Automotive Smart Tire Market was valued at USD 88.50 Billion in 2023 and is expected to grow to USD 162.5 Billion by 2030, representing a compound annual growth rate (CAGR) of 8.1% during the forecast periodGlobal Automotive Smart Tire Market Overview:

Automotive smart tires refer to technologically advanced tire systems equipped with sensors and integrated connectivity features designed to monitor and optimize various tire-related parameters in real-time. These tires incorporate sensors that continuously track crucial data points such as tire pressure, temperature, tread depth, and road conditions. The collected data is transmitted to an onboard vehicle system or a connected device, allowing for immediate analysis and adjustments. By leveraging IoT (Internet of Things) technology, smart tires offer enhanced safety, performance, and efficiency benefits to vehicles. These innovative tire solutions help prevent accidents by providing early warnings about tire issues, optimizing fuel efficiency through precise pressure adjustments, and enabling predictive maintenance to extend tire lifespan. Smart tires also contribute to the development of autonomous driving capabilities by offering detailed information about road conditions and tire status to the vehicle's control systems. The integration of smart tires in the automotive industry represents a significant advancement in vehicle safety, operational efficiency, and the overall driving experience, as they enable constant monitoring and proactive management of tire-related factors in modern vehicles. The Automotive Smart Tire Market is witnessing substantial growth driven by advancements in tire technology, emphasizing safety, efficiency, and connectivity in vehicles. With the integration of sensors, smart tires offer real-time monitoring of tire pressure, temperature, tread wear, and other crucial metrics. This market's growth is propelled by the increasing emphasis on vehicle safety and the demand for enhanced fuel efficiency. Additionally, the rise in connected cars and the integration of IoT (Internet of Things) technology in automotive systems have further accelerated the adoption of smart tires. Key players like Bridgestone, Continental AG, Michelin, Pirelli, and Goodyear are actively involved in developing innovative smart tire solutions. For instance, Bridgestone has introduced its tire pressure monitoring systems (TPMS) and tires embedded with sensors for better data collection, while Continental AG has focused on creating intelligent tires capable of transmitting data to the vehicle's control systems for improved safety and performance. These companies continue to invest in research and development to enhance tire functionalities, durability, and performance, thereby contributing to the evolution of the Automotive Smart Tire Market.To know about the Research Methodology :- Request Free Sample Report Fleet Management Solutions Smart Tires Optimizing Performance The Automotive Smart Tire Market is experiencing significant growth driven by a confluence of factors shaping the automotive industry. One of the primary drivers propelling this market forward is the amplified emphasis on vehicle safety across the globe. With advancements in technology, companies like Continental AG have introduced innovative solutions such as ContiSense and ContiAdapt, integrating sensors within tires. These sensors continuously monitor tire conditions, providing real-time data on tire health and road conditions. The integration of sensors not only enhances safety but also offers drivers critical information to ensure optimal performance and prevent potential accidents. Moreover, the pursuit of improved fuel efficiency remains a crucial factor driving the adoption of Automotive Smart Tire Market. Bridgestone's Ologic technology, notably employed in electric vehicles like BMW's i3, plays a pivotal role in reducing rolling resistance and enhancing aerodynamics, thus contributing to increased fuel efficiency. This aligns with the global focus on sustainability and reduced environmental impact, a trend further supporting the growth of smart tires. The rise of connected cars has also played a pivotal role in augmenting the demand for smart tires. Michelin's 'Connected Tire' represents a paradigm shift in tire technology by utilizing sensors to transmit data directly to vehicles. This technology enables vehicles to have more control over tire performance and overall driving experience in connected car environments. Similarly, Pirelli's Cyber Tire employs embedded sensors to gather data on tire wear and road conditions, thereby transmitting vital information to a car's systems. This integration facilitates predictive maintenance and significantly contributes to enhanced safety measures. Furthermore, stringent government regulations mandating vehicle safety standards, such as tire pressure monitoring systems (TPMS), have been instrumental in boosting the adoption of smart tires. Authorities like the U.S. National Highway Traffic Safety Administration (NHTSA) have implemented regulations that propel manufacturers and consumers towards embracing smarter and safer tire technologies. Consumer awareness regarding vehicle safety and performance has been steadily rising, encouraging the uptake of smart tires. Goodyear's 'IntelliGrip Urban' concept tire, equipped with sensors for real-time monitoring, has resonated well with safety-conscious consumers seeking advanced tire technologies that enhance their driving experience. Advancements in tire technology have been pivotal in shaping the Automotive Smart Tire Market. Bridgestone's 'Air Free Concept Tires,' designed with a unique structure eliminating the need for air, have demonstrated improved durability and reduced maintenance requirements, further driving technological progress in the industry. Additionally, the need for efficient fleet management solutions has boosted the adoption of smart tires. Companies like Michelin offer solutions such as 'Michelin Fleet Solutions,' which integrate tire monitoring technologies to optimize fleet performance, thereby reducing operational costs and enhancing efficiency. Environmental concerns have also played a significant role in the development of eco-friendly smart tires. Manufacturers have been investing in sustainable tire solutions such as Goodyear's 'Oxygene' concept tire, which incorporates moss to absorb moisture, contributing to air purification and sustainability efforts. The amalgamation of these drivers is fostering a burgeoning Automotive Smart Tire Market, showcasing immense potential for innovation and growth in the automotive industry's tire segment.

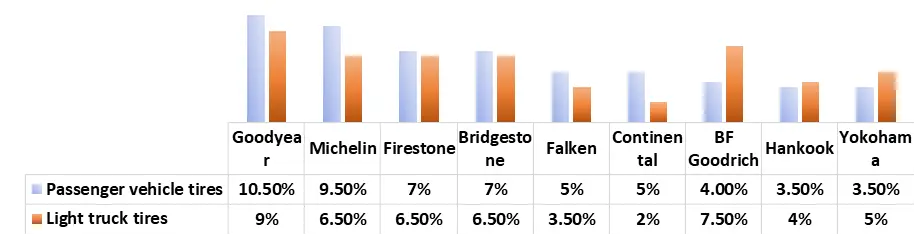

Market Share of Selected Replacement Consumer Tire Brands in the United States in 2022

Regulatory Roadblocks Global Standards and Smart Tire Integration Hinder the Growth of Automotive Smart Tire Market The Automotive Smart Tire Market encounters several impediments that hinder its widespread adoption and integration. Foremost among these challenges are the cost implications associated with incorporating advanced technology into tire systems. Integrating sensors, connectivity features, and sophisticated materials significantly escalates production costs, potentially elevating the overall vehicle cost and dissuading price-sensitive consumers. Technological complexity poses another critical hurdle, requiring sensors durable enough to withstand harsh road conditions while ensuring accurate data transmission without compromising tire performance. This intricate balance between functionality and durability remains a challenge for manufacturers like Continental AG and Bridgestone. Additionally, limited aftermarket penetration restricts consumer accessibility to smart tire technology, as retrofitting existing vehicles is complex and expensive, impeding widespread adoption. Data security concerns surrounding the collection and transmission of sensitive vehicle data raise significant apprehensions, necessitating robust cybersecurity measures by companies such as Pirelli and Continental AG. Compatibility issues in integrating smart tires across diverse vehicle models and systems, coupled with regulatory hurdles in adhering to varying global standards, further complicate Automotive Smart Tire Market growth. Ensuring the reliability and accuracy of data collected by smart tires under different road conditions, addressing consumer awareness gaps, infrastructure limitations in certain regions, and the environmental impact of disposal and recycling of smart tires collectively form the multifaceted array of challenges constraining the expansion of the Automotive Smart Tire Market. Addressing these challenges is crucial for stakeholders to propel the widespread adoption and seamless integration of this transformative technology into the automotive sector. Consumer Confidence Boost Building Trust Through Smart Tire Integration Boost the Demand of the Automotive Smart Tire Market One of the primary market opportunities lies in leveraging smart tire technology to enhance vehicle safety significantly. By introducing innovative sensors and real-time monitoring capabilities, the Automotive Smart Tire Market can address safety concerns prevalent in the automotive industry, creating a safer driving environment for consumers. Integrating these technologies into vehicles not only adds value to the market but also fosters consumer trust and confidence in automotive safety standards, thereby boosting market acceptance. Furthermore, the integration of smart tires offers a unique opportunity to tap into the increasing Automotive Smart Tire Market demand for fuel-efficient vehicles. By optimizing tire pressure and monitoring tire conditions, smart tires contribute to improving fuel efficiency, a critical factor influencing consumers' purchasing decisions in today's Automotive Smart Tire Market landscape. This alignment with evolving market preferences positions smart tire technology as a pivotal player in addressing environmental concerns while meeting consumer demands for more eco-friendly and cost-effective vehicles. The Automotive Smart Tire Market growth opportunity extends beyond traditional safety and efficiency considerations, delving into the realm of data-driven innovation and connectivity within the automotive market. The integration of smart tires into the Internet of Things (IoT) ecosystem creates an interconnected environment where tire data seamlessly interacts with other vehicle systems. This Automotive Smart Tire Market trend empowers automotive manufacturers to offer a comprehensive user experience by providing drivers with real-time insights into tire conditions, fuel efficiency metrics, and predictive maintenance alerts. The data-rich environment facilitated by smart tires not only propels market innovation but also creates new revenue streams within the automotive market through the development of value-added services and aftermarket opportunities. The aftermarket segment, in particular, holds substantial market potential, catering to existing vehicle owners seeking to upgrade their vehicles with smart tire technology. This Automotive Smart Tire Market offerings and services opens avenues for market penetration and fosters a competitive landscape, driving further innovation and growth within the Automotive Smart Tire Market.Automotive Smart Tire Market Segment Analysis:

Based on Technology, the market had been divided into Pneumatic Tire and Non-Pneumatic Tire. Among these Pneumatic Tire segment dominating the automotive smart tire market. The dominance of the Pneumatic Tire segment in the automotive smart tire market extends beyond the realm of conventional vehicles, permeating various industrial Sales Channels. In industries such as logistics, material handling, and construction, pneumatic tires play a pivotal role in ensuring efficient operations and enhanced productivity. Logistics and material handling sectors extensively employ pneumatic tires in forklifts, pallet jacks, and other handling equipment due to their ability to absorb shocks and vibrations, facilitating smooth movement of goods within warehouses and distribution centers. Moreover, in the construction industry, heavy machinery like loaders, excavators, and cranes rely on pneumatic tires for their load-bearing capabilities and adaptability to rough terrains, enabling optimal maneuverability and stability during construction activities. Agricultural machinery, including tractors and harvesters, also heavily utilizes pneumatic tires for their traction, reducing soil compaction while ensuring better grip on diverse surfaces. This dominance of pneumatic tires across various industrial Sales Channels underscores their versatility, durability, and capability to meet the demanding needs of these sectors, cementing their pivotal role in driving efficiency and performance across diverse industrial landscapes. Based on vehicle type, passenger vehicle segment dominating in the automotive smart tire market. In the automotive smart tire market, industrial Sales Channels encompass a wide array of sectors beyond passenger vehicles, exhibiting substantial potential for innovation and efficiency. One notable industrial Sales Channel is in commercial transportation and logistics. Fleet management companies, freight haulers, and logistics enterprises are increasingly integrating smart tire technology to optimize operations. Real-time monitoring of tire pressure, temperature, and tread wear helps in preventive maintenance, reducing downtime and enhancing overall fleet efficiency. For instance, companies like Michelin have introduced solutions like "Michelin Tire Care" that employ sensor-equipped tires, enabling constant monitoring of commercial vehicle fleets. Moreover, in the construction industry, heavy-duty machinery and equipment rely on robust tires for performance and safety. Implementing smart tire technology in construction vehicles enhances productivity by ensuring optimal tire conditions, thereby preventing unexpected breakdowns. This aids companies like Caterpillar Inc., a manufacturer of construction equipment, in offering advanced solutions for their machinery. The industrial integration of smart tires promises to revolutionize operational efficiency, maintenance schedules, and safety measures across various sectors, illustrating its potential impact beyond passenger vehicles in diverse industrial Sales Channels.Automotive Smart Tire Market Regional Analysis:

Asia pacific accounted for the largest market in the automotive smart tire market. Asia pacific accounted for the 41 % market share across the globe. This dominance is attributed to various factors contributing to the region's automotive sector's growth. Asia Pacific's increasing automotive industry, driven by countries such as China, Japan, South Korea, and India, has witnessed rapid technological advancements and a surge in vehicle production. Moreover, the increasing emphasis on vehicle safety, coupled with the growing adoption of smart technologies in automobiles across this region, has significantly bolstered the demand for automotive smart tires. Factors like government initiatives promoting vehicle safety standards, rising consumer awareness regarding advanced automotive technologies, and the increasing purchasing power of consumers in developing economies have collectively propelled the market share of automotive smart tires in the Asia Pacific region.Automotive Smart Tire Market Competitive Landscape:

On June 2021, Goodyear Tire & Rubber Company (Nasdaq: GT) has finalized the acquisition of Cooper Tire & Rubber Company, as declared in the merger agreement on February 22. This union merges two prominent tire companies, blending complementary product ranges and services to establish a robust U.S.-based leader in the global tire industry. The merged entity aims to provide an expanded array of choices under Goodyear and Cooper brands, simplifying selections for customers and consumers while offering a broader spectrum of value-oriented tires.Automotive Smart Tire Market Scope: Inquire before buying

Global Automotive Smart Tire Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 88.50 Bn. Forecast Period 2024 to 2030 CAGR: 8.1% Market Size in 2030: US $ 162.5 Bn. Segments Covered: By Technology Pneumatic Tire Non-Pneumatic Tire By Features Connected Tire Tire pressure Monitoring system Others By Vehicle Type Passenger Vehicle Light Commercial Vehicle Heavy Duty Truck Bus & Coach By Sales Channel OEM Aftermarket Global Automotive Smart Tire Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Automotive Smart Tire Market Leading Key Players:

North America 1. Cooper Tire & Rubber Company (United States) 2. The Goodyear Tire & Rubber Company (United States) Europe 1. Continental AG (Germany) 2. Michelin Group (France) 3. Pirelli & C. S.p.A. (Italy) 4. Nokian Tyres plc (Finland) Asia Pacific: 1. Hankook Tire & Technology Co., Ltd. (South Korea) 2. Sumitomo Rubber Industries, Ltd. (Japan) 3. Yokohama Rubber Co., Ltd. (Japan) 4. Toyo Tire Corporation (Japan) 5. Bridgestone Corporation (Japan) 6. Apollo Tyres Ltd. (India) 7. Kumho Tire Co., Inc. (South Korea) 8. Maxxis International - Cheng Shin Rubber Ind. Co., Ltd. (Taiwan) 9. Falken Tire Corporation (Japan) 10. Zhongce Rubber Group Co., Ltd. (China) 11. Giti Tire Pte. Ltd. (Singapore) 12. MRF Ltd. (India) 13. Nexen Tire Corporation (South Korea) 14. Cheng Shin Rubber (Maxxis) (Taiwan)FAQ:

1] What segments are covered in the Global Automotive Smart Tire Market report? Ans. The segments covered in the Automotive Smart Tire Market report are based on Technology, Features, Vehicle Type, and Sales Channel. 2] Which region is expected to hold the highest share in the Global Automotive Smart Tire Market? Ans. The Asia Pacific region is expected to hold the highest share in the Automotive Smart Tire Market. 3] What is the market size of the Global Automotive Smart Tire Market by 2030? Ans. The market size of the Automotive Smart Tire Market by 2030 is expected to reach USD 162.5 Billion. 4] Who are the top key players in the Automotive Smart Tire Market? Ans. Michelin Group (France), Pirelli & C. S.p.A. (Italy), and Nokian Tyres plc (Finland) are the top key players in the Automotive Smart Tire Market. 5] What was the market size of the Global Automotive Smart Tire Market in 2023? Ans. The market size of the Automotive Smart Tire Market in 2023 was valued at USD 88.50 Billion.

1. Automotive Smart Tire Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 1.1. Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 1.1.1. Pneumatic Tire 1.1.2. Non-Pneumatic Tire 1.2. Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 1.2.1. Connected Tire 1.2.2. Tire pressure Monitoring system 1.2.3. Others 1.3. Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 1.3.1. Passenger Vehicle 1.3.2. Light Commercial Vehicle 1.3.3. Heavy Duty Truck 1.3.4. Bus & Coach 1.4. Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 1.4.1. OEM 1.4.2. Aftermarket 1.5. Automotive Smart Tire Market Size and Forecast, By Region (2023-2030) 1.5.1. North America 1.5.2. Europe 1.5.3. Asia Pacific 1.5.4. Middle East and Africa 1.5.5. South America 2. North America Automotive Smart Tire Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 2.1. North America Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 2.1.1. Pneumatic Tire 2.1.2. Non-Pneumatic Tire 2.2. North America Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 2.2.1. Connected Tire 2.2.2. Tire pressure Monitoring system 2.2.3. Others 2.3. North America Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 2.3.1. Passenger Vehicle 2.3.2. Light Commercial Vehicle 2.3.3. Heavy Duty Truck 2.3.4. Bus & Coach 2.4. North America Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 2.4.1. OEM 2.4.2. Aftermarket 2.5. North America Automotive Smart Tire Market Size and Forecast, by Country (2023-2030) 2.5.1. United States 2.5.1.1. United States Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 2.5.1.1.1. Pneumatic Tire 2.5.1.1.2. Non-Pneumatic Tire 2.5.1.2. United States Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 2.5.1.2.1. Connected Tire 2.5.1.2.2. Tire pressure Monitoring system 2.5.1.2.3. Others 2.5.1.3. United States Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 2.5.1.3.1. Passenger Vehicle 2.5.1.3.2. Light Commercial Vehicle 2.5.1.3.3. Heavy Duty Truck 2.5.1.3.4. Bus & Coach 2.5.1.4. United States Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 2.5.1.4.1. OEM 2.5.1.4.2. Aftermarket 2.5.2. Canada 2.5.2.1. Canada Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 2.5.2.1.1. Pneumatic Tire 2.5.2.1.2. Non-Pneumatic Tire 2.5.2.2. Canada Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 2.5.2.2.1. Connected Tire 2.5.2.2.2. Tire pressure Monitoring system 2.5.2.2.3. Others 2.5.2.3. Canada Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 2.5.2.3.1. Passenger Vehicle 2.5.2.3.2. Light Commercial Vehicle 2.5.2.3.3. Heavy Duty Truck 2.5.2.3.4. Bus & Coach 2.5.2.4. Canada Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 2.5.2.4.1. OEM 2.5.2.4.2. Aftermarket 2.5.3. Mexico 2.5.3.1. Mexico Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 2.5.3.1.1. Pneumatic Tire 2.5.3.1.2. Non-Pneumatic Tire 2.5.3.2. Mexico Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 2.5.3.2.1. Connected Tire 2.5.3.2.2. Tire pressure Monitoring system 2.5.3.2.3. Others 2.5.3.3. Mexico Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 2.5.3.3.1. Passenger Vehicle 2.5.3.3.2. Light Commercial Vehicle 2.5.3.3.3. Heavy Duty Truck 2.5.3.3.4. Bus & Coach 2.5.3.4. Mexico Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 2.5.3.4.1. OEM 2.5.3.4.2. Aftermarket 3. Europe Automotive Smart Tire Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 3.1. Europe Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 3.2. Europe Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 3.3. Europe Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 3.4. Europe Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 3.5. Europe Automotive Smart Tire Market Size and Forecast, by Country (2023-2030) 3.5.1. United Kingdom 3.5.1.1. United Kingdom Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 3.5.1.2. United Kingdom Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 3.5.1.3. United Kingdom Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 3.5.1.4. United Kingdom Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 3.5.2. France 3.5.2.1. France Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 3.5.2.2. France Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 3.5.2.3. France Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 3.5.2.4. France Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 3.5.3. Germany 3.5.3.1. Germany Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 3.5.3.2. Germany Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 3.5.3.3. Germany Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 3.5.3.4. Germany Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 3.5.4. Italy 3.5.4.1. Italy Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 3.5.4.2. Italy Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 3.5.4.3. Italy Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 3.5.4.4. Italy Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 3.5.5. Spain 3.5.5.1. Spain Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 3.5.5.2. Spain Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 3.5.5.3. Spain Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 3.5.5.4. Spain Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 3.5.6. Sweden 3.5.6.1. Sweden Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 3.5.6.2. Sweden Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 3.5.6.3. Sweden Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 3.5.6.4. Sweden Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 3.5.7. Austria 3.5.7.1. Austria Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 3.5.7.2. Austria Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 3.5.7.3. Austria Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 3.5.7.4. Austria Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 3.5.8. Rest of Europe 3.5.8.1. Rest of Europe Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 3.5.8.2. Rest of Europe Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 3.5.8.3. Rest of Europe Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 3.5.8.4. Rest of Europe Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 4. Asia Pacific Automotive Smart Tire Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Asia Pacific Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 4.2. Asia Pacific Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 4.3. Asia Pacific Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 4.4. Asia Pacific Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 4.5. Asia Pacific Automotive Smart Tire Market Size and Forecast, by Country (2023-2030) 4.5.1. China 4.5.1.1. China Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 4.5.1.2. China Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 4.5.1.3. China Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 4.5.1.4. China Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 4.5.2. S Korea 4.5.2.1. S Korea Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 4.5.2.2. S Korea Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 4.5.2.3. S Korea Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 4.5.2.4. S Korea Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 4.5.3. Japan 4.5.3.1. Japan Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 4.5.3.2. Japan Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 4.5.3.3. Japan Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 4.5.3.4. Japan Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 4.5.4. India 4.5.4.1. India Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 4.5.4.2. India Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 4.5.4.3. India Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 4.5.4.4. India Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 4.5.5. Australia 4.5.5.1. Australia Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 4.5.5.2. Australia Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 4.5.5.3. Australia Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 4.5.5.4. Australia Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 4.5.6. Indonesia 4.5.6.1. Indonesia Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 4.5.6.2. Indonesia Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 4.5.6.3. Indonesia Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 4.5.6.4. Indonesia Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 4.5.7. Malaysia 4.5.7.1. Malaysia Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 4.5.7.2. Malaysia Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 4.5.7.3. Malaysia Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 4.5.7.4. Malaysia Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 4.5.8. Vietnam 4.5.8.1. Vietnam Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 4.5.8.2. Vietnam Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 4.5.8.3. Vietnam Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 4.5.8.4. Vietnam Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 4.5.9. Taiwan 4.5.9.1. Taiwan Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 4.5.9.2. Taiwan Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 4.5.9.3. Taiwan Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 4.5.9.4. Taiwan Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 4.5.10. Rest of Asia Pacific 4.5.10.1. Rest of Asia Pacific Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 4.5.10.2. Rest of Asia Pacific Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 4.5.10.3. Rest of Asia Pacific Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 4.5.10.4. Rest of Asia Pacific Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 5. Middle East and Africa Automotive Smart Tire Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 5.1. Middle East and Africa Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 5.2. Middle East and Africa Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 5.3. Middle East and Africa Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 5.4. Middle East and Africa Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 5.5. Middle East and Africa Automotive Smart Tire Market Size and Forecast, by Country (2023-2030) 5.5.1. South Africa 5.5.1.1. South Africa Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 5.5.1.2. South Africa Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 5.5.1.3. South Africa Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 5.5.1.4. South Africa Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 5.5.2. GCC 5.5.2.1. GCC Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 5.5.2.2. GCC Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 5.5.2.3. GCC Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 5.5.2.4. GCC Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 5.5.3. Nigeria 5.5.3.1. Nigeria Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 5.5.3.2. Nigeria Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 5.5.3.3. Nigeria Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 5.5.3.4. Nigeria Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 5.5.4. Rest of ME&A 5.5.4.1. Rest of ME&A Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 5.5.4.2. Rest of ME&A Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 5.5.4.3. Rest of ME&A Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 5.5.4.4. Rest of ME&A Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 6. South America Automotive Smart Tire Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 6.1. South America Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 6.2. South America Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 6.3. South America Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 6.4. South America Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 6.5. South America Automotive Smart Tire Market Size and Forecast, by Country (2023-2030) 6.5.1. Brazil 6.5.1.1. Brazil Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 6.5.1.2. Brazil Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 6.5.1.3. Brazil Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.1.4. Brazil Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 6.5.2. Argentina 6.5.2.1. Argentina Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 6.5.2.2. Argentina Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 6.5.2.3. Argentina Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.2.4. Argentina Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 6.5.3. Rest Of South America 6.5.3.1. Rest Of South America Automotive Smart Tire Market Size and Forecast, By Technology (2023-2030) 6.5.3.2. Rest Of South America Automotive Smart Tire Market Size and Forecast, By Features (2023-2030) 6.5.3.3. Rest Of South America Automotive Smart Tire Market Size and Forecast, By Vehicle Type (2023-2030) 6.5.3.4. Rest Of South America Automotive Smart Tire Market Size and Forecast, By Sales Channel (2023-2030) 7. Global Automotive Smart Tire Market: Competitive Landscape 7.1. MMR Competition Matrix 7.2. Competitive Landscape 7.3. Key Players Benchmarking 7.3.1. Company Name 7.3.2. Service Segment 7.3.3. Sales Channelr Segment 7.3.4. Revenue (2022) 7.3.5. Manufacturing Locations 7.4. Leading Automotive Smart Tire Market Companies, by Market Capitalization 7.5. Market Structure 7.5.1. Market Leaders 7.5.2. Market Followers 7.5.3. Emerging Players 7.6. Mergers and Acquisitions Details 8. Company Profile: Key Players 8.1. Cooper Tire & Rubber Company (United States) 8.1.1. Company Overview 8.1.2. Business Portfolio 8.1.3. Financial Overview 8.1.4. SWOT Analysis 8.1.5. Strategic Analysis 8.1.6. Recent Developments 8.2. The Goodyear Tire & Rubber Company (United States) 8.3. Continental AG (Germany) 8.4. Michelin Group (France) 8.5. Pirelli & C. S.p.A. (Italy) 8.6. Nokian Tyres plc (Finland) 8.7. Hankook Tire & Technology Co., Ltd. (South Korea) 8.8. Sumitomo Rubber Industries, Ltd. (Japan) 8.9. Yokohama Rubber Co., Ltd. (Japan) 8.10. Toyo Tire Corporation (Japan) 8.11. Bridgestone Corporation (Japan) 8.12. Apollo Tyres Ltd. (India) 8.13. Kumho Tire Co., Inc. (South Korea) 8.14. Maxxis International - Cheng Shin Rubber Ind. Co., Ltd. (Taiwan) 8.15. Falken Tire Corporation (Japan) 8.16. Zhongce Rubber Group Co., Ltd. (China) 8.17. Giti Tire Pte. Ltd. (Singapore) 8.18. MRF Ltd. (India) 8.19. Nexen Tire Corporation (South Korea) 8.20. Cheng Shin Rubber (Maxxis) (Taiwan) 9. Industry Recommendations 10. Key Findings 11. Automotive Smart Tire Market: Research Methodology