Global Bronchodilators Market size was valued at USD 22.77 Bn. in 2022 and the total Global Bronchodilators Market revenue is expected to grow by 3.3% from 2023 to 2029, reaching nearly USD 28.75 Bn.Global Bronchodilators Market Overview:

Bronchodilators are inhaled and are used to treat breathing disorders, such as asthma or emphysema. The bronchodilators market is witnessing growth due to factors such as the growing geriatric population, increasing prevalence of lung diseases, and rising awareness about lung disease treatment aided by escalating R&D efforts by key players operating in the market. The growing geriatric population globally is expected to act as a key driver for the market as the elderly population has a five times higher mortality rate attributed to asthma and thus requires enhanced support from bronchodilators. Moreover, the number of people aged over 65 is anticipated to triple by 2025 and is projected to aid the bronchodilators market to become profitable. The development of advanced products is majorly driven by the rising prevalence of respiratory disorders worldwide. Bronchodilators help in relieving the symptoms of respiratory disorders such as asthma and COPD, by opening the airways and counteracting the effects of an attack. This is causing a surge in product approval and launches for treating and managing respiratory disorders which is estimated to supplement the segment growth. The growth of the bronchodilators market is the key parameter resulting in a gradual decrease in the functionality of lungs along with the age of an individual. Thus, these cognitive and physical changes usually make normal breathing difficult in the elderly, thereby, driving the growth of the market.To know about the Research Methodology :- Request Free Sample Report

Global Bronchodilators Market Dynamics:

Global Bronchodilators Market Drivers: Asthma Disease is expected to register a Substantial Growth in the Bronchodilators Market Based on indication, the asthma segment is estimated to garner significant growth during the forecast period. This is majorly attributed to the rising prevalence of asthma worldwide. As per World Health Organization (WHO) data, asthma affected around 262 million people in 2019 and triggered 461,000 deaths worldwide. Asthma is a breathing disorder caused due to narrowing of airway passages within the lungs. The narrowing may occur due to numerous reasons such as muscle spasms, excess production of mucus, or swelling in the airway. Amidst an asthma attack, the muscles in the airway begin to tighten, leading to the narrowing of airways. Moreover, the lining of these passages tends to swell and results in the overproduction of mucus. This causes difficulty in breathing. Bronchodilators relieve these symptoms of asthma by opening the airways and counteract the effects of an attack. In addition, the surge in product approval and launches for treating asthma is further estimated to supplement the segment growth. Sanofi received European Commission approval for its ‘Dupixent’ used in treating patients with severe asthma. The increasing number of pipeline products along with an upsurge in asthma-affected population and ease of availability of bronchodilator medications are expected to propel the growth of the bronchodilators market during the forecast period. Bronchodilators Market Thrives on Growing Geriatric Population and Increasing Prevalence of Lung Diseases, Boost by R&D Efforts of Key Players The bronchodilators market is witnessing growth due to factors such as the growing geriatric population, increasing prevalence of lung diseases, and rising awareness about lung disease treatment aided by escalating R&D efforts by key players operating in the market. The growing geriatric population globally is expected to act as a key driver for the market as the elderly population has a five times higher mortality rate attributed to asthma and thus requires enhanced support from bronchodilators. The development of advanced products is majorly driven by the rising prevalence of respiratory disorders worldwide. Bronchodilators help in relieving the symptoms of respiratory disorders such as asthma and COPD, by opening the airways and counteracting the effects of an attack. This is causing a surge in product approval and launches for treating and managing respiratory disorders which is estimated to supplement the segment growth. The growth of the bronchodilators market is the key parameter resulting in a gradual decrease in the functionality of lungs along with the age of an individual. Thus, these cognitive and physical changes usually make normal breathing difficult in the elderly, thereby, driving the growth of the market. Global Bronchodilators Market Opportunity- Bronchodilators Market Sees Opportunities with Growing Prevalence of Respiratory Disorders and Increasing Disposable Income Worldwide The increasing prevalence of respiratory disorders such as asthma and COPD, as well as the rise in the incidence of respiratory diseases due to cigarette smoking, are driving the demand for bronchodilators. This trend is expected to continue in the coming years, creating opportunities for companies operating in the bronchodilators market. Moreover, the rise in disposable income and the growing geriatric population are also contributing to the growth of the bronchodilators market. As people become more affluent, they are more likely to seek medical treatment for respiratory disorders. Additionally, the aging population is at a higher risk of developing respiratory diseases, which is expected to drive demand for bronchodilators in the coming years. The bronchodilators market presents significant opportunities for companies to expand their product offerings and increase their market share. Companies that are able to effectively address the needs of patients with respiratory disorders are well-positioned to capitalize on these opportunities and achieve long-term growth. Global Bronchodilators Market Restraints- Bronchodilators Market Hindered by Stringent Regulatory Framework and Shortage of Albuterol Inhalers The market is significantly hampered owing to the regulatory framework related to bronchodilators. The regulatory approval procedure is frequently critiqued for being excessively slow or lenient when safety issues arise. The regulatory atmosphere is already complex, and the FDA is becoming ever more careful as dependency on bronchodilators is growing. Hence, the stringency of regulations associated with the approval process for bronchodilators is limiting the market growth. Moreover, in December 2022, the U.S. faced a shortage of albuterol inhalers demonstrating an unmet need that can be fulfilled by new generic companies.Global Bronchodilators Market Segment Analysis:

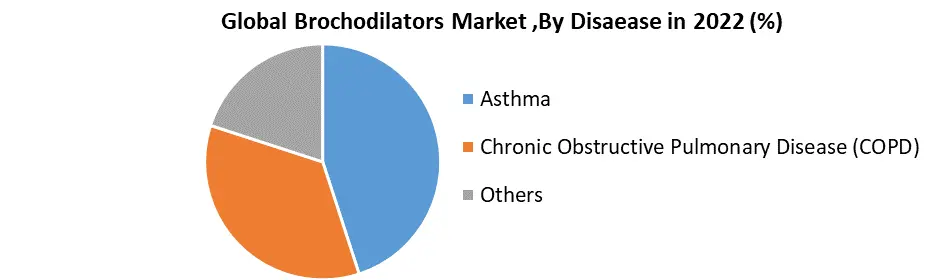

Based on Drug Class: Beta-adrenergic dominated the bronchodilator Market in 2022 and is expected to continue its dominance during the forecast period Beta-adrenergic bronchodilators relax the muscles that surround the airways for dilating bronchial airways. This class of medications is beta-2 agonists and targets smooth muscle cell receptors for the dilation of airways. Major products in the short-acting category include levalbuterol (Xopenex HFA), albuterol (Proair HFA, Proventil HFA, AccuNeb, Ventolin HFA), and epinephrine injection. Albuterol is the major revenue-generating molecule in this category and an increasing number of generic approvals and new launches are being observed for this molecule by FDA to meet the rising demands. For instance, in May 2022, Teva Pharmaceutical Industries Ltd. represented the potential of ProAir Digihaler (albuterol sulfate) inhalation powder that can be used for the treatment of patients with Asthma. The anticholinergic bronchodilators segment is expected to show a lucrative growth rate during the forecast period. The growth of the segment is attributed to the availability of anticholinergics in both long and short-acting formulations. Furthermore, anticholinergic bronchodilators prevent the parasympathetic nerve reflexes from constricting the airways, allowing the airways to remain open. Chronic obstructive pulmonary disease (COPD) is commonly treated with anticholinergic bronchodilators which are considered as the first line of therapy for the treatment of COPD. However, the growth of the segment is hampered is linked to reduced health outcomes, especially in the elderly, with a 60% increase in fall-related hospitalizations, a 50% rise in dementia risk, and a 30% increase in mortality associated with anticholinergics. Based on the type of disease: The disease segment dominated the Polyurethane Additive Market in 2022 and is expected to continue its dominance during the forecast period. The dominance of the segment is attributed to the increasing prevalence of asthma among the population. The segment has a strong research pipeline, with many candidates in late-stage or mid-stage development. Several double and triple combination inhalers for asthma are also in the last stages of development, with the objective of increasing medication adherence. For instance, in May 2022, PT027 (Albuterol/Budesonide Fixed-Dose Combo), developed through AstraZeneca and Avillion collaboration, displayed promising results in Phase III clinical trials and is accepted by FDA as a new drug application filed by both companies. The Chronic obstructive pulmonary disease (COPD) segment is expected to show lucrative growth during the forecast period. The growth of the segment is associated with the rising geriatric population as a result of which the demand for COPD drugs is also expected to surge. Individuals aged over 65 years are at higher risk of developing COPD. The prevalence of COPD is lower than asthma, however, leads to 5% of deaths globally. Overdiagnosis is also a factor associated with a high prevalence of COPD. The condition is more prevalent in low- and middle-income countries and has a high rate of mortality.

Global Bronchodilators Market Regional Insights:

North American region dominated the Polyurethane Additive Market in 2022 and is expected to continue its dominance during the forecast period. North America dominated the bronchodilators market in 2022, which is attributed to the increasing prevalence of COPD and asthma, a rising geriatric population, and increasing demand for high-efficacy and fast-acting drugs in the region. The rising COPD cases in the region is attributed to air pollution, working with chemicals, dust and fumes, second-hand smoke, and a history of childhood lung infection. According to the American Lung Association, cigarette smoking is responsible for 85 to 90% of all COPD cases. The region has a high number of smokers which is estimated to be 30.8 million adults in the U.S. and more than 16 million people living in the region are suffering from smoking-related diseases.Global Bronchodilators Market Scope: Inquire before buying

Bronchodilators Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 22.77 Bn. Forecast Period 2023 to 2029 CAGR: 3.3% Market Size in 2029: US $ 28.75 Bn. Segments Covered: by Drug Class Beta-Adrenergic Bronchodilators Xanthine Derivatives Anticholinergic Bronchodilators by Route Of Administration Oral Nasal (Inhalable) Injectable by Disease Asthma Chronic Obstructive Pulmonary Disease (COPD) Others Bronchodilators Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest) South America (Brazil, Argetina and Rest of South America)Global Bronchodilators Market Companies

1. F. Hoffmann-La Roche Ltd 2. GSK plc. 3. Johnson & Johnson Services Inc. 4. AstraZeneca 5. Siemens Healthcare GmbH 6. Abbott 7. Bio-Rad Laboratories, Inc. 8. Thermo Fisher Scientific 9. Quest Diagnostics Incorporated. 10. FOUNDATION MEDICINE, INC.Frequently Asked Questions:

1] What segments are covered in the Global Bronchodilators Market report? Ans. The segments covered in the Global Bronchodilators Market report are based on Disease, Route of Administration, Drug Class, and Region. 2] Which region is expected to hold the highest share in the Global Bronchodilators Market? Ans. The Asia Pacific region is expected to hold the highest share of the Global Bronchodilators Market. 3] What is the market size of the Global Bronchodilators Market by 2029? Ans. The market size of the Global Bronchodilators Market by 2029 is expected to reach USD 28.75 Bn. 4] What is the forecast period for the Global Bronchodilators Market? Ans. The forecast period for the Global Bronchodilators Market is 2022-2029. 5] What was the market size of the Global Bronchodilators Market in 2022? Ans. The market size of the Global Bronchodilators Market in 2022 was valued at USD 22.77 Bn.

1. Global Bronchodilators Market: Research Methodology 2. Global Bronchodilators Market: Executive Summary 3. Global Bronchodilators Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Global Bronchodilators Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Global Bronchodilators Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Global Bronchodilators Market Size and Forecast, by Drug Class (2022-2029) 5.1.1. Beta-Adrenergic Bronchodilators 5.1.2. Xanthine Derivatives 5.1.3. Anticholinergic Bronchodilators 5.2. Global Bronchodilators Market Size and Forecast, by Route of Administration (2022-2029) 5.2.1. Oral 5.2.2. Nasal (Inhalable) 5.2.3. Injectable 5.3. Global Bronchodilators Market Size and Forecast, by Disease (2022-2029) 5.3.1. Asthma 5.3.2. Chronic Obstructive Pulmonary Disease (COPD) 5.3.3. Others 6. North America Global Bronchodilators Market Size and Forecast (by Value USD and Volume Units) 6.1. North America Global Bronchodilators Market Size and Forecast, by Drug Class (2022-2029) 6.1.1. Beta-Adrenergic Bronchodilators 6.1.2. Xanthine Derivatives 6.1.3. Anticholinergic Bronchodilators 6.2. North America Global Bronchodilators Market Size and Forecast, by Route of Administration (2022-2029) 6.2.1. Oral 6.2.2. Nasal (Inhalable) 6.2.3. Injectable 6.3. North America Global Bronchodilators Market Size and Forecast, by Disease (2022-2029) 6.3.1. Asthma 6.3.2. Chronic Obstructive Pulmonary Disease (COPD) 6.3.3. Others 7. Global Bronchodilators Market Size and Forecast (by Value USD and Volume Units) 7.1. Global Bronchodilators Market Size and Forecast, by Drug Class (2022-2029) 7.1.1. Beta-Adrenergic Bronchodilators 7.1.2. Xanthine Derivatives 7.1.3. Anticholinergic Bronchodilators 7.2. Global Bronchodilators Market Size and Forecast, by Route of Administration (2022-2029) 7.2.1. Oral 7.2.2. Nasal (Inhalable) 7.2.3. Injectable 7.3. Global Bronchodilators Market Size and Forecast, by Disease (2022-2029) 7.3.1. Asthma 7.3.2. Chronic Obstructive Pulmonary Disease (COPD) 7.3.3. Others 8. Asia Pacific Global Bronchodilators Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific Global Bronchodilators Market Size and Forecast, by Drug Class (2022-2029) 8.1.1. Beta-Adrenergic Bronchodilators 8.1.2. Xanthine Derivatives 8.1.3. Anticholinergic Bronchodilators 8.2. Asia Pacific Global Bronchodilators Market Size and Forecast, by Route of Administration (2022-2029) 8.2.1. Oral 8.2.2. Nasal (Inhalable) 8.2.3. Injectable 8.3. Asia Pacific Global Bronchodilators Market Size and Forecast, by Disease (2022-2029) 8.3.1. Asthma 8.3.2. Chronic Obstructive Pulmonary Disease (COPD) 8.3.3. Others 9. Middle East and Africa Global Bronchodilators Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa Global Bronchodilators Market Size and Forecast, by Drug Class (2022-2029) 9.1.1. Beta-Adrenergic Bronchodilators 9.1.2. Xanthine Derivatives 9.1.3. Anticholinergic Bronchodilators 9.2. Middle East and Africa Global Bronchodilators Market Size and Forecast, by Route of Administration (2022-2029) 9.2.1. Oral 9.2.2. Nasal (Inhalable) 9.2.3. Injectable 9.3. Middle East and Africa Global Bronchodilators Market Size and Forecast, by Disease (2022-2029) 9.3.1. Asthma 9.3.2. Chronic Obstructive Pulmonary Disease (COPD) 9.3.3. Others 10. South America Global Bronchodilators Market Size and Forecast (by Value USD and Volume Units) 10.1. South America Global Bronchodilators Market Size and Forecast, by Drug Class (2022-2029) 10.1.1. Beta-Adrenergic Bronchodilators 10.1.2. Xanthine Derivatives 10.1.3. Anticholinergic Bronchodilators 10.2. South America Global Bronchodilators Market Size and Forecast, by Route of Administration (2022-2029) 10.2.1. Oral 10.2.2. Nasal (Inhalable) 10.2.3. Injectable 10.3. South America Global Bronchodilators Market Size and Forecast, by Disease (2022-2029) 10.3.1. Asthma 10.3.2. Chronic Obstructive Pulmonary Disease (COPD) 10.3.3. Others 11. Company Profile: Key players 11.1. F. Hoffmann-La Roche Ltd 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. GSK plc. 11.3. Johnson & Johnson Services Inc. 11.4. AstraZeneca 11.5. Siemens Healthcare GmbH Abbott 11.6. Bio-Rad Laboratories, Inc. 11.7. Thermo Fisher Scientific 11.8. Quest Diagnostics Incorporated. 11.9. FOUNDATION MEDICINE, INC. 12. Key Findings 13. Industry Recommendation