Global Carbon Tetrachloride Market size was valued at USD 335.24 Million in 2024, and the total Carbon Tetrachloride Market revenue is expected to grow by 4.8 % from 2025 to 2032, reaching nearly USD 487.8 MillionCarbon Tetrachloride Market Overview:

Carbon Tetrachloride is a colorless, non-flammable liquid known for its sweet, chloroform-like odor. Once common in household products such as cleaning agents and fire extinguishers, it has been largely phased out due to its high toxicity. Exposure severely impacts the liver, kidneys, and central nervous system, making its use highly restricted and regulated worldwide. With rising regulatory clarity and essential industrial applications, the global Carbon Tetrachloride (CCl₄) market continues to present tremendous growth opportunities. While its widespread use has declined due to environmental and health concerns, CCl₄ remains indispensable in the production of chlorinated compounds, especially refrigerants and foam-blowing agents. This ongoing demand ensures its role as a critical feedstock in chemical synthesis, particularly for pharmaceuticals, agrochemicals, and polymers. The Carbon Tetrachloride market is shaped by strict environmental policies and safety standards. In 2023, the U.S. Environmental Protection Agency (EPA) implemented a final rule restricting all discontinued uses while permitting essential applications under stringent occupational safeguards. This regulatory framework ensures CCl₄ is only used in controlled industrial environments.To know about the Research Methodology :- Request Free Sample Report

Global Carbon Tetrachloride Market Dynamics

Rising demand for refrigerants to drive the Carbon Tetrachloride Market The increasing demand for refrigerants across various industrial, commercial, and residential sectors. Carbon Tetrachloride is an essential intermediate in the production of chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs), which are widely used as refrigerants in air conditioning, refrigeration, and heat pump systems. While the use of ozone-depleting substances is regulated under the Montreal Protocol, many developing countries, particularly in Asia-Pacific, continue to rely on HCFC-based systems due to their lower cost and well-established infrastructure. Rapid urbanization, growing middle-class income, and increased demand for cold-chain logistics in countries such as India, Indonesia, and Vietnam are further accelerating refrigerant consumption. Also, the product's continued application as a chemical intermediate in pharmaceuticals, agrochemicals, and petroleum refining contributes to its market sustainability. Despite regulatory pressures, advancements in emission control and the development of environmentally compliant production technologies are enabling manufacturers to meet demand responsibly. As refrigeration demand grows, especially in emerging economies, Carbon Tetrachloride remain a crucial industrial compound, reinforcing its market relevance.Stringent Environmental Regulations Limit the Carbon Tetrachloride Market Growth The carbon tetrachloride (CTC) market faces major growth limitations due to strict global regulations driven by its ozone-depleting nature and serious health risks. In the United States, the Environmental Protection Agency (EPA) introduced a rule in December 2024 setting a very low worker exposure limit of 0.03 ppm over an 8-hour workday. This is part of the Toxic Substances Control Act (TSCA), which enforces risk evaluations and bans most consumer and industrial uses, except for chemical manufacturing. Canada strictly controls CTC under the Canadian Environmental Protection Act (CEPA), banning production, import, and export except for rare, essential uses. The European Union enforces similar restrictions through the REACH framework and the Ozone-Depleting Substances Regulation, allowing only limited feedstock use. On a global scale, the Montreal Protocol has led to the near-total phase-out of CTC, with very few permitted exceptions. While some countries, such as Japan and Russia, still allow higher workplace exposure (2–10 ppm), global pressure continues to tighten control. These layered regulatory barriers reduce production flexibility, limit international trade, and discourage new market entrants ultimately restraining the growth of the CTC market. Key Regional Regulations Impacting Carbon Tetrachloride Usage

Technological Innovation & Production Optimization creates lucrative growth opportunities for the Carbon Tetrachloride Market growth Technological innovation is creating substantial growth opportunities in the global carbon tetrachloride (CCl₄) market by enhancing efficiency, sustainability, and application diversity. Continuous-flow reactors and process automation are improving production consistency, reducing waste, and lowering energy consumption. The integration of AI and IoT enables real-time monitoring, predictive maintenance, and improved quality control, making operations safer and more cost-effective. Driven by global environmental regulations such as the Montreal Protocol, companies are shifting toward eco-friendly manufacturing by adopting closed-loop recycling systems and greener feedstocks. Firms like DuPont, Occidental Chemical, and Solvay are leading in sustainable practices, while Tokuyama and Gujarat Alkalies focus on high-purity CCl₄ production for Asia-Pacific’s advanced industrial needs. The use of CCl₄ in producing low-global-warming hydrofluoroolefin (HFO) refrigerants is expanding, especially in automotive and building sectors. Its role in pharmaceutical and agrochemical synthesis is also rising, supported by innovations in separation, purification, and catalyst design. The convergence of sustainability, automation, and application diversification positions the CCl₄ market for long-term, technology-driven expansion.

Region Regulatory Description United States EPA mandates 0.03 ppm exposure limit and bans most uses under TSCA Canada CEPA lists CTC as toxic; production and trade are allowed only for specific essential use European Union REACH and Ozone laws prohibit most uses; only feedstock use permitted under regulation Global (UN Montreal Protocol enforces global phase-out with narrow exceptions for intermediate uses Japan, Russia National laws permit CTC use with higher exposure limits (2–10 ppm), less strict than EPA Global Carbon Tetrachloride Market Segment Analysis

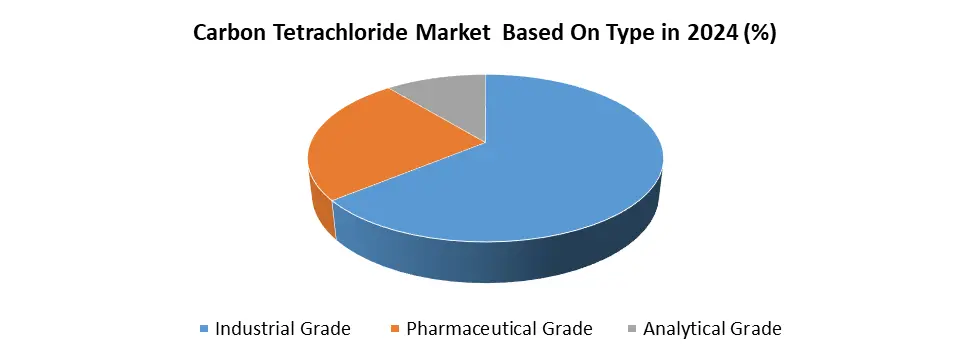

Based on the Grade, On the Basis of Grade the Market is segmented into Industrial Grade ,Pharmaceutical Grade, Analytical Grade.In year 2024, the Industrial Grade segment was dominated the Carbon Tetrachloride Market. its expansive use across multiple industries. This grade is widely employed as a solvent, degreasing agent, and chemical intermediate in sectors such as rubber processing, dry cleaning, paint removers, adhesives, and refrigeration. Its versatility and cost-effectiveness make it the preferred choice for large-scale applications. A major contributor to this dominance is its role as a feedstock in the production of refrigerants, agrochemicals, fire extinguishers, and pesticides, accounting for nearly 30% of the global market revenue. The industrial chemicals sector, particularly in high-demand regions such as China, the United States, and India, continues to rely heavily on industrial grade ccl₄ for both organic and inorganic chemical synthesis. Moreover, the adoption of continuous-flow reactor systems and automation technologies by leading producers such as Tokuyama Corporation, Occidental Chemical, and Gujarat Alkalies & Chemicals has enhanced the efficiency and safety of large-scale CCl₄ production. Integration of AI and IoT tools has further optimized operational workflows and quality control. These technological advancements, combined with growing industrial demand and efficient production capabilities, reinforced the segment's leadership in the global market.

Carbon Tetrachloride Market Regional Insights

The Asia Pacific region held 44% market share of the Carbon Tetrachloride Market in 2024. The expanding industrial base, strong chemical manufacturing capacity, and favorable regulatory environment. China and India were key contributors, with China maintaining its position as the world’s leading chemical producer, generating over USD 2,390 billion in chemical sales in 2022, while India’s chemical sector continued its rapid, nearly 9.3% annual growth. This industrial strength supports consistent demand for CCl₄ as a chemical intermediate in refrigerants, chlorine compounds, agrochemicals, and pharmaceuticals. The region’s growing population and food security needs have boosted the expansion of the agrochemical sector, where Carbon Tetrachloride is used in pesticide and fertilizer production. Technological advancements enhance the region's dominance. Companies like Gujarat Alkalies & Chemicals (India) and Tokuyama Corporation (Japan) have adopted continuous-flow reactors, automation, and AI-driven quality control to improve efficiency and sustainability. Additionally, infrastructure growth and rapid urbanization have increased the demand for industrial chemicals in construction and consumer goods. These combined factors, industrial scale, regulatory flexibility, tech adoption, and agricultural growthsolidify Asia Pacific’s leadership in the global Carbon Tetrachloride Market.The Carbon Tetrachloride Market is highly competitive, with a mix of established chemical manufacturers striving to advance production efficiencies, ensure regulatory compliance, and meet demand across refrigerants, pharmaceuticals, and industrial processing applications. Key players such as Occidental Petroleum Corporation and Tokuyama Corporation are leading the market by investing in process innovation, sustainability alignment, and regional expansions. Occidental Petroleum Corporation (OxyChem), headquartered in the U.S., remains a dominant supplier of carbon tetrachloride and other chlorinated solvents. In 2024, its Chemical segment reported revenues exceeding USD 6.8 billion, with CCl₄ contributing significantly to the company's industrial chemicals portfolio. OxyChem continues to optimize chlor-alkali production lines and expand its footprint in Latin America and Asia through strategic partnerships focused on high-purity applications and safe transport systems. Tokuyama Corporation, based in Japan, is a major producer of chlorinated compounds and specialty chemicals. Its 2024 Fine Chemicals business generated more than 1 billion, with strong growth supported by rising pharmaceutical-grade CCl₄ demand in the Asia-Pacific region. The company has increased investments in eco-efficient manufacturing and has collaborated with regulatory bodies to enhance its sustainable production roadmap. Tokuyama’s commitment to high-quality CCl₄ used in drug synthesis and semiconductor cleaning continues to set it apart. Both companies are expected to strengthen their market positions by leveraging clean technology upgrades, geographic diversification, and high-purity chemical production amid tightening global environmental regulations. Carbon Tetrachloride Market Recent Trends

Carbon Tetrachloride Market Competitive Landscape

Category Key Trend Example Product Market Impact Regulatory Compliance Shift toward low-emission and high-purity CCl₄ production methods Occidental’s Low-Emission Chlorination Process Ensures compliance with environmental standards (e.g., Montreal Protocol); supports long-term supply security Refrigerant Demand Rising demand for feedstock in HCFC and HFC refrigerant production Tokuyama’s High-Purity CCl₄ for R-22 & HFC blends Fuels growth in HVAC and refrigeration markets, particularly in Asia-Pacific and Latin America Process Optimization Integration of continuous-flow chlorination and AI-driven controls INEOS Advanced Chlorine Technologies with IoT Improves production efficiency, reduces operational risks and waste, lowers overall manufacturing cost Carbon Tetrachloride Market Scope: Inquire before buying

Global Carbon Tetrachloride Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 335.24 Mn. Forecast Period 2025 to 2032 CAGR: 4.8% Market Size in 2032: USD 487.8 Mn. Segments Covered: by Product Grade Industrial Grade Pharmaceutical Grade Analytical Grade by Application Chemical Intermediates Industrial Solvent / Synthesis Agrochemicals / Fumigants Blowing Agents & Others Others Carbon Tetrachloride Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Carbon Tetrachloride Market, Key Players

North America Carbon Tetrachloride Market Key Players 1. The Dow Chemical Company 2. Olin Corporation 3. Occidental Petroleum Corporation 4. INEOS Group Holdings S.A Europe Carbon Tetrachloride Market Key Players 1. Solvay S.A. 2. LANXESS AG 3. INEOS Inovyn 4. Kem One Asia Pacific Carbon Tetrachloride Market Key Players 1. Shandong Lubei Chemical Industry Co., Ltd. 2. Shandong Ruqiao Chemical Industry Co., Ltd. 3. Nantong Huachang Chemical Inc. 4. Sanjiang Fine Chemical Co., Ltd. 5. Gujarat Alkalies and Chemicals 6. Tokuyama Corporation 7. Loba Chemie 8. East India Chemicals 9. Chemtex Speciality Ltd. 10. Otto Chemie Pvt. Ltd. 11. SRF Limited Frequently Asked Questions: 1. Which region has the largest share in the Global Carbon Tetrachloride Market? Ans: The Asia Pacific region held the highest share in 2024. 2. What is the growth rate of the Global Carbon Tetrachloride Market? Ans: The Global Market is expected to grow at a CAGR of 4.8% during the forecast period 2025-2032. 3. What is the scope of the Global Carbon Tetrachloride Market report? Ans: The Global Carbon Tetrachloride Market report helps with the PESTEL, PORTER, Recommendations for Investors and leaders, and market estimation for the forecast period. 4. Who are the key players in the Global Carbon Tetrachloride Market? Ans: The important key players in the Global Carbon Tetrachloride Market are The Dow Chemical Company, Olin Corporation, Occidental Petroleum Corporation, INEOS Group Holdings S.A., and Others. 5. What is the study period of this market? Ans: The Global Carbon Tetrachloride Market is studied from 2024 to 2032.

1. Carbon Tetrachloride Market Introduction 1.1.1. Study Assumption and Market Definition 1.1.2. Scope of the Study 1.1.3. Executive Summary 2. Carbon Tetrachloride Market: Competitive Landscape 2.1.1. Ecosystem Analysis 2.1.2. MMR Competition Matrix 2.1.3. Competitive Landscape 2.1.4. Key Players Benchmarking 2.1.4.1. Company Name 2.1.4.2. Business Segment 2.1.4.3. End-user Segment 2.1.4.4. Revenue (2024) 2.1.4.5. Company Locations 2.1.5. Market Structure 2.1.5.1. Market Leaders 2.1.5.2. Market Followers 2.1.5.3. Emerging Players 2.1.6. Mergers and Acquisitions Details 2.1.7. KANO Model Analysis 3. Global Carbon Tetrachloride Market: Dynamics 3.1. Region wise Trends of Carbon Tetrachloride Market 3.1.1. North America Carbon Tetrachloride Market Trends 3.1.2. Europe Carbon Tetrachloride Market Trends 3.1.3. Asia Pacific Carbon Tetrachloride Market Trends 3.1.4. Middle East and Africa Carbon Tetrachloride Market Trends 3.1.5. South America Carbon Tetrachloride Market Trends 3.2. Carbon Tetrachloride Market Dynamics 3.2.1. Global Carbon Tetrachloride Market Driver 3.2.2. Global Carbon Tetrachloride Market Restraints 3.2.3. Global Carbon Tetrachloride Market Opportunities 3.2.4. Global Carbon Tetrachloride Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Carbon Tetrachloride Market: Global Market Size and Forecast by Segmentation (by Value in USD MIllion.) (2024-2032) 4.1.1. Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 4.1.1.1. Industrial Grade 4.1.1.2. Pharmaceutical Grade 4.1.1.3. Analytical Grade 4.1.2. Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 4.1.2.1. Chemical Intermediates 4.1.2.2. Industrial Solvent / Synthesis 4.1.2.3. Agrochemicals / Fumigants 4.1.2.4. Blowing Agents & Others 4.1.2.5. Others 4.1.3. Carbon Tetrachloride Market Size and Forecast, by Region (2024-2032) 4.1.3.1. North America 4.1.3.2. Europe 4.1.3.3. Asia Pacific 4.1.3.4. Middle East and Africa 4.1.3.5. South America 5. North America Carbon Tetrachloride Market Size and Forecast by Segmentation (by Value in USD MIllion.) (2024-2032) 5.1. North America Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 5.1.1. Industrial Grade 5.1.2. Pharmaceutical Grade 5.1.3. Analytical Grade 5.2. North America Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 5.2.1. Chemical Intermediates 5.2.2. Industrial Solvent / Synthesis 5.2.3. Agrochemicals / Fumigants 5.2.4. Blowing Agents & Others 5.2.5. Others 5.3. North America Carbon Tetrachloride Market Size and Forecast, by Country (2024-2032) 5.3.1. United States 5.3.1.1. United States Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 5.3.1.1.1. Industrial Grade 5.3.1.1.2. Pharmaceutical Grade 5.3.1.1.3. Analytical Grade 5.3.1.2. United States Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 5.3.1.2.1. Chemical Intermediates 5.3.1.2.2. Industrial Solvent / Synthesis 5.3.1.2.3. Agrochemicals / Fumigants 5.3.1.2.4. Blowing Agents & Others 5.3.1.2.5. Others 5.3.2. Canada 5.3.2.1. Canada Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 5.3.2.1.1. Industrial Grade 5.3.2.1.2. Pharmaceutical Grade 5.3.2.1.3. Analytical Grade 5.3.2.2. Canada Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 5.3.2.2.1. Chemical Intermediates 5.3.2.2.2. Industrial Solvent / Synthesis 5.3.2.2.3. Agrochemicals / Fumigants 5.3.2.2.4. Blowing Agents & Others 5.3.2.2.5. Others 5.3.2.3. Mexico 5.3.2.4. Mexico Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 5.3.2.4.1. Industrial Grade 5.3.2.4.2. Pharmaceutical Grade 5.3.2.4.3. Analytical Grade 5.3.2.5. Mexico Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 5.3.2.5.1. Chemical Intermediates 5.3.2.5.2. Industrial Solvent / Synthesis 5.3.2.5.3. Agrochemicals / Fumigants 5.3.2.5.4. Blowing Agents & Others 5.3.2.5.5. Others 6. Europe Carbon Tetrachloride Market Size and Forecast by Segmentation (by Value in USD MIllion.) (2024-2032) 6.1. Europe Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 6.2. Europe Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 6.3. Europe Carbon Tetrachloride Market Size and Forecast, by Country (2024-2032) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 6.3.1.2. United Kingdom Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 6.3.2. France 6.3.2.1. France Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 6.3.2.2. France Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 6.3.3. Germany 6.3.3.1. Germany Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 6.3.3.2. Germany Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 6.3.4. Italy 6.3.4.1. Italy Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 6.3.4.2. Italy Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 6.3.5. Spain 6.3.5.1. Spain Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 6.3.5.2. Spain Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 6.3.6. Sweden 6.3.6.1. Sweden Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 6.3.6.2. Sweden Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 6.3.7. Austria 6.3.7.1. Austria Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 6.3.7.2. Austria Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 6.3.8.2. Rest of Europe Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 7. Asia Pacific Carbon Tetrachloride Market Size and Forecast by Segmentation (by Value in USD MIllion.) (2024-2032) 7.1. Asia Pacific Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 7.2. Asia Pacific Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 7.3. Asia Pacific Carbon Tetrachloride Market Size and Forecast, by Country (2024-2032) 7.3.1. China 7.3.1.1. China Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 7.3.1.2. China Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 7.3.2. S Korea 7.3.2.1. S Korea Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 7.3.2.2. S Korea Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 7.3.3. Japan 7.3.3.1. Japan Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 7.3.3.2. Japan Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 7.3.4. India 7.3.4.1. India Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 7.3.4.2. India Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 7.3.5. Australia 7.3.5.1. Australia Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 7.3.5.2. Australia Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 7.3.6. Indonesia 7.3.6.1. Indonesia Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 7.3.6.2. Indonesia Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 7.3.7. Philippines 7.3.7.1. Philippines Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 7.3.7.2. Philippines Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 7.3.8. Malaysia 7.3.8.1. Malaysia Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 7.3.8.2. Malaysia Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 7.3.9. Vietnam 7.3.9.1. Vietnam Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 7.3.9.2. Vietnam Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 7.3.10. Thailand 7.3.10.1. Thailand Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 7.3.10.2. Thailand Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 7.3.11. Rest of Asia Pacific 7.3.11.1. Rest of Asia Pacific Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 7.3.11.2. Rest of Asia Pacific Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 8. Middle East and Africa Carbon Tetrachloride Market Size and Forecast by Segmentation (by Value in USD MIllion.) (2024-2032) 8.1. Middle East and Africa Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 8.2. Middle East and Africa Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 8.3. Middle East and Africa Carbon Tetrachloride Market Size and Forecast, by Country (2024-2032) 8.3.1. South Africa 8.3.1.1. South Africa Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 8.3.1.2. South Africa Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 8.3.2. GCC 8.3.2.1. GCC Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 8.3.2.2. GCC Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 8.3.3. Nigeria 8.3.3.1. Nigeria Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 8.3.3.2. Nigeria Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 8.3.4. Rest of ME&A 8.3.4.1. Rest of ME&A Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 8.3.4.2. Rest of ME&A Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 9. South America Carbon Tetrachloride Market Size and Forecast by Segmentation (by Value in USD MIllion.) (2024-2032) 9.1. South America Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 9.2. South America Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 9.3. South America Carbon Tetrachloride Market Size and Forecast, by Country (2024-2032) 9.3.1. Brazil 9.3.1.1. Brazil Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 9.3.1.2. Brazil Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 9.3.2. Argentina 9.3.2.1. Argentina Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 9.3.2.2. Argentina Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 9.3.3. Rest of South America 9.3.3.1. Rest of South America Carbon Tetrachloride Market Size and Forecast, By Product Grade (2024-2032) 9.3.3.2. Rest of South America Carbon Tetrachloride Market Size and Forecast, By Application (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Additive Players) 10.1. The Dow Chemical Company 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Olin Corporation 10.3. Occidental Petroleum Corporation 10.4. INEOS Group Holdings S.A 10.5. Solvay S.A. 10.6. LANXESS AG 10.7. INEOS Inovyn 10.8. Kem One 10.9. Shandong Lubei Chemical Industry Co., Ltd. 10.10. Shandong Ruqiao Chemical Industry Co., Ltd. 10.11. Nantong Huachang Chemical Inc. 10.12. Sanjiang Fine Chemical Co., Ltd. 10.13. Gujarat Alkalies and Chemicals 10.14. Tokuyama Corporation 10.15. Loba Chemie 10.16. East India Chemicals 10.17. Chemtex Speciality Ltd. 10.18. Otto Chemie Pvt. Ltd. 10.19. SRF Limited 11. Key Findings 12. Analyst Recommendations 13. Carbon Tetrachloride Market: Research Methodology