Global Automotive Engine Cover Market size is expected to reach US$ 1420.5 Mn. by 2029, at a CAGR of 3.2% during the forecast period. The Global Automotive Engine Cover market report is a comprehensive analysis of the industry, market, and key players. The report has covered the market by demand and supply-side by segments. The Global Automotive Engine Cover report also provides trends by market segments, technology, and investment with a competitive landscape.To know about the Research Methodology :- Request Free Sample Report

Global Automotive Engine Cover Market Overview:

Engine covers are used to protect the engine parts from any kinds of internal as well as external damages including lubricant oil leakage, damage to the hydrostatic lock, and ingression of water in the cavity of the engines. Engine covers encase the important parts of the engine including connecting rods, cylinders, pistons, crankshafts and others and protects them from any form of wear and tear during engine operations.Global Automotive Engine Cover Market Dynamics:

The increasing inclination of manufacturers towards the increase in average fuel economy of the vehicles and the global shift of automakers towards lightweight vehicles are the factors considered to drive the automotive engine cover market growth. Moreover, highly inducing sales for IC engines and thereby, implementation of engine covers are showing exponential growth in the market. According to ASME, the engine covers market was accounted for approximately 1.2 billion USD in terms of market share. In addition, increasing penetration of passenger cars with IC engine systems and increasing manufacturing capabilities of prominent players in the market are the key supporting factors considered to drive the automotive Engine cover market growth. High maintenance cost of engine covers high replacement charges of the product are the key factors considered to restrain the market growth. Moreover, increasing raw material cost of metals including steel, Aluminium, and others is the key factor considered to hamper the market growth. Increasing adoption and technological innovations carried out in the field of the automotive sector and increasing income of working classes across the emerging economies of the globe are the key factors expected to create opportunities in the market. Recently, Bugatti has developed a new mixed Carbon composite material engine case which is considered to revolutionize the industry by many manufacturers.Global Automotive Engine Cover Market Segment Analysis:

Composite Material Segment is dominating the Automotive Engine Cover Market:

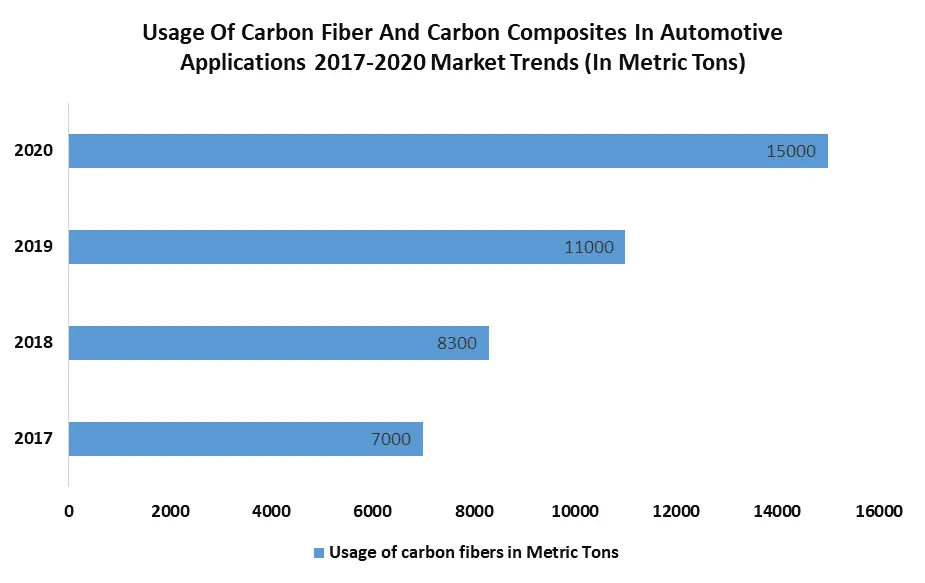

Composite materials are made from the mixing of various metals or the use of carbon-based products to increase the stability of the material structure. Before 1995, metal engine covers dominated the market owing to their malleability and high-pressure absorption capacity. But, in 1998, Carbon composite chassis was developed by McLaren to provide stability to their sports cars and since then, the automotive industry became obsessed with carbon composite materials. In 2013, DuPont developed Carbon composite for engines to absorb the engine load as well as to withstand the high-temperature conditions within the engine. The composite covers segment was accounted for approximately 2.3 billion USD in the year 2019 and expected to register CAGR of approximately 5.23% during the forecast period owing to the popularity of composites among consumers and manufactures.Casting Manufacturing Segment is boosting the Automotive Engine Cover Market Sales:

Casting is the most dominated and widely used manufacturing process for the making of engine covers with approximately 750 million USD market share owing to high compressive strength is given to the material by casting method and any size of engine covers are made by casting which removes the chances of engine design constraints for engineers. Furthermore, casting is popular amongst manufacturers as a most economic method of manufacturing and hence is readily emerged as cost-cutting solution for engine manufacturers.Engine Covers Made by Flexible PU Foam are Leading the Future of Automotive Engine Cover Market:

BASF has developed flexible PU foam which is used to produce engine covers having lightweight form and shape factors. This foam is made by a one-shot process which means the material is developed in a single process on a single go making the system more efficient and economical for the manufacturers. Flexible PUmaterial has the following properties including:

1. Thermal resistance up to 150-160° C. 2. Economic manufacturing process 3. Embedded mechanical dampener to reduce knocking in the engine 4. Prevention from acoustic vibrations created by engine. 5. Superior dimensional stability.

Impact of COVID pandemic on the Automotive Engine Cover market:

COVID pandemic posed heavy impact on Automotive Engine Cover market owing to delayed manufacturing activities and halting shipments across the globe. Moreover, a reduction in market sales for passenger cars and commercial vehicles has induced a drop in the Automotive Engine Cover market. Furthermore, the unavailability of work force owing to stringent rules and regulations of social distancing has expected to hamper the market growth. Steady demand for Automotive Engine Cover and growing manufacturing activities along with technological advancements made by the manufacturers in the product portfolio of their companies are the factors expected to create a positive atmosphere in the market. Moreover, increasing dealer inventories and implementation of economic solutions in the market has boosted the demand for the precise amount of manufacturing techniques across the market.Global Automotive Engine Cover Market Regional Insights:

The Asia Pacific holds the major share in the Automotive Engine Cover market with approximately 45%. Increasing production of automobiles in the regional market of APAC is the key factor considered to drive the market growth. Moreover, the high inclination of manufacturers towards passenger safety is the key supporting factors boosting the market growth in APAC. China dominates the APAC region with approximately 52% market share owing to increasing manufacturing and sales activities in the region and the emergence of China into the automotive hub of APAC. Europe is expected to pose as the fastest-growing region in the Automotive Engine Cover Market with approximately 30% market share. Increasing investment in the automotive sector integration by the governments of the EU and stringent emission and safety norms in the European region are the key factors attributing to market growth. Germany holds a prominent share in the market as the country is emerging as the manufacturing hub across the globe. North America holds the dominant share in the market owing to high technological adoption in the market and highly emerged infrastructure capabilities in the region. According to Magna International LLC, approximately 34 million units of automotive engine covers are sold in the year 2022 owing to the abundance of key players in the region and high transportation capabilities of regional distributors and manufacturers. The objective of the report is to present a comprehensive analysis of the Global Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Global Market dynamics, structure by analyzing the market segments and project the Global Market size. Clear representation of competitive analysis of key players by Type, price, financial position, Type portfolio, growth strategies, and regional presence in the Global Market make the report investor’s guideGlobal Automotive Engine Cover Market Scope: Inquire before buying

Global Automotive Engine Cover Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 1139.4 Mn. Forecast Period 2023 to 2029 CAGR: 3.2% Market Size in 2029: US $ 1420.5 Mn. Segments Covered: by Manufacturing Process Casting Injection molding Forging by Vehicle Type Passenger Cars Hatchback Sedan MPV MUV SUV Commercial Vehicles Light Commercial Heavy Commercial by Material Type Composites Metals Thermoplastics Others Global Automotive Engine Cover Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Global Automotive Engine Cover Market, Key Players are

1. DuPont 2. MAHLE GmbH 3. Toyoda Gosei Co. Ltd. 4. Polytec Group Inc. 5. Miniature Precision Components 6. Toray Group 7. Ascend Performance Materials 8. Magna International LLC 9. Montaplast GmbH 10. Luxfer Group 11. Rochling Group 12. The Mondragon Cooperative Corporation 13. DSM 14. BASF AG 15. Bugatti

Frequently Asked Questions: 1. Which region has the largest share in Global Automotive Engine Cover Market? Ans: North America region held the highest share in 2022. 2. What is the growth rate of Global Automotive Engine Cover Market? Ans: The Global Automotive Engine Cover Market is growing at a CAGR of 3.2% during forecasting period 2023-2029. 3. What is scope of the Global Market report? Ans: Global Automotive Engine Cover Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Market? Ans: The important key players in the Global Market are – DuPont, MAHLE GmbH, Toyoda Gosei Co. Ltd., Polytec Group Inc., Miniature Precision Components, Toray Group, Ascend Performance Materials, Magna International LLC, Montaplast GmbH, Luxfer Group, Rochling Group, The Mondragon Cooperative Corporation, DSM, BASF AG, Bugatti. 5. What is the study period of this Market? Ans: The Global Market is studied from 2022 to 2029.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Automotive Engine Cover Market Size, by Market Value (US$ Mn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2022 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Automotive Engine Cover Market 3.4. Geographical Snapshot of the Automotive Engine Cover Market, By Manufacturer share 4. Global Automotive Engine Cover Market Overview, 2022-2029 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Technologies 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global Automotive Engine Cover Market 5. Supply Side and Demand Side Indicators 6. Global Automotive Engine Cover Market Analysis and Forecast, 2022-2029 6.1. Global Automotive Engine Cover Market Size & Y-o-Y Growth Analysis. 7. Global Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 7.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 7.1.1. Casting 7.1.2. Injection molding 7.1.3. Forging 7.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 7.2.1. Passenger Cars 7.2.1.1. Hatchback 7.2.1.2. Sedan 7.2.1.3. MPV 7.2.1.4. MUV 7.2.1.5. SUV 7.2.2. Commercial Vehicles 7.2.2.1. Light Commercial 7.2.2.2. Heavy Commercial 7.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 7.3.1. Composites 7.3.2. Metals 7.3.3. Thermoplastics 7.3.4. Others 8. Global Automotive Engine Cover Market Analysis and Forecasts, By Region 8.1. Market Type (Value) Estimates & Forecast By Region, 2022-2029 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 9.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 9.1.1. Casting 9.1.2. Injection molding 9.1.3. Forging 9.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 9.2.1. Passenger Cars 9.2.1.1. Hatchback 9.2.1.2. Sedan 9.2.1.3. MPV 9.2.1.4. MUV 9.2.1.5. SUV 9.2.2. Commercial Vehicles 9.2.2.1. Light Commercial 9.2.2.2. Heavy Commercial 9.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 9.3.1. Composites 9.3.2. Metals 9.3.3. Thermoplastics 9.3.4. Others 10. North America Automotive Engine Cover Market Analysis and Forecasts, By Country 10.1. Market Type (Value) Estimates & Forecast By Country, 2022-2029 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 11.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 11.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 11.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 12. Canada Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 12.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 12.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 12.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 13. Mexico Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 13.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 13.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 13.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 14. Europe Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 14.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 14.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 14.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 15. Europe Automotive Engine Cover Market Analysis and Forecasts, By Country 15.1. Market Type (Value) Estimates & Forecast By Country, 2022-2029 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 16.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 16.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 16.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 17. France Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 17.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 17.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 17.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 18. Germany Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 18.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 18.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 18.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 19. Italy Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 19.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 19.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 19.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 20. Spain Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 20.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 20.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 20.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 Market 21. Sweden Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 21.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 21.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 21.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 22. CIS Countries Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 22.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 22.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 22.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 23. Rest of Europe Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 23.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 23.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 23.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 24. Asia Pacific Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 24.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 24.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 24.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 25. Asia Pacific Automotive Engine Cover Market Analysis and Forecasts, by Country 25.1. Market Type (Value) Estimates & Forecast By Country, 2022-2029 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 26.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 26.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 26.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 27. India Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 27.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 27.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 27.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 28. Japan Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 28.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 28.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 28.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 29. South Korea Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 29.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 29.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 29.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 30. Australia Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 30.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 30.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 30.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 31. ASEAN Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 31.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 31.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 31.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 32. Rest of Asia Pacific Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 32.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 32.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 32.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 33. Middle East Africa Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 33.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 33.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 33.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 34. Middle East Africa Automotive Engine Cover Market Analysis and Forecasts, by Country 34.1. Market Type (Value) Estimates & Forecast by Country, 2022-2029 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 35.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 35.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 35.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 36. GCC Countries Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 36.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 36.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 36.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 37. Egypt Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 37.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 37.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 37.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 38. Nigeria Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 38.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 38.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 38.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 39. Rest of ME&A Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 39.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 39.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 39.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 40. South America Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 40.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 40.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 40.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 41. South America Automotive Engine Cover Market Analysis and Forecasts, by Country 41.1. Market Type (Value) Estimates & Forecast by Country, 2022-2029 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 42.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 42.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 42.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 43. Argentina Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 43.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 43.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 43.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 44. Rest of South America Automotive Engine Cover Market Analysis and Forecasts, 2022-2029 44.1. Market Type (Value) Estimates & Forecast By Manufacturing Process, 2022-2029 44.2. Market Type (Value) Estimates & Forecast By Vehicle Type, 2022-2029 44.3. Market Type (Value) Estimates & Forecast By Material Type, 2022-2029 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Global Automotive Engine Cover Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, and R&D Investment 45.2.2. New Product Launches and Product Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Verticals 45.2.3.2. M&A, Forward Integration and Backward Integration 45.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 45.3. Company Profile : Key Players 45.3.1. DuPont 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Product Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.3.2. MAHLE GmbH 45.3.3. Toyoda Gosei Co. Ltd. 45.3.4. Polytec Group Inc. 45.3.5. Miniature Precision Components 45.3.6. Toray Group 45.3.7. Ascend Performance Materials 45.3.8. Magna International LLC 45.3.9. Montaplast GmbH 45.3.10. Luxfer Group 45.3.11. Rochling Group 45.3.12. The Mondragon Cooperative Corporation 45.3.13. DSM 45.3.14. BASF AG 45.3.15. Bugatti 46. Primary Key Insights