their market strategies, and recent developments. The competitive landscape of the Commercial Boilers Market is fragmented, with several prominent players vying for market share. Companies such as Bosch Thermotechnology, Viessmann Group, A. O. Smith Corporation, Fulton Boiler Works, and Cleaver-Brooks, Inc. hold significant market positions. Key players are focusing on product innovations to stay ahead in the market. For instance, Bosch Thermotechnology introduced the Buderus SSB Industrial StainlessSteel Boiler, featuring high-efficiency condensing technology for commercial applications. This innovative product offers enhanced energy efficiency and reduced environmental impact. Strategic collaborations and partnerships are also prevalent in the market. Companies are joining forces to leverage their strengths and expand their market reach. For example, in 2022, Viessmann Group entered into a strategic partnership with Scottish energy technology firm Star Renewable Energy to develop and deploy heat pump systems in commercial and industrial applications. Moreover, companies are focusing on mergers and acquisitions to strengthen their market presence. These strategic moves facilitate expansion into new geographic regions and enable access to complementary product portfolios. In 2021, A. O. Smith Corporation acquired Water-Right, Inc., a water treatment solutions provider, to enhance its offerings in water heating and treatment for commercial applications. To maintain a competitive edge, market players are also investing significantly in research and development activities. They aim to introduce advanced technologies, improve energy efficiency, and meet evolving customer demands. This continuous innovation helps companies gain a competitive advantage in the market.Commercial Boilers Market Scope: Inquire before buying

Commercial Boilers Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 2.4 Bn. Forecast Period 2023 to 2029 CAGR: 4.6% Market Size in 2029: USD 3.5 Bn. Segments Covered: by Fuel Type Natural Gas Oil Coal Others by Boiler Type Water-tube Boilers Fire-tube Boilers by Technology Condensing Boilers Non-Condensing Boilers by Application Offices Healthcare Facilities Educational Institutions Lodging Retail Others by Capacity Below 10 MMBtu/hr 10-50 MMBtu/hr Above 50 MMBtu/hr Commercial Boilers Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Commercial Boilers Market Key players

1. Bosch Thermotechnology 2. Viessmann Group 3. O. Smith Corporation 4. Fulton Boiler Works 5. Cleaver-Brooks, Inc. 6. Hurst Boiler & Welding Co., Inc. 7. Weil-McLain 8. Lochinvar, LLC 9. Parker Boiler Co. 10. Babcock Wanson 11. Thermax Ltd. 12. Hoval Ltd. 13. Raypak, Inc. 14. Cochran Ltd. 15. Johnston Boiler Company 16. Superior Boiler Works, Inc. 17. Miura America Co., Ltd. 18. York-Shipley Global 19. Clayton Industries 20. ICI Caldaie S.p.A. 21. Victory Energy Operations, LLC 22. Burnham Commercial Boilers 23. Smith Hughes Company 24. Laars Heating Systems Company 25. BDR Thermea Group FAQs 1. How big is the Commercial Boilers Market? Ans: Commercial Boilers Market was valued at USD 5.3 billion in 2022. 2. What is the growth rate of the Commercial Boilers Market? Ans: The CAGR of the Commercial Boilers Market is 2.4%. 3. What are the segments for the Commercial Boilers Market? Ans: There are primarily 6 segments – Fuel Type, Boiler Type, Technology, Application, Capacity and Geography Commercial Boilers Market 4. Which region has the highest market share in the Commercial Boilers Market sector? Ans: Europe has the highest market share in the Commercial Boilers Market sector. 5. Is it profitable to invest in the Commercial Boilers Market? Ans: There is a fair growth rate in this market and there are various factors to be analysed like the driving forces and opportunities of the market which has been discussed extensively in Maximize’s full report. That would help in understanding the profitability in the market

1. Commercial Boilers Market: Research Methodology 2. Commercial Boilers Market: Executive Summary 3. Commercial Boilers Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Commercial Boilers Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Commercial Boilers Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Commercial Boilers Market Size and Forecast, by Fuel Type (2022-2029) 5.1.1. Natural Gas 5.1.2. Oil 5.1.3. Coal 5.1.4. Others 5.2. Commercial Boilers Market Size and Forecast, by Boiler Type (2022-2029) 5.2.1. Water-tube Boilers 5.2.2. Fire-tube Boilers 5.3. Commercial Boilers Market Size and Forecast, by Technology (2022-2029) 5.3.1. Condensing Boilers 5.3.2. Non-Condensing Boilers 5.4. Commercial Boilers Market Size and Forecast, by Application (2022-2029) 5.4.1. Offices 5.4.2. Healthcare Facilities 5.4.3. Educational Institutions 5.4.4. Lodging 5.4.5. Retail 5.4.6. Others 5.5. Commercial Boilers Market Size and Forecast, by Capacity (2022-2029) 5.5.1. Below 10 MMBtu/hr 5.5.2. 10-50 MMBtu/hr 5.5.3. Above 50 MMBtu/hr 5.6. Commercial Boilers Market Size and Forecast, by Region (2022-2029) 5.6.1. North America 5.6.2. Europe 5.6.3. Asia Pacific 5.6.4. Middle East and Africa 5.6.5. South America 6. North America Commercial Boilers Market Size and Forecast (by Value USD and Volume Units) 6.1. North America Commercial Boilers Market Size and Forecast, by Fuel Type (2022-2029) 6.1.1. Natural Gas 6.1.2. Oil 6.1.3. Coal 6.1.4. Others 6.2. North America Commercial Boilers Market Size and Forecast, by Boiler Type (2022-2029) 6.2.1. Water-tube Boilers 6.2.2. Fire-tube Boilers 6.3. North America Commercial Boilers Market Size and Forecast, by Technology (2022-2029) 6.3.1. Condensing Boilers 6.3.2. Non-Condensing Boilers 6.4. North America Commercial Boilers Market Size and Forecast, by Application (2022-2029) 6.4.1. Offices 6.4.2. Healthcare Facilities 6.4.3. Educational Institutions 6.4.4. Lodging 6.4.5. Retail 6.4.6. Others 6.5. North America Commercial Boilers Market Size and Forecast, by Capacity (2022-2029) 6.5.1. Below 10 MMBtu/hr 6.5.2. 10-50 MMBtu/hr 6.5.3. Above 50 MMBtu/hr 6.6. North America Commercial Boilers Market Size and Forecast, by Country (2022-2029) 6.6.1. United States 6.6.2. Canada 6.6.3. Mexico 7. Europe Commercial Boilers Market Size and Forecast (by Value USD and Volume Units) 7.1. Europe Commercial Boilers Market Size and Forecast, by Fuel Type (2022-2029) 7.1.1. Natural Gas 7.1.2. Oil 7.1.3. Coal 7.1.4. Others 7.2. Europe Commercial Boilers Market Size and Forecast, by Boiler Type (2022-2029) 7.2.1. Water-tube Boilers 7.2.2. Fire-tube Boilers 7.3. Europe Commercial Boilers Market Size and Forecast, by Technology (2022-2029) 7.3.1. Condensing Boilers 7.3.2. Non-Condensing Boilers 7.4. Europe Commercial Boilers Market Size and Forecast, by Application (2022-2029) 7.4.1. Offices 7.4.2. Healthcare Facilities 7.4.3. Educational Institutions 7.4.4. Lodging 7.4.5. Retail 7.4.6. Others 7.5. Europe Commercial Boilers Market Size and Forecast, by Capacity (2022-2029) 7.5.1. Below 10 MMBtu/hr 7.5.2. 10-50 MMBtu/hr 7.5.3. Above 50 MMBtu/hr 7.6. Europe Commercial Boilers Market Size and Forecast, by Country (2022-2029) 7.6.1. UK 7.6.2. France 7.6.3. Germany 7.6.4. Italy 7.6.5. Spain 7.6.6. Sweden 7.6.7. Austria 7.6.8. Rest of Europe 8. Asia Pacific Commercial Boilers Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific Commercial Boilers Market Size and Forecast, by Fuel Type (2022-2029) 8.1.1. Natural Gas 8.1.2. Oil 8.1.3. Coal 8.1.4. Others 8.2. Asia Pacific Commercial Boilers Market Size and Forecast, by Boiler Type (2022-2029) 8.2.1. Water-tube Boilers 8.2.2. Fire-tube Boilers 8.3. Asia Pacific Commercial Boilers Market Size and Forecast, by Technology (2022-2029) 8.3.1. Condensing Boilers 8.3.2. Non-Condensing Boilers 8.4. Asia Pacific Commercial Boilers Market Size and Forecast, by Application (2022-2029) 8.4.1. Offices 8.4.2. Healthcare Facilities 8.4.3. Educational Institutions 8.4.4. Lodging 8.4.5. Retail 8.4.6. Others 8.5. Asia Pacific Commercial Boilers Market Size and Forecast, by Capacity (2022-2029) 8.5.1. Below 10 MMBtu/hr 8.5.2. 10-50 MMBtu/hr 8.5.3. Above 50 MMBtu/hr 8.6. Asia Pacific Commercial Boilers Market Size and Forecast, by Country (2022-2029) 8.6.1. China 8.6.2. S Korea 8.6.3. Japan 8.6.4. India 8.6.5. Australia 8.6.6. Indonesia 8.6.7. Malaysia 8.6.8. Vietnam 8.6.9. Taiwan 8.6.10. Bangladesh 8.6.11. Pakistan 8.6.12. Rest of Asia Pacific 9. Middle East and Africa Commercial Boilers Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa Commercial Boilers Market Size and Forecast, by Fuel Type (2022-2029) 9.1.1. Natural Gas 9.1.2. Oil 9.1.3. Coal 9.1.4. Others 9.2. Middle East and Africa Commercial Boilers Market Size and Forecast, by Boiler Type (2022-2029) 9.2.1. Water-tube Boilers 9.2.2. Fire-tube Boilers 9.3. Middle East and Africa Commercial Boilers Market Size and Forecast, by Technology (2022-2029) 9.3.1. Condensing Boilers 9.3.2. Non-Condensing Boilers 9.4. Middle East and Africa Commercial Boilers Market Size and Forecast, by Application (2022-2029) 9.4.1. Offices 9.4.2. Healthcare Facilities 9.4.3. Educational Institutions 9.4.4. Lodging 9.4.5. Retail 9.4.6. Others 9.5. Middle East and Africa Commercial Boilers Market Size and Forecast, by Capacity (2022-2029) 9.5.1. Below 10 MMBtu/hr 9.5.2. 10-50 MMBtu/hr 9.5.3. Above 50 MMBtu/hr 9.6. Middle East and Africa Commercial Boilers Market Size and Forecast, by Country (2022-2029) 9.6.1. South Africa 9.6.2. GCC 9.6.3. Egypt 9.6.4. Nigeria 9.6.5. Rest of ME&A 10. South America Commercial Boilers Market Size and Forecast (by Value USD and Volume Units) 10.1. South America Commercial Boilers Market Size and Forecast, by Fuel Type (2022-2029) 10.1.1. Natural Gas 10.1.2. Oil 10.1.3. Coal 10.1.4. Others 10.2. South America Commercial Boilers Market Size and Forecast, by Boiler Type (2022-2029) 10.2.1. Water-tube Boilers 10.2.2. Fire-tube Boilers 10.3. South America Commercial Boilers Market Size and Forecast, by Technology (2022-2029) 10.3.1. Condensing Boilers 10.3.2. Non-Condensing Boilers 10.4. South America Commercial Boilers Market Size and Forecast, by Application (2022-2029) 10.4.1. Offices 10.4.2. Healthcare Facilities 10.4.3. Educational Institutions 10.4.4. Lodging 10.4.5. Retail 10.4.6. Others 10.5. South America Commercial Boilers Market Size and Forecast, by Capacity (2022-2029) 10.5.1. Below 10 MMBtu/hr 10.5.2. 10-50 MMBtu/hr 10.5.3. Above 50 MMBtu/hr 10.6. South America Commercial Boilers Market Size and Forecast, by Country (2022-2029) 10.6.1. Brazil 10.6.2. Argentina 10.6.3. Rest of South America 11. Company Profile: Key players 11.1. Bosch Thermotechnology 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Viessmann Group 11.3. A. O. Smith Corporation 11.4. Fulton Boiler Works 11.5. Cleaver-Brooks, Inc. 11.6. Hurst Boiler & Welding Co., Inc. 11.7. Weil-McLain 11.8. Lochinvar, LLC 11.9. Parker Boiler Co. 11.10. Babcock Wanson 11.11. Thermax Ltd. 11.12. Hoval Ltd. 11.13. Raypak, Inc. 11.14. Cochran Ltd. 11.15. Johnston Boiler Company 11.16. Superior Boiler Works, Inc. 11.17. Miura America Co., Ltd. 11.18. York-Shipley Global 11.19. Clayton Industries 11.20. ICI Caldaie S.p.A. 11.21. Victory Energy Operations, LLC 11.22. Burnham Commercial Boilers 11.23. Smith Hughes Company 11.24. Laars Heating Systems Company 11.25. BDR Thermea Group 12. Key Findings 13. Industry Recommendation