The Barcode Printers Market size was valued at USD 2.48 Billion in 2024 and the total Barcode Printers revenue is expected to grow at a CAGR of 6.12% from 2025 to 2032, reaching nearly USD 3.99 Billion. Barcode printers are specialized devices used to print barcode labels or tags. These printers are equipped with technology specifically designed to generate high-quality barcode images on various types of media, such as paper labels, synthetic labels, tags, and wristbands. Barcode printers come in different types, including desktop printers, industrial printers, and mobile printers, each catering to specific printing requirements and environments. They play a crucial role in sectors such as retail, manufacturing, healthcare, logistics, and transportation, enabling efficient tracking, inventory management, and product identification processes.To know about the Research Methodology:-Request Free Sample Report The growing need for streamlined operations, enhanced productivity, and improved inventory management. One of the primary driving factors is the rising adoption of barcode technology in sectors such as retail, healthcare, manufacturing, and logistics to automate processes and reduce errors. Technological advancements in barcode printing, such as improved print resolution, faster printing speeds, and compatibility with various media types, are further fueling Barcode Printers Market growth. Additionally, the growing trend towards environmentally sustainable and eco-friendly printing solutions is influencing market dynamics, with manufacturers focusing on developing energy-efficient and recyclable barcode printers. The integration of advanced connectivity features such as Wi-Fi and Bluetooth, enables seamless integration with IoT devices and mobile applications. Another emerging trend is the increasing demand for compact and portable barcode printers to support on-the-go printing applications in sectors like transportation and logistics. Opportunities abound in emerging economies, where rapid industrialization and digitalization efforts present untapped markets for barcode printer manufacturers. Recent developments in the Barcode Printers Market include product innovations focused on enhancing print quality, durability, and energy efficiency. The recent development in the barcode printers market is the introduction of environmentally sustainable and eco-friendly products by leading Barcode Printers Market players. These products are designed to minimize environmental impact by reducing energy consumption, using recyclable materials, and implementing eco-friendly printing processes. Additionally, key players are investing in research and development to introduce innovative features such as cloud-based printing, mobile connectivity, and advanced barcode recognition algorithms to cater to evolving customer needs and industry requirements. These developments underscore the commitment of market leaders to drive technological advancements and sustainability initiatives in the barcode printers market, further propelling growth and innovation in the industry.

Market Dynamics:

BarCloud Transforms Inventory Management with Smartphone Barcode Printing Feature: The integration of antimicrobial materials in barcode printers enhances hygiene and safety in various industries. For instance, Citizen Systems America Corporation introduced the CL-H300SV barcode label printer with silver-ion-infused plastics, providing passive germ-killing capabilities. This innovation caters to sectors like healthcare and hospitality, where maintaining cleanliness is paramount. Distribution Management's partnership growth with Toshiba America Business Solutions to include label and receipt printers broadens the range of barcode printing solutions available to consumers. This increased product diversity allows businesses to meet specific printing needs across different sectors, fostering Barcode Printers Market growth and customer satisfaction. BarCloud's introduction of a barcode printing feature in its mobile app revolutionizes inventory management by enabling users to print barcodes directly from their smartphones. This technological advancement streamlines workflows, saving time and effort for businesses managing inventory in warehouses and stockrooms. ROHM's development of high-speed thermal printheads, such as the TE2004-QP1W00A and TE3004-TP1W00A, with print speeds of up to 500mm/s, addresses the growing demand for faster printing in logistics and inventory management applications. This improvement in printing speed enhances operational efficiency and productivity in various industries. Distribution Management's partnership with TSC Printronix Auto ID expands its barcode product portfolio, allowing it to offer high-quality label printers to a wider customer base. This strategic alliance strengthens Distribution Management's position in the market and provides TSC with increased Barcode Printers Market reach and visibility.Barcode Printers Drive Market Growth Amid Rising Demand for Efficient Labeling Solutions: TSC Auto ID's release of the TH DH Series desktop barcode printers, offering precise and high-quality label printing for diverse media types, addresses the need for versatile printing solutions in various vertical markets. With options for different print resolutions and a healthcare version featuring an antibacterial exterior, these printers cater to a wide range of applications, driving Barcode Printers Market growth. Toshiba America Business Solutions' introduction of the B-FP3 series of portable thermal barcode printers meets the demand for compact and rugged printing solutions in the transportation, retail, and manufacturing sectors. With high-speed printing capabilities and compatibility with mobile devices, these printers enhance efficiency and productivity in on-the-go printing applications. Toshiba's B-FP3 series printers feature built-in WiFi and Bluetooth connectivity, enabling seamless integration with NFC-embedded devices like smartphones and handhelds. This IoT integration enhances connectivity and accessibility, allowing businesses to streamline printing processes and improve operational efficiency. The growth of the e-commerce market and increasing demand for efficient labeling solutions drive the adoption of barcode printers in the retail and logistics sectors. With features like high-speed printing and a rugged design, barcode printers cater to the labeling needs of e-commerce warehouses and retail stores, fueling Barcode Printers Market growth. Toshiba's B-FP3 series printers support various label and receipt sizes, ranging from .94 to 3.125 inches in width, providing users with flexibility and customization options to meet specific printing requirements. This adaptability to different media types and sizes enhances usability and versatility, contributing to Barcode Printers Market growth. Industry Standards and Regulations Impacting Barcode Printer Adoption: The barcode printer market faces a challenge due to the high initial investment required for purchasing equipment and implementing barcode printing solutions. For smaller businesses or startups with limited budgets, this is a significant barrier to entry, hindering Barcode Printers Market growth and adoption rates. The complexity of barcode printer technology and the need for specialized knowledge for setup and maintenance act as a restraint. Businesses hesitate to invest in barcode printers due to concerns about integration with existing systems and the learning curve associated with operating the equipment. Incompatibility issues between barcode printers and software systems impede adoption. If barcode printers are not compatible with the software used for inventory management or other business operations, businesses face challenges in achieving seamless integration and efficient workflow processes. Ongoing maintenance and repair costs associated with barcode printers are a deterrent for businesses, especially those with tight budgets. The need for regular servicing, replacement of consumables like printheads and ribbons, and potential downtime for repairs add to the total cost of ownership, impacting investment decisions. Compliance with industry standards and regulations regarding barcode labeling poses challenges for businesses operating in regulated sectors such as healthcare and pharmaceuticals. Ensuring that barcode printers meet regulatory requirements for labeling accuracy and readability require additional investments in equipment and processes, adding complexity to the adoption process in the Barcode Printers Market.

Barcode Printers Market Segment Analysis:

Based on product, based on product the global Barcode Printers market is segmented into Desktop Printer, Mobile Printer and Industrial Printer. Desktop printers dominate the market due to their widespread use in small to medium-sized businesses and offices. These printers are suitable for low to medium-volume printing tasks and find applications in retail, healthcare, and logistics industries for tasks like inventory management and asset tracking. However, industrial printers are expected to dominate the Barcode Printers Market in the foreseeable future, driven by the increasing demand for high-volume printing solutions in industries such as manufacturing, automotive, and warehousing. Industrial printers offer robustness, high-speed printing, and durability, making them ideal for demanding environments where large volumes of labels need to be printed quickly and efficiently. Mobile printers, while currently holding a smaller Barcode Printers Market share, are gaining traction due to the growing trend of mobile workforce and on-the-go printing requirements in sectors like field service, transportation, and retail. These printers enable workers to print labels or receipts directly from mobile devices, enhancing operational efficiency and productivity.Barcode Printers Market Regional Insights:

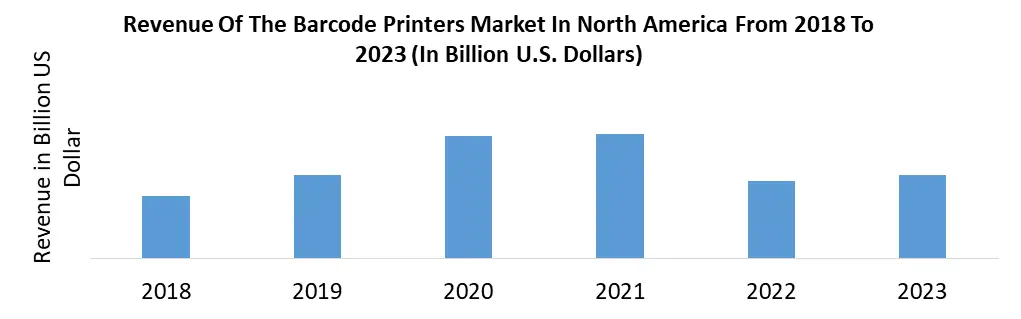

North America currently leading market share and is expected to continue its dominance through 2032. This dominance is attributed to factors such as technological advancements, widespread adoption of barcode technology across industries, and the presence of key market players in the region. For instance, the United States accounts for a significant portion of the market share, driven by the retail sector's increasing demand for barcode printers. Asia Pacific is emerging as a key growth region, expected to witness substantial expansion in the coming years. The region's growth is fueled by rapid industrialization, increasing adoption of automation solutions in manufacturing, and the booming e-commerce sector. For example, China and India are experiencing robust growth in barcode printer adoption due to the growing retail and logistics sectors, as well as government initiatives promoting digitalization. Additionally, Latin America and Europe are also expected to contribute significantly to Barcode Printers Market growth, driven by the expansion of retail and healthcare sectors, as well as increasing investments in infrastructure development. While North America maintains its dominance in the barcode printers market, Asia Pacific, Latin America, and Europe present substantial growth opportunities, supported by evolving industrial landscapes and technological advancements. Competitive Landscape The unveiling of the CL-H300SV barcode label printer by Citizen Systems America Corporation, featuring germ-killing technology, addresses growing concerns about hygiene in industries like hospitality and healthcare. Distribution Management's expanded partnership with Toshiba America Business Solutions broadens barcode printer offerings, catering to diverse business needs. BarCloud's innovative mobile app enhancement simplifies barcode printing, enhancing operational efficiency across warehouses. These developments drive market growth by meeting evolving customer demands for safer, more efficient printing solutions, fostering streamlined inventory management, and expanding service offerings to various sectors, thus propelling the barcode printers market forward. On January 13, , Citizen Systems America Corporation unveiled the CL-H300SV at NRF in New York City. This innovative barcode label printer, along with the CT-E301/601 Point-of-Sale products, offers enhanced safety features for vertical markets reliant on employee-handled printing tasks. Utilizing Silver-Ion infused plastics, known as "protective housing," these printers suppress germ growth through a passive kill mechanism, bolstering hygiene in industries like hospitality and healthcare. Glenn Williams, Vice President, emphasized Citizen's commitment to customer value, prioritizing reliability and safety across global markets. The CL-H300SV, equipped with germ-kill technology, will debut alongside other clean-ready printers at booth #6157 during NRF's January 15, tradeshow. September 25, - Distribution Management (DM), a national distributor of print and imaging solutions, expands its partnership with Toshiba America Business Solutions to include label and receipt printers. This aligns with DM’s goal of broadening its barcode offerings for resellers. Monte White, DM’s Senior VP of Merchandising, expresses excitement about representing Toshiba’s printer line, highlighting DM’s commitment to the barcode market. Toshiba's printers, renowned for professional labeling, cater to diverse business applications, enabling DM's resellers to enhance service offerings. Bill Melo, Toshiba's VP of Marketing, anticipates aiding various sectors with streamlined operations, reinforcing the successful partnership's trajectory. June 23, - BarCloud unveils a revolutionary enhancement to its mobile app, enabling seamless barcode printing directly from users' smartphones. This breakthrough empowers users to effortlessly generate and print barcodes, fostering streamlined inventory management. By supporting both barcode and standard printers, this feature simplifies tasks across warehouses and stockrooms, eliminating the need for browser transitions. With just one click, users can print barcodes, enhancing operational efficiency. October 11, - ROHM unveils groundbreaking thermal printheads, TE2004-QP1W00A and TE3004-TP1W00A, boasting unparalleled speed and reliability for barcode label printing. Specifically engineered for logistics and inventory management, these printheads redefine industry standards with print speeds of up to 500mm/s, doubling conventional rates. Leveraging innovative structures and technologies, ROHM enhances print quality and durability, addressing the surging demand in e-commerce logistics. The TE2004-QP1W00A and TE3004-TP1W00A (300dpi) feature advanced heating elements crafted through ROHM's proprietary 3D processing, elevating performance to new heights and revolutionizing label printing efficiency.Barcode Printers Market Scope :Inquire before Buying

Global Barcode Printers Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 2.48 Bn. Forecast Period 2025 to 2032 CAGR: 6.12% Market Size in 2032: USD 3.99 Bn. Segments Covered: by Product Type Desktop Printer Mobile Printer Industrial Printer by Printing Type Thermal Transfer Direct Thermal Others by End User Manufacturing Retail Transportation and Logistics Healthcare Other Barcode Printers Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Barcode Printers Market Key Players:

Key Players in North America: 1. Zebra Technologies (Headquarters: Lincolnshire, Illinois, USA) 2. Honeywell Scanning & Mobility (Headquarters: Fort Mill, South Carolina, USA) 3. Printek Inc. (Headquarters: Research Triangle Park, North Carolina, USA) 4. Printronix (Headquarters: Irvine, California, USA) 5. Canon Inc. (Headquarters: Melville, New York, USA) 6. Avery Dennison (Headquarters: Glendale, California, USA) Key Players in Europe: 7. Toshiba Tec (Headquarters: Neuss, Germany) Key Players in Asia Pacific: 8. SATO Holdings Corporation (Headquarters: Tokyo, Japan) 9. Seiko Epson Corporation (Headquarters: Suwa, Nagano, Japan) 10. TSC Auto Id Technology Co., Ltd. (Headquarters: Taipei, Taiwan) 11. Canon Inc. (Headquarters: Tokyo, Japan) 12. Oki Electric Industry Co., Ltd (Headquarters: Tokyo, Japan) 13. Dascom (Headquarters: Taipei, Taiwan) Key Players in the Middle East & Africa: 14. Stallion Systems and Solutions Pvt. Ltd. (Headquarters: Johannesburg, South Africa) Key Players in South America: 15. Suretouch Technology Limited (Headquarters: Kingston, Jamaica) FAQs: 1. What are the growth drivers for the Barcode Printers Market? Ans. BarCloud Transforms Inventory Management with Smartphone Barcode Printing Feature and is expected to be the major driver for the Barcode Printers Market. 2. What is the major Opportunity for the Barcode Printers Market growth? Ans. Barcode Printers Drive Market Growth Amid Rising Demand for Efficient Labeling Solutions and is expected to be the major Opportunity in the Barcode Printers Market. 3. Which country is expected to lead the global Barcode Printers Market during the forecast period? Ans. North America is expected to lead the Barcode Printers Market during the forecast period. 4. What was the Global Barcode Printers Market size in 2024? Ans: The Global Barcode Printers Market size was USD 2.48 Billion in 2024. 5. What segments are covered in the Barcode Printers Market report? Ans. The segments covered in the Barcode Printers Market report are by Product Type, Printing Type, End-User, and Region.

1. Barcode Printers Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Barcode Printers Market: Dynamics 2.1. Barcode Printers Market Trends by Region 2.1.1. North America Barcode Printers Market Trends 2.1.2. Europe Barcode Printers Market Trends 2.1.3. Asia Pacific Barcode Printers Market Trends 2.1.4. Middle East and Africa Barcode Printers Market Trends 2.1.5. South America Barcode Printers Market Trends 2.2. Barcode Printers Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Barcode Printers Market Drivers 2.2.1.2. North America Barcode Printers Market Restraints 2.2.1.3. North America Barcode Printers Market Opportunities 2.2.1.4. North America Barcode Printers Market Challenges 2.2.2. Europe 2.2.2.1. Europe Barcode Printers Market Drivers 2.2.2.2. Europe Barcode Printers Market Restraints 2.2.2.3. Europe Barcode Printers Market Opportunities 2.2.2.4. Europe Barcode Printers Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Barcode Printers Market Drivers 2.2.3.2. Asia Pacific Barcode Printers Market Restraints 2.2.3.3. Asia Pacific Barcode Printers Market Opportunities 2.2.3.4. Asia Pacific Barcode Printers Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Barcode Printers Market Drivers 2.2.4.2. Middle East and Africa Barcode Printers Market Restraints 2.2.4.3. Middle East and Africa Barcode Printers Market Opportunities 2.2.4.4. Middle East and Africa Barcode Printers Market Challenges 2.2.5. South America 2.2.5.1. South America Barcode Printers Market Drivers 2.2.5.2. South America Barcode Printers Market Restraints 2.2.5.3. South America Barcode Printers Market Opportunities 2.2.5.4. South America Barcode Printers Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Barcode Printers Industry 2.8. Analysis of Government Schemes and Initiatives For Barcode Printers Industry 2.9. Barcode Printers Market Trade Analysis 2.10. The Global Pandemic Impact on Barcode Printers Market 3. Barcode Printers Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 3.1. Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 3.1.1. Desktop Printer 3.1.2. Mobile Printer 3.1.3. Industrial Printer 3.2. Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 3.2.1. Thermal Transfer 3.2.2. Direct Thermal 3.2.3. Others 3.3. Barcode Printers Market Size and Forecast, by End User (2024-2032) 3.3.1. Manufacturing 3.3.2. Retail 3.3.3. Transportation and Logistics 3.3.4. Healthcare 3.3.5. Other 3.4. Barcode Printers Market Size and Forecast, by Region (2024-2032) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Barcode Printers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 4.1. North America Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 4.1.1. Desktop Printer 4.1.2. Mobile Printer 4.1.3. Industrial Printer 4.2. North America Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 4.2.1. Thermal Transfer 4.2.2. Direct Thermal 4.2.3. Others 4.3. North America Barcode Printers Market Size and Forecast, by End User (2024-2032) 4.3.1. Manufacturing 4.3.2. Retail 4.3.3. Transportation and Logistics 4.3.4. Healthcare 4.3.5. Other 4.4. North America Barcode Printers Market Size and Forecast, by Country (2024-2032) 4.4.1. United States 4.4.1.1. United States Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 4.4.1.1.1. Desktop Printer 4.4.1.1.2. Mobile Printer 4.4.1.1.3. Industrial Printer 4.4.1.2. United States Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 4.4.1.2.1. Thermal Transfer 4.4.1.2.2. Direct Thermal 4.4.1.2.3. Others 4.4.1.3. United States Barcode Printers Market Size and Forecast, by End User (2024-2032) 4.4.1.3.1. Manufacturing 4.4.1.3.2. Retail 4.4.1.3.3. Transportation and Logistics 4.4.1.3.4. Healthcare 4.4.1.3.5. Other 4.4.2. Canada 4.4.2.1. Canada Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 4.4.2.1.1. Desktop Printer 4.4.2.1.2. Mobile Printer 4.4.2.1.3. Industrial Printer 4.4.2.2. Canada Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 4.4.2.2.1. Thermal Transfer 4.4.2.2.2. Direct Thermal 4.4.2.2.3. Others 4.4.2.3. Canada Barcode Printers Market Size and Forecast, by End User (2024-2032) 4.4.2.3.1. Manufacturing 4.4.2.3.2. Retail 4.4.2.3.3. Transportation and Logistics 4.4.2.3.4. Healthcare 4.4.2.3.5. Other 4.4.3. Mexico 4.4.3.1. Mexico Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 4.4.3.1.1. Desktop Printer 4.4.3.1.2. Mobile Printer 4.4.3.1.3. Industrial Printer 4.4.3.2. Mexico Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 4.4.3.2.1. Thermal Transfer 4.4.3.2.2. Direct Thermal 4.4.3.2.3. Others 4.4.3.3. Mexico Barcode Printers Market Size and Forecast, by End User (2024-2032) 4.4.3.3.1. Manufacturing 4.4.3.3.2. Retail 4.4.3.3.3. Transportation and Logistics 4.4.3.3.4. Healthcare 4.4.3.3.5. Other 5. Europe Barcode Printers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. Europe Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 5.2. Europe Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 5.3. Europe Barcode Printers Market Size and Forecast, by End User (2024-2032) 5.4. Europe Barcode Printers Market Size and Forecast, by Country (2024-2032) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 5.4.1.2. United Kingdom Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 5.4.1.3. United Kingdom Barcode Printers Market Size and Forecast, by End User (2024-2032) 5.4.2. France 5.4.2.1. France Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 5.4.2.2. France Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 5.4.2.3. France Barcode Printers Market Size and Forecast, by End User (2024-2032) 5.4.3. Germany 5.4.3.1. Germany Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 5.4.3.2. Germany Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 5.4.3.3. Germany Barcode Printers Market Size and Forecast, by End User (2024-2032) 5.4.4. Italy 5.4.4.1. Italy Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 5.4.4.2. Italy Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 5.4.4.3. Italy Barcode Printers Market Size and Forecast, by End User (2024-2032) 5.4.5. Spain 5.4.5.1. Spain Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 5.4.5.2. Spain Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 5.4.5.3. Spain Barcode Printers Market Size and Forecast, by End User (2024-2032) 5.4.6. Sweden 5.4.6.1. Sweden Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 5.4.6.2. Sweden Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 5.4.6.3. Sweden Barcode Printers Market Size and Forecast, by End User (2024-2032) 5.4.7. Austria 5.4.7.1. Austria Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 5.4.7.2. Austria Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 5.4.7.3. Austria Barcode Printers Market Size and Forecast, by End User (2024-2032) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 5.4.8.2. Rest of Europe Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 5.4.8.3. Rest of Europe Barcode Printers Market Size and Forecast, by End User (2024-2032) 6. Asia Pacific Barcode Printers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Asia Pacific Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 6.2. Asia Pacific Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 6.3. Asia Pacific Barcode Printers Market Size and Forecast, by End User (2024-2032) 6.4. Asia Pacific Barcode Printers Market Size and Forecast, by Country (2024-2032) 6.4.1. China 6.4.1.1. China Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 6.4.1.2. China Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 6.4.1.3. China Barcode Printers Market Size and Forecast, by End User (2024-2032) 6.4.2. S Korea 6.4.2.1. S Korea Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 6.4.2.2. S Korea Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 6.4.2.3. S Korea Barcode Printers Market Size and Forecast, by End User (2024-2032) 6.4.3. Japan 6.4.3.1. Japan Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 6.4.3.2. Japan Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 6.4.3.3. Japan Barcode Printers Market Size and Forecast, by End User (2024-2032) 6.4.4. India 6.4.4.1. India Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 6.4.4.2. India Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 6.4.4.3. India Barcode Printers Market Size and Forecast, by End User (2024-2032) 6.4.5. Australia 6.4.5.1. Australia Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 6.4.5.2. Australia Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 6.4.5.3. Australia Barcode Printers Market Size and Forecast, by End User (2024-2032) 6.4.6. Indonesia 6.4.6.1. Indonesia Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 6.4.6.2. Indonesia Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 6.4.6.3. Indonesia Barcode Printers Market Size and Forecast, by End User (2024-2032) 6.4.7. Malaysia 6.4.7.1. Malaysia Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 6.4.7.2. Malaysia Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 6.4.7.3. Malaysia Barcode Printers Market Size and Forecast, by End User (2024-2032) 6.4.8. Vietnam 6.4.8.1. Vietnam Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 6.4.8.2. Vietnam Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 6.4.8.3. Vietnam Barcode Printers Market Size and Forecast, by End User (2024-2032) 6.4.9. Taiwan 6.4.9.1. Taiwan Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 6.4.9.2. Taiwan Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 6.4.9.3. Taiwan Barcode Printers Market Size and Forecast, by End User (2024-2032) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 6.4.10.2. Rest of Asia Pacific Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 6.4.10.3. Rest of Asia Pacific Barcode Printers Market Size and Forecast, by End User (2024-2032) 7. Middle East and Africa Barcode Printers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Middle East and Africa Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 7.2. Middle East and Africa Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 7.3. Middle East and Africa Barcode Printers Market Size and Forecast, by End User (2024-2032) 7.4. Middle East and Africa Barcode Printers Market Size and Forecast, by Country (2024-2032) 7.4.1. South Africa 7.4.1.1. South Africa Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 7.4.1.2. South Africa Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 7.4.1.3. South Africa Barcode Printers Market Size and Forecast, by End User (2024-2032) 7.4.2. GCC 7.4.2.1. GCC Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 7.4.2.2. GCC Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 7.4.2.3. GCC Barcode Printers Market Size and Forecast, by End User (2024-2032) 7.4.3. Nigeria 7.4.3.1. Nigeria Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 7.4.3.2. Nigeria Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 7.4.3.3. Nigeria Barcode Printers Market Size and Forecast, by End User (2024-2032) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 7.4.4.2. Rest of ME&A Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 7.4.4.3. Rest of ME&A Barcode Printers Market Size and Forecast, by End User (2024-2032) 8. South America Barcode Printers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. South America Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 8.2. South America Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 8.3. South America Barcode Printers Market Size and Forecast, by End User(2024-2032) 8.4. South America Barcode Printers Market Size and Forecast, by Country (2024-2032) 8.4.1. Brazil 8.4.1.1. Brazil Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 8.4.1.2. Brazil Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 8.4.1.3. Brazil Barcode Printers Market Size and Forecast, by End User (2024-2032) 8.4.2. Argentina 8.4.2.1. Argentina Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 8.4.2.2. Argentina Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 8.4.2.3. Argentina Barcode Printers Market Size and Forecast, by End User (2024-2032) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Barcode Printers Market Size and Forecast, by Product Type (2024-2032) 8.4.3.2. Rest Of South America Barcode Printers Market Size and Forecast, by Printing Type (2024-2032) 8.4.3.3. Rest Of South America Barcode Printers Market Size and Forecast, by End User (2024-2032) 9. Global Barcode Printers Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2024) 9.3.5. Company Locations 9.4. Leading Barcode Printers Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Zebra Technologies (Headquarters: Lincolnshire, Illinois, USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Honeywell Scanning & Mobility (Headquarters: Fort Mill, South Carolina, USA) 10.3. Printek Inc. (Headquarters: Research Triangle Park, North Carolina, USA) 10.4. Printronix (Headquarters: Irvine, California, USA) 10.5. Canon Inc. (Headquarters: Melville, New York, USA) 10.6. Avery Dennison (Headquarters: Glendale, California, USA) 10.7. Toshiba Tec (Headquarters: Neuss, Germany) 10.8. SATO Holdings Corporation (Headquarters: Tokyo, Japan) 10.9. Seiko Epson Corporation (Headquarters: Suwa, Nagano, Japan) 10.10. TSC Auto Id Technology Co., Ltd. (Headquarters: Taipei, Taiwan) 10.11. Canon Inc. (Headquarters: Tokyo, Japan) 10.12. Oki Electric Industry Co., Ltd (Headquarters: Tokyo, Japan) 10.13. Dascom (Headquarters: Taipei, Taiwan) 10.14. Stallion Systems and Solutions Pvt. Ltd. (Headquarters: Johannesburg, South Africa) 10.15. Suretouch Technology Limited (Headquarters: Kingston, Jamaica) 11. Key Findings 12. Industry Recommendations 13. Barcode Printers Market: Research Methodology 14. Terms and Glossary