Global Basalt Fiber Market size was valued at USD 313.87 Mn in 2024 and the total Basalt Fiber revenue is expected to grow at a CAGR of 12.5% from 2025 to 2032, reaching nearly USD 805.33 Mn.Basalt Fiber Market Overview:

The basalt fiber market is experiencing steady growth due to its increasing applications across various industries. Basalt fiber, derived from basalt rock, offers several advantages such as high strength, durability, and resistance to corrosion and heat. These properties make it suitable for use in the construction, automotive, aerospace, and marine sectors. In the construction industry, basalt fiber is utilized in the production of reinforcing materials for concrete structures, providing improved strength and longevity. In the automotive sector, it finds applications in manufacturing lightweight components for vehicles, contributing to fuel efficiency and environmental sustainability. The market is driven by the growing demand for sustainable and eco-friendly materials, coupled with advancements in manufacturing technologies. Also, government initiatives promoting infrastructure development and the adoption of lightweight materials are boosting Basalt Fiber market growth. According to MMR Study Report, the construction industry's $1.8 trillion value in the USA and $12.74 trillion globally presents a vast market for basalt fiber. Labor shortages affecting 74.2% of the global market and rising material costs underscore the need for cost-effective solutions such as basalt fiber, which requires fewer skilled workers for installation and offers long-term durability. Anticipated growth in the global residential construction market, expected to reach $8.2 trillion by 2030, aligns with basalt fiber's suitability for residential applications, driving its market growth. he industry's shift towards green building practices and technological adoption, including drones and AR/VR, further enhances basalt fiber's prospects. Future predictions of AI and robotics integration in construction highlight basalt fiber's potential to meet evolving industry demands for sustainable and innovative materials, positioning it for continued growth.To know about the Research Methodology:-Request Free Sample Report

Global Basalt Fiber Market: Dynamics

High strength and sustainability boost Basalt Fiber Market Growth

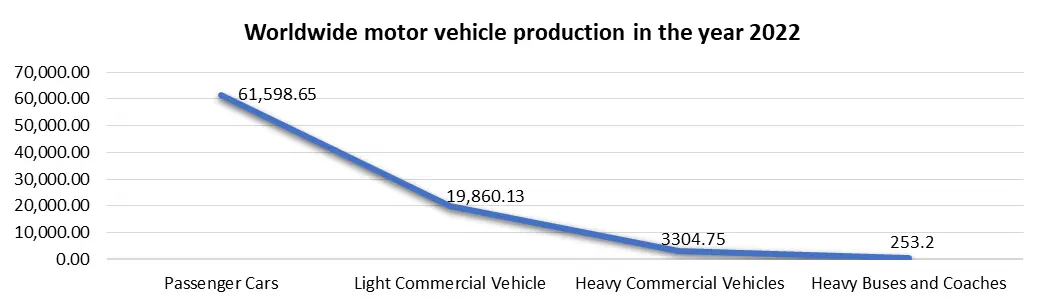

In the realm of materials innovation, Basalt Fiber emerges as a standout contender in the Basalt Fiber market, boosted by its exceptional strength and unwavering commitment to sustainability. At the heart of its appeal lies a remarkable fusion of robust mechanical properties and eco-conscious origins, making it a driving force in diverse industries. Imagine a material that not only withstands the rigors of demanding applications but also treads lightly on the planet. Basalt Fiber embodies this ideal, sourced from volcanic rock formations and processed into fibers that rival the strength of traditional counterparts such as Carbon Fiber and Glass Fiber. Basalt Fiber's innate ability to balance brawn with environmental responsibility sets it apart. As industries seek solutions that marry performance with sustainability, Basalt Fiber steps into the spotlight, offering a compelling alternative in the Basalt Fiber market. It stands as a testament to innovation that doesn't compromise on integrity, providing a pathway to a greener, more resilient future. In a world where strength and sustainability are paramount, Basalt Fiber shines as a beacon of possibility. Its allure lies not only in its formidable mechanical prowess but also in its commitment to preserving the planet for generations to come. As industries embrace the call for greener alternatives, Basalt Fiber stands ready to lead the charge, driving progress with every fiber of its being. High Competition from Alternative Materials limits the Basalt Fiber Market Growth The basalt fiber market faces significant competition from alternative materials, which constrains its growth prospects in several ways. Alternative materials such as carbon fiber, aramid fiber, and glass fiber offer diverse properties and applications, posing a challenge to basalt fiber adoption. Carbon fiber, known for its exceptional strength-to-weight ratio and stiffness, competes directly with basalt fiber in applications where lightweight and high-performance materials are required. Aramid fiber, renowned for its high tensile strength and heat resistance, finds applications in industries such as aerospace and military where basalt fiber potentially be utilized. Glass fiber, widely used for its cost-effectiveness and versatility, offers competition in various applications where basalt fiber is an alternative. The established presence and proven performance of these alternative materials create a barrier to basalt fiber penetration into existing markets. The extensive infrastructure and supply chains supporting these alternative materials make it challenging for basalt fiber to gain a foothold in certain industries. To overcome the high competition from alternative materials, basalt fiber manufacturers need to differentiate their products by highlighting unique advantages such as lower cost, environmental sustainability, or specific performance characteristics. Also, targeted marketing efforts and strategic partnerships help increase awareness and drive the adoption of basalt fiber in industries where it offers distinct advantages over traditional alternatives. The increasing demand for carbon fiber from the year 2019 to 2024 is impacting on the demand of the Basalt Fiber Market.Increasing Usage in the Automotive Industry creates lucrative growth opportunities for the Basalt Fiber Market growth The increasing usage of basalt fiber in the automotive industry creates lucrative growth opportunities for the Basalt Fiber market due to several factors. Basalt fiber, derived from natural volcanic rock, offers exceptional strength, durability, and heat resistance properties, making it an attractive alternative to traditional materials like steel and fiberglass in automotive applications. As automakers strive to reduce vehicle weight to improve fuel efficiency and meet stringent emissions regulations, basalt fiber's lightweight nature makes it an ideal candidate for use in components such as body panels, chassis, and interior parts. Basalt fiber's superior mechanical properties, including high tensile strength and corrosion resistance, enhance the overall performance and longevity of automotive components, reducing maintenance costs and improving vehicle reliability. Also, the eco-friendly and sustainable nature of basalt fiber aligns with the automotive industry's increasing focus on environmental sustainability, further driving its adoption. As demand for lightweight, durable, and environmentally friendly materials continues to rise in the automotive sector, the Basalt Fiber market is poised for significant growth. Companies involved in basalt fiber production, processing, and application development stand to benefit from the expanding opportunities in the automotive industry, catering to the growing demand for innovative solutions that improve vehicle performance, efficiency, and sustainability.

Basalt Fiber Market Segment Analysis:

Based On Form, the Continuous segment dominated the Form segment of the Basalt Fiber Market in the year 2024. The continuous basalt fibers offer superior mechanical properties compared to chopped fibers, making them more desirable for applications requiring strength and durability, such as construction, automotive, and aerospace industries. Also, continuous fibers provide better uniformity and consistency in terms of quality and performance, resulting in higher reliability in end products. This consistency makes them preferred in manufacturing processes where precise specifications are crucial. Continuous fibers enable automated production processes, leading to increased efficiency and lower production costs over time. Their versatility allows for a wide range of applications, from reinforcement in composites to insulation and textiles. It exhibits excellent resistance to corrosion, chemicals, and extreme temperatures, expanding its utility across diverse industries. Overall, these factors contribute to the continuous segment's dominance in the Basalt Fiber Market, showcasing its potential for sustained growth and innovation. Based On Usage, the composite segment dominated the Usage sub-segment of the Basalt Fiber Market in the year 2024. In the Basalt Fiber industry, the composite segment has surged ahead in the Usage sub-segment due to its versatility and adaptability across various industries. Composites, reinforced with basalt fibers, offer exceptional strength, durability, and corrosion resistance, making them highly sought after in applications such as automotive, aerospace, construction, and marine sectors. The key factor driving the dominance of the composite segment is its ability to replace traditional materials like steel and fiberglass in many applications, offering superior performance at a competitive cost. Additionally, the increasing emphasis on lightweight materials to enhance fuel efficiency and reduce carbon footprint has boosted the demand for basalt fiber composites in transportation industries.Also, advancements in manufacturing processes have made it easier to integrate basalt fibers into composite materials, expanding their range of applications and driving market growth. As industries continue to prioritize sustainability and performance, the composite segment is expected to maintain its dominance in the Basalt Fiber Market's Usage sub-segment.

Basalt Fiber Market Regional Analysis:

Asia Pacific Region dominated the Basalt Fiber Market in the year 2024. The Asia Pacific region's dominance in the Basalt Fiber Market attributed to several key factors. Firstly, rapid industrialization and urbanization in countries like China, India, and Japan have led to a surge in infrastructure development, driving the demand for basalt fiber-based products in the construction, automotive, and manufacturing sectors. The region boasts significant manufacturing capabilities and technological advancements, enabling efficient production of basalt fibers and composites at competitive costs. This has attracted investments from both domestic and international players, further fueling market growth. The growing awareness about the benefits of basalt fibers, such as high strength-to-weight ratio, corrosion resistance, and environmental sustainability, has spurred their adoption across various industries in the Asia Pacific region. Governments' initiatives promoting the use of eco-friendly materials and stringent regulations on emissions have also contributed to the Basalt Fiber Market's growth. Also, the presence of a large consumer base and increasing disposable income levels in emerging economies have boosted demand for end-user products such as automotive components, textiles, and construction materials, all of which utilize basalt fibers. Collectively, these factors have positioned the Asia Pacific region as a dominant force in the Basalt Fiber Market.Basalt Fiber Industry Ecosystem:

The Scope of the Report for Global Basalt Fiber Market: Inquire before buying

Global Basalt Fiber Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 313.87 Mn. Forecast Period 2025 to 2032 CAGR: 12.5% Market Size in 2032: USD 805.33 Mn. Segments Covered: by Form Continuous Discrete by Usage Composite Non-Composites by End User Industry Construction & Infrastructure Automotive & Transportation Electrical & Electronics Wind Energy Marine Others Basalt Fiber Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key players of the Basalt fiber market

Major market players in the basalt fiber industry include companies that specialize in advanced composite materials and manufacturing processes. The top Basalt Fiber manufacturers are heavily investing in research and development to enhance product performance and broaden their application range. These companies are implementing various strategic initiatives to strengthen their global presence such as launching innovative products, pursuing mergers and acquisitions, forming strategic partnerships, and collaborating with research organizations. Additionally, they focus on developing cost-effective solutions and sustainable practices to maintain their leadership in the basalt fiber market. Europe 1. Basaltex NV (Belgium) 2. Technobasalt-Invest LLC (Ukraine) 3. Mafic SA (Luxembourg) 4. INCOTELOGY GmbH (Germany) 5. Fiberbas Construction and Building Technologies (Turkey) North America 1. Sudaglass Fiber Technology (USA) Asia Pacific 1. Zhejiang GBF Basalt Fiber Co., Ltd. (China) 2. Zhejiang Jiuyun Fiber Technology Co., Ltd. (China) 3. Shanxi Basalt Fiber Technology Co., Ltd. (China) 4. GBF Basalt Fiber Co., Ltd. (China) 5. Mudanjiang Basalt Fiber Co., Ltd. (China) 6. Jiangsu Tianlong Continuous Basalt Fiber High-tech Co., Ltd. (China) 7. Zhongjie Composite Materials Co., Ltd. (China) 8. Hengdian Group Shanghai Russia & Gold Basalt Fiber Co., Ltd. (China) 9. Jiangsu Green Materials Vally New Material T&D Co., Ltd. (China) 10. Sichuan Aerospace Tuoxin Basalt Industrial Co., Ltd. (China) 11. NMG Corporation (Russia) Frequently Asked Questions 1] What segments are covered in the Global Basalt fiber Market report? Ans. The segments covered in the Basalt fiber Market report are based on, Form, Usage, End Use Industry, and Regions. 2] Which region is expected to hold the highest share of the Global Market? Ans. The Asia Pacific region is expected to hold the highest share of the Basalt fiber Market. 3] What is the market size of the Global Market by 2032? Ans. The market size of the Basalt fiber Market by 2032 is expected to reach US$ 805.33 Mn. 4] What was the market size of the Global Market in 2024? Ans. The market size of the Basalt fiber Market in 2024 was valued at US$ 313.87 Mn. 5] Key players in the Basalt fiber Market. Ans. Agilent Technologies, Inc. (United States), Thermo Fisher Scientific Inc. (United States), Danaher Corporation (United States), PerkinElmer, Inc. (United States), Bio-Rad Laboratories, Inc. (United States)

1. Basalt Fiber Market Executive Summary 1.1. Market Overview 1.2. Market Size (2024) and Forecast (2025-2032) and Y-O-Y% 1.3. Market Size (USD) and Market Share (%) – By Segments and Regions 2. Global Basalt Fiber Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Headquarter 2.2.3. Business Segment 2.2.4. End-user Segment 2.2.5. Y-O-Y% 2.2.6. Revenue (2024) 2.2.7. Profit Margin 2.2.8. Market Share 2.2.9. Company Locations 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Consolidation of the Market 2.4.1. Strategic Initiatives 2.4.2. Mergers and Acquisitions 2.4.3. Collaborations and Partnerships 2.4.4. Developments and Innovations 2.5. Basalt Fiber Industry Ecosystem 2.5.1. Ecosystem Analysis 2.5.2. Role of the Companies in the Ecosystem 3. Basalt Fiber Market: Dynamics 3.1. Basalt Fiber Market Trends by Region 3.1.1. North America 3.1.2. Europe 3.1.3. Asia Pacific 3.1.4. Middle East and Africa 3.1.5. South America 3.2. Basalt Fiber Market Drivers 3.3. Basalt Fiber Market Restraints 3.4. Basalt Fiber Market Opportunities 3.5. Basalt Fiber Market Challenges 3.6. PORTER’s Five Forces Analysis 3.6.1. Intensity of the Rivalry 3.6.2. Threat of New Entrants 3.6.3. Bargaining Power of Suppliers 3.6.4. Bargaining Power of Buyers 3.6.5. Threat of Substitutes 3.7. PESTLE Analysis 3.7.1. Political Factors 3.7.2. Economic Factors 3.7.3. Social Factors 3.7.4. Legal Factors 3.7.5. Environmental Factors 3.8. Technological Analysis 3.8.1. Key Technologies 3.8.1.1. Advanced Melting and Extrusion Techniques 3.8.1.2. Continuous Fiber Spinning Processes 3.8.1.3. Surface Treatment and Coating Innovations 3.8.1.4. Automated Fiber Placement and Weaving Technologies 3.8.2. Complimentary Technologies 3.8.2.1. Hybrid Composites Integration with Basalt Fibers 3.8.2.2. Resin Compatibility and Composite Material Innovations 3.8.2.3. Recycling and Reprocessing Technologies for Basalt Composites 3.8.3. Technological Roadmap 3.9. Regulatory Landscape 3.9.1. Market Regulation by Region 3.9.1.1. North America 3.9.1.2. Europe 3.9.1.3. Asia Pacific 3.9.1.4. Middle East and Africa 3.9.1.5. South America 3.9.2. Impact of Regulations on Market Dynamics 3.9.2.1. Construction Standards 3.9.3. Government Schemes and Initiatives 4. Global Basalt Fiber Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 4.1. Global Basalt Fiber Market Size and Forecast, by Form (2024-2032) 4.1.1. Continuous 4.1.2. Discrete 4.2. Global Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 4.2.1. Composite 4.2.2. Non-Composites 4.3. Global Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 4.3.1. Construction & Infrastructure 4.3.2. Automotive & Transportation 4.3.3. Electrical & Electronics 4.3.4. Wind Energy 4.3.5. Marine 4.3.6. Others 4.4. Global Basalt Fiber Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Basalt Fiber Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 5.1. North America Basalt Fiber Market Size and Forecast, by Form (2024-2032) 5.1.1. Continuous 5.1.2. Discrete 5.2. North America Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 5.2.1. Composite 5.2.2. Non-Composites 5.3. North America Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 5.3.1. Construction & Infrastructure 5.3.2. Automotive & Transportation 5.3.3. Electrical & Electronics 5.3.4. Wind Energy 5.3.5. Marine 5.3.6. Others 5.4. North America Basalt Fiber Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Basalt Fiber Market Size and Forecast, by Form (2024-2032) 5.4.1.1.1. Continuous 5.4.1.1.2. Discrete 5.4.1.2. United States Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 5.4.1.2.1. Composite 5.4.1.2.2. Non-Composites 5.4.1.3. United States Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 5.4.1.3.1. Construction & Infrastructure 5.4.1.3.2. Automotive & Transportation 5.4.1.3.3. Electrical & Electronics 5.4.1.3.4. Wind Energy 5.4.1.3.5. Marine 5.4.1.3.6. Others 5.4.2. Canada 5.4.2.1. Canada Basalt Fiber Market Size and Forecast, by Form (2024-2032) 5.4.2.1.1. Continuous 5.4.2.1.2. Discrete 5.4.2.2. Canada Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 5.4.2.2.1. Composite 5.4.2.2.2. Non-Composites 5.4.2.3. Canada Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 5.4.2.3.1. Construction & Infrastructure 5.4.2.3.2. Automotive & Transportation 5.4.2.3.3. Electrical & Electronics 5.4.2.3.4. Wind Energy 5.4.2.3.5. Marine 5.4.2.3.6. Others 5.4.3. Mexico 5.4.3.1. Mexico Basalt Fiber Market Size and Forecast, by Form (2024-2032) 5.4.3.1.1. Continuous 5.4.3.1.2. Discrete 5.4.3.2. Mexico Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 5.4.3.2.1. Composite 5.4.3.2.2. Non-Composites 5.4.3.3. Mexico Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 5.4.3.3.1. Construction & Infrastructure 5.4.3.3.2. Automotive & Transportation 5.4.3.3.3. Electrical & Electronics 5.4.3.3.4. Wind Energy 5.4.3.3.5. Marine 5.4.3.3.6. Others 6. Europe Basalt Fiber Market Size and Forecast by Segmentation (by Value USD Mn) (2024-2032) 6.1. Europe Basalt Fiber Market Size and Forecast, by Form (2024-2032) 6.2. Europe Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 6.3. Europe Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 6.4. Europe Basalt Fiber Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Basalt Fiber Market Size and Forecast, by Form (2024-2032) 6.4.1.2. United Kingdom Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 6.4.1.3. United Kingdom Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 6.4.2. France 6.4.2.1. France Basalt Fiber Market Size and Forecast, by Form (2024-2032) 6.4.2.2. France Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 6.4.2.3. France Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Basalt Fiber Market Size and Forecast, by Form (2024-2032) 6.4.3.2. Germany Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 6.4.3.3. Germany Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Basalt Fiber Market Size and Forecast, by Form (2024-2032) 6.4.4.2. Italy Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 6.4.4.3. Italy Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Basalt Fiber Market Size and Forecast, by Form (2024-2032) 6.4.5.2. Spain Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 6.4.5.3. Spain Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Basalt Fiber Market Size and Forecast, by Form (2024-2032) 6.4.6.2. Sweden Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 6.4.6.3. Sweden Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Basalt Fiber Market Size and Forecast, by Form (2024-2032) 6.4.7.2. Austria Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 6.4.7.3. Austria Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Basalt Fiber Market Size and Forecast, by Form (2024-2032) 6.4.8.2. Rest of Europe Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 6.4.8.3. Rest of Europe Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 6.4.8.4. Rest of Europe DELETE 7. Asia Pacific Basalt Fiber Market Size and Forecast by Segmentation (by Value USD Mn) (2024-2032) 7.1. Asia Pacific Basalt Fiber Market Size and Forecast, by Form (2024-2032) 7.2. Asia Pacific Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 7.3. Asia Pacific Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 7.4. Asia Pacific Basalt Fiber Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Basalt Fiber Market Size and Forecast, by Form (2024-2032) 7.4.1.2. China Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 7.4.1.3. China Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Basalt Fiber Market Size and Forecast, by Form (2024-2032) 7.4.2.2. S Korea Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 7.4.2.3. S Korea Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Basalt Fiber Market Size and Forecast, by Form (2024-2032) 7.4.3.2. Japan Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 7.4.3.3. Japan Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 7.4.4. India 7.4.4.1. India Basalt Fiber Market Size and Forecast, by Form (2024-2032) 7.4.4.2. India Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 7.4.4.3. India Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Basalt Fiber Market Size and Forecast, by Form (2024-2032) 7.4.5.2. Australia Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 7.4.5.3. Australia Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 7.4.6. ASEAN 7.4.6.1. ASEAN Basalt Fiber Market Size and Forecast, by Form (2024-2032) 7.4.6.2. ASEAN Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 7.4.6.3. ASEAN Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 7.4.7. Rest of Asia Pacific 7.4.7.1. Rest of Asia Pacific Basalt Fiber Market Size and Forecast, by Form (2024-2032) 7.4.7.2. Rest of Asia Pacific Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 7.4.7.3. Rest of Asia Pacific Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 8. South America Basalt Fiber Market Size and Forecast by Segmentation (by Value USD Mn) (2024-2032) 8.1. South America Basalt Fiber Market Size and Forecast, by Form (2024-2032) 8.2. South America Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 8.3. South America Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 8.4. South America Basalt Fiber Market Size and Forecast, by Country (2024-2032) 8.4.1. Brazil 8.4.1.1. Brazil Basalt Fiber Market Size and Forecast, by Form (2024-2032) 8.4.1.2. Brazil Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 8.4.1.3. Brazil Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 8.4.2. Argentina 8.4.2.1. Argentina Basalt Fiber Market Size and Forecast, by Form (2024-2032) 8.4.2.2. Argentina Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 8.4.2.3. Argentina Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Basalt Fiber Market Size and Forecast, by Form (2024-2032) 8.4.3.2. Rest Of South America Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 8.4.3.3. Rest Of South America Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 9. Middle East and Africa Basalt Fiber Market Size and Forecast by Segmentation (by Value USD Mn) (2024-2032) 9.1. Middle East and Africa Basalt Fiber Market Size and Forecast, by Form (2024-2032) 9.2. Middle East and Africa Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 9.3. Middle East and Africa Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 9.4. Middle East and Africa Basalt Fiber Market Size and Forecast, by Country (2024-2032) 9.4.1. South Africa 9.4.1.1. South Africa Basalt Fiber Market Size and Forecast, by Form (2024-2032) 9.4.1.2. South Africa Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 9.4.1.3. South Africa Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 9.4.2. GCC 9.4.2.1. GCC Basalt Fiber Market Size and Forecast, by Form (2024-2032) 9.4.2.2. GCC Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 9.4.2.3. GCC Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 9.4.3. Rest Of MEA 9.4.3.1. Rest Of MEA Basalt Fiber Market Size and Forecast, by Form (2024-2032) 9.4.3.2. Rest Of MEA Basalt Fiber Market Size and Forecast, by Usage (2024-2032) 9.4.3.3. Rest Of MEA Basalt Fiber Market Size and Forecast, by End User Industry (2024-2032) 10. Company Profile: Key Players 10.1. Basalt NV (Belgium) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.3.1. Total Revenue 10.1.3.2. Segment Revenue 10.1.3.3. Regional Revenue 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Technobasalt-Invest LLC (Ukraine) 10.3. Mafic SA (Luxembourg) 10.4. INCOTELOGY GmbH (Germany) 10.5. Fiberbas Construction and Building Technologies (Turkey) 10.6. Sudaglass Fiber Technology (USA) 10.7. Zhejiang GBF Basalt Fiber Co., Ltd. (China) 10.8. Zhejiang Jiuyun Fiber Technology Co., Ltd. (China) 10.9. Shanxi Basalt Fiber Technology Co., Ltd. (China) 10.10. GBF Basalt Fiber Co., Ltd. (China) 10.11. Mudanjiang Basalt Fiber Co., Ltd. (China) 10.12. Jiangsu Tianlong Continuous Basalt Fiber High-tech Co., Ltd. (China) 10.13. Zhongjie Composite Materials Co., Ltd. (China) 10.14. Hengdian Group Shanghai Russia & Gold Basalt Fiber Co., Ltd. (China) 10.15. Jiangsu Green Materials Vally New Material T&D Co., Ltd. (China) 10.16. Sichuan Aerospace Tuoxin Basalt Industrial Co., Ltd. (China) 10.17. NMG Corporation (Russia) 11. Key Findings 12. Analyst Recommendations 12.1. Strategic Recommendations 12.2. Future Outlook 13. Research Methodology 1.1 Research Data 13.1.1. Primary Data 13.1.2. Secondary Data 13.2. Market Size Estimation 13.2.1. Bottom-Up Approach 13.2.2. Top-Up Approach 13.3. Market Breakdown and Data Triangulation 13.4. Research Assumption