The Clinical Oncology Next-Generation Sequencing Market size was valued at USD 9.49 Billion in 2023 and the total Clinical Oncology Next-Generation Sequencing revenue is expected to grow at a CAGR of 20.7 % from 2024 to 2030, reaching nearly USD 35.42 Billion by 2030. Clinical Oncology Next-Generation Sequencing is a high-throughput genomic analysis to identify tumor DNA mutations, guiding personalized cancer treatments through simultaneous examination of multiple genes. Advancements in technology, increasing prevalence of cancer worldwide, and growing demand for personalized medicine driving the growth of Clinical Oncology Next-Generation Sequencing Market. With NGS technologies offering higher throughput, faster turnaround times, and reduced costs compared to traditional sequencing methods, Next-Generation Sequencing have become indispensable tools in oncology research and clinical practice. The market is expected significant investments in research and development by Clinical Oncology Next-Generation Sequencing key players to enhance sequencing platforms, improve data analysis algorithms, and expand applications in cancer diagnostics, prognostics, and therapeutics.To know about the Research Methodology :- Request Free Sample Report Key players in the Clinical Oncology Next-Generation Sequencing Market are innovating with novel NGS panels targeting specific cancer types or mutations, integrating artificial intelligence and machine learning for precise variant interpretation, and introducing liquid biopsy-based NGS assays for non-invasive cancer detection. Market giants like Illumina, Thermo Fisher Scientific, Qiagen, and Roche are actively involved in strategic collaborations, mergers, and acquisitions to bolster their product portfolios, expand market reach, and drive innovation in clinical oncology NGS. The increasing adoption of NGS in clinical settings, supported by favorable reimbursement policies and growing awareness among healthcare providers, alongside rising patient demand for genomic testing to inform treatment decisions, indicates a steady growth trajectory for the Clinical Oncology Next-Generation Sequencing Market. As precision oncology advances with genomic insights from NGS, the market holds promise for sustained growth, offering opportunities for further innovation and expansion in the forecast period.

Clinical Oncology Next-Generation Sequencing Market Dynamics:

Rising Global Cancer Burden Increases Demand for Precise Genomic Analysis Driving Clinical Oncology Next-Generation Sequencing Market Growth Ongoing advancements in NGS technology driving the growth of Clinical Oncology Next-Generation Sequencing Market. For instance, Illumina's NovaSeq platform, revolutionize cancer genome analysis with increased sequencing speed and accuracy. This innovation drives market growth by enabling rapid and cost-effective genomic profiling in oncology research and clinical applications. The escalating global burden of cancer, especially in developing regions, intensifies the demand for precise genomic analysis provided by NGS. Thermo Fisher's Oncomine assays, offering comprehensive molecular profiling, cater to this need, facilitating targeted therapy selection and monitoring, thus propelling market expansion amid rising cancer incidence projections.The trend towards personalized medicine further fuels the adoption of NGS in oncology, with companies like Foundation Medicine (now part of Roche) leading the charge. Their specialized services in comprehensive genomic profiling guide personalized treatment strategies based on unique molecular characteristics, aligning with the paradigm shift towards tailored therapies. Additionally, increasing funding for genomic research initiatives, such as the Cancer Moonshot program in the United States, fosters technological advancements and clinical validation in NGS-based cancer diagnostics and therapeutics, driving market growth and innovation in precision oncology. As the Clinical Oncology NGS Market continues to evolve, supported by favorable reimbursement policies, strategic collaborations, growing awareness, regulatory support, and technological integration with electronic health records, it remains poised for sustained expansion, offering unprecedented opportunities for further innovation and market penetration in the foreseeable future. Complexity of Data Interpretation Hinders the Clinical Oncology Next-Generation Sequencing Market Growth High initial investment and ongoing expenses associated with NGS platforms and analysis hinder market growth. For example, the high cost of purchasing and maintaining platforms such as Illumina's NGS systems may limit access to genomic testing, hindering market growth and leaving some patient populations underserved. Without adequate financial resources, these facilities may struggle to invest in the necessary infrastructure and expertise required for effective implementation of NGS, thereby constraining market expansion. The complexity of data interpretation presents another significant challenge to the adoption of NGS in clinical oncology. Analysing NGS data and interpreting genomic variations demand specialized expertise and resources, which may not be readily available in all healthcare settings. For instance, interpreting complex genetic mutations detected by platforms like Thermo Fisher's Ion Torrent requires highly skilled personnel, potentially leading to delays in treatment decisions and affecting patient outcomes. Without sufficient expertise in genomic data analysis, clinicians may struggle to effectively utilize NGS results in guiding personalized cancer treatments, thereby impeding market adoption and the realization of its full potential in improving patient care.

Clinical Oncology Next-Generation Sequencing Market Segment Analysis:

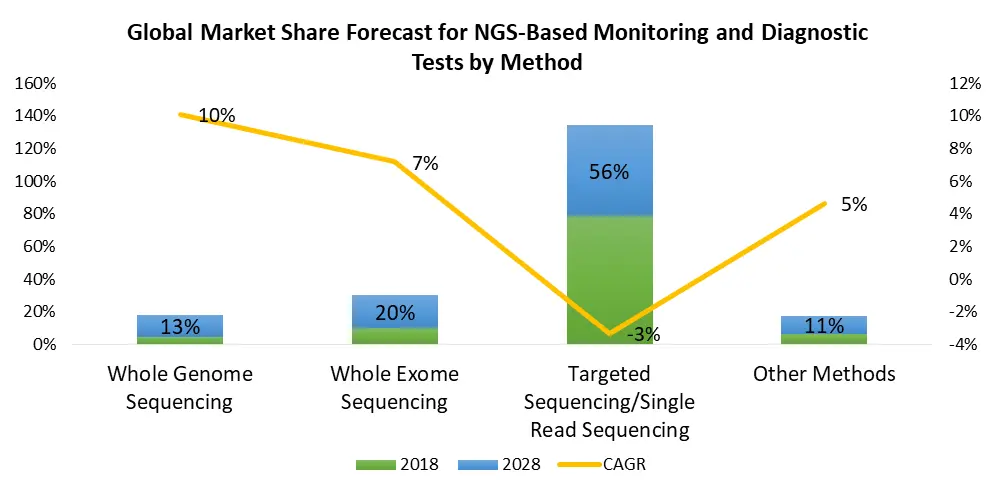

Based on Technology, Whole Genome Sequencing dominated the Clinical Oncology Next-Generation Sequencing Market in 2023, it provides a comprehensive view of an individual's entire genome, enabling the identification of novel mutations and complex structural variations, but its adoption is limited by high costs and extensive data analysis requirements. Whole Exome Sequencing (WES) focuses on sequencing the protein-coding regions of the genome, offering a balance between cost-effectiveness and comprehensive genomic coverage, making it suitable for identifying coding mutations relevant to cancer. Targeted Sequencing, on the other hand, selectively sequences specific regions of interest, allowing for high sensitivity and cost efficiency, particularly in detecting known cancer-associated mutations. Other emerging technologies, such as RNA sequencing or single-cell sequencing, offer additional insights into tumor biology and heterogeneity, albeit with varying levels of adoption and application specificity within the clinical oncology setting.

Clinical Oncology Next-Generation Sequencing Market Regional Insights:

North America Dominance in the Clinical Oncology Next-Generation Sequencing Market North America stands out as the leading region in the Clinical Oncology Next-Generation Sequencing (NGS) market, owing to several key factors. The region's dominance is underscored by regulatory initiatives in the United States aimed at enhancing cancer screening diagnoses, such as the Cancer Genome Atlas program by the National Cancer Institute (NCI), which has conducted NGS on over 20,000 cancer samples from various forms of the disease. This regulatory focus on early detection and diagnosis fuels demand for clinical oncology NGS platforms. Moreover, the region witnesses a surge in the use of sequencing platforms for clinical diagnosis, facilitated by the declining costs of installation. The accessibility of genomic and proteomic data contributes to the market's growth trajectory, presenting opportunities for further expansion in the foreseeable future. In Asia Pacific, the Clinical Oncology NGS market is poised for rapid growth, driven by factors such as the burgeoning healthcare and pharmaceutical sectors, particularly in emerging countries. The region, notably Australia and New Zealand, grapples with high cancer mortality rates, driving demand for advanced diagnostic technologies like NGS. China, in particular, has experienced a remarkable decline in sequencing costs, fostering economic development and fueling market expansion. Competitive pricing strategies by leading market players, coupled with favorable government policies and significant investment levels, further propel the growth of the Clinical Oncology NGS market in the region, promising substantial opportunities for market players and stakeholders alike.Clinical Oncology Next-Generation Sequencing Market Scope: Inquire before buying

Clinical Oncology Next-Generation Sequencing Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 7.86 Bn. Forecast Period 2024 to 2030 CAGR: 20.7% Market Size in 2024: US $ 2.93 Bn. Segments Covered: by Technology Whole Genome Sequencing Whole Exome Sequencing Targeted Sequencing Others by Workflow Pre-Sequencing Sequencing Data Analysis by Application Screening Diagnostics by End-User Hospitals Clinics Laboratories Clinical Oncology Next-Generation Sequencing Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Clinical Oncology Next-Generation Sequencing Market Key Players:

Major Contributors in the Clinical Oncology Next-Generation Sequencing Industry in North America: 1. Illumina, Inc.., San Diego, California, USA 2. Thermo Fisher Scientific, Inc., Waltham, Massachusetts, USA 3. Guardant Health, Inc., Redwood City, California, USA 4. PPacific Bioscience of California, Inc., Menlo Park, California, USA 5. Agilent Technologies, Inc., Santa Clara, California, USA Leading players in the Europe Clinical Oncology Next-Generation Sequencing Market: 1. Qiagen N.V., Venlo, Netherlands 2. Roche Holdings AG (including Foundation Medicine), Basel, Switzerland 3. Oxford Nanopore Technologies Ltd., Oxford, United Kingdom 4. Genewiz Germany GmbH, Leipzig, Germany 5. Sophia Genetics SA, Saint-Sulpice, Switzerland Key players driving the Asia-Pacific Clinical Oncology Next-Generation Sequencing Market: 1. Novogene Corporation, Beijing, China 2. BGI Group, Shenzhen, China 3. Takara Bio Inc., Kusatsu, Japan 4. MedGenome Labs Pvt. Ltd., Bengaluru, India FAQs: 1] Which region is expected to hold the highest share in the Global Clinical Oncology Next-Generation Sequencing Market? Ans. North America region is expected to hold the highest share in the Market. 2] What is the market size of the Global Clinical Oncology Next-Generation Sequencing Market by 2030? Ans. The market size of the Market by 2030 is expected to reach US$ 35.42 Billion. 3] What is the forecast period for the Global Clinical Oncology Next-Generation Sequencing Market? Ans. The forecast period for the Market is 2024-2030. 4] What was the market size of the Global Market in 2023? Ans. The market size of the Market in 2023 was valued at US$ 9.49 Billion.

1. Clinical Oncology Next-Generation Sequencing Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Clinical Oncology Next-Generation Sequencing Market: Dynamics 2.1. Clinical Oncology Next-Generation Sequencing Market Trends by Region 2.1.1. North America Clinical Oncology Next-Generation Sequencing Market Trends 2.1.2. Europe Clinical Oncology Next-Generation Sequencing Market Trends 2.1.3. Asia Pacific Clinical Oncology Next-Generation Sequencing Market Trends 2.1.4. Middle East and Africa Clinical Oncology Next-Generation Sequencing Market Trends 2.1.5. South America Clinical Oncology Next-Generation Sequencing Market Trends 2.2. Clinical Oncology Next-Generation Sequencing Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Clinical Oncology Next-Generation Sequencing Market Drivers 2.2.1.2. North America Clinical Oncology Next-Generation Sequencing Market Restraints 2.2.1.3. North America Clinical Oncology Next-Generation Sequencing Market Opportunities 2.2.1.4. North America Clinical Oncology Next-Generation Sequencing Market Challenges 2.2.2. Europe 2.2.2.1. Europe Clinical Oncology Next-Generation Sequencing Market Drivers 2.2.2.2. Europe Clinical Oncology Next-Generation Sequencing Market Restraints 2.2.2.3. Europe Clinical Oncology Next-Generation Sequencing Market Opportunities 2.2.2.4. Europe Clinical Oncology Next-Generation Sequencing Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Clinical Oncology Next-Generation Sequencing Market Drivers 2.2.3.2. Asia Pacific Clinical Oncology Next-Generation Sequencing Market Restraints 2.2.3.3. Asia Pacific Clinical Oncology Next-Generation Sequencing Market Opportunities 2.2.3.4. Asia Pacific Clinical Oncology Next-Generation Sequencing Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Clinical Oncology Next-Generation Sequencing Market Drivers 2.2.4.2. Middle East and Africa Clinical Oncology Next-Generation Sequencing Market Restraints 2.2.4.3. Middle East and Africa Clinical Oncology Next-Generation Sequencing Market Opportunities 2.2.4.4. Middle East and Africa Clinical Oncology Next-Generation Sequencing Market Challenges 2.2.5. South America 2.2.5.1. South America Clinical Oncology Next-Generation Sequencing Market Drivers 2.2.5.2. South America Clinical Oncology Next-Generation Sequencing Market Restraints 2.2.5.3. South America Clinical Oncology Next-Generation Sequencing Market Opportunities 2.2.5.4. South America Clinical Oncology Next-Generation Sequencing Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Clinical Oncology Next-Generation Sequencing Industry 2.8. Analysis of Government Schemes and Initiatives For Clinical Oncology Next-Generation Sequencing Industry 2.9. Clinical Oncology Next-Generation Sequencing Market Trade Analysis 2.10. The Global Pandemic Impact on Clinical Oncology Next-Generation Sequencing Market 3. Clinical Oncology Next-Generation Sequencing Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 3.1.1. Whole Genome Sequencing 3.1.2. Whole Exome Sequencing 3.1.3. Targeted Sequencing 3.1.4. Others 3.2. Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 3.2.1. Pre-Sequencing 3.2.2. Sequencing 3.2.3. Data Analysis 3.3. Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 3.3.1. Screening 3.3.2. Diagnostics 3.4. Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 3.4.1. Hospitals 3.4.2. Clinics 3.4.3. Laboratories 3.5. Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Clinical Oncology Next-Generation Sequencing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 4.1.1. Whole Genome Sequencing 4.1.2. Whole Exome Sequencing 4.1.3. Targeted Sequencing 4.1.4. Others 4.2. North America Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 4.2.1. Pre-Sequencing 4.2.2. Sequencing 4.2.3. Data Analysis 4.3. North America Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 4.3.1. Screening 4.3.2. Diagnostics 4.4. North America Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 4.4.1. Hospitals 4.4.2. Clinics 4.4.3. Laboratories 4.5. North America Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 4.5.1.1.1. Whole Genome Sequencing 4.5.1.1.2. Whole Exome Sequencing 4.5.1.1.3. Targeted Sequencing 4.5.1.1.4. Others 4.5.1.2. United States Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 4.5.1.2.1. Pre-Sequencing 4.5.1.2.2. Sequencing 4.5.1.2.3. Data Analysis 4.5.1.3. United States Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 4.5.1.3.1. Screening 4.5.1.3.2. Diagnostics 4.5.1.4. United States Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 4.5.1.4.1. Hospitals 4.5.1.4.2. Clinics 4.5.1.4.3. Laboratories 4.5.2. Canada 4.5.2.1. Canada Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 4.5.2.1.1. Whole Genome Sequencing 4.5.2.1.2. Whole Exome Sequencing 4.5.2.1.3. Targeted Sequencing 4.5.2.1.4. Others 4.5.2.2. Canada Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 4.5.2.2.1. Pre-Sequencing 4.5.2.2.2. Sequencing 4.5.2.2.3. Data Analysis 4.5.2.3. Canada Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 4.5.2.3.1. Screening 4.5.2.3.2. Diagnostics 4.5.2.4. Canada Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 4.5.2.4.1. Hospitals 4.5.2.4.2. Clinics 4.5.2.4.3. Laboratories 4.5.3. Mexico 4.5.3.1. Mexico Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 4.5.3.1.1. Whole Genome Sequencing 4.5.3.1.2. Whole Exome Sequencing 4.5.3.1.3. Targeted Sequencing 4.5.3.1.4. Others 4.5.3.2. Mexico Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 4.5.3.2.1. Pre-Sequencing 4.5.3.2.2. Sequencing 4.5.3.2.3. Data Analysis 4.5.3.3. Mexico Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 4.5.3.3.1. Screening 4.5.3.3.2. Diagnostics 4.5.3.4. Mexico Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 4.5.3.4.1. Hospitals 4.5.3.4.2. Clinics 4.5.3.4.3. Laboratories 5. Europe Clinical Oncology Next-Generation Sequencing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 5.2. Europe Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 5.3. Europe Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 5.4. Europe Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 5.5. Europe Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 5.5.1.2. United Kingdom Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 5.5.1.3. United Kingdom Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 5.5.1.4. United Kingdom Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 5.5.2. France 5.5.2.1. France Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 5.5.2.2. France Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 5.5.2.3. France Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 5.5.2.4. France Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 5.5.3.2. Germany Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 5.5.3.3. Germany Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 5.5.3.4. Germany Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 5.5.4.2. Italy Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 5.5.4.3. Italy Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 5.5.4.4. Italy Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 5.5.5.2. Spain Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 5.5.5.3. Spain Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 5.5.5.4. Spain Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 5.5.6.2. Sweden Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 5.5.6.3. Sweden Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 5.5.6.4. Sweden Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 5.5.7.2. Austria Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 5.5.7.3. Austria Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 5.5.7.4. Austria Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 5.5.8.2. Rest of Europe Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 5.5.8.3. Rest of Europe Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 5.5.8.4. Rest of Europe Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Clinical Oncology Next-Generation Sequencing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 6.2. Asia Pacific Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 6.3. Asia Pacific Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 6.5. Asia Pacific Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 6.5.1.2. China Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 6.5.1.3. China Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 6.5.1.4. China Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 6.5.2.2. S Korea Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 6.5.2.3. S Korea Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 6.5.2.4. S Korea Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 6.5.3.2. Japan Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 6.5.3.3. Japan Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 6.5.3.4. Japan Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 6.5.4. India 6.5.4.1. India Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 6.5.4.2. India Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 6.5.4.3. India Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 6.5.4.4. India Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 6.5.5.2. Australia Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 6.5.5.3. Australia Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 6.5.5.4. Australia Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 6.5.6.2. Indonesia Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 6.5.6.3. Indonesia Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 6.5.6.4. Indonesia Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 6.5.7.2. Malaysia Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 6.5.7.3. Malaysia Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 6.5.7.4. Malaysia Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 6.5.8.2. Vietnam Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 6.5.8.3. Vietnam Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 6.5.8.4. Vietnam Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 6.5.9.2. Taiwan Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 6.5.9.3. Taiwan Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 6.5.9.4. Taiwan Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 6.5.10.2. Rest of Asia Pacific Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 6.5.10.3. Rest of Asia Pacific Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 6.5.10.4. Rest of Asia Pacific Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Clinical Oncology Next-Generation Sequencing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 7.2. Middle East and Africa Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 7.3. Middle East and Africa Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 7.5. Middle East and Africa Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 7.5.1.2. South Africa Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 7.5.1.3. South Africa Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 7.5.1.4. South Africa Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 7.5.2.2. GCC Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 7.5.2.3. GCC Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 7.5.2.4. GCC Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 7.5.3.2. Nigeria Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 7.5.3.3. Nigeria Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 7.5.3.4. Nigeria Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 7.5.4.2. Rest of ME&A Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 7.5.4.3. Rest of ME&A Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 7.5.4.4. Rest of ME&A Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 8. South America Clinical Oncology Next-Generation Sequencing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 8.2. South America Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 8.3. South America Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application(2023-2030) 8.4. South America Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 8.5. South America Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 8.5.1.2. Brazil Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 8.5.1.3. Brazil Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 8.5.1.4. Brazil Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 8.5.2.2. Argentina Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 8.5.2.3. Argentina Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 8.5.2.4. Argentina Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Technology (2023-2030) 8.5.3.2. Rest Of South America Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Workflow (2023-2030) 8.5.3.3. Rest Of South America Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by Application (2023-2030) 8.5.3.4. Rest Of South America Clinical Oncology Next-Generation Sequencing Market Size and Forecast, by End User (2023-2030) 9. Global Clinical Oncology Next-Generation Sequencing Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Clinical Oncology Next-Generation Sequencing Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Illumina, Inc., San Diego, California, USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Thermo Fisher Scientific Inc., Waltham, Massachusetts, USA 10.3. Guardant Health, Inc., Redwood City, California, USA 10.4. Pacific Biosciences of California, Inc., Menlo Park, California, USA 10.5. Agilent Technologies, Inc., Santa Clara, California, USA 10.6. Qiagen N.V., Venlo, Netherlands 10.7. Roche Holdings AG (including Foundation Medicine), Basel, Switzerland 10.8. Oxford Nanopore Technologies Ltd., Oxford, United Kingdom 10.9. Genewiz Germany GmbH, Leipzig, Germany 10.10. Sophia Genetics SA, Saint-Sulpice, Switzerland 10.11. Novogene Corporation, Beijing, China 10.12. BGI Group, Shenzhen, China 10.13. Takara Bio Inc., Kusatsu, Japan 10.14. MedGenome Labs Pvt. Ltd., Bengaluru, India 11. Key Findings 12. Industry Recommendations 13. Clinical Oncology Next-Generation Sequencing Market: Research Methodology 14. Terms and Glossary